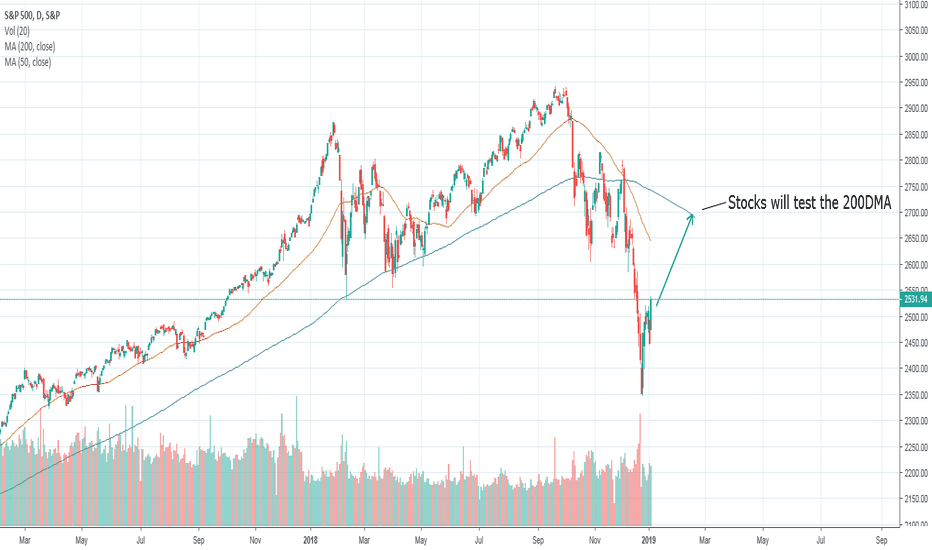

US Stock Market Set to Test the 200DMAHi everybody,

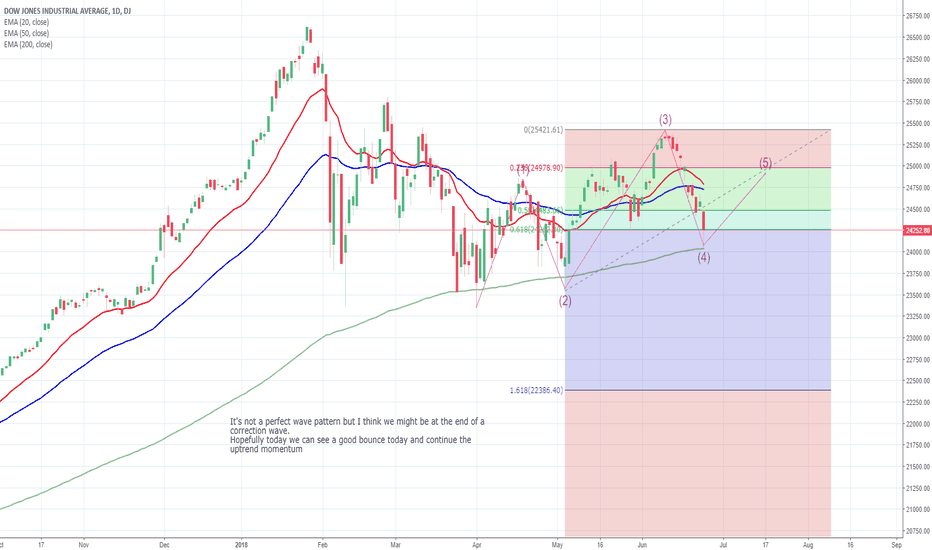

As everyone knows we have seen some massive volatility in the us stock market in Q4 2018. We had a death cross when the 50DMA plunged through the 200DMA, but if you look back in time this in itself doesn't really mean a whole lot. There have been many death crosses which simply resulted in a correction which then rallied only to turn back into a continuation of the bull market.

Is the bull market over? The answer to that question will be answered very soon here. What I expect is for stocks to rally up to the 200DMA and then we will get our answer. If stocks get rejected by the 200DMA and turn lower, then that will tell us that this bull market has most definitely turned into a bear and I would expect a significant sell off. However, if they rally and push through and break through to the upside of the 200DMA then this was just a correction and I would anticipate a rally using the 200DMA as support.

Best of luck and happy 2019!

Usstockmarket

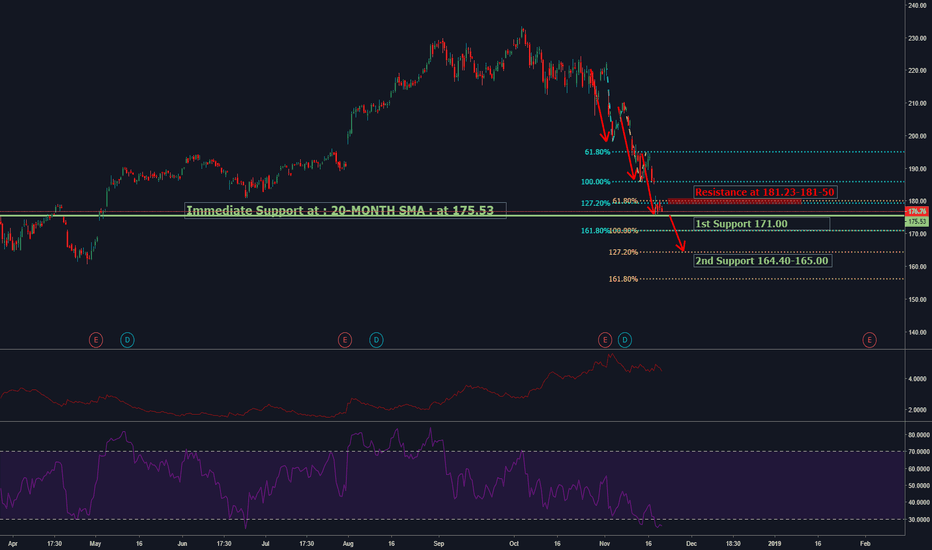

Apple ahead of US Open tomorrowBy Andria Pichidi - November 22, 2018

As US Markets are closed for Thanksgiving day, APPLE closed lower yesterday by $2.76. Apple is approaching its immediate support at 175.53 (20-month SMA) where it could find some support and could potentially rise in the short-term to its immediate resistance at 185.23-185.60 ( area between 61.8% Fibonacci extension and high price after the gap seen on Tuesday).

However as the overall outlook is strongly bearish, on the break of 175.53 , Apple share price could potentially fall to its Support at 171.00 (100% & 161.8% Fibonacci extension).

RSI is at 29, suggesting further space to the downside, while MACD extends lines below signal line.

Andria Pichidi

Market Analyst

HotForex

Disclaimer : This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

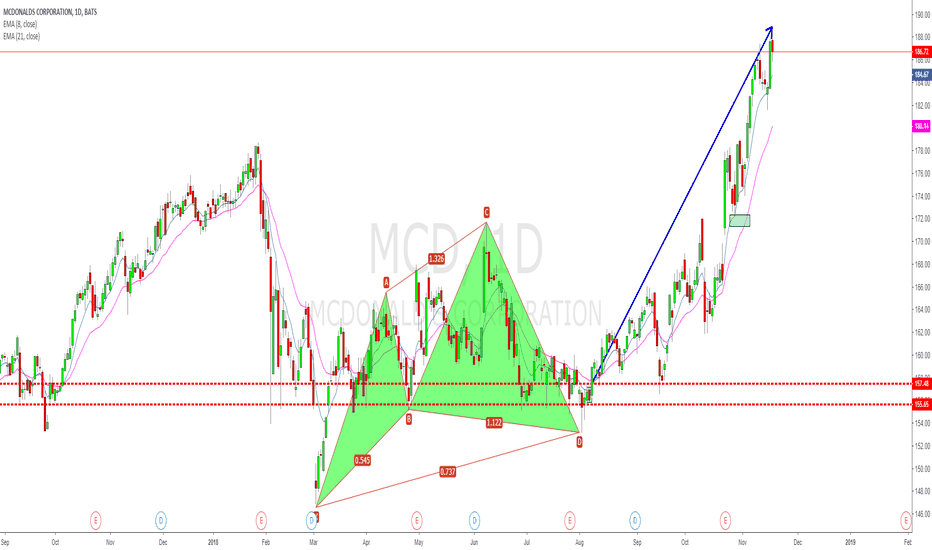

SICK sector rotations to defensive stocks for US stock market!I posted so much less stock ideas this quarter as generally I like to long stock that I'm willing to invest, and look for bullish set-ups.

While even I'm still bullish in so many names, but there aren't so many bullish set-ups in this market.

Wait a minute, defensive stocks are big exceptions and perfect choice for bottom-up strategy recently, and it's more than reasonable!

KO

PG

MCD

YUM

COST

and other classic defensive names like VZ, JNJ, MRK, PEP all showed great relative strength than the market!

(T is the lagger though)

That is, P/E ratio for tech stocks encounters huge corrections and the money come out of them just ran into these defensive stocks.

U.S stock market is still the top choice as there aren't many better alternatives.

While, investors tend to turn money into defensive stocks to fight for fluctuations.

In conclusion, it's still far from a financial crisis and it's still not too late to look for long opportunities in this sector!

Let's see how it goes!

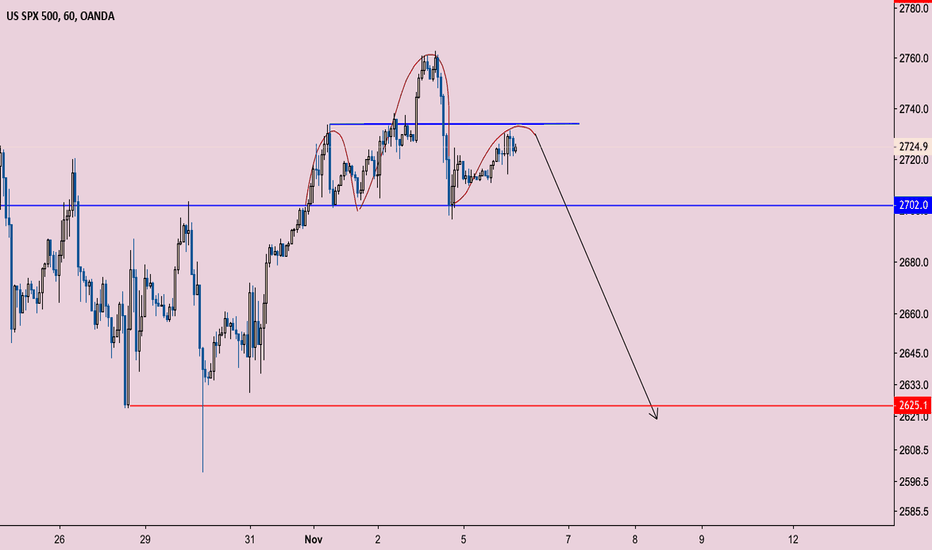

US stock markets in for the next leg down SPX500 is showing clear signs of bearishness with the formation of head and shoulders tops, 2730 level being the clear resistance. We will have confirmation of downtrend underway once the hourly candle closes below 2702 support level.

I expect the market to make its move following US midterm election's results

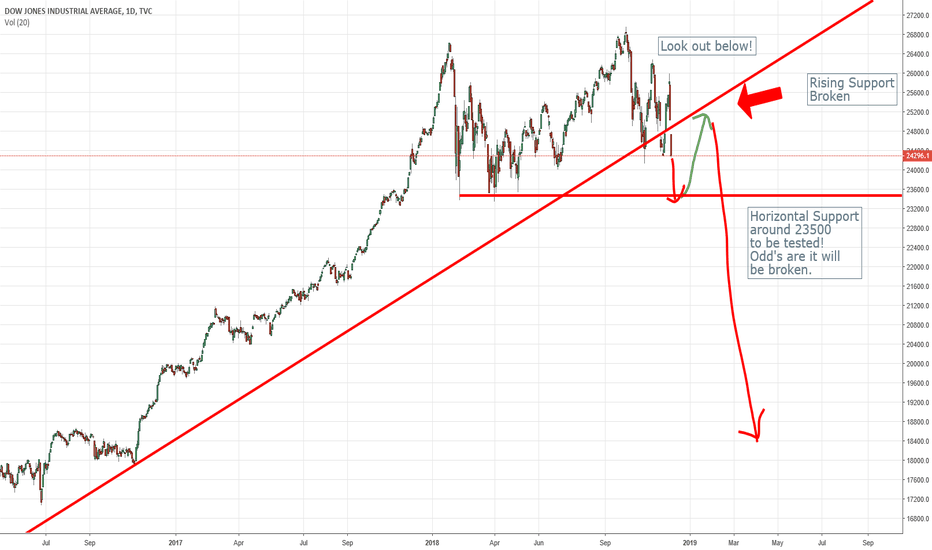

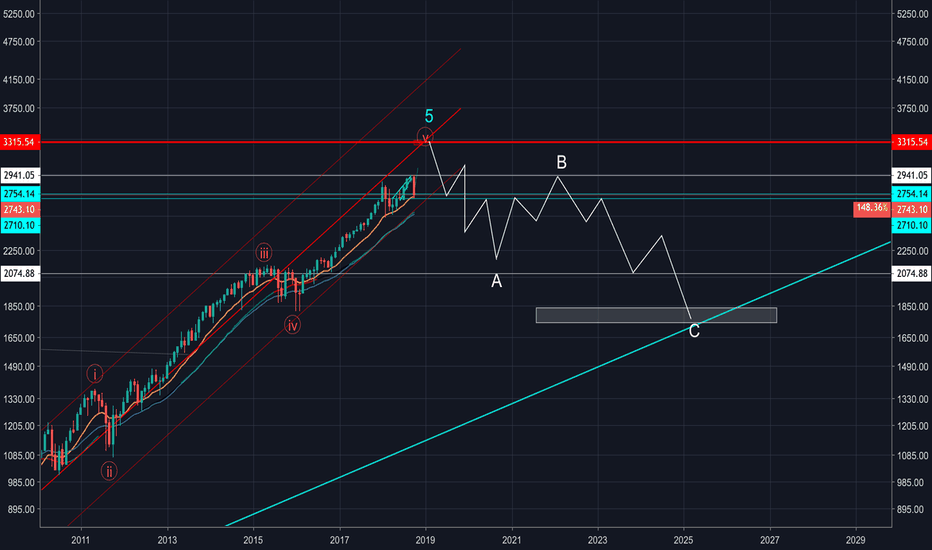

Be careful shorting before the topIn my chart analysis I indicated my future expectations for market movement.

I know that my perspective is that of the minority, but it's always worth looking at the market from a different perspective, as it may just save you from a massive loss.

As always this is simply for educational purposes and not financial advice*

Good luck trading,

Zerotozeros12

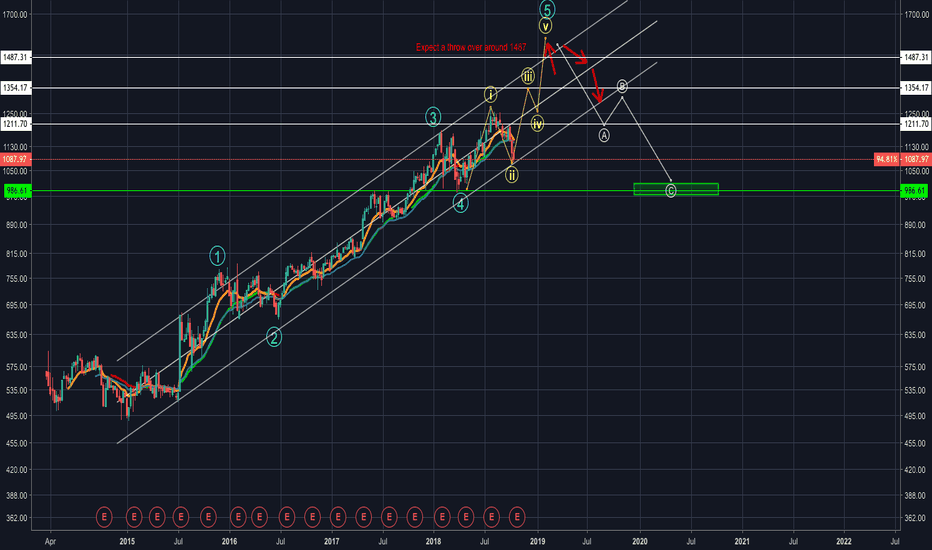

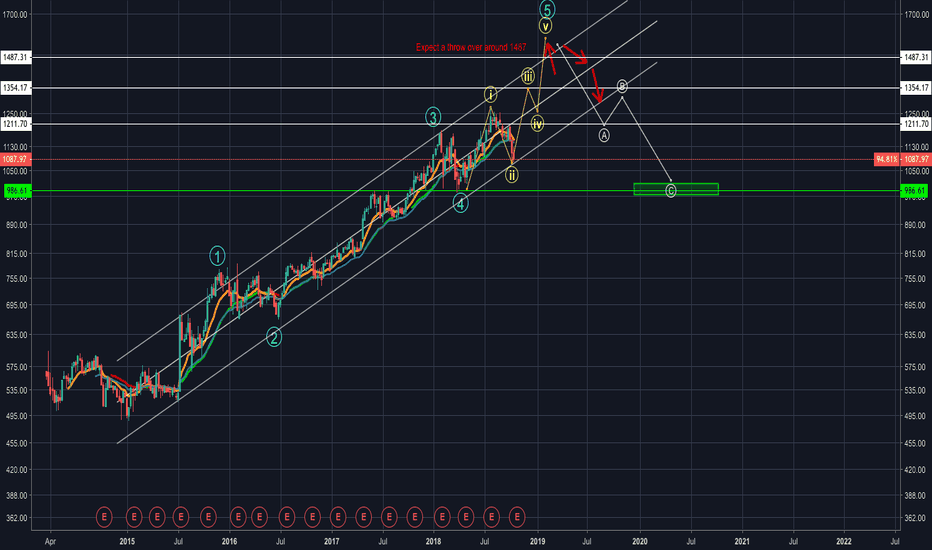

Expect google to reveal positive earnings!October 25th google will post their earnings; I expect that they will be positive (along with many other leading tech sector companies). This will lead to one last rally in the market.

I indicated on the chart where I see Google reaching out to, prior to a massive throw over following shortly after. One second the whole market will be elated by new highs and the next second bear selling will completely devastate any that are holding longs. I will likely close my position slightly ahead of target and begin opening shorts around 1450 and double down as we get closer to target. I know my perspective is that of a minority, but I believe that it is worth considering before fully committing to a bearish mindset.

*As always this is not financial advice and is intended for educational purposes only.

Let me know what your thoughts are on the market and where you see us heading!

Good luck trading,

Zerotozeros12

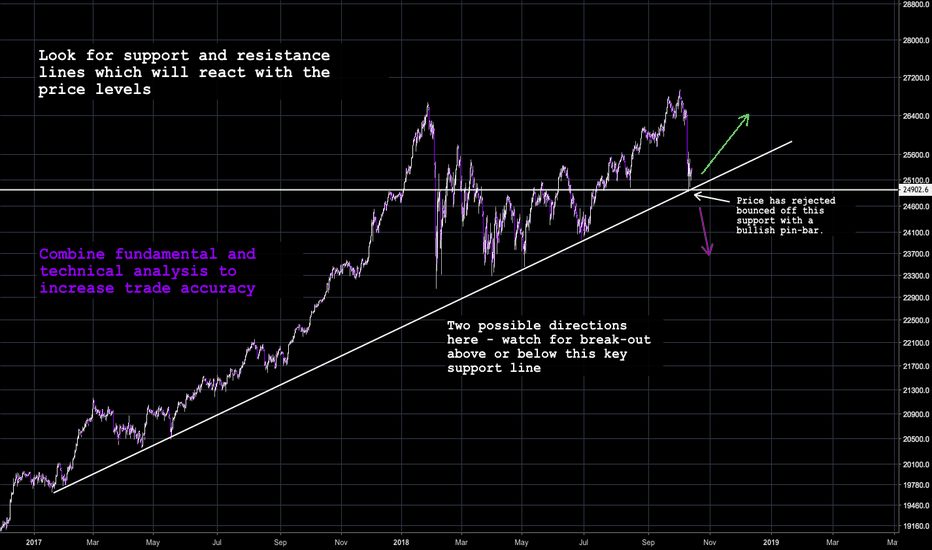

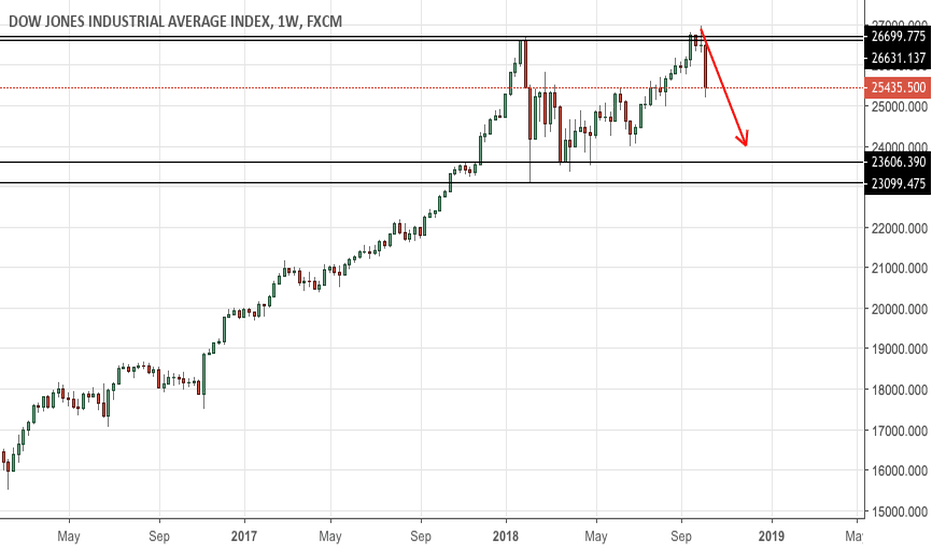

Key price level for US Stock Market - Neutral With the US30USD price sitting at a strong horizontal and upwards trend-line support - the market technical analysis here points at upwards movement (Strong pin-bar bounce from support line).

Although our market analysis points towards a potential move up, you should only enter a position if you see a strong break-out above the 25,500 level.

The DJIA could still be under pressure from the increased interest rates and geo-political tensions, if the bears are able to move the price down below this key support level then the market is in serious trouble and there could a downtrend formation in play.

You should always combine a fundamental and technical analysis together. This can give you a much better insight into where the market is looking to go. Simply using technical analysis is not good enough.

This is not investment advice - Losses can exceed initial deposits when trading. Good luck!

S&P 500 SPXFear is in the market, reasonably so, after such a huge drop. We haven't seen anything like this since February. Many are suggesting that this is the beginning of the bear market, if you're one of those individuals, I'd recommend waiting for more signs to support that idea. As If things end of playing out the way I believe they will, you will end up with a large loss. Not to say that I am correct and you are wrong, but simply suggesting that there is an alternative count and to be careful, I'd hate for you guys to get sucked into a trap. Expecting a bounce to begin around the 2680 range and followed with strong upward momentum.

AS ALWAYS THIS IS NOT FINANCIAL ADVICE

For educational purposes and a means to share ideas.

What do you think is happening in the market?

I'd like to hear your ideas!

Zerotozeros