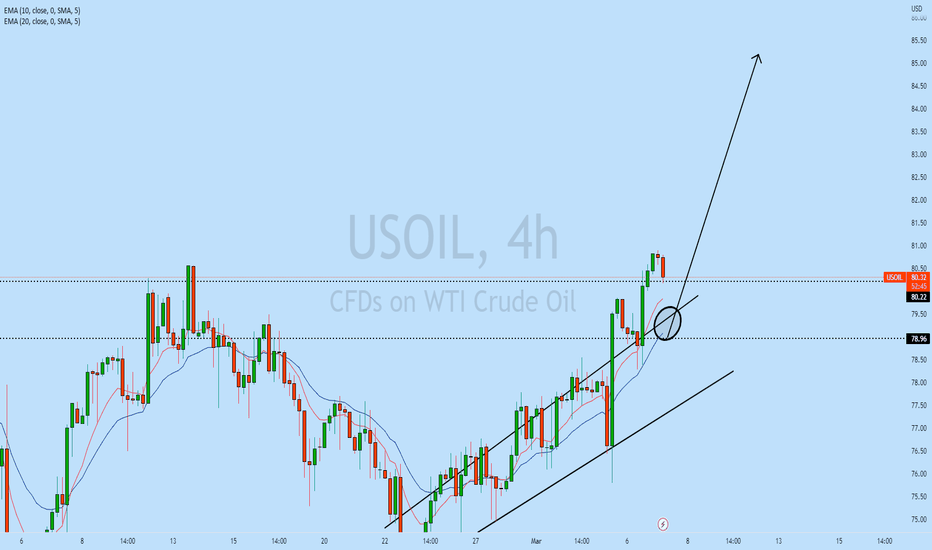

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Usoilsignal

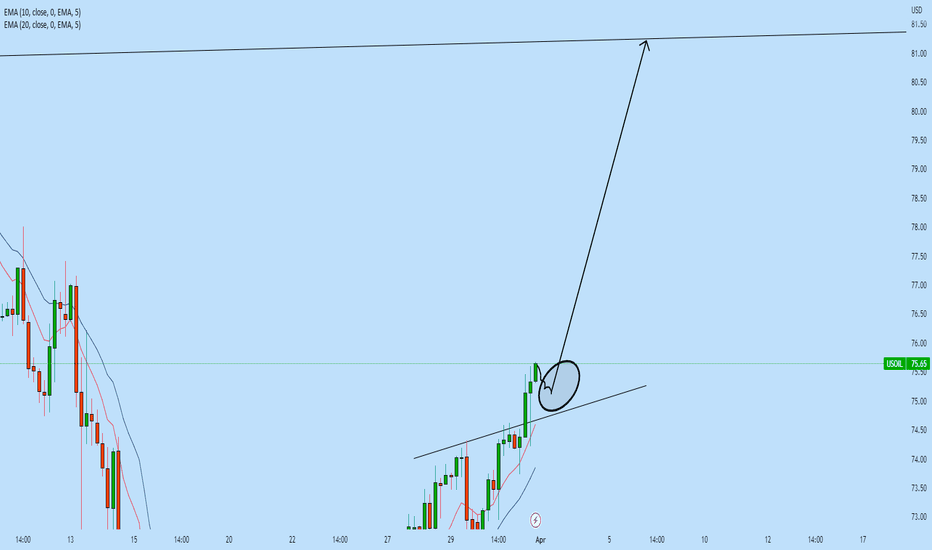

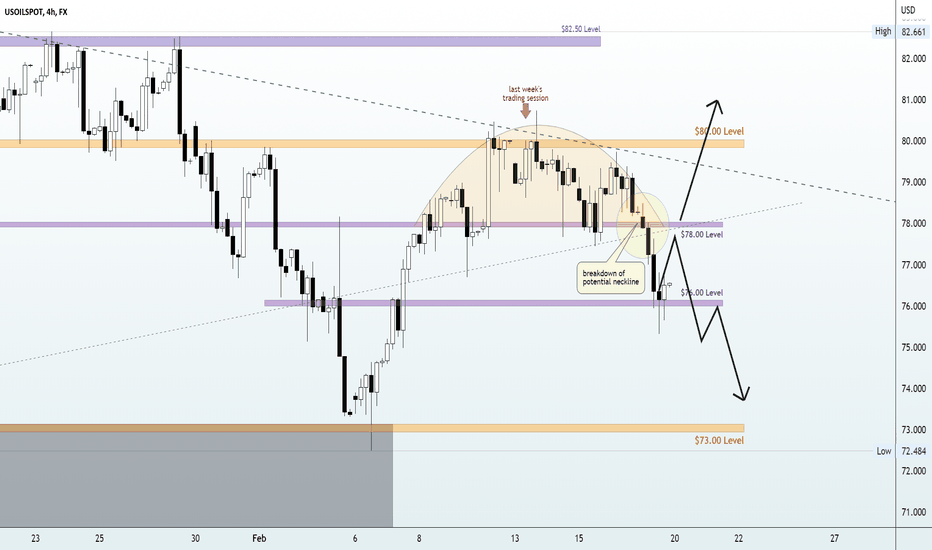

USOil | New perspective for the week | Follow-up detailFollowing the massive slide couple of weeks ago; we scooped over 800pips profit as the US oil finished last week's trading session up approximately 4%, after factoring in gains from the first four days of the week. This indicates consolidation and the possibility of a technical rebound, which has immediate resistance at both the trendline identified on the 4H timeframe and the swing high of the $71 zone. In this video, we analyzed the current market structure with the intent of identifying the potential direction of price action in the coming week(s).

00:40 Reference to last week's daily commentaries and results

04:50 USOil Technical analysis on Daily chart

10:20 USOil Technical analysis on 4H Timeframe against next week

12:38 Conclusion on next week's expectation for the USOil

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

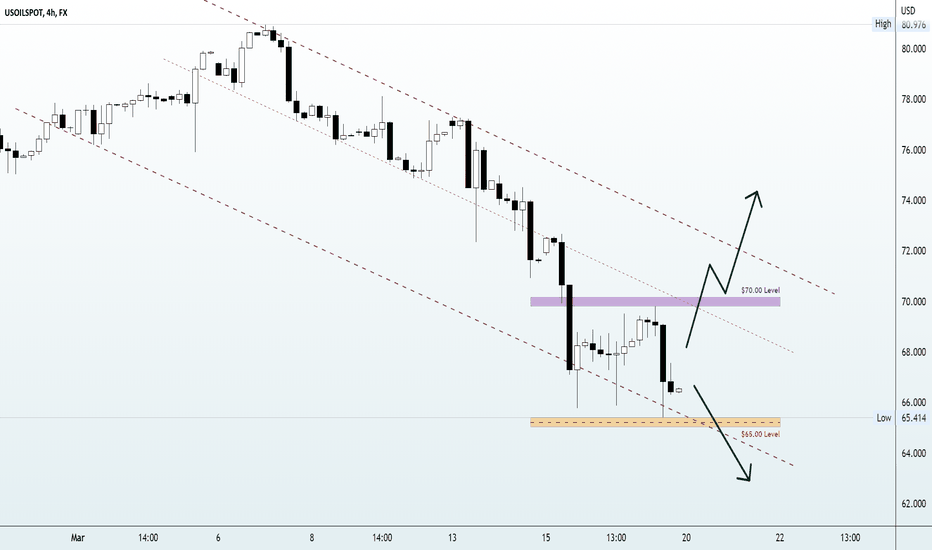

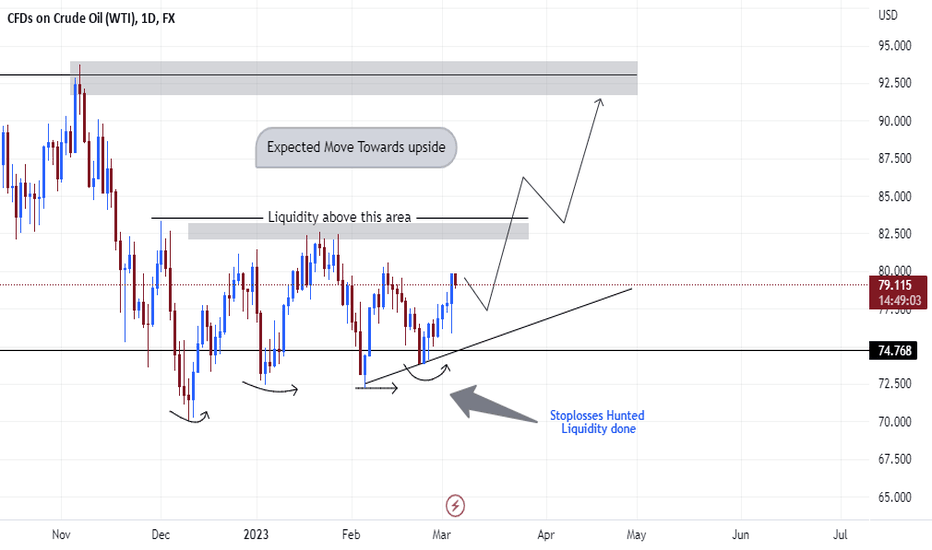

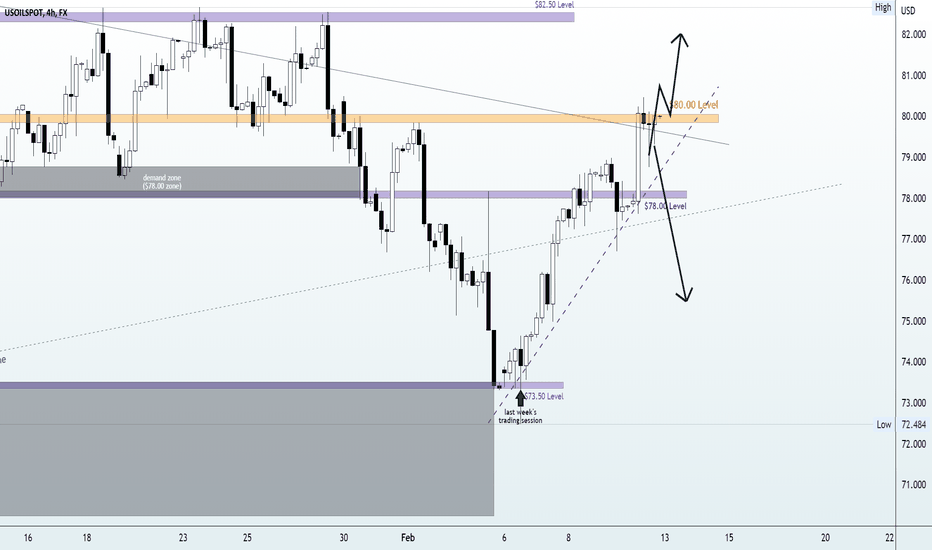

USOil | New perspective for the week | Follow-up detailFollowing approximately 2,000 pips in profit last week (see link below for reference purposes); we took a fresh new look at the chart as US Oil prices hit their lowest point since December 2021. I think the slump in oil prices this time, had little to do with supply-demand but more with the crisis of confidence at banks that provide the liquidity for trading this commodity and the potential interest rate hikes by the Federal Reserve have also led to fears that the US economy could end up in a recession. In this video, we took a technical dissection of the current market structure and identified a simple structure that we shall be using to guide trading activities in the coming week(s).

01:00 Reference to last week's daily commentaries and results

04:20 USOil Technical analysis on Daily chart

06:39 USOil Technical analysis on Weekly chart

09:00 USOil Technical analysis on 4H Timeframe against next week

10:30 Conclusion on next week's expectation for the USOil

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

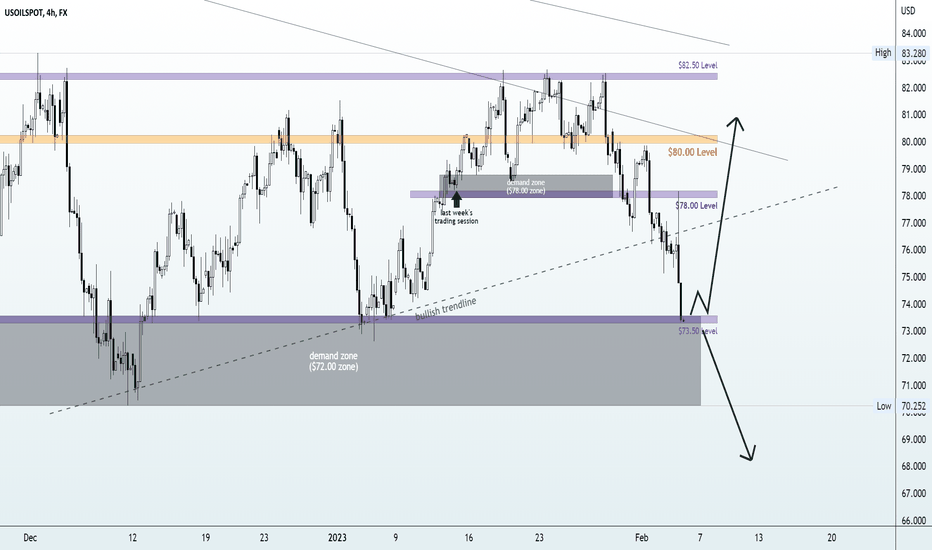

USOil | New perspective for the week | Follow-up detailWell, the past three to four months have shown that the only reason crude prices aren’t breaking out of the channel ($83/$70) is because of the inflation hangover in the U.S and the Fed’s hawkish outlook emphasizes how far and high it is ready to increase rates. This was further reiterated by Fed Chair Jerome Powell during his testimony before Congress as the central bank is more than prepared to hike rates beyond the previously indicated margin if that’s what will bring inflation down. This video illustrates in detail the technical parameters and what to look out for in the coming week.

00:50 Reference to last week's daily commentaries and results

05:50 USOil Technical analysis on Daily chart

08:30 USOil Technical analysis on 4H Timeframe against next week

08:44 Conclusion on next week's expectation for the USOil

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

howto set stoploss correctly and do a goodjob of risk managementStop loss is a necessary means to control risk, and using a good stop loss point is the only way for investors to win.

There are two types of methods for setting the stop loss point: the first type is a regular stop loss, that is, when the reasons and conditions for buying or holding disappear due to changes in market conditions, the position must be closed or stopped immediately. The second category is auxiliary stop loss. In practice, the maximum loss method, retracement stop loss, sideways stop loss, expected R multiplier stop loss, key psychological price stop loss, tangent support level stop loss, moving average stop loss, cost moving average stop loss, Bollinger band stop loss, volatility stop loss, K-line combination stop loss, chip intensive area stop loss, CDP (contrarian operation) stop loss, etc.Investors should judge based on their own risk tolerance and choose a stop loss method that suits them.

The market has been fluctuating all the time, and there are opportunities at all times, but before we make a transaction, when we look at a certain position, we also need to refer to whether the stop loss position is well set, how much profit margin can be grasped, and whether it has played a role in using small capital to fight for high returns.

The size of the stop loss: It can be set according to the resistance support in the seeking stop loss point above. The size of the stop loss we are talking about here should be set more based on the profit margin. This is the high return of small capital. When our profit margin can only be seen at 5-8 points, the stop loss can be controlled at about 3 points; The stop loss point for medium- and long-term trading can be appropriately enlarged, and when the profit point is above 30 points, the stop loss can be set to more than 8-10 points.Of course, the size of the stop loss is more of a reference factor in resistance and support.

Spread in stop loss: We all know that the cost of trading is composed of spread and commission. When we place an order, we try to find the best entry point and calculate the spread. Then the same is true when setting the stop loss. The above talked about finding the stop loss point and the size of the stop loss, then in the gold investment market, it is often a decimal point that can change the profit or loss, so we need to calculate the spread when setting the stop loss.

Several principles for setting a stop loss point:

1. Once the stop loss point is set, it is not recommended to change frequently if it is not necessary. It should be implemented decisively. Stop loss is actually a prerequisite and guarantee for profit.

2. The stop loss point should be set before each lot is traded.

3. The stop loss point can be flexibly changed, but it must not be changed day and night.

4. Before setting the stop loss point, it must be based on the current overall trend

In order to facilitate everyone to continue to follow up on my analysis and sharing, you can like and follow me; in addition, I will share the daily real-time strategy in the channel. If you can't follow up in real time, you may make operational errors.You can use the following methods to enter my channel for free to follow the latest news and follow up on market trends in real time.

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

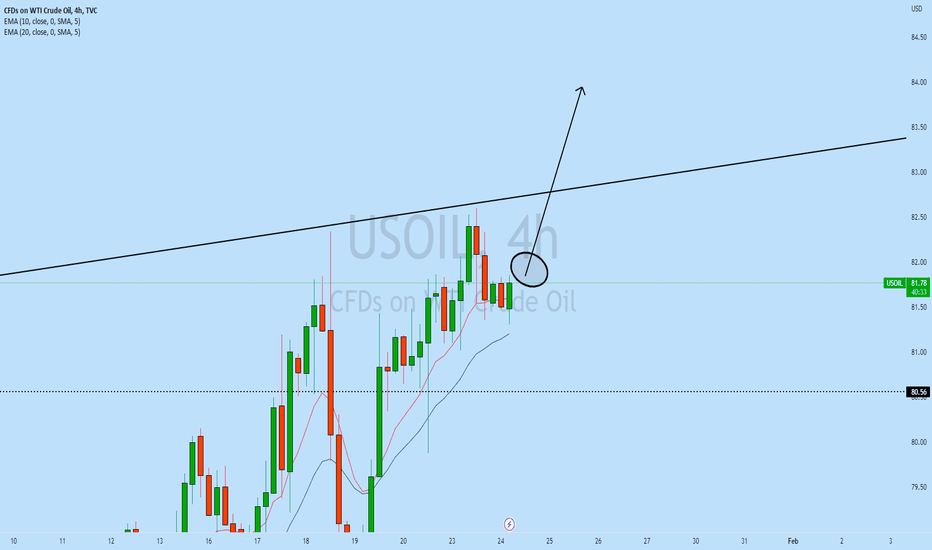

USOil | New perspective for the week | Follow-up detailFollowing the reversal of Covid-19 policy — the Chinese manufacturing sector posted its biggest improvement in more than a decade last month, service/activity is climbing and the housing market is stabilizing. Economists speculate that the reopening may see Chinese oil consumption hit a record high this year and It was indeed a positive week for the oil commodity with data showing demand figures hitting a record 101.9 million barrels per day this year. In this video, we highlighted from a technical standpoint trading opportunities for the incoming week.

00:50 Reference to last week's daily commentaries and results

04:25 USOil Technical analysis on Daily chart

07:40 USOil Technical analysis on 4H Timeframe against next week

08:44 Conclusion on next week's expectation for the USOil

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

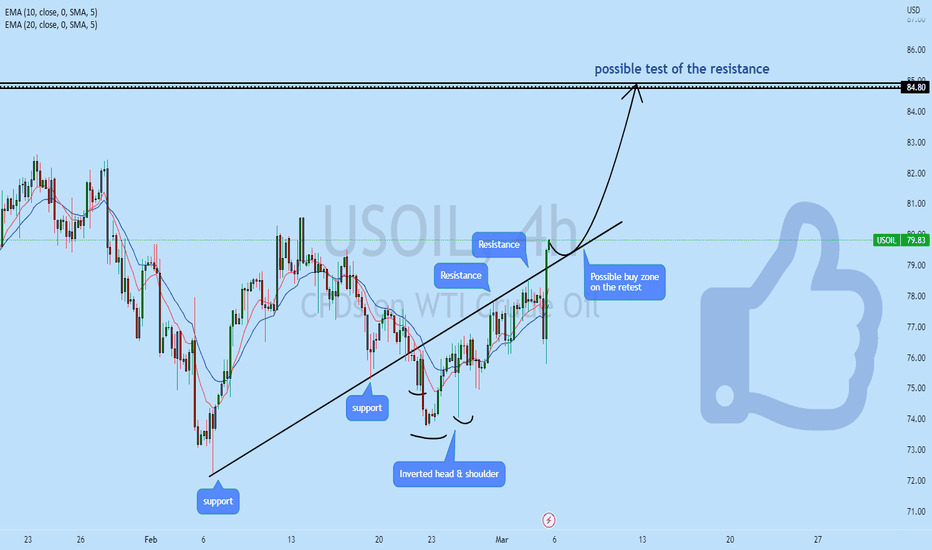

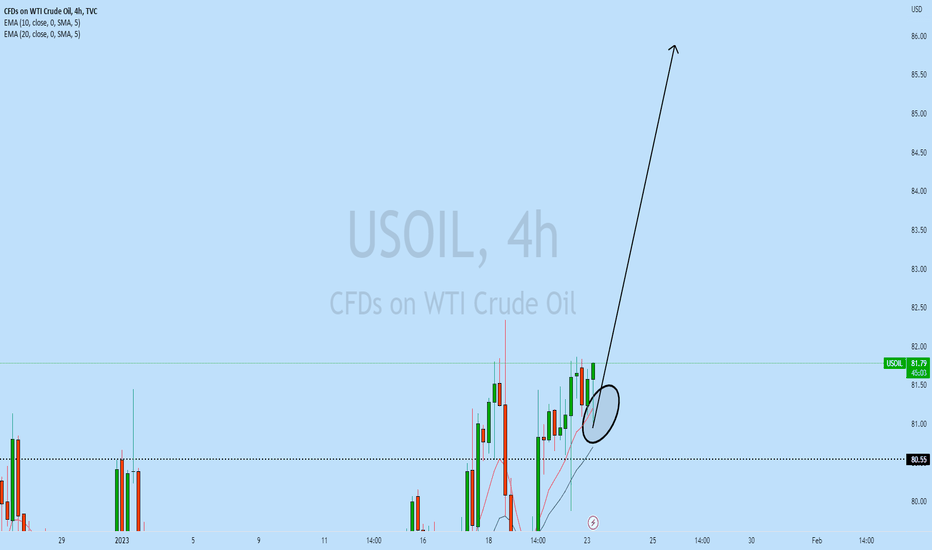

USOIL possible buy zone!Instrument : USOIL

Possible direction : Bullish

Technical Analysis : After back to back 4 months of strong rejection from the support level, USOIL bulls has taken control of the market with strong impulse on the daily, price has broken out of the weekly resistance zone and it is highly likely USOIL will continue to rise with a strong momentum and may reach to 84.80 level where is the resistance level.

Possible trade recommendation : Bullish as per sketch.

Press like button if you enjoy.

Risk Disclaimer: Trading foreign exchange on margin carries a high level of risk, and is not suitable for all investors. Past performance is not indicative of future results. The high degree of leverage is dangerous and can work against you as well as for you. Before deciding to invest in foreign exchange or any market you should carefully consider your investment goals, level of experience, and risk tolerance. It is EXTREMELY LIKELY that you will sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. No representation is being made that any account will or is likely to achieve profits or losses. Past performance is not indicative of future results. Individual results vary and no representation is made that clients will or are likely to achieve profits or incur losses comparable to those that may be shown. You acknowledge and agree that no promise or guarantee of success or profitability has been made between you, and Forex Trading Wizard. Do your own research and talk to a professional financial planner in order to be aware of all the risks associated with foreign exchange trading and investing and seek advice from an independent financial advisor before risking any capital.

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

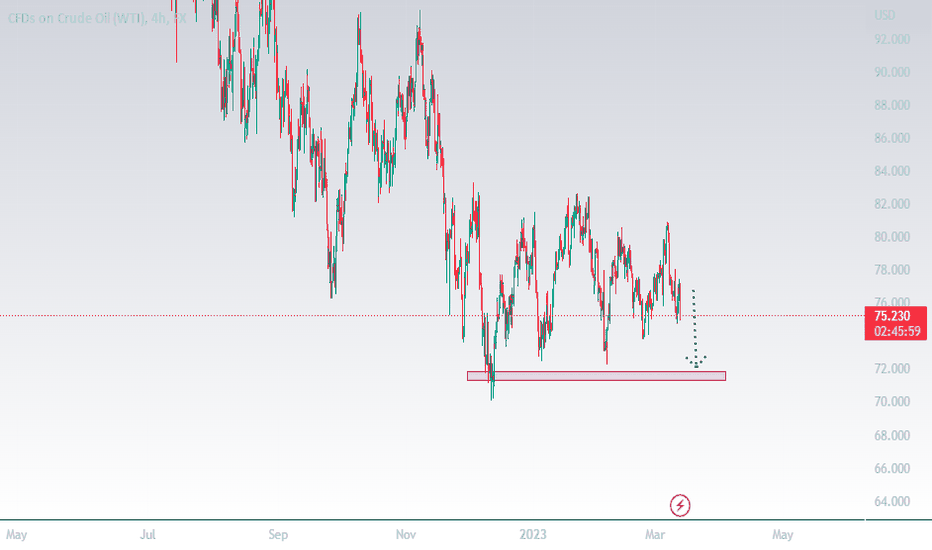

USOil | New perspective for the week | Follow-up detailThe US oil still found a way to finish in neutral territories as bulls jumped in to buy into a market that scraped three-week lows just two days earlier at the $74.00 zone. The hopes of increased demand are still a possibility in this market as the Chinese government (the world's largest importer of crude oil) has lifted all COVID restriction policies hereby opening their economy for renewed transactions. From a technical standpoint, the appearance of buying pressure above the $76.00 level this week will be seen as an endorsement of bullish expectation, and failure to sustain a break above the $76.00 level has a high chance of inciting a sell-off, prompting a drop to new lows.

00:20 Reference to last week's daily commentaries and results

03:35 USOil Technical analysis on Daily chart

06:25 USOil Technical analysis on 4H Timeframe against next week

08:35 Conclusion on next week's expectation for the USOil

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

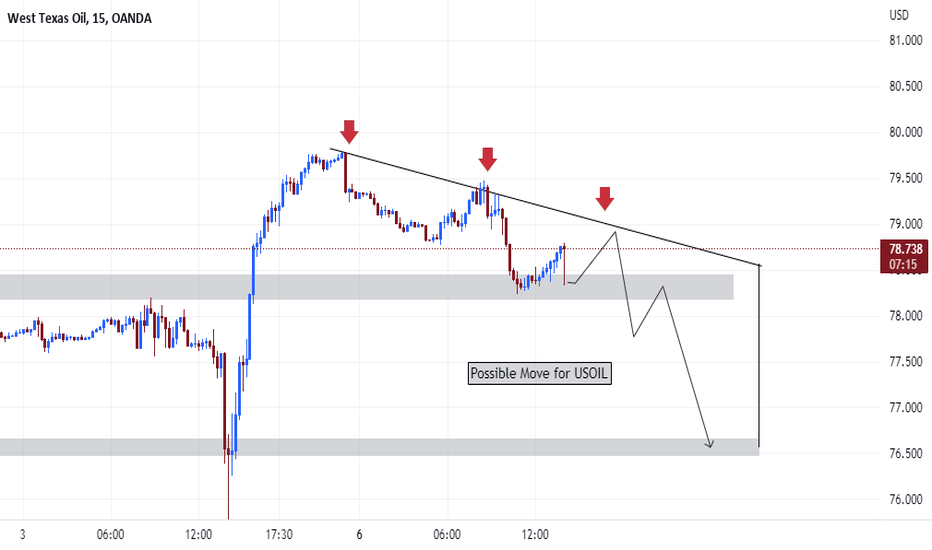

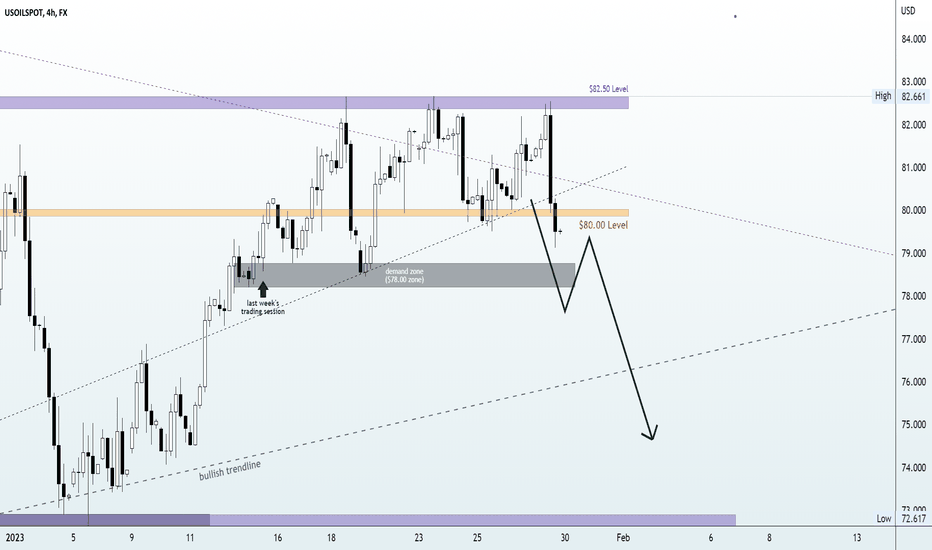

USOil | New perspective for the week | Follow-up detailDespite starting the week on a bullish note, fresh new anxieties over inflation and rate hikes rippled across the market and this development resulted in participants dumping their long positions on the US Oil. With continued selling pressure below the key level at $80.00 level, buying opportunity might likely be on hold in the coming week until there are clear signs that support positive feedback from Chinese import data following the lifting of its COVID restrictions. In this video, we looked at the market structure from a technical standpoint and indications suggest continued selling pressure as long as the price remains below the $80 level.

00:50 Reference to last week's daily commentaries and results

05:25 USOil Technical analysis on Daily chart

10:20 USOil Technical analysis on 4H Timeframe against next week

11:35 Conclusion on next week's expectation for the USOil

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

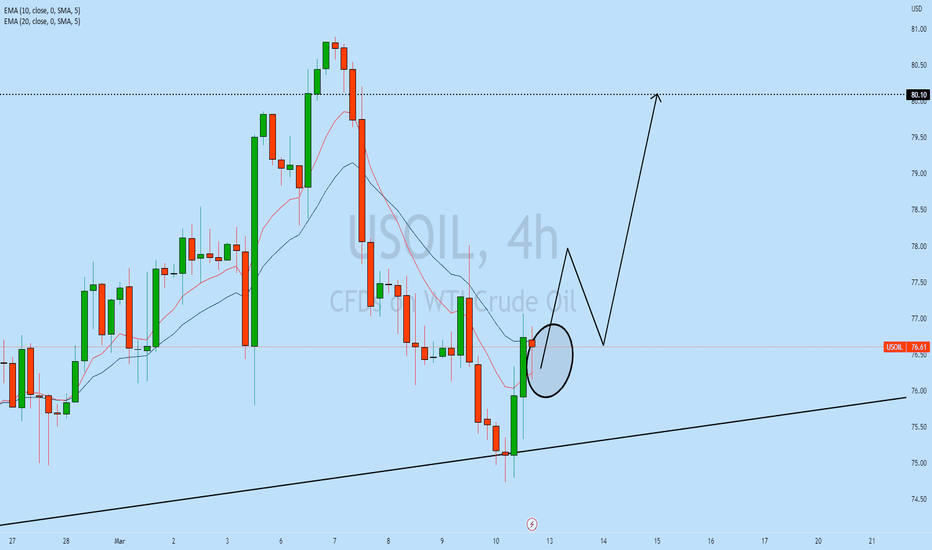

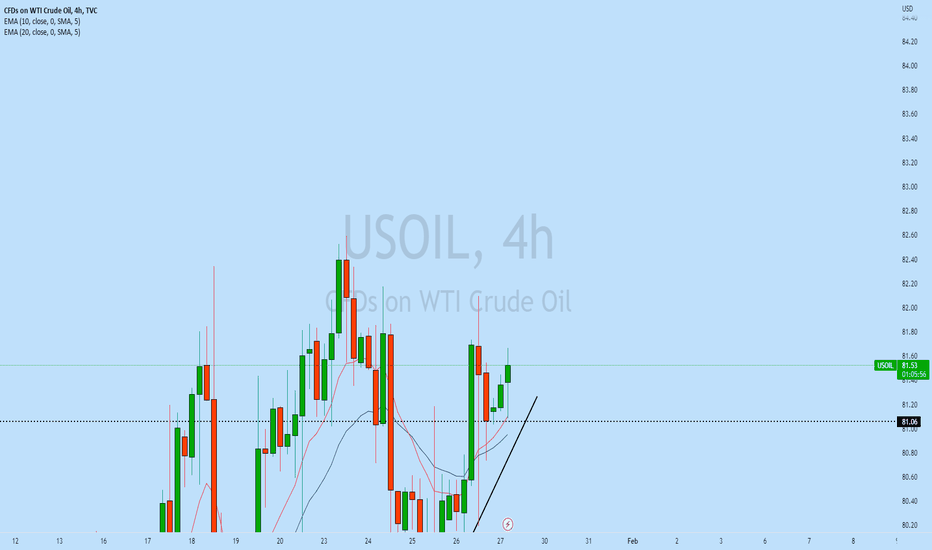

USOil | New perspective for the week | Follow-up detailLast week's trading session saw Oil prices jump as Russia respond to the G7’s price caps by announcing production cuts by 500,000 bpd (accounting for 5% of its output in March) and its own minimum price structure. We were opportune to be part of the bullish momentum (see link below for reference purposes) which later capped at the key level at the $80.00 mark at end of the week. In this video, we looked at the current market structure from a technical standpoint where the $80 zone will be our center of focus at the beginning of the new week.

00:30 Reference to last week's daily commentaries and results

02:52 USOil Technical analysis on Daily chart

07:04 USOil Technical analysis on 4H Timeframe against next week

08:00 Conclusion on next week's expectation for the USOil

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USOil | New perspective for the week | Follow-up detailOPEC+ panel endorsed the oil producer group's current output policy at a meeting on Wednesday - 2nd February 2023, leaving production cuts as agreed last year in place amid hopes of higher Chinese demand and uncertain prospects for Russian supply. Despite fundamental expectations, the US Oil prices tumbled 8.5% during the course of last week's trading session to signal a fresh dent in oil market sentiment for the month of February. This video illustrates a technical perspective on the current market structure for trading opportunities in the coming week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

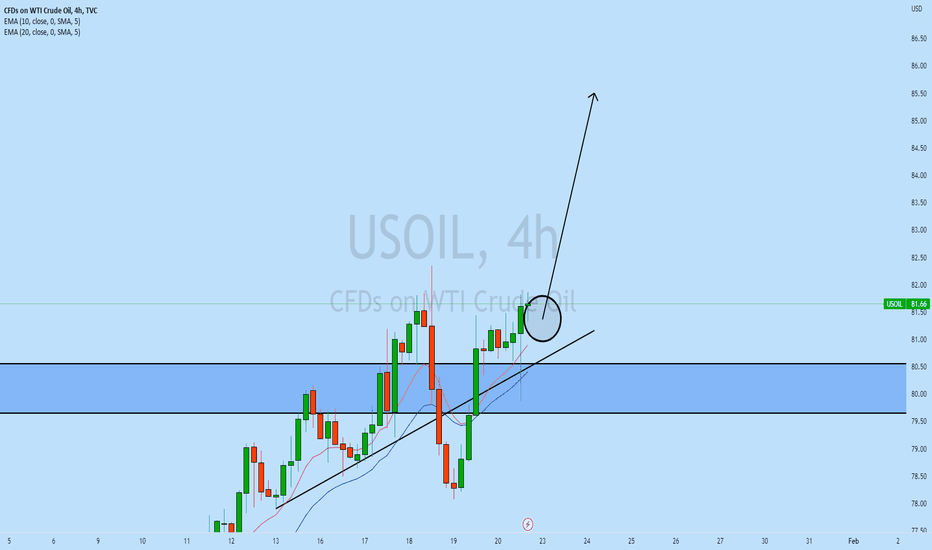

USOil | New perspective for the week | Follow-up detailAmidst reports that oil loadings from Russia's Baltic ports were set to rise by 50% this month; the price of oil continues to drop as the $82.50 level remains a strong ceiling for selling pressure - a feat which has lasted for 3 months now. Also, OPEC+ is expected to meet on Feb. 1 to decide its monthly production targets and this is one event major players in the market will be looking forward to making a well-informed decision on trading possibilities. From a technical standpoint, we have decided to utilize the $80 key level as a yardstick for trading activities in the coming week and this is detailed in this video.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USOIL top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.