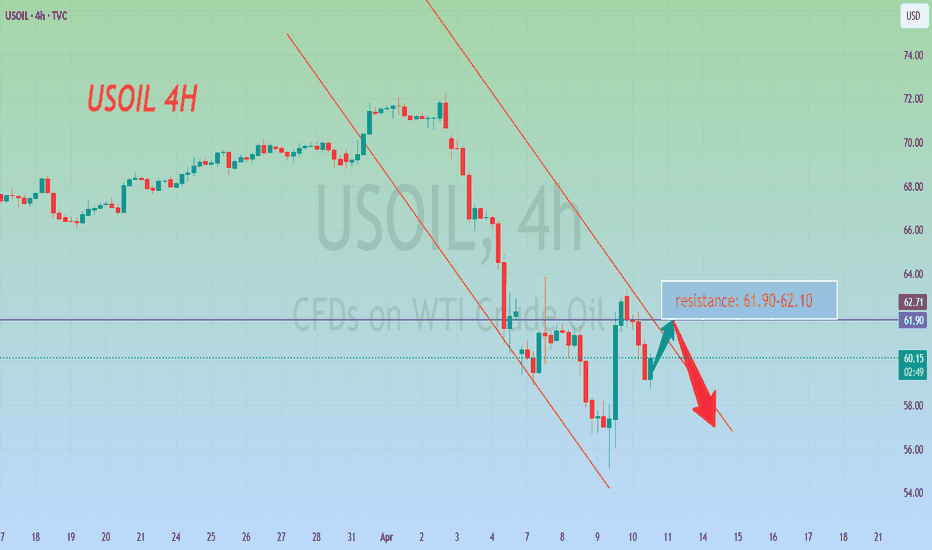

USOIL Short Trade Idea – Targeting $55.05 from $61.00Entry Point: ~61.00 USD

Stop Loss (SL): 64.77 USD

Target (TP): 55.05 USD

Risk/Reward Ratio: Favorable

Risk: ~3.77 USD

Reward: ~5.95 USD

Approximate R/R ratio: 1:1.58

🧠 Strategy Insight

Trend Context:

Prior to the entry zone, price shows a strong downtrend.

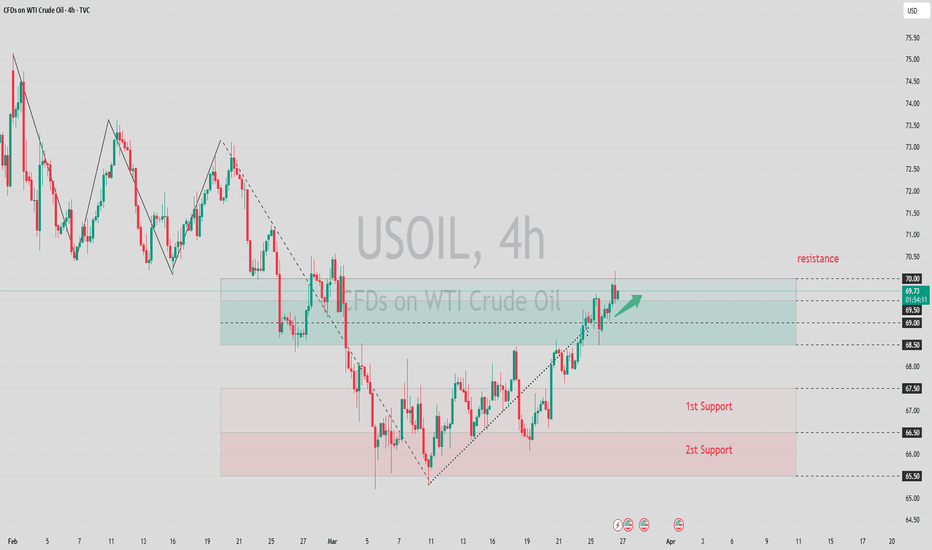

The price retraced upward into a resistance zone (highlighted in purple).

The setup suggests a short position anticipating rejection from this zone.

Indicators:

Moving Averages (red & blue):

Likely 50 EMA and 200 EMA showing bearish alignment (price mostly under both).

Resistance Zone:

The purple shaded region represents a supply zone, where price previously reversed.

Entry Zone Analysis:

Entry just below a recent rejection candle.

It's a conservative spot to catch a move back in the direction of the dominant trend.

Target Zone (55.05):

Likely based on a recent support level or demand zone from earlier price action.

Matches previous lows.

🔁 Possible Scenarios

✅ Bearish Scenario (Ideal Outcome):

Price gets rejected from the resistance zone and continues the downtrend toward the target at 55.05.

❌ Bullish Scenario (Risk):

Price breaks above 61.00 and continues toward 64.77, invalidating the short setup.

Usoilsignal

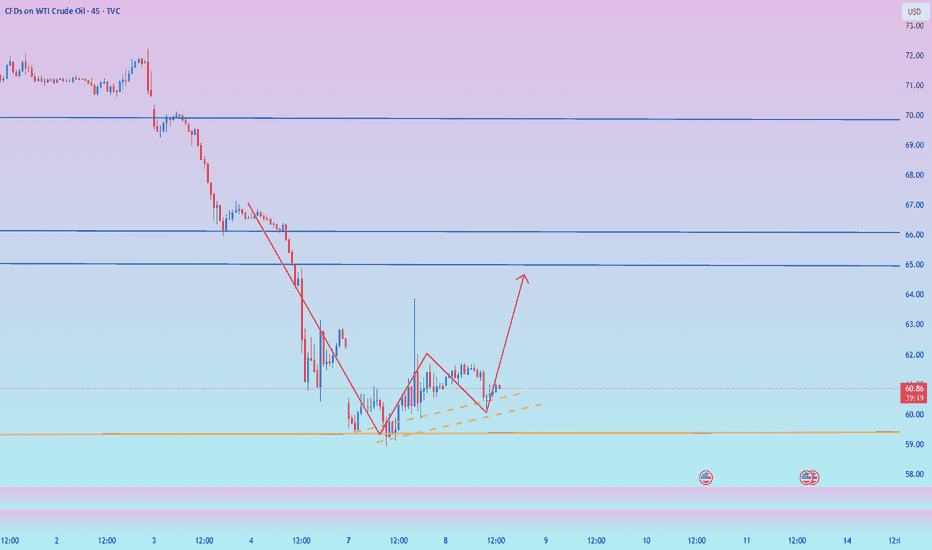

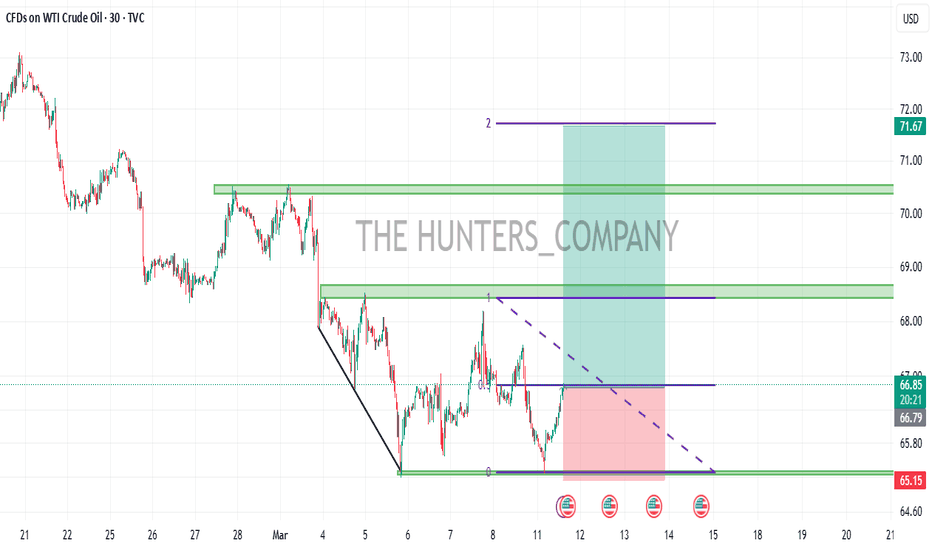

Analysis of Crude Oil StrategiesCrude oil bottomed out and rebounded sharply on Wednesday. This was also due to the impact of the tariff war, which is currently dominating the trend of the financial market. However, on Thursday, it didn't continue to rise. Instead, it fell successively and retraced. Pay attention to going long at the support level of 58.20 below, and consider going short at the resistance level of 61.90 above.

Oil trading strategy:

sell @ 61.90-62.10

sl 62.80

tp 60.95-61.10

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

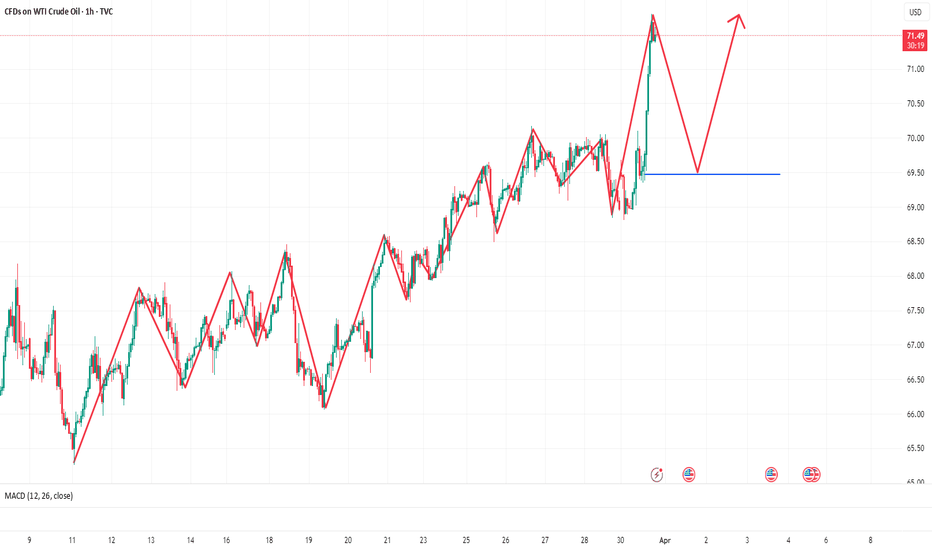

Buy oil! Target 63-65!Crude oil is currently in a short position overall, and the rebound momentum is relatively weak. However, in the short-term structure, oil has shown obvious signs of stopping the decline, and the support of the 60-59 area below is still valid.

After hitting the low point of 58.9, oil began to rebound, and the rebound low gradually shifted upward. At present, oil holds the support near 60, and is expected to build a W-bottom structure in the short-term structure, which is conducive to further rebound of oil prices.

Therefore, in terms of short-term trading, you can try to go long on crude oil in the 60.5-59.5 area, and the rebound target will first look at 63, followed by 65

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

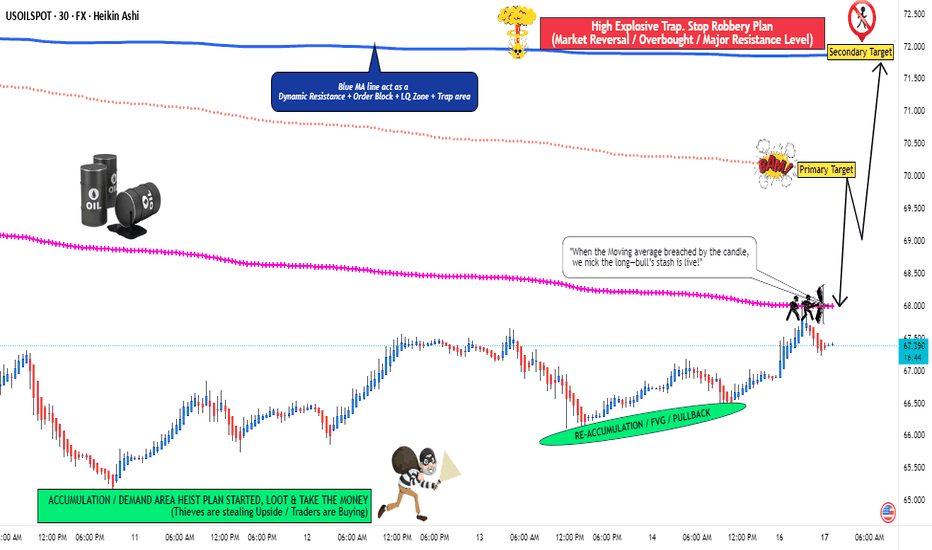

USOILSPOT "WTI CRUDE OIL" Energy Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USOILSPOT "WTI CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (68.000) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout Level (or) placing the Buy limit orders within a 15 or 30 minute timeframe, Entry from the most Recent or Swing low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 30mins timeframe (66.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 70.000 (or) Escape Before the Target

🏴☠️Secondary Target - 72.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ USOILSPOT "WTI CRUDE OIL" Energy Market Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

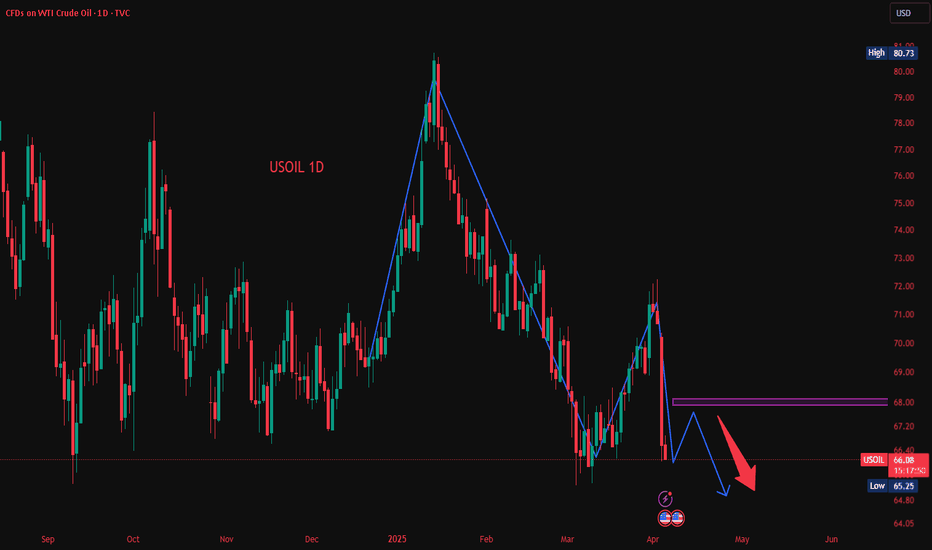

USOIL:Continue to move downwardAfter U.S. President Donald Trump announced tariffs and the OPEC+ decided to increase oil production, concerns about the demand outlook intensified, leading to a significant decline in crude oil prices on Thursday.

The short-term trend of crude oil has dropped sharply, with all the gains since mid-March being given back. The oil price has touched a low near 66. The moving average system diverges downward, and objectively, the short-term trend direction is downward. The bearish momentum is abundant. It is expected that after a minor adjustment at a low level in the intraday trading, the short-term trend of crude oil will mainly continue to move downward.

Trading Strategy:

buy@67.5-68

TP:66-65.5

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL:Give priority to go long positions on the retracementU.S. heating oil futures gave back their gains. EIA (Energy Information Administration) data showed that U.S. distillate fuel oil inventories unexpectedly increased. U.S. gasoline futures' upward momentum expanded slightly, and the EIA data indicated that the inventory was basically in line with expectations.

The commercial crude oil imports in the United States excluding the strategic petroleum reserve for the week ended March 28 reached the highest level since the week ended January 31, 2025. The EIA strategic petroleum reserve inventory in the United States for the week ended March 28 was at its highest level since the week ended October 28, 2022. The increase in EIA crude oil inventories in the United States for the week ended March 28 recorded the largest gain since the week ended January 31, 2025. The domestic crude oil production in the United States for the week ended March 28 was at its highest level since the week ended December 20, 2024. The commercial crude oil inventory in the United States excluding the strategic petroleum reserve for the week ended March 28 was at its highest level since the week ended July 12, 2024.

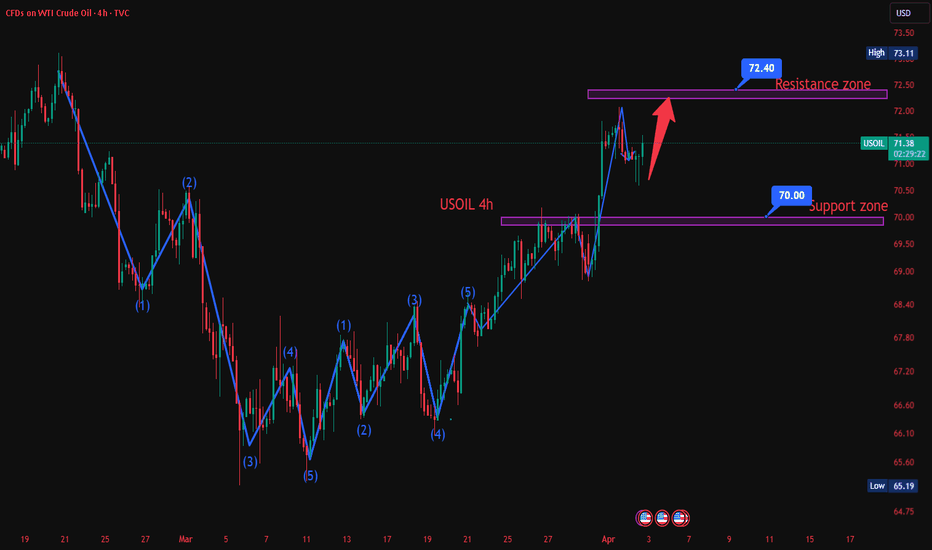

Crude oil showed a trend of bottoming out and rebounding on Wednesday. It stabilized and rose near 70.7. After breaking through the $71.2 mark, there might have been a bullish reversal in crude oil. The oil price is expected to test the resistance level above 72.0. Once it further breaks through, it is expected to open up the upside space. In terms of future trading operations, it is advisable to consider laying out long positions on the retracement first.

Trading Strategy:

buy@70-70.5

TP:71.5-72

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL-Sell in the 71.6-72 rangeUSOIL has also experienced a strong uptrend recently, driven by news events. However, as we all know, "what goes up must come down"—even in a one-sided market, technical corrections are inevitable. Right now, we are seeing a perfect opportunity for a pullback-based short trade after the sharp rally.

Trading Recommendation:

📉 Sell in the 71.6-72 range

USOIL:The bullish momentum demonstrates strong performanceRecently, the United States has stepped up its sanctions against Iran. It also made threatening remarks indicating that if the peace talks between Russia and Ukraine fail to reach an agreement, it will further intensify sanctions against Russia. Such actions have heightened the market's concerns about the future supply side.

Meanwhile, the short-term and phased decline in the United States' domestic oil production, combined with its temporary abstention from taking additional measures to suppress oil prices, has led to a certain increase in the supporting strength of the oil market recently. Yesterday, the upward trend of oil prices continued.

Take a long position at $71.05 for the oil price. Set a stop-loss of 30 basis points and a take-profit at $72.70.

Trading Strategy:

buy@70.8-71.05

TP:72.20-72.50

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

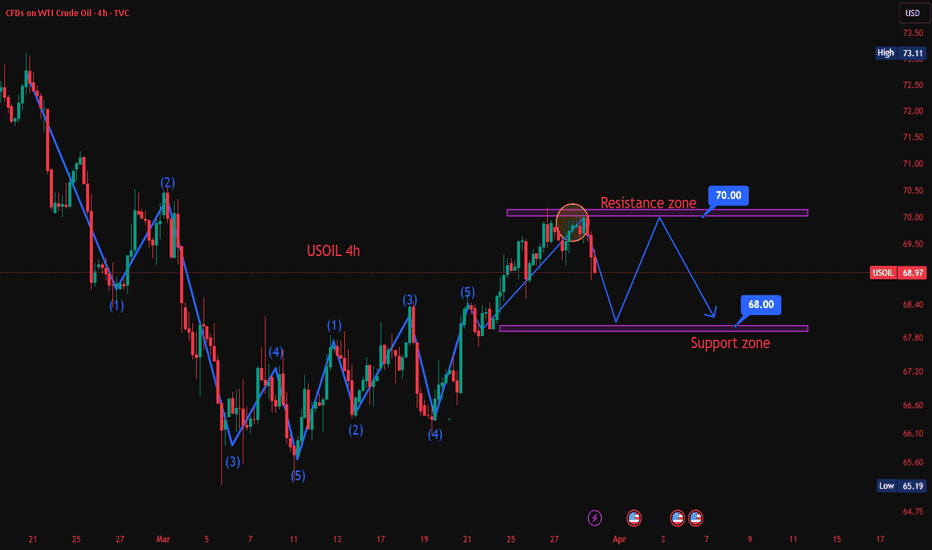

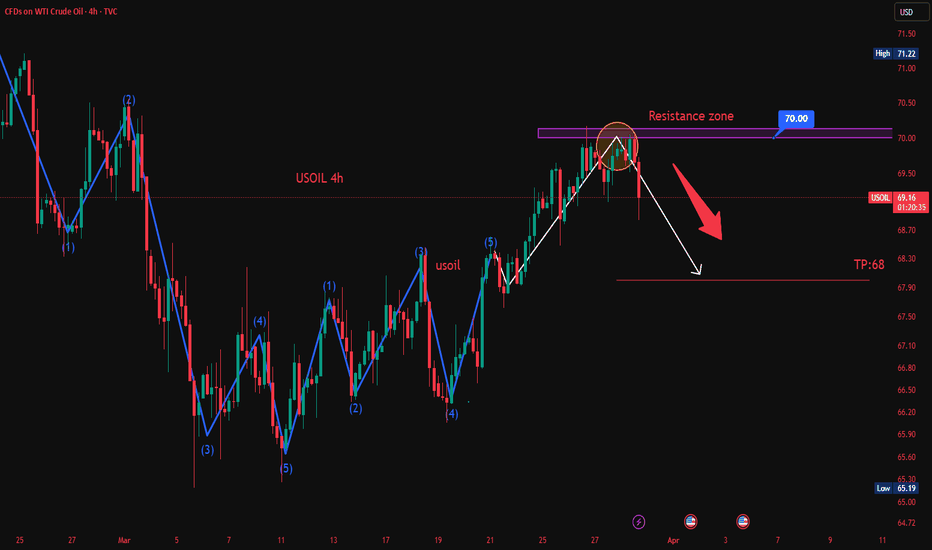

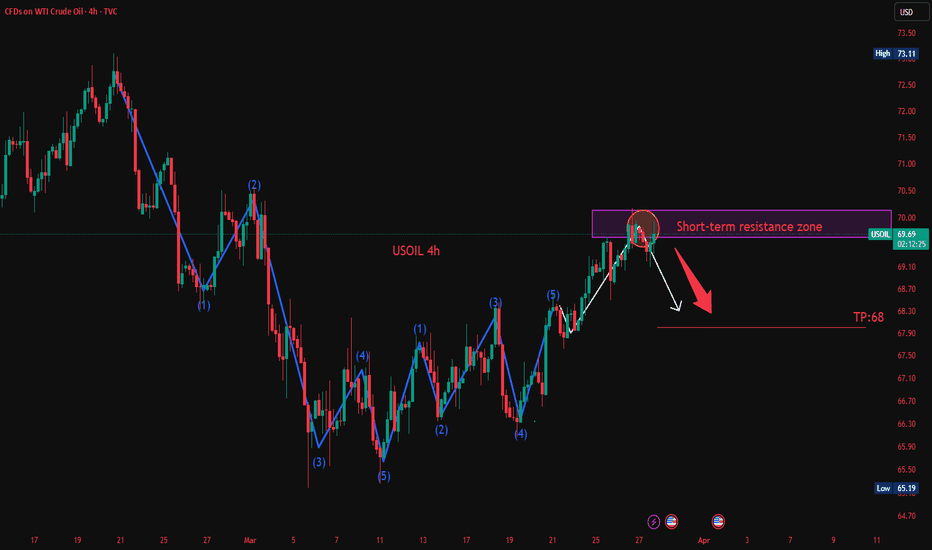

What to do if crude oil rises? The latest layout strategyCrude oil futures showed volatility during the day on Monday. Prices rose sharply in early European trading, breaking through the 70.00 integer mark and then falling back, but still fluctuating at a relatively high level. Oil prices rose slightly after countries importing Russian oil imposed tariffs of 25% to 50%. Brent crude oil futures climbed and WTI also rose. However, gains were limited as traders questioned the seriousness of the proposal. ING Group pointed out that the market was "fatigued" by Washington's tariff rhetoric, indicating that the crude oil market was unlikely to react strongly without concrete actions.

Crude oil plan: Crude oil is recommended to retreat to 70.0-69.5, with a target of 71.0-72.0 and a stop loss of 0.5 US dollars.

If oil prices break below $69.0/barrel, this will stop the expected bullish trend and push oil prices to regain the main trend of volatility.

It is expected that today's oil prices will trade between the support level of $69.0/barrel and the resistance level of $72.0/barrel.

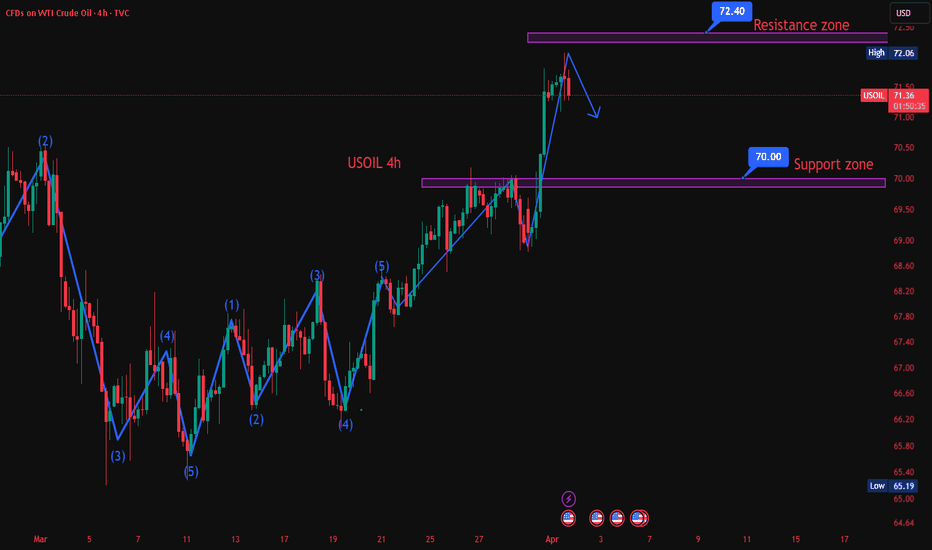

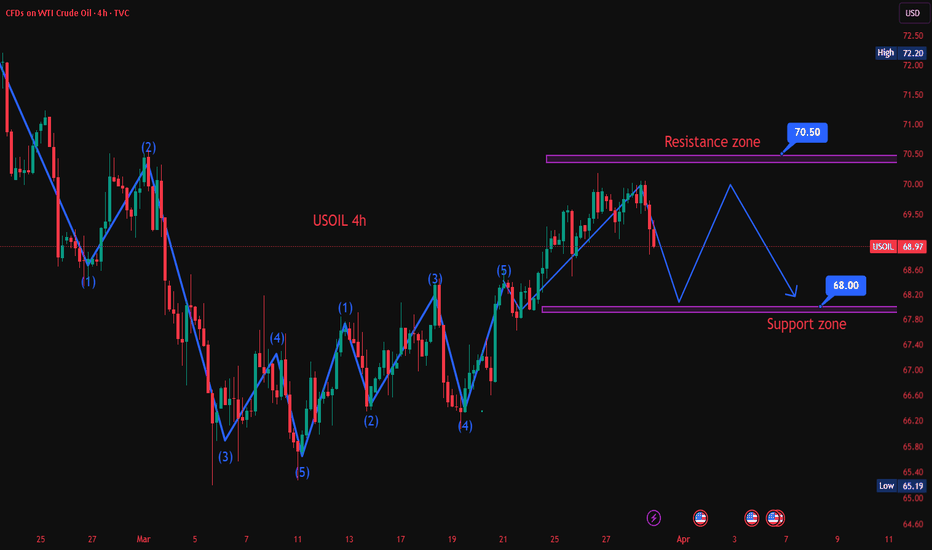

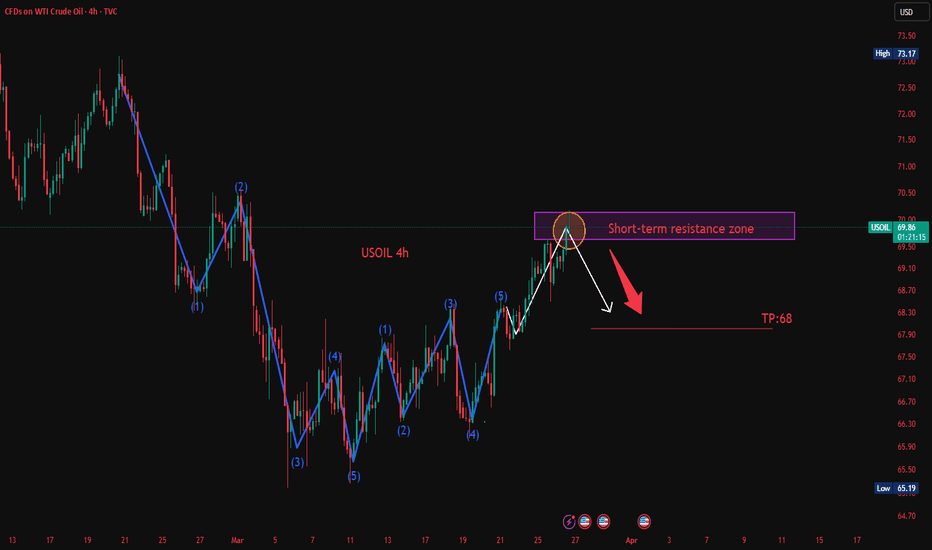

USOIL: GO short positions during the oscillation at a high levelThe short-term trend of crude oil has been oscillating and declining at a high level. The oil price has broken below the moving average system, and the objective short-term trend has entered a transition period. The bearish momentum is gradually intensifying, and the oil price dropped below 70 in the early trading session. In the 4-hour chart, the objective short-term trend direction within this week still remains upward. The trading strategy for crude oil still mainly focuses on the oscillation and decline at a high level.

Trading Strategy:

Sell@69.8-70

TP:69-68.5

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL:Continue to sell at highs tomorrowAfter breaking below the lower edge of the range, the medium-term trend of crude oil has been continuously moving in a secondary oscillation around low levels. In terms of momentum, neither the bullish nor bearish momentum has significantly overwhelmed the other, and there has been no continuation of the bullish trend.

Regarding the support level, we should first consider the 68.5 mark, which was an important resistance level that the oil price previously broke through. For tomorrow's trading operations, it is advisable to mainly consider selling at highs.

USOIL Trading Strategy:

Sell@70-70.5

TP:69-68.5

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL:Analysis of the Oil Market Trend for Next WeekAmid the anticipated trade uncertainties, concerns on the supply side have resurfaced. With the April 2nd tariff effective date approaching, the market is taking a cautious stance in the short - term. Supported by the decline in oil inventories and the prevailing concerns, oil prices have rebounded and are nearing the resistance range. In the medium - term, the market is constrained by the expected slowdown in global demand, and the focus is on waiting for the resistance test.

Strategy recommendations: Given the range - bound trading, consider short - selling at high levels and buying at low levels.

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOil:Profit realized by shorting on reboundsOn Thursday, crude oil dipped and then rallied towards the end of the trading session, reaching a low of around 69.1. Today, it rebounded to around 69.8 and then started to decline. The short-selling strategy implemented in the morning resulted in a profit.

Next, attention should be paid to whether the upper resistance level of 70 can be broken through. If it cannot be broken through in a short period of time, consider shorting again during the subsequent rebound.

USOIL Trading Strategy:

Sell@69.7-70

TP:68.5-68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

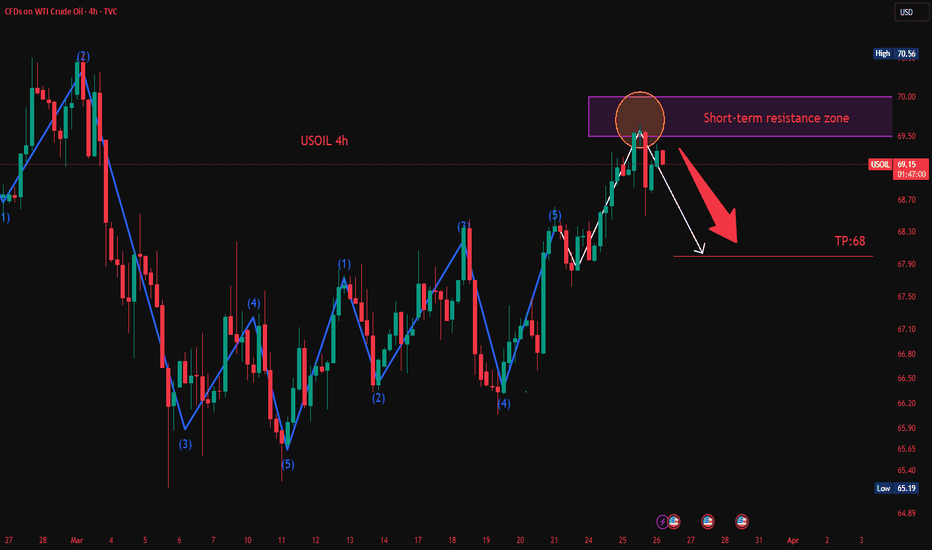

USOil:When it rebounds to the resistance, continue go shortIn terms of crude oil, in the short term, with the decline in US crude oil inventories, the escalation of US sanctions against Iran and Venezuela, and the resumption of hostilities between Russia and Ukraine, efforts at reconciliation have been ineffective. Therefore, the short-term market has hyped up the reduction in crude oil supply, causing crude oil to fluctuate repeatedly at high levels without being able to decline. However, as tariffs are upgraded and concerns about the global economic downturn intensify, the demand for crude oil has further decreased. At the same time, in order to control inflation, the control of crude oil prices remains a top priority.

Therefore, the medium- to long-term downward trend remains unchanged. Currently, from a technical perspective, when crude oil rebounds to the resistance level, it is advisable to continue taking short positions as before.

USOIL Trading Strategy:

Sell@69.7-70

TP:68.5-68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL:Pay attention to the short-term adjustmentCurrently, in the 4-hour time frame, the crude oil price is temporarily maintaining a high-level oscillatory consolidation. However, after consecutive periods of oscillation, there are signs that the technical pattern is gradually weakening. The short-term moving averages are beginning to gradually turn downward and diverge, and the K-line is starting to be under pressure from the short-term moving averages, maintaining a slightly weaker operating trend. It is believed that there may still be a certain room for adjustment in the short-term trend. In terms of trading operations, consider the short position opportunity around 69.7-70.

USOIL Trading Strategy:

Sell@69.7-70

TP:68

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOIL Strategy DiscussionThis week, we've analyzed the reasons behind the short - term strong performance of crude oil. We specifically remind you to pay attention to the price movements within the range of $68.5 - $69.5.

Once again, we advise you to observe more and trade less.

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income,You can follow the link below this article

USOIL:It's time to go shortRecently, the WTI crude oil has been on a continuous upward trend with fluctuations. The current intraday price has reached a three - week high. At present, the long - position sentiment in the market is greatly influenced by the fundamental news, mainly due to the intensified U.S. sanctions on Iranian energy and the ineffective implementation of the 30 - day cease - fire agreement between Russia and Ukraine.

Today's trading strategy: Focus on shorting at high levels. Currently, the price has a firm support at $69. Observe whether it can reach the resistance range of $69.5 again. If it breaks through the upper level, look at the important psychological resistance level of $70. Select to short again within the range.

USOIL Trading Strategy:

Sell@69.5-70

TP:68-67

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

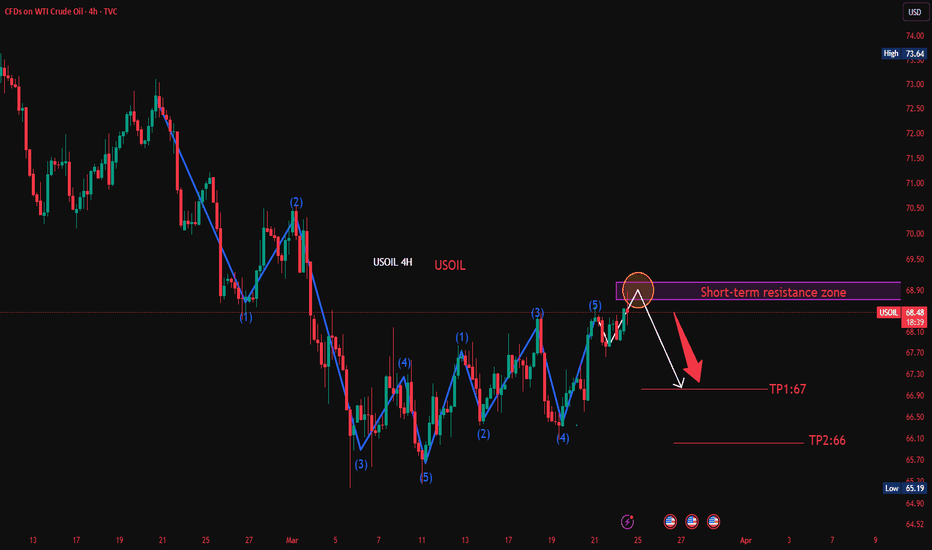

USOil:When to short at high levels?During the evening session yesterday, the price of crude oil surged again, reaching the resistance level of 69.5 per barrel in the session. However, after encountering resistance, part of the bullish momentum took profits and fled the market, causing the price to decline slightly to the support level of 69 per barrel without further drops.

After today's opening, the bullish momentum is obviously insufficient, and the price has not risen further, showing a downward extension trend.

Today's trading strategy: Focus on taking short positions at relatively high levels. Currently, the support at 69 per barrel is relatively solid. Observe whether the price can reach the resistance range of 69.5 per barrel again. If it breaks through upwards, look at the important psychological resistance level of 70 per barrel. Choose to take short positions again within the range of 69.5 - 70 per barrel, with the target price at $68 per barrel. Participate with a small position.

USOIL Trading Strategy:

Sell@68.5-69

TP:68-67

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

USOil:Wait for rebound to shortThe market movement on Friday was not significant. The intraday high was reached at the opening in the morning, hitting a peak of $68.65, while the low was at $67.65. The maximum intraday fluctuation was just $1, and the price trend showed a shallow V - shape. Considering that Trump is bound to end the Russia - Ukraine conflict over the weekend, crude oil will likely remain bearish in the short term. Therefore, today's market is generally expected to rise first and then decline under pressure again.

USOIL Trading Strategy:

Sell@68.5-69

TP:67-66

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

OIL Today's strategyCurrently, crude oil prices are fluctuating near the resistance level. Recently, the increase in US crude oil inventories has affected the supply dynamics and exerted certain pressure on oil prices. However, overall, the geopolitical tensions and supply risks have a relatively significant supporting effect on oil prices at present.

OIL Today's strategy

sell@68.5-68.8

buy:67.2-67.6

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses

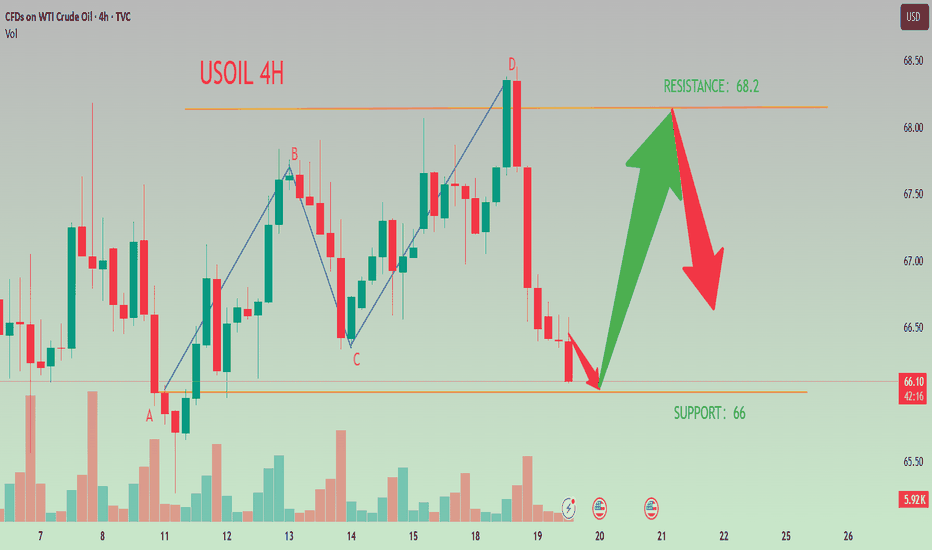

USOIL Strategy AnalysisInternational crude oil prices have been trending sideways-to-downward recently. As of March 19, WTI crude oil was priced at $66.58/barrel, marking a cumulative decline of over 7% since the beginning of the year. The current core market contradiction focuses on the dual pressures of loose supply expectations and divergent demand prospects.

Oil trading strategy:

sell @ 68.2

buy @ 66

If you are currently unsatisfied with your crude oil trading performance and need daily accurate trading signals, you can visit my profile for free strategy updates every day.

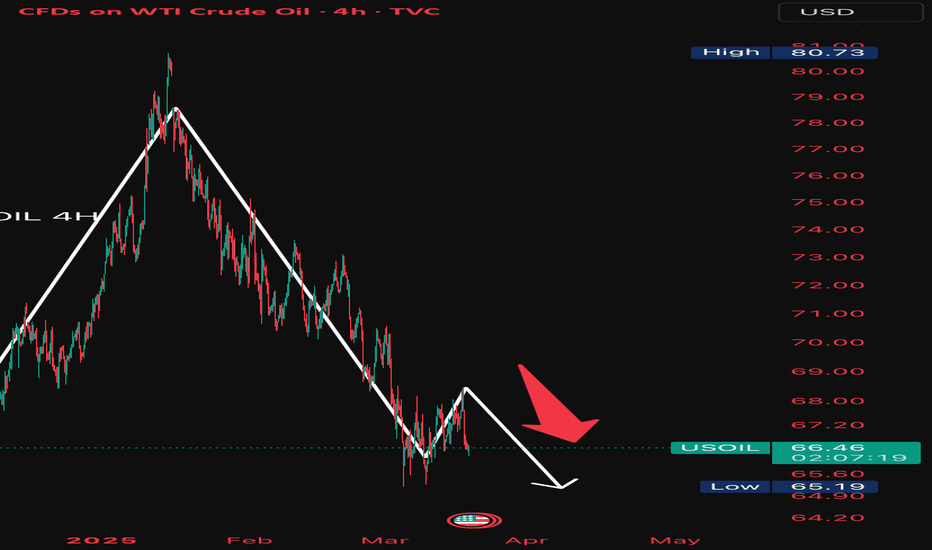

USOil: The trading strategy is to continue shortingYesterday, crude oil prices peaked and then witnessed a sharp decline, directly plunging through the upward gap that opened at the beginning of the week.

The current market situation is at the initial stage of a downtrend. It is projected that after rebounding to the range of 67.00 - 67.80, the downward movement will resume. Moreover, the strength of today's rebound indicates relatively feeble upward momentum, and market sentiment leans towards caution.

Consequently, today's trading strategy will mainly focus on shorting on rebounds. Traders should wait for the market to rebound to key resistance levels before entering the market.

USOIL Trading Strategy:

Sell@67.7-68.3

TP:66-65

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.