USOIL Long Idea#USOIL

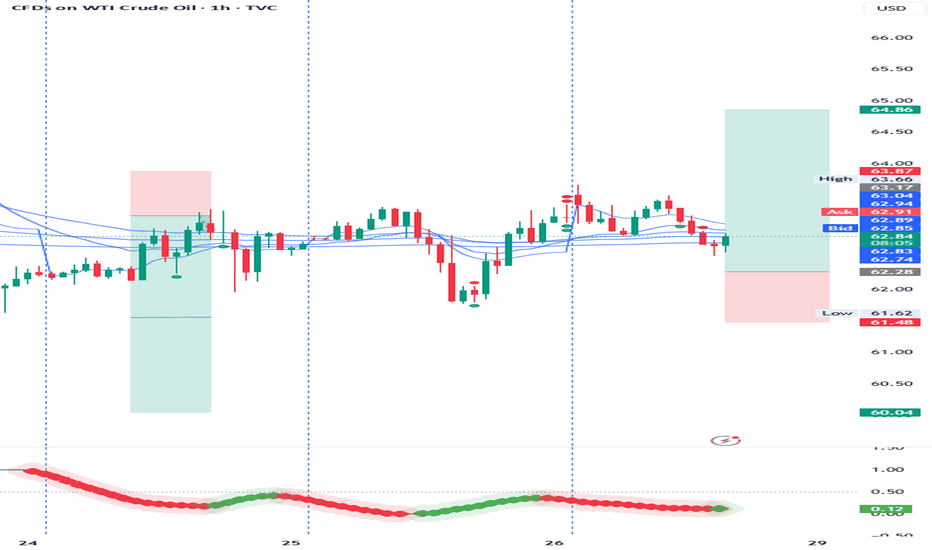

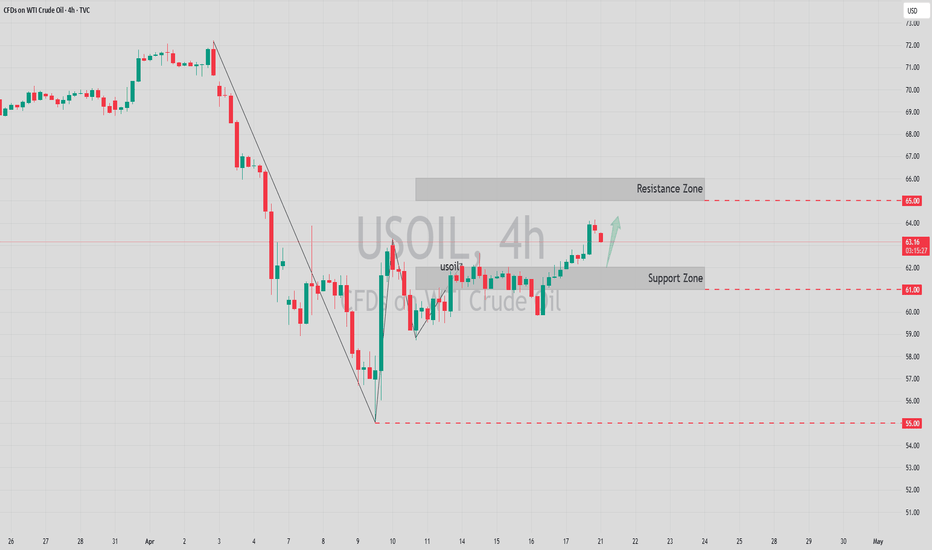

Under current market conditions, the area near 62.28 has been identified as a critical support zone, where the AI model detects a high-probability trade setup.

From a technical perspective, a clear directional bias based on recent price action patterns. If the market demonstrates increased volume and price stability above key moving averages in the 62.28 area, traders are advised to monitor for trend-continuation entry opportunities in alignment with the prevailing momentum.

Profit targets are defined at 63.67 and 64.86, corresponding to logical technical resistance zones. These levels are designed for staged profit-taking across different trade management styles. Stop-loss should be strictly enforced at the designated level; once breached, the strategy is considered invalidated in order to limit potential downside.

Usoillong

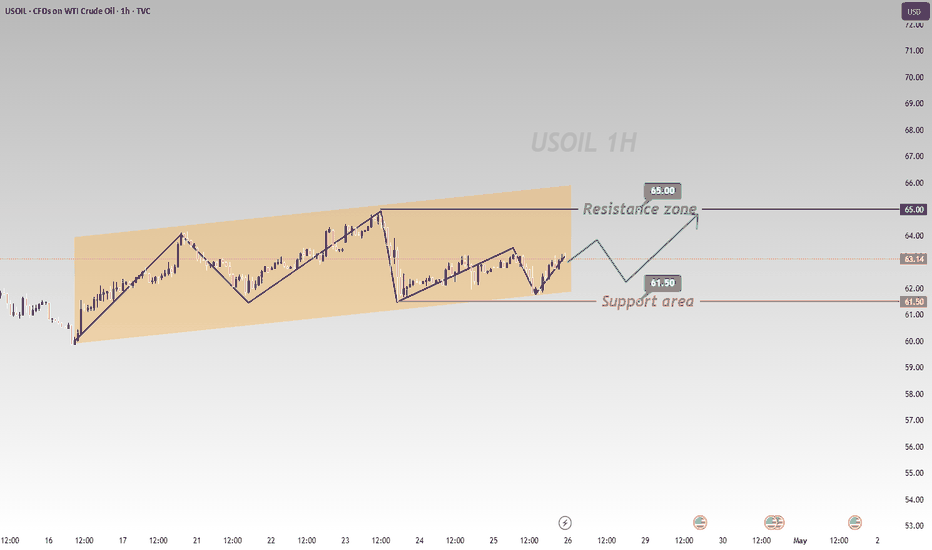

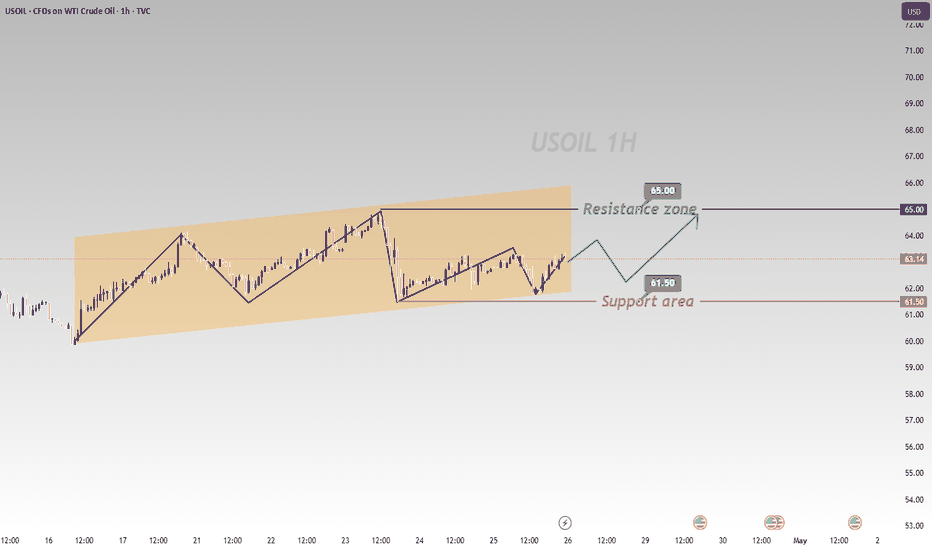

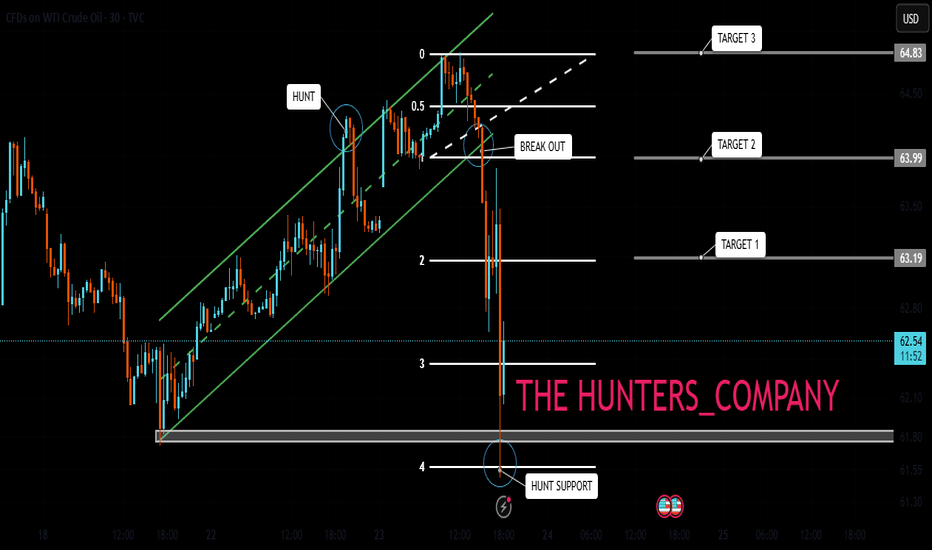

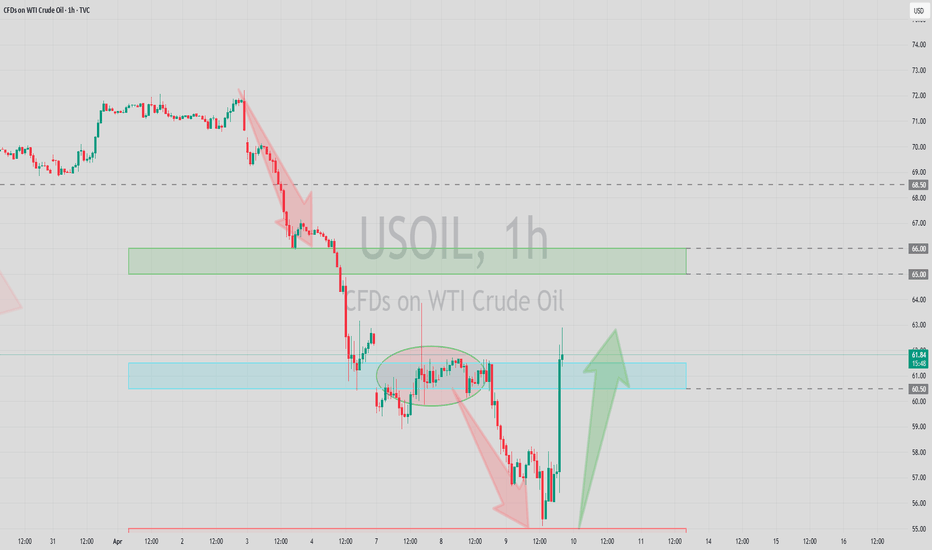

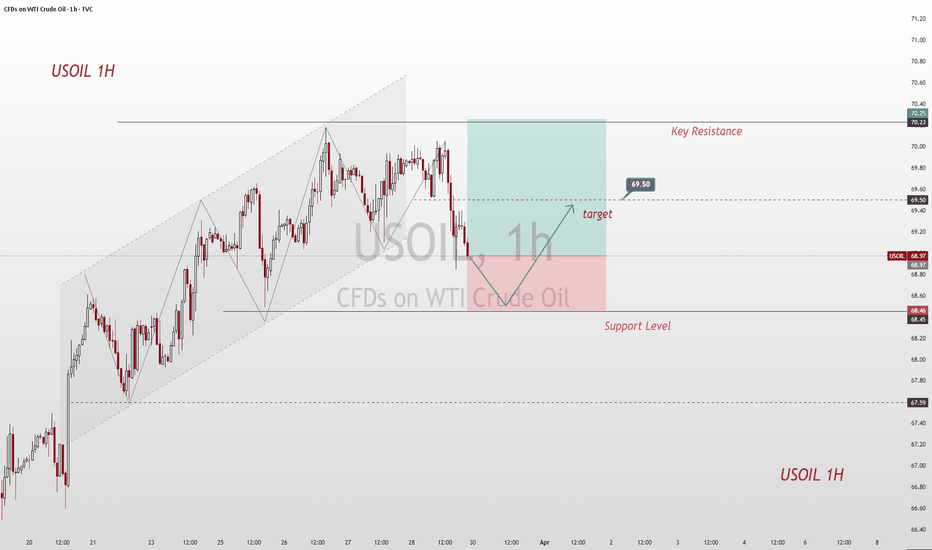

Bullish on USOILAs the chart shows, in the 1 - hour timeframe, USOIL is in an upward - trending channel 📈. The price fluctuates upwards between two trendlines. Despite pullbacks, the uptrend persists, suggesting short - term bullish dominance. Still, the frequent swings reveal ongoing bull - bear market battles.📈

⚡⚡⚡ USOIL ⚡⚡⚡

🚀 Buy@61.5 - 62.0

🚀 TP 63.5 - 65.0

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟

USOIL Opening Trends and Trading Strategies Next WeekTrend Analysis

As shown in the chart, in the 1 - hour time frame, USOIL is moving within an upward - trending channel 📈. This channel is defined by two trendlines, and the price is fluctuating upwards within it. Although there have been pullback trends during this period, the overall trend remains upward. This indicates that in the short term, the bullish forces are relatively dominant, driving the price to gradually climb 📈. However, the frequent price fluctuations also reflect a certain degree of game - playing between the bulls and bears in the market 🤺.

⚡⚡⚡ USOIL ⚡⚡⚡

🚀 Buy@61.5 - 62.0

🚀 TP 63.5 - 65.0

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟

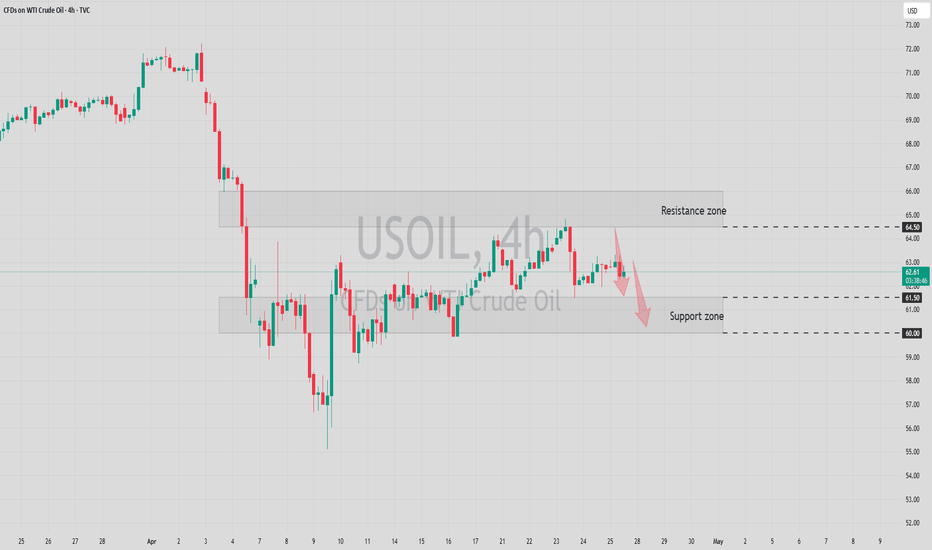

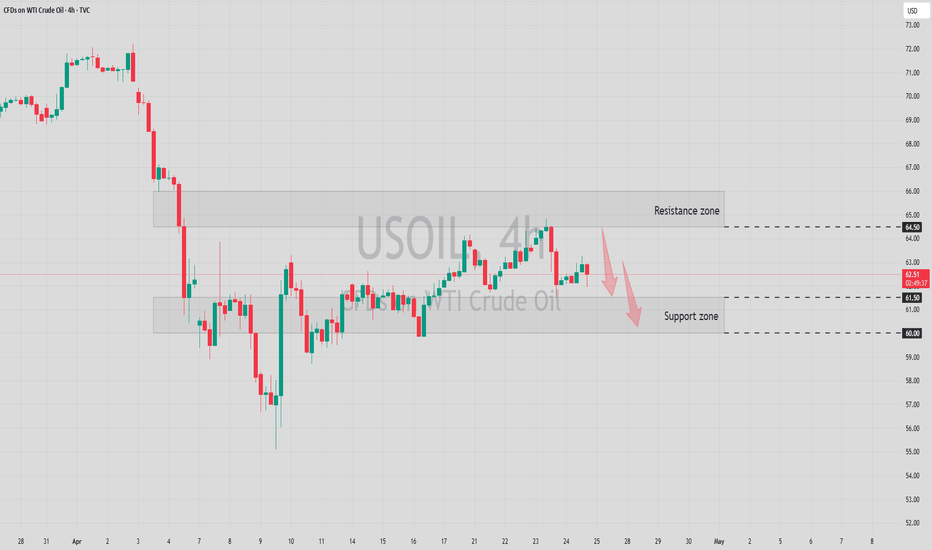

Concerns about demand limit the upside potentialCrude oil lacks upward momentum, with the target pointing to $60.

USOIL

sell@62.8-63.3

tp:61.5-61

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

Primary and secondary rhythm: sudden drop in crude oil pricesLast week, OPEC announced a new compensation plan to offset previous overproduction. Under the plan, eight affected countries plan to reduce production by a total of 457,000 barrels per day by mid-2026, failing to sustain a short-term rise in oil prices.

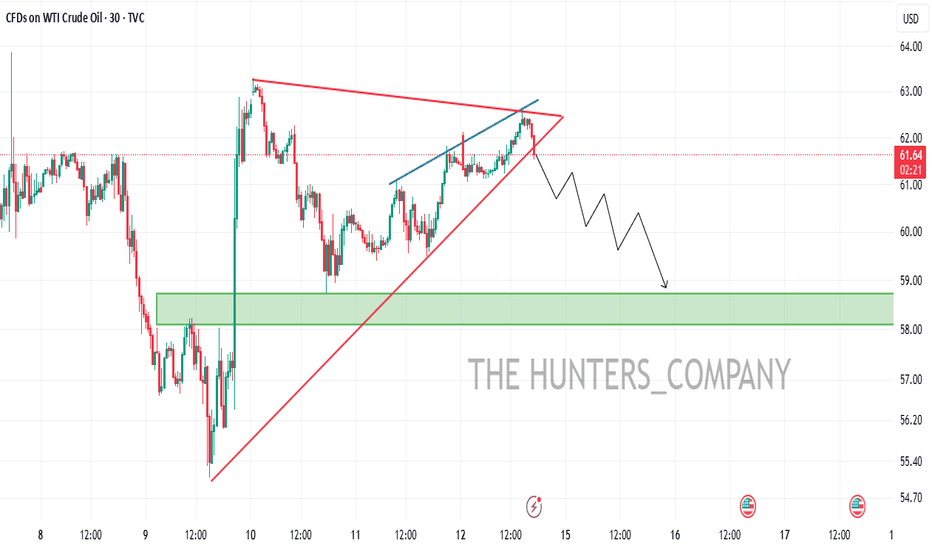

Crude oil's short-term trend hit strong resistance near 64.90 and fell, with the decline erasing the gains of the previous three trading days. The MACD fast and slow lines remain within bearish momentum, indicating abundant downward momentum. From the perspective of primary and secondary rhythms, the decline in the North American market yesterday formed a primary downward trend, while the weak rebound in early trading today represents a secondary rhythm. According to the law of primary-secondary alternation, crude oil is expected to continue to decline today, breaking below the 61.50 support level and testing 60.

USOIL

sell@62.8-63.3

tp:61.5-61

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

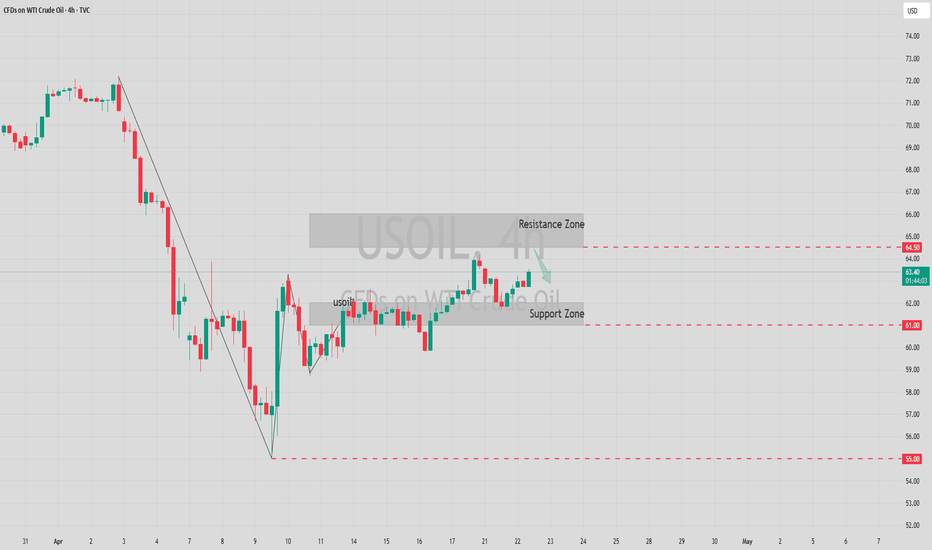

Concerns about demand limit the upside potentialYesterday's strategic analysis noted that U.S. sanctions on Iranian oil exports limited crude oil's upside, though short-term rebounds occurred. Combined with the U.S. plan to zero out Iranian energy exports, short-term news-driven oil price gains primarily reflect supply disruptions and sentiment repair rather than fundamental improvements.

While U.S.-Iran sanctions and OPEC quota adjustments may trigger periodic tensions, intensified global trade concerns and institutional downward revisions to demand forecasts will cap the upside potential of oil price rebounds.

USOIL

sell:64.5-65

tp:63-62

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

Concerns about demand limit the upside potentialDriven by the U.S. sanctions on Iran's oil exports, crude oil rebounded in the short term. OPEC has received updated compensation production reduction plans from eight countries (reducing daily oil production by 305,000 barrels until June 2026), coupled with the U.S. intention to reduce Iran's energy exports to zero. The recent oil price rally is primarily driven by short-term news, reflecting supply disruptions and sentiment repair rather than fundamental improvements.

Although U.S.-Iran sanctions and OPEC quota adjustments may trigger periodic tensions, escalating global trade concerns and institutional downward revisions to demand forecasts will limit the upside of oil price rebounds.

USOIL

buy@62-63

tp:64-65

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

USOIL Today's strategyWith the combination of oversupply, weak demand, technical factors, and geopolitical uncertainties, there is a high probability of a short-term decline in USOIL prices. Investors should closely monitor the dynamic changes.

USOIL

sell@61.5-62

tp:60.5-60

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

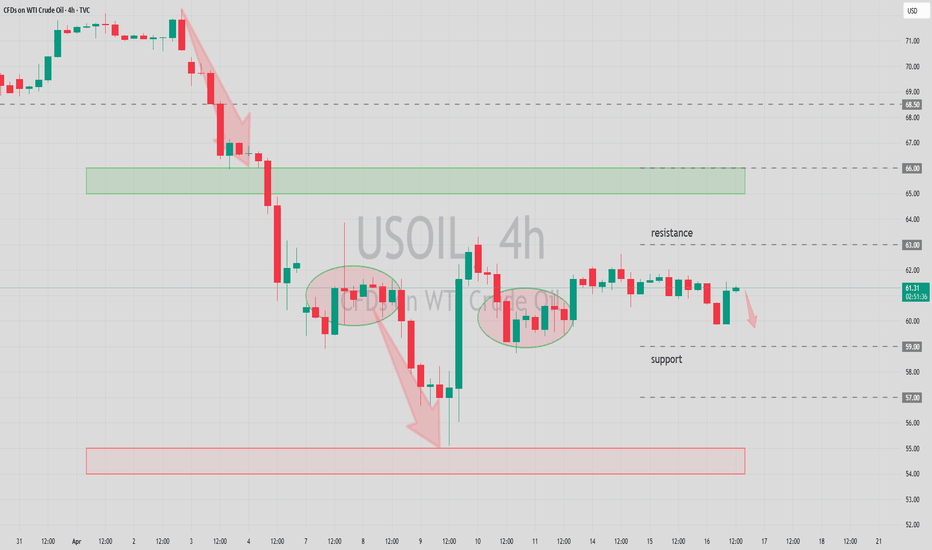

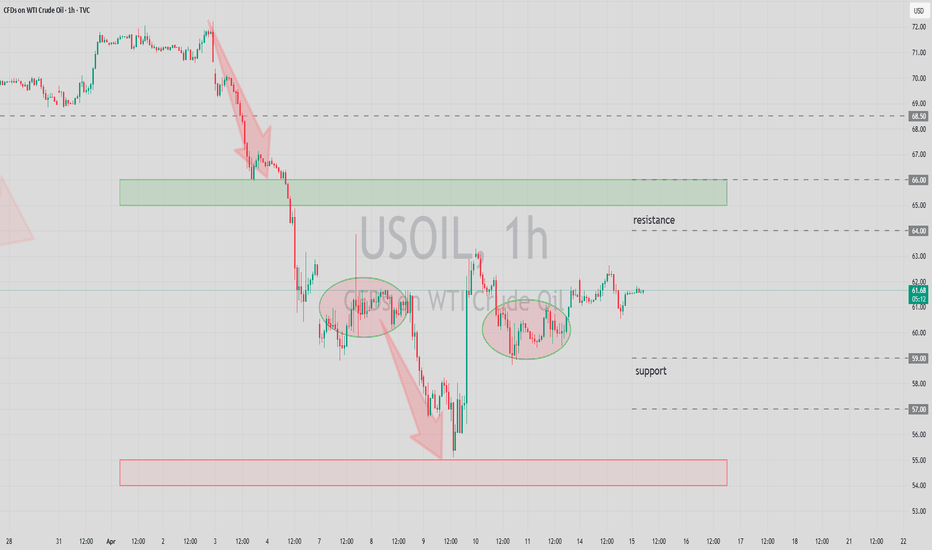

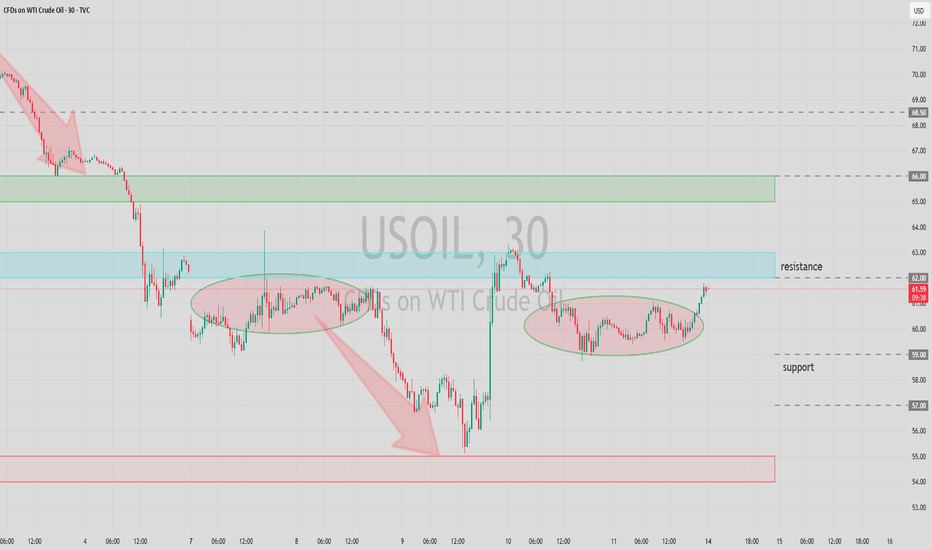

USOIL Today's strategyCurrently, USOIL is fluctuating within a range without a clear directional bias. If it stably breaks through the range of $63 to $64, it is highly likely to continue rising. Conversely, if it fails to break through, it may trigger a decline towards the range of $59 to $57.

USOIL

sell@63-62

tp:60-59

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

USOIL Today's strategyCurrently, USOIL is in a stage of a tug-of-war between bulls and bears. Fundamentally, it is being pulled in two directions by geopolitical risks and weak demand, while technically, it shows a pattern of oscillating and converging. It is recommended to focus on range trading, pay close attention to the breakthrough situation of the resistance at $62 and the support at $57, and adjust the position flexibly.

USOIL

sell@62-63

tp:60-59

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

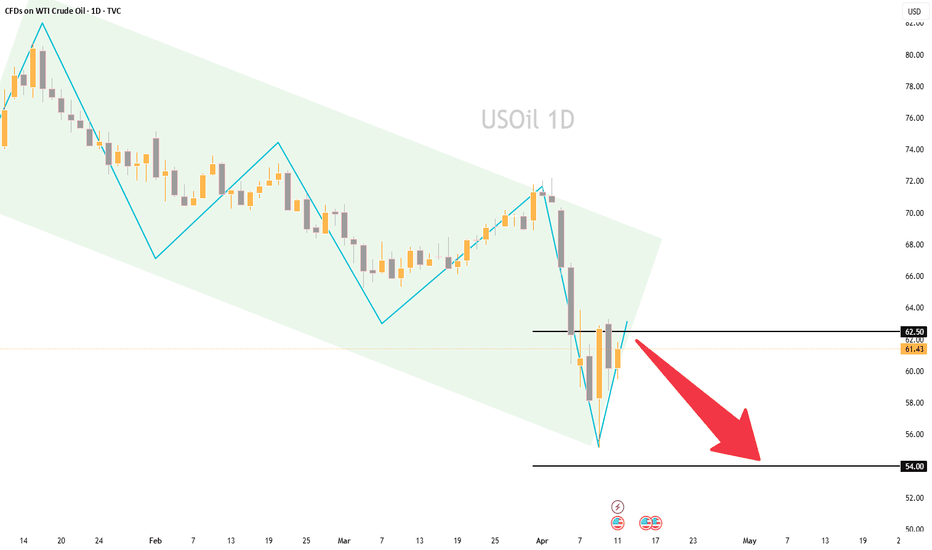

USOIL may continue to decline due to tariffsRestricted Economic Growth : The United States imposes tariffs, and other countries take countermeasures, intensifying global trade frictions and greatly increasing the risk of economic recession. NIESR predicts that if Trump imposes a 10% tariff on the world and a 60% tariff on China, the global GDP will shrink by 2% and the trade volume will decrease by 6% within five years 😕. The weak economy causes the demand for crude oil in various industries to decline, leading to a drop in the price of USOIL 📉.

Changes in Crude Oil Supply and Demand :

Demand Side: China imposes tariffs on U.S. crude oil, raising the import cost and reducing the import volume. The United States imposes tariffs on energy imports from Canada and Mexico, affecting the crude oil exports of these two countries to the U.S., reducing the demand for crude oil in the United States and putting pressure on the price of USOIL 😟.

Supply Side: After China reduces its imports of U.S. crude oil, it increases imports from other exporting countries, changing the global crude oil supply pattern and possibly strengthening the expectation of a supply surplus. The decrease in U.S. crude oil exports may lead to an increase in domestic inventory, exerting downward pressure on the price of USOIL 😣.

Influenced Market Sentiment :

The uncertainty of tariff policies and the escalation of trade frictions trigger market panic and speculation, intensifying the volatility of the crude oil market. Investors, being pessimistic, sell futures contracts, further driving down the price of USOIL 😨.

This upward movement has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟.

💰💰💰 USOIL💰💰💰

🎯 Sell@61.0 - 61.5

🎯 TP 59.0 - 58.0

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

USOIL:You need to refer to this strategyPresident Trump of the United States suddenly announced the suspension of tariffs, which led to a significant change in market sentiment.

Since tariffs play a crucial role in global economic relations and market expectations, this unexpected move has caused investors to adjust their investment portfolios.

As the new tariff suspension policy has reduced market uncertainties to a certain extent, gold, which is usually regarded as a safe-haven asset, has been sold off.

Conversely, the price of USOIL has soared, reflecting the market's rapid response to this major policy change.

If you're at a loss right now, don't face it alone. Please contact me. We are always ready to fight side by side with you.

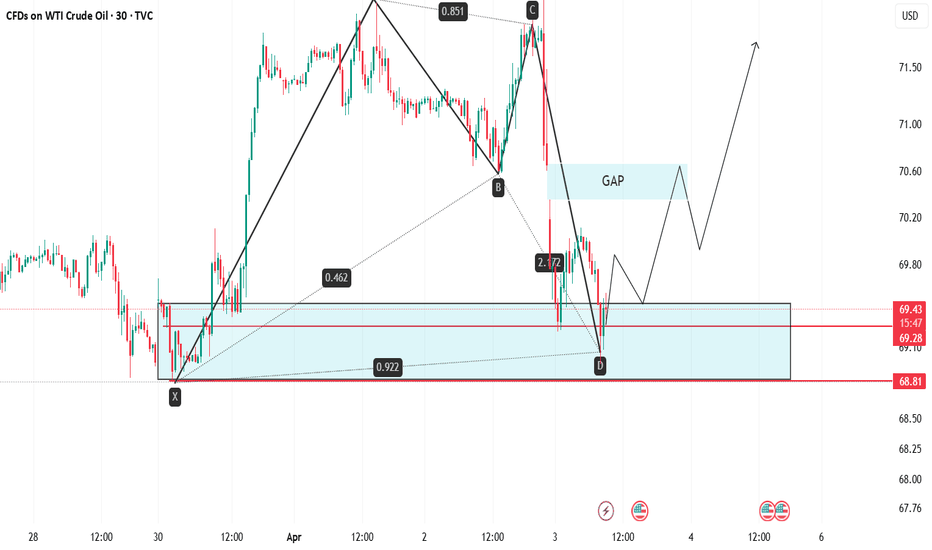

USOIL: Key Levels and Bullish Prospects Amid Trade War ConcernsGood morning Traders,

Trust you are doing great.

Kindly go through my analysis of USOIL.

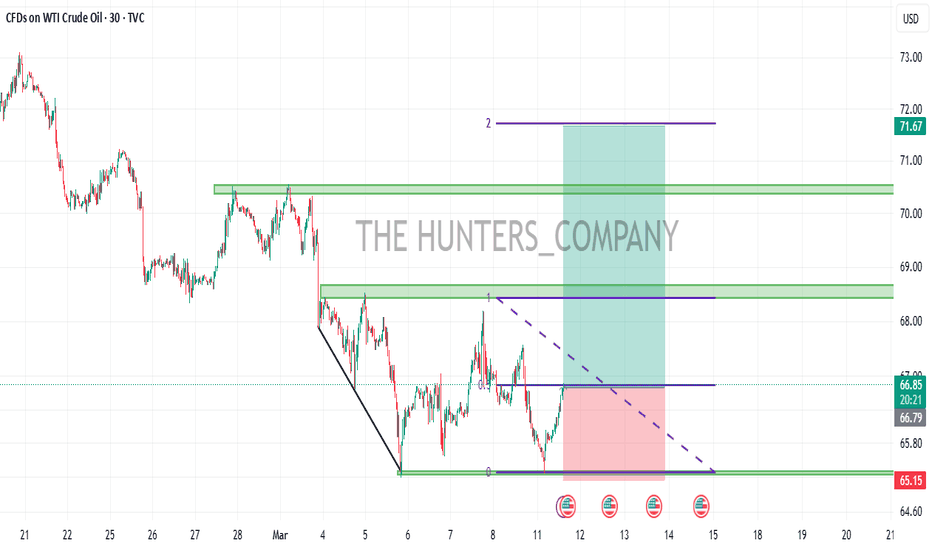

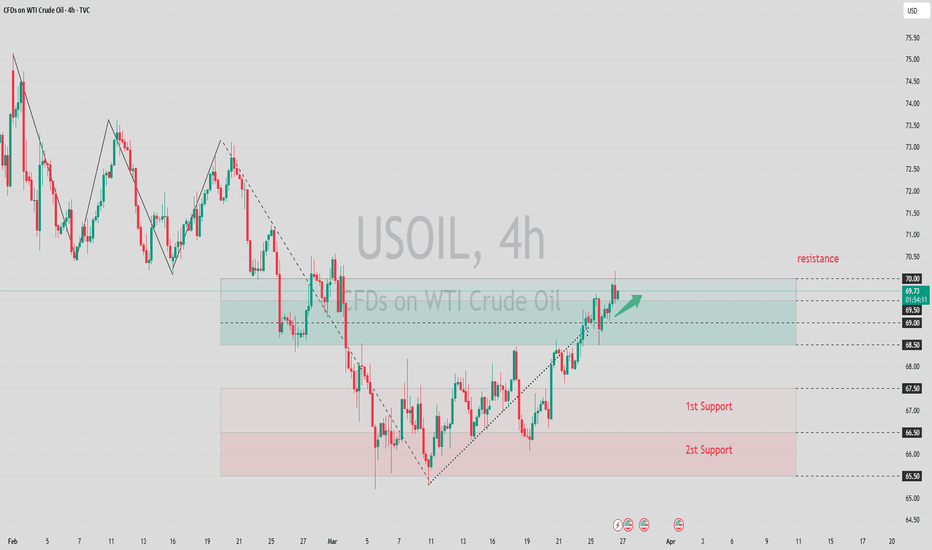

USOIL is currently experiencing market imbalance due to the nature of its opening range, following a gap-down decline last night in response to trade war concerns that have fueled recession fears. The price dropped from its weekly high of 72.22 to a key support zone at 69.00, which is near the week's low. As we anticipate the release of the ISM Services PMI at 3 PM GMT+1, I expect the demand zone to hold, driving the price higher—initially to fill the gap and subsequently toward the 71.35 region. Furthermore, this outlook is strengthened by the formation of a bullish Bat pattern on the M30 chart.

The key levels I will be monitoring for potential price action include the previous week's high at 70.10, the five-week high at 70.62, and the 71.35 region. These areas represent significant resistance levels that could be tested as price moves upward. A break below 68.80 will invalidate this outlook.

Cheers and Happy trading.

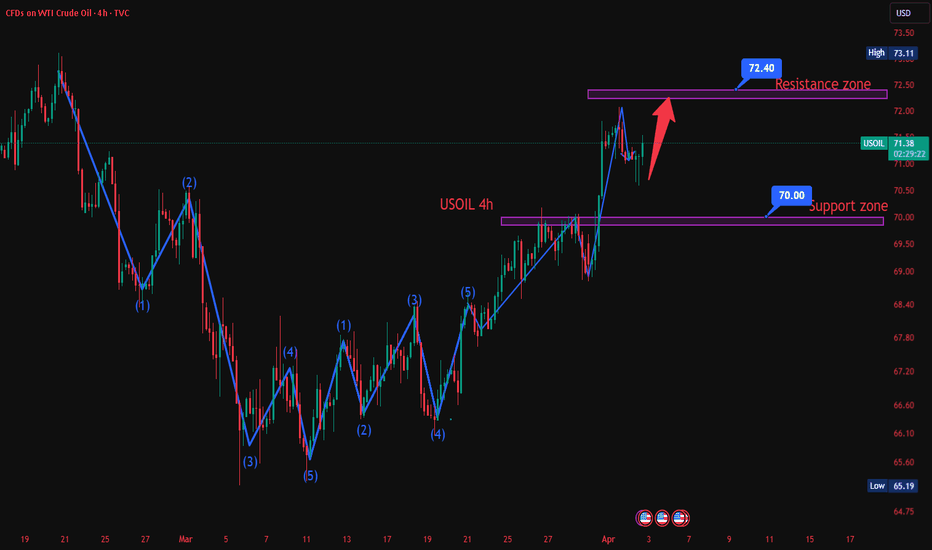

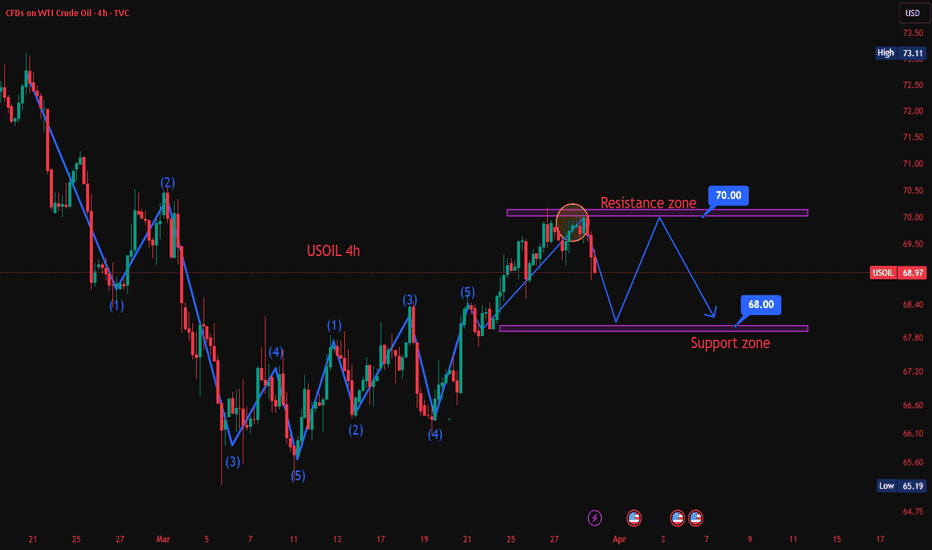

USOIL:Give priority to go long positions on the retracementU.S. heating oil futures gave back their gains. EIA (Energy Information Administration) data showed that U.S. distillate fuel oil inventories unexpectedly increased. U.S. gasoline futures' upward momentum expanded slightly, and the EIA data indicated that the inventory was basically in line with expectations.

The commercial crude oil imports in the United States excluding the strategic petroleum reserve for the week ended March 28 reached the highest level since the week ended January 31, 2025. The EIA strategic petroleum reserve inventory in the United States for the week ended March 28 was at its highest level since the week ended October 28, 2022. The increase in EIA crude oil inventories in the United States for the week ended March 28 recorded the largest gain since the week ended January 31, 2025. The domestic crude oil production in the United States for the week ended March 28 was at its highest level since the week ended December 20, 2024. The commercial crude oil inventory in the United States excluding the strategic petroleum reserve for the week ended March 28 was at its highest level since the week ended July 12, 2024.

Crude oil showed a trend of bottoming out and rebounding on Wednesday. It stabilized and rose near 70.7. After breaking through the $71.2 mark, there might have been a bullish reversal in crude oil. The oil price is expected to test the resistance level above 72.0. Once it further breaks through, it is expected to open up the upside space. In terms of future trading operations, it is advisable to consider laying out long positions on the retracement first.

Trading Strategy:

buy@70-70.5

TP:71.5-72

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL:The bullish momentum demonstrates strong performanceRecently, the United States has stepped up its sanctions against Iran. It also made threatening remarks indicating that if the peace talks between Russia and Ukraine fail to reach an agreement, it will further intensify sanctions against Russia. Such actions have heightened the market's concerns about the future supply side.

Meanwhile, the short-term and phased decline in the United States' domestic oil production, combined with its temporary abstention from taking additional measures to suppress oil prices, has led to a certain increase in the supporting strength of the oil market recently. Yesterday, the upward trend of oil prices continued.

Take a long position at $71.05 for the oil price. Set a stop-loss of 30 basis points and a take-profit at $72.70.

Trading Strategy:

buy@70.8-71.05

TP:72.20-72.50

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

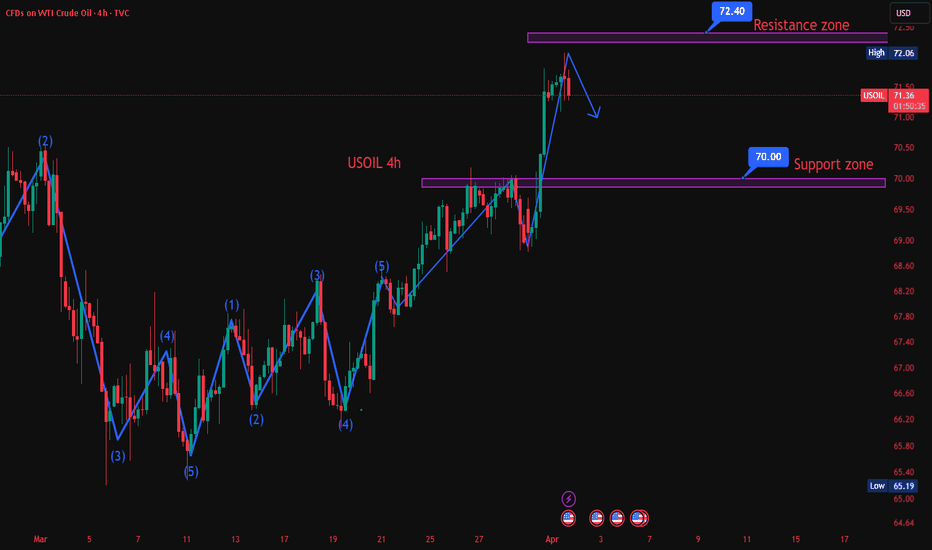

USOIL: Next Week's Blueprint for Profit Amid VolatilityDuring the US trading session on Friday, March 28th, international oil prices fluctuated slightly and declined. However, both Brent crude oil and WTI crude oil remained firmly near their one - month highs and were projected to register "three consecutive weekly gains" on the weekly chart. The ongoing tug - of - war between the supply tightness instigated by geopolitical unrest and the latent concerns regarding an economic downturn has placed oil prices in a volatile state of being "caught between a rock and a hard place".

From the perspective of the USOIL daily chart, following the medium - term trend's breach of the lower edge of the range, it has predominantly fluctuated around lower levels. The oil price has experienced consecutive short - term increases, breaking through the suppression of the moving average system, and the medium - term objective trend has entered a transition phase. Nevertheless, in terms of kinetic energy, neither the bulls nor the bears have demonstrated a clear - cut inclination to overpower the other. It is anticipated that the medium - term trend will persist in its volatile rhythm for a while, awaiting the establishment of a distinct trend direction.

The short - term (1H) trend of USOIL has not continuously set new highs and has exhibited a pattern of high - level consolidation. The short - term objective trend remains upward. In the early trading session, the oil price underwent a narrow adjustment at a high level, presenting an overall secondary rhythm with a sound internal rhythm. The fundamental objective trend during the week has been upward in sync, and it is highly likely that the short - term trend of USOIL will continue its upward trajectory next week.

USOIL

buy@68-68.5

tp:69.5-70

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Tariffs can have a significant impact on USOILThe expiration of the extended US import tariffs on Canada and Mexico next Wednesday may impact USOIL:

Supply : Tariffs could disrupt US-Canada crude oil trade, cutting US supply and raising prices. Trade pattern changes may also affect global supply and USOIL prices.

Demand : Tariffs may slow economic growth, reducing crude oil demand and exerting downward price pressure. Uncertainty dampens consumer and business confidence, further suppressing demand.

Market Sentiment & Finance : Policy changes heighten uncertainty, making investors cautious and increasing USOIL price volatility. Capital may flow out, pressuring prices, but portfolio adjustments for hedging could support them.

Also, OPEC and non-OPEC plans to end production cuts in April may boost global supply and lower USOIL prices.

USOIL:Analysis of the Oil Market Trend for Next WeekAmid the anticipated trade uncertainties, concerns on the supply side have resurfaced. With the April 2nd tariff effective date approaching, the market is taking a cautious stance in the short - term. Supported by the decline in oil inventories and the prevailing concerns, oil prices have rebounded and are nearing the resistance range. In the medium - term, the market is constrained by the expected slowdown in global demand, and the focus is on waiting for the resistance test.

Strategy recommendations: Given the range - bound trading, consider short - selling at high levels and buying at low levels.

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Continue to be bearish.Supply : The United States has intensified its energy sanctions against Iran. Attacks on Saudi facilities have affected their performance. The OPEC+ will gradually lift the voluntary production cuts starting from April and may increase production for the second time in May. The 30-day ceasefire agreement between Russia and Ukraine has not been effectively implemented in substance. However, recently, the United States, Russia, and Ukraine have reached some consensus on Black Sea navigation and the protection of energy facilities.

From a technical perspective, when the price repeatedly encounters resistance below an important resistance level and fails to achieve an effective breakthrough, it is often a bearish signal. This implies that the selling force in the market is dominant. Once the price starts to retrace due to its inability to break through the resistance, it may initiate a downward trend. Therefore, based on the strong resistance level at 70.000, there is a certain basis in technical analysis for a bearish outlook.

💎💎💎 USOIL 💎💎💎

🎁 Sell@70.000 - 70.200

🎁 TP 68.5 68.0 67.5

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

USOIL Strategy DiscussionThis week, we've analyzed the reasons behind the short - term strong performance of crude oil. We specifically remind you to pay attention to the price movements within the range of $68.5 - $69.5.

Once again, we advise you to observe more and trade less.

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income,You can follow the link below this article