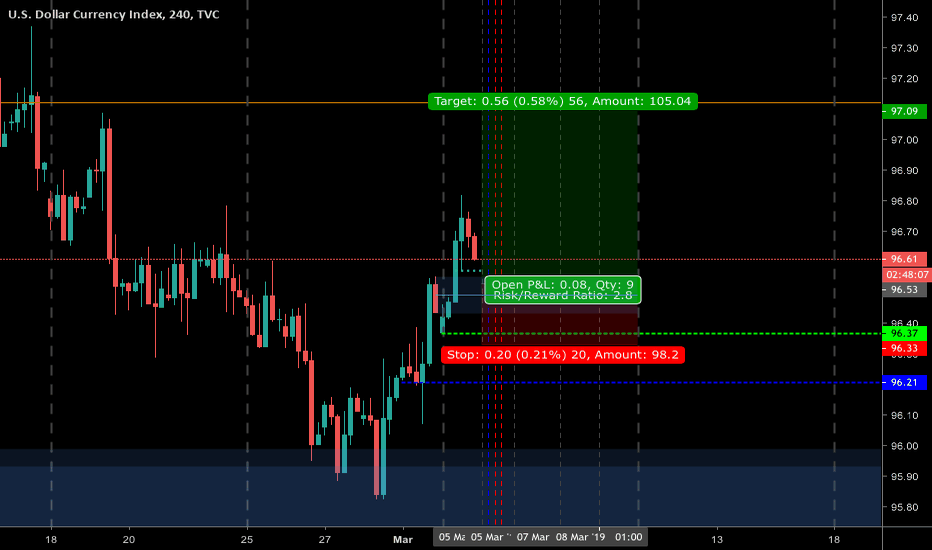

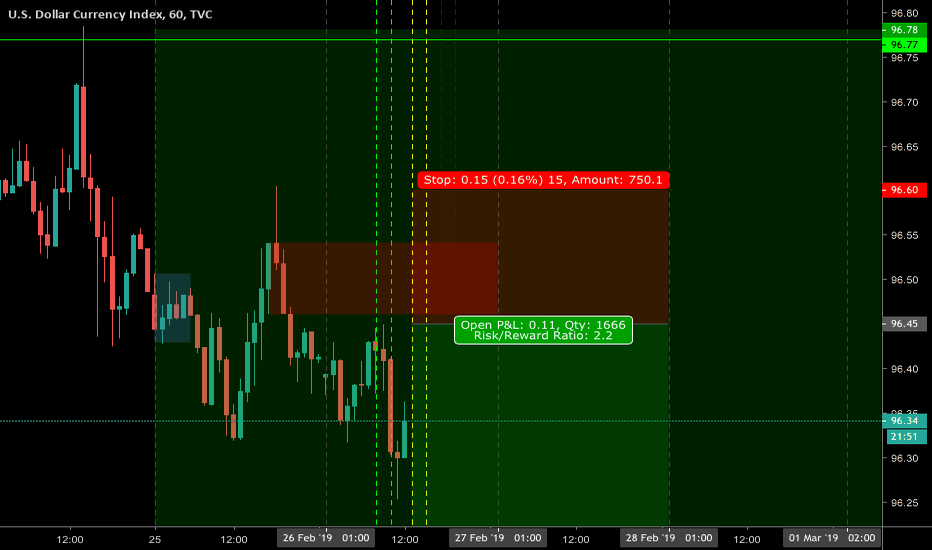

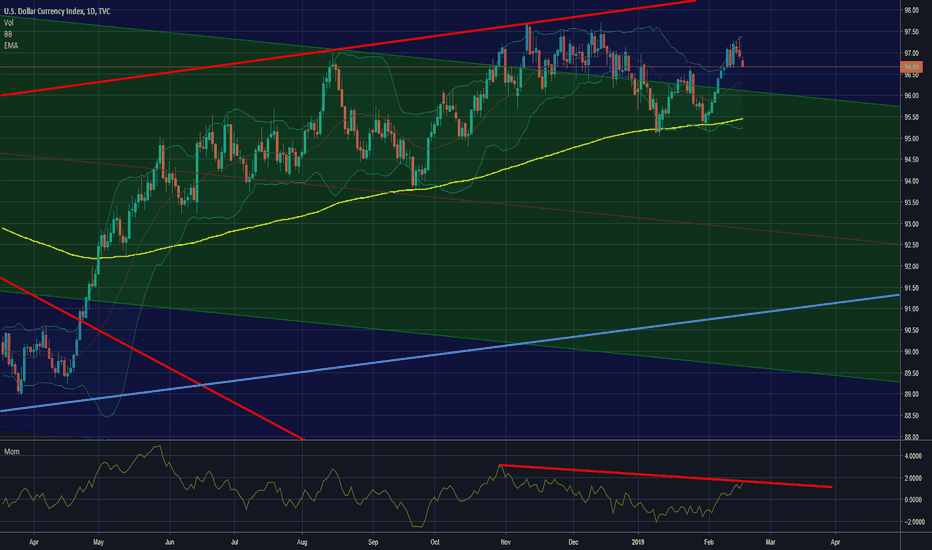

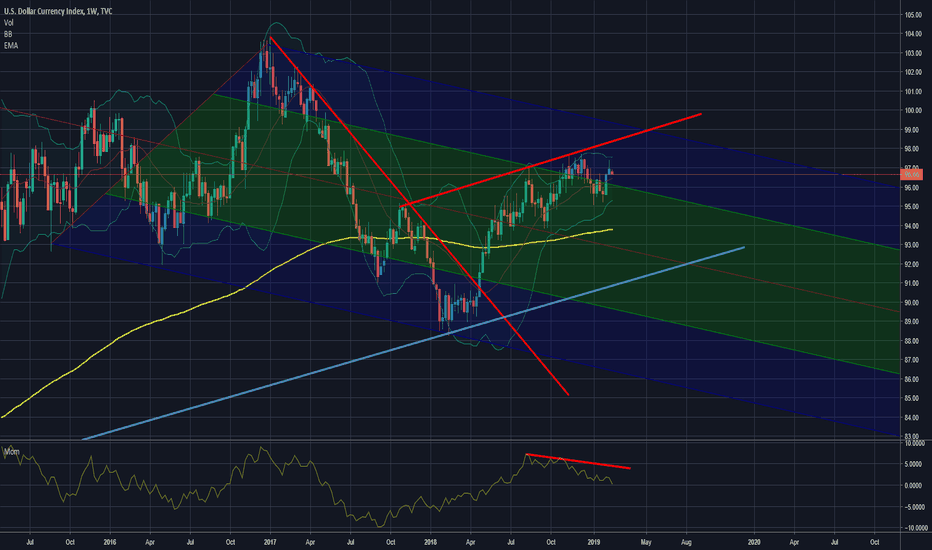

Usdx

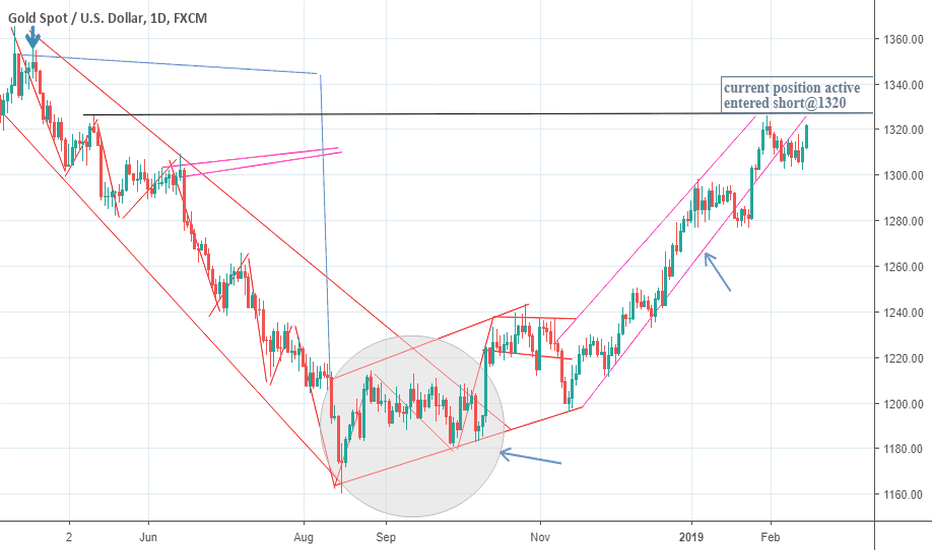

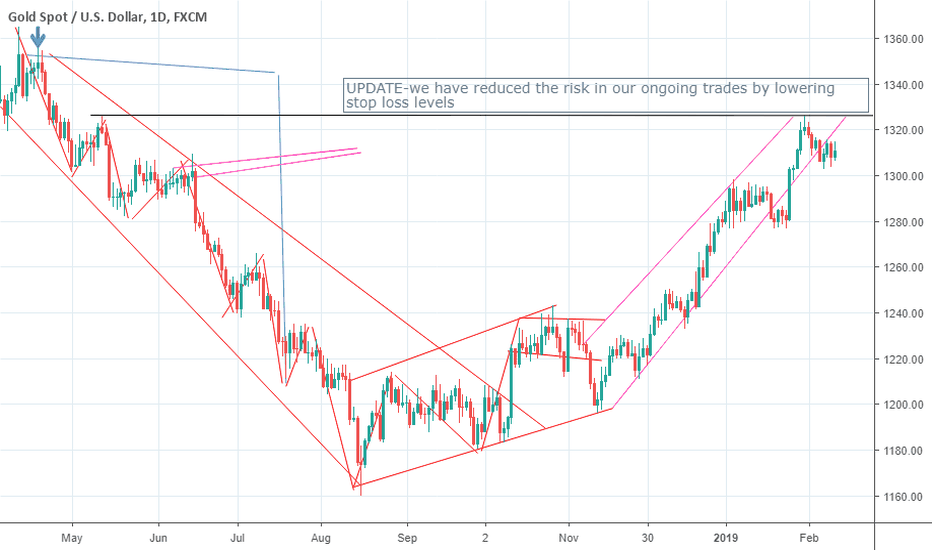

THE TECHNICAL DAMAGE HAS ALREADY BEEN DONEGold and silver prices are getting hammered as the investor's attitudes towards risky assets have returned. Today Gold hits a five-week low while silver prices felt more rapidly as expected.

The China stock market reached it's nine-month high today. Asian and European equity market are also heading higher along with the U.S. stock indexes. The U.S. jobs report from the Labor Department which is The most important U.S. economic data of the month is scheduled to release on Friday, Today the eurozone PPI also came out which didn't surprise anyone as Those numbers were in line with market expectations. Analysts are also focusing on upcoming European Central Bank’s r monetary policy meeting which will be held on Thursday as the ECB is expected to take action in order to make the Eurozone economy stronger.

Trade war: Signs of progress in US-China talks

Based on The Wall Street Journal research the U.S. and China are close to finalizing a trade agreement.The story said China would lower its tariffs on U.S. imported goods, with the U.S. doing the same on most or all of the trade sanctions it levied against China last year. The report said U.S. President Trump and Chinese President Xi Jinping will meet in Florida later this month.

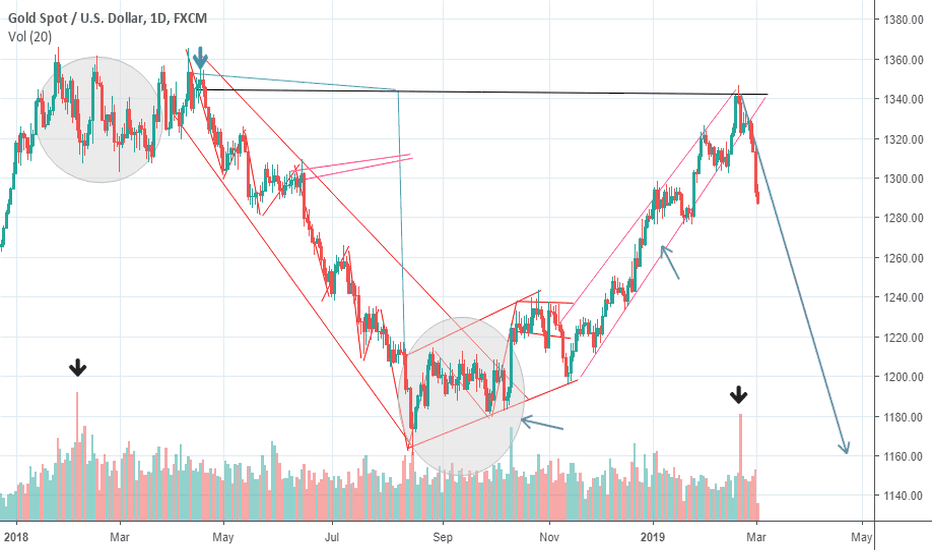

The Technical damage in gold and silver chart has already been done as the metal has corrected more than $50 from last month’s highs, many analysts are looking at long-term support at $1,275, which represents a key retracement level in gold’s recent rally. minor corrections should be expected from these levels which could take the price up to $1300 however we'll add more capital to this trade once yellow metal will break below $1270 level as a close below from this level will open the door to more selling.

Summary-It’s a “do-or-die” week for the gold and silver market bulls. They need to step up and show good power this week, to avoid more serious technical damage being inflicted.minor corrections should be expected from these levels which could take the price up to $1300 however we'll add more capital to this trade once yellow metal will break below $1270 level as a close below from this level will open the door to more selling.

TENSION BETWEEN TWO NUCLEAR-ARMED COUNTRIES- ADDING A TRADEThe market is closely watching the building tension between two nuclear-armed countries India and Pakistan

As we are preparing this report gold is trading at $1325 while white metal is hovering around $15.800.We have seen the yellow metal to drop below $1318 due to the strong DXY movement which we have witnessed today. This week we have also seen the U.S equity market to reach their three-month highs along with the rising crude oil prices which are trading above $57.00 a barrel.

Europian traders are still worried due to the ongoing Brexit dispute however now it seems U.K prime minister Theresa may and parliament have finally agreed to extend the Brexit deadline only if the deal will not be settle on the fixed deadline, The other market news which is not favoring gold bulls is that the German government today auctioned its 10-year bonds for an average yield of just 0.12% which is the lowest in 3 years which is a sign of low inflation expectations in the world.

The market is closely watching the building India-Pakistan tensions but the impact on the market is almost negligible due to the conflict between the two nuclear-armed countries. The India-Pak war escalated when India bombed a terrorist camp called jaish-e-Mohammed in Pakistan with Pakistan then retaliating by shooting down two Indian warplanes where one Indian pilot has been taken on in a custody by Pak army, In a counter attack India also shot down Pakistan air force most advanced warplane F16 however this all started after Pulwama attack when a militant who was a member of terrorist camp in Pakistan bombed Indian paramilitary police with a suicide car which killed 41 members of CRPF in a horrible manner.U.S. Secretary of State Mike Pompeo,U.K. Prime Minister Theresa May also called for de-escalation, stating that “U.K. is deeply concerned about rising tensions between India and Pakistan and urgently calls for restraint on both sides to avoid further escalation.we believe the building tension between two countries does not seem to escalate however if If India and Pakistan’s relationship continues to deteriorate and there is a risk of war, markets will speak up

We are going long in gold but that doesn't mean our medium-term outlook has been changed that just means the very short-term outlook for gold improved based on yesterday’s second close above 2019 high and today’s pre-market upswing, but this didn’t change the medium-term outlook at all instead when prices will move higher as we are hoping for more naive investors to join in this parabolic run we will simply close our long position which will help us to make immense profit in our upcoming short position due to enormous reward and little risk

Currency Pair: XAUUSD ( Gold )

Buy Stop Entry Price:1325

Take Profit: 1365

Stop Loss:1290(we will reduce the stop loss points once positions will be more favorable)

Risk/Reward: 1:1

(we can adjust (limit, close or even reverse) the position before this price level is reached

TAKING HUGE PROFITS OUT WITH SILVER AND REOPENING THE GOLD TRADEUPDATE-We have took the entire profit out of the table from our silver trade at $15.700 which is mentioned below and making profit of about 1500 USD,However our risk free trade gold has been closed Automatically with no profit and no loss-we are reopening the gold trade

Currency Pair: XAGUSD ( SILVER )-(This trade has been closed)

Sell Stop Entry Price:16.00

Take Profit: 14.00

Stop Loss:16.100(moved stop loss)

Capital Risk:500 USD

Potential Reward: 12000USD

Risk/Reward: 1:6

OUR EXISTING POSITION

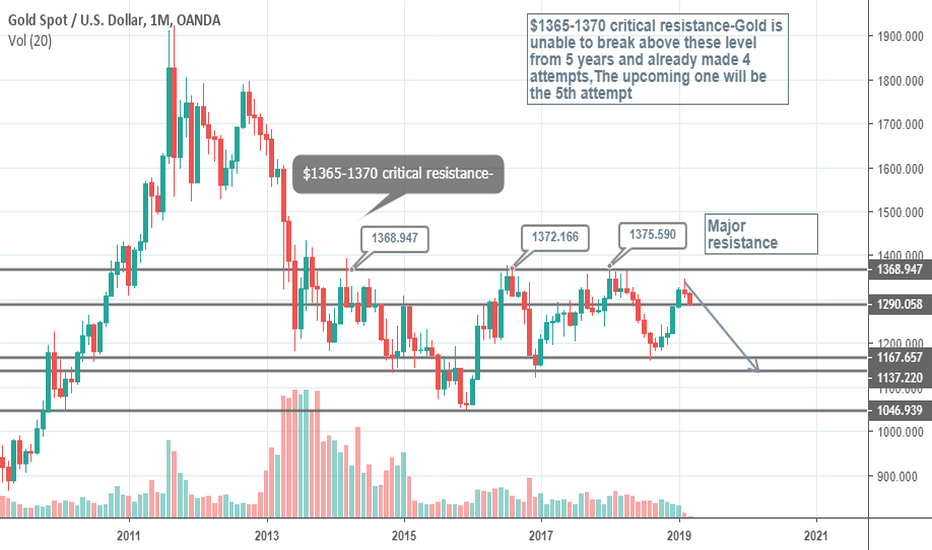

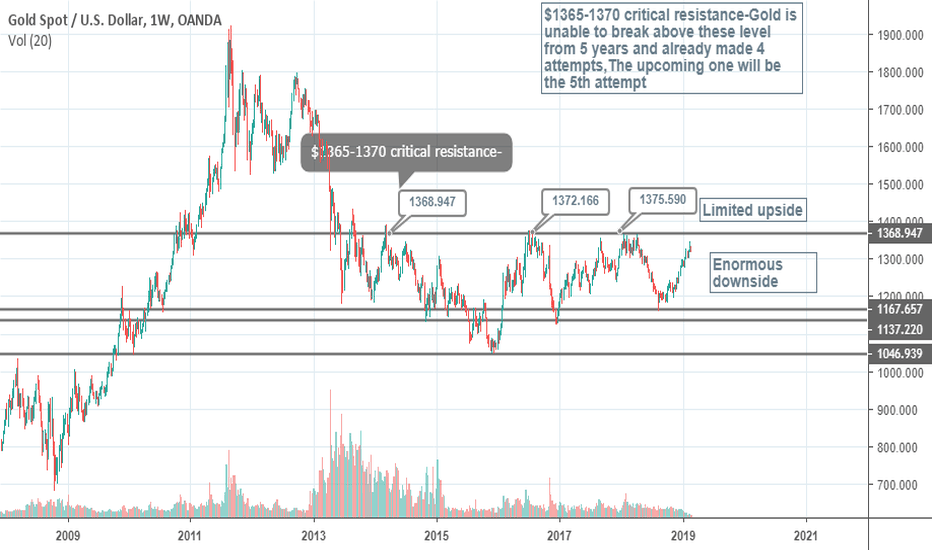

Currency Pair: XAUUSD ( Gold )

Sell Stop Entry Price:1320

Take Profit: 1160

Stop Loss:1320(we will reduce the stop loss points once positions will be more favorable)

Capital Risk:2000USD(amount may vary depending on your account size and risk tolerance)

Potential Reward: 18000USD

Risk/Reward: 1:9

(we can adjust (limit, close or even reverse) the position before this price level is reached)

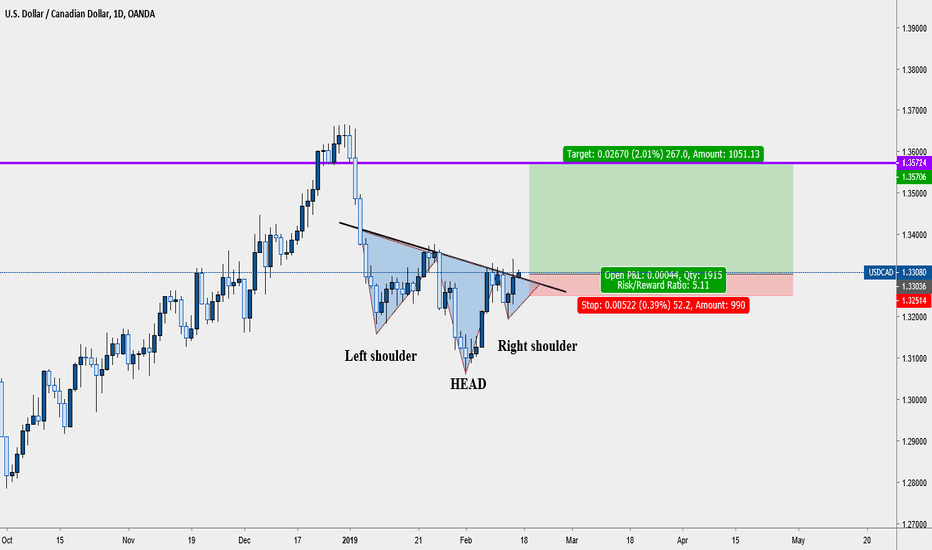

USDCAD BUY Head & Shoulder FormedThe daily Head and Shoulder has been completed, I trust this will respect the pattern and go bullish

Inverted head and shoulder pattern is a reversal signal!

In this analysis I tried to make SL very tight though it shouldn't be following the rules of H&S

But lets pray it didn't get to strike our SL quickly.

Goodluck!

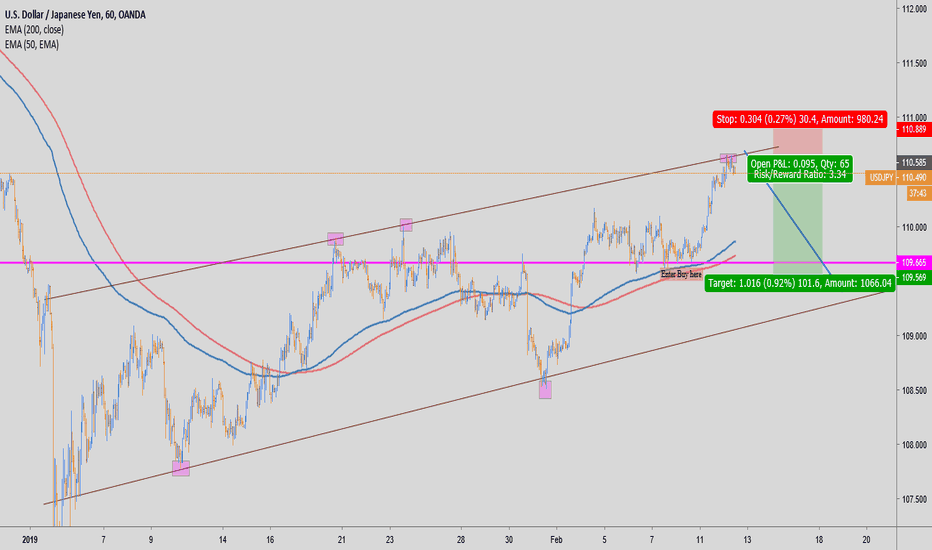

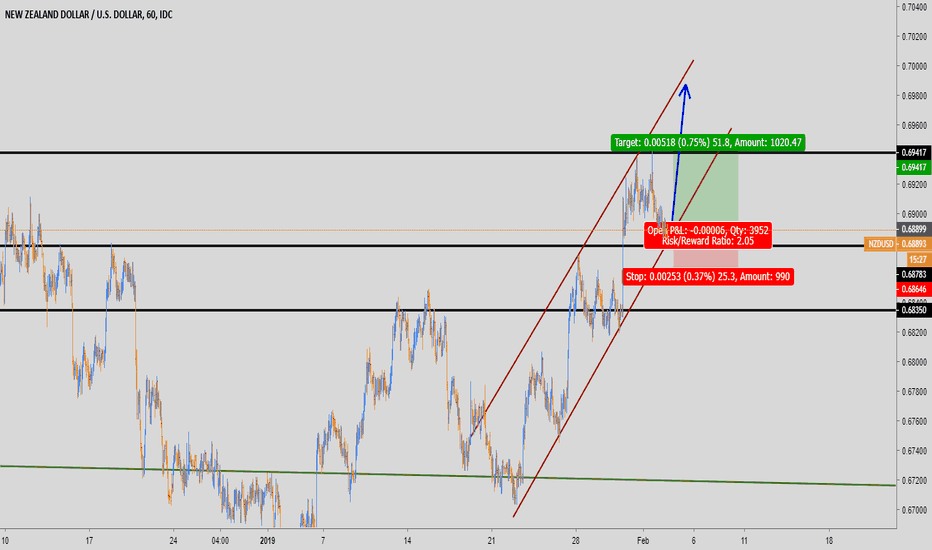

Dollar index is on the verge of a breakoutGold and silver are trading range bound from quite some days however we have seen a slight bounce in the yellow metal today and the primary reason for that is the sell-off in the greenback which we have witnessed today. Yesterday we informed you about the possibility of the government shutdown this Friday but now It appears that the government shutdown will be avoided this Friday, However, the main focus of the market continues to be on the U.S-China trade war negotiation talk which will be held in Beijing. The precious metal sector is showing a little bit of weakness due to the recent rally we have witnessed in the greenback. The technical picture of USDX is very bullish and it seems greenback is on the verge of a breakout which will ultimately prove to be a bearish case for the yellow and the white metal(In our next analysis we will discuss the reasons That why we believe the USDX is on the verge of a breakout-EURO Weakness is definitely one of them)

OUR EXISTING POSITIONS

Currency Pair: XAGUSD ( SILVER )

Sell Stop Entry Price:16.00

Take Profit: 14.00

Stop Loss:16.100(moved stop loss)

Capital Risk:500 USD

Potential Reward: 12000USD

Risk/Reward: 1:6

Currency Pair: XAUUSD ( Gold )

Sell Stop Entry Price:1320

Take Profit: 1160

Stop Loss:1320(we will reduce the stop loss points once positions will be more favorable)

Capital Risk:0USD(amount may vary depending on your account size and risk tolerance)

Potential Reward: 18000USD

Risk/Reward: 1:9

(we can adjust (limit, close or even reverse) the position before this price level is reached)