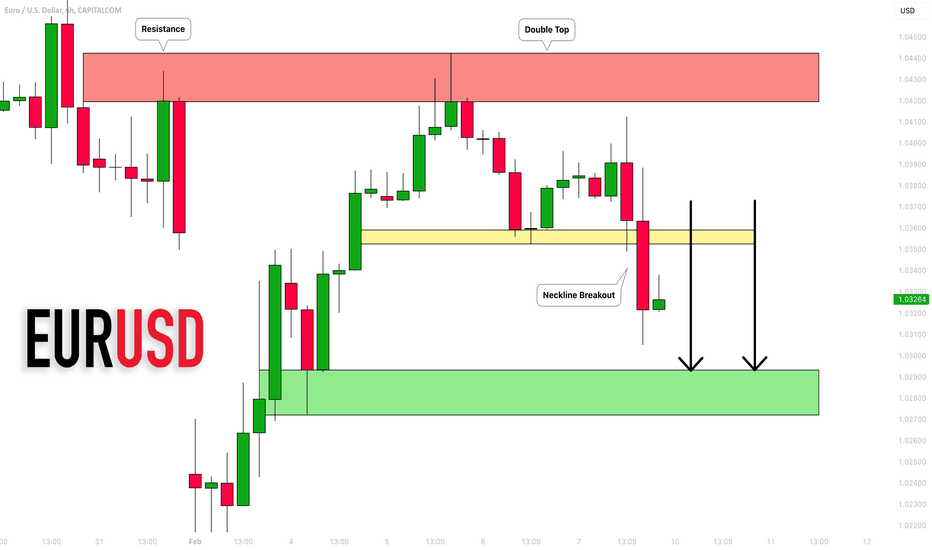

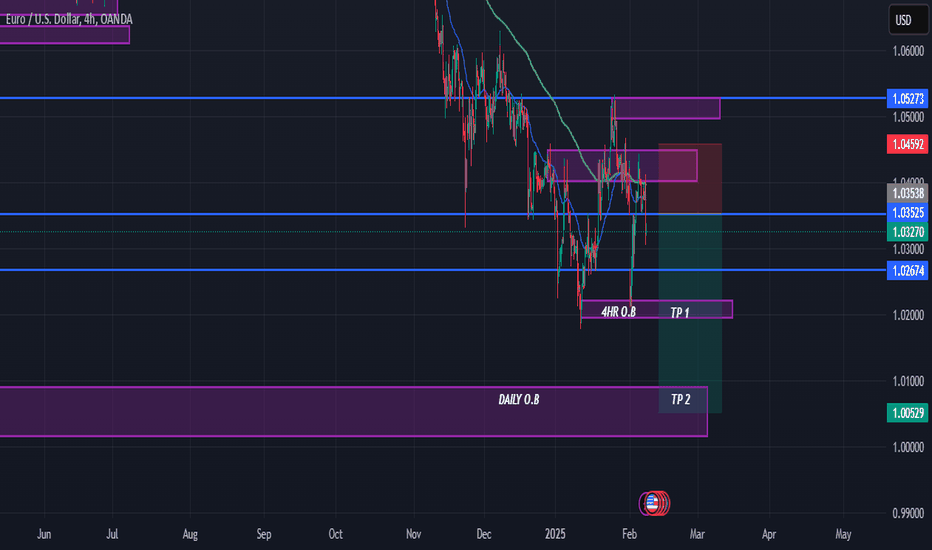

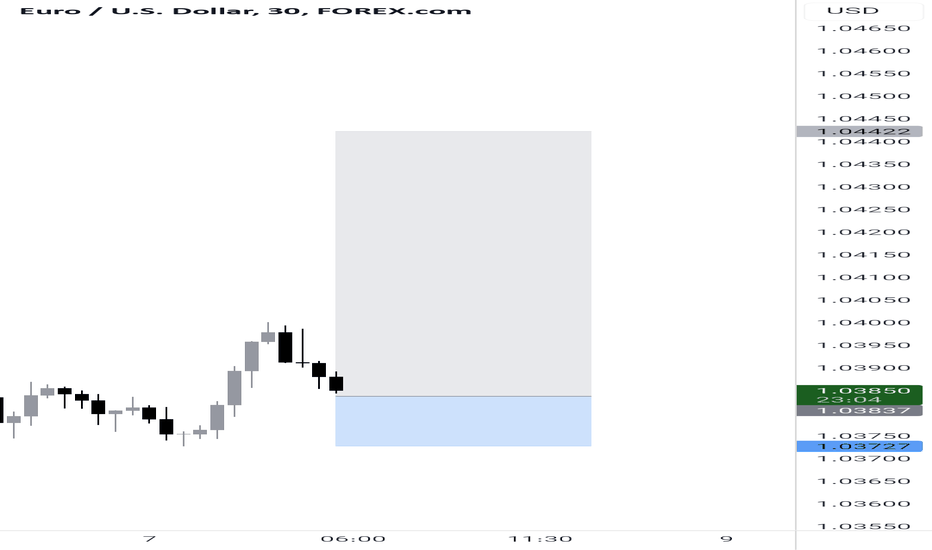

EURUSD: Bearish Outlook Explained 🇪🇺🇺🇸

It feels like EURUSD may continue falling,

following a strong bearish reaction to the underlined

key daily/intraday resistance.

A breakout of a neckline of a double top pattern on a 4H

give a strong bearish confirmation.

Next support - 1.0295

❤️Please, support my work with like, thank you!❤️

DJ FXCM Index

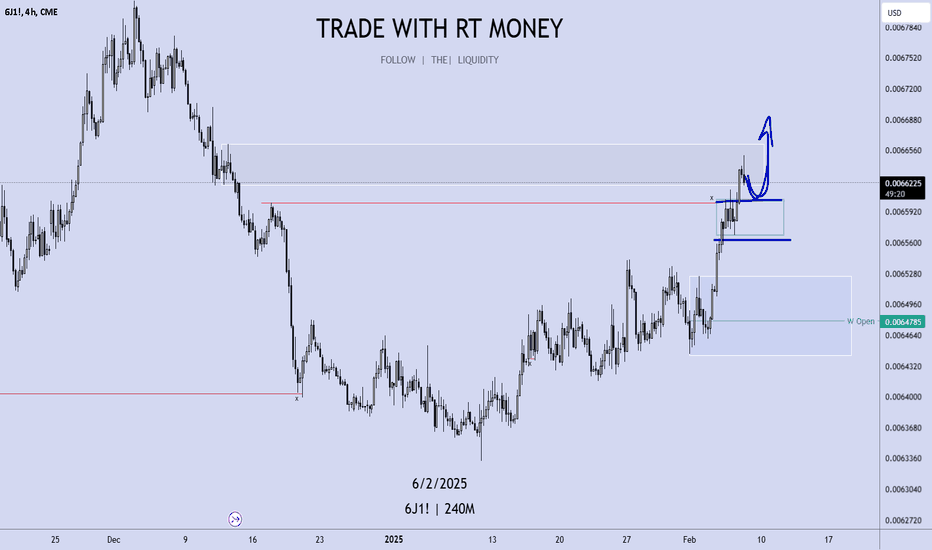

Weekly FOREX Forecast Feb 10-14thThis is an outlook for the week of Feb 10-14th

In this video, we will analyze the following FX markets:

USD Index

EURUSD

GBPUSD

AUDUSD

NZDUSD

CAD, USDCAD

CHF, USDCHF

*JPY, USDJPY

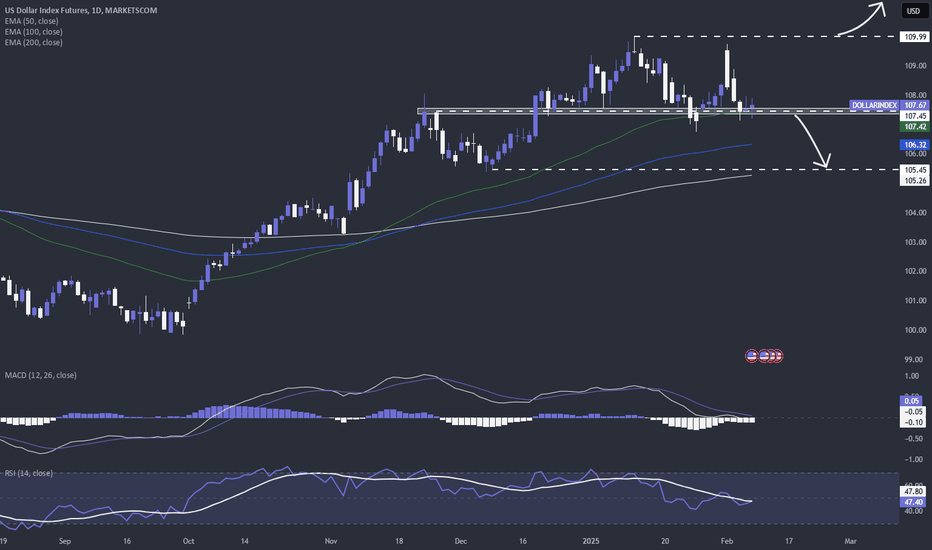

The USD Index has reacted to Weekly Supply, and we saw an attempt on Monday to make a new high fail. This was after Trump announced tariffs and all. The swing failure resulted in the market slowly turning bearish. This would mean that the other currencies can potentially find higher pricing.

As we wait for a definitive break of market structure in the currencies to the upside, selling the USD vs its currency counterparts may be the way to go this week.

The JPY may be the exception, as it continues to underperform.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

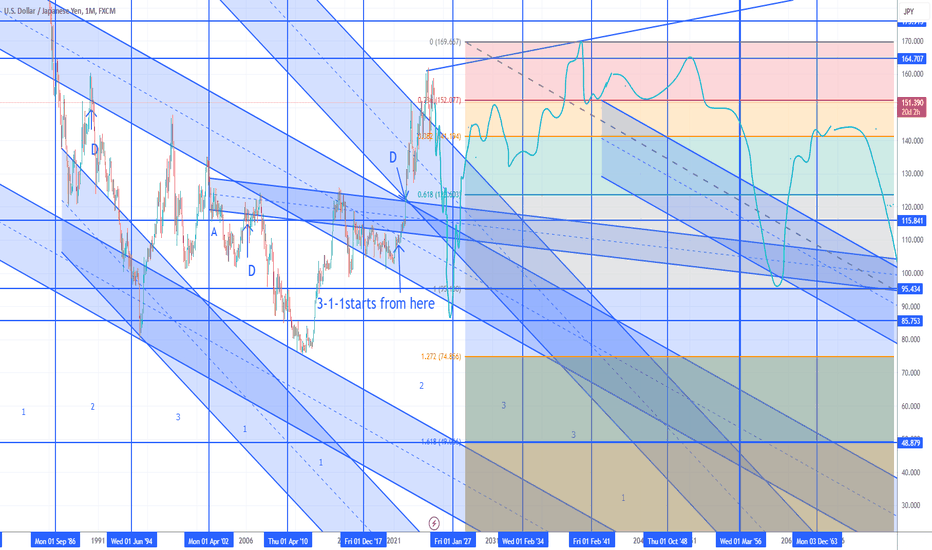

USD JPY Monthly Prospective Analysis up to 2060 (updated)This is the idea combined with elliott wave theory(I forgot to mention in the previous upload, but, in my chart, the number 2 wave corresponds to the 3 in the elliott and the 3 to the 5. The number 1 wave is the same as the 1 in the elliott). Up to 2027 the trend is down, bounced at around 85 and then going up all the way to reach around 170 (maybe does not reach 200 yen this time, that would be accomplished more than about 50 years later). Hope to live long to see if its correct!

EURUSD SHORTNFP came in lower than expected but unemployment rate declined. The next event coming up is US CPI, which is expected to go up. I am still maintaining a sell position because any higher than expected CPI will force the FED to continue holding. Also with the Trump's tariff threats I still anticipate the EURO to remain under pressure. Those with no entries watch for 1.03500 and go short.

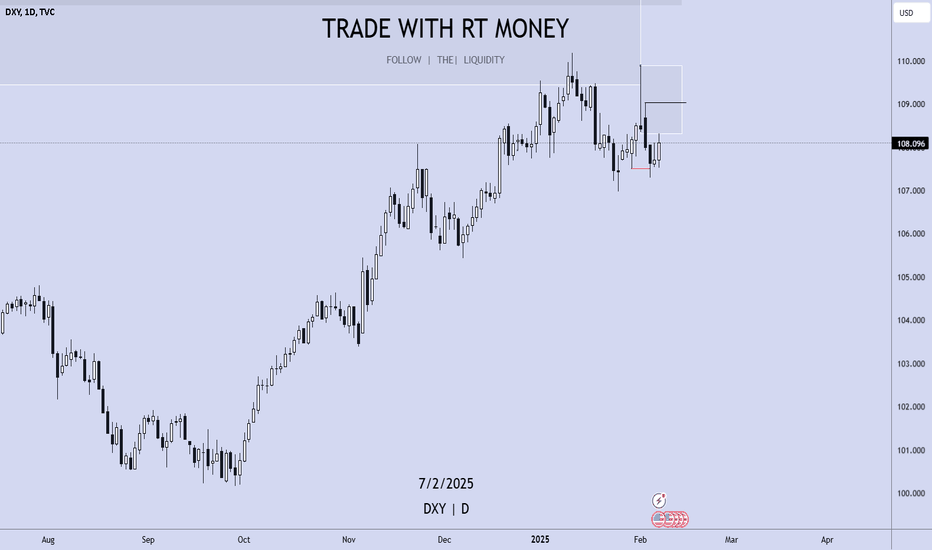

US DOLLAR at Key Support: Will Price Rebound to 108.200?TVC:DXY is currently testing a key support zone, an area where the price has previously shown strong bullish reactions. The recent price action suggests that buyers may step in and drive the price higher. A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a bounce from this level. If buyers regain control, the price could move toward the 108.200 level.

However, a breakout below this support would invalidate the bullish outlook, potentially opening the door for further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

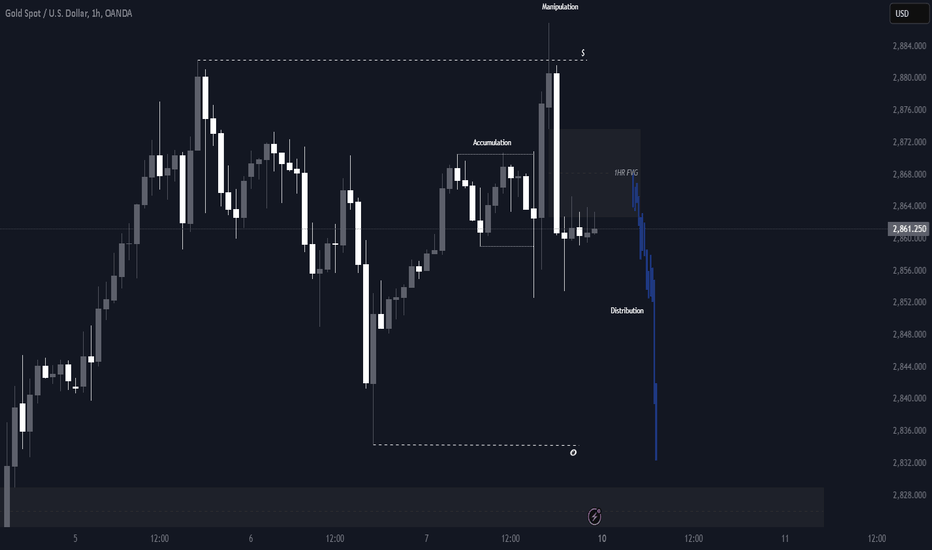

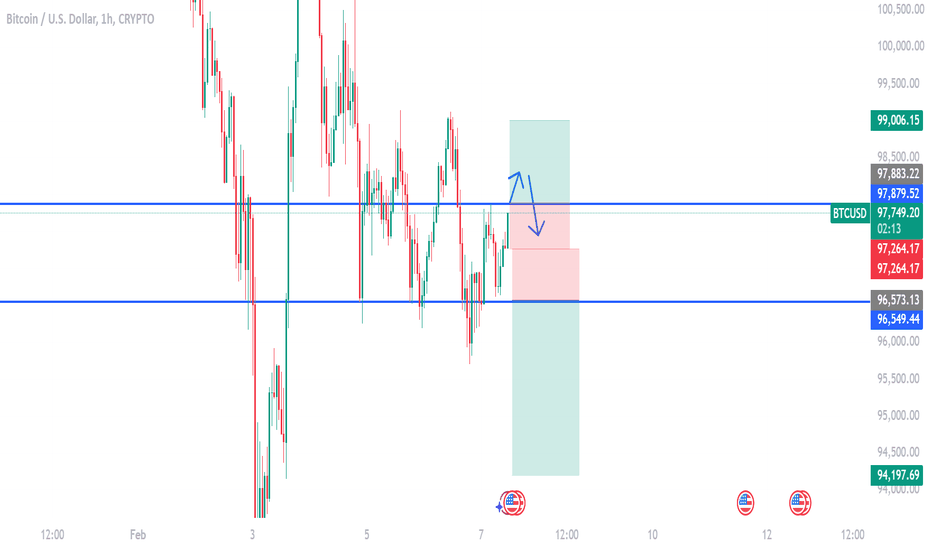

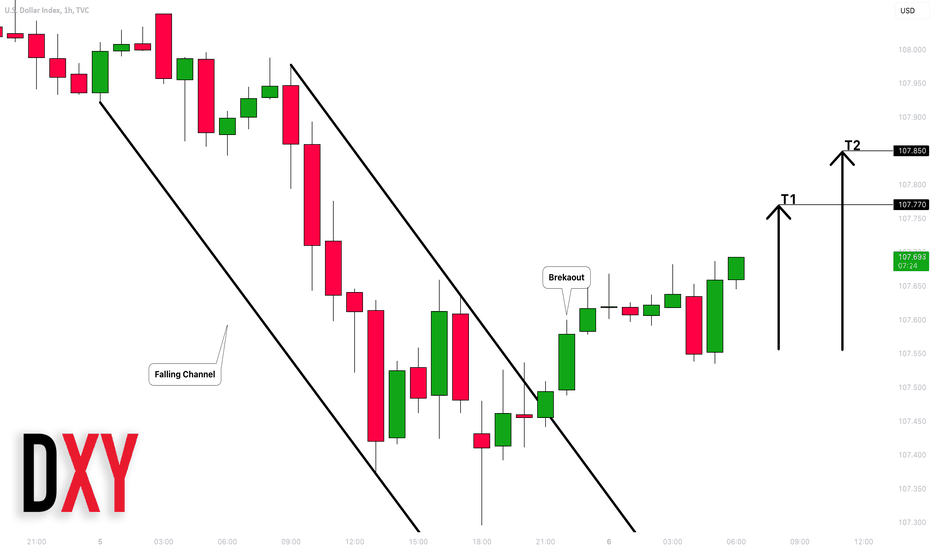

A quick glance at what's happening after the NFP releaseLet's see how markets are performing right now after we received the US NFP number for January, which showed a significant decline from the previous reading. However, average hourly earnings improved and unemployment fell to 4%. Last time we saw a reading as low as 4% was back in June of 2024.

MARKETSCOM:DOLLARINDEX

MARKETSCOM:GOLD

FX_IDC:USDJPY

FX_IDC:USDCAD

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

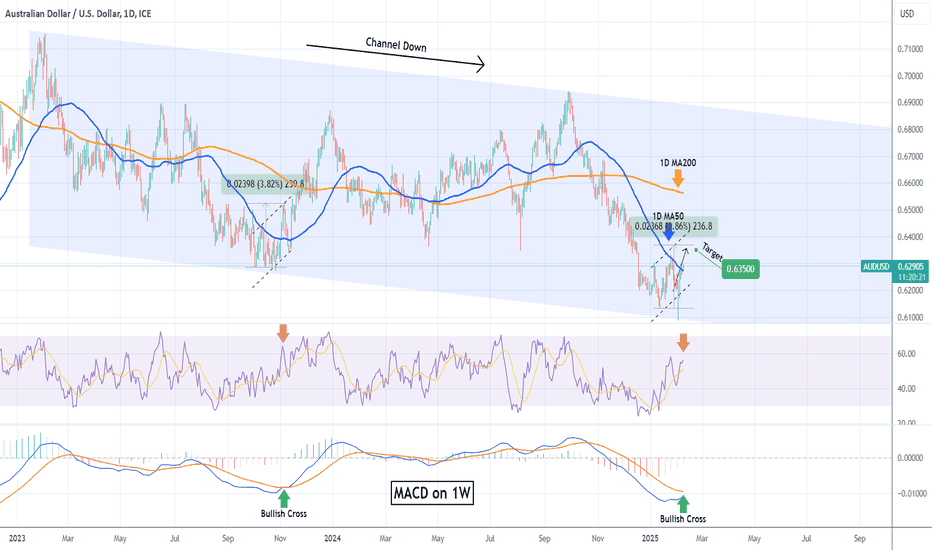

AUDUSD Has it found Support?The AUDUSD pair gave us an excellent sell signal on our September 18 2024 bearish call (see chart below), which went straight to the 0.63750 Target within the time-frame we expected:

This time we are looking at a potential Support rebound as the price appears to have made a bottom on the 2-year Channel Down Lower Lows trend-line. Based on the upcoming 1W MACD Bullish Cross and the 1D RSI symmetrical positioning, we might be starting a rally similar to October 31 2023 during the last Lower Low.

This rose by +3.82% before pulling back to the 1D MA50 (blue trend-line) again, so our short-term Target is 0.63500. Beyond that, we need to observe whether the 1D MA200 (orange trend-line holds or not, in order to engage in buying break-outs.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

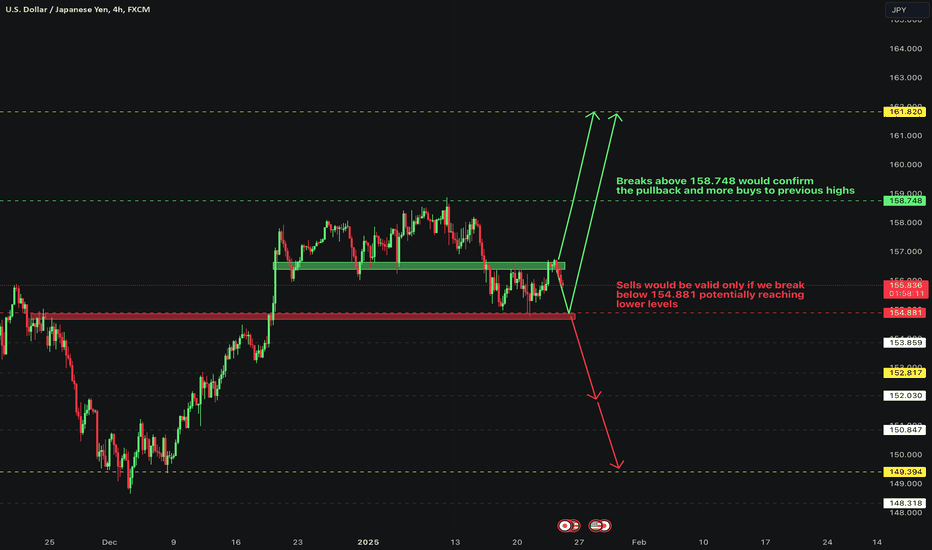

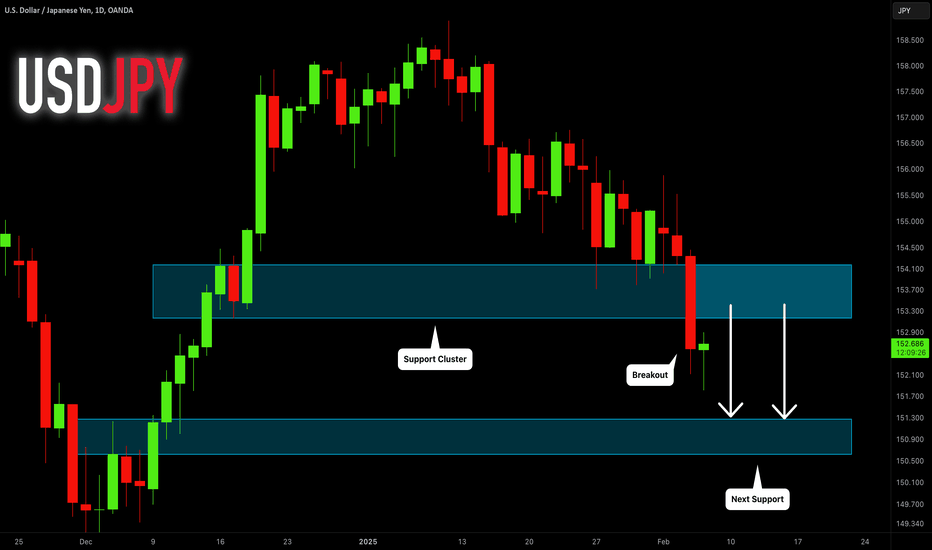

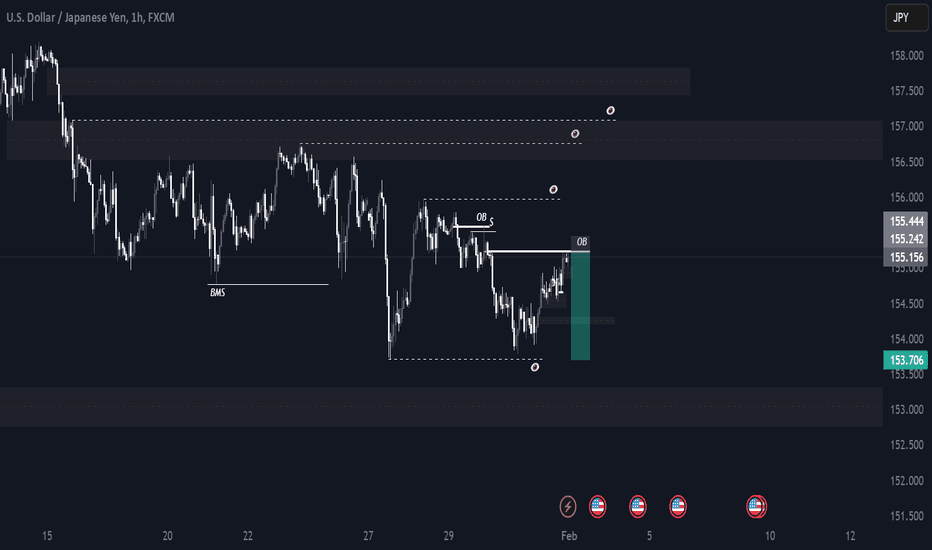

USDJPY - BoJ Interest Rate Decision?!Here is our in-depth view and update on USDJPY . Potential opportunities and what to look out for. This is a long-term overview on the pair sharing possible entries and important Key Levels.

Alright first, let’s take a step back and take a look at USDJPY from a bigger perspective. For this we will be looking at the H4 time-frame .

USDJPY is currently trading at around 155.800 . Our scenarios are in play after the BoJ (Bank of Japan) Interest Rate Decision is out. Let’s take another look at them with more in-depth outcomes. These scenarios are written from just a TA (Technical Analysis) point of view.

Scenario 1: BUYS

-We broke above 156.700 .

With the break of 156.700 we can expect a possible move up to 158.748. With a a further break of this KL (Key Level) we can expect more upside on the pair potentially reaching top of the long-term range sitting at 161.820.

Scenario 2: SELLS

-We broke below 154.881 .

If we break bellow 154.881 we can expect more downside on the pair even up to 152.000. With breaks of this level we could see even lower levels sitting at around 149.394 or “bottom of the long-term range”.

IMPORTANT KEY LEVELS:

- 161.820; top of the long-term range

- 158.748; breaks above would result in more upside

- 154.881; breaks below would result in sells

- 152.817; breaks below confirming lower levels

- 152.030; breaks below confirming lower levels

- 149.394; bottom of the long-term range

Personal opinion:

It’s not advised to enter into sells or buys before we have a clear break or the BoJ Interest Rate Decision data out. For now we are patiently waiting on either breaks to the upside or breaks to the downside. More volatility on the pair is expected tomorrow so be careful.

KEY NOTES

- USDJPY breaking above 156.700 would confirm buys.

- USDJPY breaking below 154.881 would confirm sells.

- BoJ Interest Rate Decision is tomorrow.

Happy trading!

FxPocket

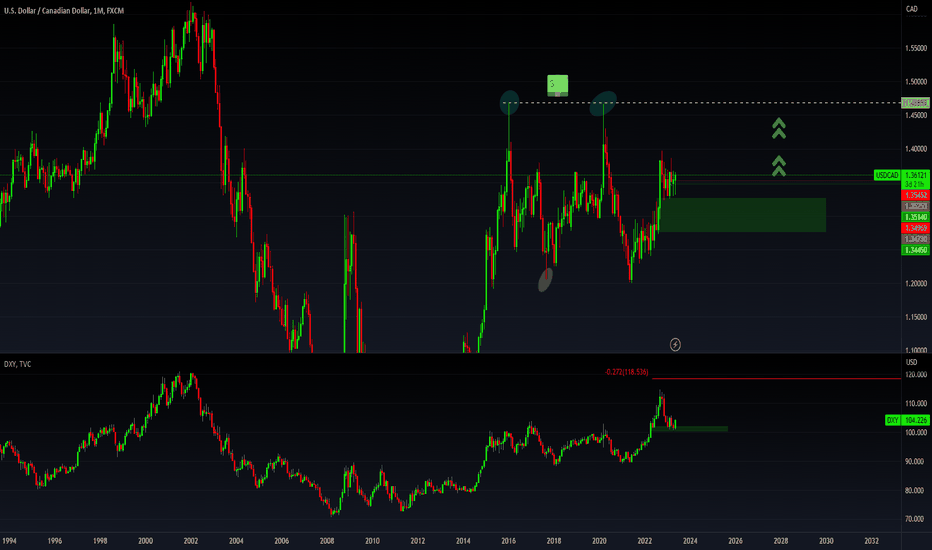

USDCAD Could move 1,064pips up the next month.The reasons why I strongly believe this move will happen are the following:

According to the CFTC non-commercials are shorting CAD.

Non-commercials have 20,388 positions long and 68,914 positions shorts. This means that they are selling more CAD than they actually buying it. According to this info we could expect a move to the upside.

From a monthly perspective there is plenty of buy side liquidity in USDCAD.

If you look at the chart you will see two blue circles and a dollar bill between them . Those highs have not been liquidated yet. The price is aggressively chasing those highs. According to the explanation provided the price is extremely bullish because is moving to a strong liquidity area.

From monthly perspective the price already liquidates sell side liquidity.

If look at the chart you will see a yellow circle . The yellow circle represents the sell side liquidity that was liquidated by the price.

The price has bullish structure.

The price is making higher highs will doing so liquidating sell side liquidity.

There is a lot of optimists about the dollar getting stronger in the near future.

DXY has bullish structure.

The DXY is currently making a retracement. It is currently at 50%. We could assume that is very close to be ready because it took sell side liquidity as well.

In other words, the CAD is getting weaker and the USD stronger.

Surging Dollar Spurs Jump in Corporate FX HedgingThe relentless rise of the U.S. dollar is sending ripples of concern through the global economy, and businesses are taking notice. Faced with a strengthening greenback, corporations are increasingly turning to foreign exchange (FX) hedging strategies to mitigate the impact of currency fluctuations on their bottom lines. This surge in hedging activity reflects a growing awareness of the risks associated with currency volatility and a proactive approach to protecting profits in an increasingly uncertain global landscape.

The Dollar's Dominance

The U.S. dollar has been on a tear, appreciating significantly against a basket of other major currencies. This surge is driven by a confluence of factors, including the Federal Reserve's hawkish monetary policy, safe-haven demand amid geopolitical tensions, and the relative strength of the U.S. economy. While a strong dollar can have some benefits, such as lower import costs, it also poses significant challenges for multinational corporations.1

Impact on Corporate Earnings

For companies that generate revenue in foreign currencies but report earnings in U.S. dollars, a strong dollar can create a significant headwind. When foreign revenues are converted back into dollars, they are worth less than they were before the dollar's appreciation. This can lead to lower reported earnings, even if the company's underlying business performance remains strong. Conversely, companies that import goods priced in dollars but sell them in other currencies see their profit margins squeezed as their input costs rise.

The Hedging Imperative

In this environment of heightened currency risk, FX hedging has become a crucial tool for corporations.2 Hedging involves using financial instruments, such as forward contracts, options, or swaps, to lock in exchange rates for future transactions.3 This allows companies to insulate themselves from adverse currency movements and provides greater certainty about their future cash flows and earnings.4

Surge in Hedging Activity

Market data suggests a significant uptick in corporate FX hedging activity. Treasurers and finance departments are increasingly prioritizing currency risk management, recognizing that even small fluctuations in exchange rates can have a material impact on their financial results. This increased focus on hedging is driven by several factors:

• Heightened Volatility: The dollar's rapid appreciation has created significant volatility in currency markets, making it more difficult for companies to predict future exchange rates. This uncertainty underscores the need for hedging strategies to protect against unexpected currency swings.

• Earnings Protection: As mentioned earlier, a strong dollar can erode corporate earnings. Hedging allows companies to mitigate this risk and ensure that their financial performance is not unduly impacted by currency fluctuations.5

• Strategic Planning: Hedging provides greater predictability in cash flows, which is essential for strategic planning and investment decisions.6 By locking in exchange rates, companies can make more informed decisions about future investments and expansion plans.7

• Shareholder Expectations: Investors are increasingly scrutinizing companies' currency risk management practices. Companies that proactively hedge against currency risks are often seen as more prudent and better managed, which can be a positive factor for investor confidence.

Types of Hedging Strategies

Companies employ a variety of hedging strategies depending on their specific needs and risk tolerance.8 Some common approaches include:

• Forward Contracts: These contracts obligate a company to buy or sell a specific amount of currency at a predetermined exchange rate on a future date.9 This is a straightforward way to lock in exchange rates for future transactions.

• Options: Currency options give a company the right, but not the obligation, to buy or sell currency at a specific price on or before a certain date.10 Options provide flexibility and allow companies to benefit from favorable currency movements while limiting their downside risk.11

• Currency Swaps: These agreements involve exchanging principal and/or interest payments in one currency for those in another currency.12 Swaps can be used to manage currency risk associated with long-term debt or investments.13

Challenges and Considerations

While hedging can be an effective way to manage currency risk, it's not without its challenges. Hedging strategies can be complex and require specialized expertise. Furthermore, hedging involves costs, such as premiums paid for options or fees for forward contracts.14 Companies need to carefully weigh the costs and benefits of hedging and choose strategies that are appropriate for their specific circumstances.

Looking Ahead

The strong dollar is likely to remain a significant factor in the global economy for the foreseeable future. As such, corporate FX hedging is expected to remain a priority for multinational companies. Companies that proactively manage their currency risk are better positioned to navigate the challenges of a strong dollar environment and protect their earnings from adverse currency movements.15 The current surge in hedging activity reflects a growing recognition of this reality and a proactive approach to mitigating currency risk in an increasingly interconnected world. As global economic conditions evolve, companies will need to remain vigilant and adapt their hedging strategies accordingly to ensure they are adequately protected from currency volatility.

The Friday Forecast; Best Setups Frr Feb 7This market outlook will cover 15 markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

USD Index

EURUSD

GBPUSD

AUDUSD

NZDUSD

CAD, USDCAD

CHF, USDCHF

JPY, USDJPY

Non Farm Payroll news tomorrow! This is likely to inject a lot of volatility into the markets.

I recommend to wait until after the news is announced before executing on any trades. You never know where the market will go!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

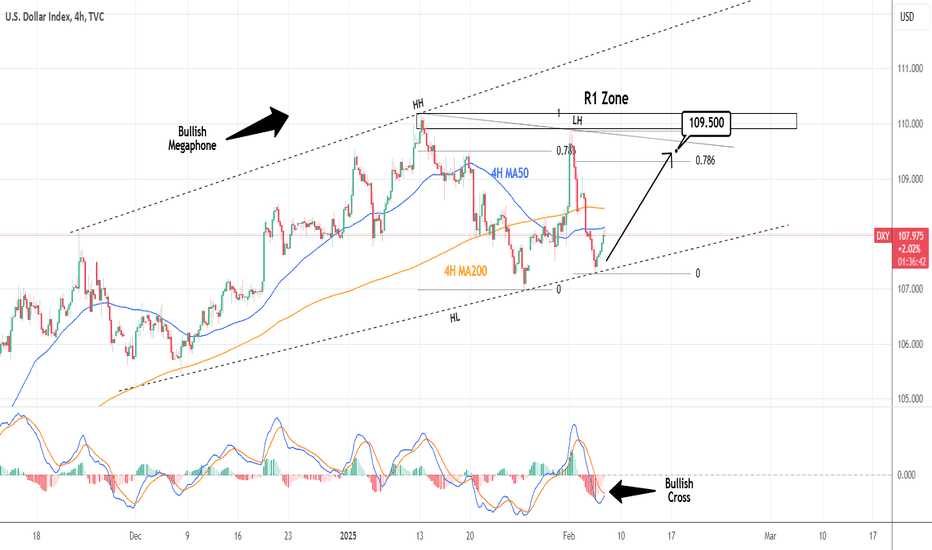

DXY: rebounding at the bottom of the Megaphone.The U.S. Dollar Index is neutral on its 1D technical outlook (RSI = 48.335, MACD = 0.03, ADX = 16.853) as it took a turnaround on the HL trendline of the 2 month Bullish Megaphone. The 4H MACD will form a Bullish Cross today and once the 4H MA50 breaks, we will have the buy trigger for the new bullish wave. We expect this to test at least the LH trendline (if not the R1 Zone), which is where January's wave peaked, marginally over the 0.786 Fibonacci. Go long (TP = 109.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

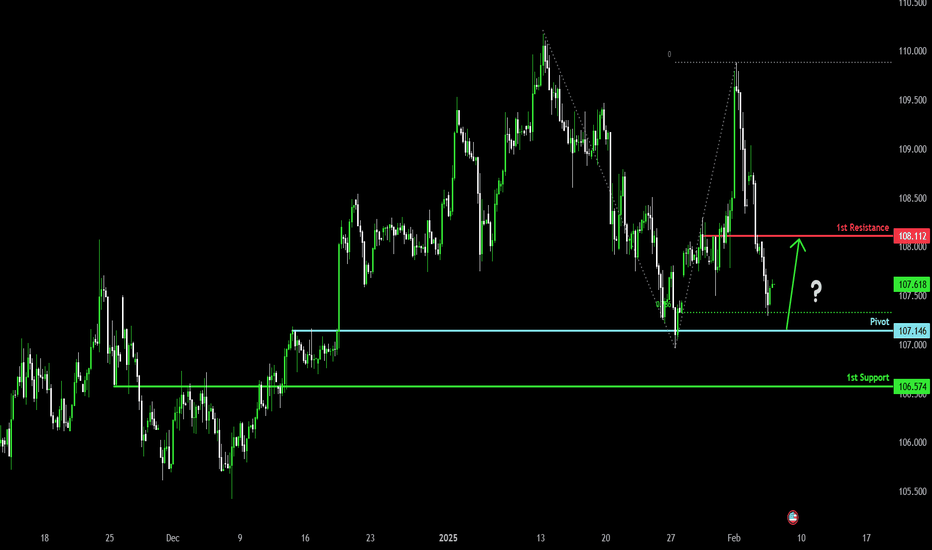

Could the price bounce from here?US Dollar Index (DXY) is falling towards the pivot which is an overlap support and could bounce to the pullback resistance.

Pivot: 107.14

1st Support: 106.57

1st Resistance: 108.11

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDJPY - SHORT - 02/02/25On the daily timeframe, USDJPY is still on a retracement. This idea is based off of looking to continue with this trend and reach the daily tf FVG marked.

On the 30min, price has been reaching higher towards a 30min Order Block. This order block meets the criteria: 1.Swept Liquidity 2. Break of Structure 3. Prescence of Structural Liquidity.

The target being the previous structural low, with hopes of price continuing further down.

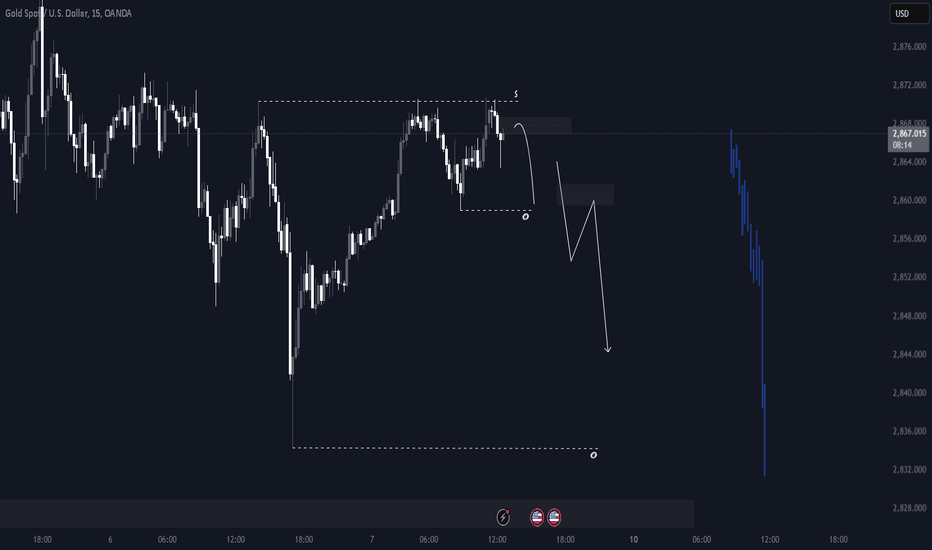

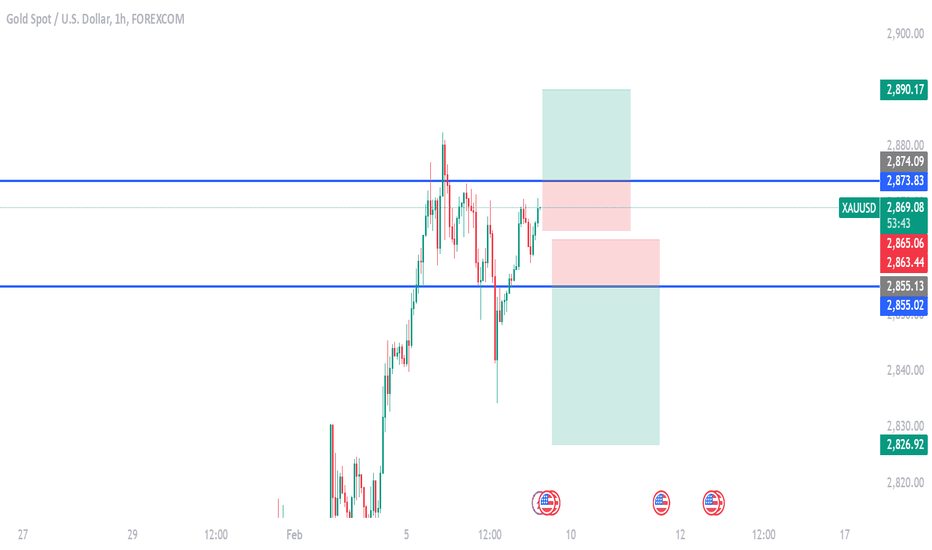

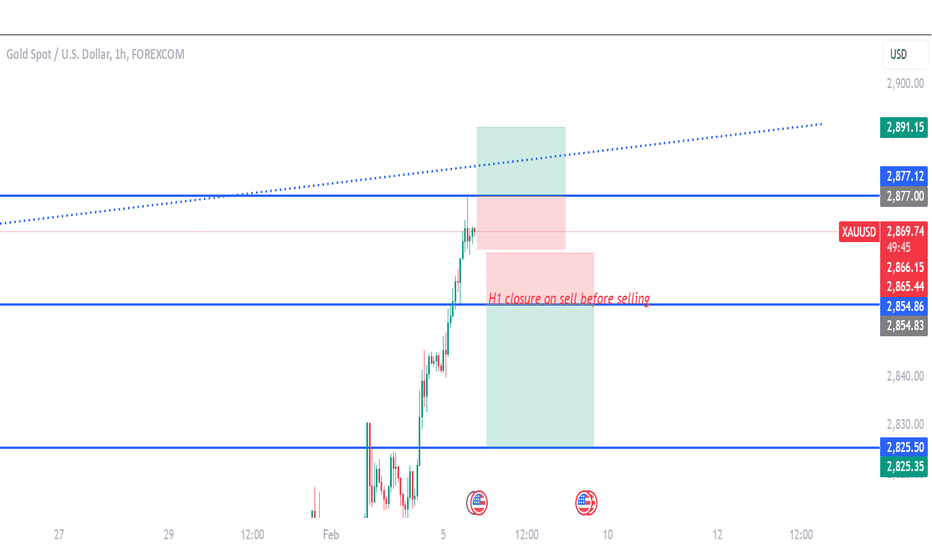

gold on 2 formation#XAUUSD price have finally breakout new high, now based on what happens on past 2 hour following the fast drop at 2877, if price retracment happens above 2877 then target is 2891, but if the H1 time drops and close below 2855 then target is below 2825-2800. SL ON buy 2866, SL ON sell 2866.