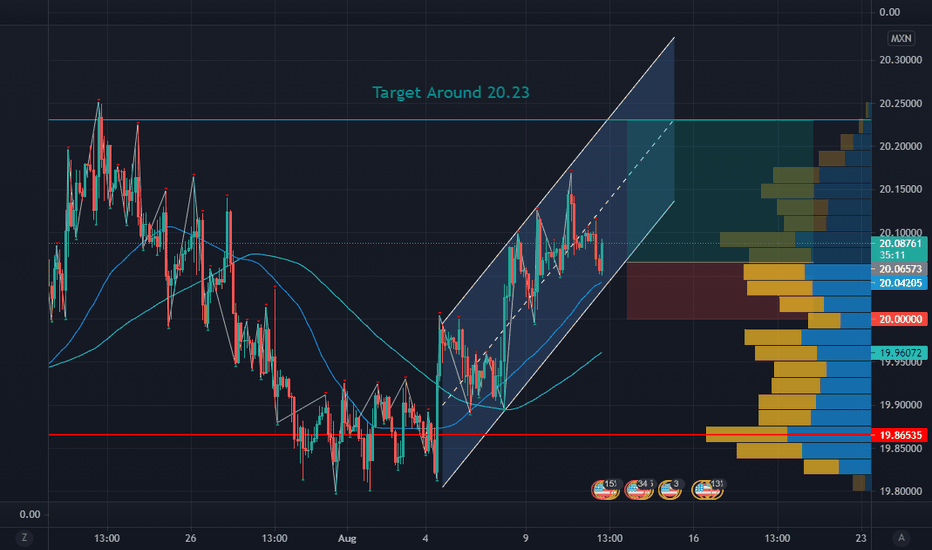

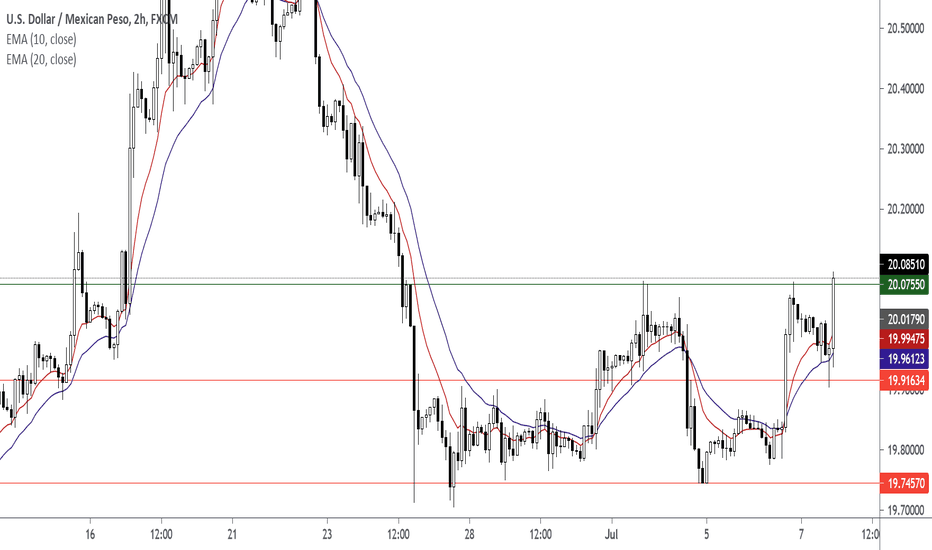

USDMXN Channelling Higher, Targeting 20.23Trend Analysis

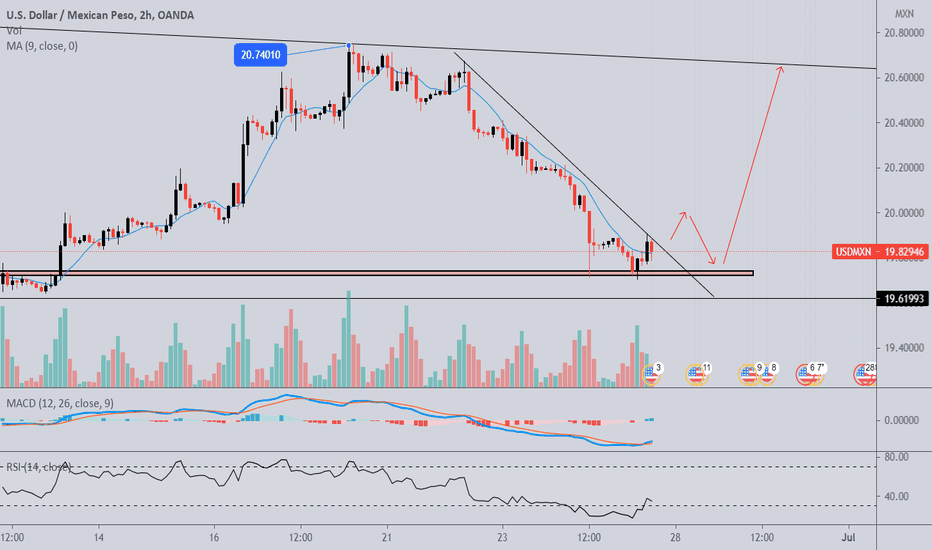

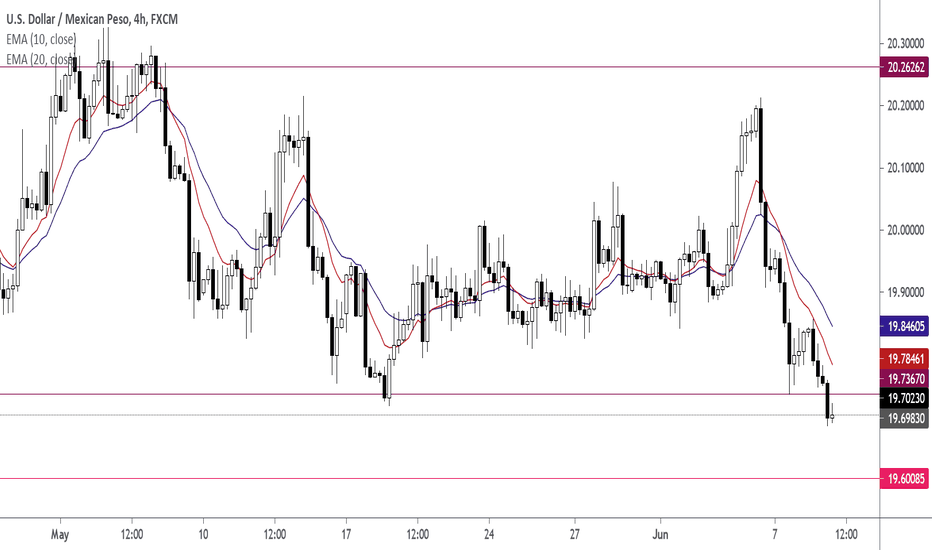

The main view of this trade idea is on the 2-Hour Chart. The FX Cross USDMXN is channeling higher and is currently and the lower end of the support channel around 20.05. Expectations are for support to hold and the FX Cross rally towards the upper end of the trend channel at around 20.23, 0.81% away. If this upward price movement breaks down, a stop loss should be set at around 20.

Technical Indicators

The short (25-MA) and medium (75-MA) fractal moving averages indicates a change in trend in USDMXN, supporting the short term bullish view. Currently USDMXN is trading above these respective moving averages and there has been a bullish crossover on them, with the short term fractal moving average crossing above the medium term fractal moving average.

Recommendation

The recommendation will be to go long at market. Stop loss will be set around the 20.00 price level and a target of 20.23. This produces a risk-reward ratio of 2.50.

Disclaimer

The views expressed are mine and do not represent the views of my employers and business partners. Persons acting on these recommendations are doing so at their own risk. These recommendations are not a solicitation to buy or to sell but are for purely discussion purposes. At the time publishing, I have a position in USDMXN .

USDMXN

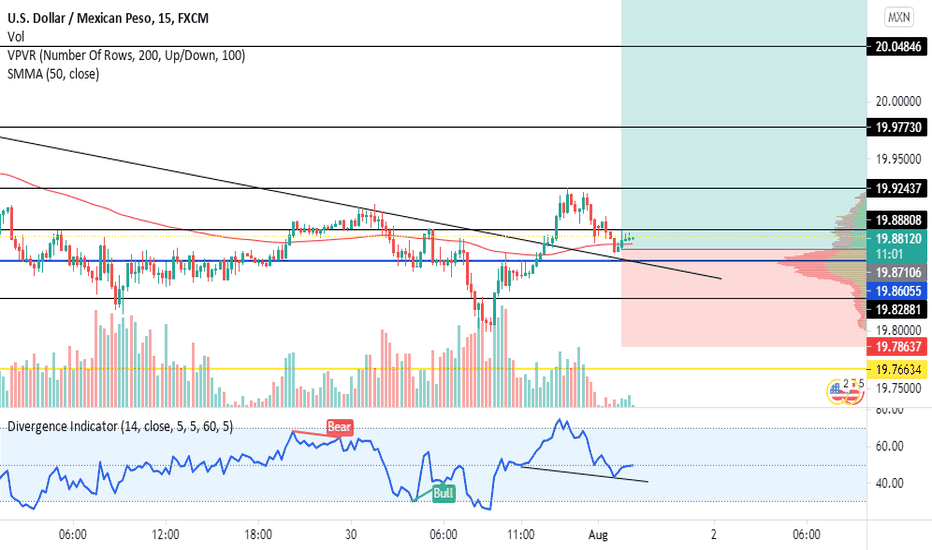

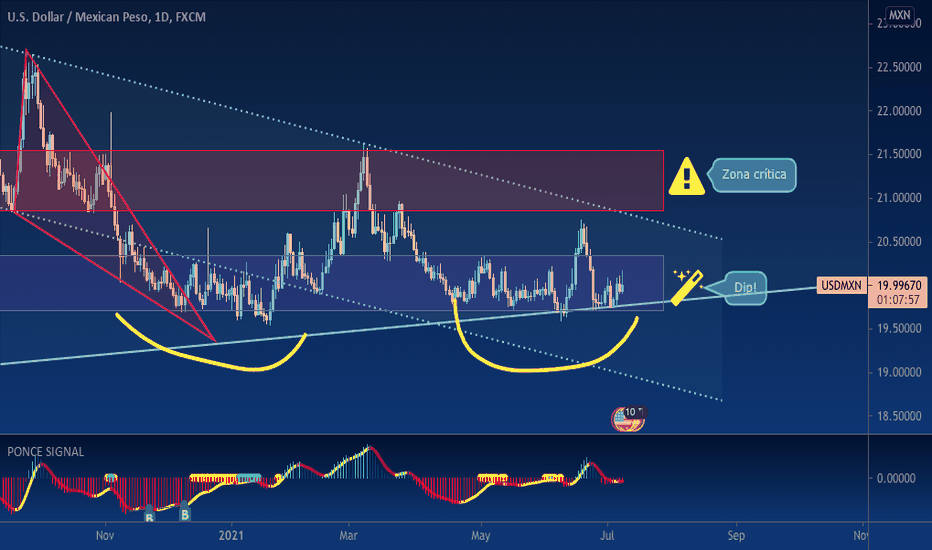

Elliott Wave Analysis: USDMXN Is Forming A Bearish TriangleHello traders!

We want to share a chart with interesting and known pattern called triangle on USDMXN currency pair.

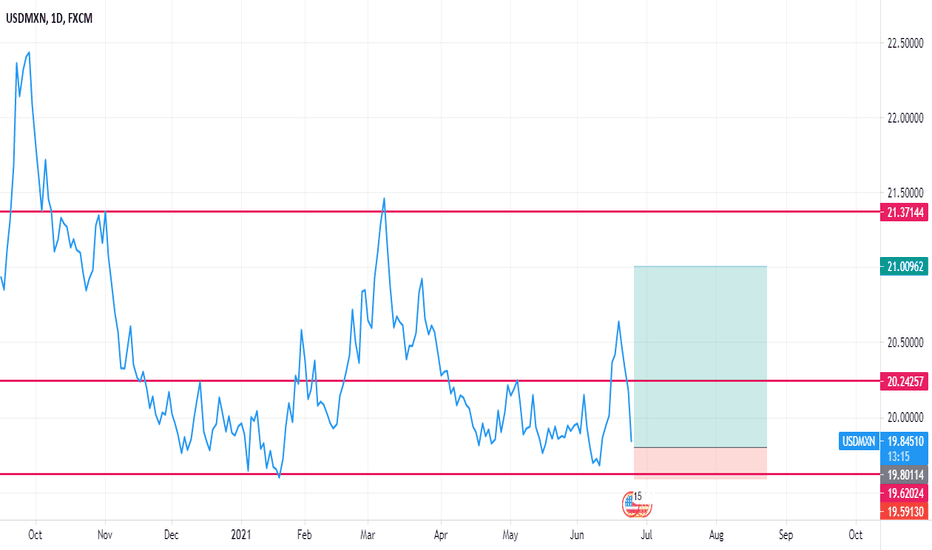

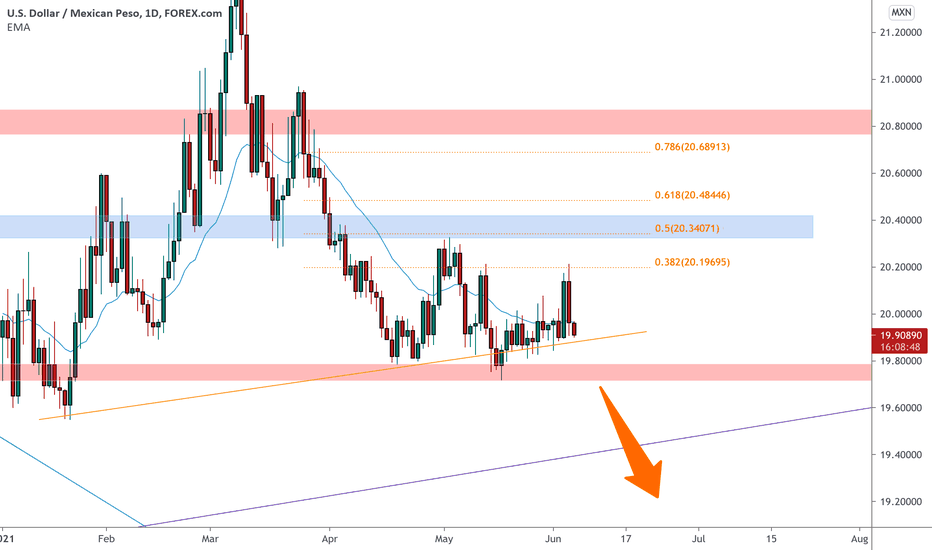

As you can see, USDMXN is trading sideways since the beginning of 2021. With slow price action and corrective sideways wave structure, we believe it's just a correction within downtrend, ideally a bearish triangle formation within a higher degree wave (IV) that can send the price even lower within wave (V).

Triangles are continuation patterns which consist of five waves A-B-C-D-E and seems like the final wave E can be now in progress, so watch out for a drop back to lows towards 18.x area soon.

It’s also worth to mention that three weeks back the central bank of Mexico (Banxico) hiked the benchmark interest rate by 25 basis points to 4.25%. This seems to be very bullish for MXN across the board and it may last until other banks will start increasing the rates as well. However, a lot of CB seem to be waiting on the FED first. Today, Powell will definitely talk about inflation, but recent retracement on some of the commodities, like Lumber, may give more time to the FED, so they can wait with aggressive taper- talk, possibly till September or maybe even end of the year. Under that situation dollar may face limited upside.

Be humble and trade smart!

If you like what we do, then please like and share our idea!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

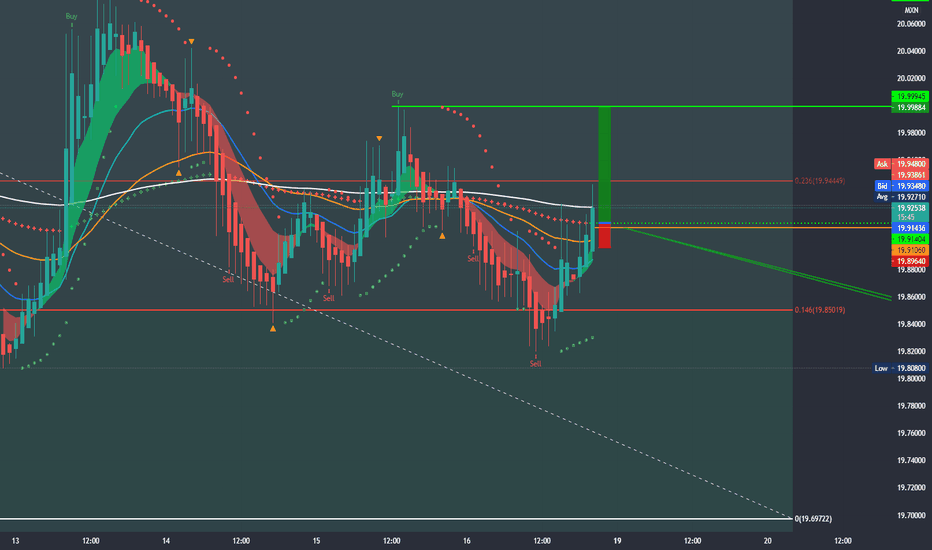

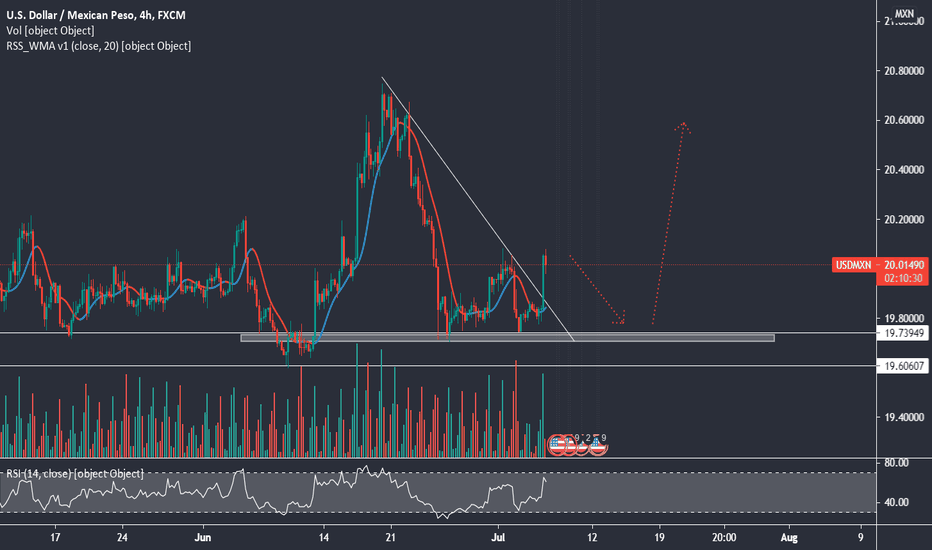

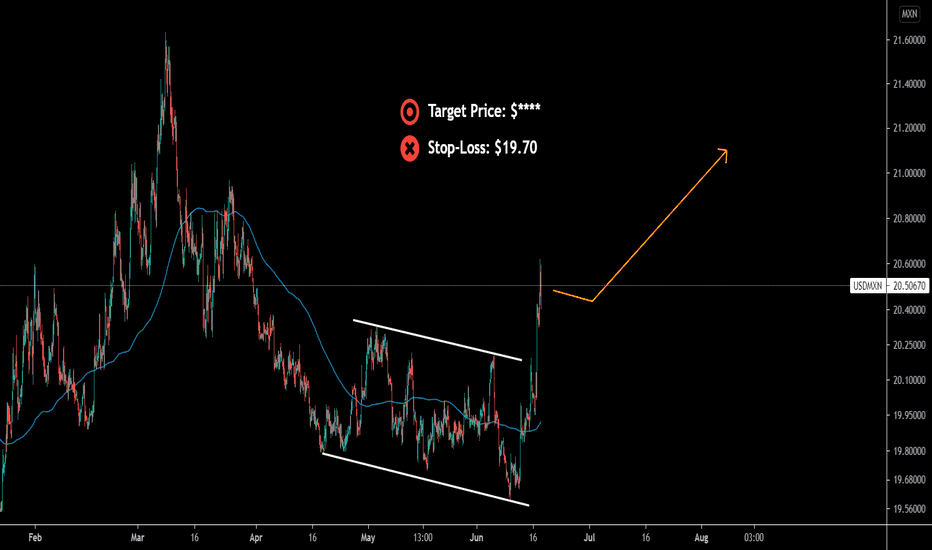

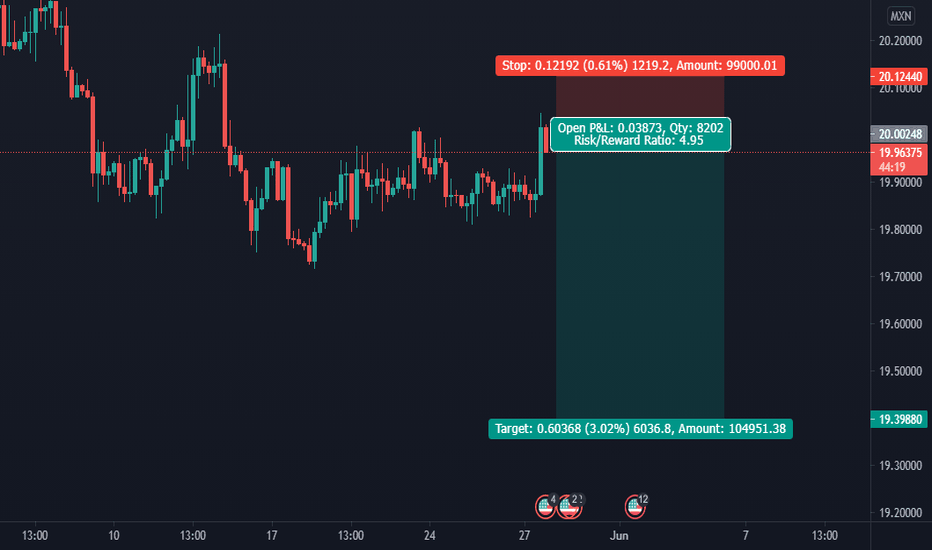

USDMXN on a spicy level 🦐USDMXN is currently testing a weekly support.

The price is trading above an ascending trendline with some retracement to the upside for a test of the 0.5 and 0.382 Fibonacci level.

According to Plancton's strategy if the price will break below the structure we will set a nice short order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

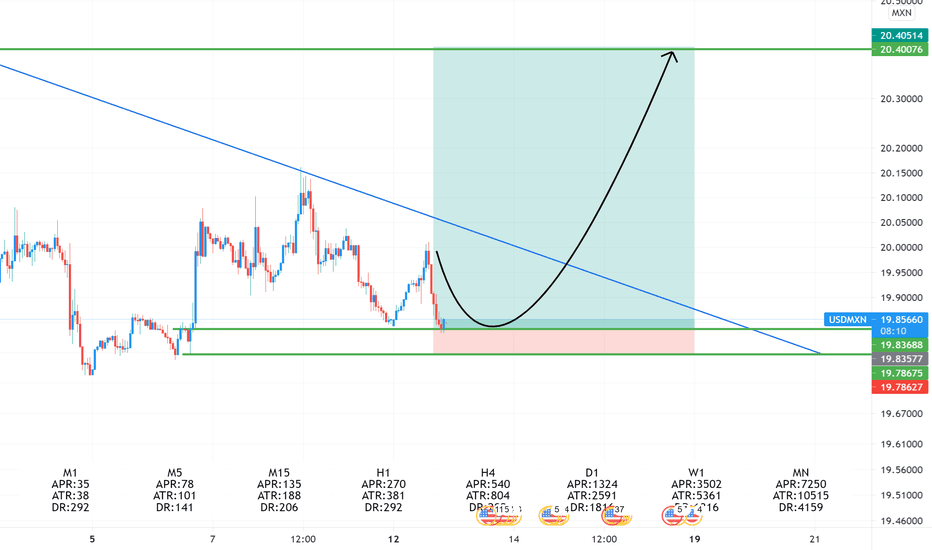

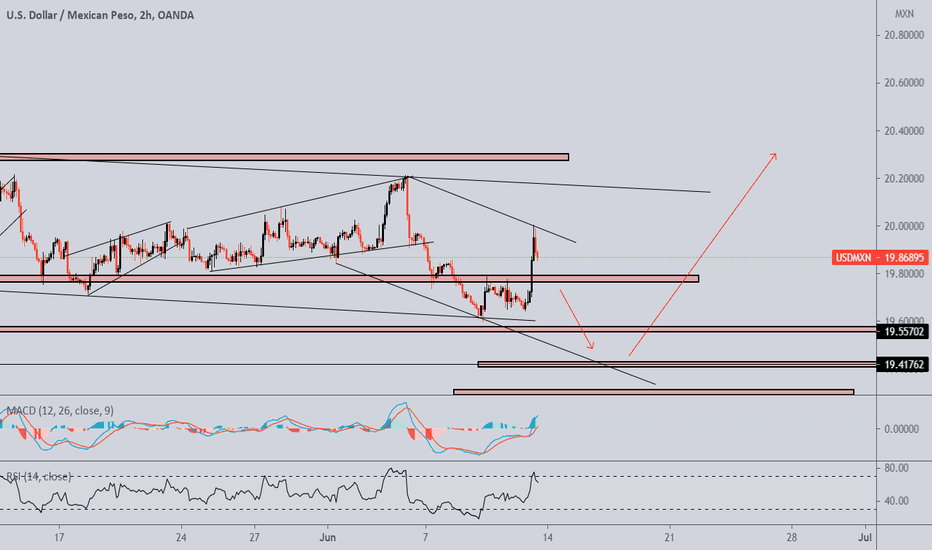

USDMXN top-down analysisHi Guys, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis video. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover my next analysis.

Also let me know your thought in the comment section what you think about this pair.

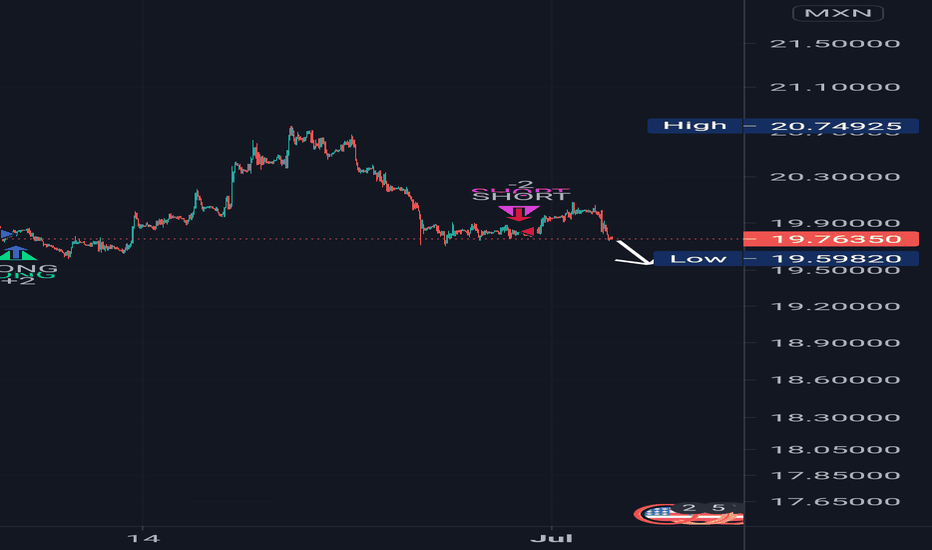

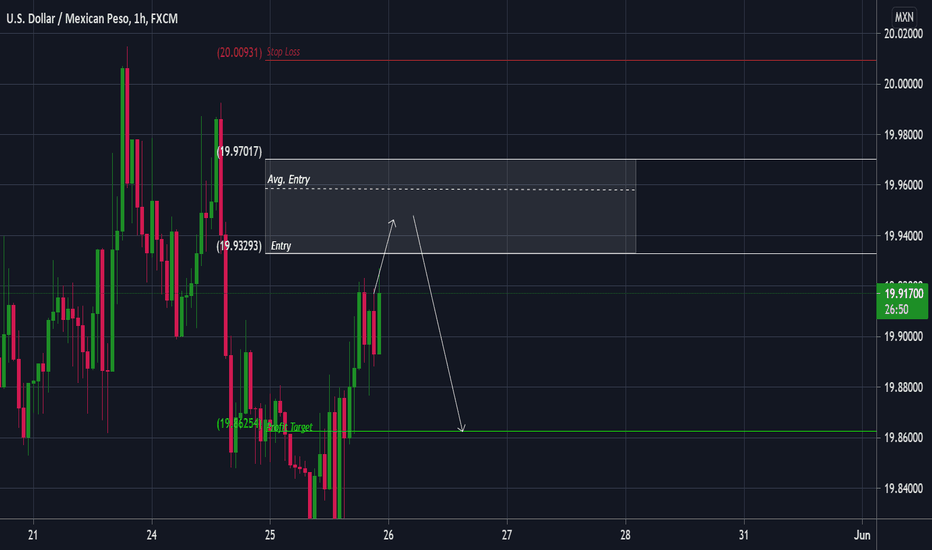

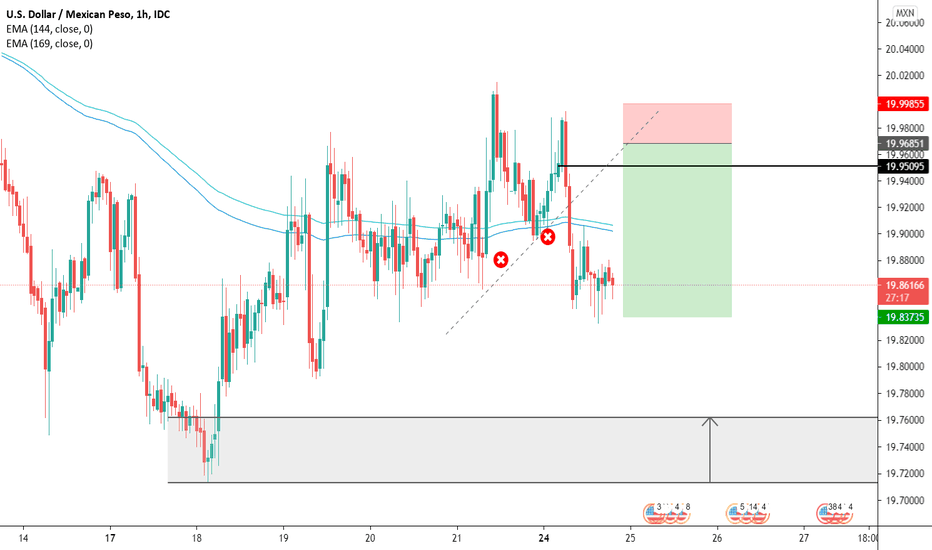

USDMXN | SHORT-Values-

Entry Range: 19.93293 - 19.97017

Average Entry: 19.95845 (RRR: 1.86)

Stop Loss: 20.00931

Profit Target: 19.86254

-HOW TO ENTER MY TRADES-

1. Ladder your entries.

You'll want to ladder place your orders exponentially within the Entry Range to the point your RRR is atleast 1.5 if fully filled.

2. Only first touches are valid.

If price is rebounding back into the entry zone after either the profit target or stop loss was hit the entry zone is no longer valid.

Example:

Trade Idea:

Valid and Invalid Entry: