Usdjpy-analysis

USDJPY AnalysisGood Afternoon Everyone,

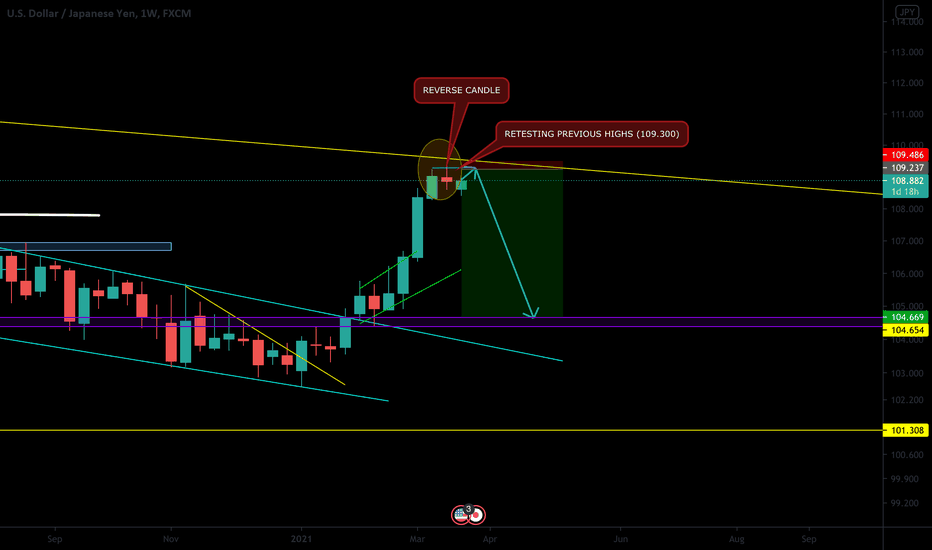

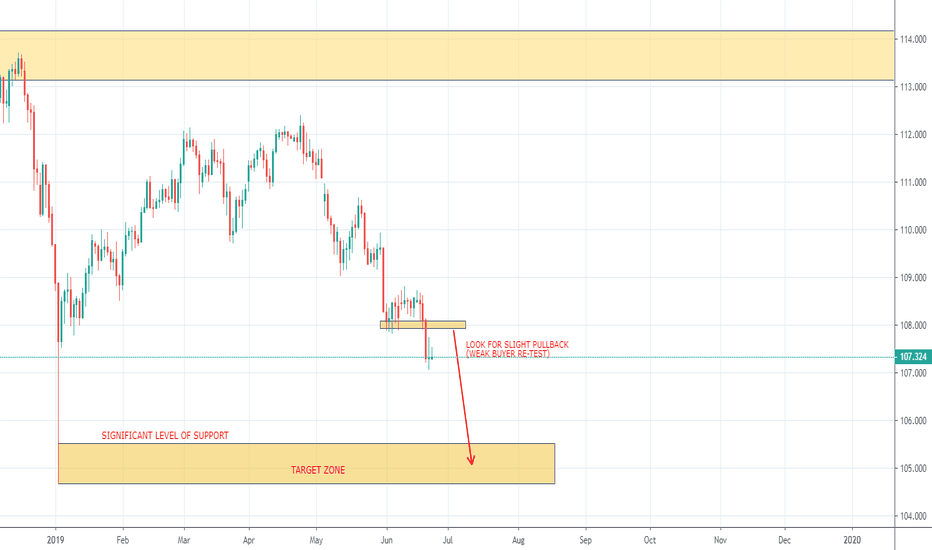

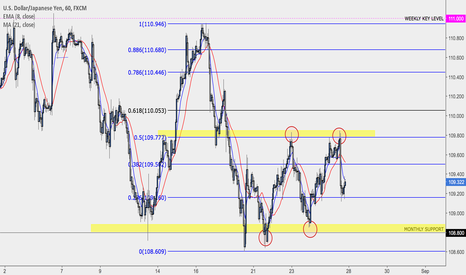

The USDJPY is primed to continue its recent downtrend.

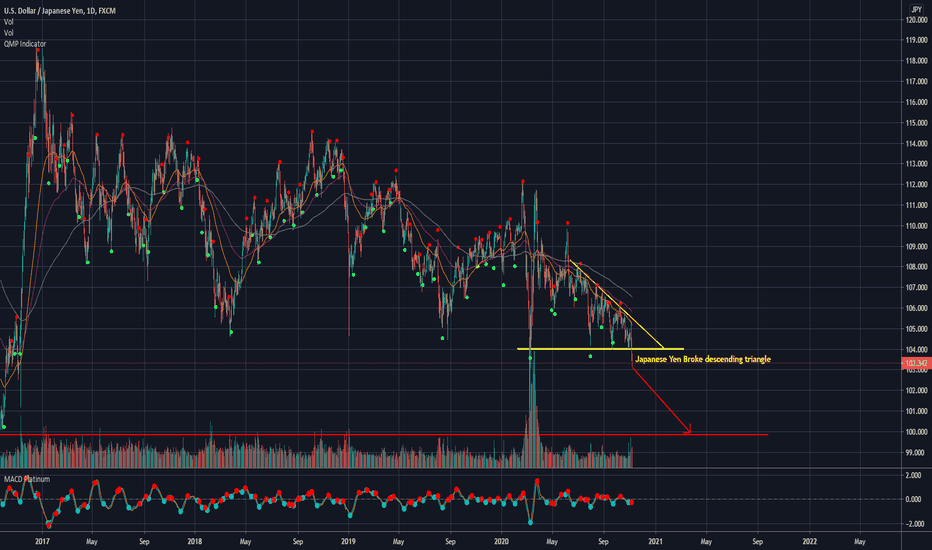

On the 1D chart, price has just broken below the descending triangle. The next significant area of resistance looks to be in the 100.00 zone. I will be looking for entry points during the upcoming trading sessions.

On the 12H, price is nearing the bottom of the descending channel it has been trading in. First entry will be considered when price closes below the descending channel.

Thank you for reading and please follow along during the upcoming sessions

*This is not investment advice*

DXY Analysis BreakdownGood evening Everyone,

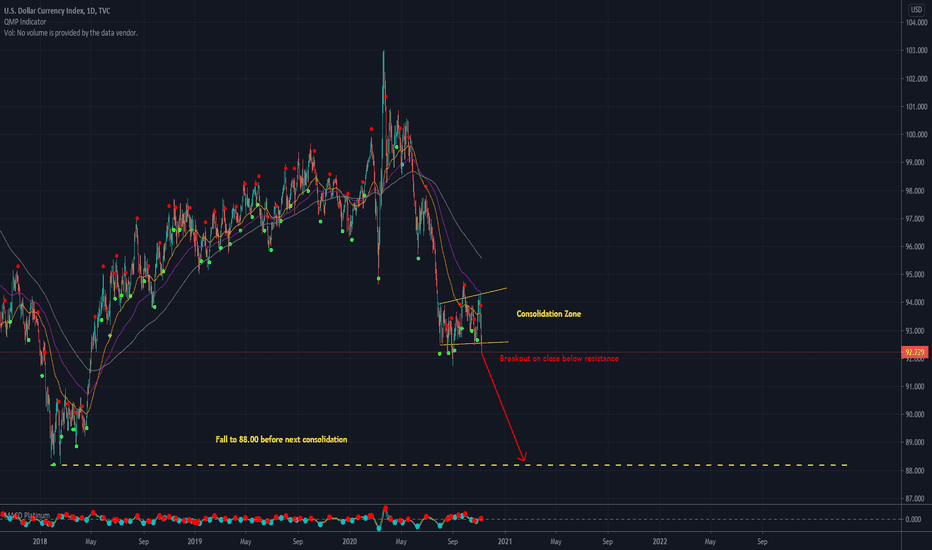

The US Dollar looks to be primed to continue its recent downtrend. With the presidential elections wrapping up in the US, the markets appear to be steadying out. With COVID relief packages likely to pass in the new year and increased government spending expected, the dollar will likely struggle.

On the 1D charts, the dollar is starting to break below a recent consolidation zone. I personally feel this consolidation was fueled by uncertainty at the start of the election week (I think the DXY would have dropped sharply had there been little to no uncertainty surrounding the election results). The next significant area of support looks to be in the 88.00 range.

The CHF and JPY are following suit, with the USDJPY recently breaking below a moderately strong support. The USDJPY appears to be on the fast track to the 100.00 region now that it has closed below the descending triangle it has been stuck in (see below chart). The USDCHF looks to be having a bit more trouble breaking its support but is looking to do so in the upcoming sessions.

I expect the above pairs to be fairly active in the upcoming sessions and will be following along closely.

Please feel free to follow along and provide any input!

*This is not intended to be investment advice*

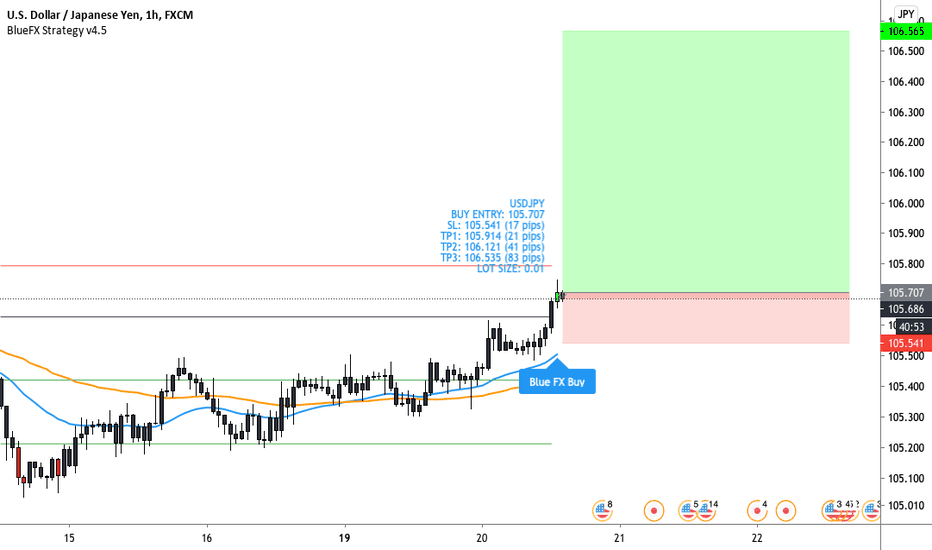

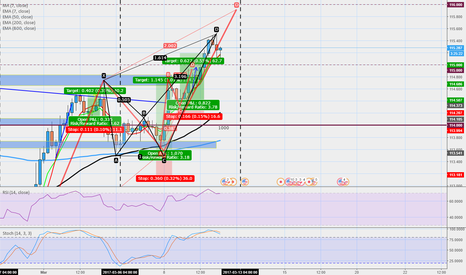

USDJPY BUY ALERT NO ACTIVE ! Details On The Chart...USDJPY NEW BUY ALERT PRINTED ON OUR 1HR STRATEGY.

PLEASE USE APPROPRIATE RISK MANAGEMENT !

OUR STRATEGY EXPLAINED:

The entry price, SL and multiple TPs are shown on the chart.

Our back testing and money management strategy itself is holding until a reverse signal to ride a big trend, but as you will not see the next signal - manage the trade as you wish should you decide to enter.

What is our strategy?

Our strategy is a trend following strategy, can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too - how cool is that? The strategy will confirm and support every open and closed position - so its quite easy to follow.

We just have to do what Percy does.

Please see our related ideas below for more information to explain what we do and how it can help you.

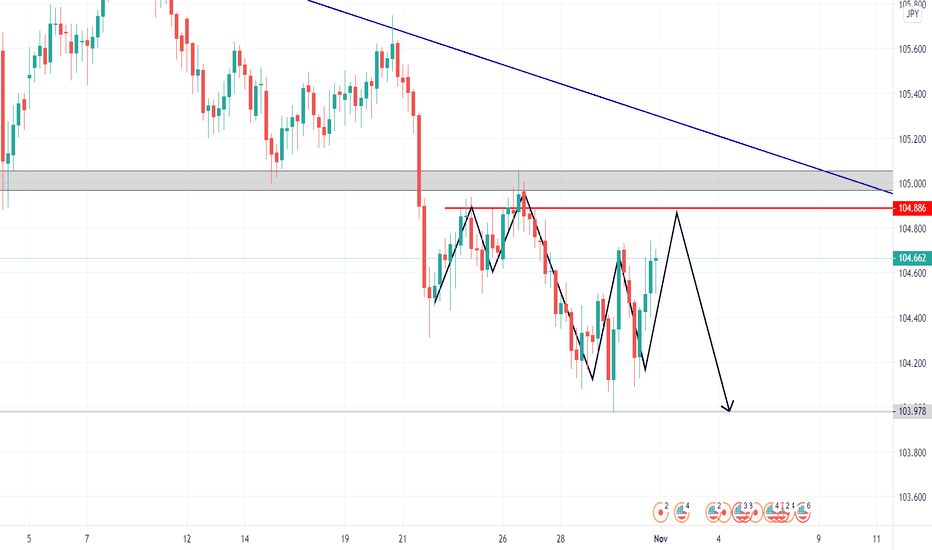

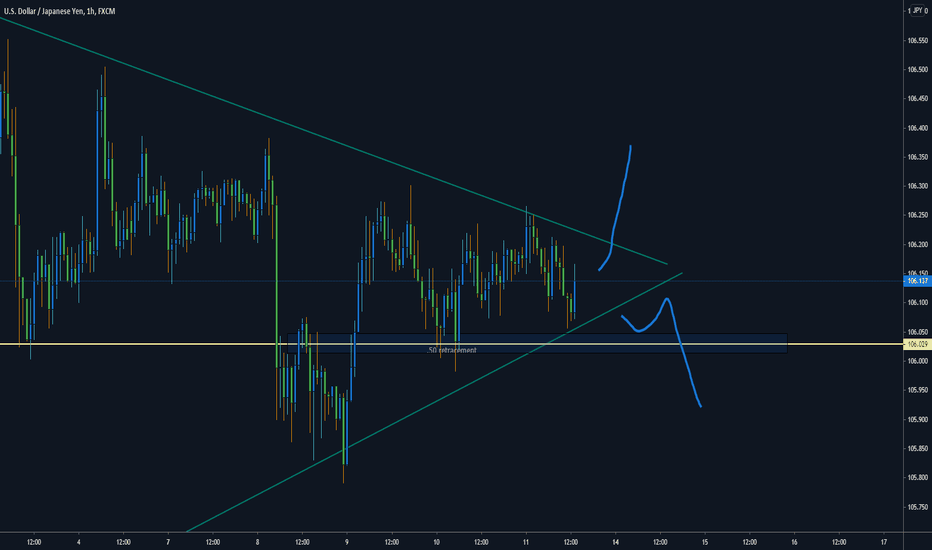

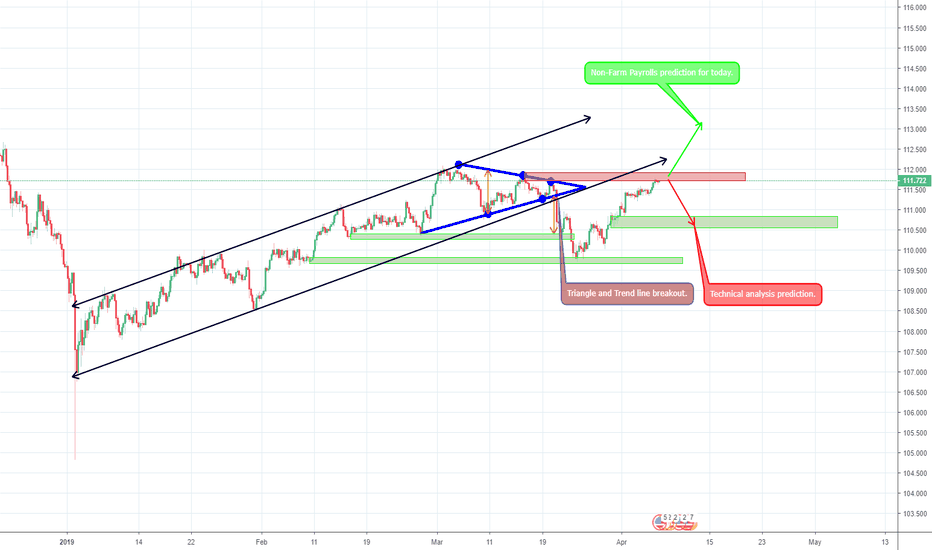

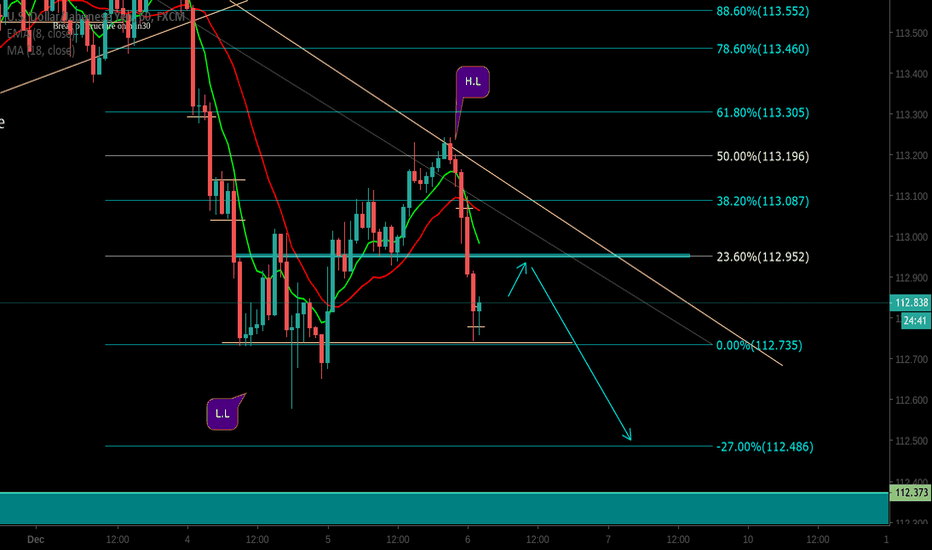

USDJPY Analysis [9-13]Hello traders, price has bounced from the trendline

and it looks to form a double bottom or soon to be one at the .50 retracement.

Wedge is near breakout, so it looks to appear to a breakout above.

If bottom trendline breaks look for a pullback to retest trendline then down wave.

Goodluck traders.

Trade with wisdom.

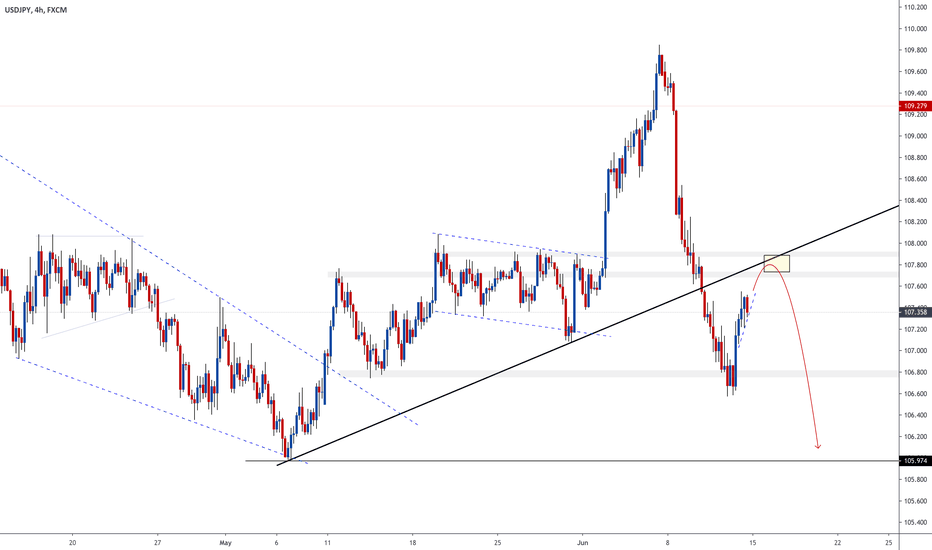

USDJPY POTENTIAL SHORT (LAST PUSH) THIS IS A MORE AGGRESSIVE TRADING SETUP BUT I WANTED TO MAKE THIS POST FOR THOSE THAT STILL SEE POTENTIAL IN THIS PAIR. IF YOU LOOK AT USDJPY IT HAS BEEN DOWNTRENDING CONSISTENTLY ON THE DAILY CHART FOR A LITTLE OVER A MONTH NOW. IF YOU LOOK THE SELLERS ARE STILL CREATING NEW LOWS AND PUSHING PRICE ACTION TO THE DOWNSIDE SHOWING THERE IS STILL INTEREST IN SELLING THIS PAIR. IT IS STILL AT A HIGH LEVEL AND BUYERS AREN'T READY TO JUMP IN FROM THE LOOKS OF IT. POTENTIAL QUICK SHORT OPPORTUNITY FOR WHAT I THINK MAY BE A LAST PUSH. WAIT FOR A WEAK BUYER RE-TEST TO THE UPSIDE STRUCTURE AREA OF 107.900 TO ATLEAST GET A BETTER RISK/REWARD SETUP OR CAN TAKE AGGRESSIVE ENTRY IF YOU FEEL THAT IS MORE OF YOUR STYLE. KEEP AN EYE ON THIS PAIR AND THE MOMENTUM AND LEVELS IT HOLDS! KEEP AN EYE OUT!

CHEERS!

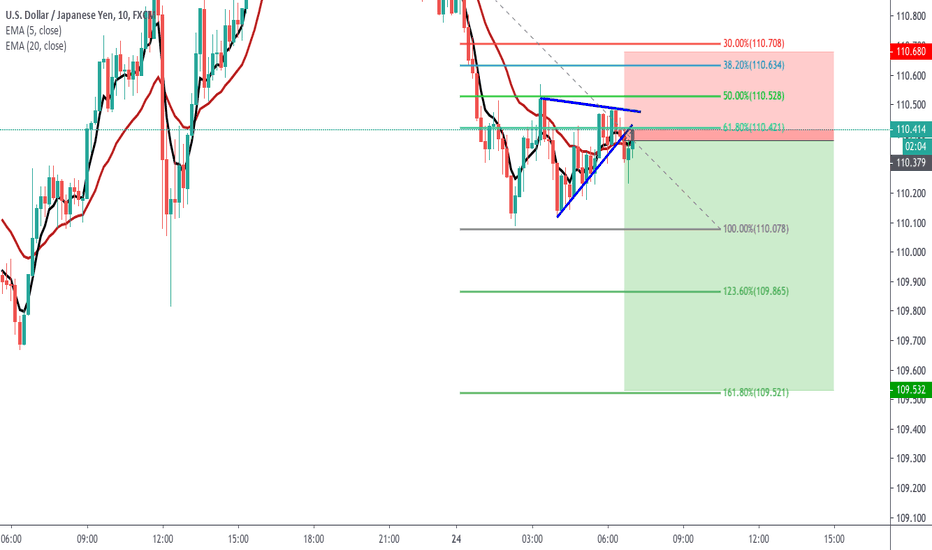

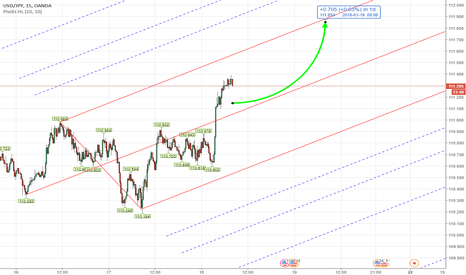

DOLLAR TO JAPPY RANGING 100 pips+UJ 4 Hour Chart = $$$$$$$$$$$$

UJ ranged this week, a battle between Supply & Demand of both currencies, at a range of about 100 - 105 pips.

New week and last weekly candle of the month for UJ this week and I'm pushing in the direction that we will get final confirmations on whether Seller or Buyers will take control of this pair, don't count out either.. It is going to be an amazing week of patience and pips. Good luck to all.

******************

Disclaimer :

This analysis not include personal feeling/opinion, and pure base on technical analysis

Trading foreign currencies can be a challenging and potentially profitable opportunity for investors. However, before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk appetite. Most importantly, do not invest money you cannot afford to lose.