Usoil weekly Target Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market's volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

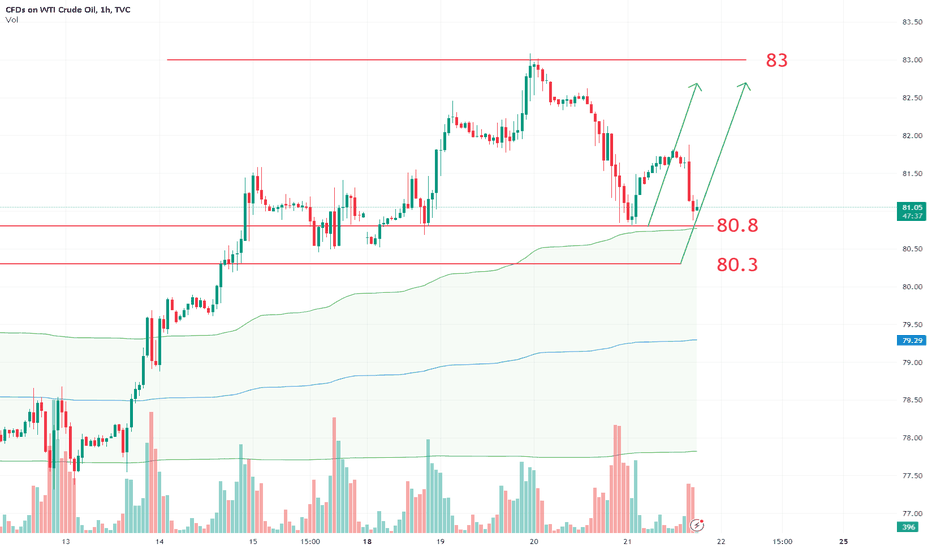

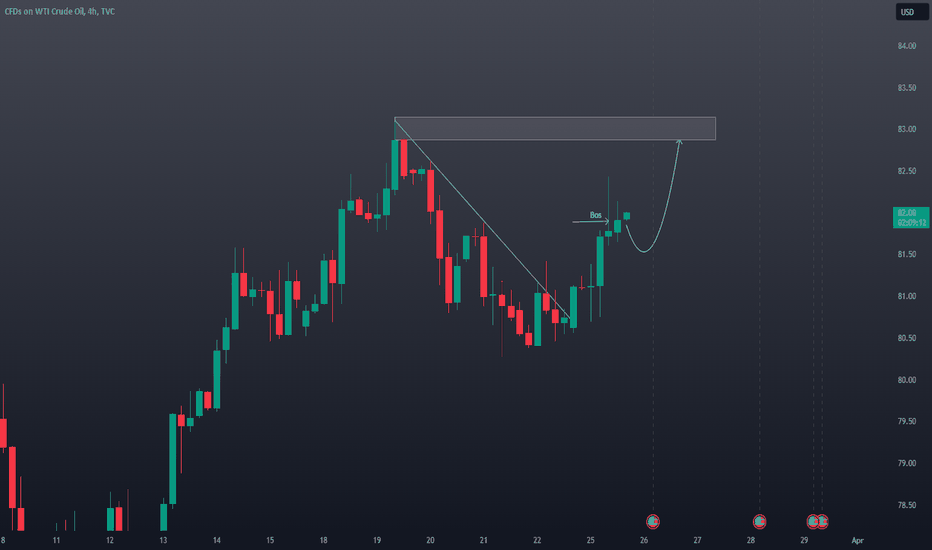

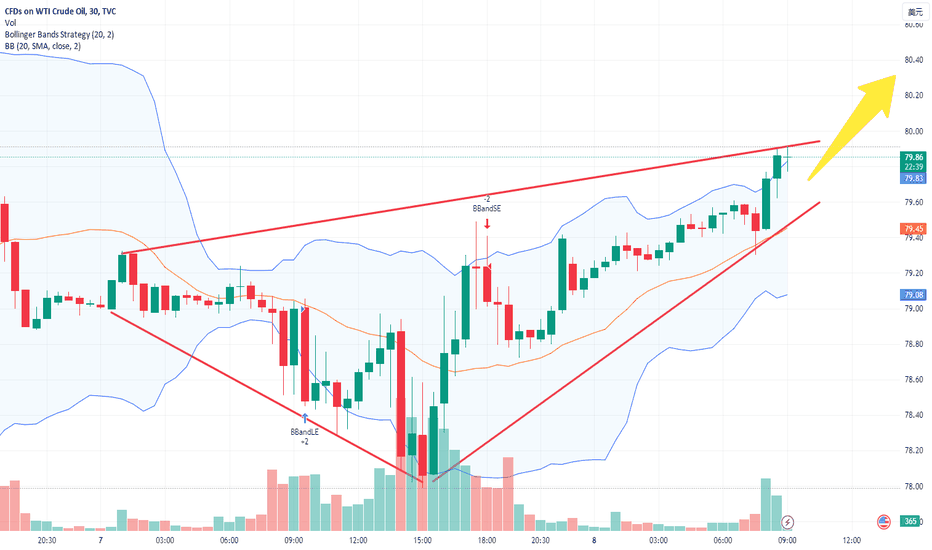

Usoil up 83

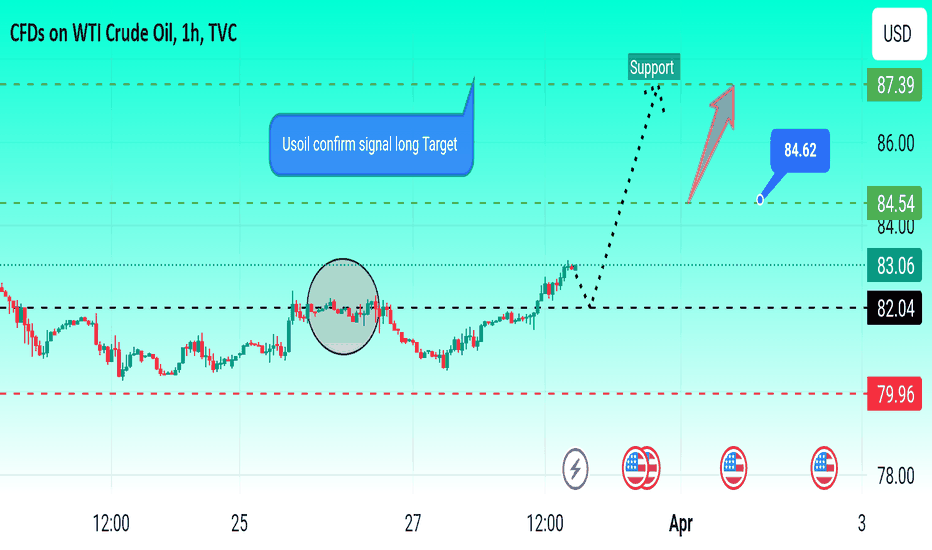

Target 87

Resistance 80

Usoilsignal

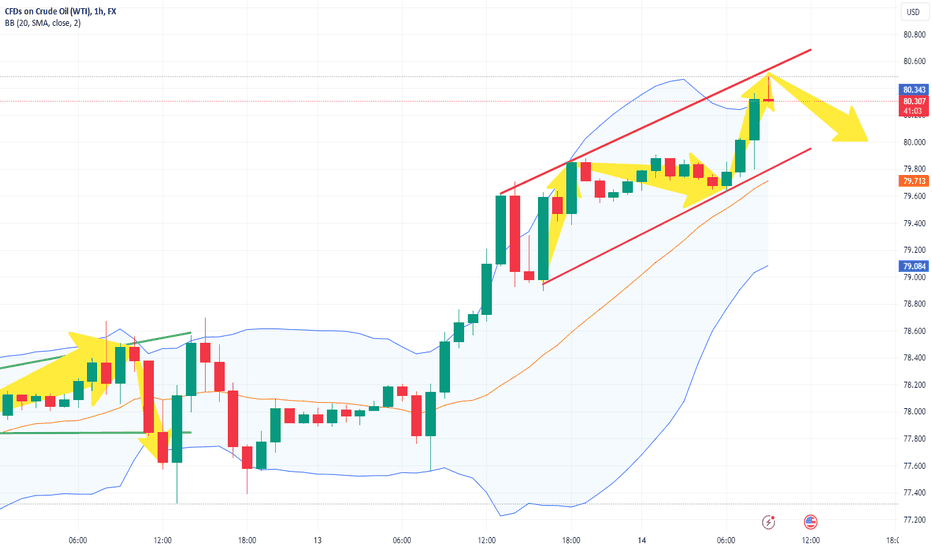

Usoil-Reasonable decline

If oil is above 80, it is still an upward trend. The lowest oil price yesterday was around 80.8, and the current range is about 80-83.5

Published API data showed that U.S. crude oil inventories fell by 1.52 million barrels in the past week, slightly higher than market expectations. Separately, the American Petroleum Institute reported that Cushing crude oil inventories increased by 325 million barrels. In terms of refined oil products, gasoline inventories decreased by 1.57 million barrels, while distillate inventories increased by 0.5 million barrels.

You can still buy near the support point and control your position reasonably

Following my strategy, your success rate will be greatly increased and trading will be simpler

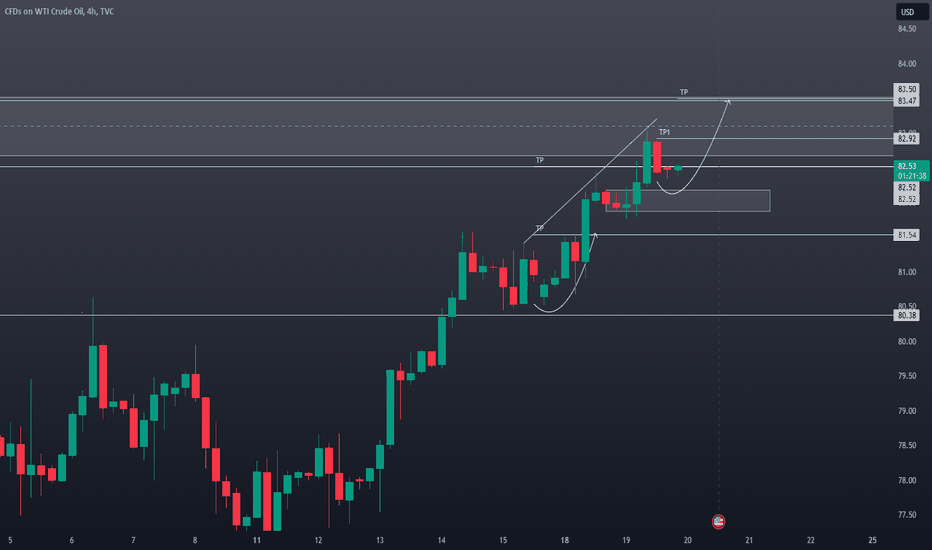

Usoil confirm signal buy Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market's volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

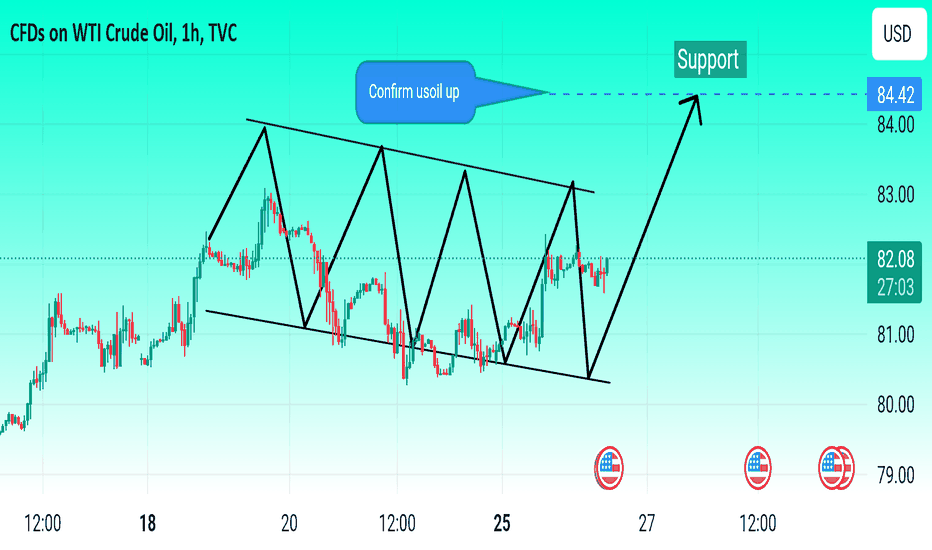

Usoil now 82

Target 83

Target 84

Resistance 81

Confirm Chart

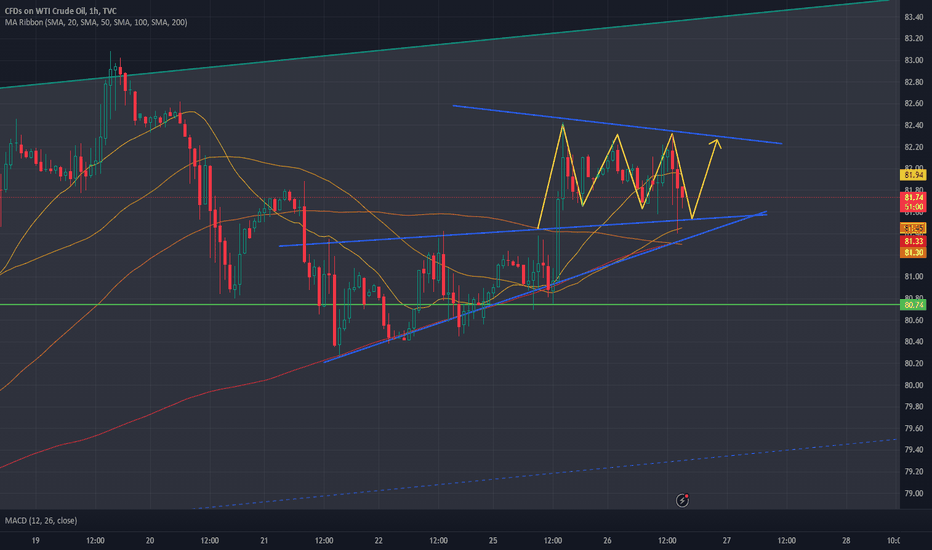

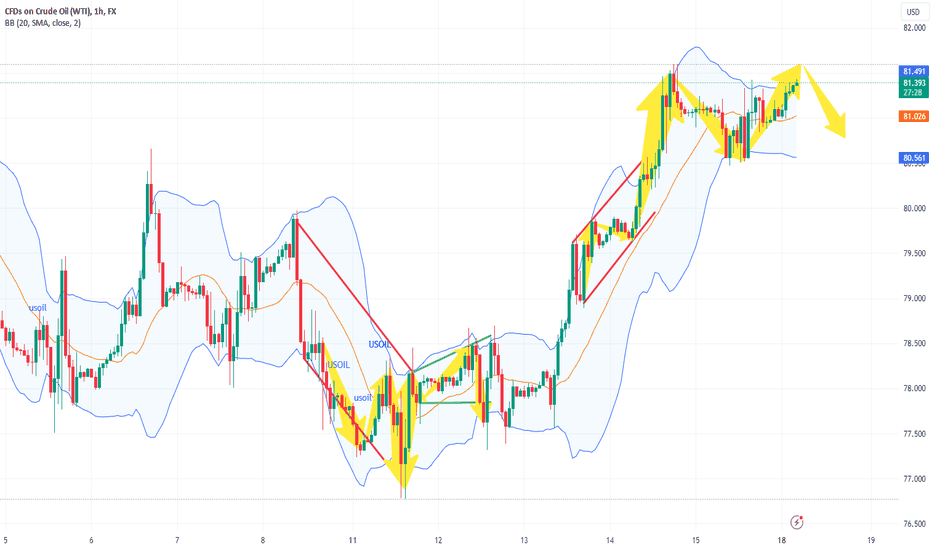

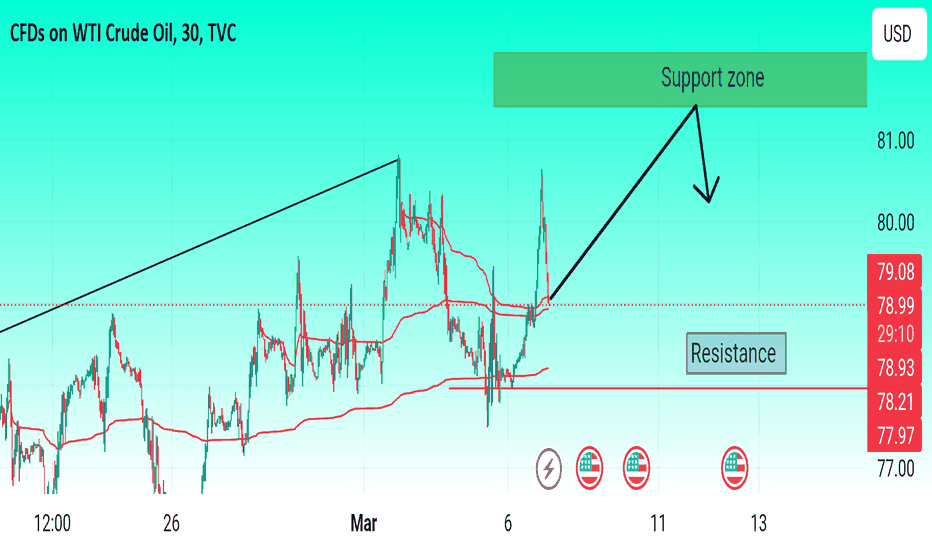

USOIL:Support at 80.2, resistance at 81.3

Let’s first look at the support in the 80.5-80.2 range. If the support is valid, go long. The indicators are now more favorable to shorts, with resistance around 81.3.

If it falls below 80.2, there will be a small rebound, but 80.5-80.8 will become strong resistance, so the risk of shorting is smaller and the profit opportunity is greater.

usoil sellWest Texas Intermediate US Crude Oil prices remain under some selling pressure for the third successive day on Friday and trades near the weekly low, around the $80.30 region during the Asian session.

Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market's volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

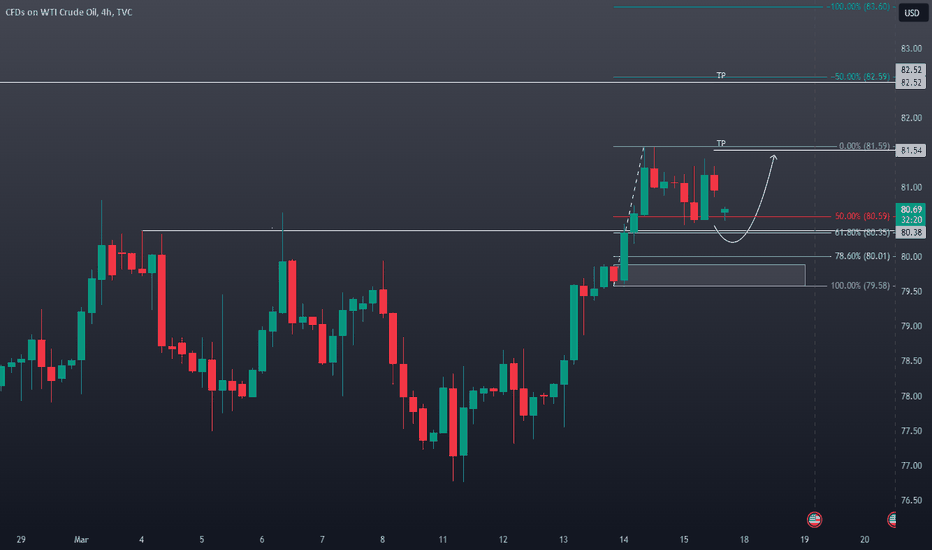

USOil WTI Technical Analysis and Trade IdeaI posted a trade idea a few moments ago, this is the video explaining my idea. There are important points in the video that are noteworthy.

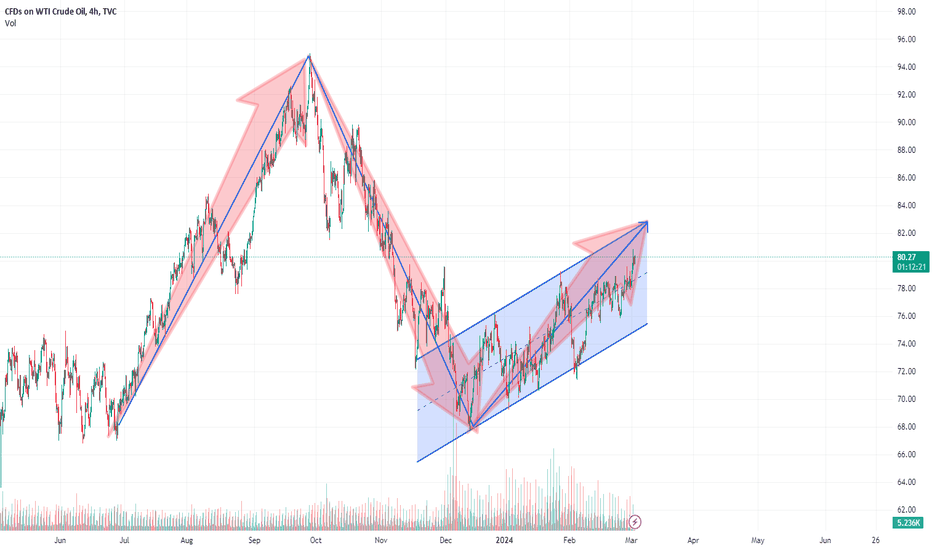

USOIL is exhibiting a strong bullish trend on the 4-hour timeframe, marked by clear higher highs and higher lows. We'll are watching the 50-61.8% Fibonacci level for a potential entry point. However, this trend is advanced, and a bearish reversal could occur at any time. Trade cautiously, prioritize risk management, and remember – this is not financial advice.

Usoil up Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

Usoil up confirm Chart

Crude oil trading analysis

Crude oil trading analysis

The oil market was mixed and volatile last week. The Red Sea shipping crisis has drawn attention, while an increase in demand forecasts from the International Energy Agency has also caused market volatility. Although WTI crude oil futures fell slightly, the overall trend showed a weekly increase of more than 3.88%.

International Energy Agency forecasts show that global oil demand will continue to increase until 2024. However, the agency also warned that if OPEC+ countries continue to cut production, it may lead to supply shortages. In addition, geopolitical factors and central bank monetary policies will also have an impact on future market trends.

Currently, crude oil prices are now at $81.4 and encounter two resistance levels of $81.7 and $82.5. If these levels are touched on the day, short positions can be made at high prices.

At the top, pay attention to the resistance at $82.0-$82.5, and at the bottom, pay attention to the support at $80.0-79.5.

Today's short-term recommendations are mainly short selling at high prices.

I will share trading strategies and trading ideas every day. Follow me in the channel at the bottom of the article to get detailed trading signals. I hope that with my help, everyone can make huge profits!

USOIL Oil holds steady around $80.60 area, just below the YTD peak touched on Thursday

West Texas Intermediate US Crude Oil prices oscillate in a narrow range, just above mid-$80.00s during the Asian session on Friday and remain well within the striking distance of the highest level since November 6 touched the previous day.

Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

Crude oil may fall back after rising today

Crude oil fluctuated upward on Wednesday, with a minimum of 77.5 and a maximum of 79.8 that day. The daily line closed at 79.5. From the daily line, the oil price has reached the upper track. Today, the focus is on the 81 line. If it rises to around $81, will there be strong resistance above?

As far as the current trend is concerned, the price of crude oil has risen to 80.3 US dollars. Waiting to see if it can reach 81 US dollars, you can make the right choice by paying attention to my signals at any time.

My suggestion is to prefer shorting at high prices: shorting in the range of 80.5-81 US dollars.

I will share trading strategies and trading ideas every day. Follow me in the channel at the bottom of the article to get detailed trading signals. I hope that with my help, everyone can make huge profits!

Crude oil analysis signals make you money easily

In the short term, the oscillation pattern of crude oil and fuel oil futures may continue

On March 12, crude oil varieties fell as a whole yesterday, especially fuel oil futures fell significantly.

1. The weakening of macro factors has hedged the benefits of OPEC+'s extension of production cuts. The weakening of oil prices has led to the decline in the support effect of fuel oil costs. Coupled with the recent decline in the shipping index, the outlook for fuel oil demand has dimmed. In the context of weakening demand factors and cost support factors, domestic fuel oil futures fell significantly this Monday. Although the market has always been skeptical about whether OPEC+'s production cuts are sufficient, there is no doubt that the oil market's supply and demand balance is in a relatively healthy state due to OPEC+'s efforts to reduce production.

2. The periodic decline of crude oil is the main factor driving the decline of oil products. Since the implementation of the OPEC+ production reduction plan, the market's trading focus has begun to shift to demand. Crude oil is still in a range-bound oscillation pattern, and there is great pressure on both long and short positions. Among them, OPEC+ production cuts provide bottom support at the bottom, and weak demand is suppressed at the top. There is no improvement in the long-short logic in the short term.

According to the current trend of crude oil, the price of crude oil is basically fluctuating between 78 and 78.5 US dollars. At this stage, the crude oil price reached 78.6 and was unable to break through due to resistance, and then fell again. As far as the current trend is concerned, the crude oil price is oscillating at 78 US dollars. Please pay attention to my signals at any time. Only then can you make the right choice.

It is recommended to go long at low prices in the short term: go long around $78.0

I will share trading strategies and trading ideas every day. Listen to my signal and advocate seeking victory in stability and not making rash advances.

For those who want to make easy profits, follow me in the channel at the bottom of the article to get detailed trading signals. I hope that with my help, everyone can make huge profits!

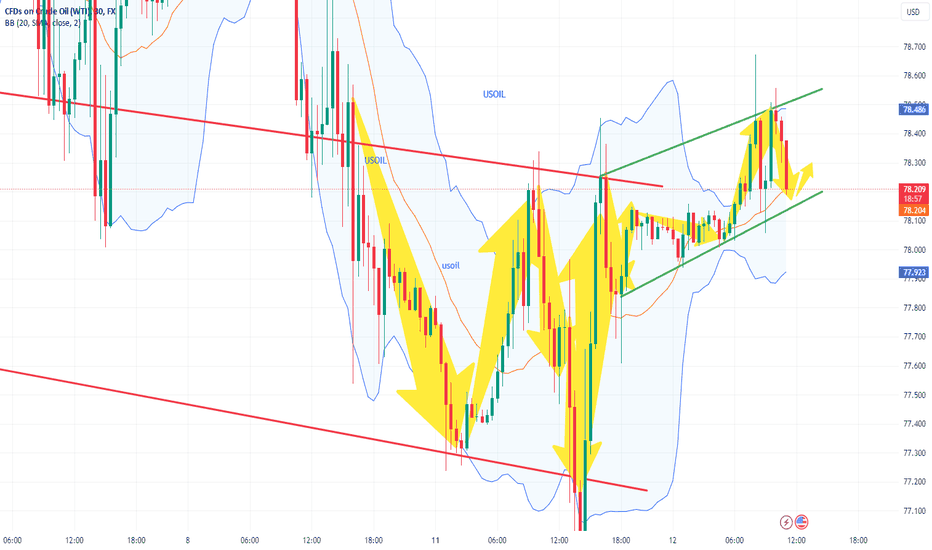

Crude oil analysis signals make you money easily

According to the current trend of crude oil, the price of crude oil is basically fluctuating at 77-78 US dollars. At this stage, the crude oil price reached 78.6 and was unable to break through due to resistance, and then fell again. As far as the current trend is concerned, the crude oil price is oscillating at 78 US dollars. Please pay attention to my signals at any time. Only then can you make the right choice.

It is recommended to go short at high prices in the short term: short around $78.5.

I will share trading strategies and trading ideas every day. Listen to my signal and advocate seeking victory in stability and not making rash advances.

For those who want to make easy profits, follow me in the channel at the bottom of the article to get detailed trading signals. I hope that with my help, everyone can make huge profits!

Crude oil trend analysis, easily make money for you

Crude oil trend analysis, easily make money for you

The overall trend of crude oil rose and fell back last week. The expected strength did not appear, but the upward trend has not changed. As long as crude oil price does not fall below 77 US dollars per barrel, the oil price will still rebound, and the weekly negative closing means that there will definitely be a rebound in the morning. It is bottoming out and rising, and the 4-hour moving average trend should also be bottoming out and rising. The current decline has bottomed out, and now there is a trend of bottoming out and rebounding. In the short term, we should pay attention to the support level and the short-term resistance reached by the rebound and increase. Bit.

Therefore, in terms of operation ideas, it is recommended to go short at high prices and long at low prices;

Recommendation: go long around 77.6 and go short after reaching $79.5

Tp 78.5

SL77

Go short after reaching $79.5

Tp 77.5

SL 80.5

Listen to my signal and advocate seeking victory in stability and not making rash advances.

If you want to make easy profits, please follow me

Comments welcome

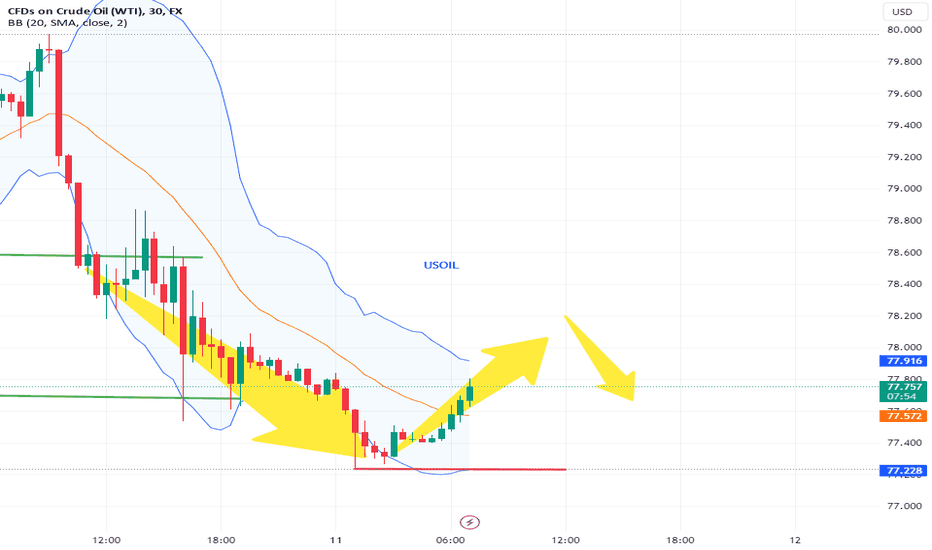

Crude oil price trend analysis, easily make money for you

Although OPEC+, an organization of oil-producing countries, has extended production cuts, the market remains wary of crude oil demand. Oil prices closed down more than 1% on Friday, with Brent crude oil falling by 1.69% this week and WTI crude oil falling by 2.46% this week.

Brent crude oil futures closed down $0.91, or 1.10%, to $82.05 per barrel. This week’s cumulative decline was 1.69%, and the one-week volatility was the lowest since September 2021.

WTI crude oil futures closed down $1.08, or nearly 1.37%, to $77.84 per barrel. It fell by 2.46% this week.

Supply remains tight due to slower exports due to OPEC production cuts and Russian production cuts, but demand in some countries appears to be lagging, while demand in the U.S. driving season has yet to kick off.

On the supply side, OPEC+ members led by Saudi Arabia and Russia agreed on Sunday to extend voluntary oil production cuts of 2.2 million barrels per day into the second quarter.

That provided additional support to the market amid concerns about global economic growth and rising production outside the group.

Crude oil continued to fluctuate this week, and the overall trend was a small dip and recovery.

My suggestion: go long at low prices, go long around $77.5

Tp 78.5

SL 77

Listen to my signal and advocate seeking victory in stability and not making rash advances.

Comments welcome!

Easily make money for you with crude oil trend analysis

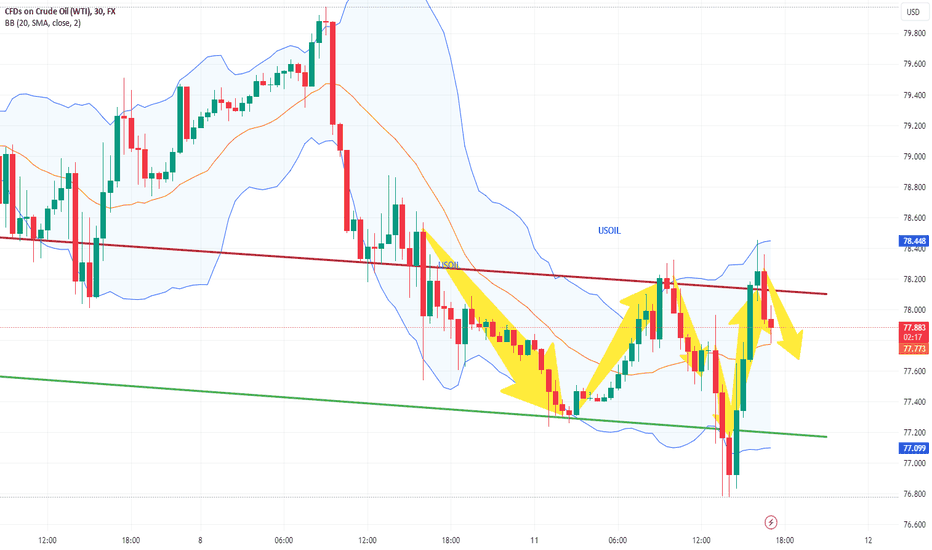

Crude oil prices fell back from highs and will bottom out and rebound

From yesterday to today, the overall trend of crude oil fell back after rising, with $80.5 as the resistance level and $77.6 as the support level.

The U.S. Department of Energy announced the purchase of approximately 3 million barrels of oil for delivery in September to replenish the Strategic Petroleum Reserve;

Attacks by the Houthi armed forces in the Red Sea region have also blocked oil shipments and disrupted tanker activities;

EIA report: The four-week average supply of U.S. crude oil products was 19.499 million barrels per day, a decrease of 1.25% from the same period last year;

Combining the above data and events, I believe that the current crude oil price will fluctuate around $77.8 and then show an upward trend.

Recommendation: Go long around $78

TP:79.5

SL:77

Listen to my signal and advocate seeking victory in stability and not making rash advances.

Comments welcome

Today's crude oil trading analysis

Today's crude oil trading analysis

Yesterday, crude oil continued to fluctuate upwards, and the second time it tested high, it looked around 80.7, but it has not yet formed a breakthrough. The recovery range in late trading was within 80.0, and the daily closing line had an upper shadow line, which is still in the stage of shock and rise. At this stage, it is being set The upper track of Linguan is oscillating and is expected to break through the upper track.

From the daily chart, crude oil is expected to continue to fluctuate upward along the upward trend line in the short term. In the short term, buy at low prices.

Recommendation: Buy crude oil at $79.6

TP 80.5

SL 78.6

Usoil up confirm Chart Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

Confirm signal usoil buy

Usoil up Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today

Crude Oil Prices Struggle As China Growth Plans Fail to Convince

Worries about Chinese energy demand have been a problem for oil bulls for some time as the world’s number two economy struggles to regain anything like its pre-pandemic vigor. Beijing has announced its intentions to ‘transform’ its development mode, and address endemic overcapacity, but its 2024 growth target of 5% perhaps only served to remind investors that China remains in the slow lane by its own recent standards.

Confirm Chart

USOIL H4 / Long Trade Opportunity ✅💲Hello traders!

This is my idea related to USOIL H4. I expect the USOIL to go bullish after the retracement from the OB and supply area.

Traders, if my proposal resonates with you or if you hold a divergent viewpoint regarding this trade, feel free to share your thoughts in the comments. I welcome the opportunity to hear your perspectives.

____________________________________

Follow, like, and comment to see my content:

tradingview.sweetlogin.com

The rules for making money in oil in the short and medium term From the four-hour chart of crude oil, oil prices are still in the rebound stage. Mainly fluctuating and rising, it continues to test the upper edge of the channel. Judging from the past background of this round of testing, the accumulated momentum is sufficient, and the mid-term trend will mainly be upward.

The short-term support is mainly strong support from OPEC production cuts. The demand for oil prices has increased significantly, and geopolitics has once again consolidated the status of this hard currency. If the dollar falls due to some economic fallout, oil will rise even faster. Trading on March 4 was dominated by buying at low prices. Buying transactions can be conducted near the price of 80. If you are a mid-term trader, you can buy at low prices in batches. The target position for this week is above 83. Whether you are a mid-term trader or a short-term trader, you need to pay attention. You can stop trading after making a profit. Prevent profits from blowing back and causing losses at the same time.

This price is based on the tradingview oil price as a reference.

Accurate prices and trading opportunities for real-time trading. Stay tuned. TVC:USOIL FX:USOIL FOREXCOM:USOIL GBEBROKERS:USOIL FX:USOILSPOT BLACKBULL:USOIL.F