USDJPY Slightly Bearish Bias Today: Key Fundamental Drivers !Introduction

Today, USDJPY exhibits a slight bearish bias amid shifting fundamental factors and evolving market conditions. The yen’s appeal as a safe-haven currency and recent developments in the US economy are shaping USDJPY’s direction. In this article, we’ll analyze the main drivers that contribute to this bearish outlook for USDJPY and highlight what traders should watch in today’s forex market.

---

Key Drivers of the Bearish Bias in USDJPY

1. Weakening US Dollar on Mixed Economic Data

The US dollar has recently shown signs of softening, driven by mixed economic reports. Data from the past week, including non-farm payrolls and the ISM Manufacturing PMI, indicated a slowdown in US economic activity. This uncertainty around US growth is weakening the dollar’s position against safe-haven currencies like the yen. A weaker USD generally supports a bearish outlook for USDJPY as traders adjust their positions based on changing expectations for the Federal Reserve's policy direction.

2. Dovish Signals from the Federal Reserve

Recent signals from the Federal Reserve suggest that it may be nearing the end of its rate-hiking cycle, with a possible pivot in sight for 2025. The Fed’s cautious stance has dampened expectations for further rate increases, which reduces demand for the USD. This dovish shift makes the dollar less attractive, especially when paired against the yen, a currency that typically benefits from safe-haven demand. The reduced rate differential between the US and Japan lends further support to a bearish USDJPY outlook.

3. Bank of Japan’s Monetary Policy Adjustments

The Bank of Japan (BOJ) has recently hinted at making adjustments to its ultra-loose monetary policy, indicating a slow but potential shift toward normalization. Although the BOJ has maintained a dovish stance overall, any sign of policy tightening is significant for USDJPY. Market participants are speculating on a gradual shift, which could increase the yen’s appeal relative to the dollar, contributing to the current bearish bias for USDJPY.

4. Global Risk Sentiment and Safe-Haven Demand for Yen

The yen’s safe-haven status provides it with support in times of risk aversion, and today’s market sentiment reflects a cautious tone. Geopolitical tensions and economic uncertainty in other major markets are heightening safe-haven demand. As investors seek safety, the yen becomes more attractive, leading to bearish pressure on USDJPY as funds flow into Japan’s currency.

5. US-Japan Yield Spread Narrowing

One important factor influencing USDJPY is the yield differential between US Treasuries and Japanese government bonds (JGBs). Recently, the gap has begun to narrow, as US Treasury yields decline amid expectations of a more dovish Fed, while Japanese yields remain steady or inch slightly higher. A narrower yield spread weakens the case for holding USD over JPY, adding weight to a bearish USDJPY outlook.

---

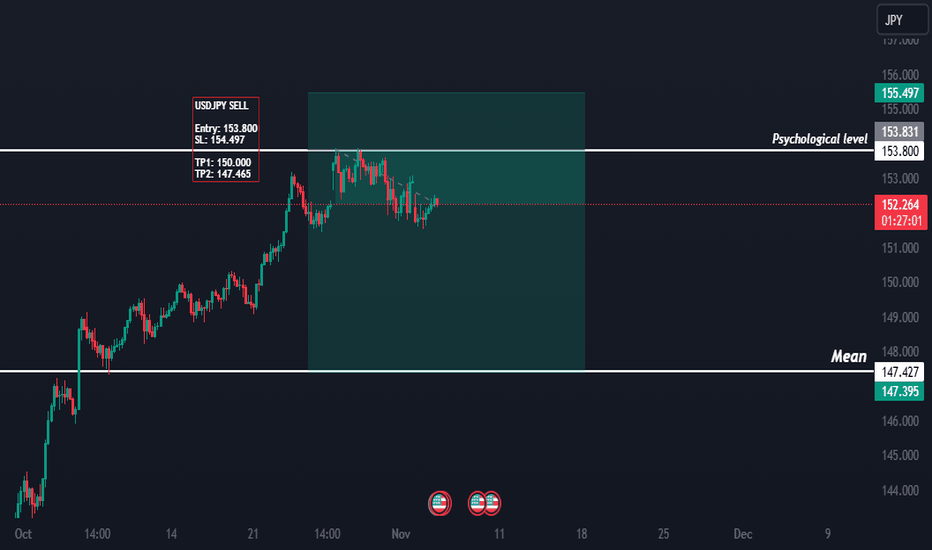

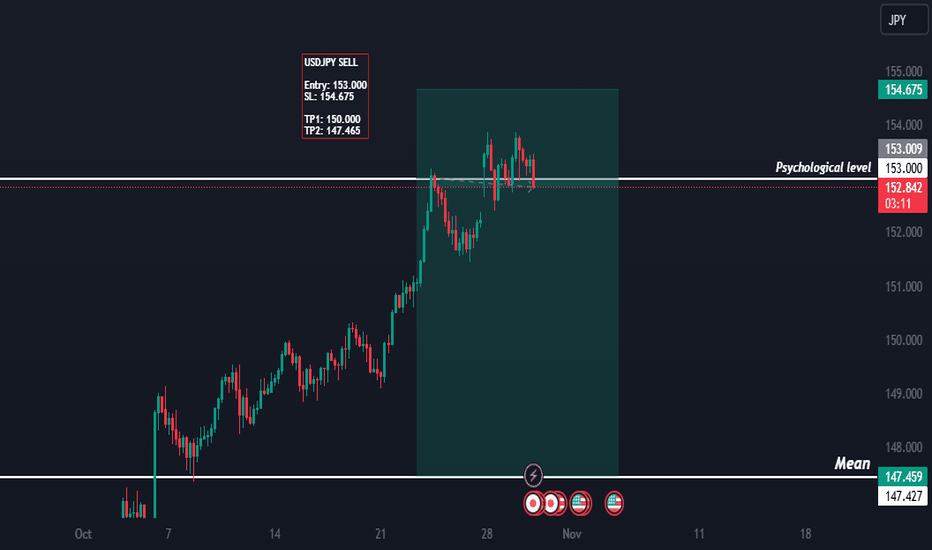

Technical Analysis of USDJPY

Technically, USDJPY appears to be trading near resistance levels, suggesting potential for a pullback. The pair’s price action is testing support around the 148.50 mark, a critical level that could dictate near-term momentum. Should bearish sentiment intensify, traders could look for downside targets near 148.00 or lower. Conversely, any break above resistance near 149.50 could challenge the bearish bias, although today’s fundamentals lean towards a slightly bearish trend.

---

Conclusion

In summary, today’s bearish bias in USDJPY is driven by a combination of US dollar weakness, potential adjustments from the BOJ, safe-haven demand for the yen, and a narrowing yield differential. As these factors continue to play out, USDJPY may face further downside pressure unless there is a significant shift in either US or Japanese economic policy. Traders should keep a close watch on upcoming US data releases and any new BOJ policy commentary, as these events could shape the pair’s movement in the near term.

---

SEO Tags:

#USDJPYAnalysis

#USDJPYForecast

#USDJPYToday

#USDJPYFundamentalAnalysis

#USDollarYenOutlook

#BankofJapanPolicy

#ForexMarketUpdate

#TradingUSDJPY

#USDJPYBearishBias

Usdjpybearishbias

USDJPY Daily Analysis: A Slight Bearish Bias Expected!!Introduction

Today’s analysis of the USDJPY pair suggests a potential for slight bearish movement. Key fundamental factors, including recent US and Japanese economic data and central bank positions, seem to favor a downside bias. Let’s examine these drivers in detail to provide a comprehensive view for traders and investors monitoring the USDJPY.

1. Federal Reserve’s Dovish Tone

The US Federal Reserve’s latest communication indicates a cautious approach, with market participants widely expecting the Fed to maintain its current interest rate. This dovish tone, coupled with moderating US economic data, could weaken the US Dollar. If the Fed holds rates or hints at potential rate cuts in 2024, this could weigh on the USD, providing room for JPY strength against the Dollar. Consequently, the market’s perception of a less aggressive Fed policy may contribute to the USDJPY pair’s bearish bias today.

2. Bank of Japan’s Evolving Stance

The Bank of Japan (BoJ) has recently shown signs of potentially moving away from its ultra-loose policy stance. Governor Kazuo Ueda’s comments have signaled a potential shift in monetary policy, raising speculation around adjustments in yield control measures. Any further tightening of Japanese yields or gradual normalization signals may strengthen the JPY as Japanese bond yields rise, attracting capital inflows. This shift, however gradual, could support a stronger JPY, thereby pressuring USDJPY downward.

3. Japanese Economic Resilience

Japan’s economy has recently demonstrated steady resilience, with improved inflation data aligning closer to the BoJ’s targets. Stronger-than-expected inflation readings and positive manufacturing activity lend support to the JPY. The BoJ’s confidence in these indicators may reinforce market sentiment that Japan is on a steady path to growth. Consequently, with USD expected to remain relatively soft, this positions the JPY more favorably in the USDJPY pair, reinforcing today’s bearish outlook.

4. Risk Sentiment and Safe-Haven Flows

In today’s mixed risk sentiment environment, safe-haven assets like the JPY often become more attractive. Investors may favor the JPY in times of global economic uncertainty or as geopolitical events unfold. As the US Dollar is pressured by softer economic indicators, the JPY’s safe-haven appeal may drive demand, contributing to USDJPY’s bearish tendency today.

Conclusion

In conclusion, the USDJPY pair shows potential for a slight bearish bias today due to the Fed’s cautious stance, the BoJ’s gradual policy evolution, resilient Japanese economic data, and safe-haven flows favoring the JPY. Traders may find it beneficial to watch these fundamental factors closely, as they provide critical insights into USDJPY’s likely direction.

Keywords:

#USDJPYanalysis,

#USDollar,

#JapaneseYen,

#USDJPYbearishbias,

#ForextradingNovember12024,

#FederalReservepolicy,

#Bankof Japanstance,

#JPYstrength,

#Safehavencurrency,

#Forextechnicalanalysis,

#Japaneseinflationdata,

#Forextradinginsights.

USDJPY Analysis: Potential Bearish Bias for October 30, 2024Find out what’s driving a potential bearish trend for USDJPY today. Explore the latest analysis of USDJPY with insights on central bank policies, risk sentiment, and technical trends that could impact this popular currency pair.

---

Introduction

Today, October 30, 2024, USDJPY may lean slightly bearish as a confluence of economic and fundamental factors unfolds in favor of the Japanese yen (JPY) over the U.S. dollar (USD). This article analyzes the forces potentially influencing a decline in USDJPY, including central bank actions, the latest market sentiment, and key technical indicators. This analysis is essential for traders seeking insights into the short-term trajectory of USDJPY.

Current Market Sentiment and Risk Aversion

USDJPY typically reflects shifts in global risk sentiment, with the Japanese yen often viewed as a safe-haven currency. Recent signs of global economic caution have led to a “risk-off” sentiment, benefiting the JPY as investors look to reduce exposure to riskier assets. Additionally, concerns over U.S. economic stability have cast a shadow over the dollar, potentially encouraging a mild bearish tilt in USDJPY.

Key Drivers Influencing USDJPY

1. Bank of Japan’s Policy and Yield Curve Control

The Bank of Japan (BoJ) has remained consistent with its ultra-loose monetary policy, particularly its yield curve control (YCC) measures. However, with recent statements indicating potential tweaks to long-term interest rates, there is speculation that the BoJ may be open to slight policy adjustments to control inflation. A BoJ with even minor adjustments on the table could create downward pressure on USDJPY as expectations build for a stronger yen.

2. U.S. Federal Reserve’s Monetary Policy Outlook

The U.S. Federal Reserve’s approach remains a major influence on USDJPY. As markets anticipate that the Fed might pause or slow down its rate hike trajectory due to signs of slowing growth, this uncertainty around rate increases could dampen USD demand, thereby adding to USDJPY’s potential bearish bias. Any U.S. economic data releases today, such as inflation or consumer confidence indicators, could further impact USDJPY if they reflect economic cooling.

3. Risk Aversion and Safe-Haven Flows

Growing risk aversion in the global markets favors the Japanese yen, as it traditionally acts as a safe-haven currency during uncertain times. With geopolitical tensions and financial market uncertainty persisting, demand for the yen could increase, putting downward pressure on USDJPY. Investors often turn to the yen in times of volatility, and today’s market conditions support that trend.

4. Economic Data from Japan and U.S.

Economic data out of Japan has shown moderate improvement, suggesting the potential for a slightly stronger yen. Japan’s latest industrial output and consumer spending figures indicate resilience, adding support to the yen. Conversely, any soft U.S. economic data today could reduce USD appeal, enhancing a bearish bias for USDJPY.

Technical Overview

On the technical side, USDJPY is trading near key resistance levels, and a downward break could signal further declines. With momentum indicators such as the RSI showing overbought conditions, traders might see bearish opportunities if USDJPY breaks below the 20-day moving average. A drop below key support levels could further confirm a short-term bearish outlook for the pair.

Conclusion

The USDJPY outlook for today points to a slight bearish bias, fueled by risk aversion, potential policy tweaks from the BoJ, and moderate U.S. dollar weakness in the face of Fed uncertainty. While there are several factors at play, traders should monitor any significant data releases that could shift sentiment and impact the USDJPY trend.

This analysis is essential for traders focused on USDJPY’s short-term fluctuations amid shifting economic indicators and market sentiment.

---

SEO Keywords:

USDJPY analysis,

USDJPY today,

Japanese yen forecast,

USDJPY bearish bias,

Bank of Japan policy,

Federal Reserve outlook,

USDJPY risk sentiment,

forex trading USDJPY,

USDJPY technical analysis,

USDJPY trend.

USDJPY Analysis: Anticipating a Slight Bearish Bias for Next WeeUSDJPY Analysis: Anticipating a Slight Bearish Bias for Next Week

Date: 28/09/2024

As we look ahead to the coming week for the USDJPY currency pair, a slight bearish bias seems likely based on the latest fundamental factors and market conditions. Several key drivers contribute to this outlook, and in this article, we'll explore the factors that may weigh on the USDJPY pair, creating potential opportunities for traders.

1. Dovish Signals from the Federal Reserve

One of the primary drivers for USDJPY's potential bearish bias next week is the recent dovish shift in the Federal Reserve's tone. While the Fed has maintained a firm stance on keeping interest rates elevated to curb inflation, recent economic data in the U.S. suggest that inflationary pressures may be easing. If the Fed signals a slower pace of tightening or hints at rate cuts in the future, this could weaken the U.S. dollar, pushing the USDJPY lower.

The key phrase here is "inflation slowdown," as this could be the primary focus in upcoming economic releases. Traders should keep a close eye on any updates from Federal Reserve Chair Jerome Powell and other policymakers, as dovish commentary could lead to further USD weakness.

2. Japan's Central Bank Policy

On the other side of the coin, the Bank of Japan (BoJ) continues its ultra-loose monetary policy. While the BoJ has resisted raising interest rates, there have been increasing discussions around tweaking its yield curve control (YCC) program. If the BoJ surprises markets by adjusting its policy, this could provide a boost to the Japanese yen, exerting downward pressure on USDJPY.

The BoJ's governor, Kazuo Ueda, has emphasized that they will remain accommodative, but with inflation in Japan beginning to rise, markets may start to price in a more hawkish BoJ in the near future.

3. U.S. Economic Data and Dollar Sentiment

U.S. data releases, including the upcoming non-farm payrolls (NFP) report and the core PCE (Personal Consumption Expenditures) index, will be crucial in shaping the USDJPY trend next week. A weak NFP or lower-than-expected PCE inflation figures could weigh on the U.S. dollar, contributing to a bearish outlook for USDJPY.

Additionally, geopolitical tensions or unexpected developments in global markets could drive safe-haven demand for the yen, pushing USDJPY lower. With risk-off sentiment growing due to uncertainties in global markets, the yen may see inflows as investors seek safety.

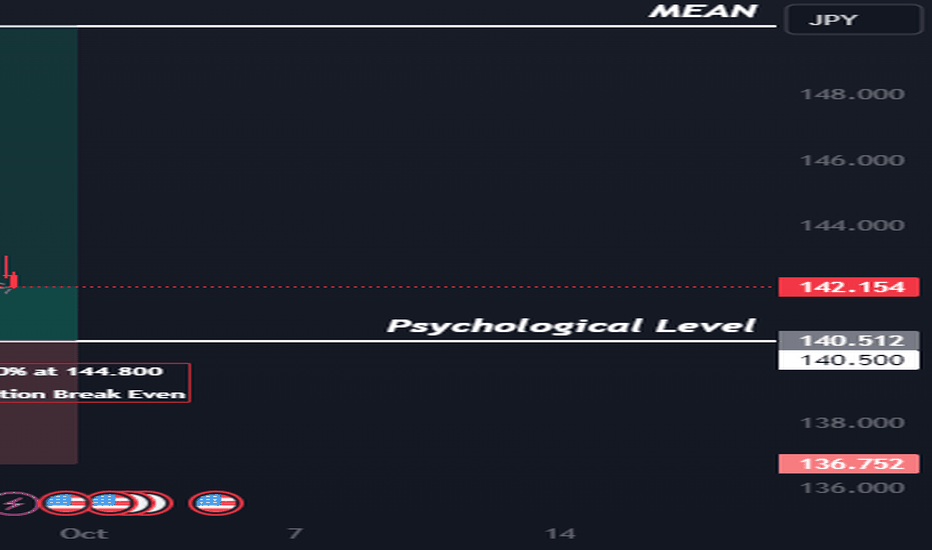

4. Technical Analysis

From a technical perspective, USDJPY has been hovering near key resistance levels, and the pair’s inability to break higher could signal a pullback. If USDJPY fails to hold above the 149.00 level, it could retrace toward the 147.50 and 146.00 support areas. Short-term momentum indicators, such as the RSI (Relative Strength Index), are showing signs of overbought conditions, further supporting the potential for a corrective move lower.

Conclusion

In summary, the USDJPY currency pair could experience a slightly bearish bias next week, driven by dovish signals from the Federal Reserve, potential shifts in Japan’s monetary policy, and weaker U.S. economic data. Traders should remain vigilant about key data releases, Fed speeches, and any surprises from the Bank of Japan. As always, proper risk management is crucial when navigating currency markets.

Stay tuned for more updates on USDJPY and other forex pairs. As we enter a potentially volatile week, it's essential to monitor these key drivers and make informed trading decisions.

Keywords: USDJPY analysis, Federal Reserve policy, Bank of Japan, USDJPY bearish bias, forex trading, USDJPY technical analysis, USDJPY forecast, U.S. economic data, dovish Fed signals, forex trading signals, tradingview analysis