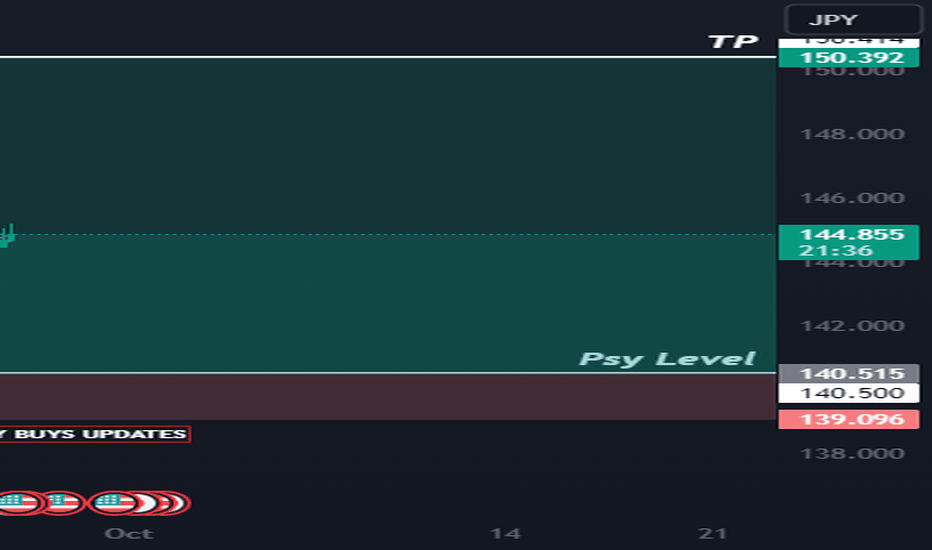

Slight Bullish Bias Driven by Key Fundamentals on USDJPY.USDJPY Analysis for 04/10/2024: Slight Bullish Bias Driven by Key Fundamentals

On October 4, 2024, the USDJPY currency pair displayed a slight bullish bias, influenced by several fundamental factors and market conditions. These elements provided upward momentum for the pair, making it an attractive opportunity for traders. Below is an in-depth analysis of the key drivers that shaped the bullish sentiment in USDJPY:

1. Strong US Dollar Momentum

The primary factor behind the bullish bias in USDJPY on October 4, 2024, was the ongoing strength of the US dollar. The release of positive U.S. economic data, particularly strong non-farm payrolls and robust manufacturing data, bolstered investor confidence in the U.S. economy. This economic resilience reaffirmed expectations that the Federal Reserve would maintain its hawkish stance on interest rates, potentially keeping rates elevated for a longer period.

As a result, the USD gained strength across the board, driving USDJPY higher as traders moved into dollar-denominated assets. The higher yields offered by U.S. assets compared to Japanese assets provided additional support for the dollar, causing upward pressure on the pair.

2. Diverging Central Bank Policies

The monetary policy divergence between the Federal Reserve and the Bank of Japan (BoJ) continues to be a significant driver of the USDJPY pair. While the Federal Reserve remains committed to its tightening cycle to combat inflation, the BoJ has maintained its ultra-loose monetary policy. The BoJ’s reluctance to shift away from its low interest rate environment has kept the Japanese yen under pressure, creating a favorable environment for a bullish USDJPY bias.

Investors are increasingly focused on the Fed's hawkish stance, especially as the BoJ remains committed to keeping yields low, which has created a significant interest rate differential between the U.S. and Japan. This yield differential is a core reason why USDJPY is supported at higher levels, as traders are incentivized to seek higher returns in USD-denominated assets.

3. Rising U.S. Treasury Yields

Another key factor supporting the bullish bias in USDJPY on October 4, 2024, was the rise in U.S. Treasury yields. With the Fed’s monetary tightening policy expected to continue, yields on longer-term U.S. Treasuries increased, making U.S. bonds more attractive to global investors. Higher yields provide better returns for holding USD assets, further boosting the demand for dollars.

In contrast, Japanese yields remain suppressed due to the BoJ's yield curve control policy, which keeps interest rates near zero. This divergence in bond yields between the U.S. and Japan continues to make the yen less appealing compared to the dollar, adding to the bullish momentum in USDJPY.

4. Safe-Haven Demand Shift

Traditionally, the Japanese yen is considered a safe-haven currency, attracting demand during times of global uncertainty. However, on October 4, 2024, the risk sentiment in global markets was relatively stable, with investors favoring the U.S. dollar as the dominant safe-haven currency. This shift in safe-haven demand towards the USD rather than the yen has supported the bullish bias in USDJPY.

With no major geopolitical risks materializing and the U.S. economy showing signs of strength, investors found the USD a more attractive safe-haven asset, further driving up USDJPY as risk aversion eased.

Conclusion: USDJPY Outlook

The combination of a strong U.S. dollar, monetary policy divergence, rising U.S. Treasury yields, and a shift in safe-haven demand contributed to the slightly bullish bias in USDJPY on 04/10/2024. As long as the BoJ maintains its accommodative stance and the Federal Reserve continues with its tightening cycle, USDJPY could remain on an upward trajectory.

Traders should continue to monitor both U.S. economic data and BoJ policy announcements, as these will play a crucial role in shaping the future direction of the pair. A continued rise in U.S. yields, along with solid U.S. economic growth, may further support the bullish bias, while any signs of policy changes from the BoJ could lead to increased volatility in USDJPY.

Keywords for SEO:

- USDJPY analysis

- USDJPY bullish bias

- USDJPY forecast

- Federal Reserve interest rates

- US Dollar strength

- Bank of Japan policy

- USDJPY technical analysis

- U.S. Treasury yields impact

- Diverging central bank policies

- Trading USDJPY

- Safe-haven currency shift

- USDJPY daily update

- USDJPY bullish outlook

Usdjpybullishbias

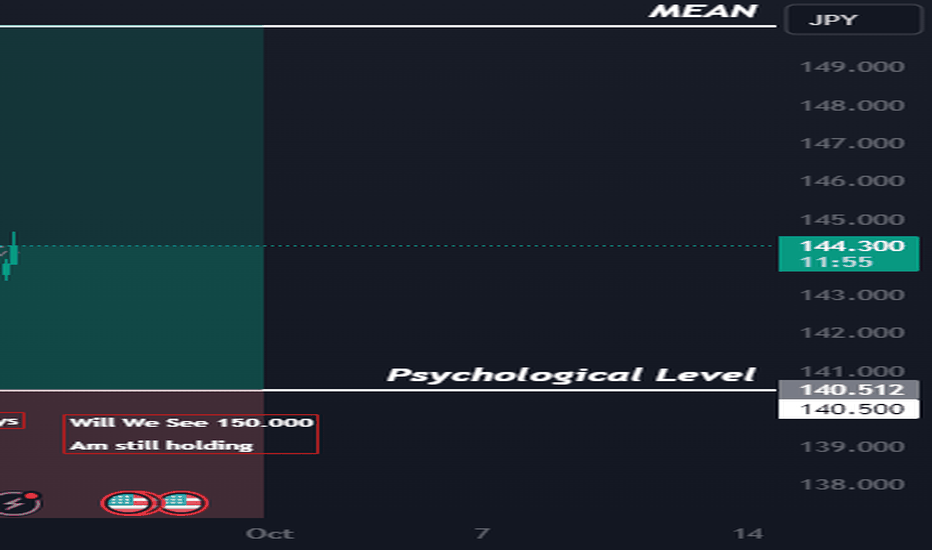

USDJPY Analysis for 03/10/2024: Anticipating a Slightly Bullish.As of October 3, 2024, the USDJPY currency pair is exhibiting signs of a slightly bullish bias. Several fundamental factors and market conditions are aligning to support this outlook. Traders focusing on USDJPY today should be aware of key drivers influencing this potential movement.

Key Drivers for USDJPY Bullish Bias

1. US Dollar Strength

- The U.S. dollar is maintaining its strength amid ongoing Federal Reserve hawkishness. Recent speeches from Fed officials have reinforced the possibility of additional interest rate hikes, which supports the USD. Higher U.S. interest rates typically attract foreign investment, leading to increased demand for the dollar.

- Today, expectations of economic resilience in the U.S. are high, with upcoming non-farm payrolls and inflation data later in the week likely to cement this bullish outlook.

2. Divergence in Central Bank Policies

- The Federal Reserve’s stance is increasingly at odds with the Bank of Japan (BoJ), which remains committed to ultra-loose monetary policies. The BoJ continues to support its yield curve control program, making the yen less attractive for investors. As the U.S. tightens, the BoJ’s dovish position could lead to further depreciation of the yen, supporting a bullish USDJPY trend.

- Today’s market sentiment reflects this divergence, as traders expect the BoJ to stay accommodative while the U.S. dollar benefits from higher yields.

3. Treasury Yields on the Rise

- U.S. Treasury yields, especially the 10-year note, have been climbing. Higher yields are a crucial indicator of rising demand for the dollar. As bond yields rise, so does the attractiveness of U.S. assets, drawing capital away from yen-denominated assets.

- With Treasury yields set to increase, USDJPY is likely to follow a bullish trajectory today, as investors seek better returns from U.S. bonds.

4. Risk-On Sentiment

- Today’s global risk sentiment is relatively optimistic, which traditionally favors higher-yielding currencies like the USD over the safe-haven yen. Equity markets have seen gains, and positive sentiment around U.S. economic data could continue to support risk-on trades, driving USDJPY higher.

Technical Factors Supporting Bullish Bias

- Support and Resistance Levels: Currently, USDJPY is trading near key support levels around 149.00. A successful hold above this zone could encourage a bullish push towards the 150.00 psychological level. Breaking through this level could lead to further upward momentum, strengthening the pair's bullish bias.

- Moving Averages: On the daily chart, USDJPY remains above both the 50-day and 200-day moving averages, indicating a well-established uptrend.

Conclusion: USDJPY Slightly Bullish Bias for 03/10/2024

In conclusion, the USDJPY pair is expected to maintain a slightly bullish bias today, supported by strong U.S. dollar fundamentals, central bank divergence, rising U.S. Treasury yields, and favorable market sentiment. Traders should watch for key levels of resistance and monitor U.S. data releases later this week, which could provide additional bullish momentum for the pair.

This analysis reflects the latest fundamental factors and market conditions for USDJPY on October 3, 2024, offering insights for traders seeking to capitalize on today's potential bullish movement.

Keywords for SEO: USDJPY analysis, USDJPY forecast, USDJPY trading, USDJPY bullish bias, U.S. dollar strength, Bank of Japan monetary policy, Federal Reserve interest rates, U.S. Treasury yields, Forex market analysis, USDJPY 03/10/2024, TradingView analysis.

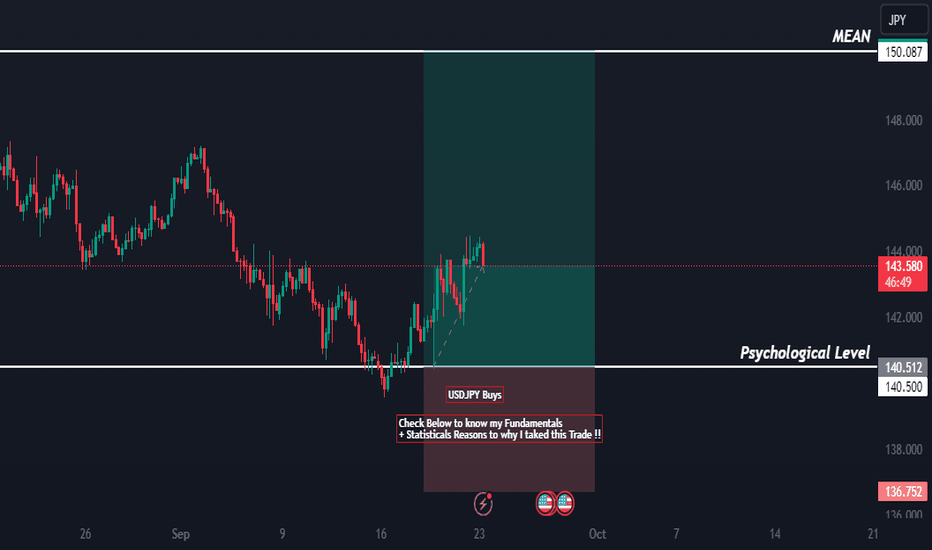

USDJPY Analysis: Slightly Bullish Bias on 02/10/2024. As we head into the 2nd of October 2024, the USDJPY currency pair shows signs of a slightly bullish bias. Several key factors, including fundamental drivers and technical market conditions, support this outlook. Traders and investors looking for insights into the pair should consider the following factors influencing USDJPY today.

1. US Dollar Strength

The US dollar has been supported by strong economic data coming out of the US, especially with the continued resilience in the labor market. The Non-Farm Payroll (NFP) report scheduled later this week is anticipated to reflect strong employment trends, which may lead to speculation that the Federal Reserve could maintain its hawkish stance on interest rates. This has kept the USD well-supported across the board, and USDJPY is no exception. Higher interest rate expectations typically benefit the USD, making it more attractive to investors seeking yield.

2. Bank of Japan’s Monetary Policy

On the other side, the Bank of Japan (BoJ) remains committed to its ultra-loose monetary policy. With inflation in Japan still struggling to gain significant traction, the BoJ is unlikely to shift its dovish stance in the near term. The interest rate differential between the US and Japan continues to widen, favoring USDJPY bulls. This divergence in policy is one of the major contributors to the bullish sentiment in the pair.

3. Risk Sentiment and Safe-Haven Demand

Global risk sentiment has improved slightly, leading to reduced demand for safe-haven assets such as the Japanese yen. The yen typically strengthens in times of market uncertainty, but with equities stabilizing and geopolitical tensions easing, there’s less of a need for safe-haven assets today. This reduces demand for the yen and lends support to USDJPY’s bullish outlook.

4. Technicals Pointing to Upside

From a technical perspective, USDJPY has broken above key resistance levels in recent sessions. The pair is trading above its 50-day and 100-day moving averages, signaling strong upward momentum. Additionally, the RSI (Relative Strength Index) remains in neutral territory, allowing room for further upside without signaling overbought conditions. If USDJPY can hold above the 149.00 psychological level, further gains toward the 150.00 mark are possible.

5. Upcoming Economic Events

While no major Japanese economic releases are expected today, traders should keep an eye on US data releases, particularly any statements from Federal Reserve officials. Any hawkish commentary could further fuel USDJPY’s bullish trajectory.

Conclusion

In summary, the fundamental and technical factors point toward a slightly bullish bias for USDJPY on 02/10/2024. The ongoing divergence between the Federal Reserve’s hawkish stance and the BoJ’s dovish policy, coupled with solid US economic data and improving risk sentiment, supports this outlook. Traders should remain mindful of any new developments in the US that could further impact the pair’s direction.

Keywords for SEO Optimization:

USDJPY analysis, USDJPY forecast, USDJPY bullish bias, US dollar strength, Bank of Japan monetary policy, BoJ, Federal Reserve interest rates, USDJPY technical analysis, USDJPY 02/10/2024, forex trading, USDJPY tradingview analysis, forex market outlook, USDJPY fundamental factors, US economic data impact on USDJPY, USDJPY price prediction.

This article provides a comprehensive overview of the potential USDJPY movement today, offering valuable insights for forex traders looking to capitalize on the pair’s slightly bullish bias.

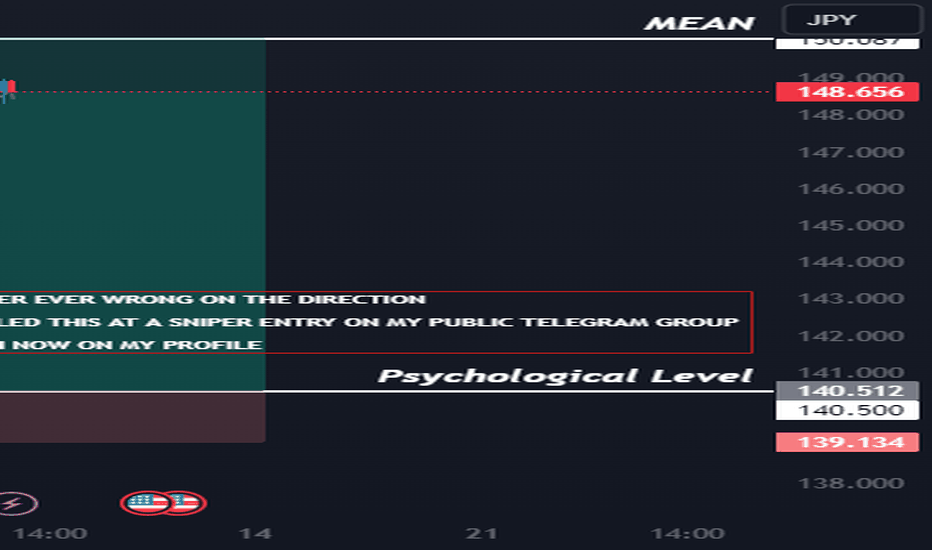

USDJPY weekly analysis: AM NEVER WRONG IN THE DIRECTION EVER !!USDJPY Weekly Analysis (27/09/2024): Slightly Bullish Bias Ahead

As we approach the end of September 2024, USDJPY has shown signs of a potential bullish bias for the upcoming week. Traders and investors are closely monitoring the latest fundamental factors that could shape the pair's movement. In this article, we will provide a detailed analysis of USDJPY’s outlook, focusing on the driving factors, current market conditions, and why we expect a slightly bullish bias this week.

Key Fundamental Drivers Behind the USDJPY Bullish Outlook

1. Diverging Monetary Policies

One of the main reasons for the slightly bullish bias in USDJPY this week is the ongoing divergence between the monetary policies of the Federal Reserve (Fed) and the Bank of Japan (BoJ). The Fed has maintained its relatively hawkish stance, keeping interest rates elevated to combat inflation. In contrast, the BoJ continues its ultra-loose monetary policy, with little indication of tightening any time soon.

The widening interest rate differential between the U.S. and Japan is pushing investors towards the U.S. dollar, favoring the USDJPY pair. This dynamic is likely to continue in the coming days as the market digests recent central bank communications.

2. U.S. Economic Resilience

Recent U.S. economic data has exceeded expectations, reinforcing the bullish sentiment for the dollar. The U.S. GDP figures, released earlier this week, showed that the economy grew at a faster pace than anticipated, further solidifying the case for the Fed's tight policy stance. Additionally, strong job market data continues to support the idea of a resilient U.S. economy, boosting demand for the USD.

With these positive economic indicators, the U.S. dollar is expected to remain supported, potentially driving USDJPY higher.

3. Safe Haven Demand Easing

While the Japanese yen is traditionally considered a safe-haven currency, the recent stabilization in global financial markets has reduced the appeal of the yen as a risk-off asset. Investors are currently more willing to take on risk in search of higher yields, which benefits the U.S. dollar. The calm in global markets, combined with Japan’s low-interest environment, reduces the attractiveness of the yen, giving USDJPY a bullish tilt.

Current Market Conditions: USDJPY Technical Outlook

From a technical perspective, USDJPY is trading within a consolidation range, but recent price action hints at an upward breakout. The pair has held above the key 148.00 support level, with momentum indicators such as the Relative Strength Index (RSI) showing signs of strengthening bullish momentum.

If USDJPY breaks above the 149.00 resistance level this week, we could see further gains toward the psychological 150.00 level. However, traders should watch for any signs of overbought conditions, which could lead to short-term pullbacks.

Key Risks to Consider

While the fundamental and technical factors point to a slightly bullish bias, it is essential to be aware of potential risks that could derail this outlook:

- U.S. Government Shutdown: Ongoing discussions about a potential U.S. government shutdown could introduce market volatility. If the shutdown is prolonged, it could lead to risk-off sentiment, favoring the yen as a safe haven and weakening USDJPY.

- Geopolitical Developments: Any sudden escalation in geopolitical tensions could boost safe-haven demand for the yen, putting downward pressure on USDJPY.

Conclusion: Slight Bullish Bias for USDJPY this Week

Based on the latest fundamental drivers and current market conditions, USDJPY is expected to maintain a slightly bullish bias this week. The diverging monetary policies between the Fed and BoJ, coupled with strong U.S. economic data and easing safe-haven demand, are likely to keep the pair supported. However, traders should stay vigilant for potential risks that could affect the outlook.

Key Levels to Watch:

Support: 148.00

Resistance: 149.00 and 150.00

As always, manage risk carefully and stay updated on market developments throughout the week. Keep an eye on the U.S. government situation and any central bank announcements that could shift market sentiment.

For more updates and detailed analysis on USDJPY and other currency pairs, follow me on TradingView.

Keywords:

- USDJPY analysis

- USDJPY forecast 27/09/2024

- USDJPY weekly outlook

- USDJPY bullish bias

- USDJPY key levels

- USDJPY trading strategy

- USDJPY technical analysis

- USDJPY support and resistance

- Federal Reserve and USDJPY

- Bank of Japan impact on USDJPY

- USDJPY interest rate differential

- USDJPY trading signals

- USDJPY market conditions

- USDJPY forex analysis

- USDJPY price action

- USDJPY technical indicators

- USDJPY consolidation pattern

- USDJPY breakout levels

- USDJPY trade opportunities

- Forex trading USDJPY

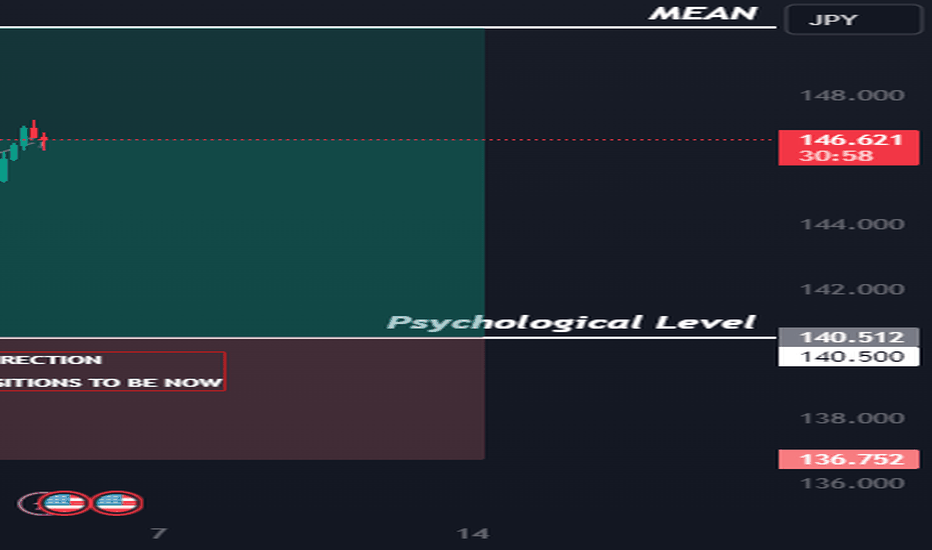

USDJPY Forecast: Slight Bullish Bias Expected on 26/09/2024Introduction

As we step into the trading session on 26/09/2024, the USDJPY currency pair shows signs of a potential slight bullish bias. This article delves into the latest fundamental factors and market conditions that are likely to drive the pair today. Key economic indicators and geopolitical events will be crucial for traders analyzing USDJPY. If you’re trading USDJPY today or simply following the forex market, this analysis will help you gauge the key factors influencing its movement.

Fundamental Drivers for USDJPY's Bullish Outlook

1. US Dollar Strength Supported by Fed’s Hawkish Tone

A major factor behind the USDJPY bullish sentiment today is the continued hawkish stance from the Federal Reserve. Following the FOMC meeting earlier this month, Fed Chair Jerome Powell reaffirmed that inflation is still a major concern, and interest rates will remain elevated for longer. This has boosted the US dollar’s value, making it attractive against the Japanese yen, which continues to suffer from the Bank of Japan’s ultra-loose monetary policy.

2. Diverging Monetary Policies

The Bank of Japan (BoJ) remains committed to its yield curve control program, keeping interest rates at near-zero levels. With no signs of the BoJ moving toward monetary tightening, the Japanese yen remains under pressure. On the contrary, US interest rates are already among the highest among major economies, pushing the USDJPY pair higher as investors seek better returns in US dollar-denominated assets.

3. US Treasury Yields Influence

The correlation between US Treasury yields and the USDJPY pair remains strong. As of 26/09/2024, the 10-year US Treasury yield has climbed further, supported by expectations of future rate hikes. This surge in bond yields bolsters demand for the USD, leading to upward momentum in USDJPY. Higher yields make US assets more attractive compared to Japan’s negative-yielding bonds, contributing to the bullish bias.

4. Safe Haven Demand Fading

Another factor favoring USDJPY bullishness today is the reduction in safe-haven demand for the yen. Global markets have seen reduced volatility, with no immediate geopolitical tensions or economic shocks driving traders into the yen as a safe haven. Investors are, therefore, more comfortable seeking higher returns in USD assets, adding upward pressure on the USDJPY pair.

5. US Economic Data Releases

Traders will also be closely watching today’s US economic data, including durable goods orders and the weekly initial jobless claims. Positive results in these data sets could provide further impetus for USD strength, reinforcing the bullish bias in USDJPY. On the Japanese side, the absence of significant economic releases today leaves the yen vulnerable to broader market forces.

Technical Analysis Supporting Bullish Sentiment

From a technical perspective, USDJPY is currently trading above key support levels, maintaining upward momentum. The pair is hovering near the psychological level of 150.00, and a breakout above this could further fuel bullish momentum. The RSI (Relative Strength Index) on the 4-hour chart is still in bullish territory, indicating buying pressure. Moreover, moving averages on both daily and 4-hour timeframes are supporting the bullish outlook for the day.

Conclusion

In summary, the USDJPY pair is showing a slight bullish bias as of 26/09/2024, driven primarily by strong US dollar fundamentals, higher Treasury yields, and continued divergence in monetary policies between the US and Japan. Traders should keep an eye on US economic data today, as positive results could propel the pair further upward. For forex traders, positioning for bullish moves in USDJPY could offer opportunities, with key resistance levels coming into focus.

---

Key SEO Keywords for Ranking:

USDJPY forecast, USDJPY bullish bias, USDJPY analysis 26/09/2024, US dollar vs Japanese yen, forex trading USDJPY, FOMC impact on USDJPY, US Treasury yields and USDJPY, trading USDJPY on 26/09/2024, BoJ monetary policy and USDJPY, USDJPY technical analysis today.

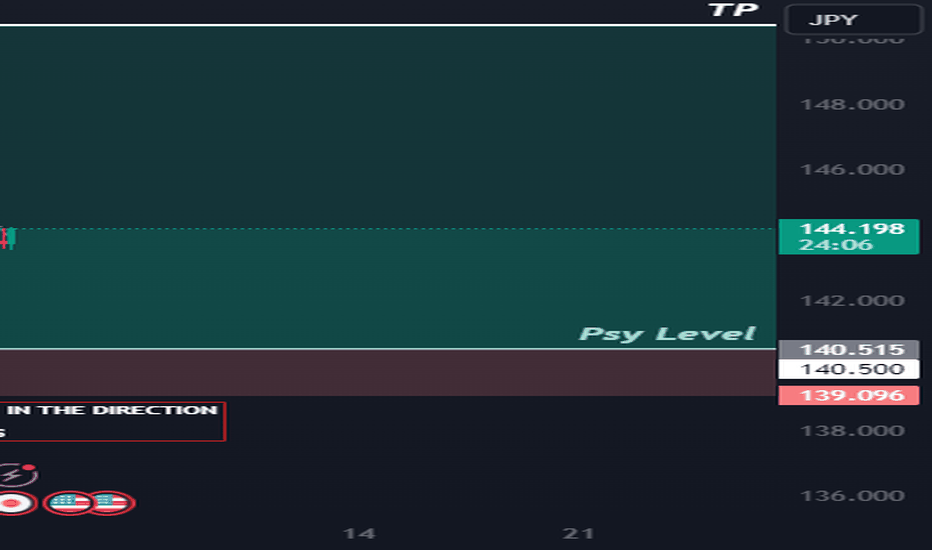

USDJPY Analysis for the Week of 24th September 2024: 150.000 !!The USDJPY pair has been a subject of interest in the forex market as it approaches a critical psychological level of 150.000. Traders are speculating whether the pair could reach this target given the current fundamental and technical landscape. In this article, we will analyze the potential for a slightly bullish bias for USDJPY this week, supported by key market drivers and macroeconomic factors.

Fundamental Drivers Supporting a Bullish Bias:

1. Federal Reserve's Hawkish Stance on Monetary Policy:

The Federal Reserve’s hawkish tone in recent weeks, reinforced by the latest Federal Open Market Committee (FOMC) meeting, suggests that further interest rate hikes are on the table. This has led to a strengthening of the U.S. dollar against major currencies, including the Japanese yen. With inflationary pressures still evident in the U.S. economy, the market is pricing in another rate hike before the end of the year. Higher interest rates increase the yield on U.S. assets, making them more attractive to global investors, which directly supports the USDJPY.

2. Bank of Japan's Ultra-loose Monetary Policy:

In contrast, the Bank of Japan (BoJ) continues to maintain an ultra-loose monetary policy stance, keeping its interest rates in negative territory. BoJ Governor Kazuo Ueda has reiterated that the bank will remain accommodative until inflation sustainably reaches its 2% target, which still seems distant. This divergence between U.S. and Japanese monetary policies is a major driver of the USDJPY bullish momentum, and it is expected to continue fueling the pair’s rise toward the 150.000 level.

3. Rising U.S. Treasury Yields:

U.S. Treasury yields have been rising steadily, with the 10-year yield nearing the 4.5% mark, its highest level in years. This surge is indicative of market expectations for prolonged high interest rates in the U.S., which adds further upward pressure on the dollar. Historically, higher U.S. Treasury yields have a direct correlation with USDJPY strength as global investors seek higher returns on their investments.

4. Geopolitical Uncertainty:

Geopolitical tensions in Eastern Europe and the Middle East are contributing to safe-haven flows into the U.S. dollar, adding to its bullish momentum. While the yen is also considered a safe-haven currency, the growing demand for the dollar due to the U.S. economy’s relative strength and higher yields is tipping the balance in favor of USDJPY bulls.

5. Japanese Intervention Risks:

As the USDJPY approaches the 150.000 level, market participants are wary of potential intervention by Japanese authorities to stem yen depreciation. However, recent remarks from Japanese officials suggest that intervention is not imminent unless volatility becomes disorderly. Until intervention threats materialize, the path of least resistance for USDJPY appears to be upward.

Technical Analysis:

On the technical front, USDJPY has been trading in a well-defined uptrend, with higher highs and higher lows forming on the daily chart. The pair is currently testing resistance near the 149.50-149.80 zone, with 150.000 acting as the next psychological target. A sustained break above 150.000 could pave the way for further gains, with potential resistance around 151.50 and 152.00.

Momentum indicators, such as the Relative Strength Index (RSI), are approaching overbought territory, suggesting that while the bullish trend is strong, there may be some short-term consolidation before a decisive move beyond 150.000. Nonetheless, dips are likely to be viewed as buying opportunities, with strong support seen around 148.50.

Conclusion:

Given the current fundamental and technical landscape, USDJPY is poised to maintain a slightly bullish bias this week. The combination of a hawkish Federal Reserve, a dovish Bank of Japan, rising U.S. Treasury yields, and geopolitical uncertainty supports further upside for the pair. While intervention risks may temper gains, a move toward and possibly beyond the 150.000 level seems achievable in the near term.

SEO Keywords:

USDJPY analysis

USDJPY forecast

USDJPY bullish bias

USDJPY 150.000 target

U.S. dollar strength

Federal Reserve interest rates

Bank of Japan policy

USDJPY technical analysis

USDJPY fundamental drivers

USDJPY September 2024 analysis

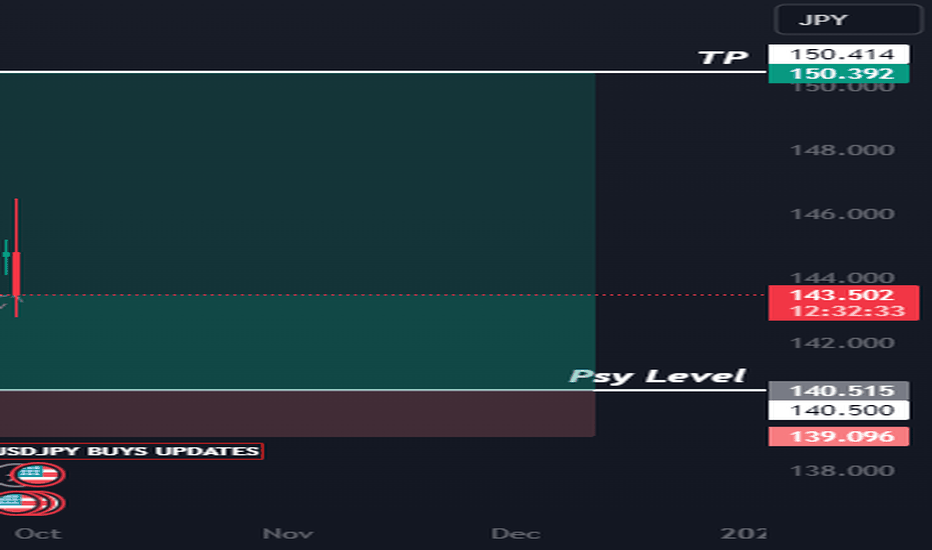

USDJPY Weekly Outlook: Slightly Bullish Bias – September 23,2024USDJPY Weekly Outlook: Slightly Bullish Bias – September 23, 2024

The USDJPY pair has been a focal point for traders, and as we enter the week of September 23, 2024, a slightly bullish bias seems to be developing. Several key factors suggest that the US Dollar (USD) could continue to edge higher against the Japanese Yen (JPY), driven by fundamental and technical market conditions. This article provides an in-depth analysis, highlighting critical elements affecting USDJPY this week.

Key Drivers Behind the Bullish Bias for USDJPY

1. Federal Reserve's Hawkish Stance

The primary driver for the USD strength is the Federal Reserve’s recent monetary policy stance. With the central bank signaling that interest rates could remain elevated for an extended period, the US Dollar has found solid support. Traders are pricing in the possibility that the Fed may hike rates again in the near future, which tends to strengthen the USD. Higher interest rates in the U.S. make the dollar more attractive to investors compared to the low-yielding Japanese Yen, which still sits in a negative interest rate environment.

2. BOJ's Ultra-Dovish Policy

The Bank of Japan (BOJ) continues to maintain its ultra-loose monetary policy, with no significant shifts expected in the near term. This dovish stance puts pressure on the Japanese Yen, especially as other central banks, including the Federal Reserve, are moving toward tighter monetary policies. The policy divergence between the Federal Reserve and the BOJ remains a significant factor driving USDJPY higher.

3. US Economic Strength

Recent U.S. economic data has shown resilience, with key indicators such as employment figures, retail sales, and inflation trends supporting the idea that the economy is in a solid position. This economic strength underpins the USD's upward trajectory. The robust economic outlook increases the likelihood of sustained monetary tightening by the Federal Reserve, further bolstering the USD.

4. Safe-Haven Flows Favoring USD Over JPY

While the Japanese Yen has traditionally been a safe-haven currency, the USD has increasingly taken on that role in times of global uncertainty. With ongoing geopolitical tensions and concerns about global economic growth, the USD has been more appealing to investors seeking safety, diminishing the Yen's haven status. This factor adds to the bullish momentum for USDJPY.

5. Technical Factors Supporting USDJPY

From a technical standpoint, USDJPY has been trading in a bullish channel, with higher highs and higher lows observed on the daily chart. Key support levels around 148.00 have held strong, providing a base for potential upside movement. On the upside, a break above the 149.50 resistance could trigger further gains, targeting the psychological level of 150.00.

Conclusion: USDJPY Slightly Bullish This Week

In conclusion, USDJPY is expected to exhibit a slightly bullish bias this week, primarily driven by the Federal Reserve’s hawkish stance, the BOJ’s dovish approach, and the relative strength of the US economy. Safe-haven flows are also favoring the USD over the Yen, while technical factors suggest room for further upside.

As we navigate the markets this week, traders should closely monitor central bank commentary, economic data releases, and geopolitical developments, as these will likely shape USDJPY’s trajectory in the coming days.

SEO Keywords:

USDJPY analysis, USDJPY forecast, USDJPY bullish bias, USDJPY September 23 2024, Federal Reserve USDJPY impact, BOJ monetary policy, USDJPY technical analysis, US dollar strength, USDJPY interest rate divergence, USDJPY safe-haven flows, USDJPY trading strategy.