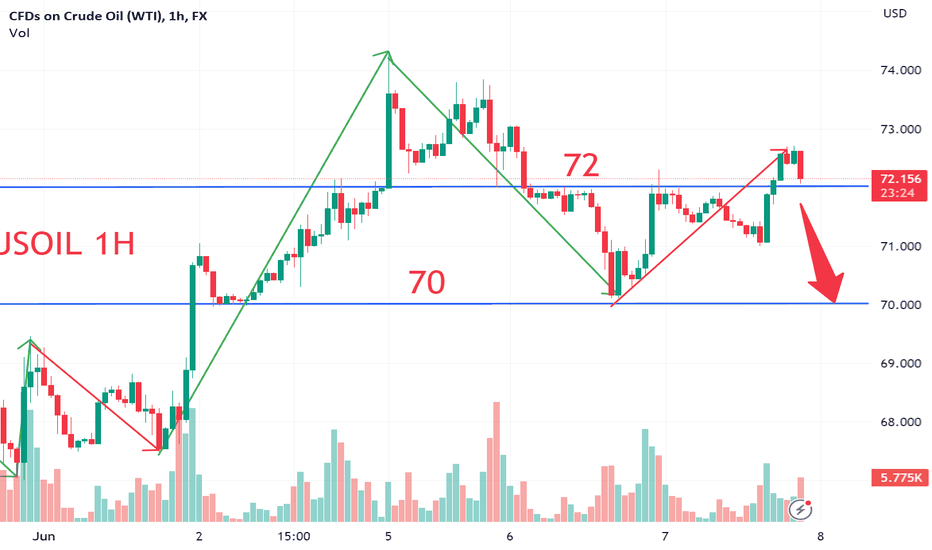

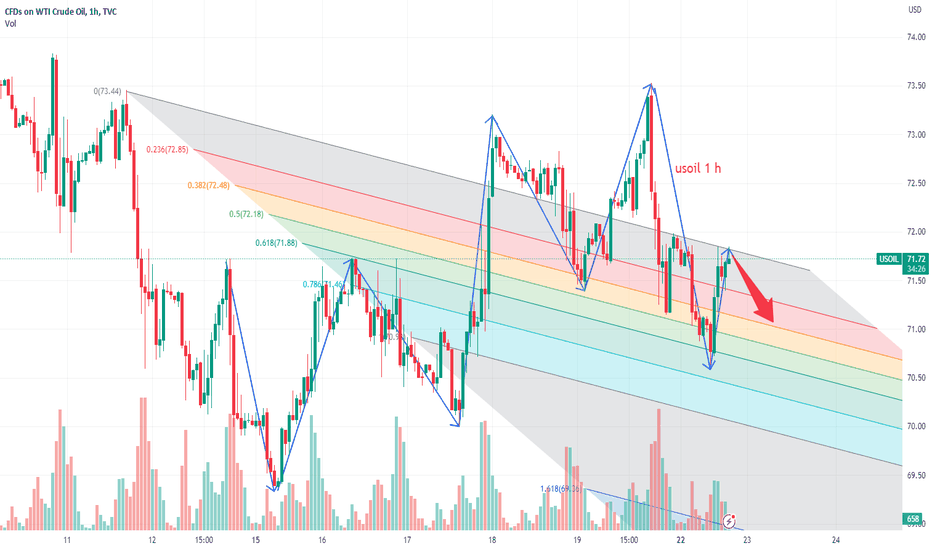

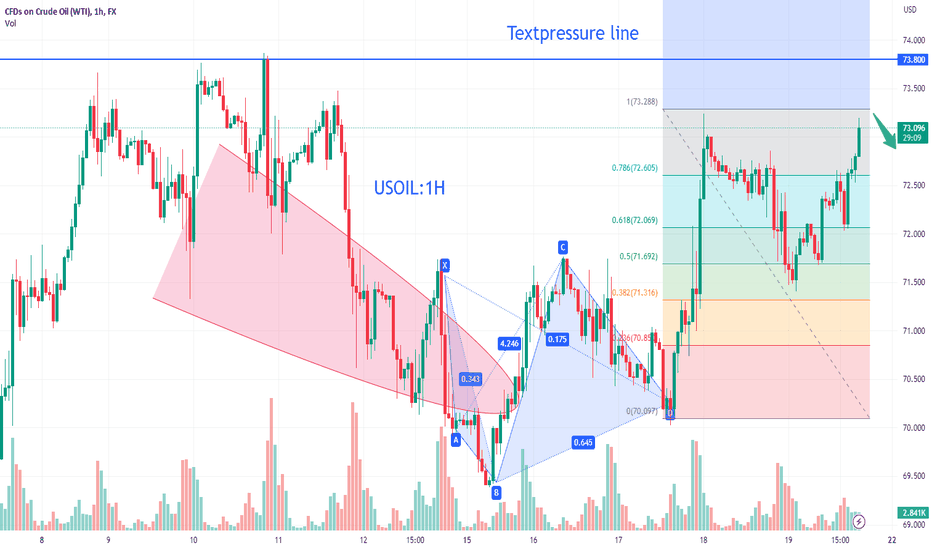

USOIL: SELL around 71.8, short-term within the day to see 72.3-6SELL71.8, see the 70.5 line, just break through 72.3 and stop loss. Generally speaking, the oil price range is 72.3-69.9 within the day! If you break the upper and lower support levels, change your strategy and follow up!

Intraday strategy follow-up is closer. . .

Usoilsignal

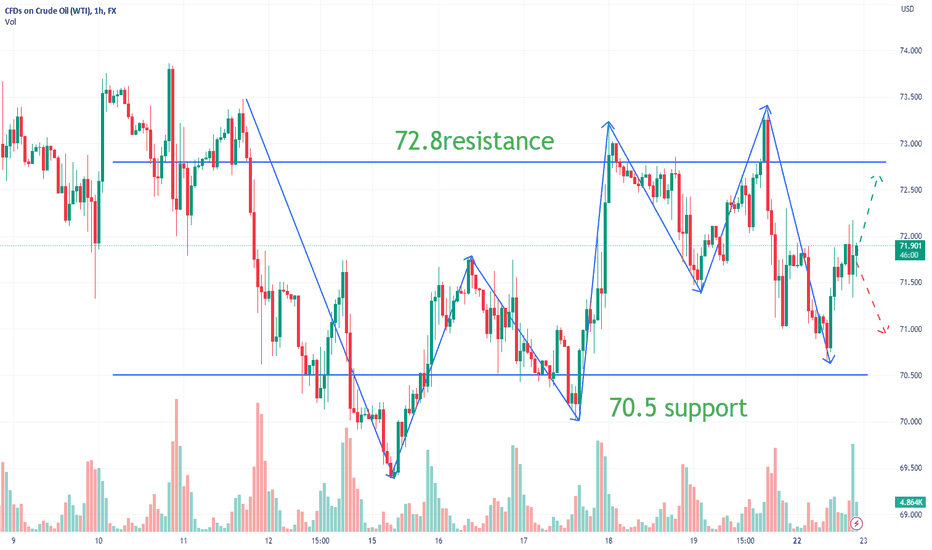

USOIL: Resistance level 72.5, trading strategy between 70.4~71.8On the whole, today's crude oil price should focus on the 71.8 high point and 72.5 resistance for the upper resistance, and the 70.4-69.5 support for the lower part. During the shock period, you can sell high and buy low, and swing trading can maximize today's benefits

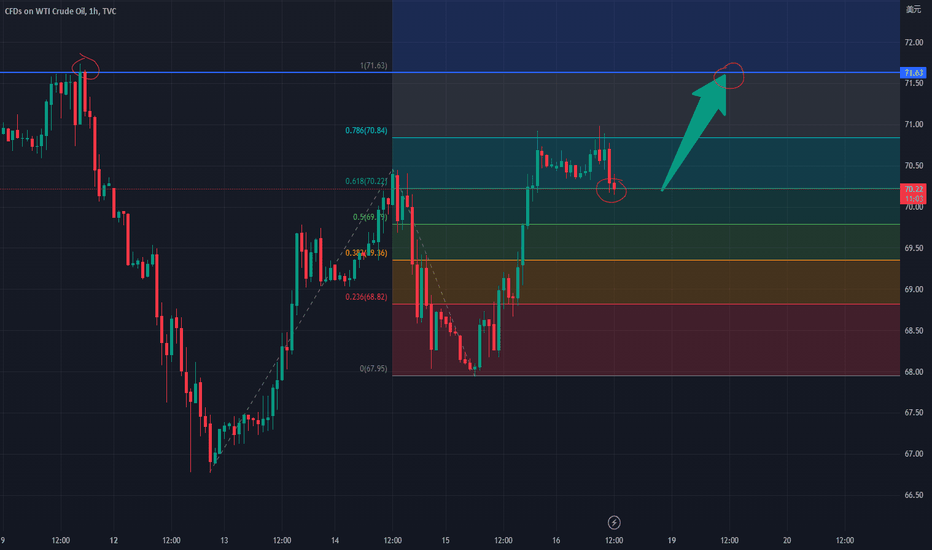

USOIL is poised to reach $71.63International oil prices were basically stable this Friday, and the U.S. index rebounded from a more than one-month low, limiting the rise in oil prices. Oil prices snapped a two-week losing streak on optimism over rising energy demand in top crude importer China. The upper pressure level of crude oil is 71.63 US dollars.

The data released on Thursday showed that the number of Americans filing for unemployment benefits last week was higher than expected, and the U.S. industrial production unexpectedly fell by 0.2% in May, causing the U.S. dollar index to plummet by nearly 0.9%. However, U.S. retail sales unexpectedly rose in May, and the U.S. index rebounded after hitting a low of 102.043 since May 12 on Friday.

Data released on Thursday showed that China's refinery throughput in May increased by 15.4% year-on-year, the second highest in history. The chief executive of Kuwait Petroleum Company said that China's demand for oil is expected to continue to climb at a confident pace in the second half of this year.

Analysts also expect the latest production cuts announced by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) in May and further voluntary cuts by Saudi Arabia in July to support prices. Still, markets are struggling to shake the panic as the global growth outlook remains vulnerable to further shocks from aggressive rate hikes.

The European Central Bank raised interest rates to a 22-year high as scheduled overnight. The Fed said this week that it will raise interest rates by at least 50 basis points by the end of the year. Higher interest rates end up increasing borrowing costs for consumers, which could slow economic growth and reduce oil demand.

On the hourly chart, oil prices have started an upward trend from US$68, and the upper resistance is looking at the 100% target at US$71.63.

USOIL: Trading Signals

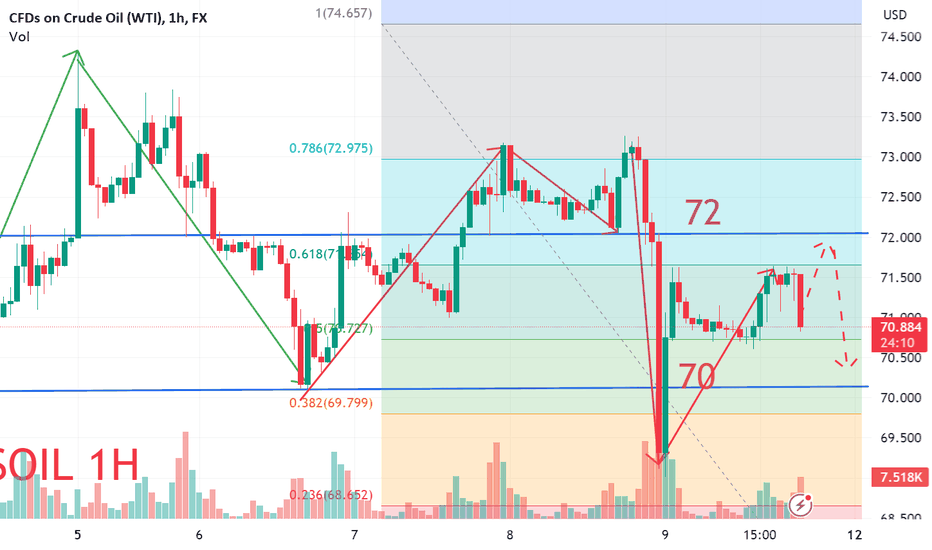

USOIL30m chart, after the arc bottom is formed, encounters resistance near 70, forming M top (double top), MACD death cross, judging from the shape, it should be a pullback and then rise, so, my trading point of view is to be short first , and then go long.

Trading Signals:

sell:69.3-69.5

tp:68.5-68.3

buy:68.5-68

tp:70.3-71

USOIL:Trading advice for the day

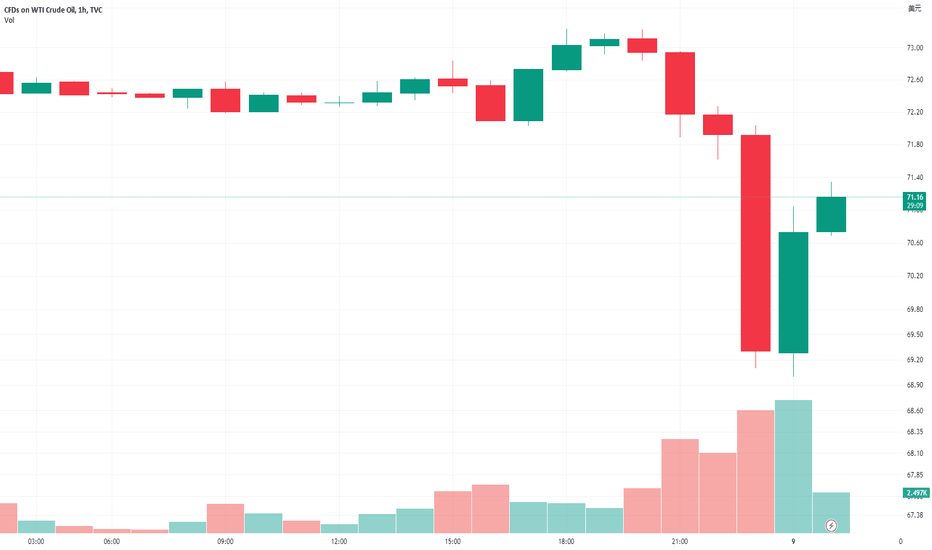

A very typical shock trend, last trading day under the EIA and API double favorable stimulation oscillation upward test pressure level, from around 72 oscillation counter-pumping in the refresh high touched the 73.2 line and then the shock fall, a wave of sharp fall touched around 69 and then rebounded, in the short term a shock box is also very obvious, this is also the idea we have been sharing with you recently, the upper pressure level gradually moved down to around 72, the short-term support below is still at 70, strong support around 69.

If you need a detailed strategy, you can contact me.

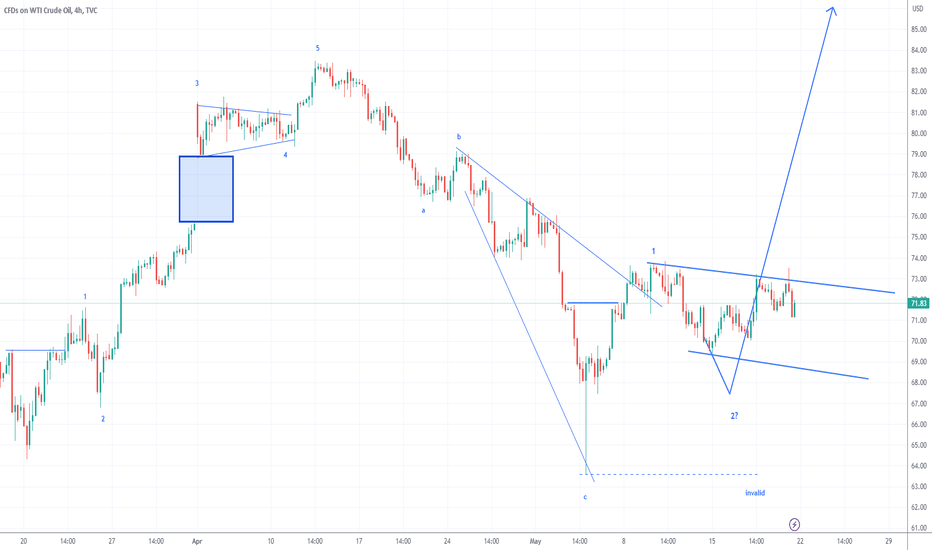

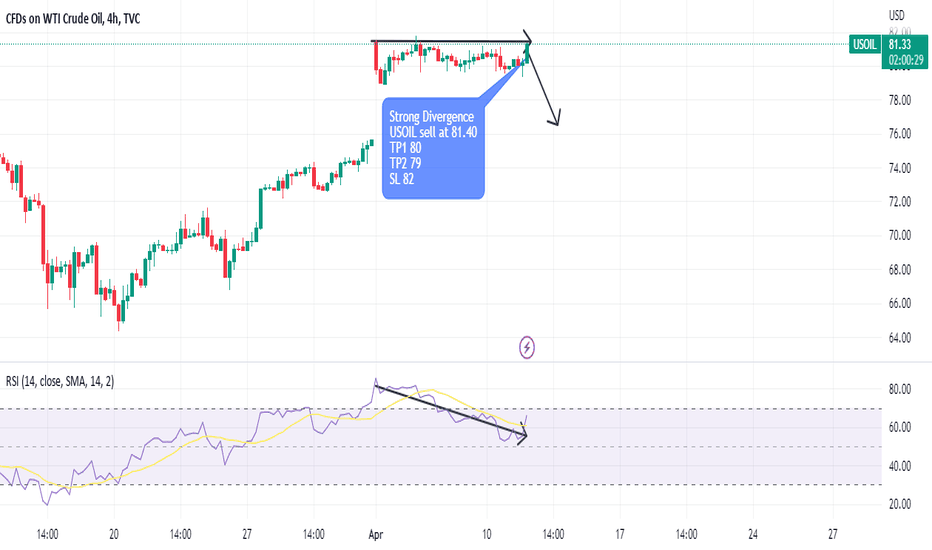

USOIL Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

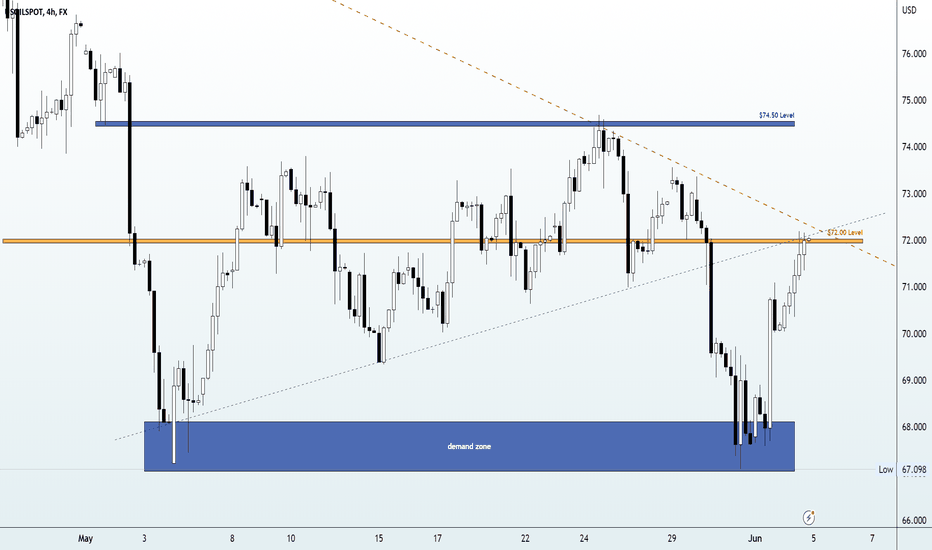

USOILSPOT Weekly Analysis: New Perspective and Follow-Up DetailsJoin me as we delve into the fundamental factors surrounding the upcoming OPEC+ meeting, taking place over the weekend. During this crucial gathering, OPEC+ members are expected to make important decisions regarding new production cut levels. These measures aim to regain control of oil prices by counteracting the influence of short-sellers and maintaining a target price of $80 or higher. This strategy involves creating an artificial supply squeeze to drive prices up. As a result, the outcome of the OPEC meeting adds an exciting layer of anticipation to the market's reaction on Monday.

In addition, this video includes a comprehensive technical analysis of USOILSPOT, focusing on key support and resistance levels, as well as trendlines identified in the 4-hour timeframe. By examining these indicators, I aim to provide insights into the potential direction of price action for USOILSPOT in the upcoming week.

Don't miss out on this insightful analysis, which combines fundamental factors and technical analysis to enhance your understanding of USOILSPOT's future trajectory. Stay ahead of the curve by watching this video now!

Disclaimer Notice:

Please be aware that margin trading in the foreign exchange market, including commodity trading, CFDs, stocks, and other instruments, carries a high level of risk and may not be suitable for all investors. The content of this speculative material, including all data, is provided by me for educational purposes only and to assist in making independent investment decisions. All information presented here is for reference purposes only, and I do not assume any responsibility for its accuracy.

It is important that you carefully evaluate your investment experience, financial situation, investment objectives, and risk tolerance level. Before making any investment, it is advisable to consult with your independent financial advisor to assess the suitability of your circumstances.

Please note that I cannot guarantee the accuracy of the information provided, and I am not liable for any loss or damage that may directly or indirectly result from the content or the receipt of any instructions or notifications associated with it.

Remember that past performance is not necessarily indicative of future results. Keep this in mind while considering any investment opportunities.

USOIL:Trading advice for the day

Crude oil currently continues to maintain a wide range of oscillations in the daily trend. After a wave of bottoming out and rebounding in the hourly trend, there is currently no particularly obvious trend in the short-term, and there is a high probability that it will maintain a volatile trend in the daily trend.

usoil:sell@72.5-72.2 tp:71.7-71.2

It's that simple to take you to make money, follow me.

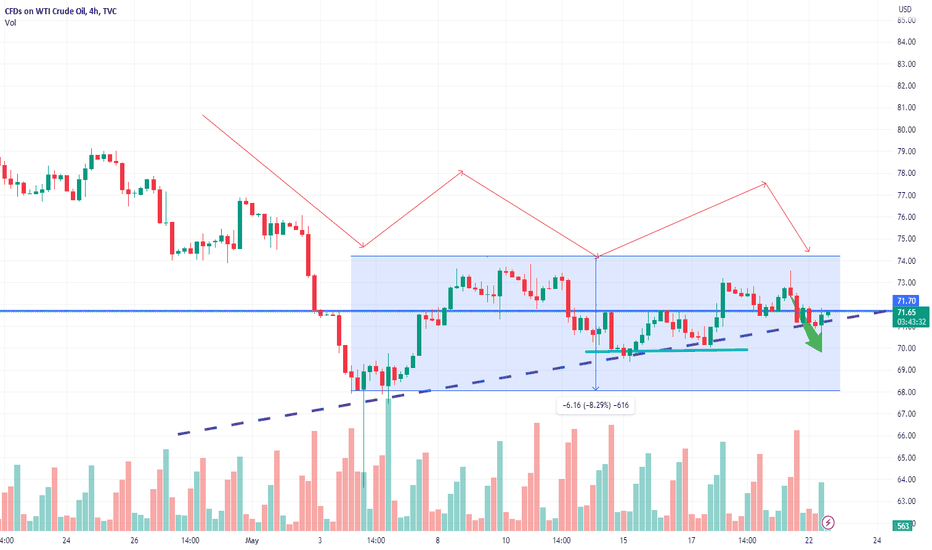

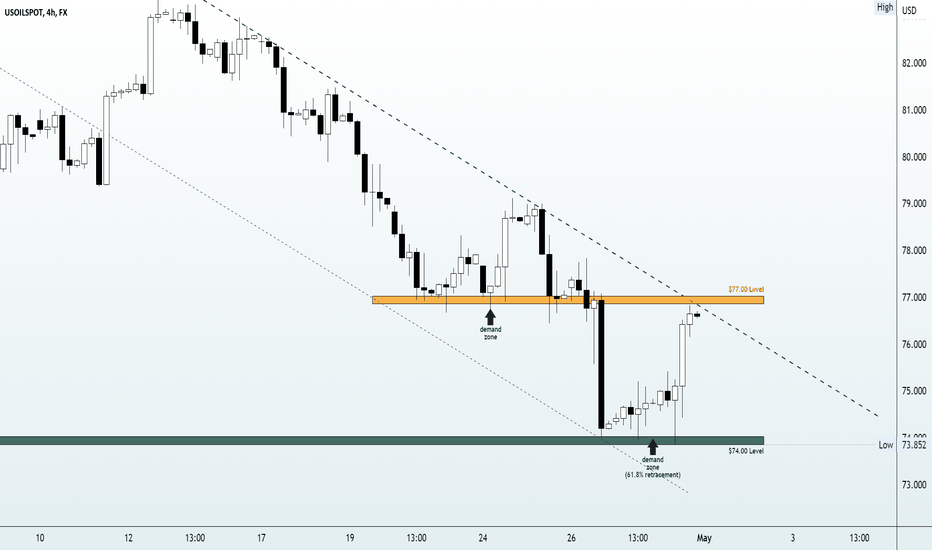

USOil | New perspective for the week | Follow-up detailOil prices reversed on Thursday and Friday to transition into a choppy situation to the disappointment of buyers as talks to raise the U.S. debt ceiling hit an impasse. Market participants were reluctant to have open buy positions into the weekend, on the off chance that an agreement to raise the U.S. government’s debt ceiling is struck over the weekend which could result in a huge gap at the beginning of the incoming week. In this video, we acknowledged the consolidation phase (between 70 and 74 zones) - a range that will be a determinant of price action in the coming week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

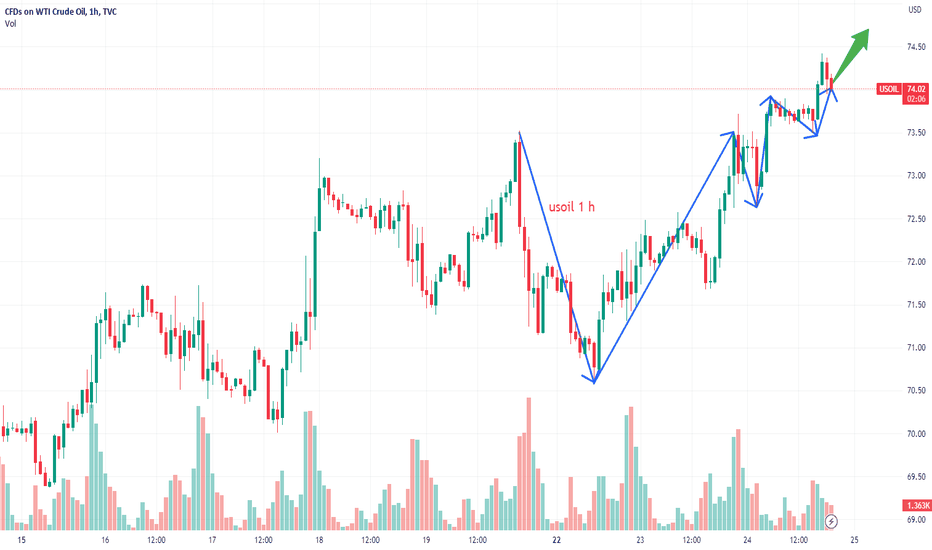

Crude oil will break through the straight line and accelerate up

Crude oil fell back today and bulls rose again, and the point of decline was also very close to the expected point, but there will be normal shocks in the rise, and if there is a fall, there will be new long opportunities.

Crude oil closed positive on a daily basis and broke through the range high, indicating that the recent sideways correction has ended, and the market is once again not as good as the bulls.

Trading strategy

buy@73.90 tp1:74.70 tp2:75.9

Next, there will be many trading opportunities for crude oil. I will provide you with more signals. Don't miss the opportunity to make money!

USOIL:Today's trading advice

On the fundamentals, it is still in a state of intertwined long and short positions. The optimistic expectations of short-term debt negotiations have given the market some support. Coupled with the recent strong demand for gasoline, there is a certain positive stimulus for crude oil in the short term. However, there is currently some uncertainty about the production cuts promised by Russia, which has led to a more cautious attitude in the market. Last trading day, crude oil fell back to near 70.7 after the shock, and it rebounded to near 72.5 in the evening. The short-term range is still not broken, and the range opportunity can continue to be maintained.

Today's trading advice

usoil:sell@72.4-72.9 tp:71.8-71.3

usoil:buy@70.7-71.2 tp:71.8-72.4

As long as you keep up with my signal, you can make more money

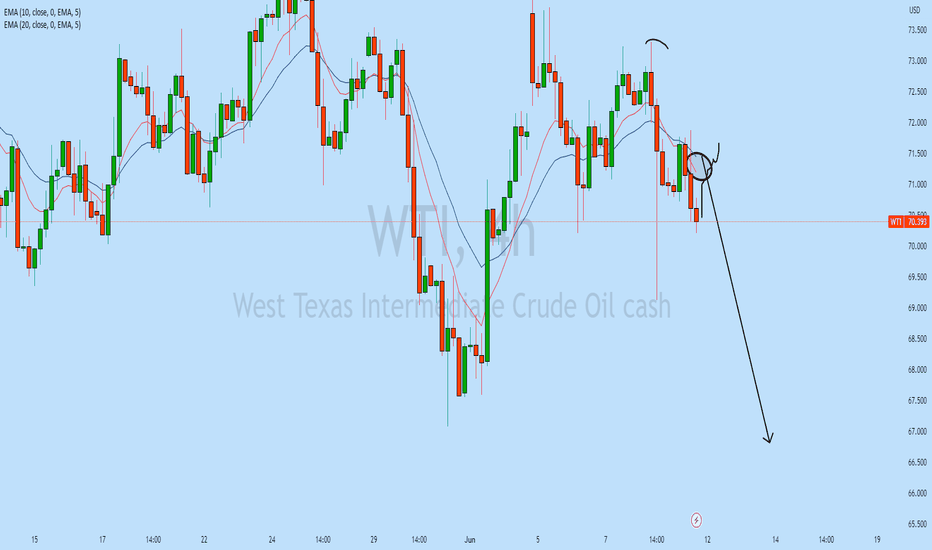

Crude oil shorting

After the price rebounded slightly, the five-minute pattern peaked again, conforming to the one-hour bearish cycle, the rebound can be regarded as a correction to the downward rebound that began on Friday, so I will continue to wait for this opportunity tonight

Trading strategy:

sell@71.8 tp1:71 tp2:70.8

Next, there will be many trading opportunities for crude oil. I will provide you with more signals. Don't miss the opportunity to make money!

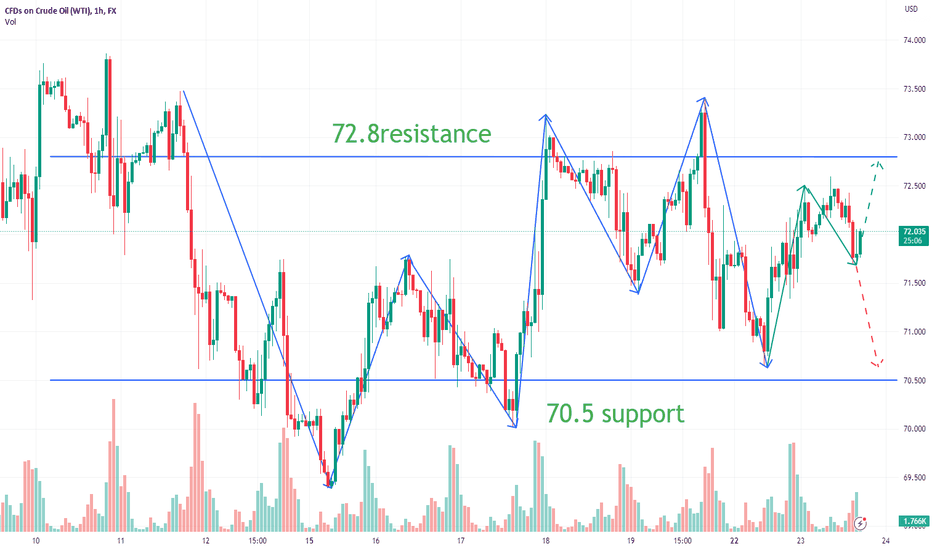

Usoil:Today's trading advice

The weekly crude oil closing line is below the middle rail. At present, the moving average MA5 and the middle rail are both flattened, and the indicator macd is also flattened from time to time, which means that gold is currently in a low volatility.

The three-track contraction of the daily Bollinger band represents the compression of the range, which also shows the price fluctuation.Currently focusing on support near 70-70.5.The short-term daily line is suppressed on the 72.3 and 72.8 lines of the middle rail.

usoil:buy@70.8-71.3 tp:72-72.5

usoil:sell@72.7-73.2 tp:72.2-71.9

Crude oil transaction analysis

The U.S. debt ceiling negotiations failed to reach an agreement last week. Although they will continue on Monday, there are some concerns in the market, which put pressure on oil prices, and U.S. Treasury Yellen's speech on the possible need for more bank mergers has also increased market concerns about the banking turmoil and crisis.

At present, it is already showing a weak trend, but the support of the uptrend line below is relatively speaking, and it is expected that the narrow volatility adjustment will continue in the short term. In terms of operation, we will continue to short at a high level.

Trading strategy:

USOIL:sell@72.7-71.7 tp71-70.7

Next, I will continue to provide more trading signals, and the weekly profit can reach more than 5K-10Kusd. I need signals to join me as soon as possible!

USOIL:Trading straregy

Yesterday, the market continued to fall as scheduled and adjusted to reach the support level of the chips below. In the short term, we can continue to focus on the pressure of the chip peak (around 73.80). We can also clearly see from the above picture that the CCI has further upward movement In the short term, there is also a lot of pressure at the top, just focus on the pressure of 73.20 and 75.70. The specific suggestions are as follows:

usoil:sell@73.2-73.6 tp1 72.3 tp2 71.8

Accurate trading signals will be updated in real time in the follow-up, friends who need it follow me!

USOIL Top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

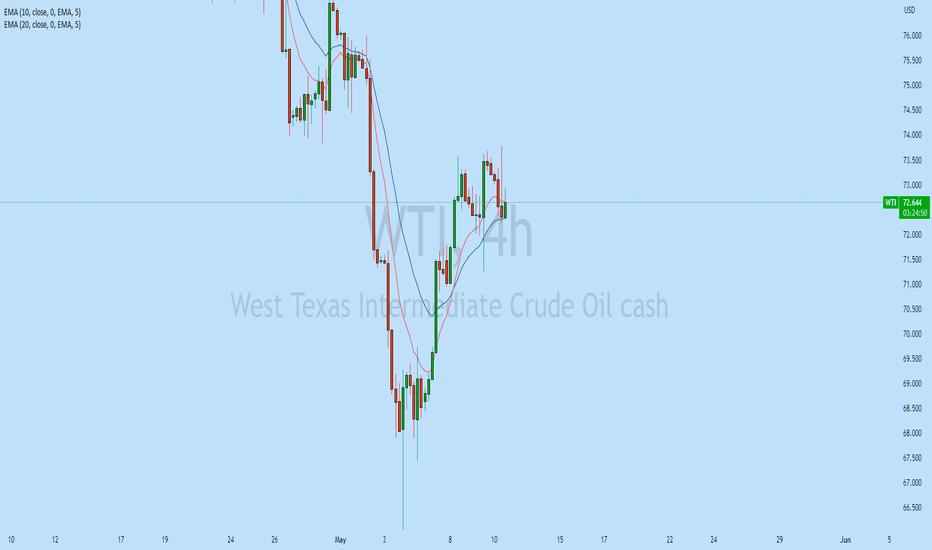

USOil | New perspective for the week | Follow-up detailThe previous month witnessed a 4% drop in oil prices despite the OPEC+ member's decision to cut a further 1.7 million barrels from its daily output, adding to an earlier pledge from November to take off 2.0 million barrels per day. The implementation of this pledged cut is supposed to begin next month - May 2023 and this could result in some interesting market influx as the month starts in the coming week. In this video, I shared with you my thought process from a technical standpoint as we plan to take a decisive position ahead of the market opening.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USOil | New perspective for the week | Follow-up detailThe much-expected bullish pressure following the OPEC+ decision to cut oil production appears to be losing steam as bears are defying OPEC+ again. The majority of market participants are of the opinion that the selling pressure witnessed in the previous week is a result of persistent US rate hikes and recession fears but if we take a look at this bearish move from a technical standpoint, it could be a retracement phase which most of the time is a consequence of profit-taking activities. This video illustrated the technical side of the current market structure and highlighted a key level at the 78.00 level which will be serving as our yardstick for trading activities in the coming week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

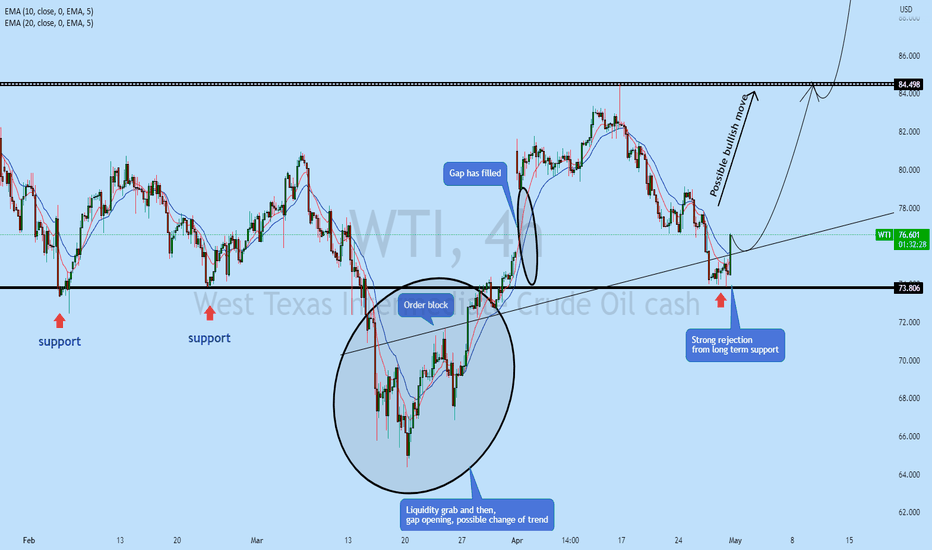

USOIL set for a ride!Instrument : WTI

Possible direction : Bullish

Technical Analysis : Early this month WTI opened with a gap and was in consolidation and finally price has filled that gap and bounced from the long term support zone. As there is strong illiquidity grab and filling out of gab, WTI may start its uptrend and may continue to rise. Upon retest of the previous resistance as support a buy trade is high probable.

Possible trade recommendation : Bullish as per sketch.

Press like button if you enjoy.

Risk Disclaimer: Trading foreign exchange on margin carries a high level of risk, and is not suitable for all investors. Past performance is not indicative of future results. The high degree of leverage is dangerous and can work against you as well as for you. Before deciding to invest in foreign exchange or any market you should carefully consider your investment goals, level of experience, and risk tolerance. It is EXTREMELY LIKELY that you will sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. No representation is being made that any account will or is likely to achieve profits or losses. Past performance is not indicative of future results. Individual results vary and no representation is made that clients will or are likely to achieve profits or incur losses comparable to those that may be shown. You acknowledge and agree that no promise or guarantee of success or profitability has been made between you, and Forex Trading Wizard. Do your own research and talk to a professional financial planner in order to be aware of all the risks associated with foreign exchange trading and investing and seek advice from an independent financial advisor before risking any capital.

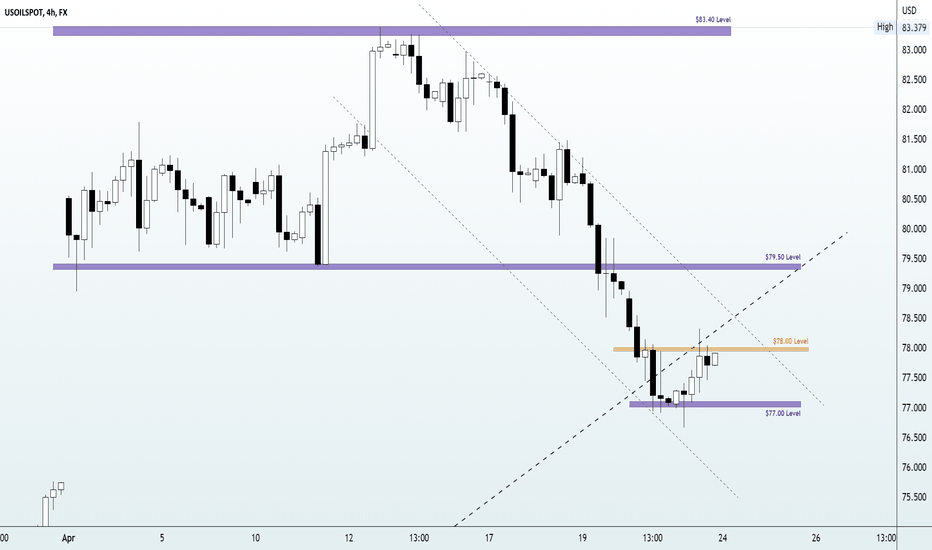

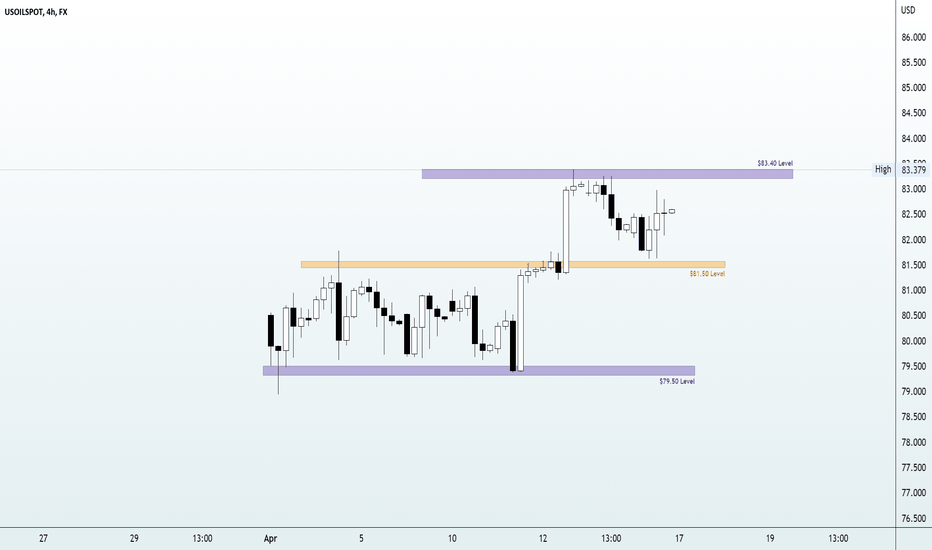

USOil | New perspective for the week | Follow-up detailFollowing a profitable week for us, the US Oil prices rose for a fourth consecutive week, riding on global energy agency IEA’s upgraded demand prospects for 2023 to break out of the $82.00 level for the first time in 5 months, but a resurgent of the US dollar on Friday following Fed Governor Waller’s remarks favoring more rate hikes; shook up some of the gains as selling pressure resumed at the $83.40 Level. Higher rates often tend to benefit the dollar, especially against commodities like Oil. Will the breakout of the HKEX:82 barrier become a platform for more bullish momentum in the coming week or will it turn out to be just a false breakout? In this video, we looked out for potential trading opportunities from the perspective of both the buyers and sellers and came up with a simple trading set-up that we can use to guide our trading activities in the coming week(s).

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.