Usdjpy-bullish

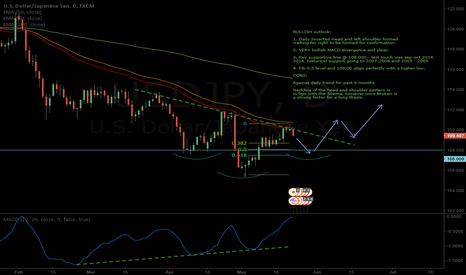

USDJPY - 'Potential Inverse head and shoulder'BULLISH outlook:

1. Daily Inverted Head and left shoulder formed

waiting for right to be formed for confirmation.

2. VERY bullish MACD divergence and clean

3. Key supportive line @ 108.000 - last touch was sep-oct 2014

2014, historical support going to 2007-2008 and 2003 - 2005

4. Fib 0.5 level and 108.00 align perfectly with a higher low.

CONS:

Against daily trend for past 6 months

Neckline of the head and shoulder pattern is

aligned with the 50ema, however once broken is

a strong factor for a long thesis.

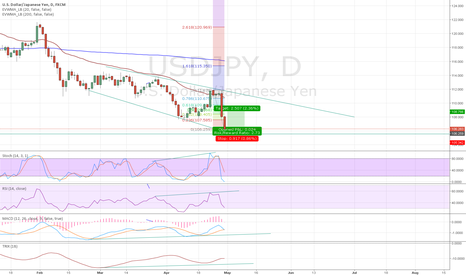

USDJPY Is Due To A RetraceFX:USDJPY

This pair is in a definite downtrend but with such huge moves down corrections are inevitable. The price will bounce up closer to the moving average. We have multiple bullish divergences on multiple indicators confirming this analysis. The projected take profit level is a 61.8% fib level. There is still a chance that it will honour weekly bearish engulfing candle formation and continue to fall down thus the stop loss is placed just under the previously respected S/R level.

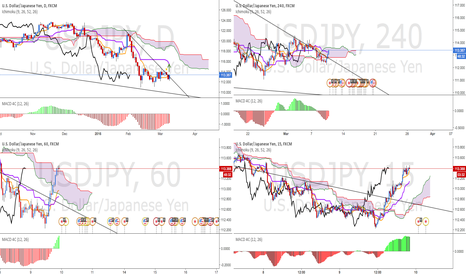

USDJPY HEADING BACK UPJPY announced a -0.1% interest rate on January 28th and popped over 200 pips. Since then the market has calmed itself down and retraced back down a little. Now USDJPY reaches a crucial level of 61.8% retracement level. With heavy oversold RSI, overall bullish market, and bullish trendline protecting the pair, I think it is safe to that USDJPY is going to reach higher highs.