Usdollarshort

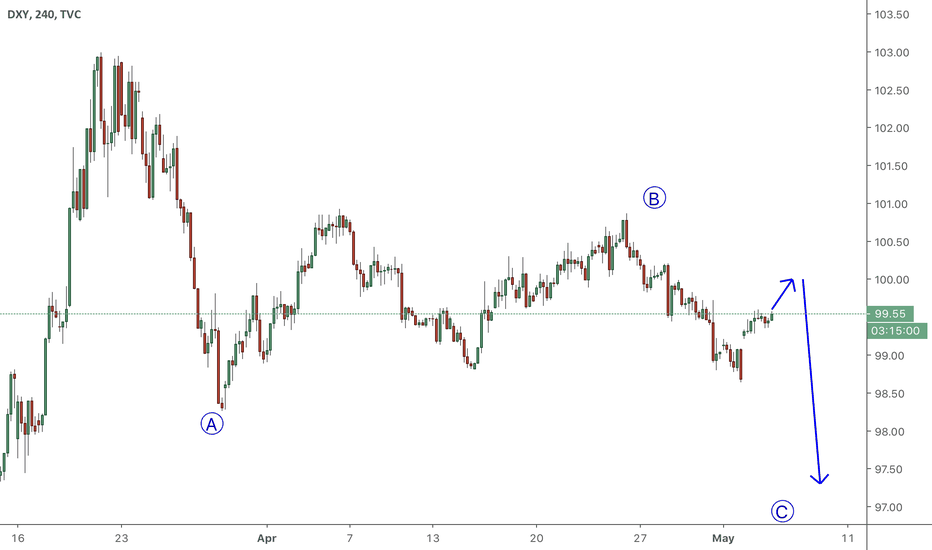

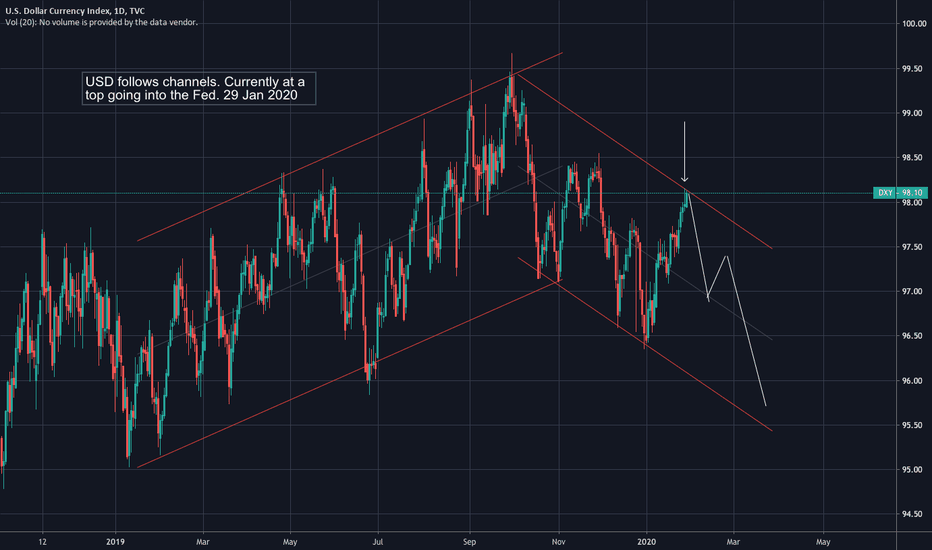

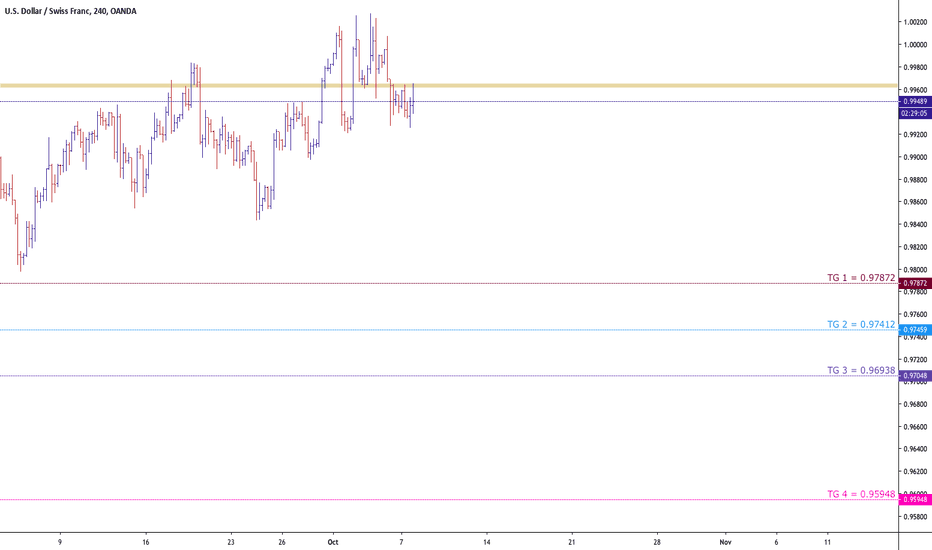

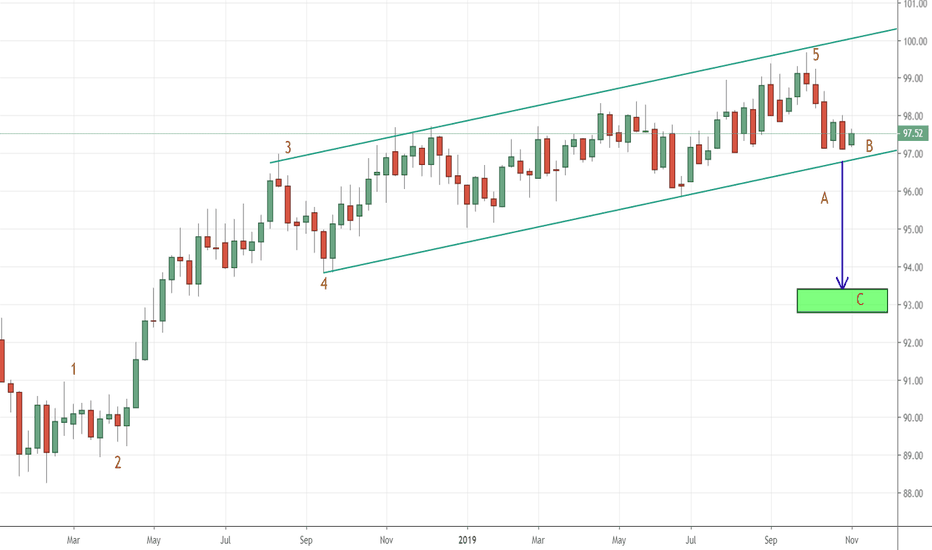

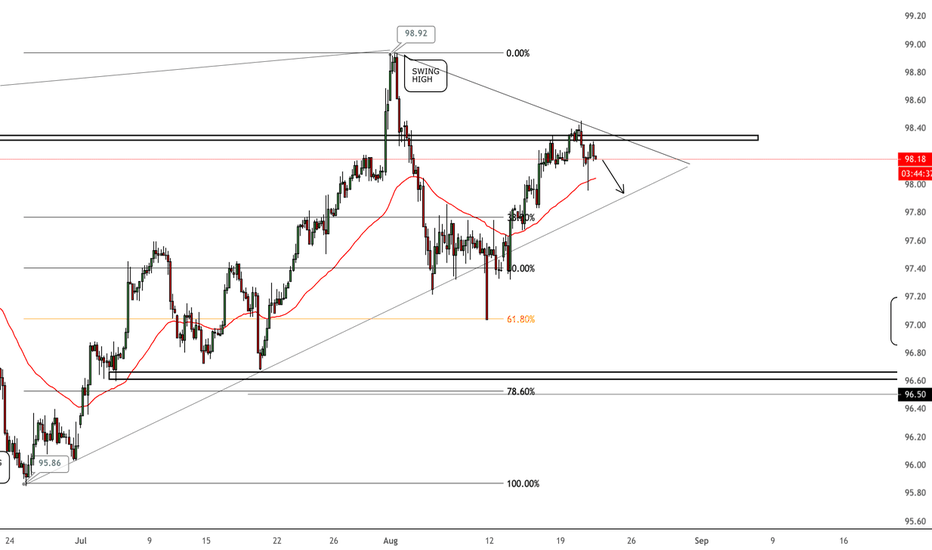

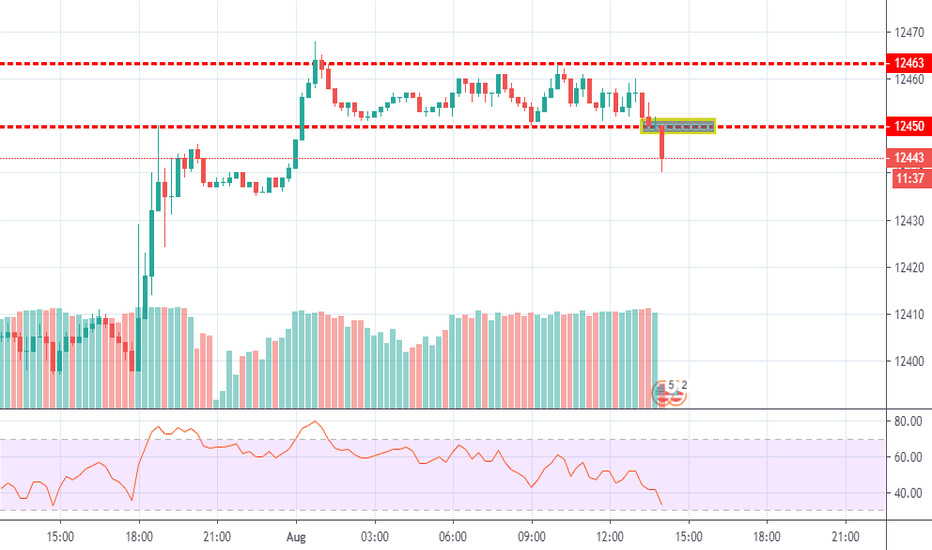

An update on my last DXY ideaUpdated TA from my previous post. This time on the 4H.

Sellers held 100.75 and are now fighting for 99.80. If buyers take control here then we'll see a possible technical event in the yellow box with a confluence of:

-multiple moving averages

-100.00 handle

where sellers can reject price from once again.

Biased to the downside for reasons stated previously.

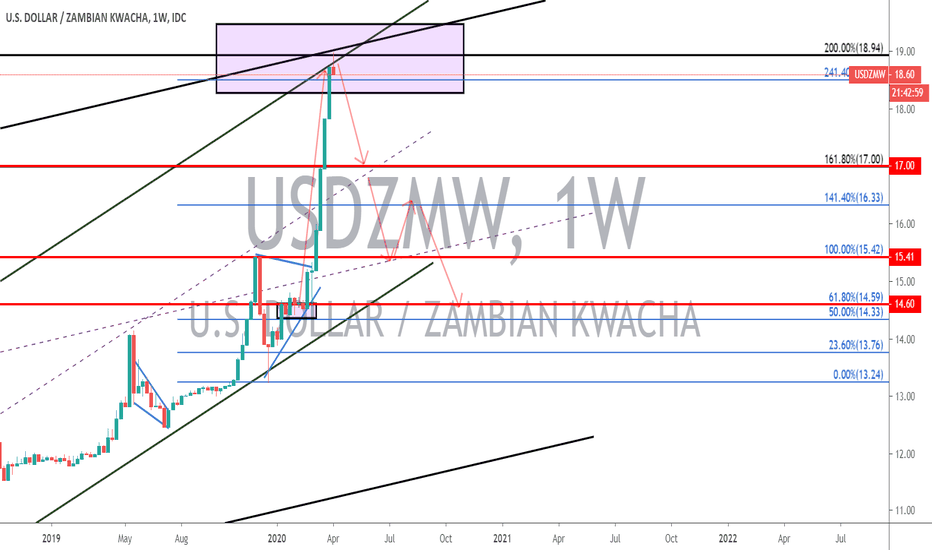

TIME TO BUY THE KWACHAI think it's time to short the dollar and buy some Kwacha.

Price perfectly bounced off the 200% fib level (K18.94 / $1) on the monthly time frame matching up the same price at 261.8% fib level on the weekly time frame.

Going long term, I am seeing a week dollar and some Kwacha appreciation.

I expected the Kwacha to appreciate to about K17/$1 and K15.41/$1 IF price breaks through the support of the monthly ascending channel .

Disclaimer: This is only an idea and should not be taken as a trading signal.

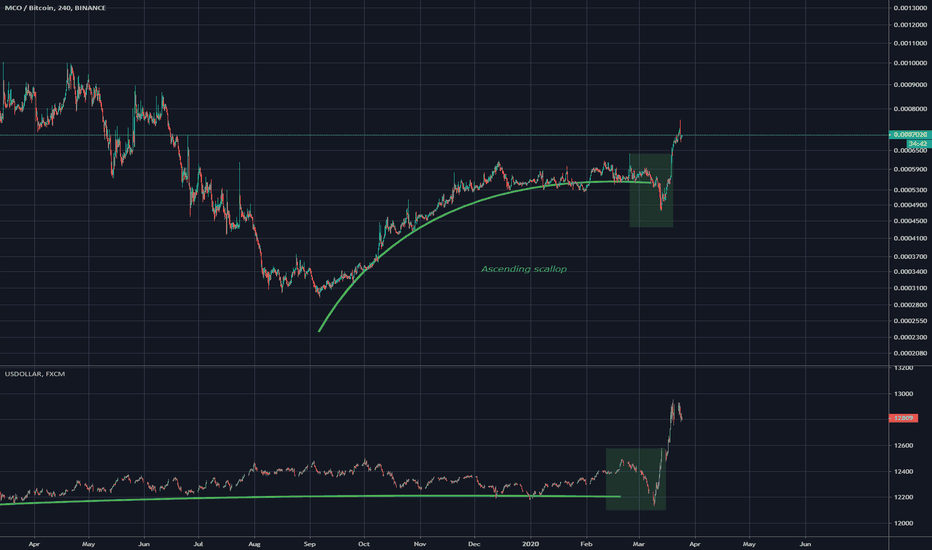

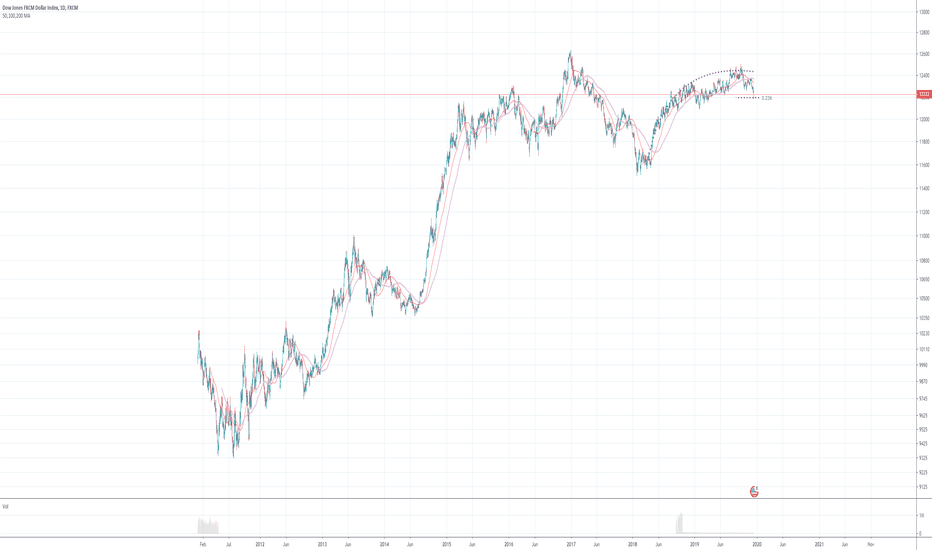

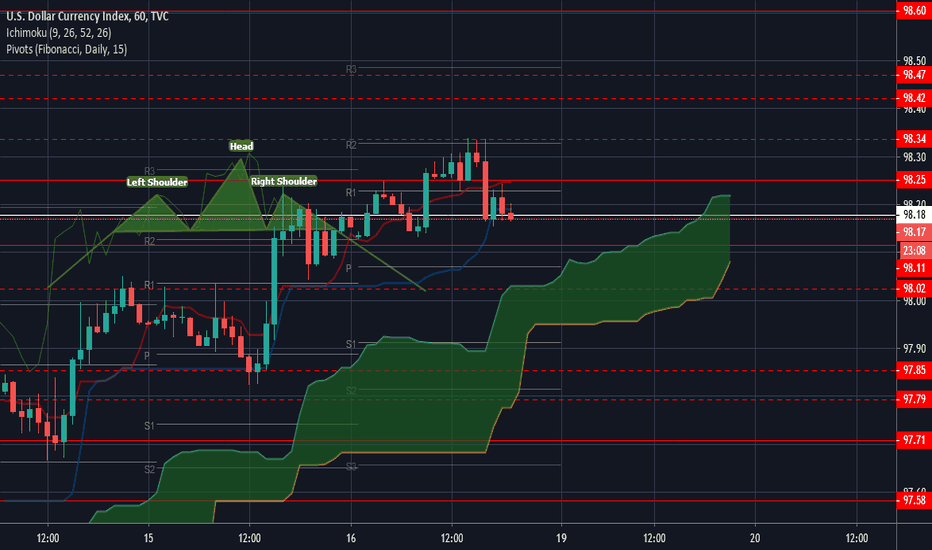

MCO vs USDOLLAR fractalComparison fractal of MCOBTC to USDOLLAR, very strange to see this correlation across such different pairs. Any thoughts? leave them below :) It can be seen that an ascending scallop led to a bullish breakout in both.

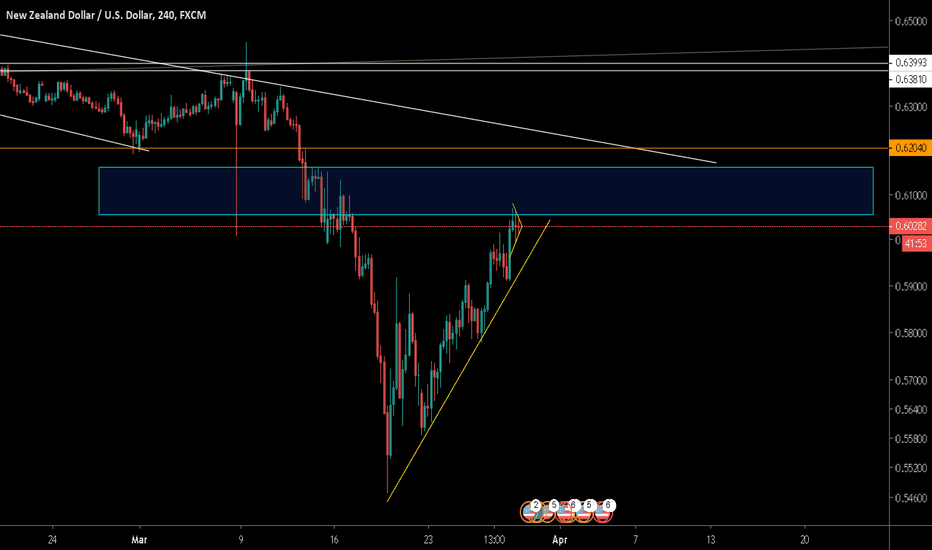

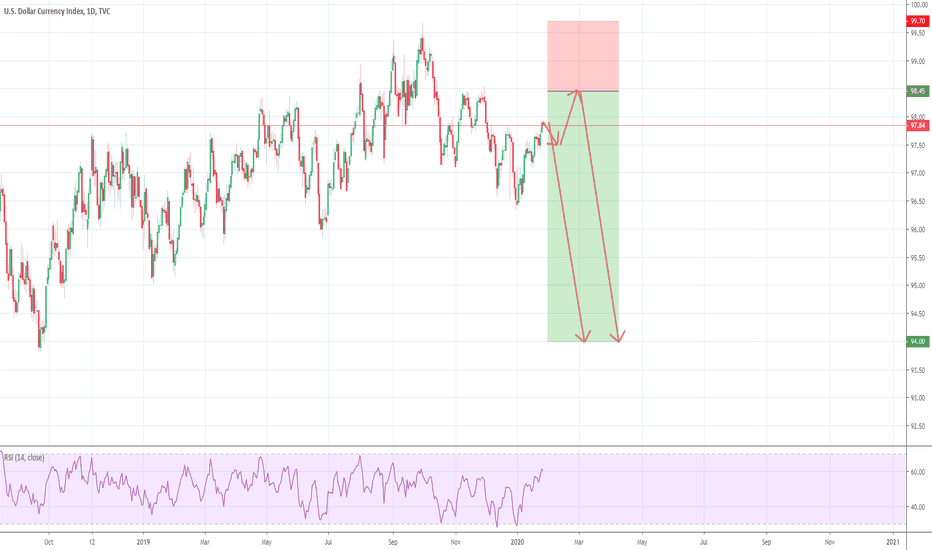

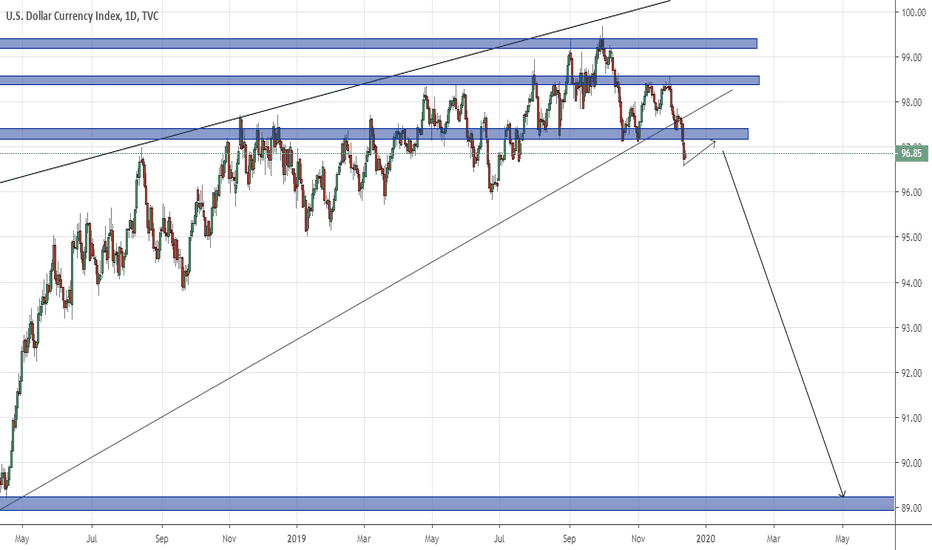

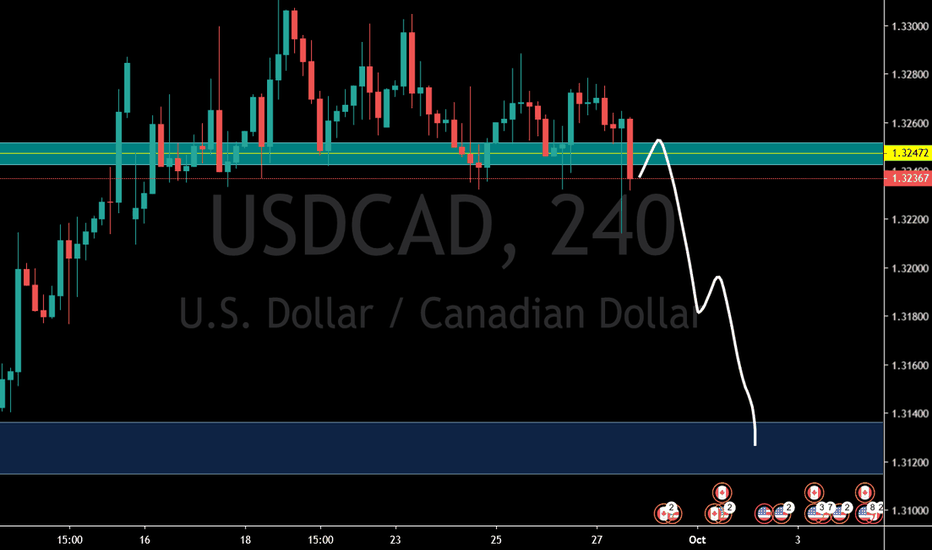

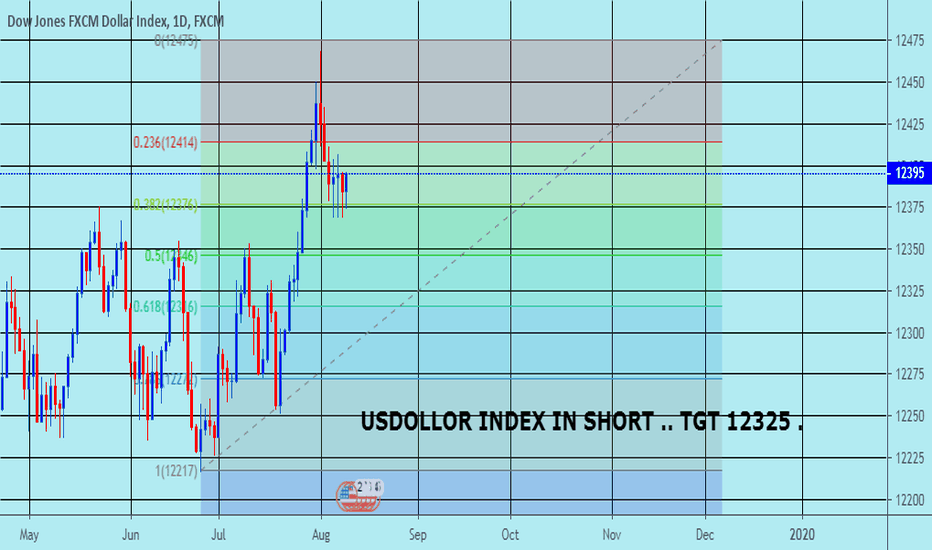

SELL DXY US dollarThe US dollar index is currently a bit uncertain, whether it is a direct decline from the current position or a slight adjustment to continue to overshoot the 98.50 area, but one thing can be confirmed that the current US dollar index is trending downward

SELL DXY ENTER:97.80-98.50 The perfect ideal entry point is near 98.50

SL:99.70 TP1:95.00 TP2:93.30-94.10

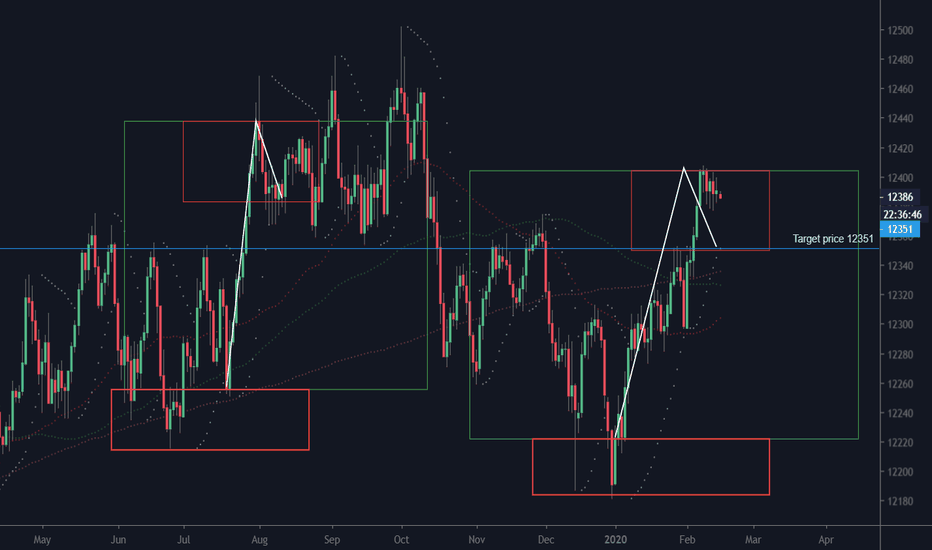

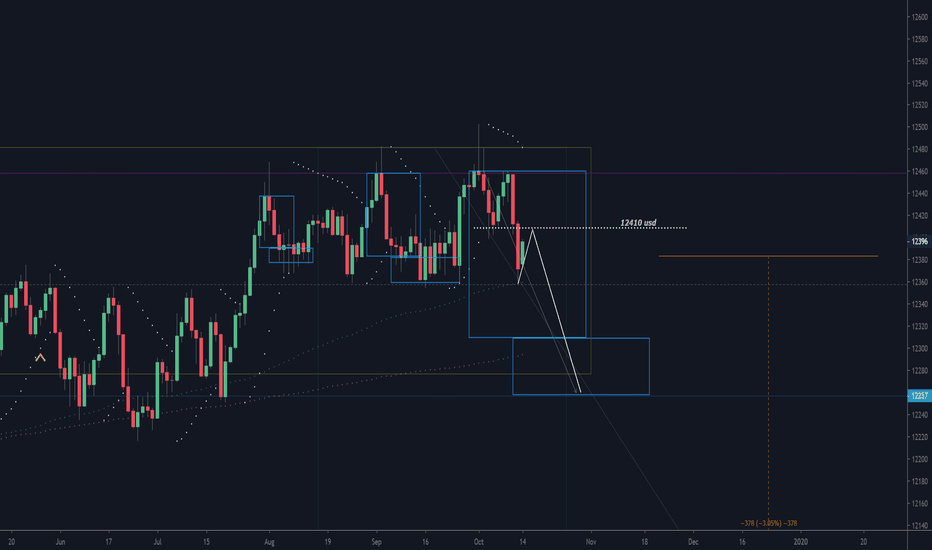

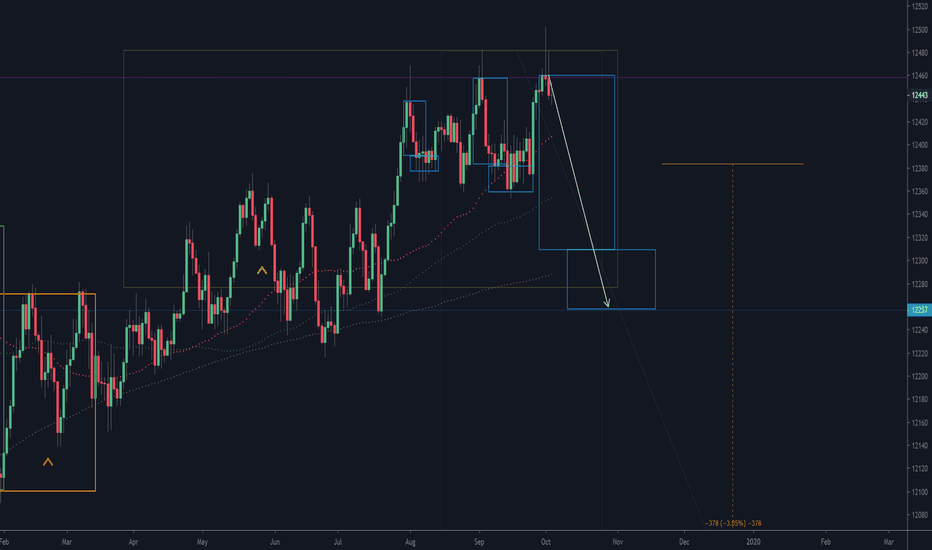

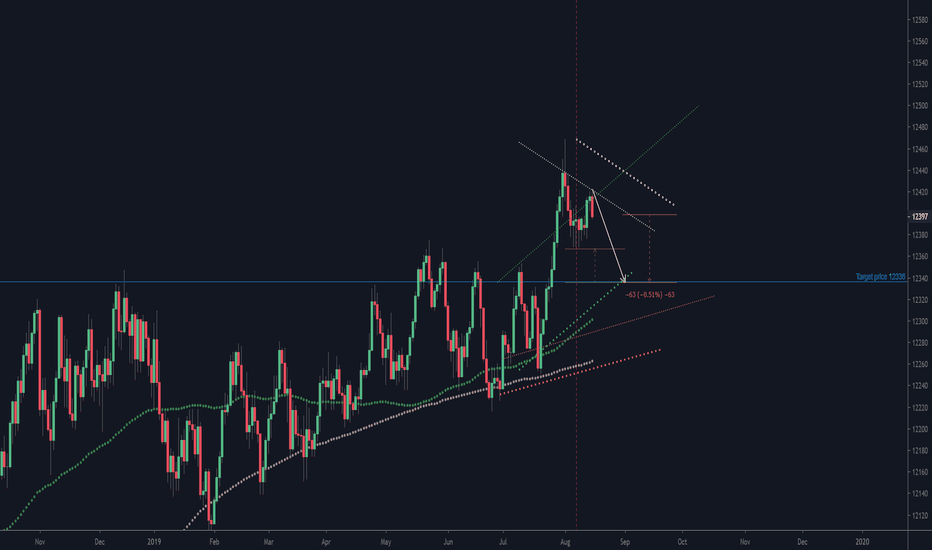

USDOLLAR before 0.51% decline... The exchange rate does not follow fractal rules for the time being. Therefore I used ATR axis strategy. The white ATR axis indicates that the exchange rate movement is strengthening towards the south. And the green and brown shafts are the standard MA100 and MA200 shafts. Currently, the intersection of the MA100 mirror axis and the ATR mirror axis has stopped further dollar index appreciation. Therefore, I expect further adjustment from this level. Target price is 12336.

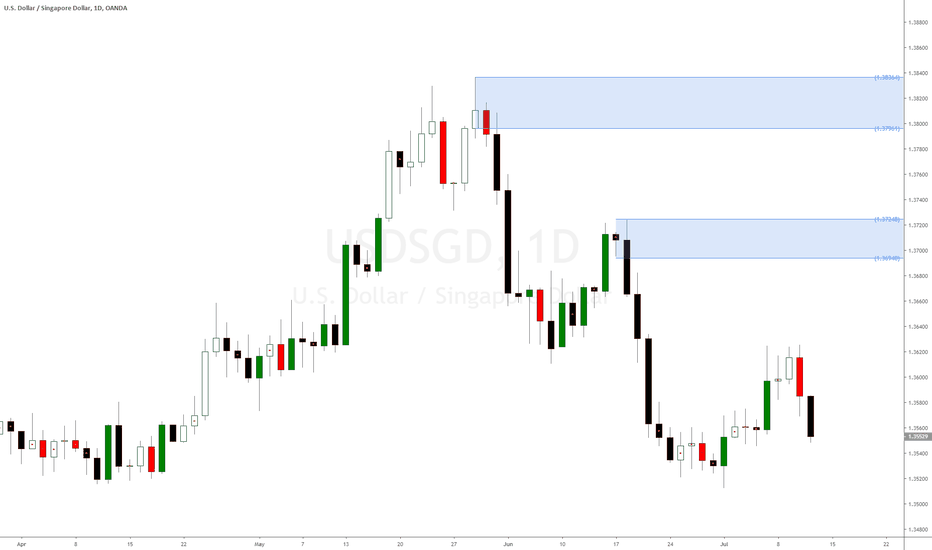

USDSGD forex cross pair supply and demand analysis forecastUSDSGD Forex cross pair is in a clear downtrend creating new supply levels on the way down. As supply and demand traders, we should be interested in trading very strong impulses that end up creating new supply and demand imbalances. Price action together with supply and demand technical analysis is the perfect combination.

Trading is a waiting game where we should be stacking as many odds in our favour as possible. Being impatient will end up getting you in trouble by chasing the trades and causing unnecessary losses. USDSGD cross pair forecast is clearly bearish with very strong supply levels created around 1.36 and 1.37. There is still room for price to keep on dropping further.

The US Dollar and Dollar Index DXY is getting weaker in most Forex Cross Pairs, this is helping USDSGD Forex cross pair to drop as it does creating new supply levels on the way down.