Usoilsignal

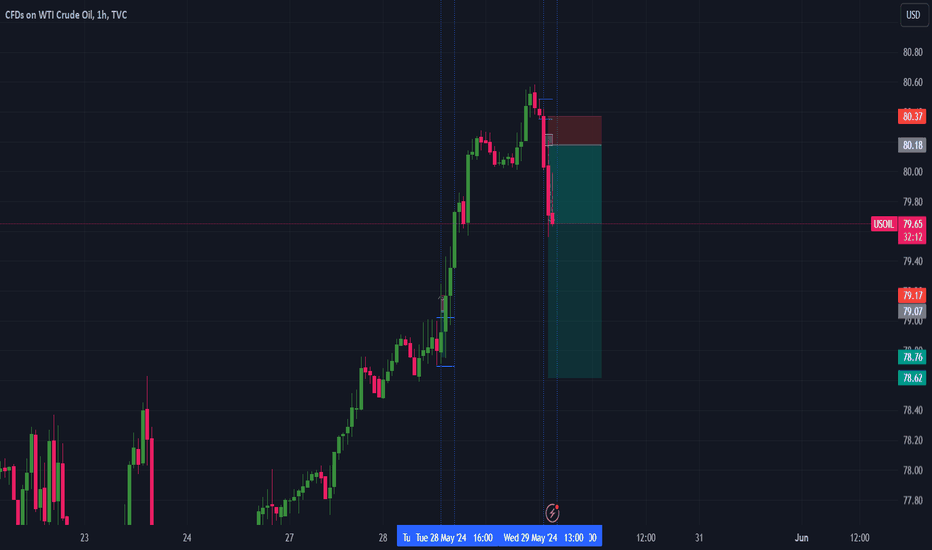

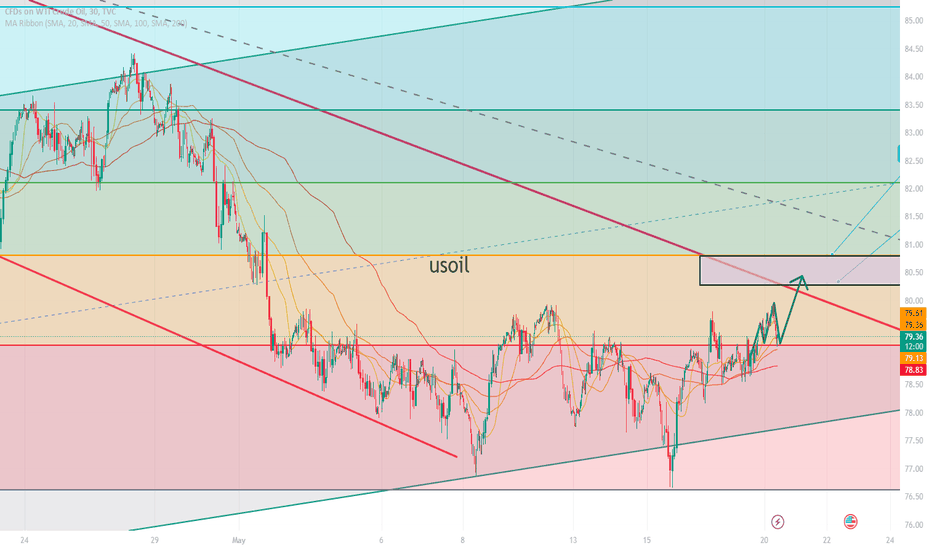

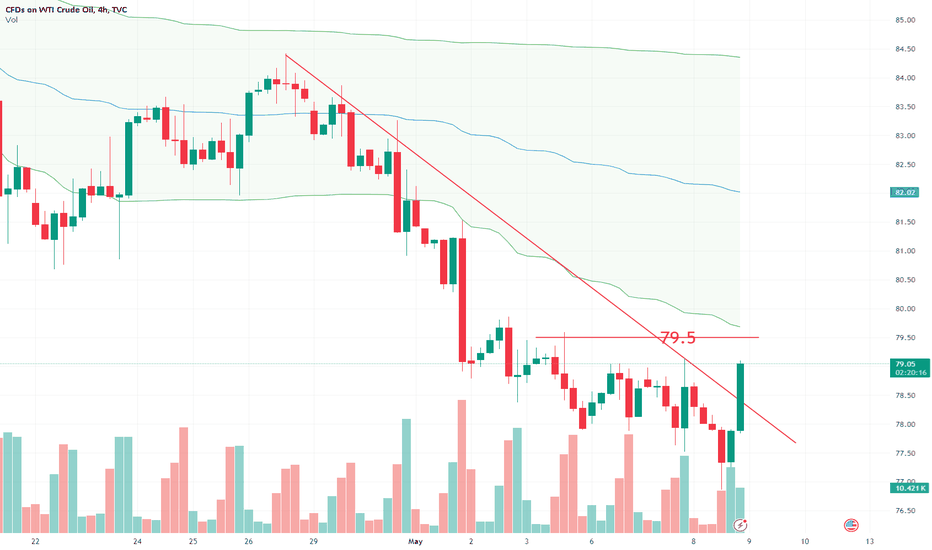

USOIL: Short-term oil prices are on the way to recovering to $80USOIL: Short-time period oil fees are at the manner to convalescing to BSE:EIGHTY because the marketplace is presently watching for the subsequent OPEC+ meeting. However, the chance of a lower is fantastically excessive due to the fact OPEC+ nations have nearly all showed the growth in production. This will probably reason oil fees to drop even lower. Consider ready to promote with USOIL around BSE:EIGHTY with the anticipated goal to go back to $75-76

USOIL: Oil prices have turned downUSOIL: Oil fees have became down. In the fast time period, there are symptoms and symptoms of breaking the preceding growing channel. Besides, the fast-time period accumulation region around $77 -seventy nine is likewise displaying a main weak point withinside the context that OPEC+ has finished its discount goal and is making plans to boom production. In the fast-time period destiny scenario, it's far in all likelihood that OIL will drop to deeper charge levels. You can watch to promote with short-time period expectancies of around $75/1 barrel.

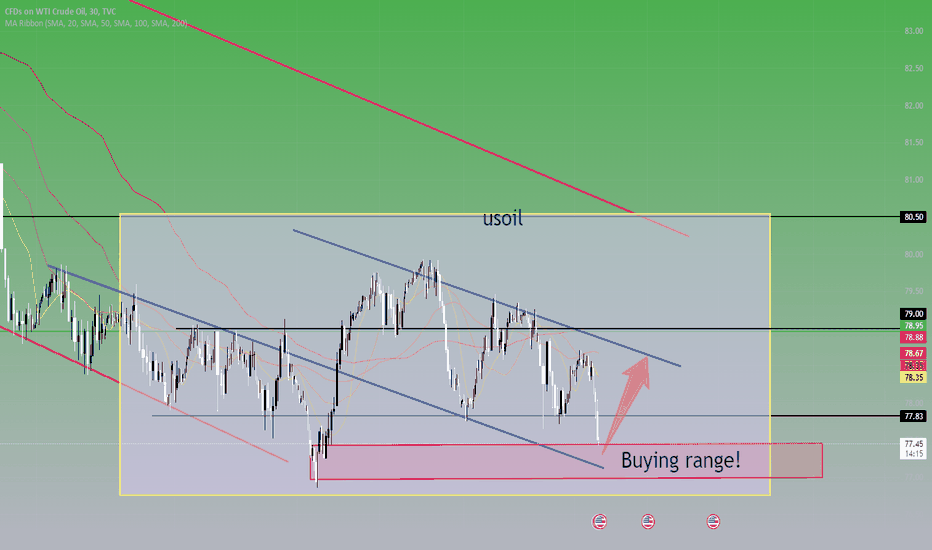

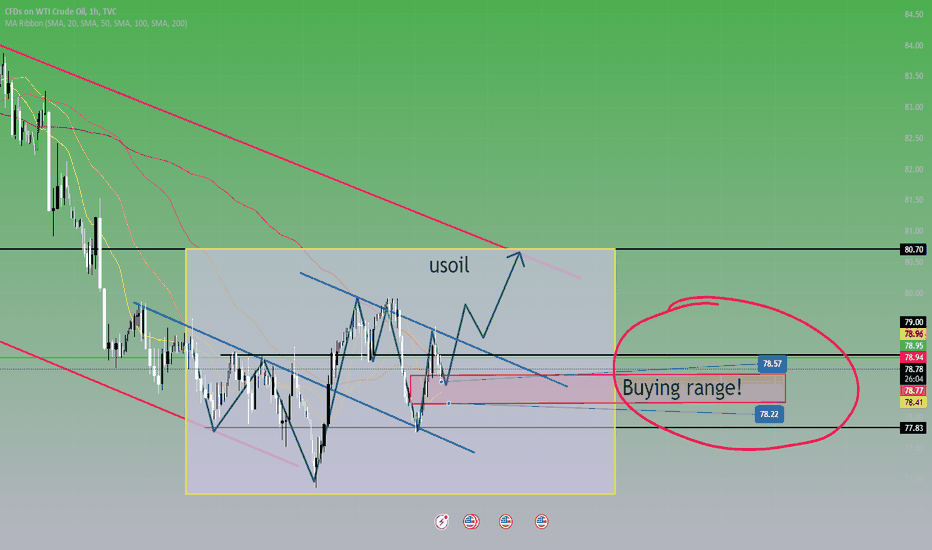

OIL can go long in these positions, today’s analysis and strategCrude oil technical analysis

Daily resistance is 79-81, support below is 76.8-75

Four-hour resistance is 79-80, and support below is 78.3-76.8

Crude oil operation advice: Crude oil still fluctuated widely yesterday, with the lowest backtest of 78.2 starting to stabilize, and the highest hitting 79.8. Then it fell sideways, and after reaching near the previous high, it failed to break through directly, and continues to fluctuate upward today.

The overall price has stabilized at the 78 mark and continues to operate in a wide range of long and short shocks. Today, we will continue to focus on the vicinity of 79-79.6. If we break through this position during the day, we will continue to be bullish first. The short-term pressure above will focus on 79.6. Once the daily line firmly holds the 79.6 mark, we can see a big rise.

BUY:78.3near SL:78.00

BUY:79.0near SL:78.70

BUY:79.6near SL:79.30

Technical analysis only provides trading direction!

A must-read for trading oil

If you are a friend who likes to trade oil, you can do a rebound at 77.5-77.8. Combined with the trend channel, oil will rebound to a certain extent after falling. For ultra-short-term trading, you can also buy to earn the difference.

In the past, you always failed when trading alone.

But everything will change after you follow me.

Because we will be the ultimate winner!

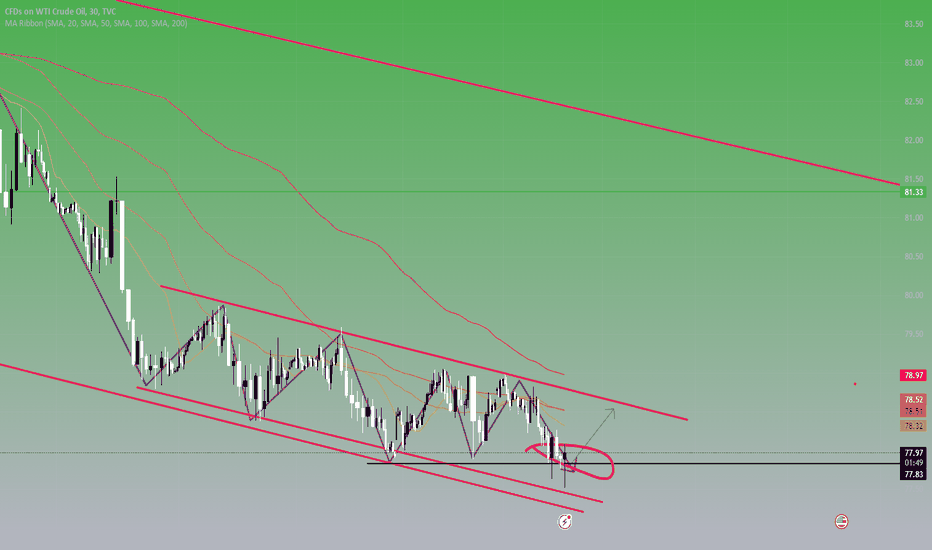

Sell oil. A must read if trading oil.

In terms of oil, after the news of substantial persistence came to light. Oil prices have been trending downward. This is true in the medium term and also in the short term. Currently, the top of 79 serves as a pressure position and is a good selling point. The small-level target below is around the price of 77.5.

Operations are still focused on selling.

In the past, you always failed when trading alone.

But everything will change after you follow me.

Because we will be the ultimate winner!

Oil price real-time trading details

Oil prices are currently back at low levels, supported by the June production cut agreement. In the short term, buying is still the main focus, taking the price of tradingview as an example. 78.2-78.5 is used as the buying range.

The target can be set at 79.6-80.5.

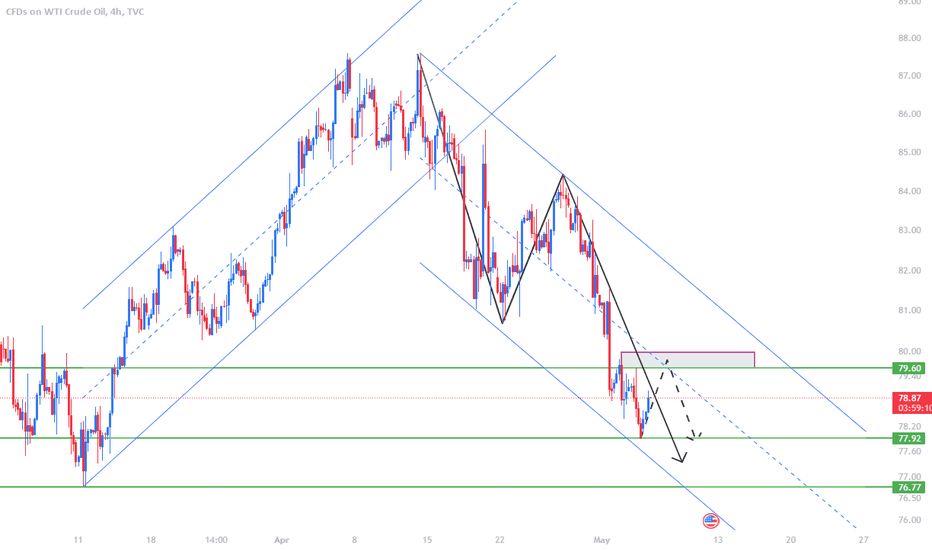

Usoil-analyze

Yesterday I thought oil would reach 79.5, and I thought that if oil closed at 79, the probability of rising today would be high, but the highest it could only reach 79.2.

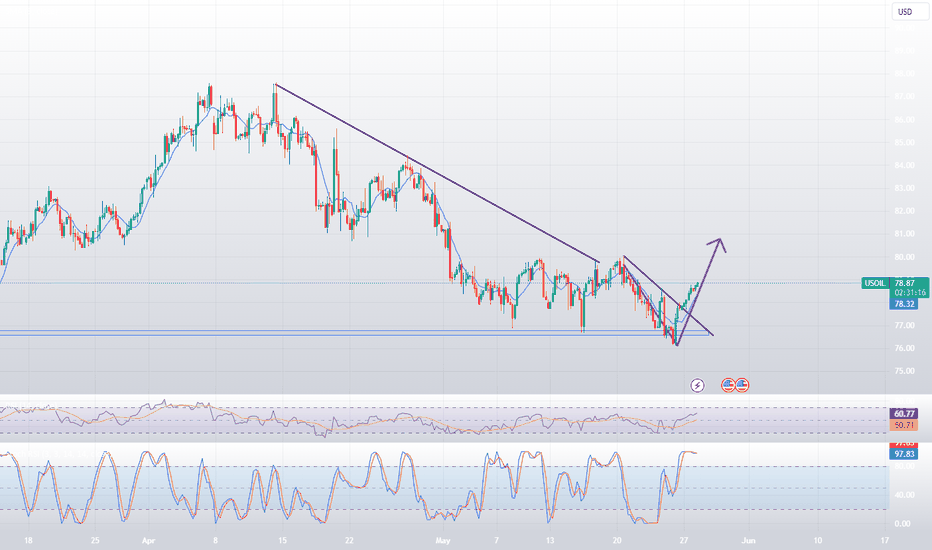

After my analysis today, I believe that oil started to fall from 87.6, reached as low as 77, and finally fell to around 76.9, a total drop of almost 11, so I judge that oil has some room for repair.

My short term goal is 79.5-80, let's see if we can get there

Today's closing price is also very important. If it can break through 79.2 and stand firm, the probability of oil continuing to rise tomorrow will increase, and it may even reach 81. If today's closing price is below 79.2, oil may continue to fluctuate between 77-80.

What if you don't know how to trade? Join me as I analyze and provide ideas every day

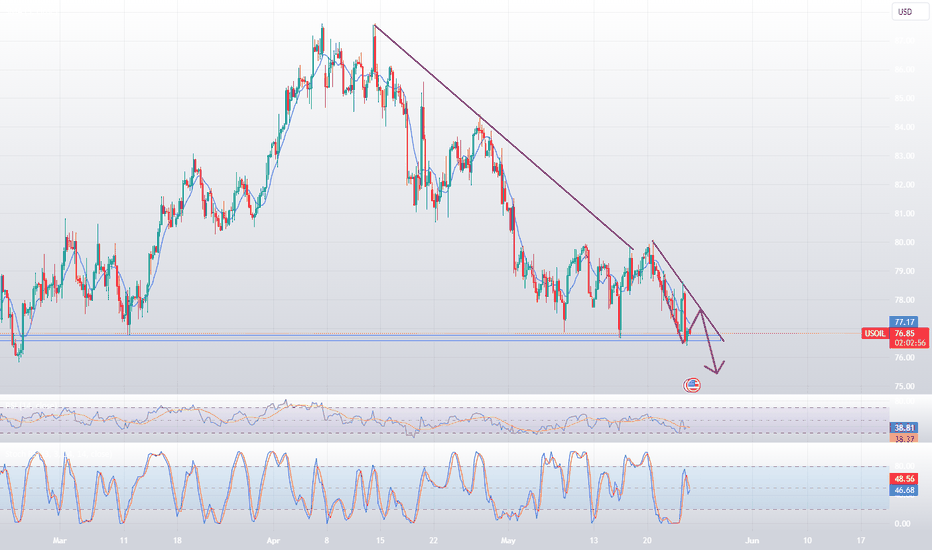

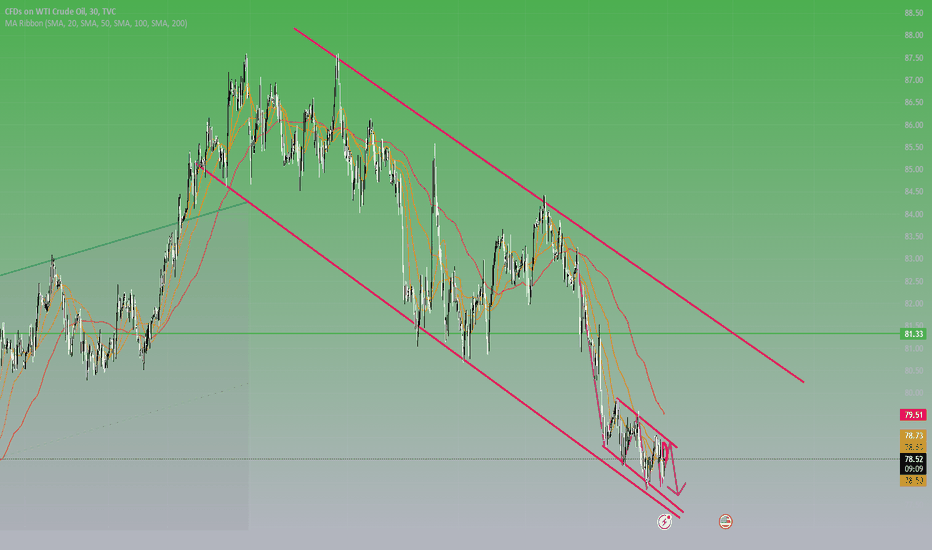

Crude oil continues to be shorted at high pricesCrude Oil Technical Analysis

Daily resistance is 79.6-83.4, support below is 76.8

Four-hour resistance is 79.6-80, support below is 78-76.8

Crude oil operation suggestions: Shorts dominate the daily chart, and the trend of suppressing shorts and oscillating downwards has been formed for 6 consecutive trading days.

The short-term resistance above today continues to focus on the vicinity of 79.6. The rebound relies on this position to continue to be bearish and the target continues to be new lows. The short-term oil price long-short dividing line focuses on the 80.5 mark. Any counterattack before the daily level does not break through and stand at this position is Short opportunities and keep trading with the trend.

SELL:79.6 near SL:80.00

SELL:83.4 near SL:83.80

SELL:79.0 near SL:79.40

Technical analysis only provides trading direction!

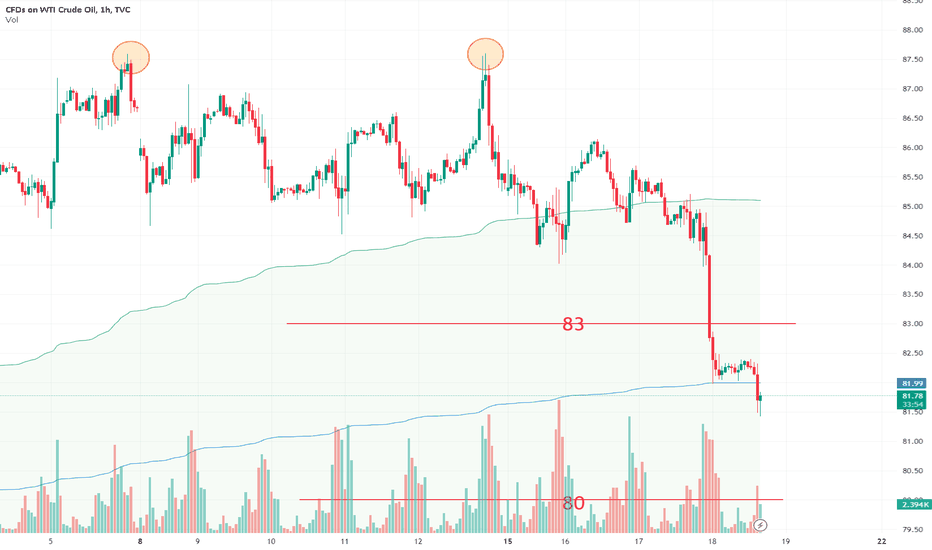

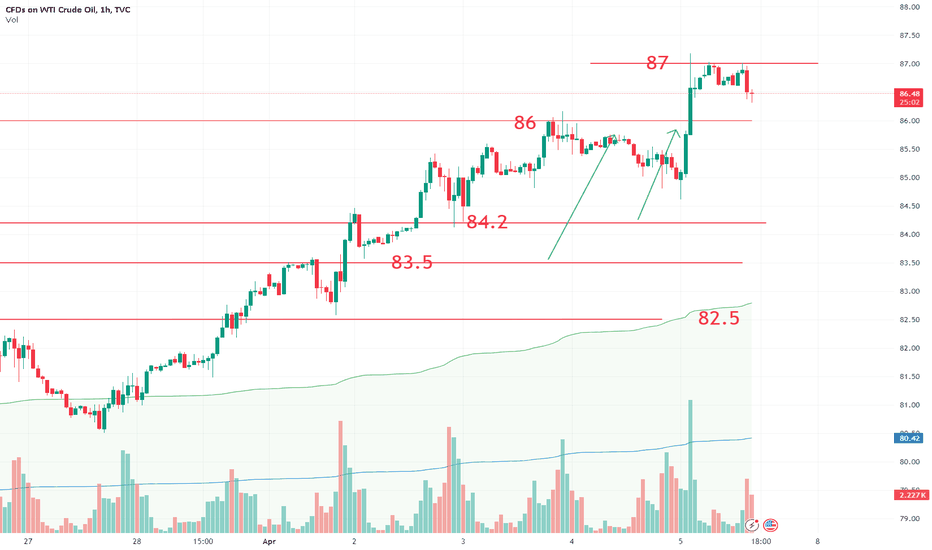

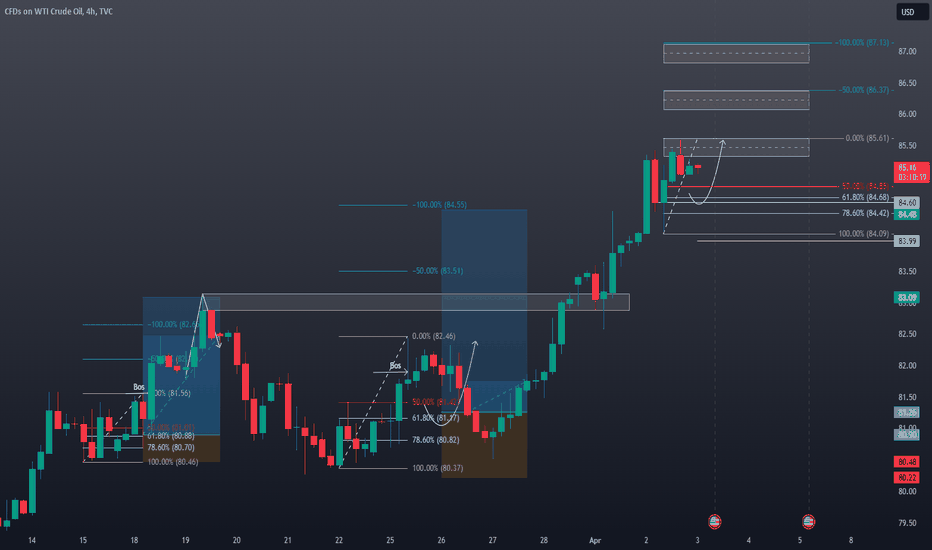

Crude oil bottoms out and continues to riseCrude Oil Technical Analysis

Daily resistance is 83.4-85.7, support below is 80-78

Four-hour resistance is 83.4, support below is 81-80

Crude oil operation advice: Crude oil fell first and then rose yesterday, ushering in a deep v bottom, rebounding and breaking through the high. The price of the Asian and European markets was under pressure and fell back to the 83 mark. In the evening, it fell rapidly downward and pierced the 80.9 mark before the US market and stabilized and rebounded. The strong consecutive positive trend led to a breakthrough and stood on the 83 line, which opened in the morning, and continued to strengthen. Finally, the closing accelerated and broke through the 83.5 line to close strongly. The overall price stabilized with secondary support at the 80.9 mark. The short-term price once again returned to the long-short wide shock range. Today, the lower support focuses on the 82.3-82 area, and the upper pressure focuses on around 85.70. We will continue to rely on this range to maintain the long-short wide range during the day. shock

BUY:83.4-83.2

SELL:82.1-81.8

SELL:81.0-80.7

Technical analysis only provides trading direction!

Usoil-fall

I have always emphasized that oil will fall, and the target is 83.5-84.5. Yesterday, oil reached the lowest level near 84. Now oil has been oscillating back and forth in the 84-87 range. We can still wait for the upper edge of the range to sell.

Control your positions reasonably and wait for the right opportunity to trade

If you don’t know how to trade, join me, contact me and increase your chances of trading success

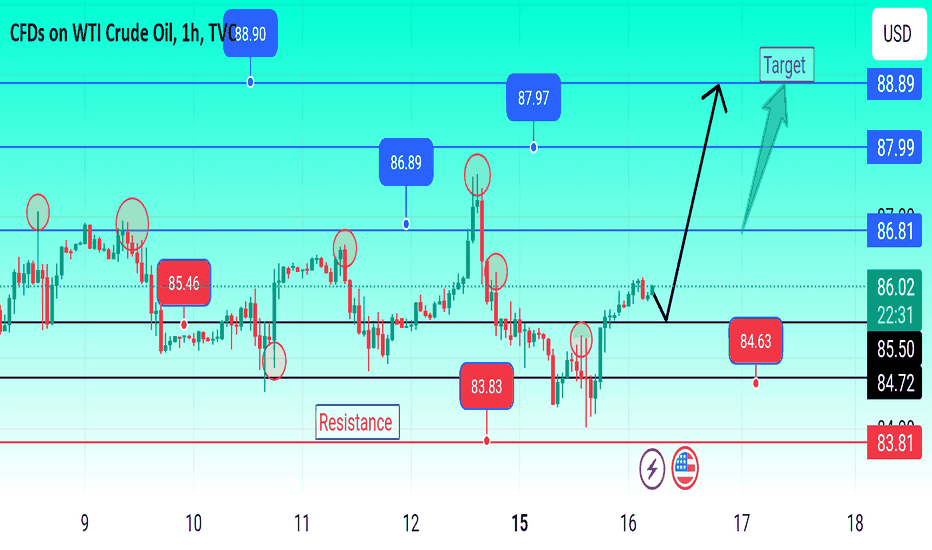

Usoil-analysis and ideas

As can be seen from the chart, two great resistance points formed near 87.6, which can mean that the short-term top of oil is slowly beginning to form. The previous idea was to call back to around 83.5, or even reach 80-82. The short-term decline was too fast, so I I think there will be a certain rebound, reaching 83-83.5, and then continuing to fall.

The current trend has verified my last idea. This is the latest idea for your reference. Join me and make money with me.

Usoil up Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market's volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

Confirm usoil signal

Usoil-Analysis and Trading Strategies

Israel has withdrawn more troops from southern Gaza and pledged new talks with Hamas on a possible ceasefire, easing concerns about the risk of further escalation in the conflict and disruption to Middle East crude supplies.

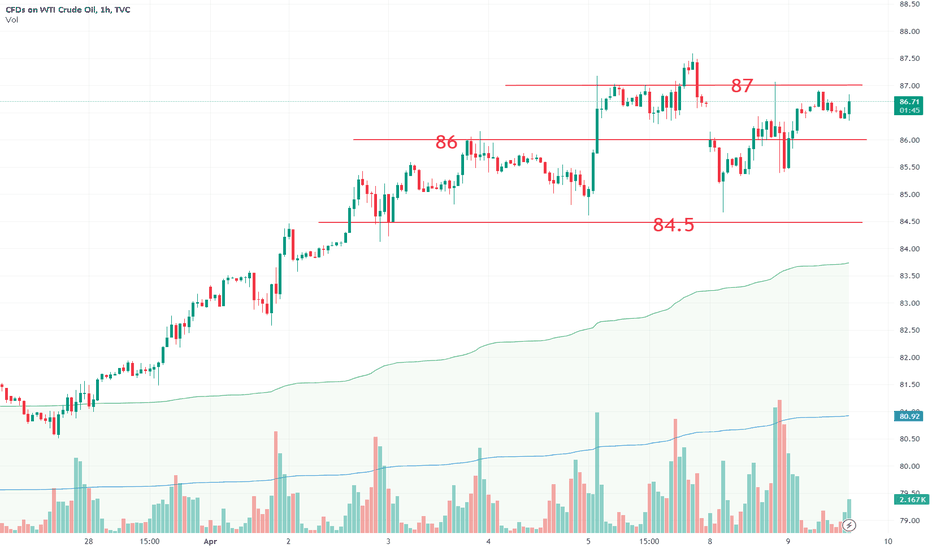

The current oil 4H and 1H charts show that the possibility of oil falling is very high, and it has been in the 87-87.5 range without breaking through. Today, the support of oil is still around 84.5. Only if it falls below this support point, will there be any A wider range of decline

If it falls below 84.5 today, you can choose to buy in batches in the 83.6-83.3 range, SL: 82.8

If it continues to rise today and breaks through 87.5, you can sell in batches at 87.8-88.2, SL: 88.8

The above trading strategies are for your reference. The market changes rapidly. I will send the specific trading strategies to my VIP customers. I hope everyone will make a profit today.

The above strategies are for your reference. Join me and I will analyze how to trade every day.

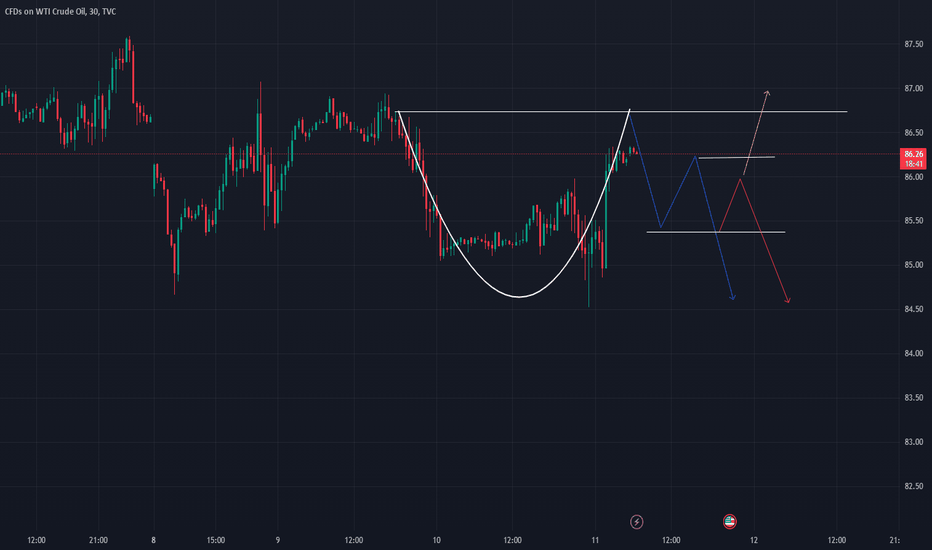

USOIL: SELL @ 86.3-86.8

Yesterday, EIA was good for shorts. The market rebounded quickly after falling. It is now near the resistance level (86.3-86.8). The indicators show that shorts have the advantage, so the transaction can be sold in the resistance range first. The support is 85.6-85.2, which can be used as the TP level.

If it falls below the support, look at the 84.4-83.3 range below.

Pay attention to the rebound after falling below the support, and focus on the vicinity of 85.8.

If there is no breakthrough, you can sell a second time.

Then continue to pay attention to the support range. If the support is valid, close the short position and go long.

If the support falls below, 84.8-84.4 can be used as the TP target.

USOIL: Take profit on buy orders

In the plan given yesterday, we bought 2lots near 85.6, made a profit of 50 points and continued to hold it to TP position, making a total profit of 160 points. Congratulations to the friends who followed!

Trading is how to protect profits and reduce losses of the game, need to follow the friends can join my channel!

Usoil-Callback requirements

Oil is as I predicted, with a strong upward momentum. If you buy at the support point, you will also make good profits.

Oil reached a maximum of around 87.2. I previously thought that there would be a need for adjustment when oil reached 87, so I am cautious about buying now.

Join me, I will analyze in detail how to trade and improve your success rate

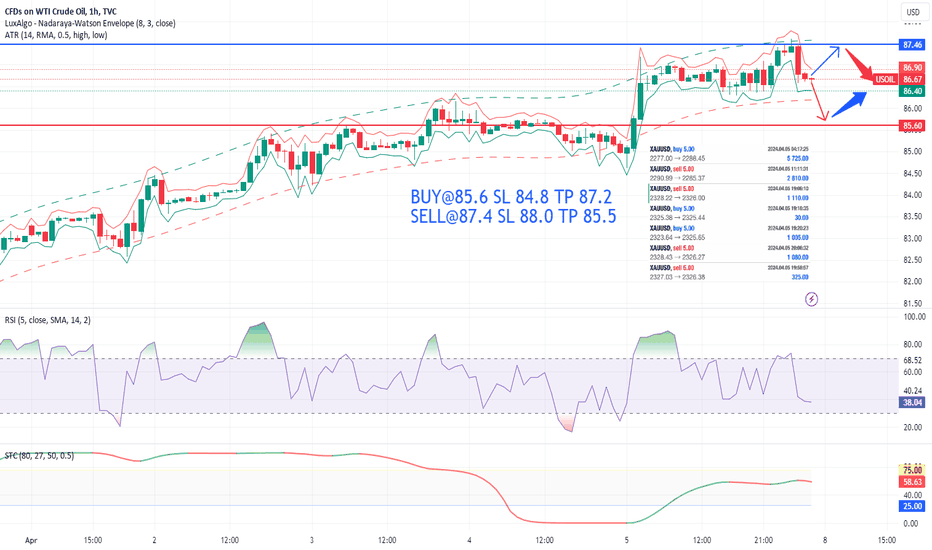

USOIL: Crude oil operation strategy

Crude oil is likely to continue to rise next week, but there are still short opportunities, the operation plan has been given in the chart, this week to participate in crude oil orders are very few, the main reason is to focus all on gold, there is a good opportunity to enter the channel next week will prompt everyone!

USOil WTI Technical Analysis and Trade IdeaUSOil WTI Technical Analysis and Trade Idea

In the video, we analyse a potential trading opportunity for USOil. We delve into the prevailing trend, examine price movements, evaluate market structure, and pinpoint a potential entry point based on favourable conditions (if they arise), as outlined in the video. It is crucial to incorporate sound risk management principles into your trading strategy. As always, please be aware that this information is strictly for educational purposes and should not be construed as financial advice.