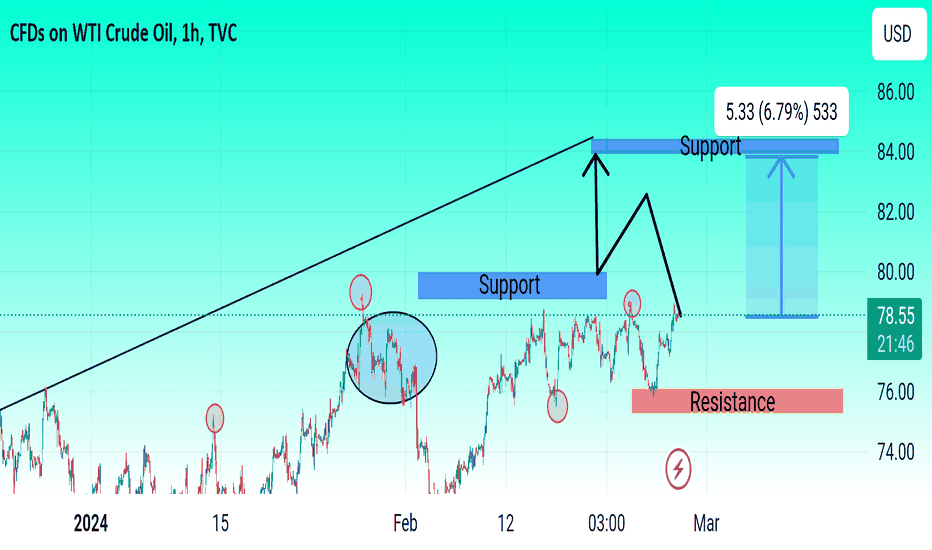

Usoil up Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

WTI US Crude Oil traded closely with the $78.00 handle on Thursday as bullish Crude Oil momentum stopped in its tracks as rising US Crude Oil stocks begin to weigh on energy risk appetite. US Personal Consumption Expenditure inflation came in at expectations but failed to spark renewed hopes for Federal Reserve rate cuts.

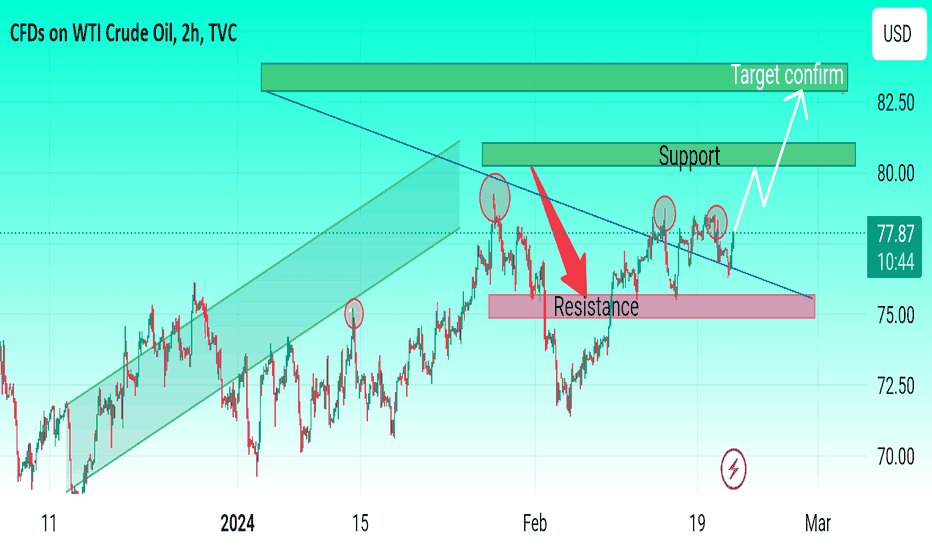

Usoilsignal

Usoil confirm buy Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

Crude Oil Prices failed to hold early gains on Tuesday although concerns about supply disruptions in the crucial Red Sea trade link continue to dominate the market.

US President Joe Biden has said that a ceasefire between Israel and Hamas is ‘close’ but the extent to which any limited cessation would halt Houthi attacks remains unclear.

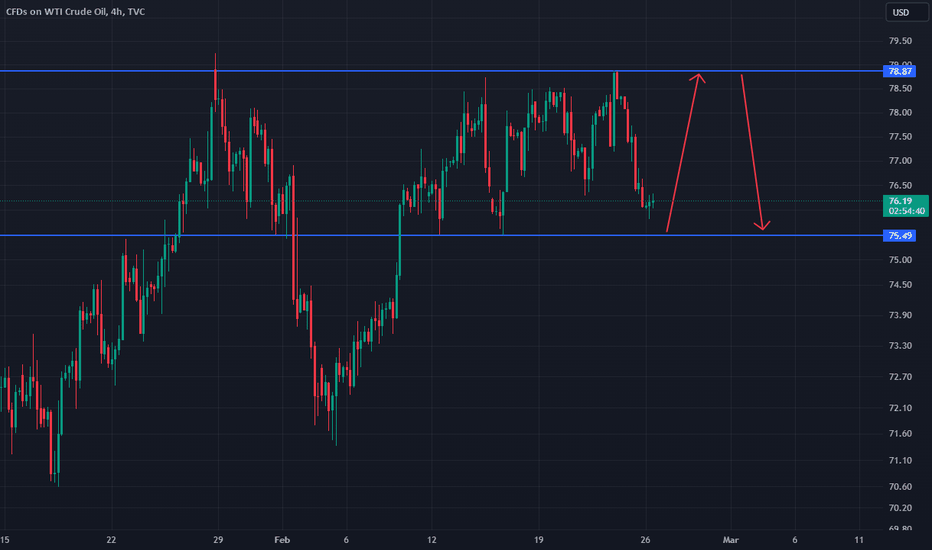

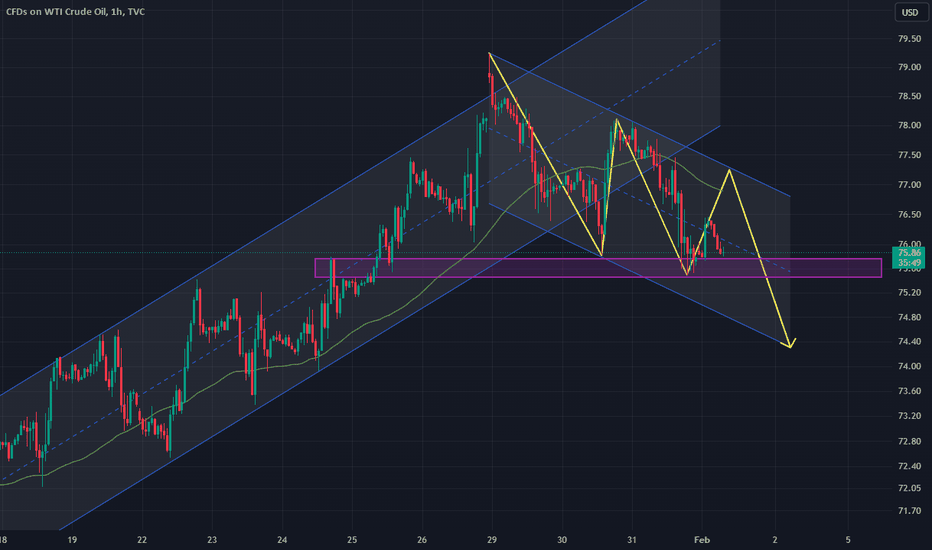

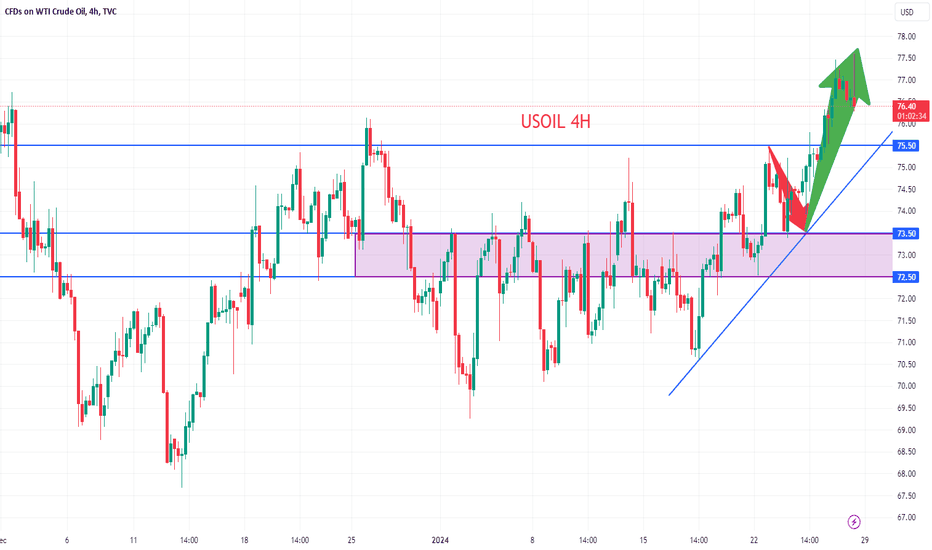

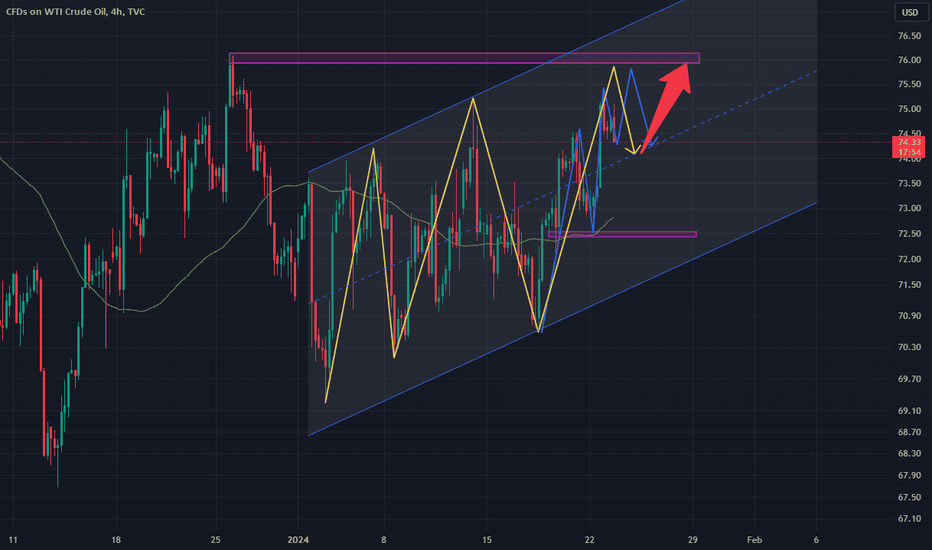

USOIL: Trading in the range of 75.5~79Crude oil technical aspects

Daily resistance is 79.2, support below is 75.5-74.4

Four-hour resistance is 76.8, and support below is 75.5-74.4

Crude oil operation suggestions:

Judging from the daily analysis, crude oil prices fell last week and closed down, and the bullish trend weakened, but the overall trend was still bullish. The daily level has not exceeded 79.00, and below it is the support of 75.5-74.4. Today, focus on trading in this range.

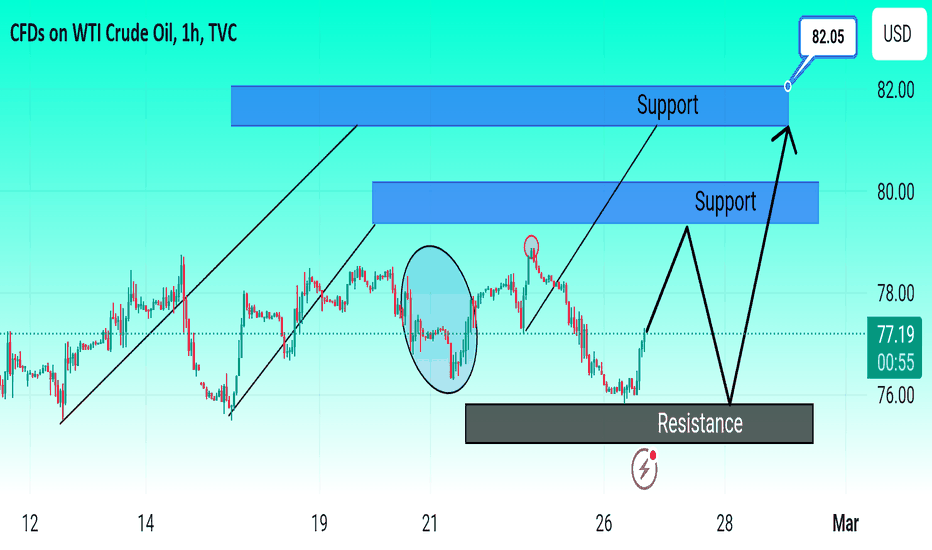

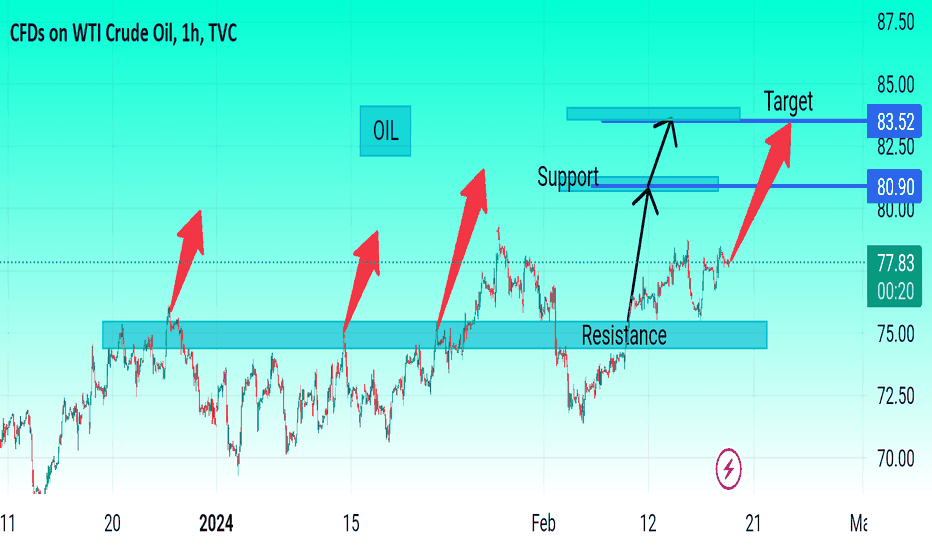

Usoil confirm signal Note: Low and High figures are for the trading day.

Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

Crude Oil Prices are sliding once again.

Traders remain worried about demand if inflation proves resilient and interest rates stay up.

Still the broad price uptrend is not yet under serious threat.

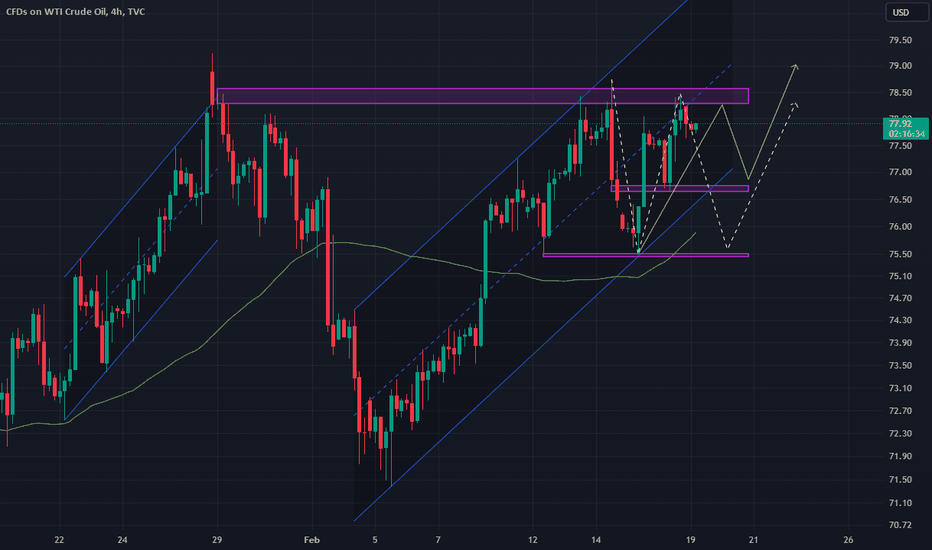

Confirm Chart

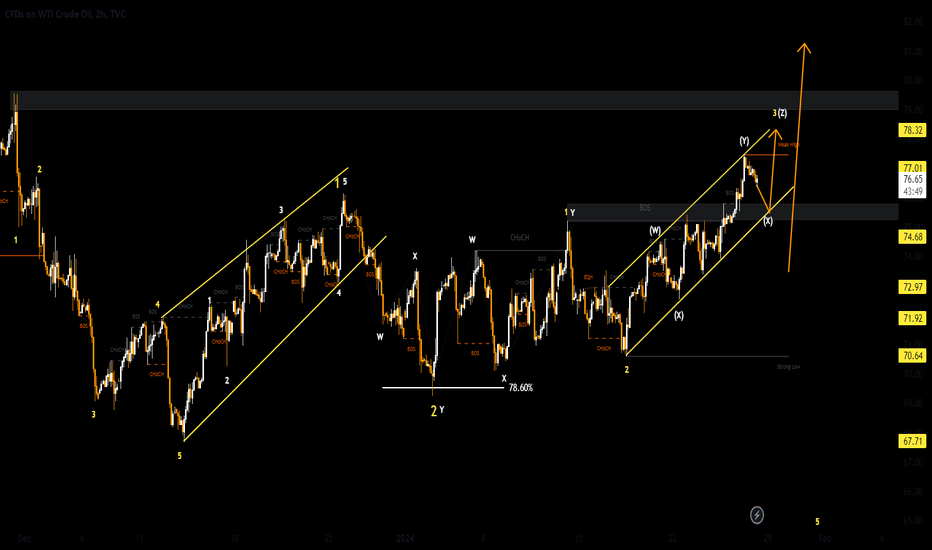

Usoil-Trend analysis

Oil has been in a volatile range recently. The large range is 74-79.5 and the small range is 75.5-78.5. The lowest reached around 76.3 yesterday and the highest today reached around 78.4.

Recently, due to geopolitical reasons, oil has been trending stronger, but it has not broken through the strong resistance point of 79.5 during the OPEC meeting. Therefore, I recently informed my clients that they have been mainly selling. In the volatile range, you cannot do both buying and selling. , if you want to make money on both sides, this will test your skills and your time watching the market.

Before breaking through the range, you can still buy at low levels and sell at high levels based on your funds. As long as you arrange your positions reasonably, you will have a very high possibility of making a profit in the end.

Join me as I share my strategies every day so you know how to trade

USOIL up Crude oil is one of the most in-demand commodities, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity. The oil price charts offer live data and comprehensive price action on WTI Crude and Brent Crude patterns. Get information on key pivot points, support and resistance and crude oil news today.

In the early hours of Tuesday morning it was confirmed that the 5-year loan prime rate dropped by more than expected, in yet another show of support for not only the Chinese economy but for the real estate sector in particular.

Confirm signal buy USOIL

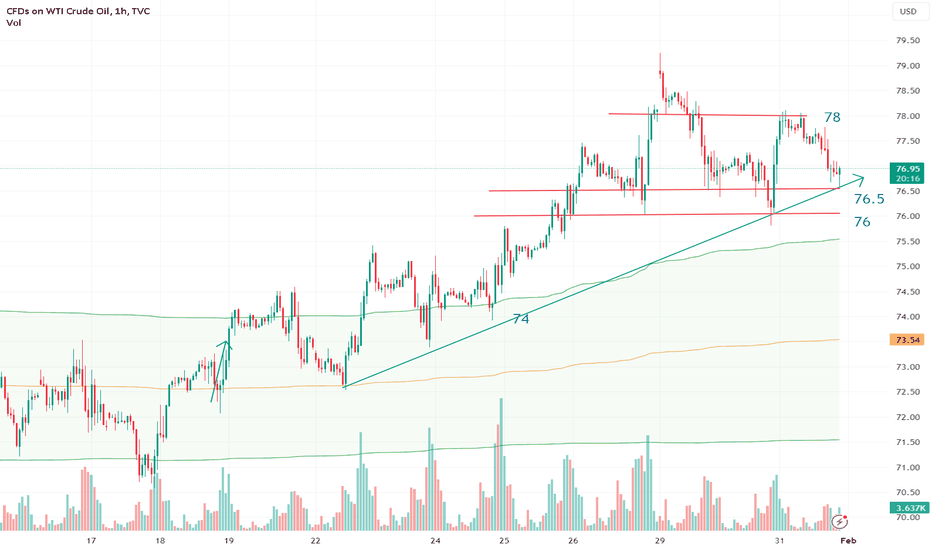

Crude oil analysis, focus on 76.5~78.5From the daily analysis, crude oil is currently in the range of 71.5-78.5. The daily level has not broken through and stabilized at 78.5, but is still in shock. Below is the support of 76.5-75.4. Trade based on this range first. If the price breaks through 78.5, and Oil prices above 78.5 will see further room for growth

Usoil upWTI depreciates amid thin trade on US Presidents’ Day, inches lower to near $77.80

Crude Oil, commonly known as petroleum, is a naturally occurring fossil fuel liquid composed of hydrocarbon underground deposits and organic materials. The prices of this popular commodity are measured in USD. Saudi Arabia, Russia, United States, Iran and China are the countries producing more oil. On the other hand, United States, China, Japan, Russia, and Germany are the countries consuming more oil.

Usoil confirm signal buyCrude Oil, commonly known as petroleum, is a naturally occurring fossil fuel liquid composed of hydrocarbon underground deposits and organic materials. The prices of this popular commodity are measured in USD. Saudi Arabia, Russia, United States, Iran and China are the countries producing more oil. On the other hand, United States, China, Japan, Russia, and Germany are the countries consuming more oil.

Sulphur content determines the quality of a crude oil. This corrosive material decreases the purity of a crude oil. Therefore, a crude oil with high sulphur content (sour crude) should sell cheaper than one with low sulphur content (sweet crude). There are two main benchmarks for pricing Crude Oil: WTI (West Texas Intermediate) from USA and Brent from UK.

Crude Oil tests multi-week high before receding on supply buildup, WTI back below $77.00

By Joshua Gibson | 18:34 GMT

USD/CAD Price Analysis: Corrects gradually below 1.3550

By Sagar Dua | 13:06 GMT

WTI seems to extend its gains after recovering intraday losses, hovers around $77.50

By Akhtar Faruqui | 05:20 GMT

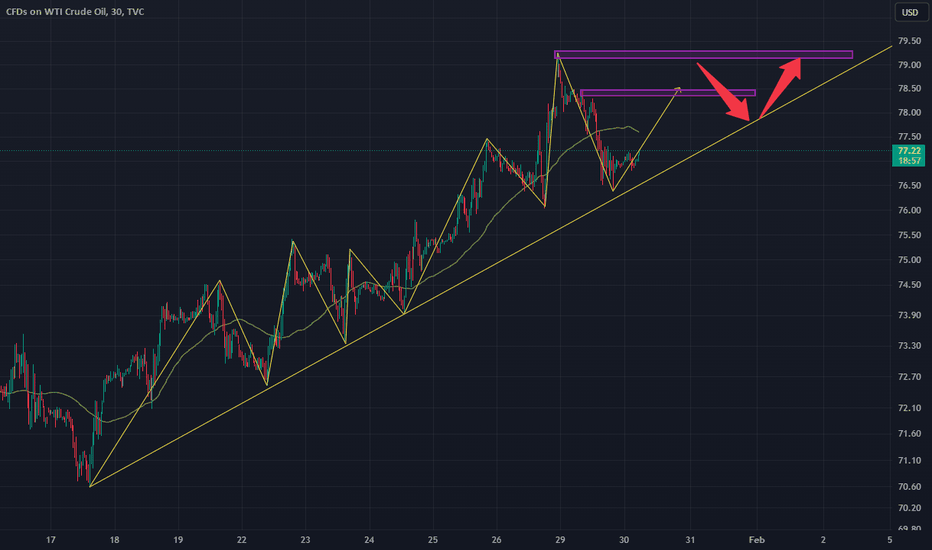

OIL BULLISH MORE !!HELLO FRIENDS!!

As I can see USOIL is now trading above the uptrend line and it will be more bullish because of Asian Demand and War in Middle East Technically also it showing us clear view that it is holding above the support level and trading in bullish trend after a small reversal we expecting more buys in USOIL Trade As you can see our pervious entry on USOIL is preforming great job chart is attached in comment and we are loading more bags on this after a little Dip Friends Geopolitical Issue vs Supply & Demand is a clear view for Oil Prices It's just a trade Idea share Ur thoughts with us it help many other traders Stay Tuned for more updates.

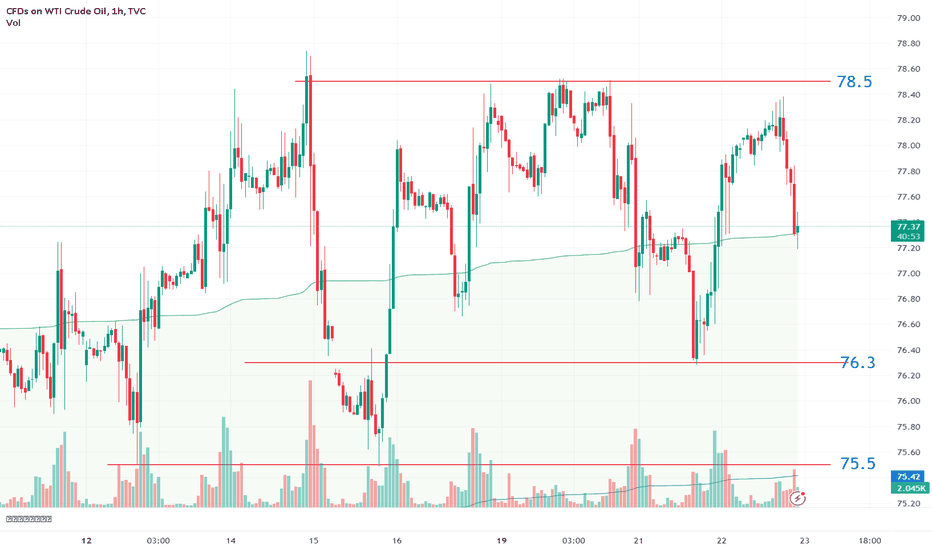

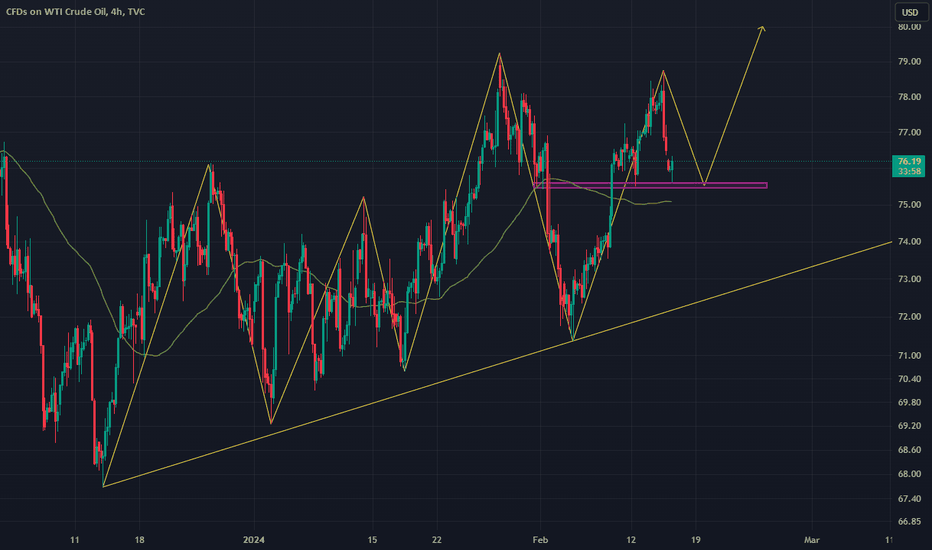

Usoil-analyze

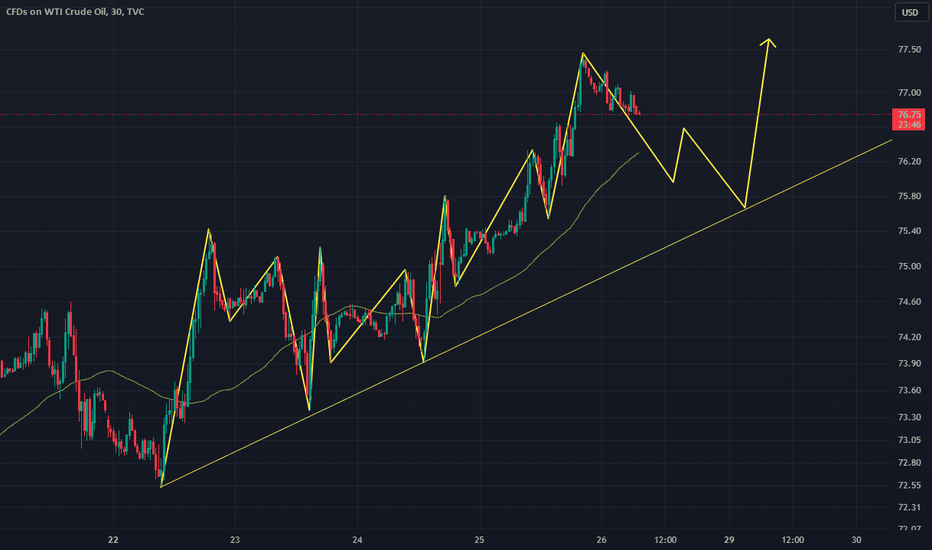

Keep asking me about oil. Last week I emphasized that oil did not fall below 74 and will continue to rise this week

It can be seen that yesterday the lowest oil price reached around 75.8 and the highest reached around 78.2, but it did not break through 78 many times, so it can be judged that the current range is between 75.8-78.2

In an upward trend, you mainly rely on support points to buy, or sell at high levels within the range, and adjust your strategy according to market conditions.

Join me, I will tell you detailed trading strategies and guide you how to trade

Crude oil prices fluctuated up and down in the short term today.In terms of crude oil, we continue to pay attention to the idea of shocks during the day. With the current unstable situation in the Middle East and the surge in OPEC crude oil production, the market outlook continues to be dominated by shocks. Technically, focus on the upper pressure near 78.40 during the day, and the lower support is around 76.65/74.7

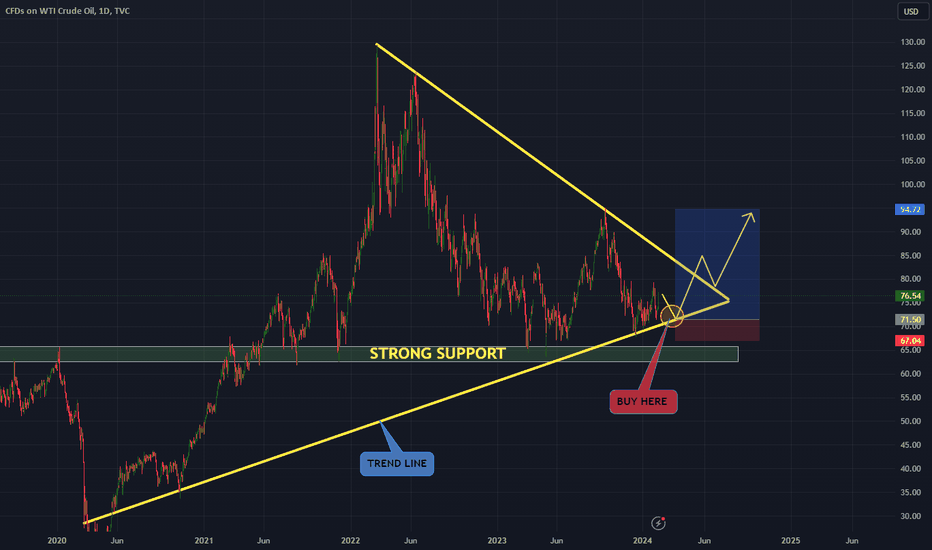

Usoil-Market trend analysis

Oil is still in an upward trend, wait for the right support point to buy

During the recent period, the highest point of oil was 75.8 and the lowest point was 70.5.

Daily line: 67.71 support point, 79.8 resistance point

4H: 70.5 support point, 76.18 resistance point

These three important resistance points are 76.1-76.7-77.1

I see the possibility of oil bottoming at 70. The upward trend at this stage may reach 78-80. The previous shock range has gradually broken through. At this stage, as long as it does not fall below 74 this week, it is not recommended to trade short orders.

The above is my oil analysis. The market changes rapidly. The prediction needs to be combined with the market trend to achieve expectations. The above analysis is for your reference. I will continue to follow up and share in the future.

Today’s strategy:

Usoil:buy74.5-74.8

TP:75.3-75.8-X

SL:73.8

You can make appropriate adjustments based on your trading habits and funds

Join me, I will analyze the market situation every day and give you strategies for your reference

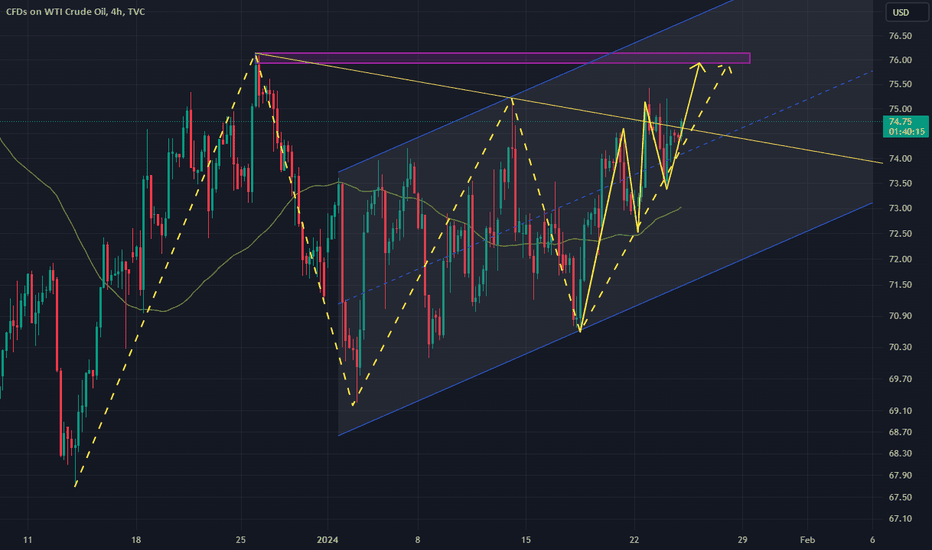

Crude oil has an obvious upward trendDuring the day, focus on the support near 76.70 to maintain a bullish attitude. The situation in the Middle East is currently escalating, and the probability of crude oil rising in the market outlook is relatively high. Above, focus on the resistance of 78.40/79.3

USOIL:Continue longHello friends, Luke here again. As a recipient of several regional trading awards, I'm excited to be part of TradingView where I can share my strategies with you daily, hoping to be of assistance.

I've previously emphasized a bullish target for crude oil at $80. Currently, the upward trend is clear, and dips should be seen as opportunities to go long. The buying zone to focus on is between $77.6 and $76.

I update my market analysis daily and also share precise trading signals within my exclusive group, Luke's Circle, to help you achieve steady and long-term profits in your account. Don't miss out!

USOIL: Continue to Go Long Next WeekHello, friends. I'm Luke, a former champion trader in multiple regions, and I'm delighted to join TradingView to share my strategies with you every day, hoping to provide assistance.

This week, I've analyzed that crude oil is expected to continue rising to the range of $78-80 per barrel. Today, it has reached a high of $77.5 per barrel, and I remain optimistic about the future upward movement of crude oil. If it retraces to the range of $73-75 per barrel, consider going long once again!

I update my market analysis daily and also send accurate trading signals within Luke's small group to help stabilize and sustain profitability in your accounts. Don't miss out!

Crude oil’s short-term uptrend on TuesdayGlobal energy markets continue to be rattled by the growing likelihood of supply constraints, with successful attacks in Ukraine on Russian oil infrastructure highlighting how easy it is to disrupt broad energy supply chains. WTI tested multi-week highs on Monday as market tensions mounted.

The short-term (1H) trend of crude oil has recovered, and oil prices have broken through the resistance at the upper edge of the triangle. The moving average system is gradually arranged in a long position, and the short-term objective trend is upward. Pay attention to the strength and continuity of today's rise in oil prices, and it is expected that there is a high probability that the rise will continue during the day.