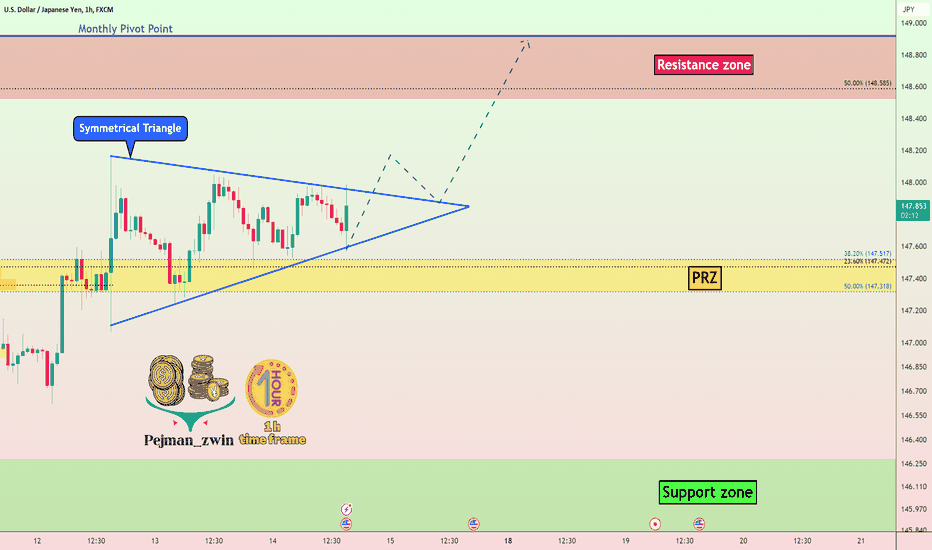

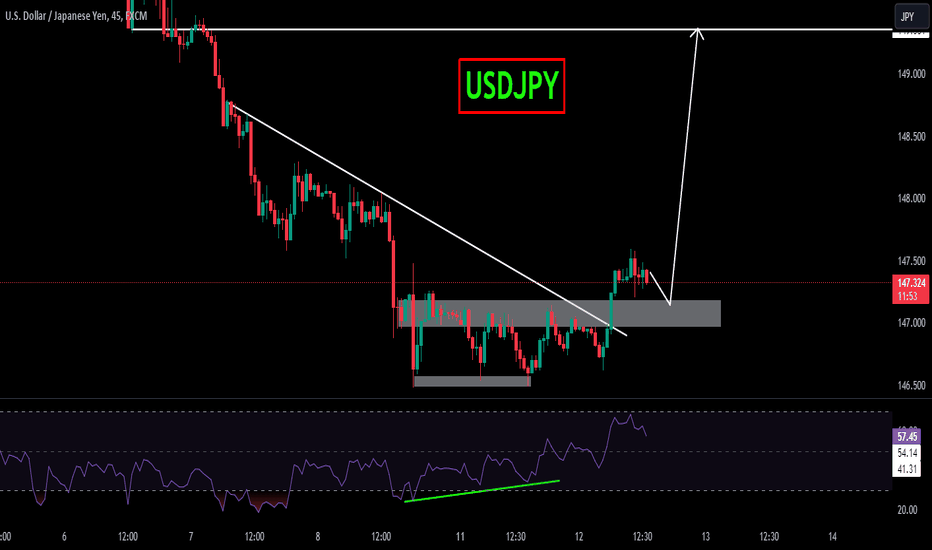

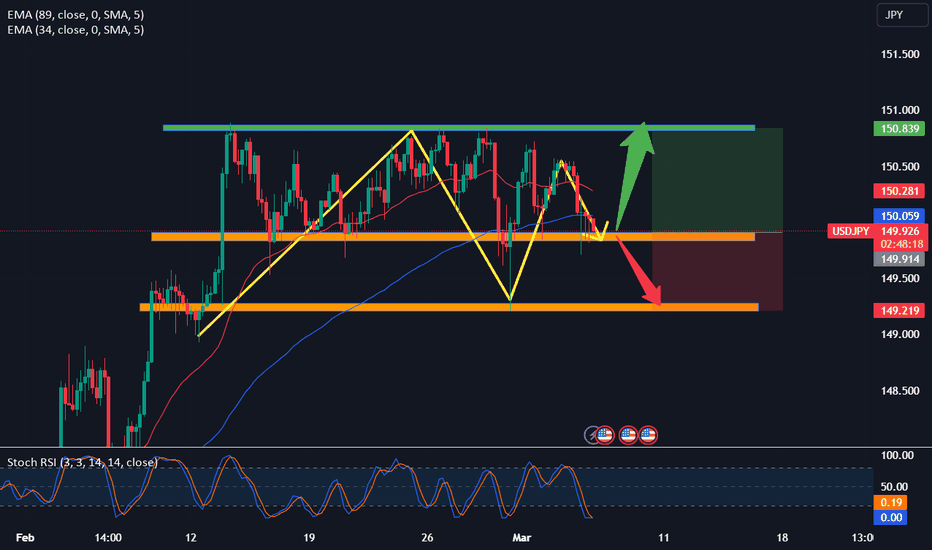

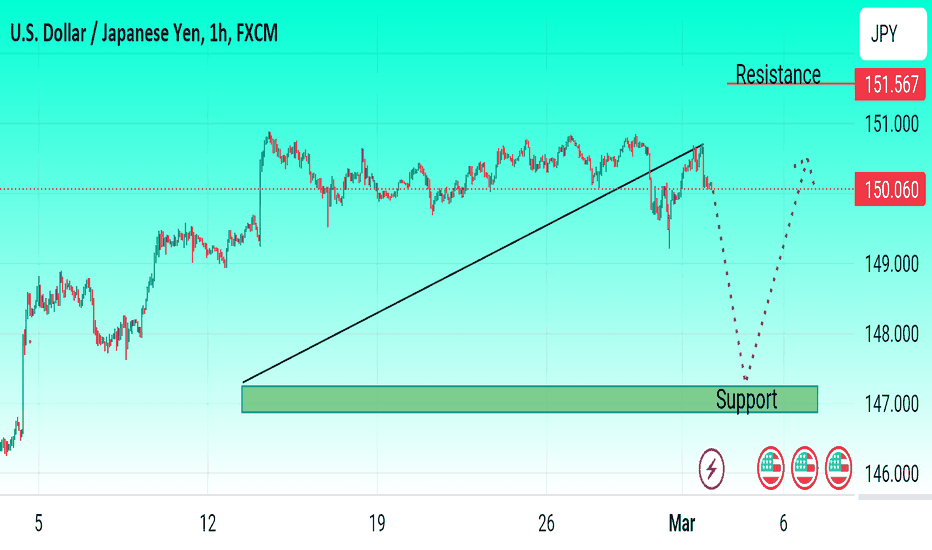

USDJPY is Ready to GO UP by Symmetrical Triangle Pattern🚀🏃♂️ USDJPY is moving near the 🟡 Potential Reversal Zone(PRZ)(147.520 JPY-147.318 JPY) 🟡.

✅It also seems that USDJPY has succeeded in forming a Symmetrical Triangle Pattern .

📚 What is a Symmetrical Triangle❗️❓

🔸 The symmetrical triangle, which can also be referred to as a coil, usually forms during a trend as a continuation pattern. The pattern contains at least two lower highs and two higher lows. When these points are connected, the lines converge as they are extended and the symmetrical triangle takes shape.

🔔I expect USDJPY to rise to at least the 🔴 Resistance zone(148.930 JPY-148.520 JPY) 🔴 after breaking the upper line of the triangle .

U.S.Dollar/Japanese Yen Analyze ( USDJPY ), 1-hour time frame⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Usdjpylong

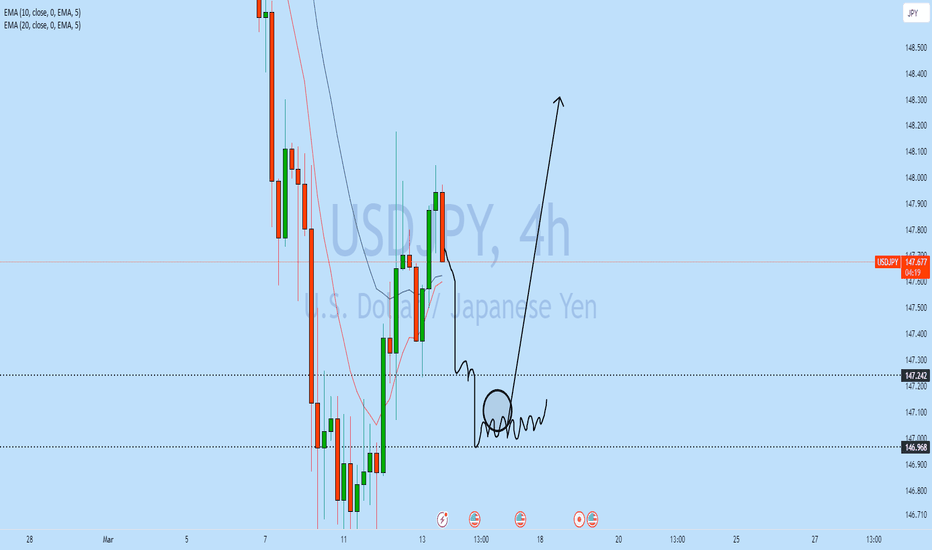

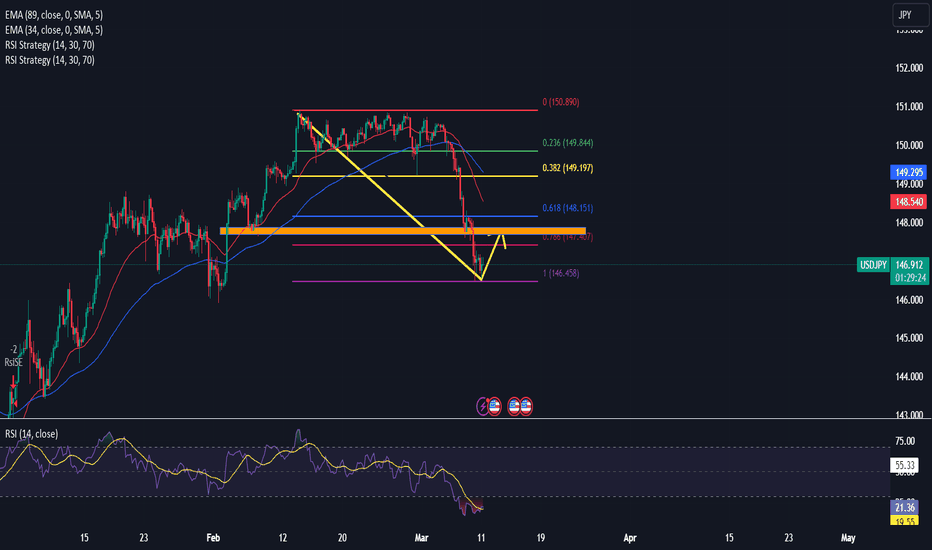

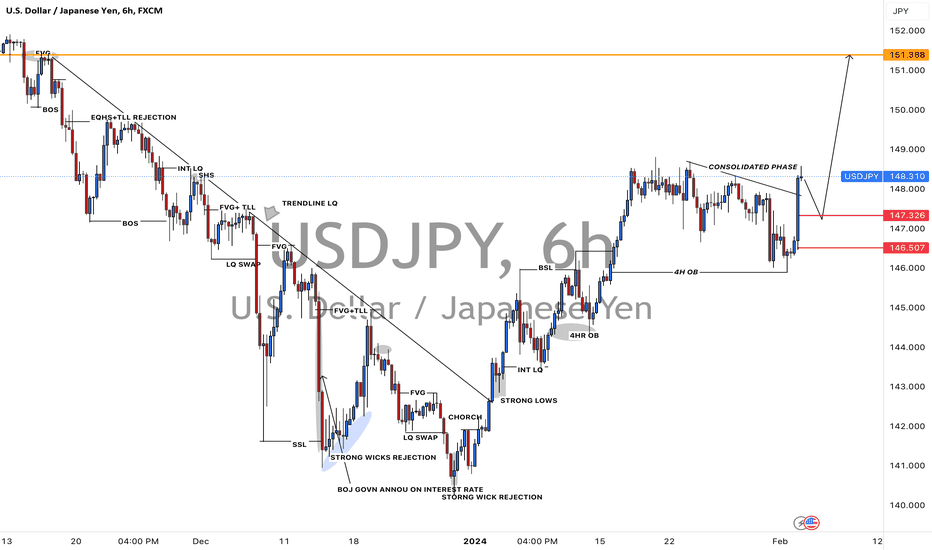

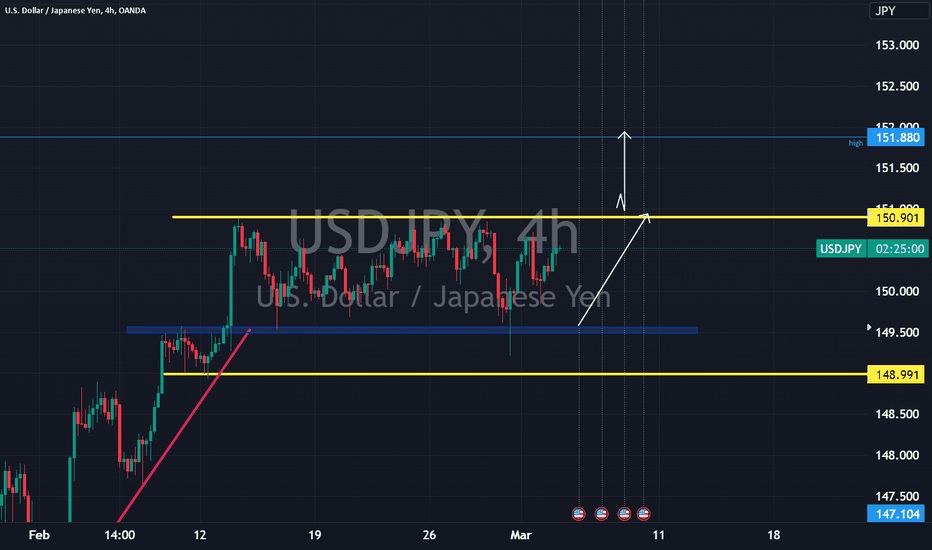

USDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

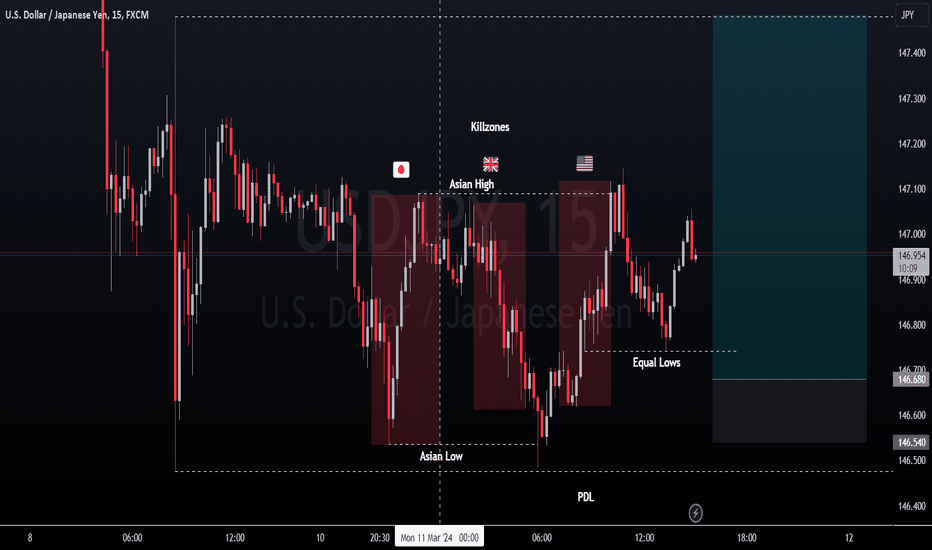

USDJPY: Asian foreign exchange was little changed, the dollar neMost Asian currencies were range-bound on Monday, while the dollar fell near a two-month low as markets awaited key US inflation data for further reading. signals about when the Federal Reserve will cut interest rates.

Regional currencies are surging from last week after dovish signals from Fed Chairman Jerome Powell and labor data reinforced expectations that the central bank will begin cutting interest rates soon. after June.

This notion weighed on the dollar, dragging the greenback to a nearly two-month low.

Japanese yen is nearly 1 month high as expectations of BOJ's pivot increase

The Japanese yen is one of the currencies that has benefited the most from the dollar's decline, rising sharply in the past two sessions to its highest level in more than a month.

The yen traded around 147 per dollar on Monday and was also supported by growing confidence that the Bank of Japan is close to ending its policy of negative interest rates and yield curve control this week. next.

The upwardly revised GDP data shows that the Japanese economy is avoiding a technical recession in the fourth quarter. The strength of the economy gives the BOJ more room to tighten policy sooner.

The BOJ is expected to hold a meeting next week, with a Reuters report saying that policymakers are considering changing interest rates in March or late April.

Other Asian currencies moved in flat to low ranges. The Australian dollar fell 0.2% as expectations that the Reserve Bank would gradually increase interest rates weighed on the currency.

Signs of cooling economic growth also raise expectations that the RBA will cut interest rates this year.

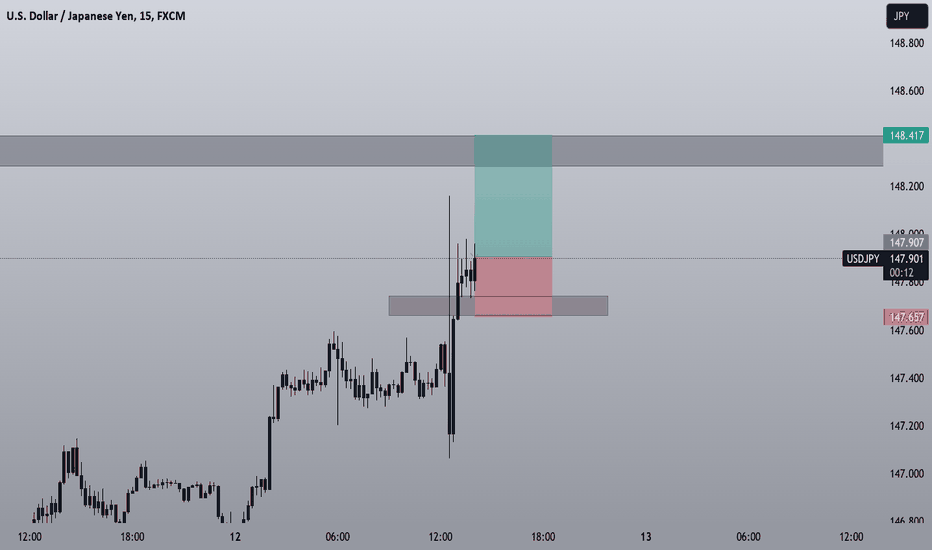

USDJPY H2 / Possible Reversal from OB and Supply Area✅💡Hello Traders!

This is my idea related to USDJPY H2. I expect another retracement in the OB level and after that I will execute a long trade in case of confirmation. I see the price to go up until the level of 149.500.

Wait for confirmation!

Apply Risk Management!

Traders, if my proposal resonates with you or if you hold a divergent viewpoint regarding this trade, feel free to share your thoughts in the comments. I welcome the opportunity to hear your perspectives.

____________________________________

Follow, like, and comment to see my content:

tradingview.sweetlogin.com

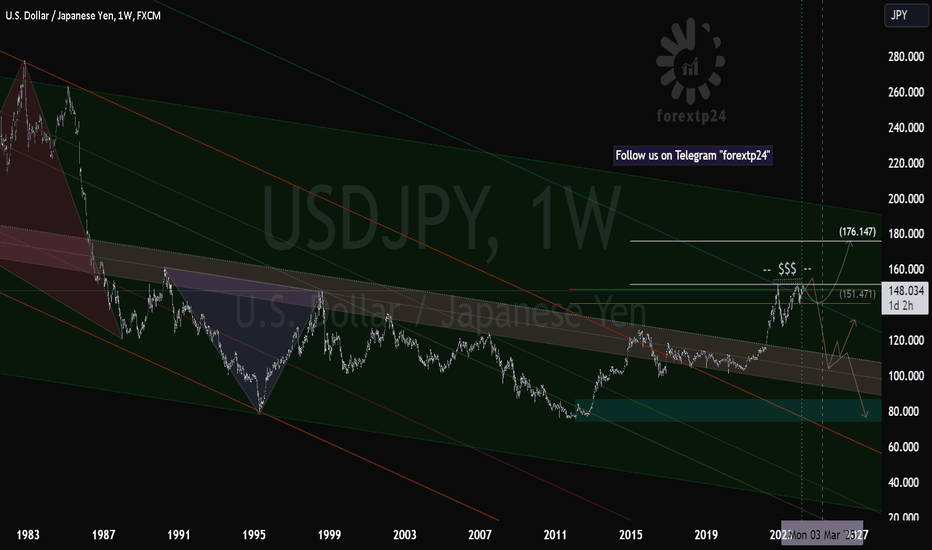

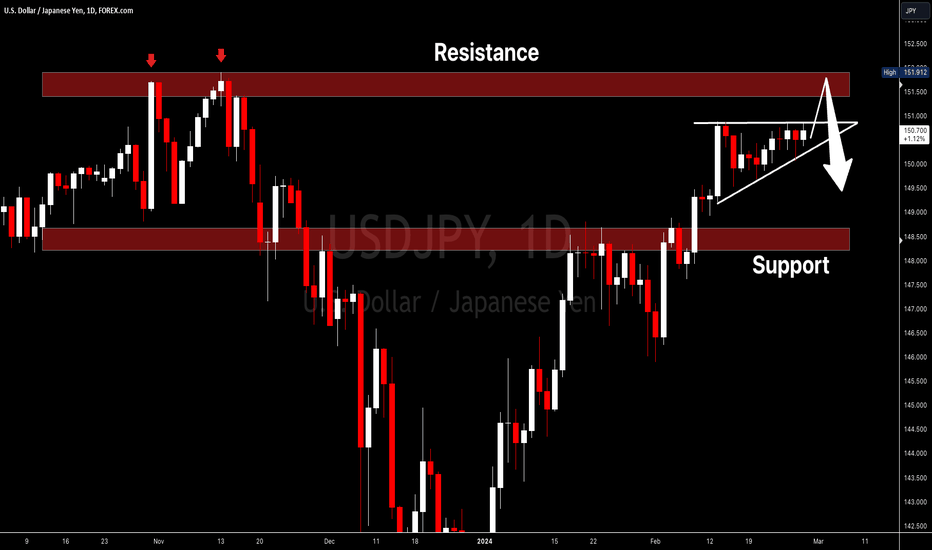

USDJPY big picture in daily time frame USDJPY: On the daily time frame, after hitting the middle line of the horizontal white channel, it cannot return to its upward purple channel. Therefore, it can hunt for twin ceiling after collecting liquidity. If it turns, it will most likely lose its last support and enter a long-term downtrend

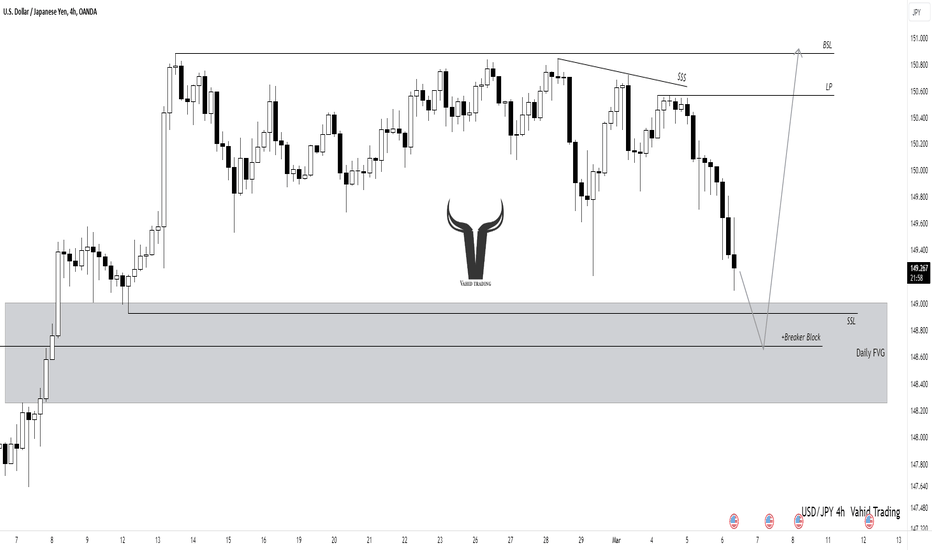

USDJPY: Second Possible Entry on UJ!Our first entry successfully hit above 500 pips, now there is possible second entry on UJ, as price has left strong bullish candle. Now, possible second wave of bullish can start from the marked area of reversal. This can be a huge swing trade on UJ taking price to 152-155 region.

usdjpy has formed a twin ceilingIn the daily time frame, usdjpy could not break its previous ceiling and weakness in the power of buyers is observed. In the weekly time frame, the price is in the range of the ceiling of the descending channel and the ceiling of the ascending cycle, and it seems that we will see a correction in the weekly candles: either a large correction after collecting liquidity above the twin ceiling or a retest to the ceiling of the broken channel and then movement to 176.

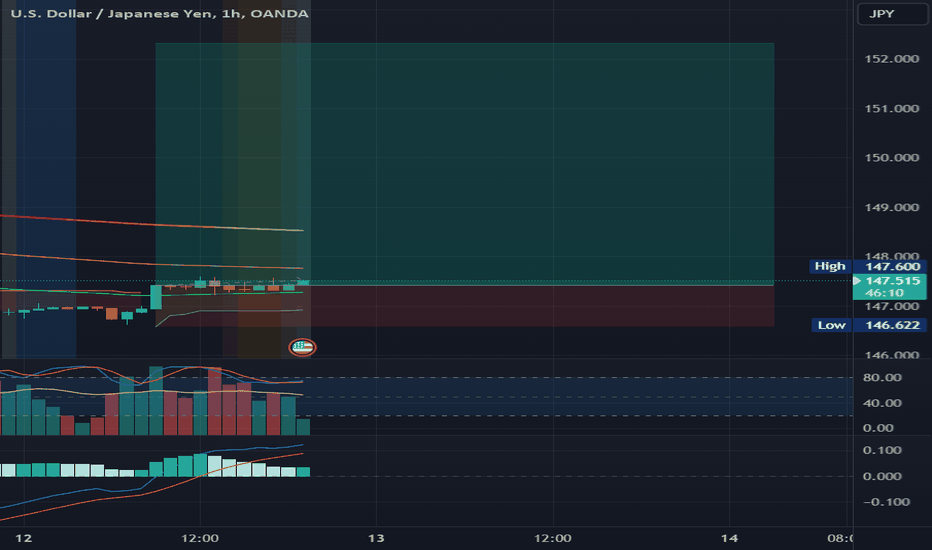

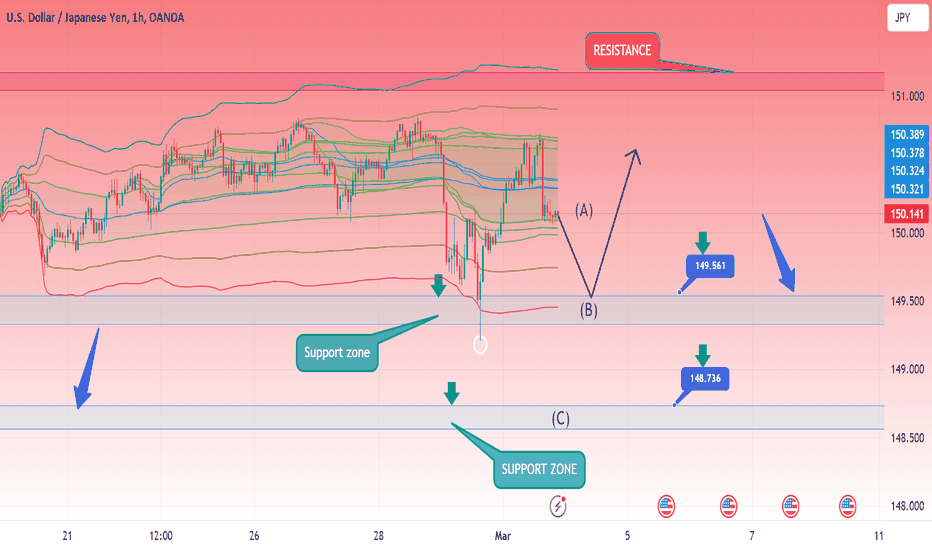

USDJPY,🟢Can price move highr...?🟢(Details on caption)As you can see, the price was in the range for a while and there is a liquidity pool on both sides of this range.

A sell-side liquidity in daily FVG makes this FVG a high probability support and we can also define the bullish 4-hour breaker block inside the FVG.

Now, we can expect price support from the FVG and move higher to collect the liquidity above the previous highs.

Please pay attention: We need LTF confirmation to execute the buy position.

💡Wait for the update!

🗓️06/03/2024

🔎 DYOR

💌It is my honor to share your comments with me💌

USDJPY: Asian Foreign Exchange market is quietThe Japanese yen hovered close to a four-month low, whilst statistics confirmed inflation in Tokyo recovered as predicted in February. Stable inflation offers the Bank of Japan extra motivation to elevate hobby costs from extraordinarily low levels.

The greenback index and greenback index futures had been consistent at some point of the session

buying and selling in Asia on Tuesday, after seeing a few volatility in latest sessions.

While latest statistics indicates inflation withinside the US relatively stabilizing, buyers appear like preserving bets that the Fed will reduce hobby costs in June.

But the change is predicted to be in large part examined this week, with a two-day testimony from Fed Chairman Jerome Powell in which analysts anticipate him to preserve tons of his hawkish stance. .

Then key nonfarm payrolls statistics is due out this Friday and is predicted to offer similarly alerts at the hard work market.

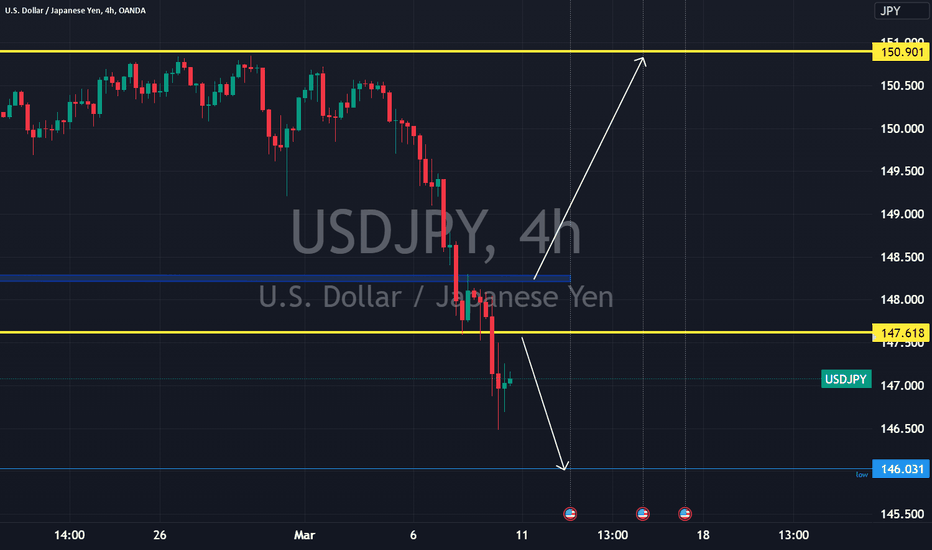

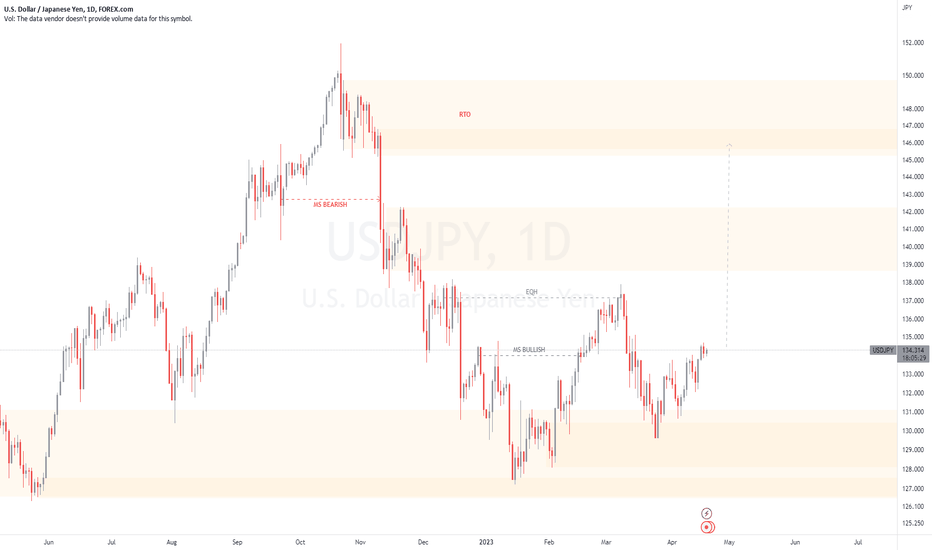

usd jPY LONGThe Japanese Yen drifts lower on Friday and moves away from over a two-week high. The BoJ policy uncertainty and the risk-on environment undermine the safe-haven JPY. Hawkish Fed expectations underpin the USD and remain supportive of the momentum.

rom a technical perspective, any subsequent move up is likely to confront stiff resistance near the 150.65-150.70 region. This is closely followed by a multi-month peak, around the 150.90 zone touched on February 13, which if cleared decisively will be seen as a fresh trigger for bullish traders. Given that oscillators on the daily chart are holding comfortably in the positive territory, the USD/JPY pair might then climb to the 151.45 hurdle en route to the 152.00 neighbourhood, or a multi-decade peak set in October 2022 and retested in November 2023.

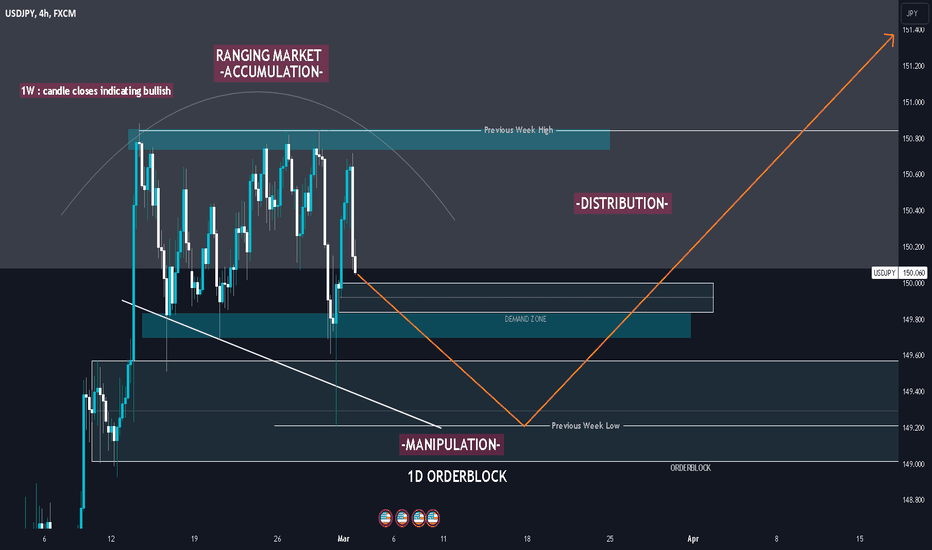

USDJPY BUY USING PO3 ? (market cycles)hello guys i hope you are having a good week ,

today i am looking at USDJPY

this weekly candle on usdjpy closes as a hammer looking like candle indicating buy.

for the daily tf the price started consolidating for a while now (accumulation) , since friday candle closed as inverted hammer am guessing monday we are going to see a red candle possible the candlle that will do the manipulation.

my point of interest is the Orderblock/Demand zone on the 1Dtf i will llook for entries in that area it also serves as a rejection block we can see a candle leaving a big whick in that area.

but i have to be careful since the price is on the 150 zone this zone is notorious because of the manipulations caused by bank of japan in that price range it is also a psycological level that the price has been testing for a while now so my tp will not be crazy .

keep in mind very very action packed week ahead trade safe !

USD JPY Long The Japanese Yen drifts lower on Friday and moves away from over a two-week high. The BoJ policy uncertainty and the risk-on environment undermine the safe-haven JPY. Hawkish Fed expectations underpin the USD and remain supportive of the momentum.

USD/JPY is the forex ticker that shows the value of the US Dollar against the Japanese Yen. It tells traders how many Yen are needed to buy a US Dollar. The Dollar-Yen is one of the most traded forex pairs – second only to EUR/USD – and is a benchmark for Asian economic health and even the global economy. View the live Dollar-Yen rate with the USD/JPY chart and improve your technical and fundamental analysis with the latest USD/JPY forecast, news and analysis.

Confirm Chart

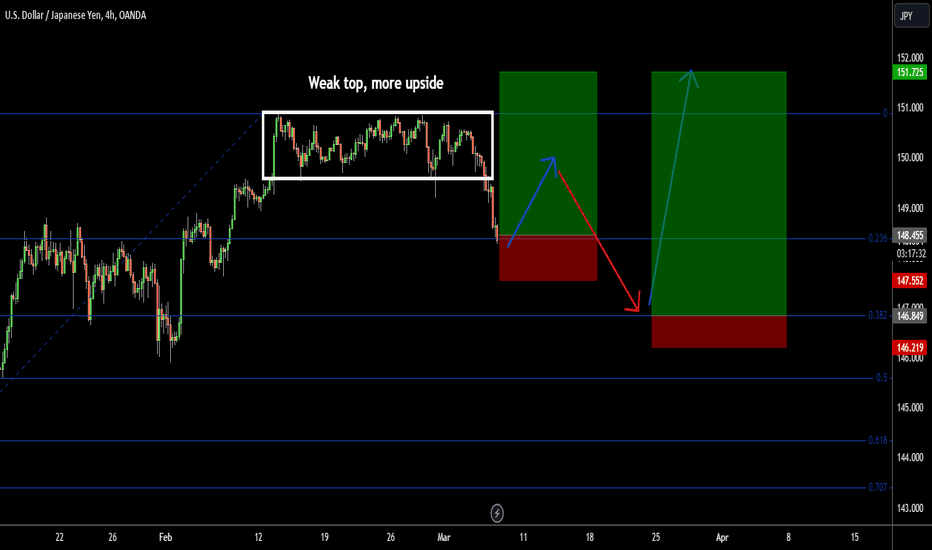

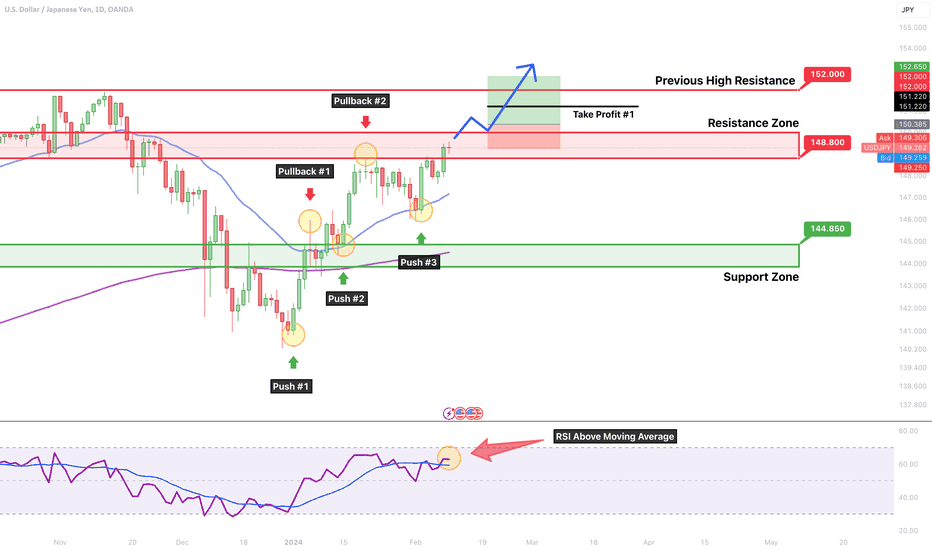

USDJPY → About to Breakout to New Highs? Let's Maximize Profits!USDJPY is on its third leg up in this bull channel that started at 141.000. We're near the top of Resistance Zone, is a long justified?

How do we trade this? 🤔

We need confirmation of a breakout to justify a long. After the initial bull run to 152.000, USDJPY pulled back with three legs to 140.200 and followed with a run to our current position of just over 149.000. The price action is technically at a new high in this run which could be the top of the third and final leg up.

Given the two strong bull bar closes on February 2nd and 8th and the lack of a sell signal, I do not believe this leg is over yet. What we need is a close above the Resistance Zone at 150.000 followed by a test of the top of Resistance as support. Once we see that support, it's reasonable to enter a long position with a 1:2 Risk/Reward Ratio. Take half profits at 1:1 Risk/Reward which is 151.200, move the stop loss up to the entry price to lock in profits, then swing the second half above the previous 152.000 high. 152.000 is a significant resistance area and I would be cautious to assume we'll make it to that price, however, the trend is our friend until the very end. Until we have a reason to change our bias, we must remain long.

💡 Trade Idea 💡

Long Entry: 150.385

🟥 Stop Loss: $149.250

✅ Take Profit #1: $151.200

✅ Take Profit #2: $152.650

⚖️ Risk/Reward Ratio: 1:2

🔑 Key Takeaways 🔑

1. Two strong legs up in a micro bull channel.

2. Third leg in progress, strong bull bar closes on February 2nd and 8th, indicating more upward momentum.

3. Near the top of the Resistance Zone, wait for a close above and test of Resistance as Support.

4. Enter a 1:2 Risk/Reward trade taking half profits at 1:1 Risk/Reward.

5. RSI at 63.00 and above the moving average, supports long bias.

💰 Trading Tip 💰

The longer a trend continues after 3 legs, the probability of that trend continuing lessens. Because of this decreased probability, we ought to reduce our risk when entering trades.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

USDJPY I Technical and fundamental analysis & Trading PlanWelcome back! Let me know your thoughts in the comments!

** USDJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

USDJPY | Market outlookIn the absence of significant economic releases, the movement of the yen is generally driven by external factors. It is worth noting the latest comments of the new head of the Bank of Japan, Kazuo Ueda. Today, speaking in parliament, he said that the regulator will continue to achieve the central bank's inflation target of 2.0%, easing monetary policy, even though this may take a considerable time. Ueda also stressed the need for Japanese firms to increase investment in human capital, saying that economic growth should lead to higher wages and keep inflation rising. In general, these comments disappointed market participants, who are counting on the fact that the new chairman of the regulator will change the course of his predecessors, give up control of the bond yield curve and start raising interest rates.