USDJPY Bearish Bias on October 29, 2024: Fundamental Analysis !USDJPY Bearish Bias on October 29, 2024: Fundamental Analysis and Key Market Drivers

Overview: USDJPY Daily Analysis with Slight Bearish Bias on 29/10/2024

As of October 29, 2024, the USDJPY (U.S. Dollar to Japanese Yen) currency pair leans toward a bearish bias, driven by a range of economic factors and shifting market sentiment. The Japanese Yen, often considered a safe-haven currency, appears set for gains as investor risk appetite remains cautious. In this analysis, we’ll break down the primary drivers of a bearish USDJPY outlook and explore what this could mean for traders today.

Key Drivers for USDJPY Bearish Bias

1. Dovish Stance from the Federal Reserve

- The U.S. Federal Reserve's recent statements have indicated a more dovish tone, with Chair Jerome Powell suggesting a pause in rate hikes as the U.S. economy faces slower growth and moderating inflation.

- As the Fed scales back aggressive tightening, demand for the USD could soften, giving way to downward pressure on USDJPY.

2. Economic Resilience in Japan

- Japan’s latest economic indicators, including rising exports and steady growth in industrial output, are showing signs of resilience. The Bank of Japan (BOJ) has maintained its accommodative policies, yet recent remarks hint at a more balanced approach, adding stability to the JPY.

- With the Japanese economy performing well, the Yen is gaining support, especially against a potentially weaker USD.

3. Risk-Off Sentiment in Global Markets

- USDJPY typically reacts to shifts in risk sentiment, as the Yen benefits from safe-haven flows. In today’s market, concerns over geopolitical risks and potential global economic slowdown are driving investors to seek safer assets.

- This risk-off environment is reducing demand for USD-denominated assets while increasing interest in JPY, putting additional bearish pressure on USDJPY.

4. U.S. Dollar Weakness Amidst Lower Treasury Yields

- U.S. Treasury yields have pulled back as the Fed pauses its rate hikes. Lower yields tend to weaken the appeal of the USD compared to safe-haven currencies like the Yen.

- This yield differential further supports a bearish USDJPY outlook, as lower Treasury returns make the USD less attractive in the FX market.

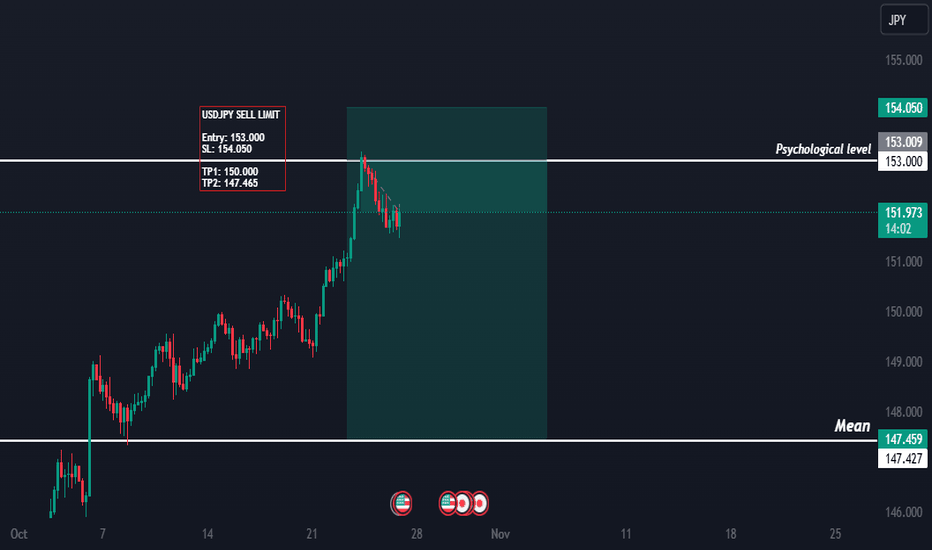

Technical Analysis of USDJPY

On the technical front, USDJPY is approaching a support zone near 148.00, with resistance around the 149.80 level. If the bearish bias continues and the pair falls below this support, we could see USDJPY trend lower, making this an important level to watch.

Conclusion: USDJPY Outlook on October 29, 2024

Today’s fundamental and market conditions suggest a bearish bias for USDJPY. A dovish Fed, Japan’s economic resilience, cautious market sentiment, and lower U.S. Treasury yields are all factors likely to favor the Yen over the Dollar. Traders should monitor key support levels and any shifts in risk sentiment, as these could impact USDJPY’s trend throughout the day.

---

Tags:

USDJPY analysis, USDJPY forecast, Japanese Yen outlook, Forex market trends, USDJPY bearish trend, Federal Reserve impact on USD, USDJPY technical levels, Forex trading insights, October 2024 USDJPY

Usdjpytechnicallevels

USDJPY: Potential for a Slight Bearish Bias Amid Key FundamentalUSDJPY: Potential for a Slight Bearish Bias Amid Key Fundamental Drivers (25/10/2024)

Today, the USDJPY currency pair could experience a slight bearish bias, driven by recent shifts in both the Japanese and U.S. economic landscape. Here’s a breakdown of the factors contributing to this potential trend, along with insights into what traders should watch as the day unfolds.

1. Bank of Japan’s Potential Shift in Policy

The Bank of Japan (BoJ) has maintained its ultra-loose monetary policy stance for years, but recent signals suggest a possible move towards tightening. Japanese inflation rates have gradually risen, and with core inflation holding steady above target levels, the BoJ may finally consider adjusting its dovish stance. Any indication of a shift toward a more hawkish BoJ, even if gradual, could support the JPY, creating downward pressure on the USDJPY pair.

2. US Dollar Weakness on Federal Reserve Pause Speculation

The US Dollar (USD) has softened recently as speculation grows that the Federal Reserve may pause rate hikes. U.S. economic data has shown signs of cooling inflation, and Fed officials have hinted that a pause could be on the horizon, given recent macroeconomic indicators. A dovish tone from the Fed typically weakens the USD, thus enhancing the relative strength of the JPY. This potential softening in the dollar is an essential factor in the slight bearish bias for USDJPY.

3. Market Sentiment Shifting Towards Safe-Haven Assets

Investor sentiment is currently tilted toward safe-haven assets, largely due to ongoing geopolitical tensions and uncertain global economic conditions. While the USD is also a safe-haven currency, the Japanese Yen (JPY) often gains favor when there’s heightened uncertainty in markets, especially in Asia. This risk-averse sentiment is driving investors to seek the JPY, which could contribute to additional downward momentum in the USDJPY pair today.

4. Technical Indicators Suggest Resistance for USDJPY

From a technical perspective, USDJPY is encountering resistance around the 150.00 level. This is a critical psychological threshold, and the pair’s failure to break above this level reinforces a potential bearish sentiment. With Relative Strength Index (RSI) levels approaching overbought territory, a bearish correction might be anticipated. Additionally, a dip below the 149.00 support level could confirm this outlook and signal further downside potential.

Summary: Slight Bearish Bias for USDJPY

Today’s fundamental factors suggest a slight bearish bias for USDJPY, largely due to potential changes in Bank of Japan policy, a softer US Dollar from Federal Reserve pause speculation, and increased demand for safe-haven assets. Technical resistance at key levels also reinforces the likelihood of a bearish tilt for the pair.

Traders should watch for real-time updates on BoJ announcements, Fed commentary, and any developments in geopolitical news that could impact USDJPY direction.

---

Keywords

1. USDJPY forecast

2. Bank of Japan policy

3. US Dollar analysis

4. Fed rate pause

5. USDJPY bearish trend

6. Forex trading insights

7. Safe-haven assets

8. Japanese Yen strength

9. USDJPY technical levels