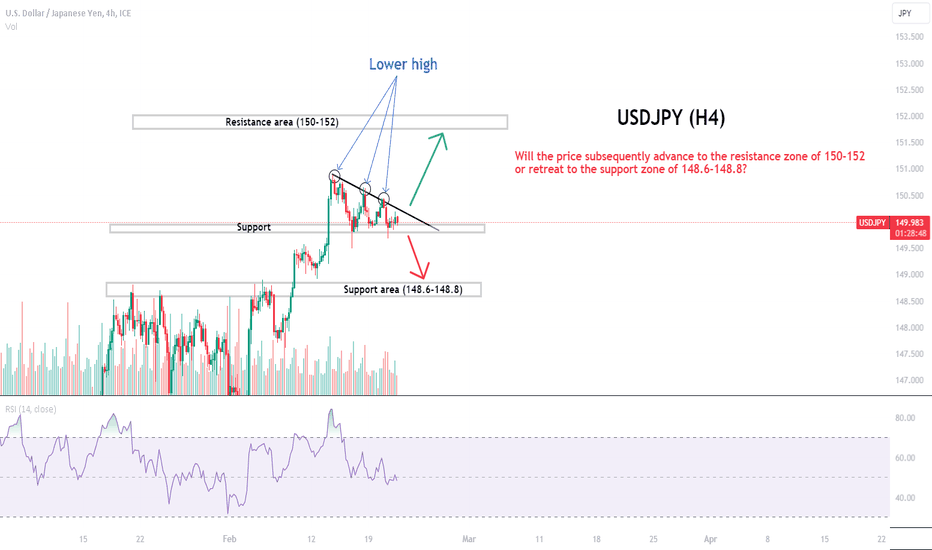

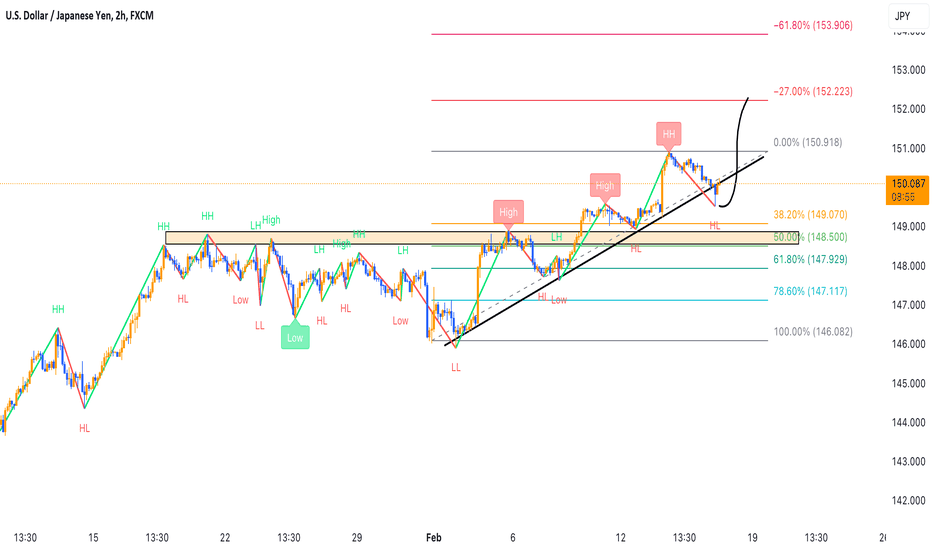

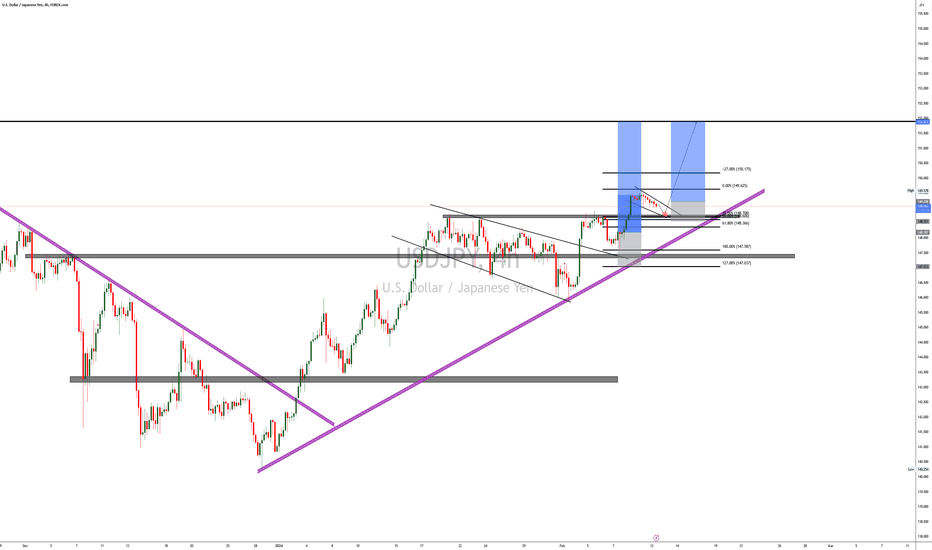

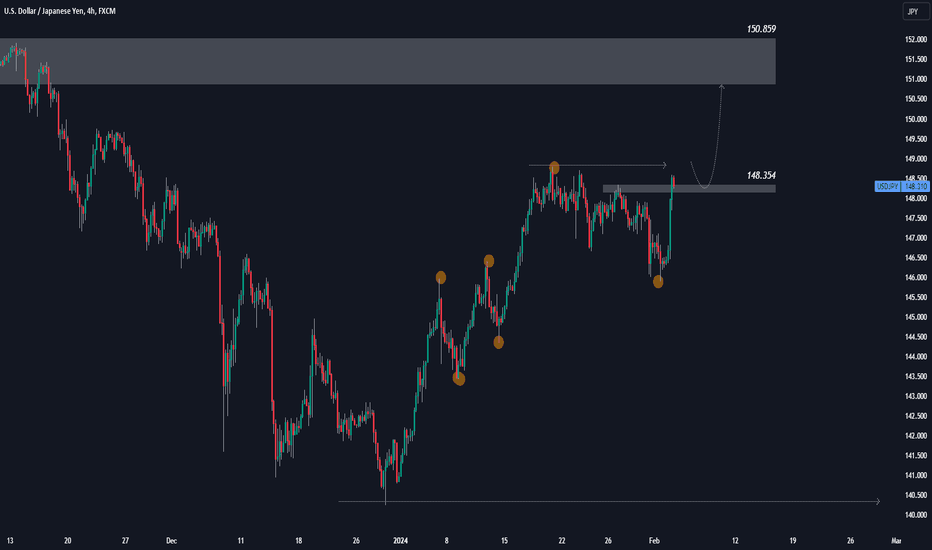

USDJPY (H4) Will fall to 148 or increase to 152 ?OANDA:USDJPY USDJPY (H4) Will fall to 148 or increase to 152 ?

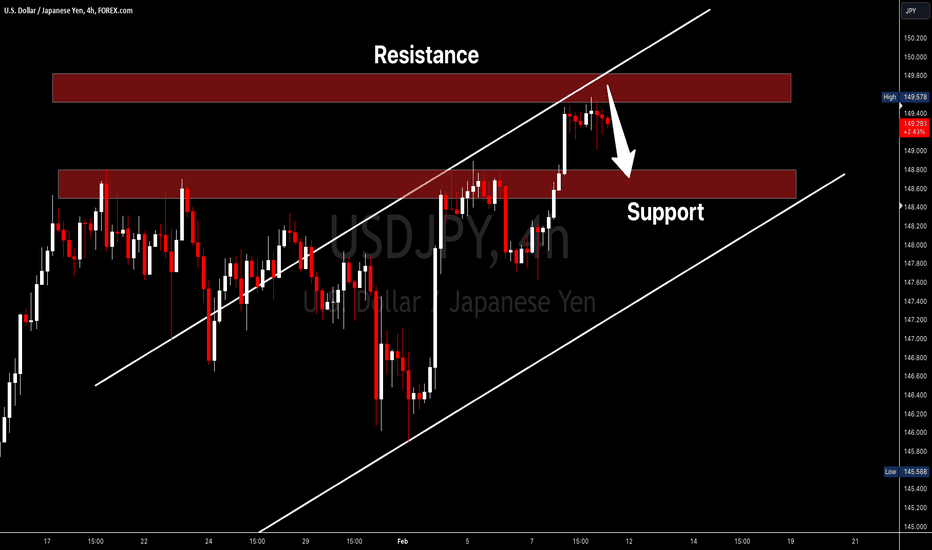

The USDJPY market on the H4 timeframe exhibits the following characteristics:

The ongoing contraction phase suggests a period of hesitation and gradual consolidation before significant fluctuations occur.

The peaks depict a pattern of lower-high prices, indicating a potential weakening of buying power.

Simultaneously, the lower end establishes a loosely defined price support region, with cand

lesticks extending below the support area.

Consequently, there is a likelihood that this pair might decline towards the price support zone at 148.6-148.8. However, given the absence of a clear directional break in the price pattern, there remains a possibility that the exchange rate could continue to rise towards the resistance area of 150-152.

It is advised to monitor the market closely. Despite the absence of significant news today with a strong impact on these currencies, unforeseen market movements can still pose risks to your account. Please adhere to trading principles and implement capital management strategies diligently.

Usdjpylong

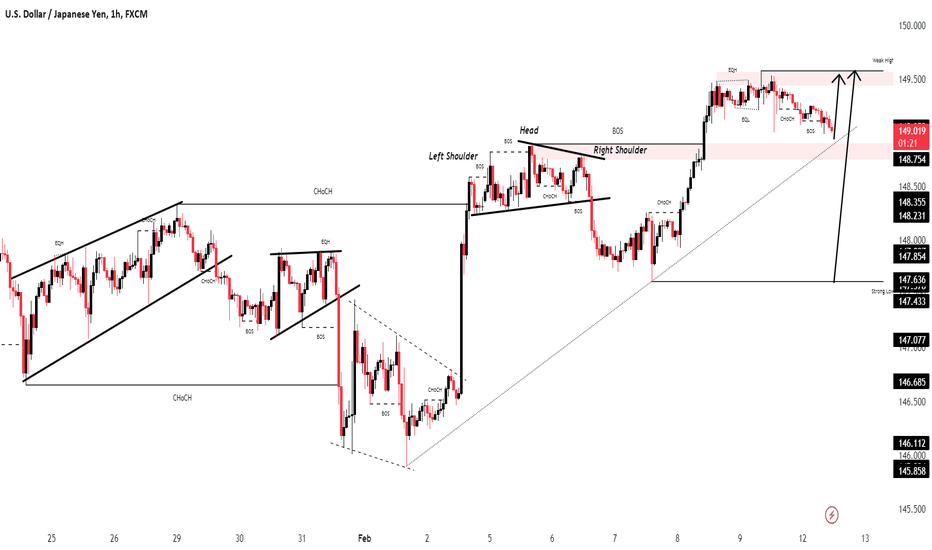

USDJPY I Wait for pullback to key level and bullish continuationWelcome back! Let me know your thoughts in the comments!

** USDJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

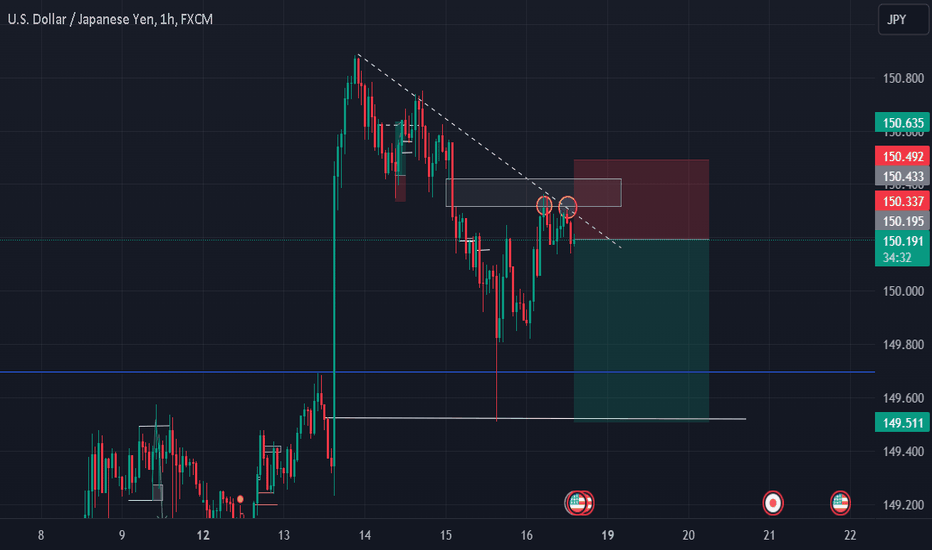

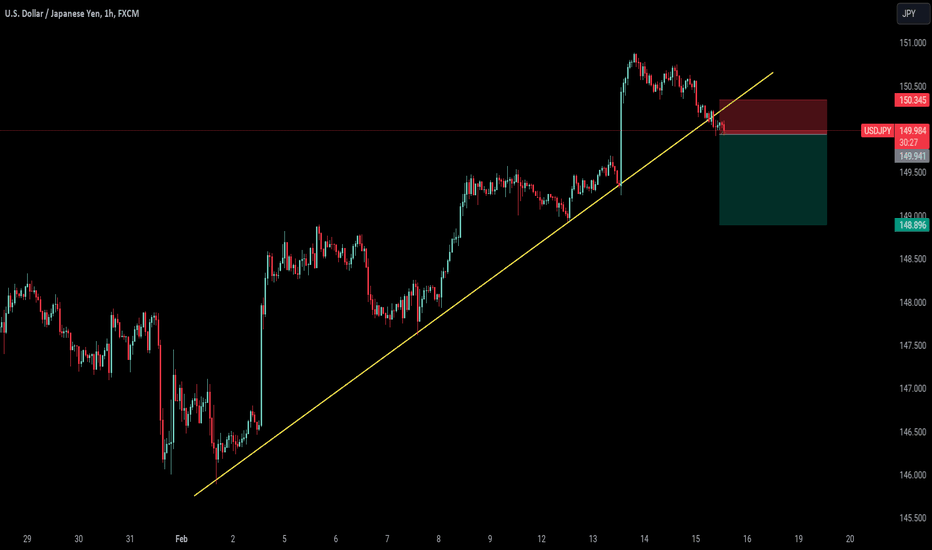

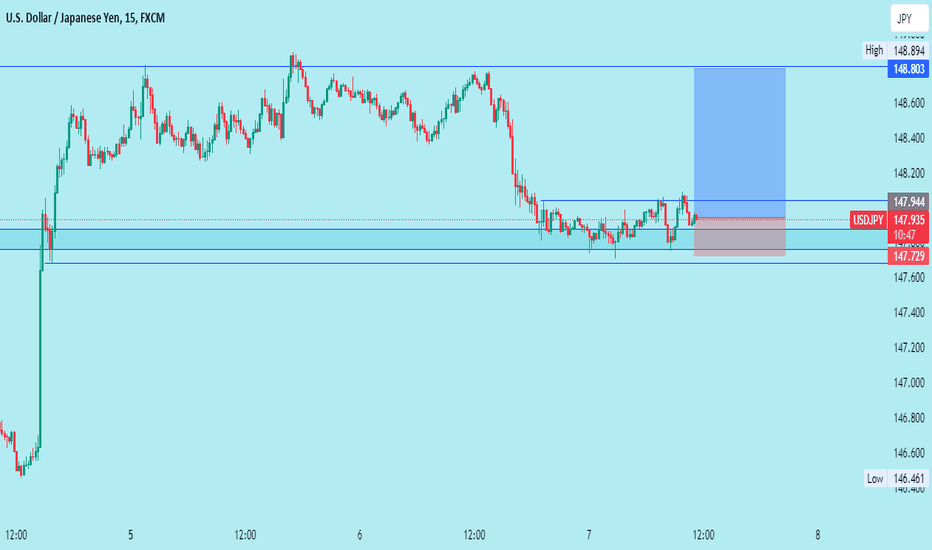

USDJPY H1 / Short Trade Entry Alert! ✅💲Hello Traders!

This is my idea related to USDJPY H1. I see a double reaction from the FVG H1 and I expect a continuation of a bearish market until the price of 149.500 where we have the OB level.

Traders, if you liked my idea or if you have a different vision related to this trade, write in the comments. I will be glad to see your perspective.

____________________________________

Follow, like, and comment to see my content:

tradingview.sweetlogin.com

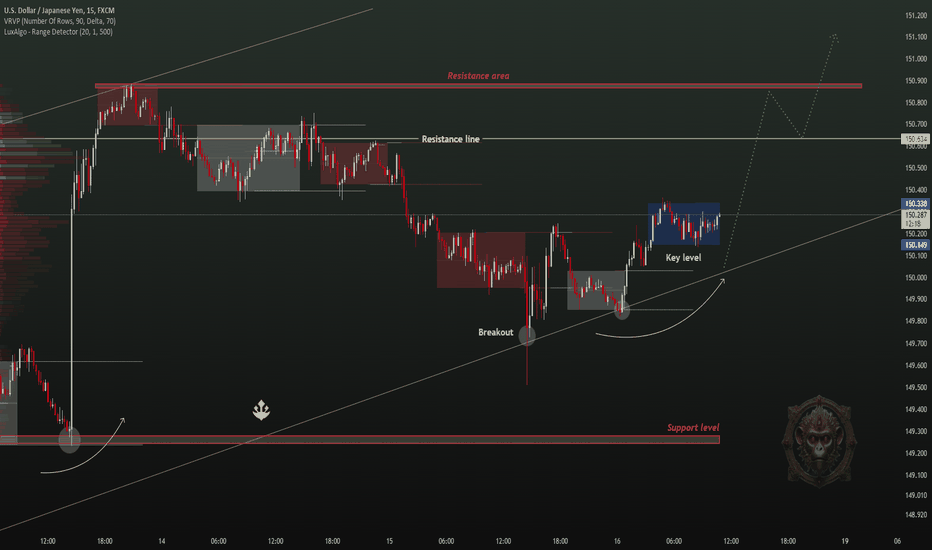

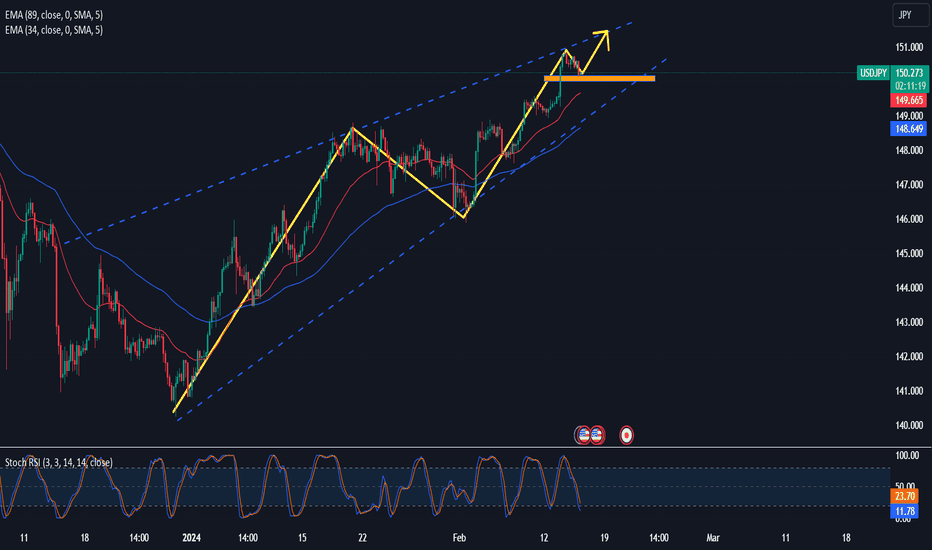

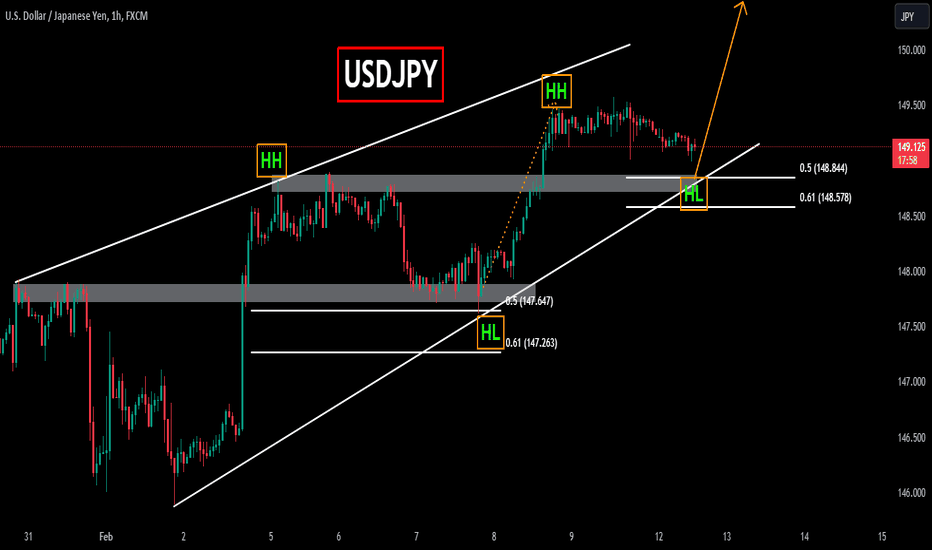

USDJPY BUY | Day Trading AnalysisHello Traders, here is the full analysis.

The completed correction, recovery and formation of a pre-breakout set-up hint at the continuation of growth. GOOD LUCK! Great BUY opportunity USDJPY

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

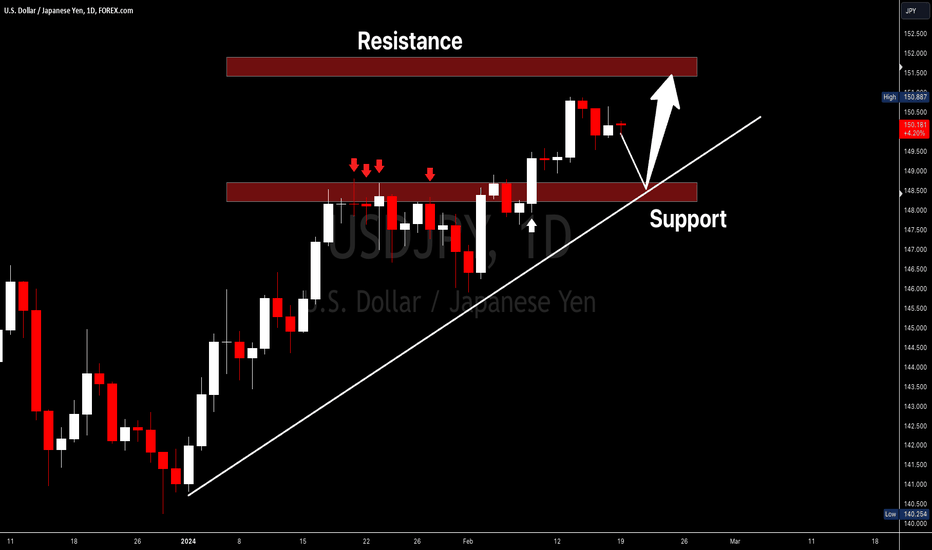

USDJPY may continue to growUSDJPY appears poised for continued growth, supported by its pattern of forming higher highs and maintaining trendline support. With this momentum intact, market sentiment suggests an anticipation of further price appreciation. Traders may view this trend as an opportunity for potential upward movement in the USDJPY pair, aligning with bullish expectations.

USDJPY: The USD is stable in the context of the Fed cutting specThe yen showed resilience, up 0.23% against the dollar at 150.26, although Japan's GDP figures showed a larger-than-expected recession and Germany overtook Japan as the world's leading economic power. third largest economy in the world. Commonwealth Bank of Australia currency strategist points out that the technical recession in Japan has minimal impact on the dollar/yen exchange rate, with upcoming spring wage negotiations seen as has more influence on the policy direction of the Bank of Japan and the performance of the yen. The market is still considering the high possibility of BOJ raising interest rates in April, despite negative GDP data.

BUY TRADE SETUP ON USDJPYHey Traders,

Check this analysis out on USDJPY. The pair had been trending toward the upside for quite some time. Now, it had broken the immediate resistance that could cause a bit of pressure that sellers could take advantage of, followed by an actual smooth pullback.

Provided that the price remains below the support, I will look for a short trade.

Keep a close tab on this one.

USDJPYUSDJPY is in strong bullish trend.

As the market is consistently printing new HHs and HLs.

currently the market is retracing a bit after last HH, which is 50% Fib retracement level and local support as well. if the market successfully sustain this bullish confluence the next leg high could go for new HH.

What you guys think of this idea?

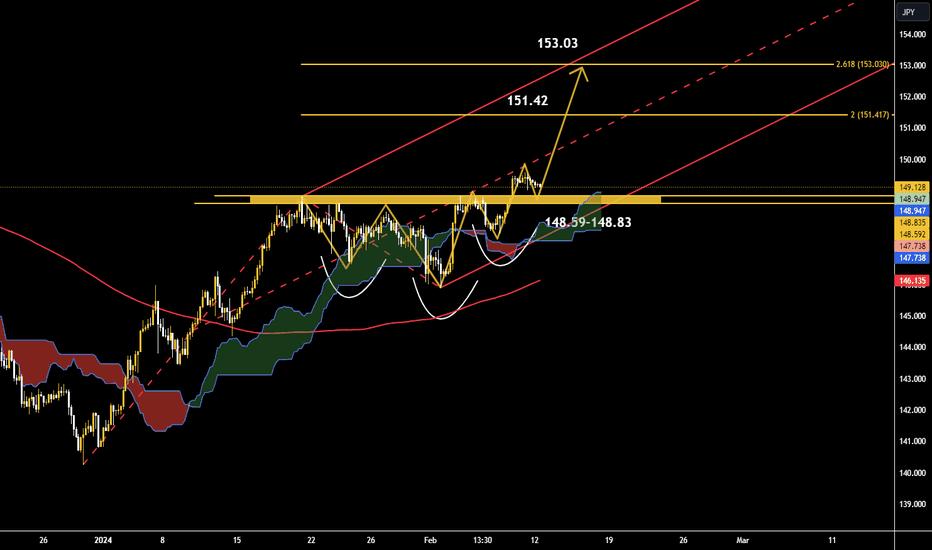

"Forex: Secret Strategies for Mastering USD/JPY Trades!"📌Examining the trend in the four-hour time frame, USD/JPY has formed a bullish head and shoulder pattern, which seems that the rate after the pullback to the neckline resistance range in the range of 148.59-148.83 can reach resistance. 🎯The upper level of the Andrews fork in the Fibo range of 261.8% will increase at 153.03.✔️

USDJPY I Potential pullback and more growth Welcome back! Let me know your thoughts in the comments!

** USDJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

USDJPY | Perspective for the new week | Follow-upExplore the latest market dynamics in our new video as we analyze the USD/JPY movement, surging over 0.90% to 148.05 following a robust US jobs report and elevated Treasury yields. The addition of 353K jobs in January has shifted Fed rate cut forecasts, reflecting a tightening labor market and bolstering confidence in the US economy.

However, amidst this positive momentum, factors such as heightened conflicts in the Middle East are fostering cautious sentiment among investors. The Japanese Yen, drawing in some buying potential, cannot be overlooked. Additionally, the Bank of Japan's recent hawkish stance signals potential shifts away from extensive stimulus and negative short-term interest rates, potentially providing support to the Yen.

As we navigate these intricate market dynamics, this video serves as your guide, offering insights on how to plan your positions strategically for the upcoming week.

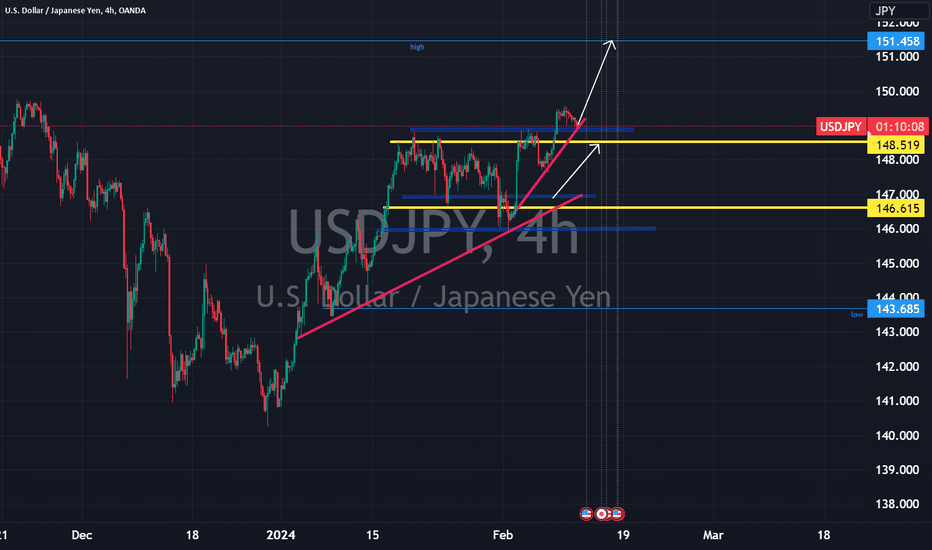

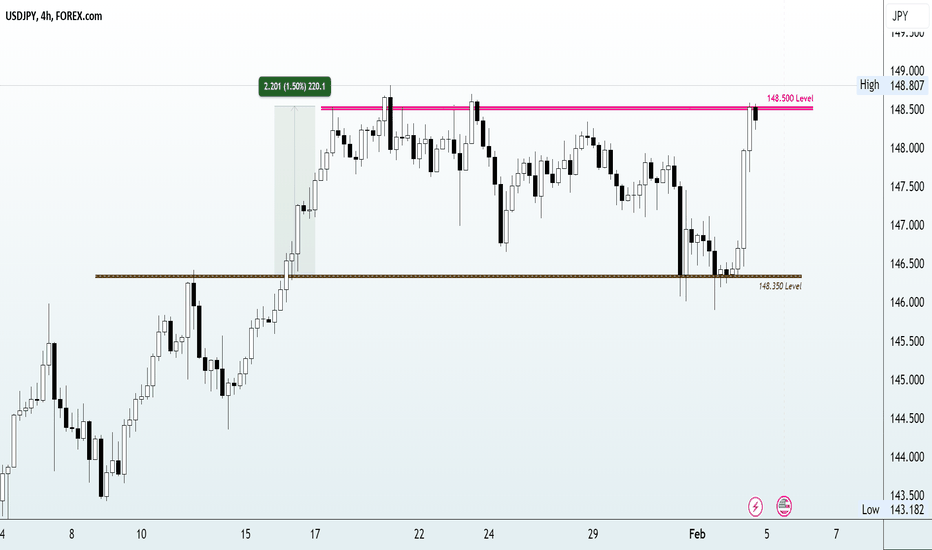

USDJPY Technical Analysis:

As discussed in the video, the recent upward momentum is showing signs of easing, leaving room for a possible USD pullback. However, for a confirmed uptrend continuation, we need to see sustained trading above 148.500. Our detailed technical analysis focused on the current bullish market structure, with particular attention to the crucial level of 148.800, set as a pivotal point for the upcoming week. This level gains significance as a potential catalyst for a clear uptrend if buying pressure persists. The market's response to this level at the beginning of the new week will strongly influence the direction of price action in the days ahead.

Join me in exploring potential trading opportunities using trendlines, key levels, and chart patterns. Stay connected to my channel, follow updates, and actively participate in the comment section as we navigate the dynamic USDJPY market together.

Wishing you success as you navigate the USDJPY market this week!

#USDJPY #technicalanalysis #tradingopportunities #inflation #monetarypolicy #Fed #interestrates #economicanalysis #Forextrading

Disclaimer Notice:

Please be aware that margin trading in the foreign exchange market, including commodity trading, CFDs, stocks, and other instruments, carries a high level of risk and may not be suitable for all investors. The content of this speculative material, including all data, is provided by me for educational purposes only and to assist in making independent investment decisions. All information presented here is for reference purposes only, and I do not assume any responsibility for its accuracy.

It is important that you carefully evaluate your investment experience, financial situation, investment objectives, and risk tolerance level. Before making any investment, it is advisable to consult with your independent financial advisor to assess the suitability of your circumstances.

Please note that I cannot guarantee the accuracy of the information provided, and I am not liable for any loss or damage that may directly or indirectly result from the content or the receipt of any instructions or notifications associated with it.

Remember that past performance is not necessarily indicative of future results. Keep this in mind while considering any investment opportunities.

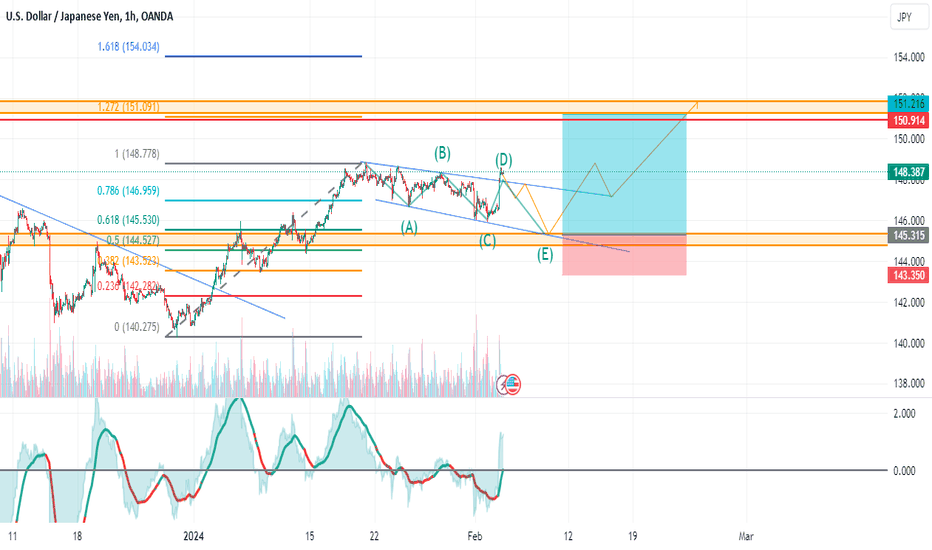

USDJPY will grab liquidity then surge!Pure technical analysis.

USDJPY has penetrated the upper channel of the trendline, but will not shoot straight up. Instead, the price will retrace to the strong traditional support in the 145,000 zone, as the price has had a lot of interaction in this area formerly.

The 145.000 area coincides with the Fibonacci zone between 0.384 and 0.5, as well as the leg E zone of Elliot Waves.

For entry, wait for the price to turn back to this important zone, then take a buy position in the price range of 143.500 to 145.350, then set take profit in the Fibonacci extension zone of 1.272 at the price of 151.000 - 152.000, an area that was also previous resistance.

If it works, continue take profit to 1.618 area as second take profit (154.000 level). Subsequent analysis needed.

Cancel the setup if the price breaks below 143.550 level.

Bullish or bearish signs build in USD/JPY? Bullish or bearish signs build in USD/JPY?

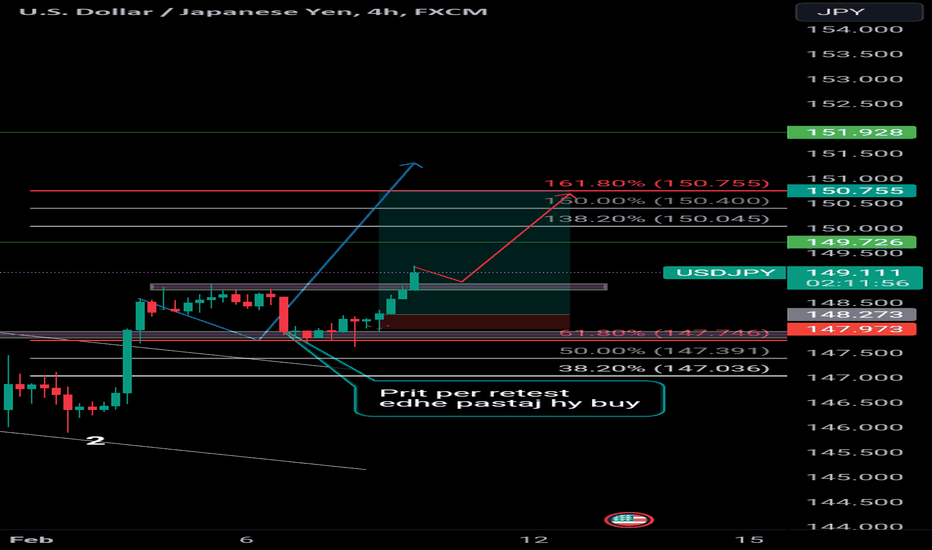

The USD/JPY surpassed a crucial resistance level at 148.650 on Thursday and hit its highest value since November 2023.

The obvious next step is of course to explore the 150.00 threshold. However, any incremental advance beyond this point should be eyed with caution and uncertainty. The Yen faced is facing pressure due to dovish remarks from Bank of Japan (BoJ) Deputy Governor Shinichi Uchida, where he emphasized a gradual approach to policy tightening.

On the other side of the trade, unexpected selling pressure might find defence around 148.300. Further downturns below this technical support may bring attention to 147.800, followed by 146.00. Notably, economists at ANZ Bank anticipate a near-term recovery for the JPY against the USD, projecting the USD/JPY to trade within the range of 146 to 148.50. A substantial decline to 136.00 is then envisaged by the end of 2024.

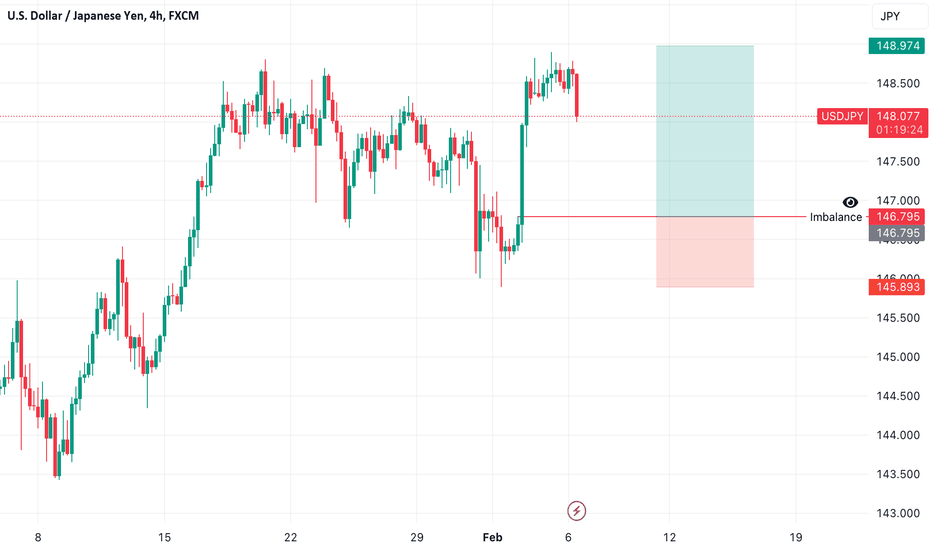

USDJPY - Long after filling the imbalance ✅Hello traders!

‼️ This is my perspective on USDJPY.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I am looking for a long. I wait price to make a retracement to fill the that huge imbalance lower and then to react from that zone.

Like, comment and subscribe to be in touch with my content!

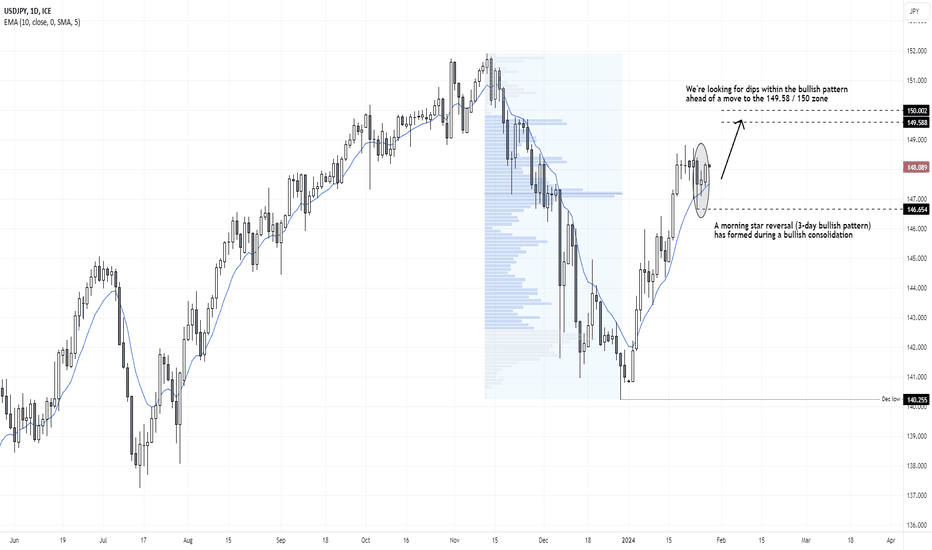

USD/JPY bulls eye a move to 150Trading conditions have been choppy over the past week and a half for currency traders whilst the US dollar index has remained trapped between its 50 and 20-day EMAs. But USD/JPY shows the most promise for a breakout, which we suspect could be to the upside.

A false break below 147 last week suggests the corrective low could be in, and a 3-day bullish reversal (Morning Star pattern) hints of an upside breakout from its consolidation. The 10-day EMA is also providing support on the daily chart.

From here, we're looking for dips within the bullish pattern and ideally for prices to hold above the 10-day EMA to initiate a long. Whilst prices remain above last week's low, the bias is for a move to the 149.58 - 150 zone.

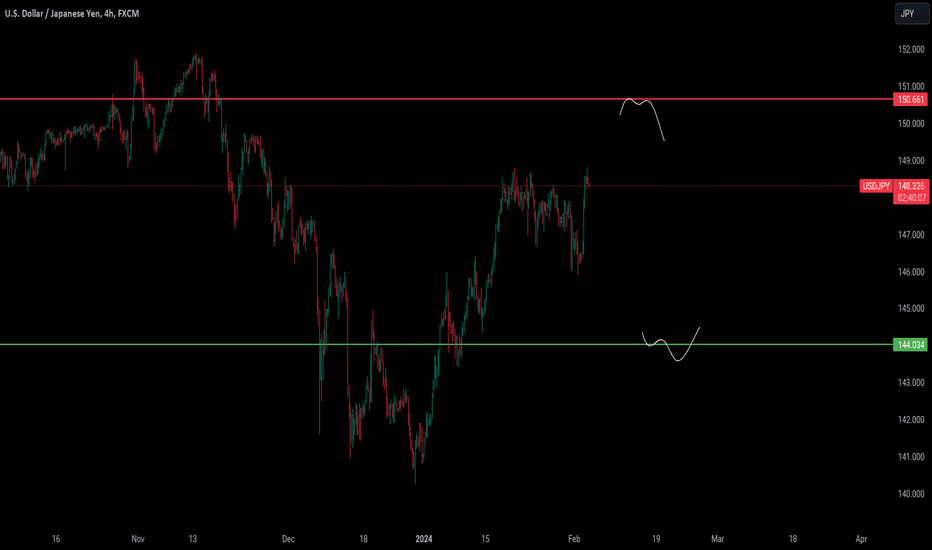

USDJPY Levels of interestI am waiting two level on USDJPY before entering. 150.600 is the level where i wil start shorting, otherwise at 144.000 i will start buying. This two levels are really important, because they are daily support and resistance. This levels also fit as fibo level 1.618 and -0.618 of recent leg

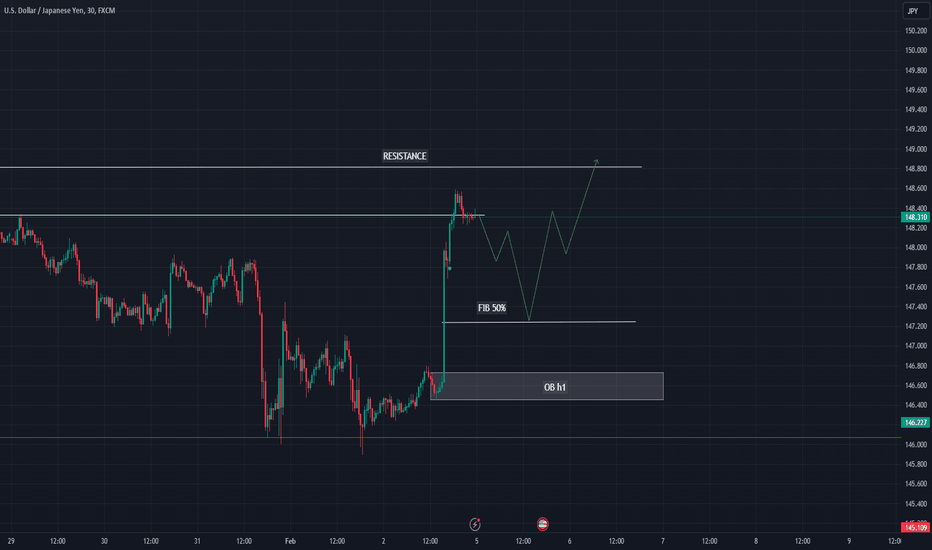

USDJPY M30 / Bullish Move Forecast 💲Hello Traders!

This is my idea related to USDJPY M30. I expect a continuation of the bullish trend and I will look for a long entry on USDJPY. We have a very strong bullish move and I want to see a retracement at the FIB 50% level.

Traders, if you liked my idea or if you have a different vision related to this trade, write in the comments. I will be glad to see your perspective.

____________________________________

Follow, like, and comment to see my content:

tradingview.sweetlogin.com