USOIL: Bulls are about to start

With the EIA data today, the market is bound to experience significant fluctuations. From the current point of view, I think the probability of an upward trend is relatively high, so my trading strategy is to go long.

During this process, since the fluctuations will be very large, you must do a good job in risk management and never let your transactions bear too much risk.

Each of our transactions should involve small risks and large gains. Only such transactions will be long-lasting.

Analyzing the market is a complicated matter, but if you can master a method proficiently and get it verified, your trading will become simple.

I hope all my friends can profit from the market! good luck!

Usoilsignal

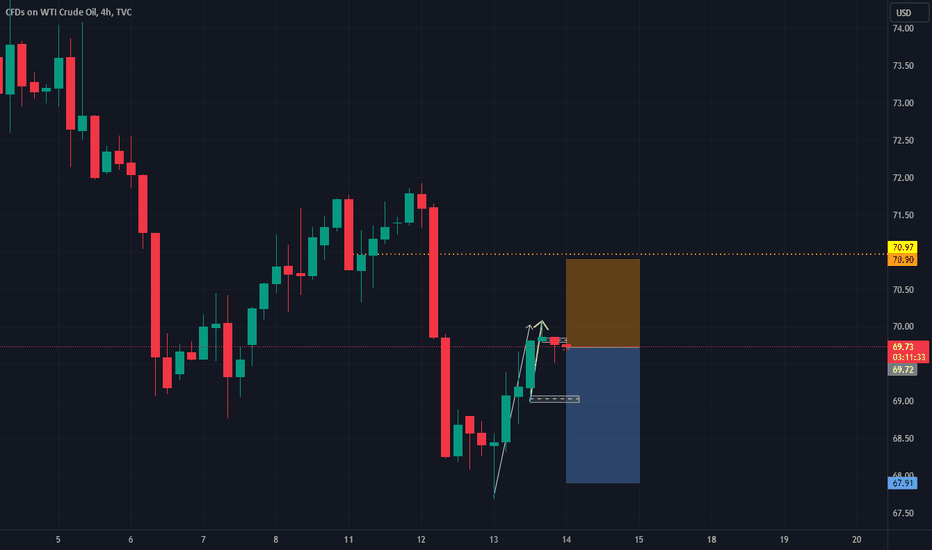

USOIL: 14/12 market analysis, plans to sellCrude oil (USOIL): Yesterday, crude oil broke through the 68 area, reaching the lowest position of 67.7. Today opened at 69.8, and the amplitude of five or six dollars in the morning was not too big. It broke below yesterday, but it did not stay too much. In the evening, the decline was gradually recovered, and the daily K closed a green line. There was only one explanation given, short correction, just like the previous two days. Only after correction can the short acceleration be ushered in more smoothly! Crude oil trading signal sent later

USOil WTI Technical Analysis And Trade Idea USOil WTI has shown a robust bearish trend of late, reaching into a noteworthy support level on both daily and weekly charts. The accompanying video offers an extensive breakdown of this trend, meticulously dissecting price actions and pinpointing potential trading prospects by conducting a comprehensive analysis across various timeframes, spanning from weekly down to as brief as 15 minutes. Expect a thorough exploration encompassing price fluctuations, market trends, trend assessments, and critical technical analysis elements. It's imperative to highlight that the insights shared here are solely for educational purposes and should not be construed as financial guidance.

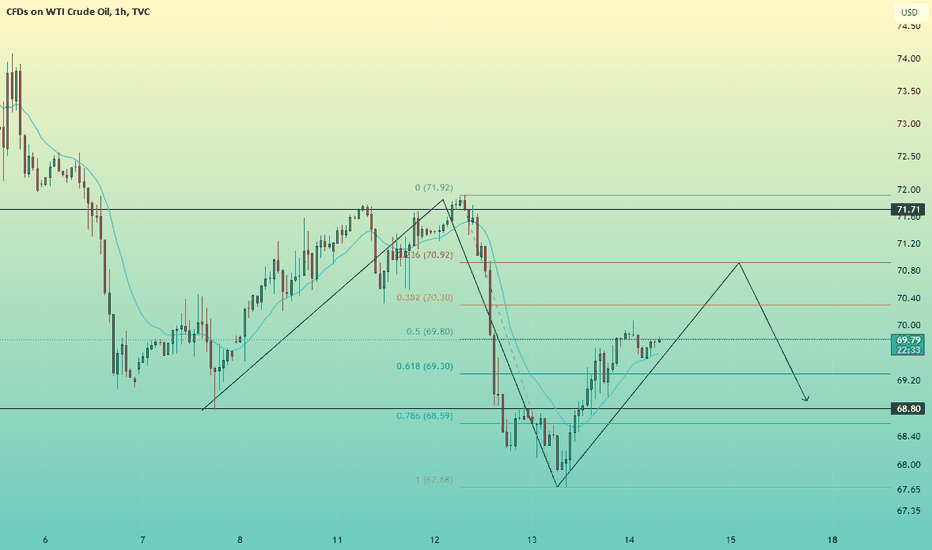

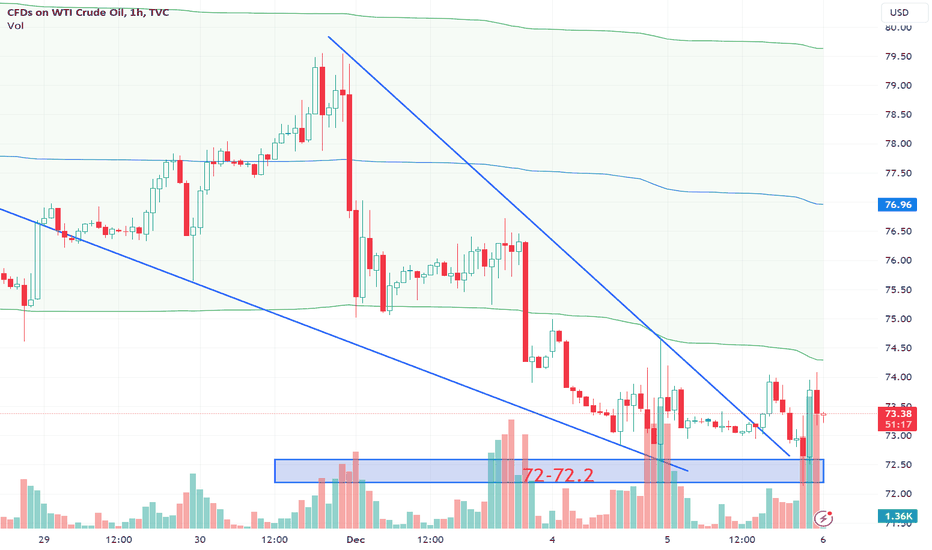

USOIL: Crude oil continues to sell at high prices on 11/12Crude oil (USOIL): Today opened at 71.1, the Asian market rose by 6 US dollars, the daily chart continued to rise, the upper pressure is in the area of 72.2-72.3, today we will first see whether the upper resistance is effective.

I will update the crude oil signal later

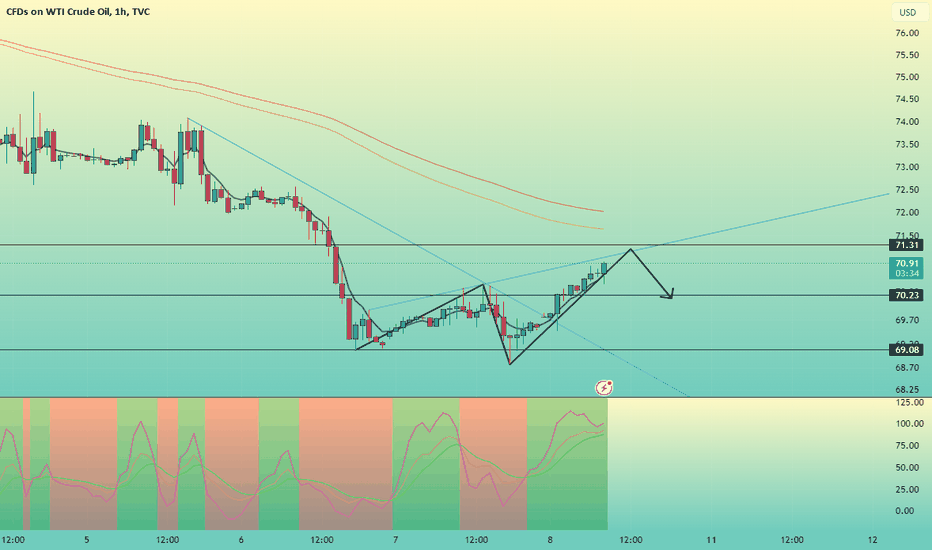

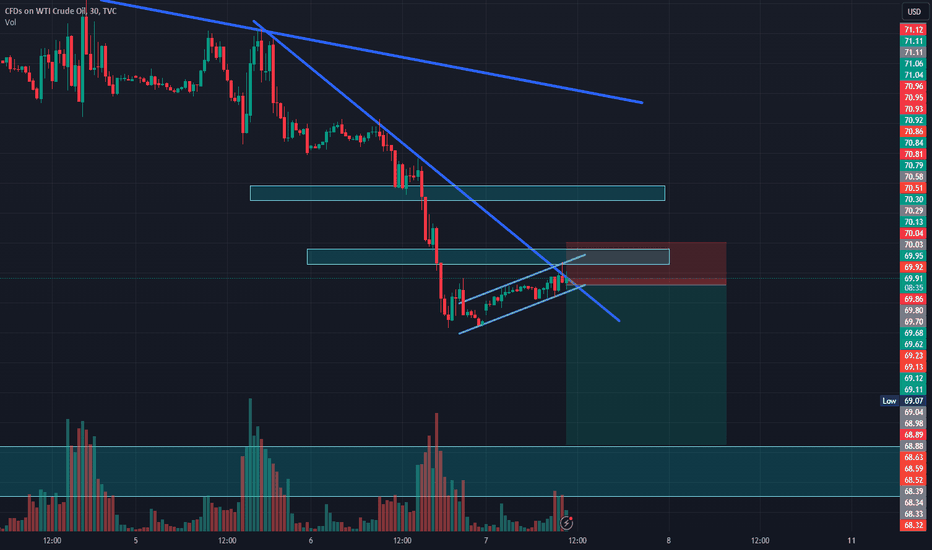

USOIL: 8/12 crude oil market analysisCrude oil (USOIL): Crude oil opened at 69.7 today and rose by 7 US dollars in the morning. Yesterday, we planned to go short near the daily pressure of 70. In the afternoon, it broke through the 70.4 line and stopped falling at the 68.8 line in the evening. We successfully made a profit, but It did not fall to my ideal point of 68, but has since rebounded and returned to the 70.4 line. At the end of today's weekly line, the market has been volatile, so we have to be on guard and be more prudent in our layout. The top focus will be on the 71.2 area. After the bullish sentiment in crude oil is released, it is time for us to take action! !

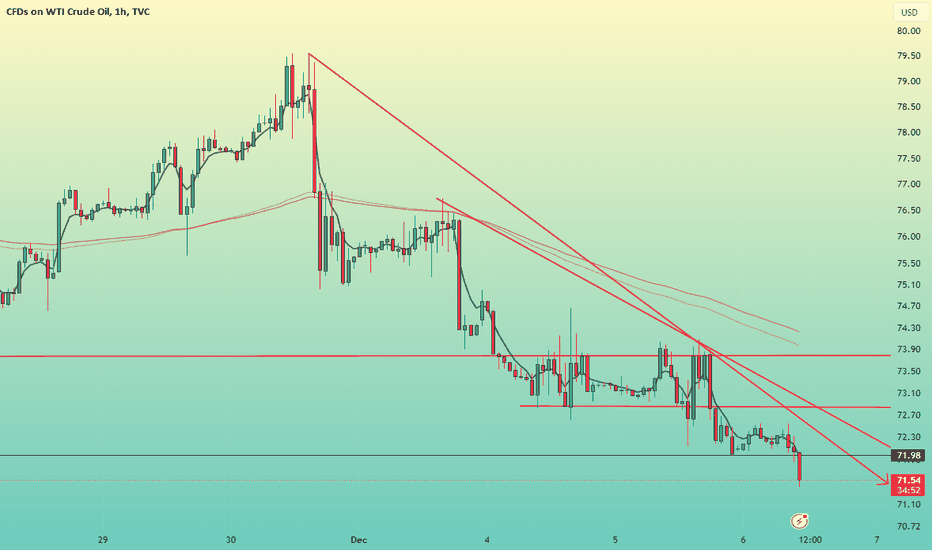

USOIL: Crude oil analysis today, continues to fallCrude oil (USOIL/XTIUSD): Yesterday, crude oil entered the market as planned and harvested profits, reaching a perfect position of 72.2, with a profit of 140pips. Today it opened at 72.1, rising by 5 US dollars in the morning and then falling back, similar to the trend of the previous two days. The bulls resisted tenaciously in the morning. Although there is strong support at the low level to resist the decline, the downward trend remains unchanged. The focus is on the 72.9/73.4 position at the top today. With the strength of the shorts, we are firmly bearish on the acceleration of the bottom break!

Signals will be sent in real time

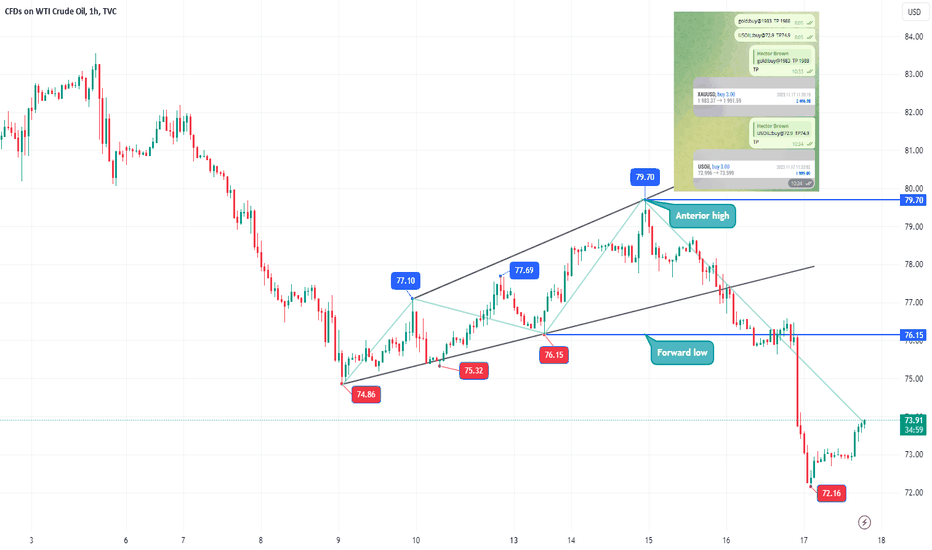

Usoil:forecast

Oil was supported near 72, has now risen, has broken through the downward trend, and is now in shock

If the oil does not fall below the important support of 72 this week, we can be sure that the oil may have reached a phased bottom.

So this week we need to pay important attention to the support strength of 72. If it falls below, the oil will look for the bottom again, and it may reach the important support of the monthly line near 68, so this week is very critical.

I judge that if it does not fall below 72 this week, oil will sprint to 79.7 again. If it falls below this important support, observe the monthly support of 68-70.

Pay attention to OPEC news, Saudi Arabia and Russia do not want oil prices to fall, if the oil reaches the monthly support point, you can choose to buy

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

Usoil:Waiting to choose the direction

OPEC has not taken a real approach to enforce compliance with selective production cuts, and the production cuts are expected to continue until the first quarter of 2024.Since OPEC's meager production cuts of one million barrels per day are unlikely to offset the impact of the decline in global crude oil demand, it is expected that there may be an oversupply of oil in the coming months.

Judging from the chart, oil is still in a downward trend, but the support below 72 is very strong, so we need to observe the support of 72-72.2 and wait for the oil to choose the direction.

So you can try to buy and strictly observe the support point to make a stop loss, because it is a downtrend, you can also wait for the rebound to the resistance point to sell, so that your success rate is greatly increased

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

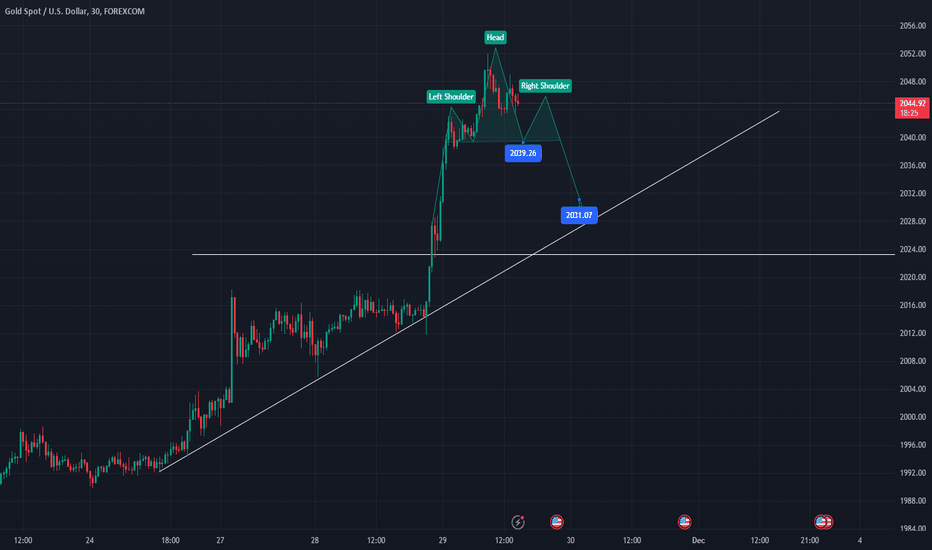

XAUUSD/USOIL:The bear is about to fight back

After this sharp rise, the 1h chart once again showed a top divergence, with supports located at 2039, 2031, and 2023. The market is very close to the high of 2076, so long transactions should be cautious. My trading today will be mainly short positions.

At the same time, some will be reserved for waiting around 2020. If your account has enough margin, you can also do this.

In addition, there is EIA data today, which has a high probability of being negative for OIL. If you want to participate in this data market, you can consider shorting. Since the data market is highly volatile, I hope everyone can control risks during the transaction to ensure the safety of the account!

good luck!

Usoil:The impact of the OPEC+ meeting

Severe storms in the Black Sea region interrupted Kazakhstan and Russia's oil exports of up to 2 million barrels per day.The Ministry of Energy of Kazakhstan said that the average daily oil production of Kazakhstan's largest oilfield will be reduced by 56%.This has led to the possibility of short-term supply constraints and pushed up crude oil prices.Secondly, a report from the U.S. Energy Information Administration showed that U.S. crude oil and distillate stocks unexpectedly increased last week, indicating weak demand.Although gasoline inventories increased more than expected, these effects were offset by the large consumption of other refined products such as fuel oil.This has also played a certain supporting role in the rise in crude oil prices.

Investors' attention to the results of the upcoming OPEC+ meeting has also pushed up crude oil prices to a certain extent.The OPEC+ Group of Oil Producing Countries will decide on the level of oil production in 2024 at the meeting.So we must pay attention to the final result of the OPEC+ meeting

I also said yesterday that oil is still above the trend line and maintains an upward trend, reaching a maximum of 78.75 today.

So you can still buy at the support point today, or it will be more secure to wait for the meeting before trading.

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

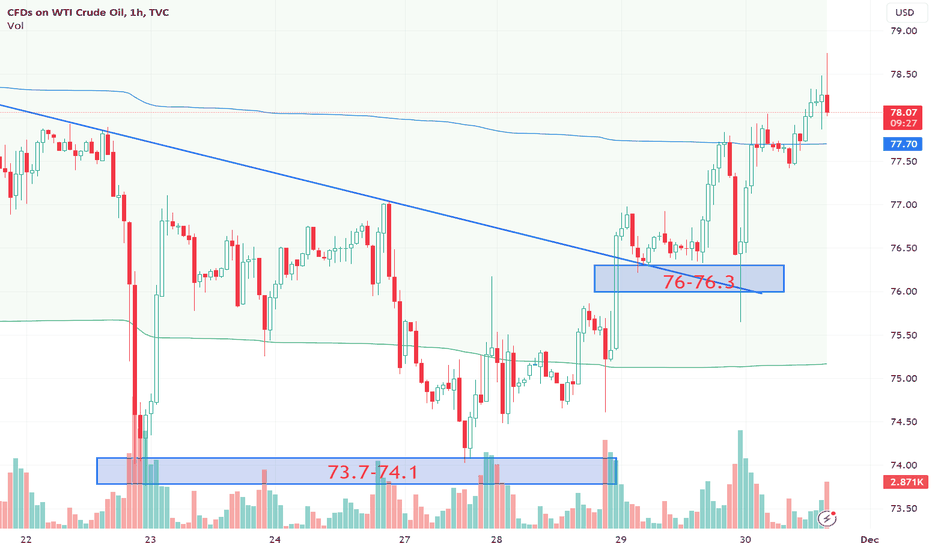

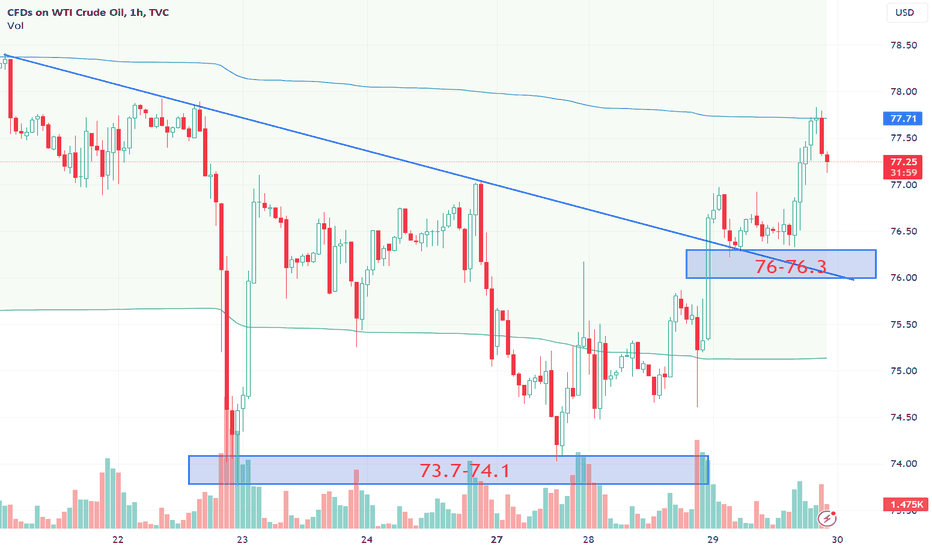

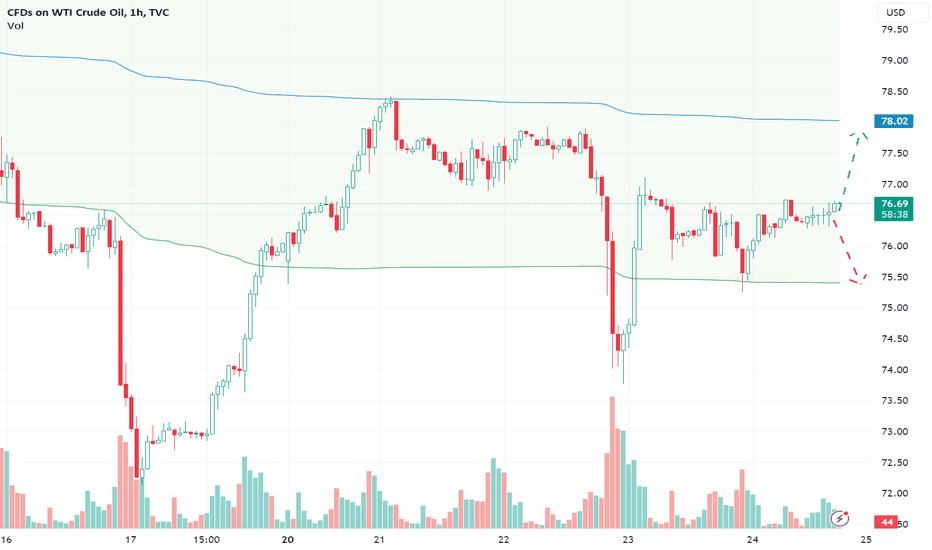

Usoil:Will it continue to break through?

Yesterday I said that oil has broken through the downward trend, and now it is blocked from falling in the middle of the trend line.

If it continues to fall, we need to observe the support strength of 76-76.3

So you can buy gradually in this range, because the OPEC meeting is still uncertain, if it falls below the range, you need to strictly set the stop loss

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

Usoil:Fluctuation is too small

On the news side, OPEC+ officially announced that the meeting to be held on November 30th will be changed to an online meeting.Regarding the rumors of discord within OPEC, the representative of Nigeria said that he did not know that there were differences within OPEC+, and he was satisfied with the survey results on Nigeria's production plan. Angola stated that it does not intend to withdraw from OPEC+.

OPEC+ is approaching a compromise with African oil-producing countries on production levels in 2024.There are various signs that a new round of production cuts may be coming.

As can be seen from the chart, oil rose again after falling yesterday, and today it also fluctuated narrowly, indicating that oil is still waiting to choose the direction, but recently it is unwilling to fall.

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

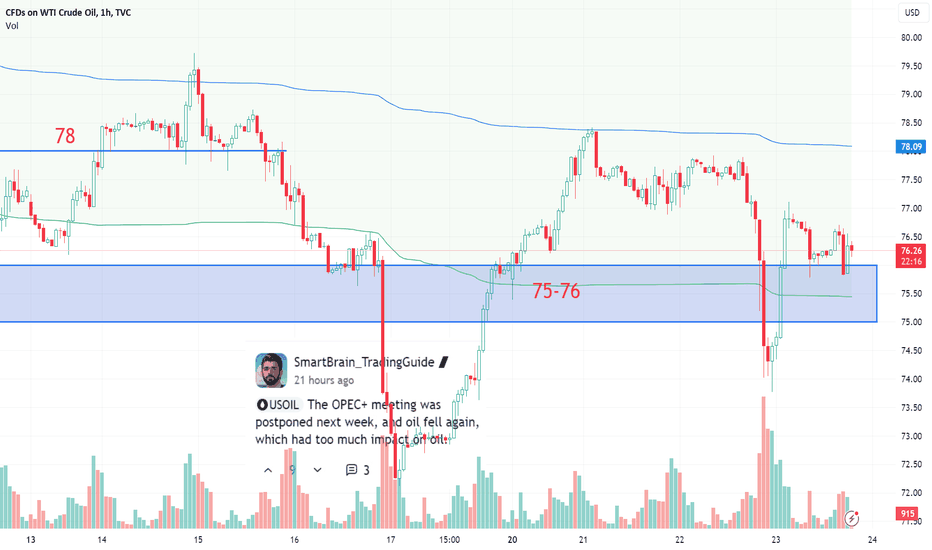

Usoil:What exactly is OPEC+ going to do?

I reminded yesterday that oil fell rapidly because of the postponement of the OPEC+ meeting, but the final time was set to be held again on November 30, so oil prices began to rebound yesterday.

As can be seen from the chart, the trend of oil after the rebound is relatively weak, and today it did not break through the point where it started to fall at 77 yesterday.

So today you can still choose to sell below 77. If you break through 77.2, you need to re-observe. As long as you strictly set the stop loss and follow my trading, your success rate will be greatly increased.

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

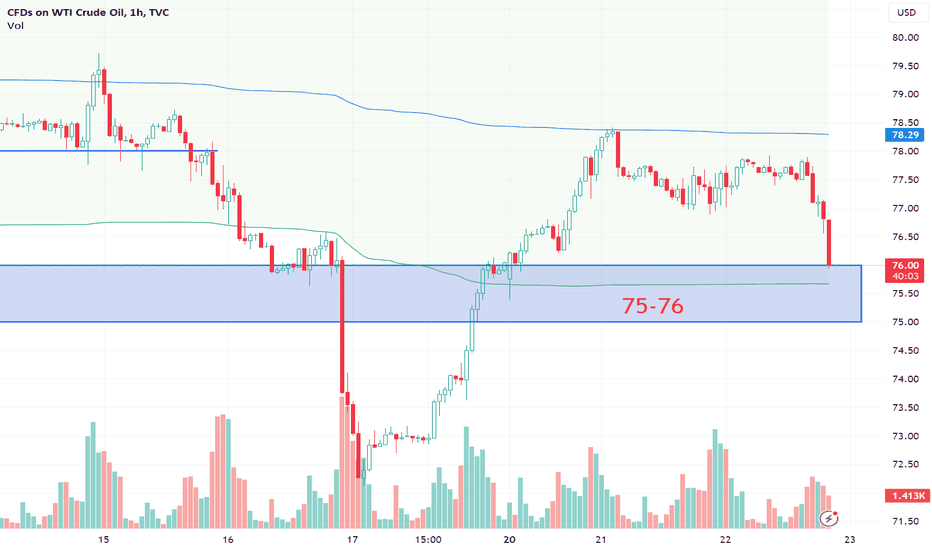

Usoil:Observe the trend line

OPEC+ will hold a meeting this weekend, and WTI oil traders will face significant risks.If more and longer production cuts are announced at the OPEC+ meeting, oil prices may pick up

As can be seen from the chart, oil has been in an upward trend, but it has not broken through the middle edge of the trend line.

So we are still waiting to fall to the support point to buy, strictly set the stop loss, and continue to observe the strength of 78.4 and 79.5 resistance, so that your success rate will be greatly improved

It can be observed that the support of the trend line is near 75.7

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

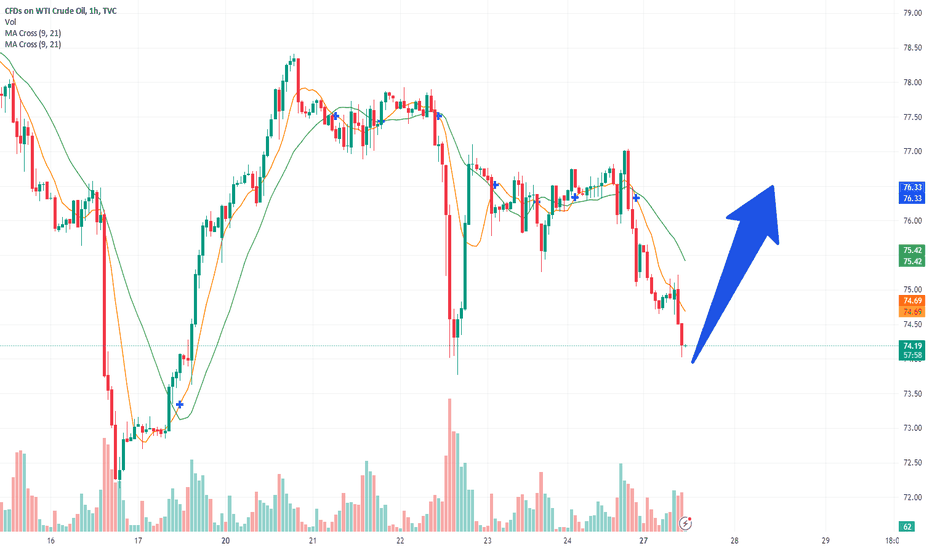

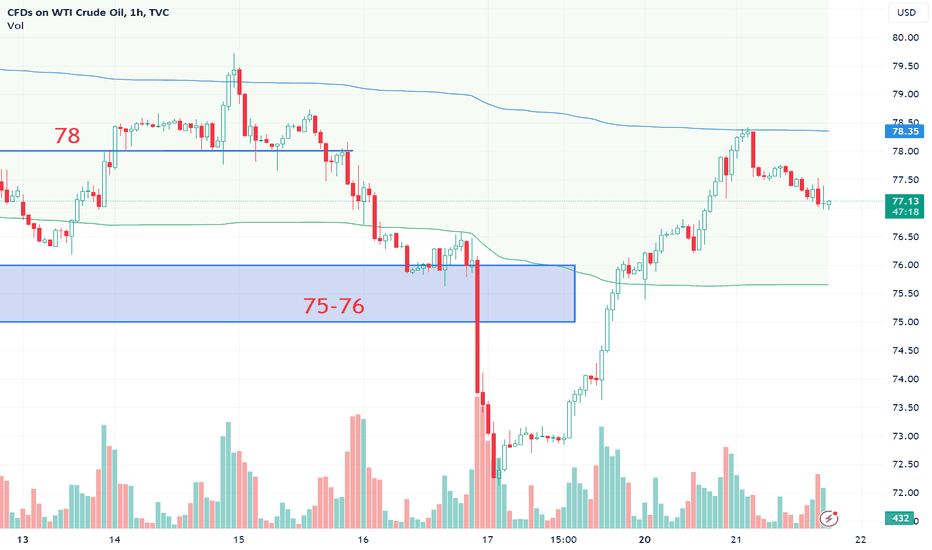

Usoil:Will oil rise today?

Oil was blocked from the middle edge of the trend line yesterday and began to fall

As long as oil breaks through 78.4, there is still a lot of room for growth above, so the resistance of 78.4 is still observed today.

Oil is still on the upward trend for the time being, so you can still choose to buy at the support point

You need to strictly set the stop loss every time you trade, so that even if the trend changes, you can reduce your losses.

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

Usoil:The prediction is correct

This is my forecast in the morning. Now that the oil has risen to the middle edge of the trend line, observe the resistance of 78.4.

Judging from the news, the OPEC+ meeting is discussing further production cuts, which may intensify tensions with the United States. At the same time, the market is focusing on whether Saudi Arabia and Russia will extend voluntary production cuts to 2024.Based on the comprehensive assessment of the core member states such as Saudi Arabia and Russia, based on their own interests, they are expected to do their best to maintain the stability of the crude oil market, and there is still some room for short-term prices to rebound.

I also reminded last week that oil is rebounding

From the chart, you can see that the oil has broken through the trend line, and now you need to observe the resistance above.

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

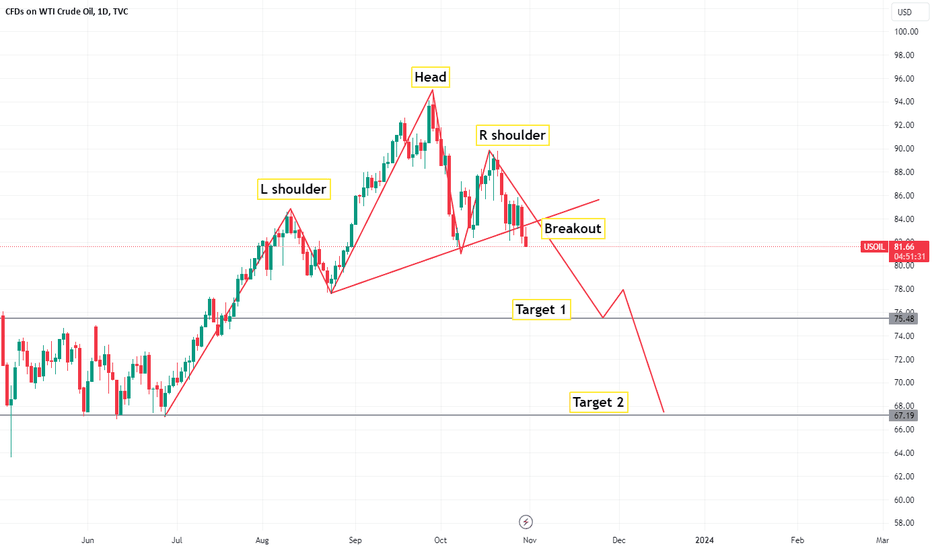

Usoil:Where is the bottom?

The EIA report shows that the inventory of Cushing crude oil in the key hub of the United States has increased, rising to the highest level since August last year.In addition, the monthly report of the American Petroleum Institute (API) showed that oil shipments in October increased by 4.6% year-on-year to 31 million barrels per day.Oil supply increased by 3.2% in October to 28.8 million barrels per day.Oil production increased by 6.1% in October to 13.1 million barrels per day, a record high, an increase of 53,000 barrels per day sequentially.U.S. oil companies are taking advantage of high oil prices to sell oil quickly, and they may also smell some less optimistic news in the future.

However, it should be noted that the OPEC+ meeting is about to be held on November 26th. The decline in oil prices has increased the pressure on Saudi Arabia, Russia and other OPEC+ members. They may continue to maintain their production reduction plans and even ask other countries besides Saudi Arabia and Russia to join the reduction team.

Oil is now on a downward trend, because of the rapid decline yesterday, it is now rebounding

From a technical point of view, oil prices have returned to near the low point in early July. If they fall again, it will test the low point of the year, but I think the weekly level of 67-70 is not so easy to be broken.

Mine share my thoughts every day, follow me, if my point of view is useful to you, please join me and like and comment

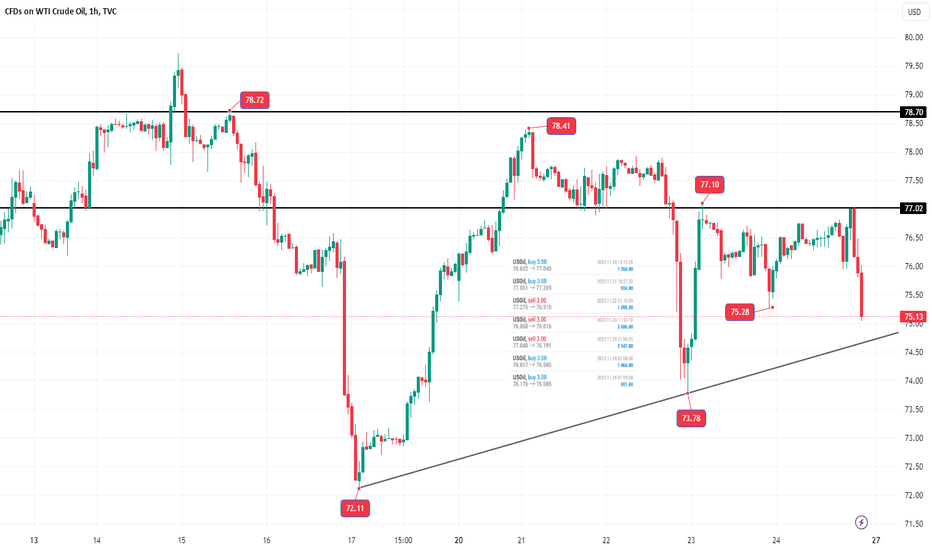

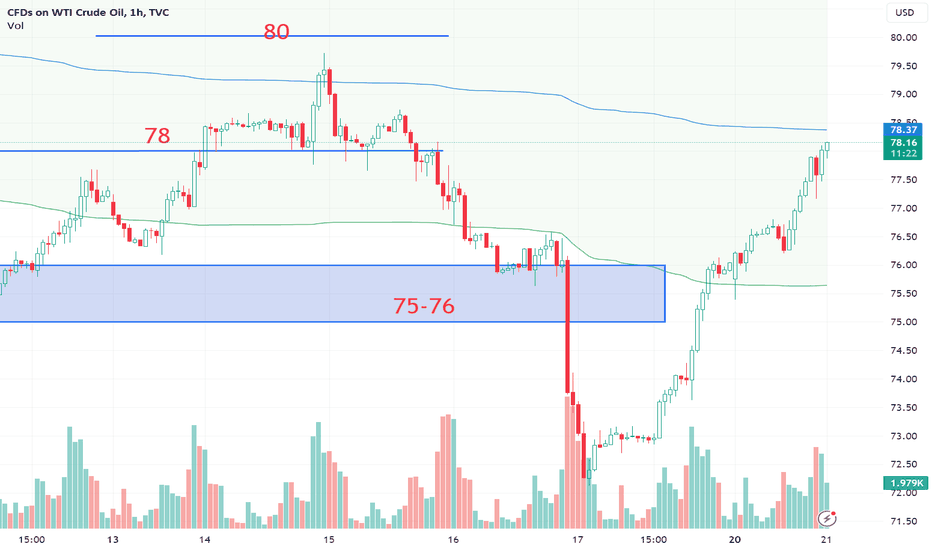

USOIL: Summary of the week

The original income this week was more than 10k, after experiencing CPI data, crude oil fell sharply to 72.2, down nearly 500 points, and rose all the way to near 76 on Friday, basically recovering the decline, next week focus on the break near 76!

Currently there are orders do not know how to operate friends, you can pay attention to me, I will answer for you!

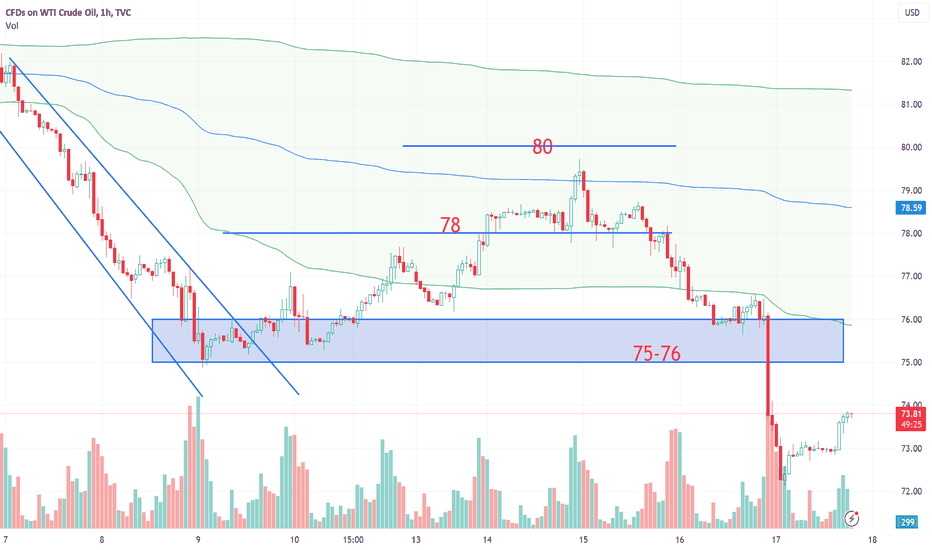

USOIL: Trend analysis and operation strategy

EIA released nearly two weeks of inventory data, a cumulative increase of 17.5 million barrels, more than expected accumulation led to a rapid decline in the disk, of which crude oil inventories reached 439 million barrels in the week of November 3, a higher since August. In addition, the market expects Saudi Arabia to extend production cuts until January next year. At present, the accumulation of expectations is deepening, and the upward movement of crude oil prices is blocked. Yesterday, oil prices on the technical side of the weak unilateral downward trend, ASEM slightly back pressure 76.6 line down to break the bottom, the evening accelerated down to 75 and 74 two integer marks, and continued to close weak near the 72 mark, the Japanese line Baoshu pressure down to break the bottom bardo, closed at a low level for three consecutive days. Oil prices fell 4.81% yesterday, closing large negative line, the decline has accelerated signs. From the perspective of technical indicators, the moving average system helped the downward form to be complete, and the superimposed MACD was located below the zero axis for a long time, and the overall form had obvious short advantages. On the operation, it is recommended to consider the rebound and short, low and many are auxiliary.

WTI Crude Oil Handling Recommendations:

Strategy 1: Rebound near 74.5-75.2 short entry, stop loss 0.6 points, target 72.6-72.2 line;

Strategy two: Callback 72.2-72.5 near multiple single entry, stop loss 0.6 points, the target 74.0-75.0 line.

Currently there are orders do not know how to operate friends, you can pay attention to me, I will answer for you!