Usoilforecast

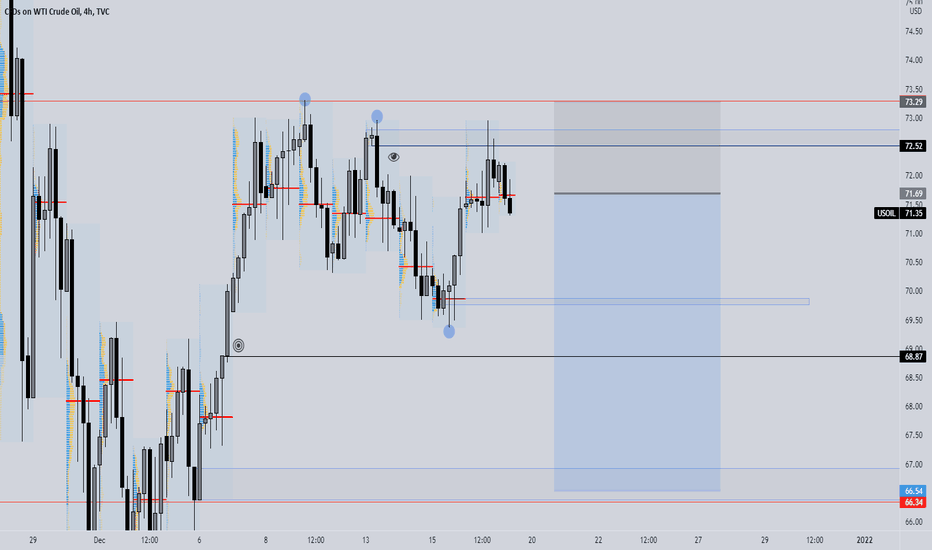

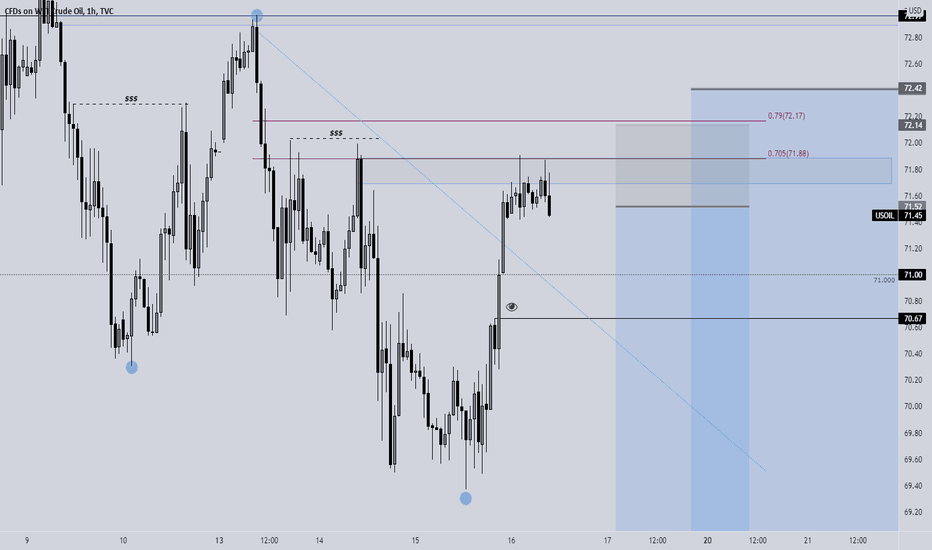

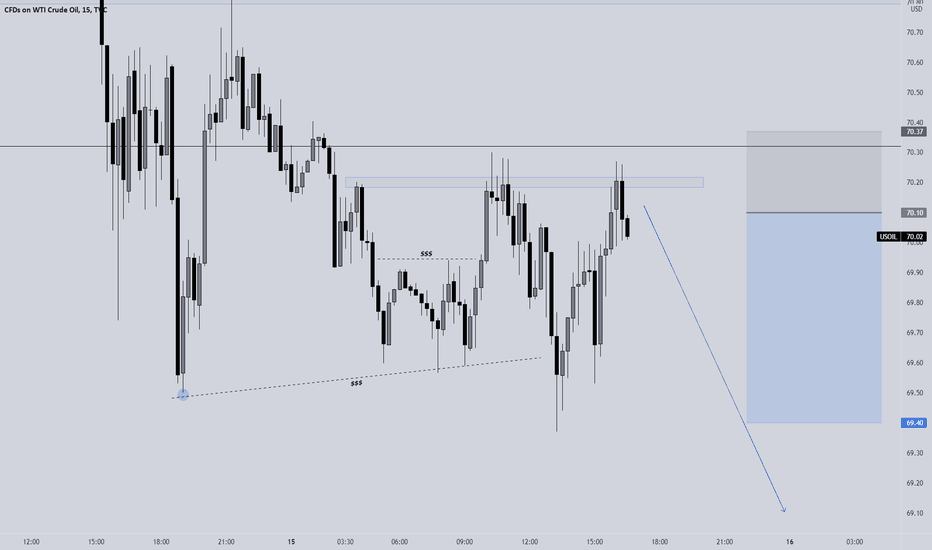

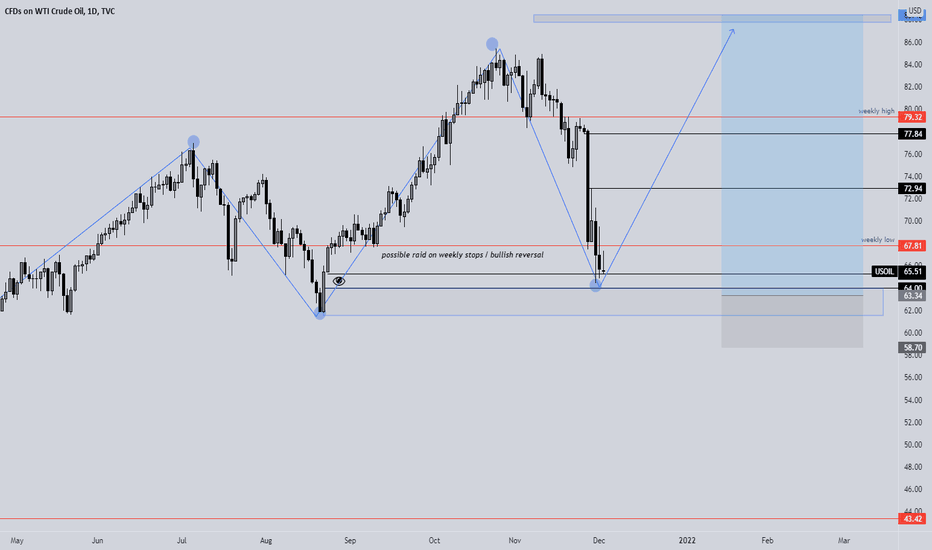

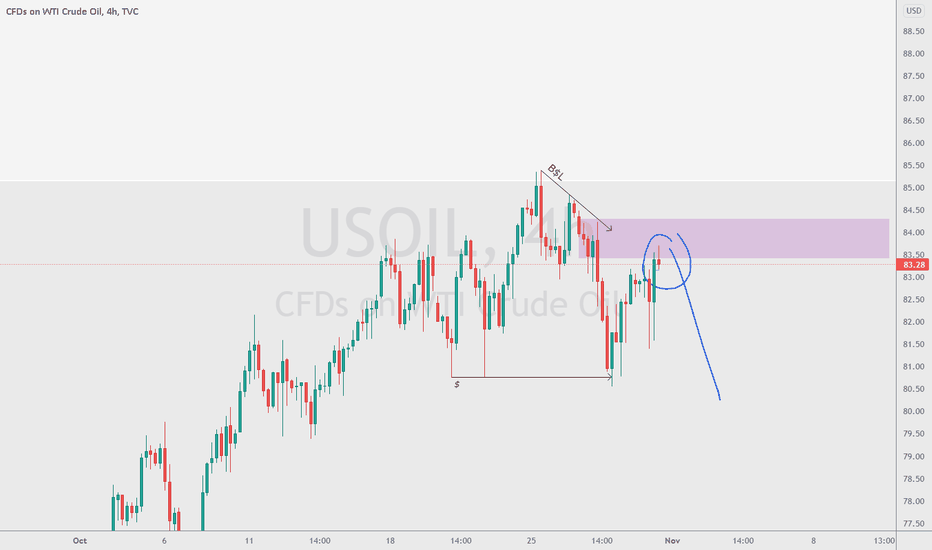

USOIL UPDATE SHORTS 📉📉📉We have strong bearish momentum on USOIL i dont think it is the best moment to close our short entries, we have a risk off market sentiment right now so we should expect bearish price action still...

I moved my stop loss to my entry so i have a risk free trade.

What do you think ?

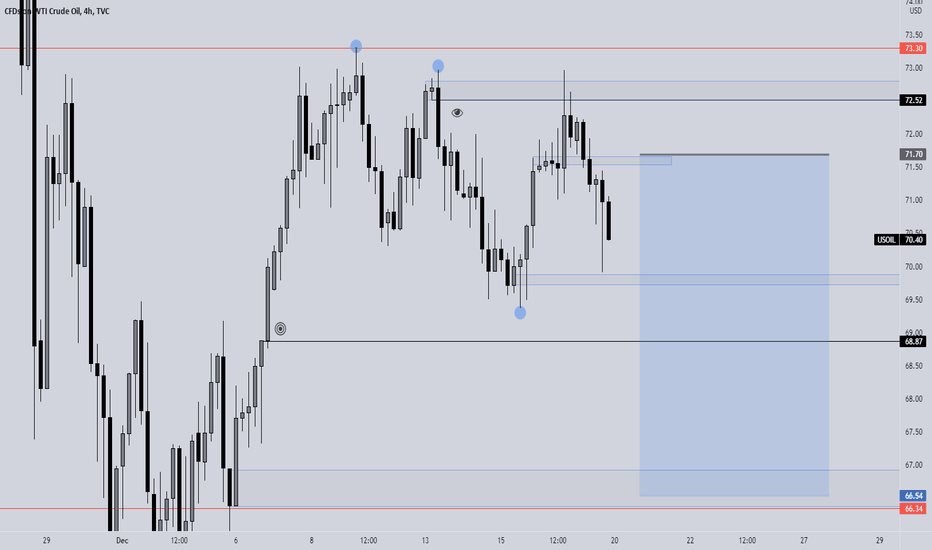

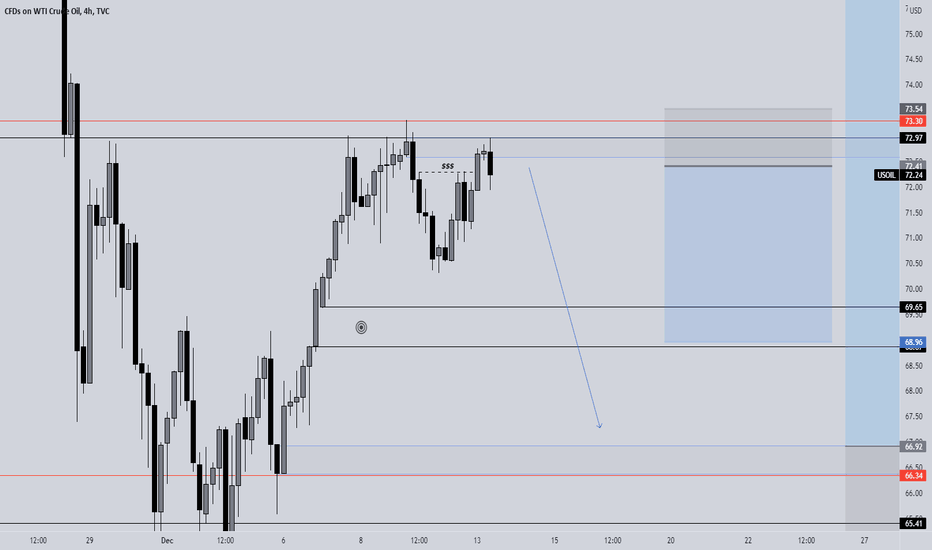

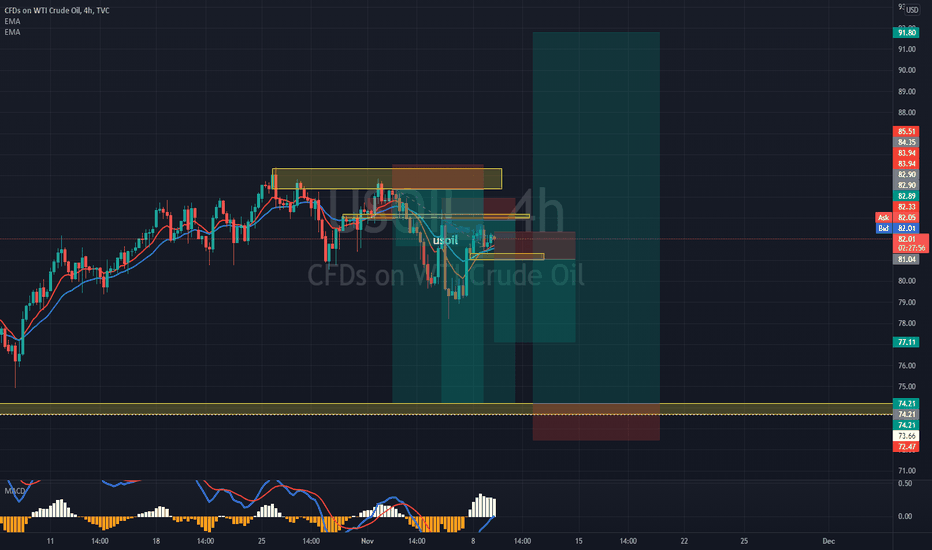

USOIL SHORTS 📉📉📉Price is rejecting in this moment an important area of ,, resistance ,, a bearish orderblock on h4 filling in the same area the bearish imbalance that means the price is repriced at this level. We also took out some buy stops above old highs and right now we should go lower after h4 candlestick bearish will be CLOSED. I target bullish imbalances.

What do you think ? Comment below..

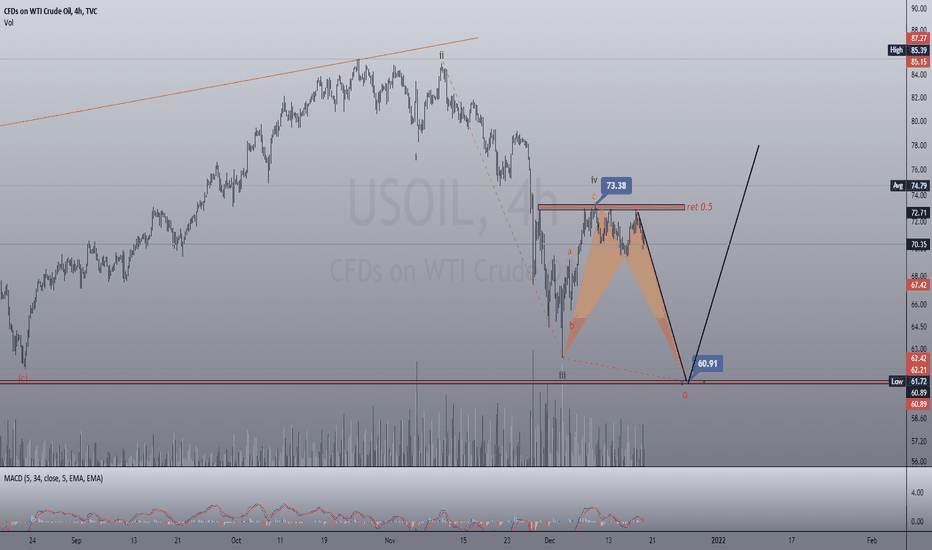

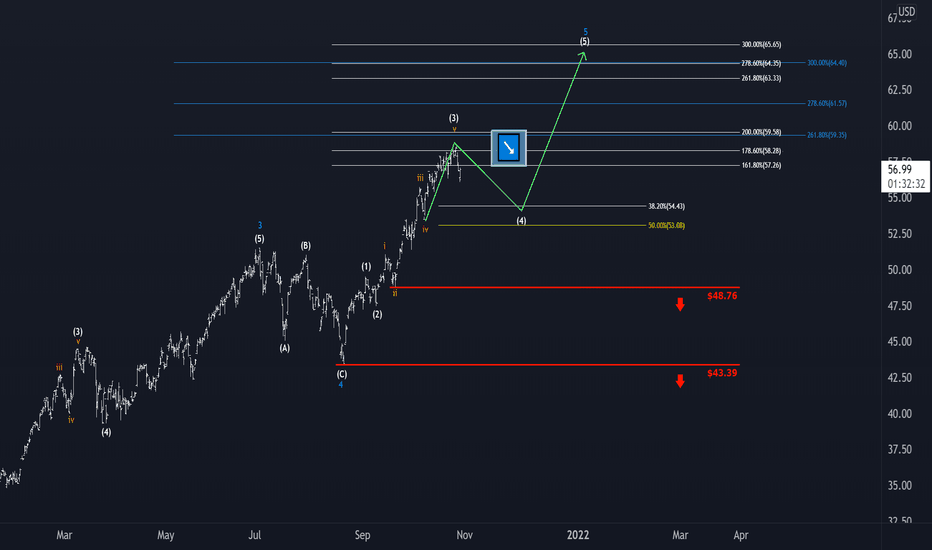

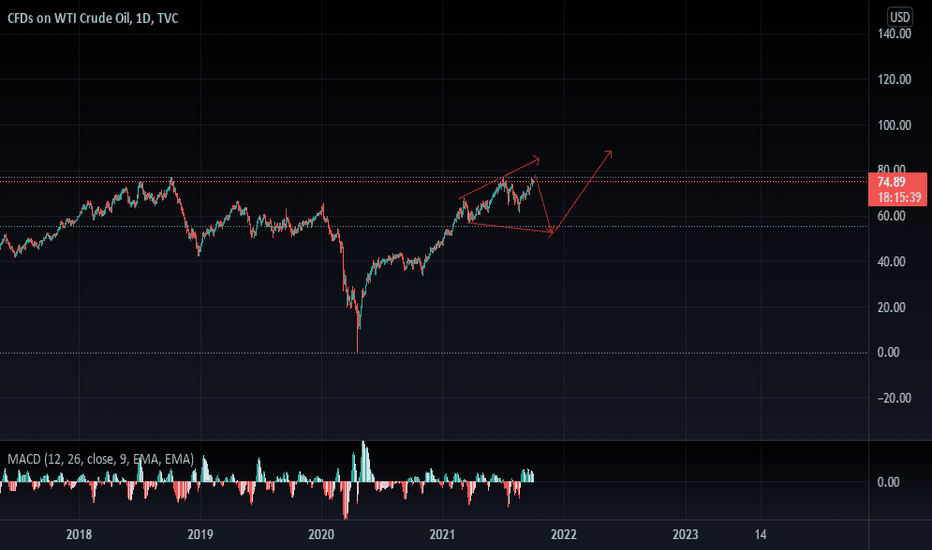

UUSOIL LONGS LONG-TERM 📉📉📉From a long-term perspective USOIL looks like a good buy from 63-64 area, we have a bullish market structure on a HTF, price just made the retracement back into bullish orderblock d1 an important area of supply for the price in that area closing the bullish imbalance as well, price left a lot of inefficiens in the past that should be closed in the future, price should be magnetize back above 70$, that's my long-term perspective long term meaning 1-2-3weeks.

What do you think ? Comment below..

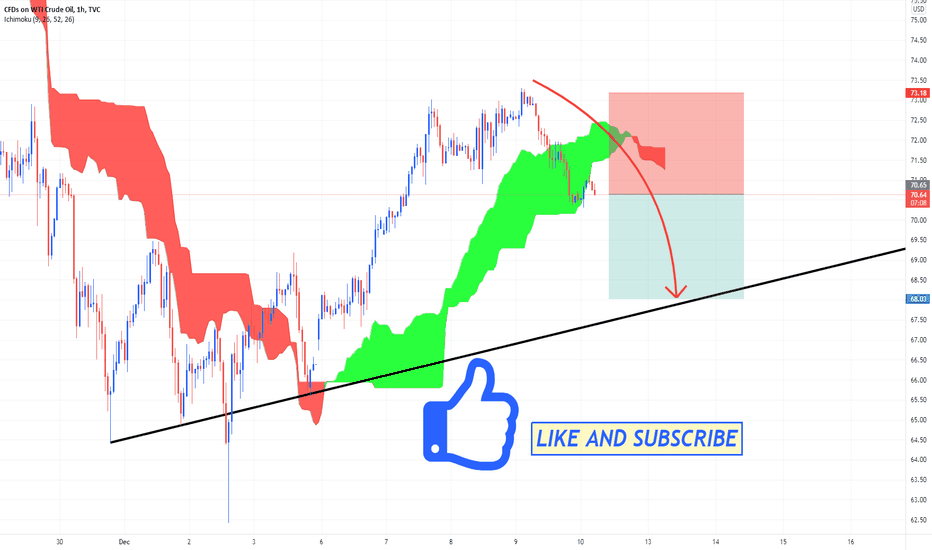

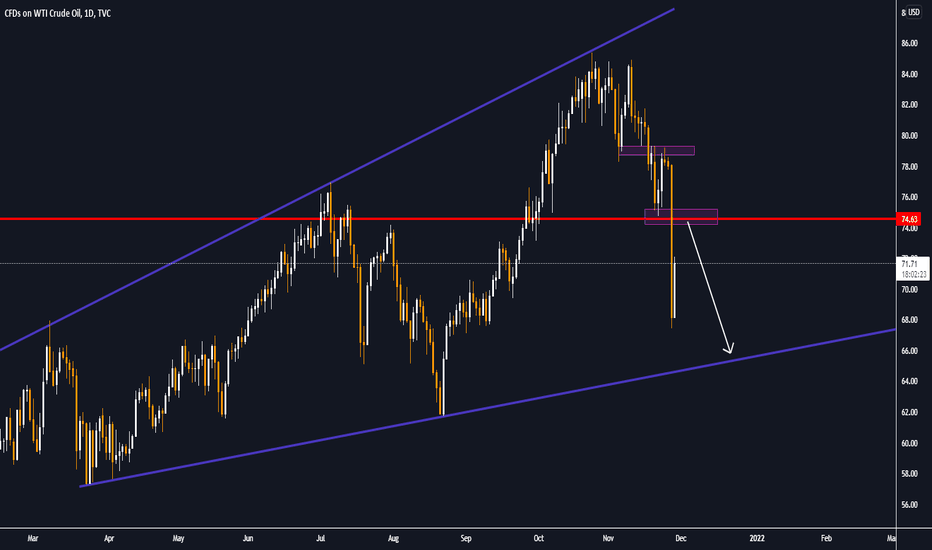

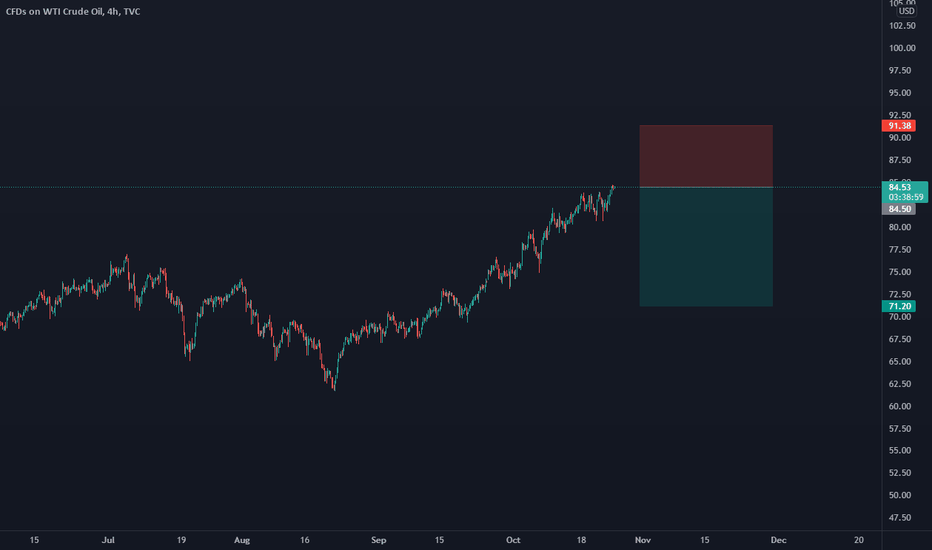

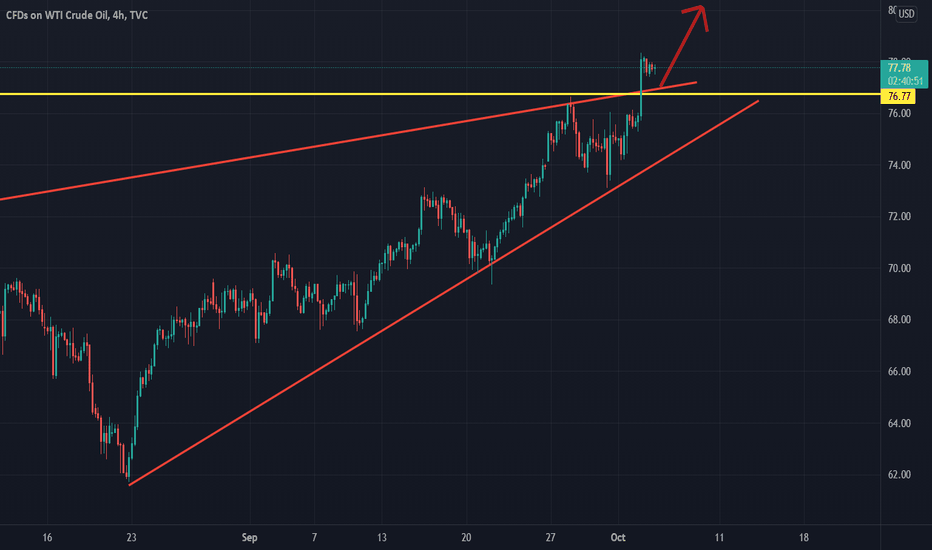

USOIL SELL TRADE IDEAHello everyone, if you like the idea, do not forget to support with a like and follow.

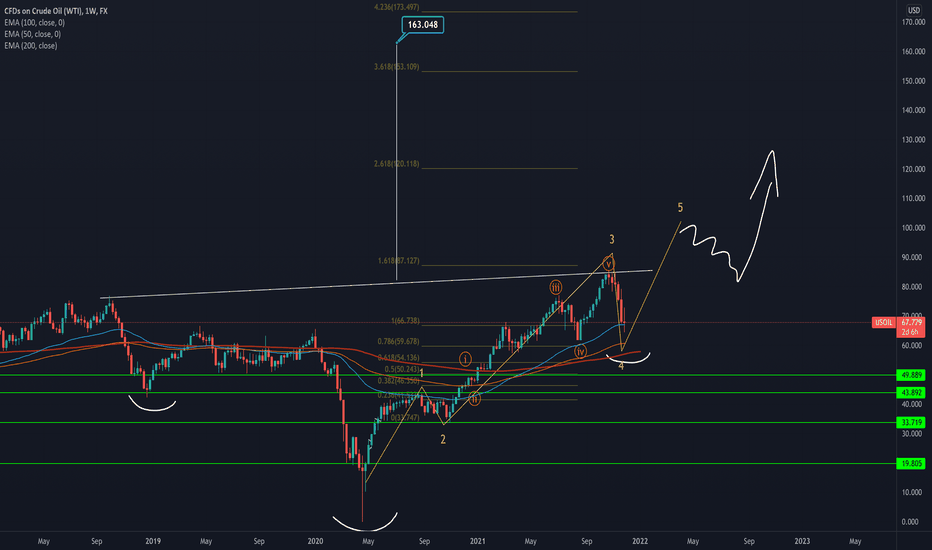

We do have a W pattern formation on the Weekly. We can expect a rejection to the downside, and we still didnt see the retracement to the 0.382 so a deeper correction does seem possible

On the daily, we can see an ICI strategy and is currently testing previous daily support which it has tested 2 times and now currently testing as resistance which if we see a candle closure below this support. Taking the fibonacci on this daily impulse we can see that the market has retraced back to the 0.618 golden ration taken on this daily impulse.

On the 4H time frame, we can see the area is acting as support, while MACD is below 0 but EMA's have just slightly cut for long, so if the market manages to cut below this support, EMA's will cut for short, so the break and shift of the environment, on the retest and when EMA's line up with structure. Stop loss is above the high or above the 0.786 of the fibo on the impulse and take profit on the fibo on the daily retracement.

Trade Signals

SELL

Entry: 81.04

Take Profit: 77.11

Stop Loss: 82.33

Good luck!

All Strategies Are Good; If Managed Properly!

~FX_SHIFTER

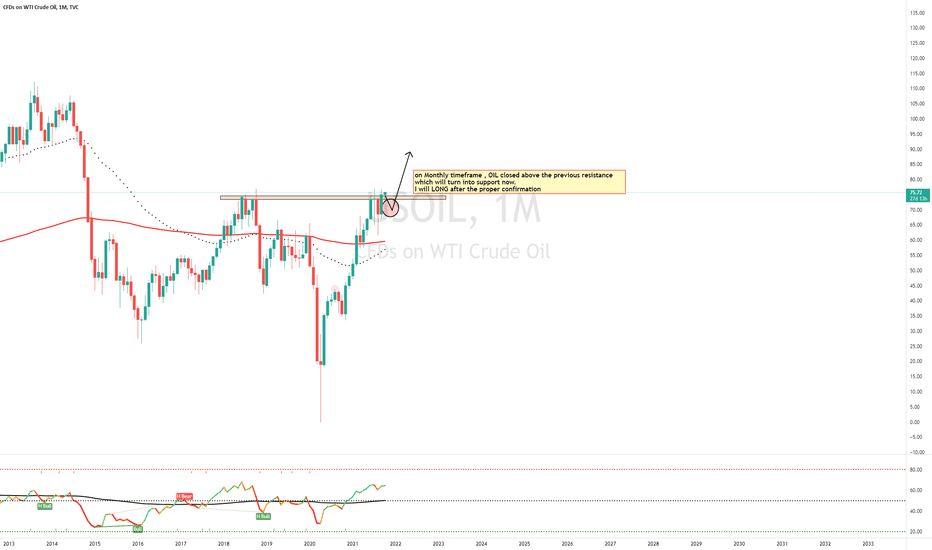

USOIL - Long Opportunity Hello guys,

Oil closes above the resistance on the monthly time frame and as per fundamentals the crisis in UK & energy crisis in China also indicating the demand side is strong.

I am very much Bullish on OIL and will take the Long Opportunity once found the proper confirmation.

US Oil (WTI Crude Oil) Analysis and trade IdeaOil has broken structure to the downside, and a return to the originating impulse was expected... and now fulfilled. What now? This video explains identifies the most likely scenarios... and the higher probability movement.

I believe price is indicating further declines, for a shallow pullback on the HTFs.

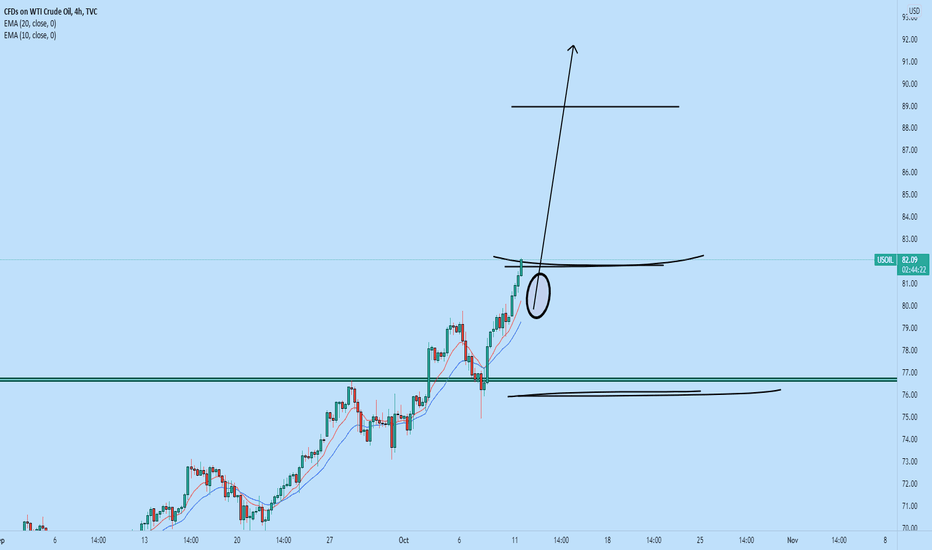

USOIL LongMy view of USOIL . Potential long opportunity.

I am a bit late with this idea and it’s a bit minimalistic and quick but it will hopefully do. After a pullback down to our PBA 1 and respecting the consolidation area , I’m expecting the price to come back up to the top of the consolidation area . Double bottom on 4H is also confirming the long idea. After a clear break of the consolidation area we can expect another upside move. Entry is at 81.898 . Stop Loss is below current low and below a possible pullback area . Stop Loss is at 80.547 . TP is at 86.660 . Overall we are in a uptrend and without breaking the uptrend structure , we will keep looking for buys at pullback areas . If we don’t come down to our entry, take a smaller position due to risk being higher.

Keep in mind prices may vary from broker to broker.

PARAMETERS

- Entry: 81.898

- SL: 80.547

- TP: 86.660

KEY NOTES

- Overall we are in a uptrend and without breaking the uptrend structure , we will keep looking for buys at pullback areas.

- Respecting the consolidation area

- 4H double bottom confirmation

Happy trading!

WTI Crude OilCrude oil prices pulled backed slightly overnight after a US report showed a large build in stockpiles. The American Petroleum Institute (API) reported a 5.213 million barrel build for the week ending October 8. That is the third weekly inventory build reported by the API. Energy traders will shift their focus to the upcoming Energy Information Administration’s Weekly Petroleum Status Report where analysts expect to see a build of just over half a million barrels for the week ending October 8, according to a Bloomberg survey.

The Organization of the Petroleum Exporting Countries (OPEC) released its Monthly Oil Market Report, which trimmed its global demand outlook for this year. The organization lowered its 2021 demand forecast for oil from 5.96 million barrels per day (bpd) to 5.82 bpd. The 4.2 million bpd forecast for 2022 was unchanged from its September report. Delta variant-driven outbreaks in the summer months were responsible for the downward revision.

However, OPEC did note a possible tailwind for oil prices due to rising natural gas prices. The energy crunch across Asia and Europe sent prices for the heating gas soaring this year. US prices are also higher, partially due to export demand from those energy crunches. UK natural gas prices are up nearly 300% for the year, although the meteoric rise appears to be taking a breather.

That rise is incentivizing some energy producers to switch to crude and Brent oil products. That said, if natural gas prices continue to rise, it may likely drag oil prices higher alongside. The EIA will report weekly US natural gas stocks tonight. Analysts expect a 94.58 billion cubic feet (bcf) build. A larger-than-expected build may see prices ease, which could ease demand for crude oil from energy producers.

CRUDE OIL TECHNICAL FORECAST

Prices are hovering just above the psychologically imposing 67 handle. The 61.8% Fibonacci extension from the middle August move capped upside action earlier this week. Bulls may see that as a level to overcome before moving higher. The RSI oscillator is in overbought territory on the daily time frame, suggesting prices may need to cool for a period before resuming the preceding uptrend.

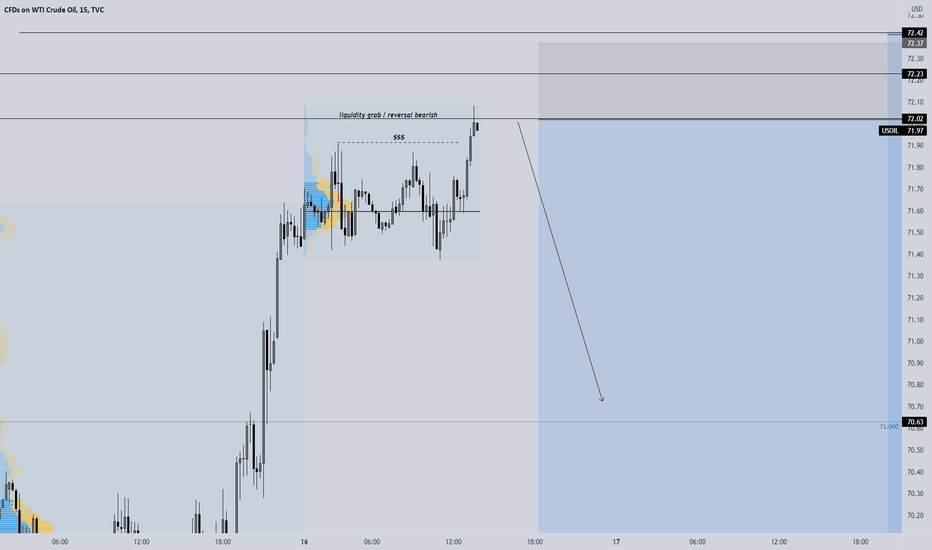

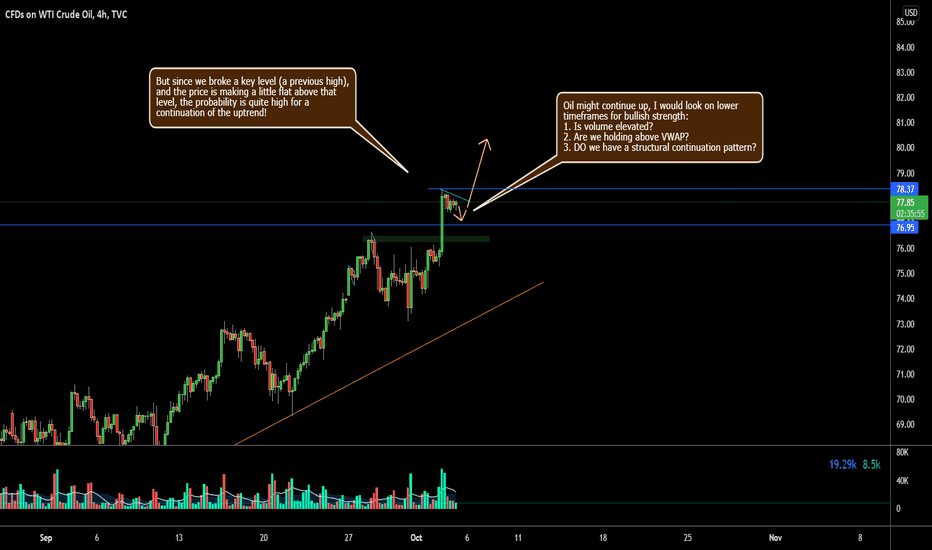

USOIL top-down analysisHello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Tuesday: USOIL - Week 40Hello Traders! Check Related Idea for market context!!

I will update my idea as the trade progresses if any changes occur and my analysis is wrong, or need to be adapted to the new development of price-action.

Thanks for the support!

-----------------------------------------------------------------------------------------------------------------------

-----------------------------------------------------------------------------------------------------------------------

SMASH that follow button! 👍

💡 Leave a comment and/or message me on how I can improve and provide better content, I'm open to suggestions to create a better experience for you!

RISK DISCLAIMER: Please be advised that I am not telling anyone how to spend or invest their money. Take all of my videos as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this channel. This content is for educational purposes only and is not tax, legal, financial, or professional advice. Any action you take on the information in this video is strictly at your own risk. We, therefore, recommend that you contact a personal financial advisor before carrying out specific transactions and investments. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Inotfancy.com and all individuals affiliated with this channel assume no responsibility for your trading and investment results.

Crude Trend analysisThe energy benchmark had previously benefited from the Organization of Petroleum Exporting Countries, Russia, and its allies, known as OPEC+, decision on Monday. According to Reuters, the oil cartel reaffirmed a previously agreed accord in which 400,000 barrels per day (BPD) will be added in November. “An OPEC+ source told Reuters soon before Monday's ministerial talks that the group had been pressured to ramp up output faster, but added: ‘We are terrified of the fourth wave of corona; no one wants to make any huge moves,'” according to Reuters.