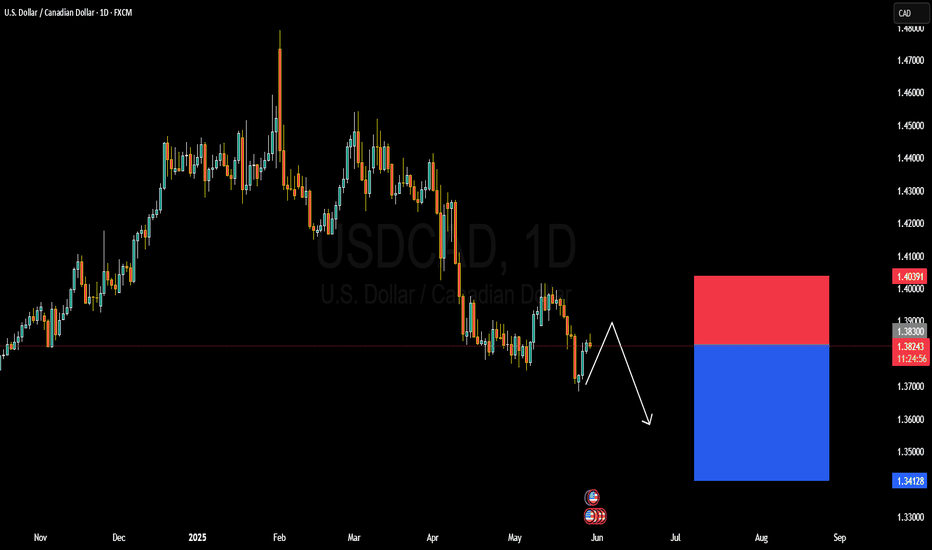

USDCAD BULLISH OR BEARISH DETAILED ANALYSIS ??USDCAD continues to follow the predicted bearish path, currently trading around 1.38300, and still moving gradually toward our target zone of 1.34300. After a strong bearish impulse from the 1.40391 supply zone, price has consistently formed lower highs, confirming selling pressure and market intent. The recent bounce was shallow, and price is respecting previous resistance levels perfectly, validating the bearish continuation setup.

Fundamentally, the Canadian dollar is gaining strength off rising oil prices and improving economic data from Canada, while the US dollar remains under pressure as the market begins pricing in a potential Fed rate cut in the second half of 2025. With softer US economic indicators including lower consumer confidence and slowing GDP growth, the momentum clearly favors CAD in this pair. The divergence in monetary policy outlooks between the Bank of Canada and the Federal Reserve adds further downside bias to USDCAD.

Technically, the structure remains bearish, with a clean breakdown below the 1.3900 psychological level and clear rejection at the 1.40300 resistance zone. Market liquidity appears to be shifting below the current price, and with the pair printing consistent lower highs and lower lows, there's significant space toward our target zone near 1.34128. A rejection from the minor pullback zone between 1.38800–1.39000 could provide another entry opportunity for trend continuation traders.

USDCAD remains a high-probability short setup in line with both technical structure and current fundamentals. As long as price stays below the 1.40300 resistance, I expect the bearish trend to continue with increased momentum as we approach summer liquidity shifts. This trade is already deep in profit and aligns with key institutional selling zones, making 1.34300 a realistic and conservative target in the coming weeks.

USDJPY

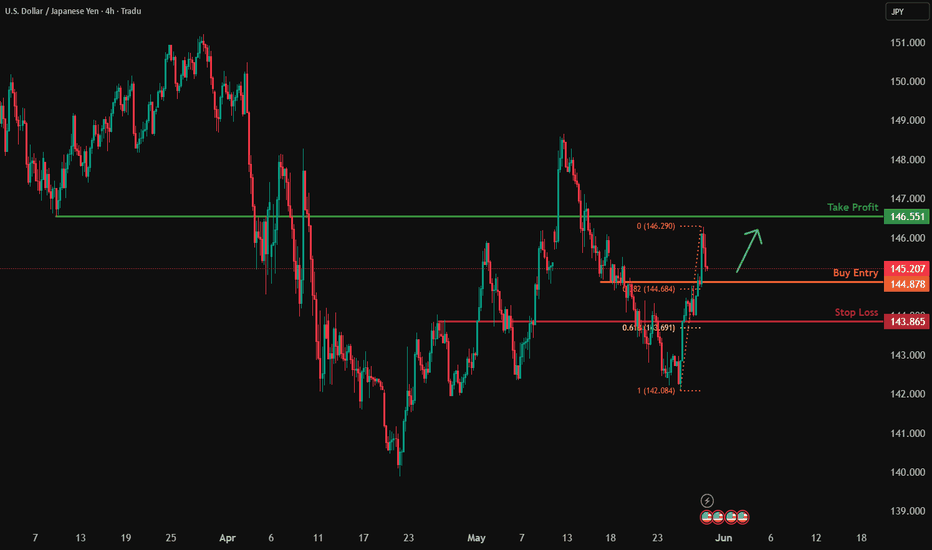

USDJPY H4 | Bullish Bounce Off Based on the H4 chart analysis, the price is falling our buy entry level at 144.87, a pullback support that aligns with the 38.2% Fibonacci retracement.

Our take profit is set at 146.55, a pullback resistance.

The stop loss is placed at 143.86, a pullback support that aligns close to the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDJPY - Will the dollar weakness stop?!The USDJPY currency pair is above the EMA200 and EMA50 on the 4-hour timeframe and is moving in its ascending channel. In case of correction due to the release of today's economic data, we can see a downward trend and then see the demand zone and buy in that range with an appropriate risk-reward ratio. A credible break of the indicated resistance range will pave the way for the currency pair to rise.

Japanese Prime Minister Shigeru Ishiba emphasized that investment is more crucial to economic growth than tariffs, reaffirming Japan’s continued commitment to negotiating the removal of U.S. trade tariffs. He also pointed to encouraging signs in the Japanese economy following wage increases and offered an optimistic outlook on the country’s recovery.

Meanwhile, Bank of Japan Governor Kazuo Ueda, speaking on Wednesday, warned that significant volatility in ultra-long-term bond yields could affect short-term borrowing costs, which in turn might exert a stronger impact on the broader economy. His remarks highlight the BOJ’s growing focus on recent fluctuations in long-dated bond yields, which could influence the board’s decision next month regarding the pace of its bond purchase reduction.

Ueda explained that in Japan, short- and medium-term interest rates tend to have more direct influence on the economy than ultra-long yields, due to the maturity structure of household and corporate debt. However, he acknowledged in a parliamentary session that sharp moves in ultra-long yields can also affect long- and even short-term bond yields indirectly.

Turning to Friday’s inflation report, expectations suggest that overall inflation remained subdued in April, as falling gasoline prices provided some relief to household budgets. However, core inflation—excluding food and energy—remains stubbornly high.

The PCE inflation index is anticipated to have risen 2.2% in April from a year earlier, slightly down from 2.3% in March, marking the lowest level since last September. Federal Reserve officials are still awaiting more data on how newly imposed tariffs are feeding into the broader economy, making it unlikely that the recent moderation in inflation will prompt a rate cut in the near term.

Although the Fed’s preferred inflation measure may have reached its lowest point since September, a second consecutive month of encouraging price data is unlikely to be sufficient to justify easing interest rates.

According to a survey conducted by Dow Jones Newswires and The Wall Street Journal, economists expect Friday’s report—covering inflation, income, and spending—from the Bureau of Economic Analysis to show that consumer prices rose 2.2% year-over-year through April. This would mark the lowest reading since September and a potential turning point in the Fed’s battle against post-pandemic inflation.

Goldman Sachs economists noted that falling gasoline prices have more than offset the inflationary impact of new tariffs introduced by the Trump administration. However, they cautioned that this dynamic may not last, as retailers are likely to start passing along the added import tax costs to consumers in the coming months.

Several Federal Reserve officials, concerned that tariffs could reignite inflation, have stated that they will wait to assess the full impact of these trade policies on the economy before making changes to the federal funds rate—which directly affects borrowing costs on everything from mortgages and auto loans to credit cards.

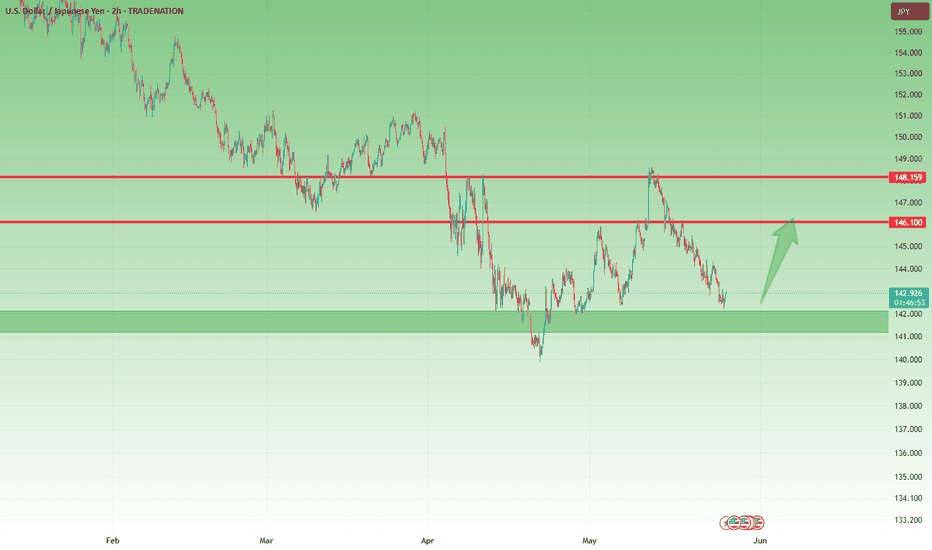

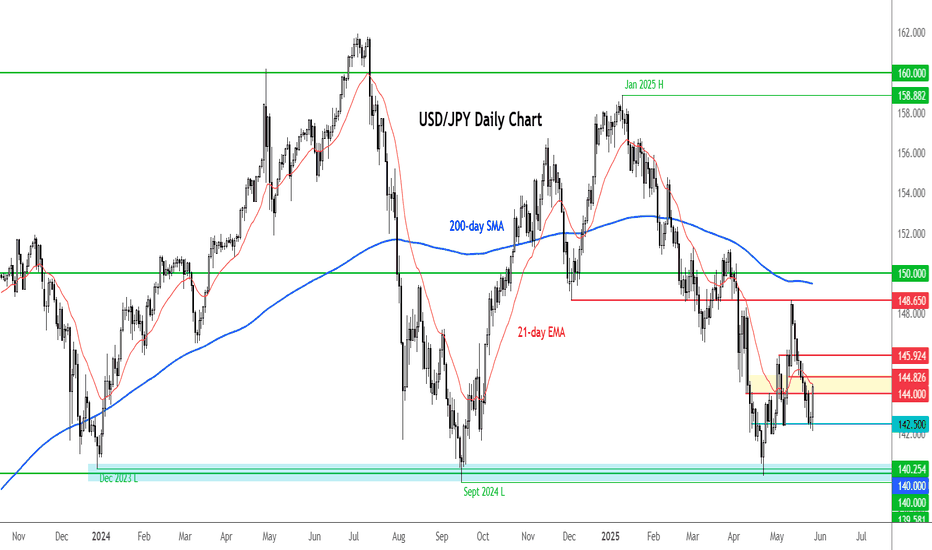

USDJPY Returns to Key Support – Another Bounce Ahead?At the end of April and beginning of May, I pointed out the importance of the 142 support zone and argued that USDJPY could reverse to the upside, targeting the 146 resistance.

The pair did exactly that — not only hitting the 146 target, but also spiking as high as 148, reaching the next major resistance.

🔁 Now We're Back towards 142

Since mid-May, USDJPY has pulled back again and is now retesting the 142 area — the same zone that previously triggered a strong bounce.

📌 Outlook and Trading Plan

I still consider the 142 level a solid support, and this recent drop could offer a new buying opportunity.

Any dips under 142 that quickly reverse can be used to build long positions, with a target once more around 146.

That offers a clear trade setup with a good risk-to-reward ratio.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

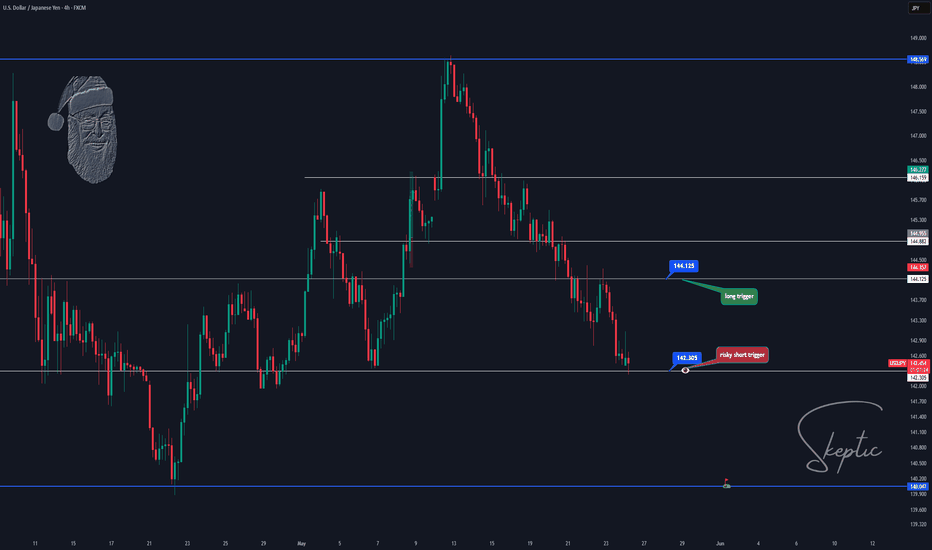

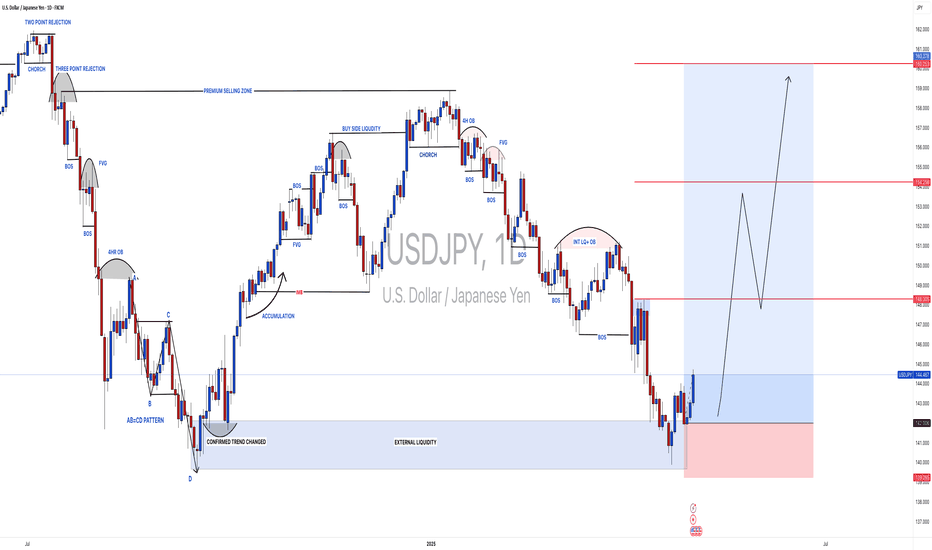

Skeptic | USD/JPY Analysis: Bearish Momentum Fuels Short Setups!Hey everyone, Skeptic here! I know some of you might’ve missed our last USD/CHF short signal that hit a sweet 3:1 R/R—no worries! 😊 The market’s always here, so missing a trade isn’t the end of the world. I’m not here to push FOMO; my goal is to take you on a long-term trading journey, and I’m stoked to have you along for the ride! :))) Let’s get back to USD/JPY and break down the latest action. 📊

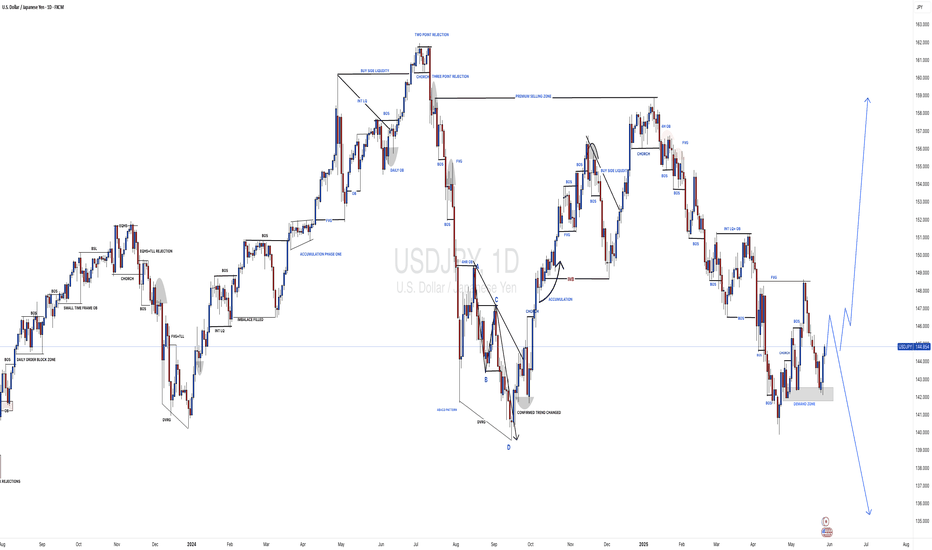

Daily Timeframe: The Big Picture

First, let’s zoom out and talk about the DXY (US Dollar Index), which recently broke the 99.005 support and turned bearish. This puts USD-based pairs like USD/JPY in the spotlight for short opportunities this week. Here’s what’s happening with USD/JPY:

Trend Context: The major trend is bearish. Last week, sellers showed no mercy to buyers, and with DXY’s bearish move, we’re likely to see more of the same this week.

Key Level: We’re currently reacting to a major daily support at 142.305. Expect a range or reaction here, so we must wait for confirmation before shorting.

Recent Correction: The prior correction reached the 0.50% Fibonacci retracement and seems to have resumed the major bearish trend.

With this in mind, let’s zoom into the 4-Hour Timeframe to hunt for long and short setups.

4-Hour Timeframe: Long & Short Setups

The 4-hour chart is giving us some clear signals to work with. Here’s the plan:

Short Setup:

Key Level: The 142.338 level is critical, as it formed a ceiling at 148.569 in the past and acted as support before.

Trigger: If we form a lower high and then break below 142.305, open a short position.

Confirmation: Use RSI to back up the breakout, ensuring momentum aligns.

Why It Works: A lower high signals increasing weakness in this support, making a break more likely.

Long Setup:

My Take: I personally don’t have a long trigger right now. Both the major and minor trends are downtrends, so going long doesn’t make sense in these conditions.

If You Insist: If you’re set on a long, wait for a break above 144.125. But keep it tight—low risk, small stop loss, and take profits quickly once you hit a decent R/R.

💬 Let’s Talk!

If this analysis sparked some ideas, give it a quick boost—it really helps! 😊 Got a pair or setup you want me to dive into next? Drop it in the comments, and I’ll tackle it. Thanks for joining me—see you in the next one. Keep trading smart! ✌️

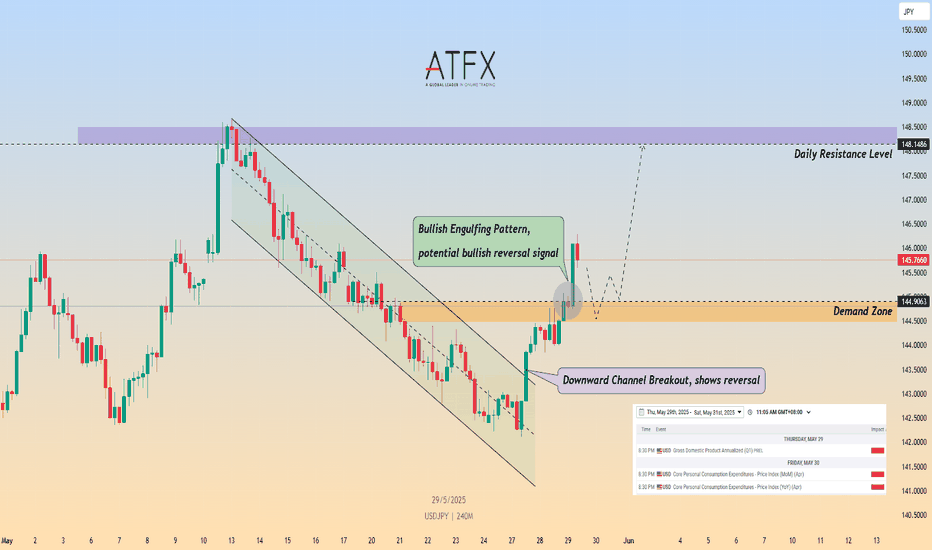

Bullish Reversal on Risk-On Shift and Channel BreakoutCMCMARKETS:USDJPY USD/JPY surged as risk appetite returned after a U.S. federal court blocked President Trump's "Liberation Day" tariffs, undermining demand for safe-haven assets like the yen. Meanwhile, weak demand in Japan’s 40-year bond auction raised concerns over fiscal stability, adding further downside pressure to JPY. Technically, the pair broke above a downward channel and formed a bullish engulfing pattern near the 144.90 demand zone. If price consolidates above 145.00, a test of the 148.15 resistance zone is possible. Traders now eye upcoming U.S. GDP and PCE inflation data for direction on Fed policy.

Resistance : 148.14 , 148.67

Support : 144.90 , 144.42

As Goes USD/JPY, so goes the USD USD/JPY continues to drive impact in broader USD themes and given the fact that there's still considerable carry remaining in the pair, the consequences of a deeper sell-off could bring impact to several macro markets. USD/JPY is about 40% above the early 2021 lows when the carry trade began to build on the back of stronger US inflation, and even as US rate cuts started last year and BoJ rate hikes began, the carry trade only started to unwind - until the bounce from 140.00 in Q3 of last year.

That same 140.00 level was back in action in April, right around the time that the USD bounced from a big spot of support on its own chart. And the four weeks that followed showed similar bounces in both markets. The pain for bulls last week was, similarly, felt in both markets.

But this week has shown a different tone as a higher-low has held in USD/JPY around 142.50 and for DXY, around the 98.98 Fibonacci level. As looked at in the USD post, there's now the possibility of a monthly doji and if that completes, there's turn potential for the US Dollar.

This would need to be supported by continued recovery in USD/JPY and for that, we're likely going to be looking for continued softening in longer-dated Japanese yields. Or else - as the divergence between Japanese and US rates continues to narrow, so too could the motivation for hedges and carry trades to close, putting downward pressure on the pair and the US Dollar.

In that scenario, I think USD/CAD and GBP/USD could remain as attractive venues for USD-weakness to play out. But in the opposite, with USD-strength showing, I'm still favoring EUR/USD for USD-strength to continue playing out. And also for the Yen, USD/JPY has been 'trappy' on both sides and I'd instead look to work with Yen-weakness against the British Pound (GBP/JPY) and Yen-strength against the Euro. - js

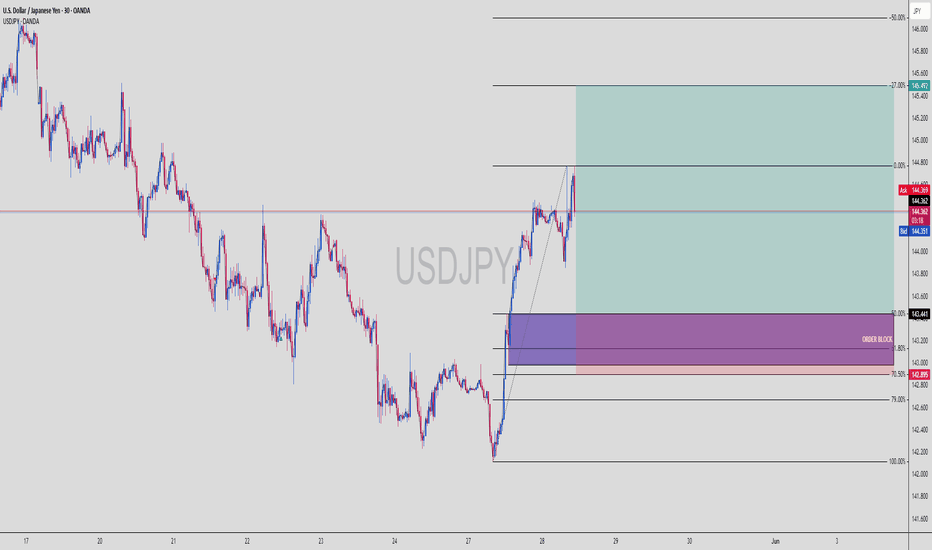

USDJPY | Smart Money Long Setup – Deep Fib + OB Reaction💴 USDJPY | Institutional Long Play with Perfect OB + Fib Confluence

Price gave us an aggressive push off the demand zone, showing clear Smart Money accumulation behavior. This setup is high probability based on Smart Money Concepts (SMC).

🔍 1. Technical Breakdown

Strong impulse move upward

Clean pullback into the Order Block

Confluence with 70.5%–79% Fibonacci retracement zone

Price respected the OB zone and printed higher highs

That reaction was institutional — no cap 🧢.

🧱 2. Bullish Confluences

🔥 Order Block (OB): Purple demand zone = unmitigated

📐 Fib Sweet Spot: 70.5%–79% = institutional re-entry levels

✅ Strong Wick Rejection: Shows absorption of sell-side liquidity

📈 Market Structure Shift: Break of structure to the upside

🎯 3. Trade Plan

Entry: 142.89 (within OB + 70.5%)

Stop Loss: 142.00

Take Profit: 145.49 zone

This setup targets the -27% fib extension — a classic institutional TP level.

⚖️ 4. RRR (Risk-Reward Ratio)

💰 Entry: 142.89

🔒 SL: 142.00

📍 TP: 145.49

✅ RRR ≈ 1:2.9

Solid intraday-to-swing play with clean structure.

🧠 5. Key Confirmation Points

Break and close above 144.36 = confirmed bullish intent

Price respecting 143.44 OB = bulls still in control

SL below OB = protected by demand block

💬 Comment “SMC Long Sniper 💹” if you caught this move!

🔄 Share this if you love OB + fib sniper entries

📌 Save this setup for your next demand zone playbook

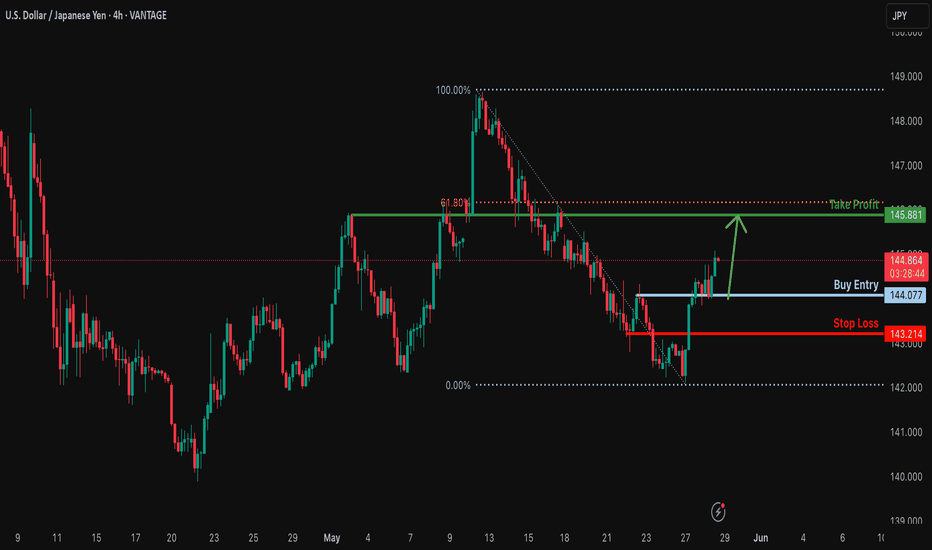

Bullish momentum to extend?USD/JPY has bounced off the support level which is a pullback support and could rise from this level to our take profit.

Entry: 144.07

Why we like it:

There is a pullback support level.

Stop loss: 143.21

Why we like it:

There is a pullback supoprt level.

Take profit: 145.88

Why we like it:

There is a pullback resistance level that is slightly below the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY: Neutral View! One of The Hardest Forex Pair To TradeUSDJPY has not yet shown a clear move, ranging between 141 and 144. We are currently neutral as the price could go in either direction. Trade cautiously and manage risk according to your trade plan.

Thanks for your support! 😊

If you’d like to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

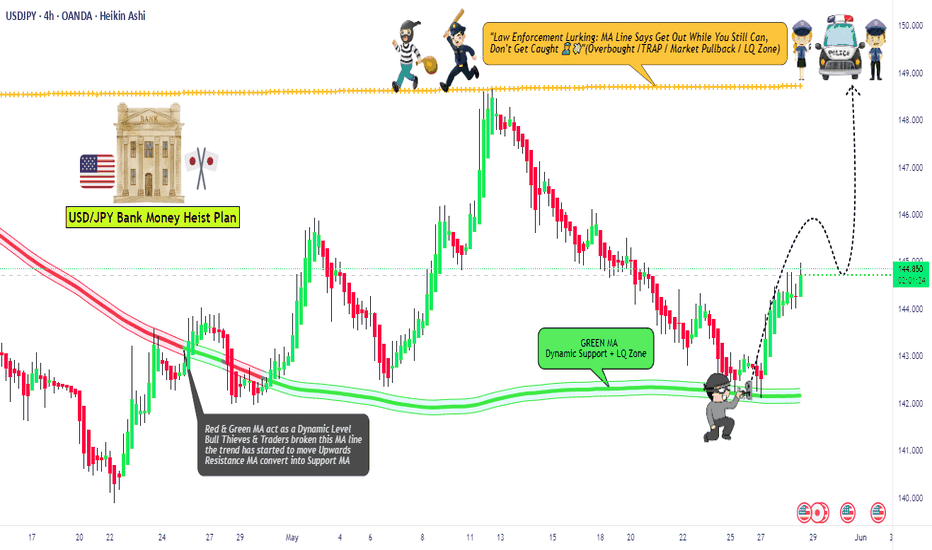

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

148.700 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

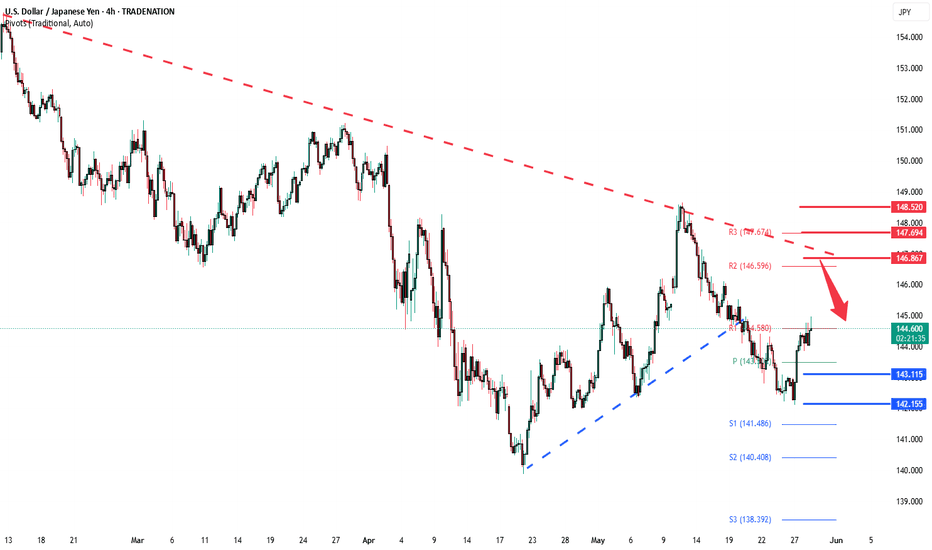

USDJPY INTRADAY bearish below 145.60The USDJPY pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 145.60, which represents the current intraday swing low and the falling resistance trendline level.

In the short term, an oversold rally from current levels, followed by a bearish rejection at the 145.60 resistance, could lead to a downside move targeting support at 141.00, with further potential declines to 139.50 and 138.40 over a longer timeframe.

On the other hand, a confirmed breakout above the 145.60 resistance level and a daily close above that mark would invalidate the bearish outlook. This scenario could pave the way for a continuation of the rally, aiming to retest the 147.90 resistance, with a potential extension to 149.00 levels.

Conclusion:

Currently, the USDJPY sentiment remains bearish, with the 145.60 level acting as a pivotal resistance. Traders should watch for either a bearish rejection at this level or a breakout and daily close above it to determine the next directional move. Caution is advised until the price action confirms a clear break or rejection.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

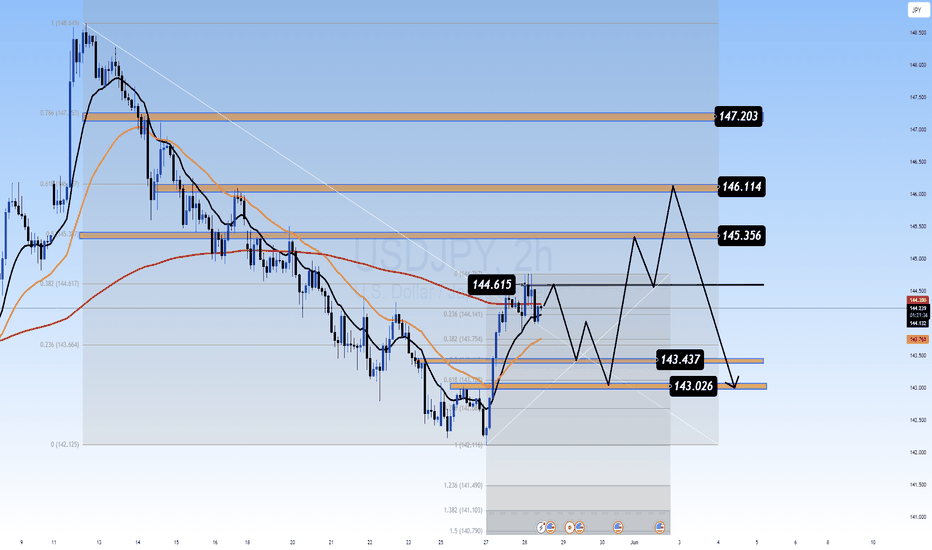

USDJPY PLAN – Will FOMC Be the Next Big Catalyst?USDJPY PLAN – Will FOMC Be the Next Big Catalyst?

💬 After several sessions of sideways movement, USDJPY is showing signs of a potential breakout, supported by both technical signals and macro fundamentals. As the FOMC meeting approaches, the market is poised for a major shift — making this the perfect time to prepare actionable trade plans.

🔍 TECHNICAL ANALYSIS

Primary Trend: Short-term bullish retracement within a broader downtrend – currently testing the 200 EMA on H2.

EMAs in use: EMA13 (black), EMA34 (orange), EMA89 (red) – effective dynamic support/resistance indicators.

Key Resistance Levels:

145.35: Major confluence zone with 0.618 Fibonacci and trendline resistance.

146.11 – 147.20: Previous highs and Fibonacci extension targets.

Key Support Zones:

144.61: EMA200 acting as immediate pressure point.

143.43 – 143.02: Crucial demand zone with strong reaction expected on pullback.

🌍 MACRO & FUNDAMENTAL FACTORS

FOMC Outlook: With recent CPI data softening and labor numbers moderating, markets anticipate a hold on rates. However, any hawkish tone from Chair Powell could trigger a sharp bullish move on USDJPY.

BOJ’s Dovish Stance: The Bank of Japan remains accommodative, showing no clear intent to hike rates. This weakens the Yen and supports mid-term upward momentum for USDJPY.

Interest Rate Differentials & Carry Trade Flows continue to drive volatility and directional bias in this pair.

🎯 TRADE SETUP SUGGESTION

If price breaks and sustains above 144.61 (EMA200): look to BUY on pullback toward 144.15–144.20, targeting 145.35 and 146.11.

If price gets rejected at 145.35: consider a short-term SELL toward 144.00 – 143.43 for a corrective leg.

⚠️ STRATEGY NOTE:

Avoid entering right at the time of the FOMC release. Wait for post-event confirmation. Prioritize strong breakouts or rejections, and manage risk carefully under volatile conditions.

USD/JPY BEARISH BIAS RIGHT NOW| SHORT

USD/JPY SIGNAL

Trade Direction: short

Entry Level: 144.107

Target Level: 141.877

Stop Loss: 145.579

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDCAD BULLISH OR BEARISH DETAILED ANALYSIS ??NZDCAD is currently coiling within a textbook bullish flag formation after an aggressive impulsive leg to the upside. Price action remains tight inside this consolidation structure, respecting both trendline resistance and support. As we approach the apex of this flag, I’m closely watching for a breakout confirmation to trigger the next bullish continuation leg toward the 0.8600 target.

From a macro perspective, the New Zealand dollar is gaining strength following the RBNZ’s firm stance on keeping rates elevated due to persistent inflation risks, particularly in housing and services. On the flip side, the Canadian dollar is showing relative weakness as oil prices stall and the Bank of Canada shifts toward a more dovish tone amid weaker economic data and slowing consumer spending. This divergence in central bank policy and economic outlook is building a strong fundamental case for NZDCAD upside.

Technically, the structure remains clean. The market formed a strong bullish engulfing rally earlier in April, and since then has entered a symmetrical correction with higher lows forming under compression. This is a classic continuation setup with strong momentum buildup underneath. A breakout above the 0.8280–0.8300 zone with volume would likely trigger institutional interest and drive price rapidly toward the 0.8600 level, which aligns with the measured move of the flag.

This is a high-probability trade idea supported by both technical and fundamental convergence. With risk well-defined below 0.8135 and momentum favoring the bulls, NZDCAD is one of my top setups going into June. Breakout traders and swing traders alike should keep this pair on the radar as the next bullish expansion looks imminent.

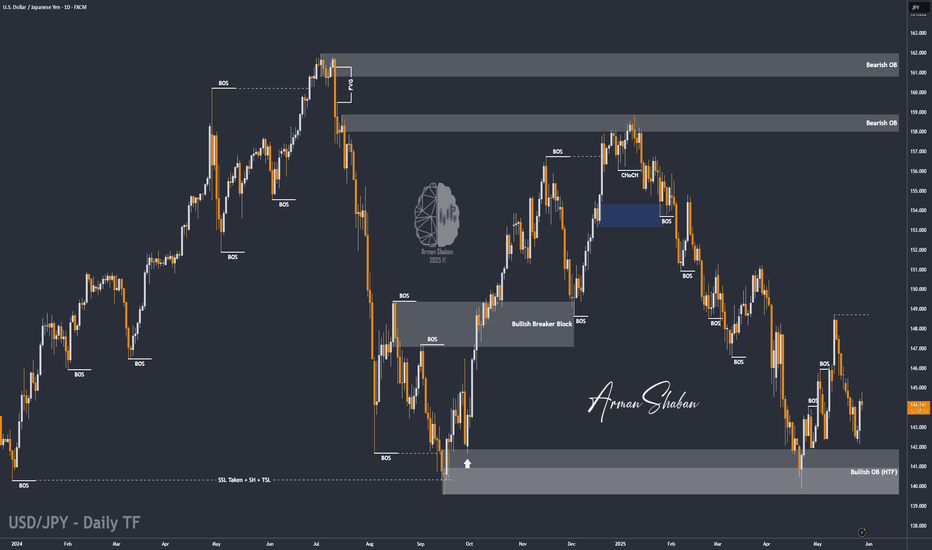

USD/JPY Poised for Upside: Momentum Building Toward Key TargetsBy examining the USD/JPY chart on the daily timeframe, we can see that the price is currently trading around 144. Given the momentum, I expect this pair to rise soon. The potential bullish targets are 145.5, 147.35, and 148.65 respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

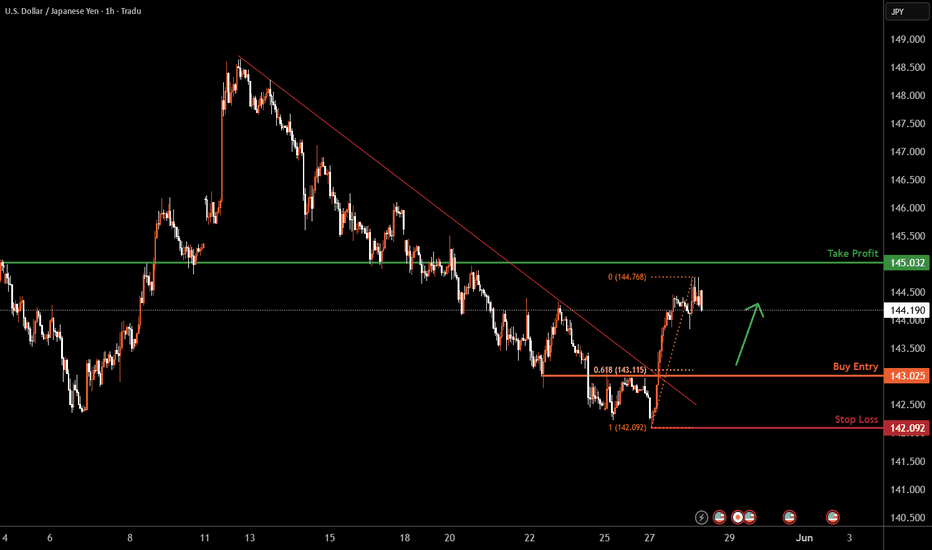

USDCHF H1 I Bullish Bounce Off Based on the H4 chart analysis, the price is falling toward our buy entry level at 143.02, a pullback support that aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 145.03, a pullback resistance.

The stop loss is placed at 142.09, a swing low support

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

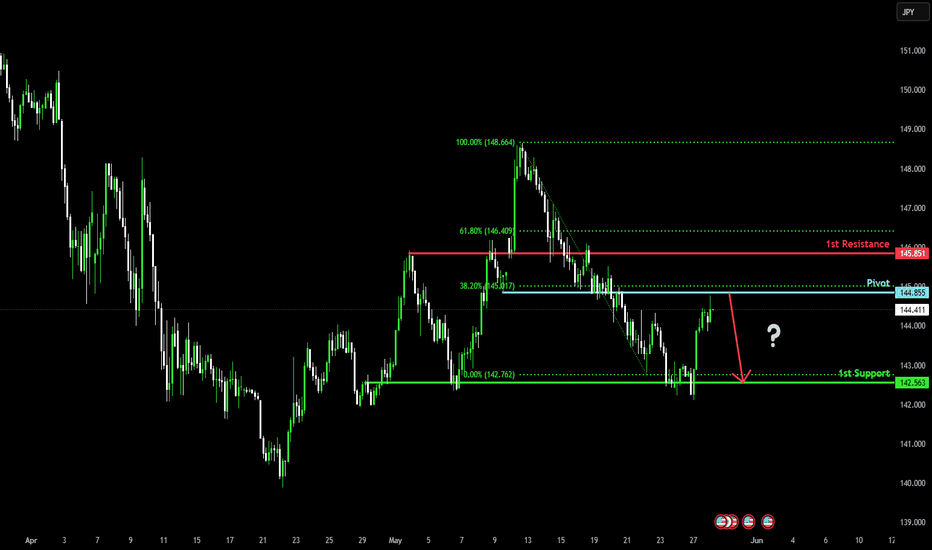

Could the price reverse from here?USD/JPY is rising towards the pivot, which has been identified as a pullback resistance and could reverse to the pullback support.

Pivot: 144.85

1st Support: 142.56

1st Resistance: 145.85

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

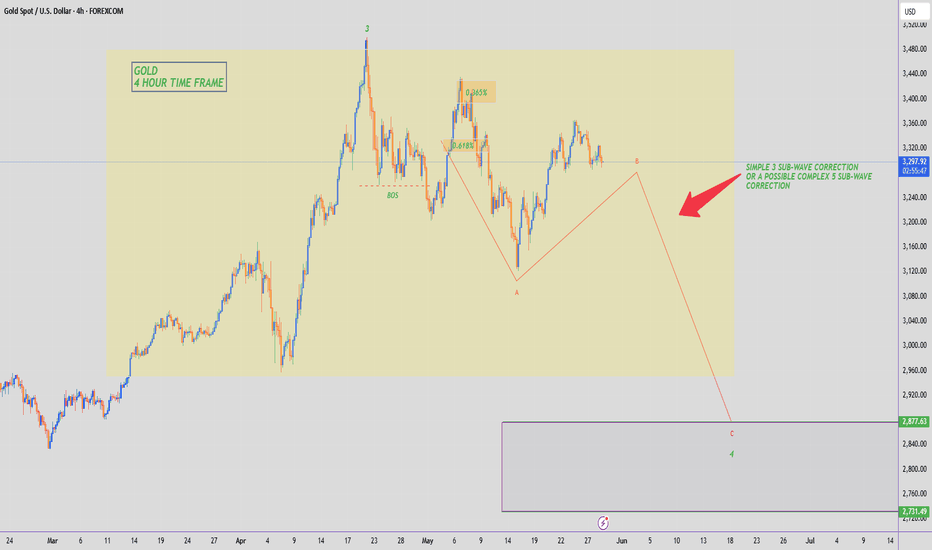

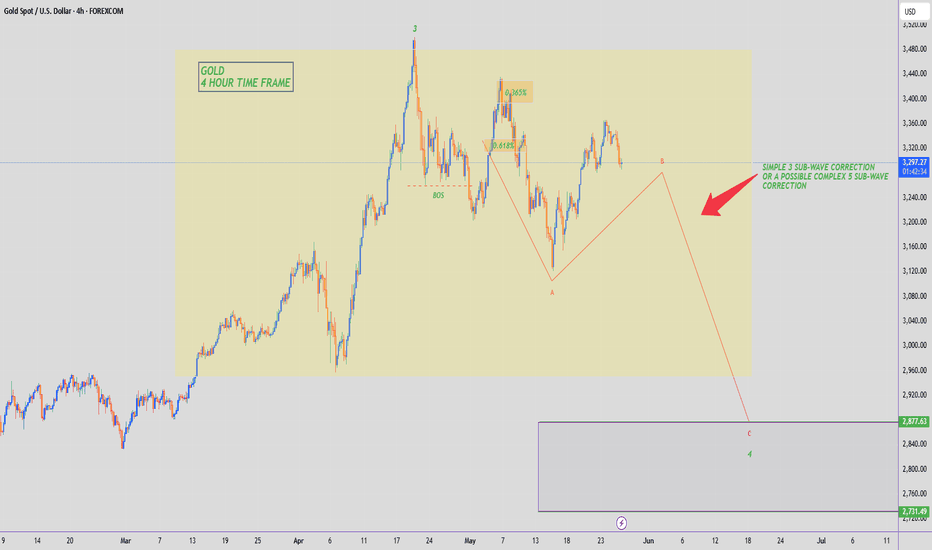

GOLD - WAVE 4 CORRECTION TO $2,800 (UPDATE)After hitting both of our buying targets of $3,274 & $3,318, Gold pushed a little higher than expected. But price came back down again & is following our sell bias very nicely!

With Wave B now supposedly complete, Wave C bearish momentum can now continue down. Gold has been extremely bearish since the start of this week.

USD/JPY key levels to watch after powerful rallyThe USD/JPY has rallied decisively today, aided by the shift in Japanese bond sentiment.

The pair has broken several short-term levels and moving averages. At the time of writing, it was trading bang in the middle of the 144.00 -144.80 resistance area, formerly support. We also have the 21-day exponential moving average residing here.

As things stand, the next key upside target for the USD/JPY is now positioned near the 145 mark. Should price approach or breach it, we might begin to see growing confidence among longer-term bulls.

On the downside, key support is seen around the 142.50 level. Bearish below towards 140.00 next.

By Fawad Razaqzada, market analyst with FOREX.com

USDJPY: 300+ Pips From Previous Idea, What Hold Next? Hey Everyone

USDJPY is on a roll! It’s rebounded a whopping 300+ pips and is now on the positive side. We reckon it’s going to keep climbing in the coming days as DXY is starting to regain its strength.

And here’s the cherry on top: there’s some exciting news coming up, including the NFP tomorrow. This could really boost the USDJPY to a new record high.

But remember, when trading, it’s crucial to manage your risk carefully.

Now, let’s talk about the potential for a significant market movement. We’ve spotted a chance for a substantial bullish swing that could reach around 2050 pips. We’ve also identified three potential targets, so you can choose the one that best fits your analysis.

The main driver behind this move is the reversal of the Japanese Yen (JPY) from a bullish trend to a bearish one. So, let’s be cautious and use precise risk management techniques during this period.

Good luck and happy trading! 😊

Oh, and if you’d like to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Thanks a bunch for your support! 😊

Cheers,

The Setupsfx_ Team