US Dollar Index: Was Friday the Start of a Pullback Or Reversal?Welcome back to the Weekly Forex Forecast for the week of Aug 4 - 8th.

In this video, we will analyze the following FX market:

USD Index

The DXY had a strong week, but turned bearish Friday on weak jobs numbers. Was this just a retracement from the impulsive move up? Will price now find support for another bullish leg?

It all comes down to the +FVG, whether it holds or folds.

Look for price to continue down to discount prices early in the week... and then find it's footing on support.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Usdoutlook

DXY - 240 MINS CHART TIMEFRAMEThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: its my view only and its for educational purpose only. only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. we anticipate and get into only big bullish or bearish moves (Impulsive moves).

Just ride the bullish or bearish impulsive move. Learn & Know the Complete Market Cycle.

buy low and sell high concept. buy at cheaper price and sell at expensive price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

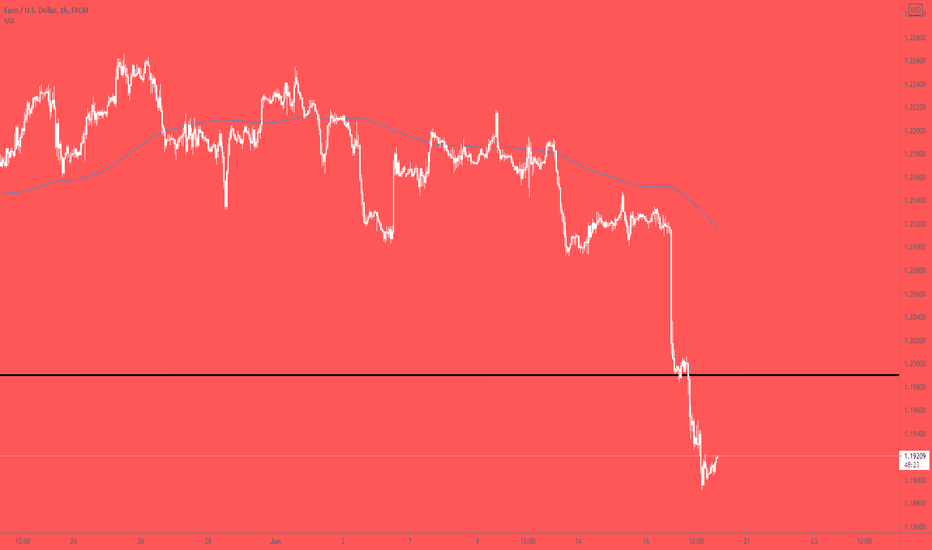

Well this is quite the sell off!EURUSD is finding a fair bit of downside following the Fed announcing they have changed their interest rate outlook. The fed announced it's projections to change rates in 2023 instead of 2024 on Wednesday, and as a result the USD is back as king. Surprise surprise, the currency of global trade and debt is making a comeback. If you had seen our USDCHF monthly pivot signal you'd know we have been looking out for some long term USD upside. Inflationary concerns had been rising in the USA, and it was a matter of time until the Fed took action to ward off concerns.

So what next? This USD rally has a fair bit of steam to blow off, so we may see a USD retracement before further continuation. Is this the end of the USD Bear market? I say NO! Whilst the revised projections are USD positive, they are still 2 years away. I anticipate this rally to fade and see some more USD downside in the later parts of 2021.

HOWEVER - It is my opinion that the Fed will raise interest rates earlier than expected, and adjust the rates in Q1/2 of 2022.

My outlook is for USD UPSIDE for the next week or three (remember, this is also financial institutions taking profits from the USD bear trend at the end of the financial year!). Following this I anticipate USD DOWNSIDE in mid Q3 and Q4. Then following this look for USD upside in 2022, as the fed will be itching to raise rates by then.

Happy trading friends!