Overlooked silver explorer-developer with no debtGolden Minerlas Company ($AUMN)

This is a Delaware corporation based in Golden, Colorado. The Company is primarily focused on advancing its El Quevar silver property in Argentina, as well as acquiring and advancing mining properties in Mexico, Nevada and Argentina.

The following is not investment advice, but simply captures my personal observations:

The market seems to have completely forgotten the stock; The most recent seeking alpha articles date back from 2014, for example. Current valuation reflects this, with a face-ripping 99% drawdown from its peak.

Management, however, has invested in expanding the resource base during the depth of the PM bear market, and now just entered in a new JV agreement with the potential to broaden their resource base even further (see: www.marketwatch.com)

That news seems to have sparked a break-out.

Now we see this breakout being backtested. I don't see increased volume, and I suspect silver bugs are mostly overlooking this stock still. Its marketcap is tiny at only 30M, so it won't take much to start making waves and get noticed....

Valueinvesting

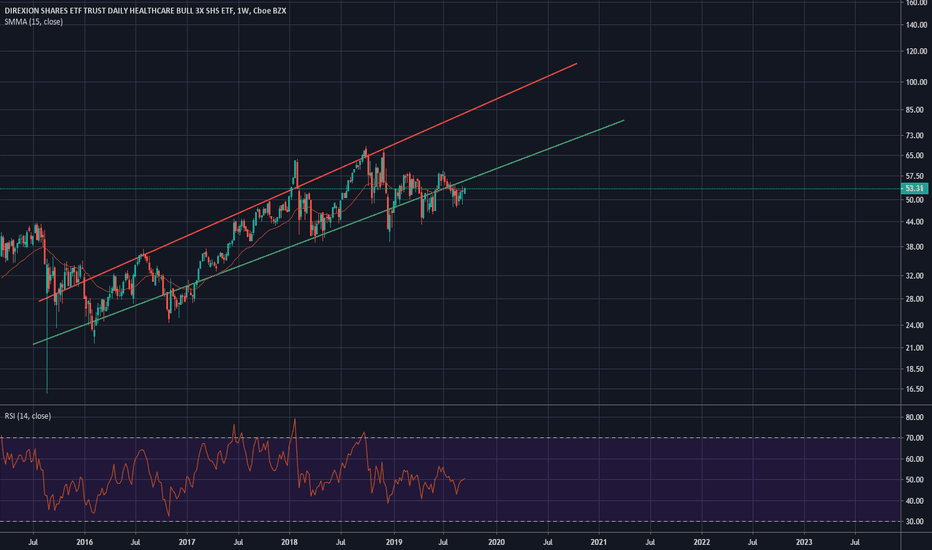

‘Growth’ stocks are making a comeback versus ‘Value’The market saw a big shift in early September when money started pouring into “value” stocks, like banks and energy. Investors had neglected them for years and they were supposed to benefit from the U.S. and China ending their trade war. But that’s been fading in recent weeks, especially with Apple and Microsoft flying to new highs.

This hourly chart compares two major ETFs tracking the two buckets of companies: The Vanguard Value ETF (VTV) and the Vanguard Growth ETF (VUG) .

Notice how VTV initially surged ahead of VUG on September 5, right after Beijing confirmed it was holding trade talks with the White House. That strength continued until about two weeks ago.

The first setback was President Trump talking down hopes of a trade deal with China. Then came some weaker economic news – especially industrial production on November 15. Those two catalysts have dragged interest rates back lower and undermined one of the basic arguments in favor of “value.” Meanwhile, GDP estimates from the Atlanta Federal Reserve have nosedived from 1.5 percent to under half a percent. Topping it off today, oil is breaking down.

A backdrop like goes against the “value trade.” It could mean to watch out for a pullback in the banks because financials are the largest sector in the value index. But it could also help restore interest in the big Nasdaq companies that have led the market for years.

USO XLE QQQ

Tailored Brands (TLRD) due for a bounceTLRD has received a ton of negative press, sentiment is negative, price action is $h!t BUT bullish divergence is showing. Seems like a ripe one for a pump. However, dont bet your life saving on it. Still a $h!t stock although many argue its a great value stock

DOW Dupont Chemical: Value play (6% yield)Graph says all. PE = NMF, they're losing money and stock's been in down channel for quite a while; but the dividend yield at $44 is 6.4%; analyst expectations estimates agree DOW is going to earn more next year in FY 2020 with resizing and trimming, efficiency improvements &tc. Revenue is growing; From $3.4 RPS FY 2019 is expected to go to $4.4 RPS next year and may become profitable again thereafter. Mean target price = $54 based on these estimates. Still paying the >6% dividend; they pay you to wait, and you can sell weekly or monthly calls every month forever. I did a buy-write on just 200 shares/2 Oct calls.

Will add more if we get a full correction; support is around $40, so you can sleep at night holding these over long-term. It's a "Dogs of the Dow" theory value play!

This is not investment advice, just a pretty darn good trade idea IMO; trade at your own risk and consult a certified financial advisor before you plunge in here; GLTA!

SP-500/ Gold - How to Buy Shares 90% Off - ValueCyclesSP-500/ Gold - #ValueCycle Analysis

*Note that the vertical price axis reflects the number of ounces of gold required to purchase 1 share of the SP-500

*I understand there is a lot going on with this chart, but bear with me as i walk you through it (see worked example below)

Macro Analysis: Lower Chart

- After the lunacy of the tech wreck in the late 90's into 2000 the ratio peaked at just shy of 5.5 oz to 1 share of the SP-500 (obviously this would be more pronounced if we were looking at the Nasdaq)

- From the peak in 2000, the value of the SP-500 has plummeted largely unabated until 2009 - 2011, finally hitting a low of around 0.5 oz at the time of the financial crisis and the introduction of Central banking QE,

- This means that had you utilized this pricing/ entry method you would have been able to sell your shares at 5.5 oz and buy them back for a 1/10 of the price (illustrated with the red arrow)

- This eventual bottom also coincided with the 90% bubble fib retracement level (a useful level, few people utilize)

'Near-term Analysis: Upper Chart

- As you can see the SP-500 has stalled at the 38.2% fib retracement (possibly a dead cat bounce on the way lower)

- This, coupled with the broader macro economic outlooks (weaker economic data, weaker manufacturing and greater Geo-political tensions) makes a strong case for this to result in higher gold prices (thus a lower ratio of stocks to gold)

- I think it quite likely that the Fed will have their hand forced and will resume QE or some other form of stimulus to prop these markets up, but the beauty of this system is that you are pricing the assets in a more stable, non-inflationary numeraire, one that under such QE/ central bank intervention would thrive (thus revealing the true depreciation in value of the underlying)

Putting it all together: An example

- E.g. Sell your 10 Shares of SPX at 5.5 oz (red arrow) = 55 oz ($250/ oz) = $13,750

- Re-enter stocks at the green arrow for 0.5 oz/ share = 110 share of SPX (55/ 0.5) = $104,500 (55 oz times $1900/ oz)

- Convert your shares back to gold (2nd red arrow) at 2 oz / share = 110 shares times 2 oz/ share =220 oz = 220 oz times $1520/ oz = $334,400

Total return = 2432%

But more importantly, you have been able to leverage your existing holdings to acquire a non-depreciating asset, in this case gold (but there are many, many different options available to those who can properly utilize this strategy).

If you liked this idea, let me know, give me a follow, thumbs up and follow my Twitter so you never miss a trade/ investment idea a

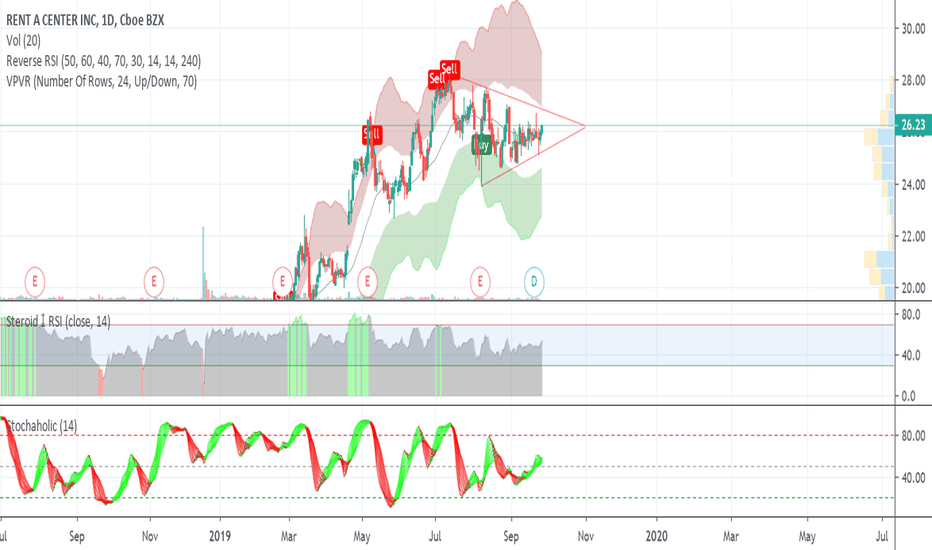

RCII forming pennant, likely to run againRCII has a 9.3/10 Equity StarMine Summary Score, has beaten analyst estimates on its last 5 earnings reports, and has grown earnings by 113% this year. Its P/E of 12.3 is quite attractive for a growing company.

Here's S&P Capital IQ's analysis of the fundamentals, scored out of 100:

Valuation: 99/100 (extremely undervalued)

Quality: 98/100 (extremely high quality)

Growth stability: 97/100 (extremely stable)

Financial health: 95/100 (extremely healthy)

Man. You don't see numbers like those every day. About the only thing RCII *doesn't* have going for it is that rentals aren't a very sexy sector. This isn't going to run like a Tesla or a Beyond Meat. Still, this is a very solid stock that should climb out of its pennant soon, in my opinion. Set a stop loss beneath the pennant bottom.

Edit to add: 1) several directors added shares on September 6, which I assume was part of their compensation plan, 2) RCII's price stayed stable after its dividend, which is always a good sign, 3) RCII got upgraded by Recognia today after the algorithm detected a breakout. I think this was a false positive, but it could move the stock price up anyway.

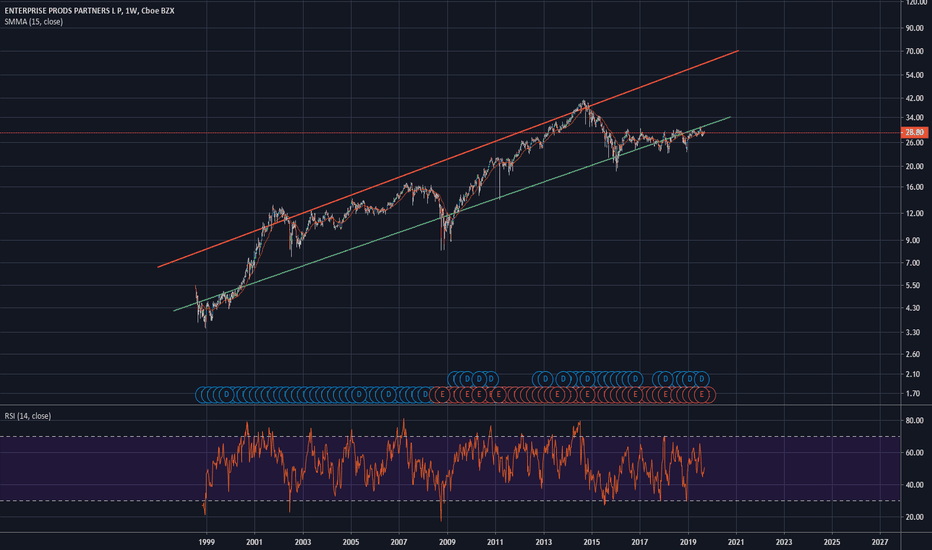

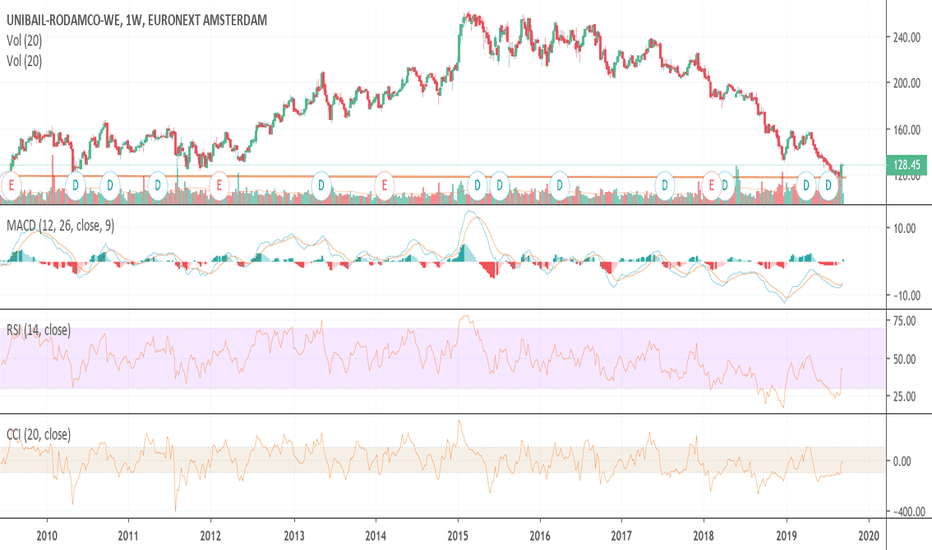

10-year low resistance! HUGE dividend yield (10%)The stock has been striked by fear of the internet! However, it has hugely overdone it.

The stock is trading at P/NAV of 50%. Basically you are buying the assets for a 50% discount.

> The reason? Investors will take out all the need for physical stores.

However, what they don't realize for URW is that they are mainly in A-locations. The malls are actually increasing in rent (4%+ growth year on year) and fully utilized (95%+ always).

The stock gives you today therefore a dividend yield of 9-10% depending on the price that you buy it.

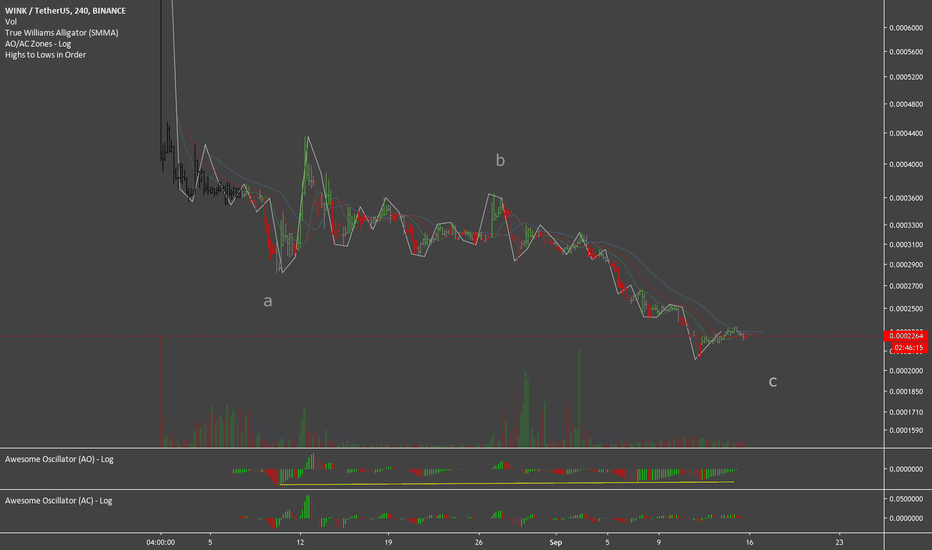

WINk in Large Bullish Divergence & Fundamentally UndervaluedThere's currently a large momentum and acceleration divergence forming on WINk, this will likely play out relatively soon and I think that as the larger crypto bull market begins WINk will be a top performing asset for the following fundamental reasons

1) WINk pays large dividends in TRX, which will be a top performing cryptocurrency because it is the largest dapp platform in the world, scalable, instant and free.

2) More games are being developed and added to the platform, and independent developers will be able to build on it soon too

3) More gaming licenses are coming, like New Jersey and Europe

4) Already posting strong numbers from organic marketing

5) Paid marketing begins in 2020, will see a massive explosion of the user base and dividends

6) Already secured partnerships with major sports organizations like Liverpool

7) WIN represents the best example of an income producing crypto asset that is tied to a decentralized application

8) Highest USD volume of any DApp on any blockchain

Also from a value standpoint:

WIN earns about 4,000,000 TRX/day on average or 120,000,000 TRX/month or 1,440,000,000 TRX/year

At current prices this is about $22,000,000/year

Earnings Per Share = 22,000,000/220,000,000,000 = 0.0001

Price/Earnings Ratio = 0.0002255/0.0001 = 2.255

Average P/E Ratio in online gaming industry usually over 20, making WIN significantly fundamentally undervalued, on top of being the most innovative platform in the industry. Also these are very conservative numbers as income and dividends are likely going to increase by orders of magnitude when paid marketing begins and the price of TRX increases. Wouldn't be surprised to see this over a dollar one day after developers finish building out the platform and really begin marketing it.

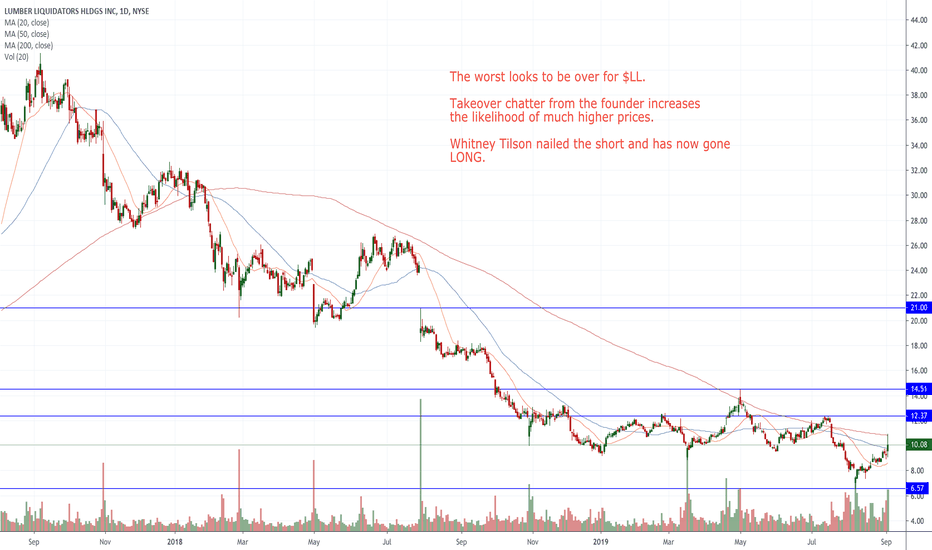

$LL A Good Risk/Reward SetupWe believe the worst is over for $LL.

Well-known investor Whitney Tilson called the Short, but has now gone LONG.

Headlines of Sept 4:

Lumber Liquidators (NYSE:LL) soars after founder Thomas Sullivan presses the company to evaluate strategic options, including a sale.

Sullivan tells Bloomberg he is considering putting a bid together himself with private equity investors. A long-term plan from Sullivan could be to combine Lumber Liquidators with Cabinets To Go, which he founded in 2008.

Sullivan also called out the LL board for overspending.

As always, use protective stops and trade with caution.

Good luck to all!

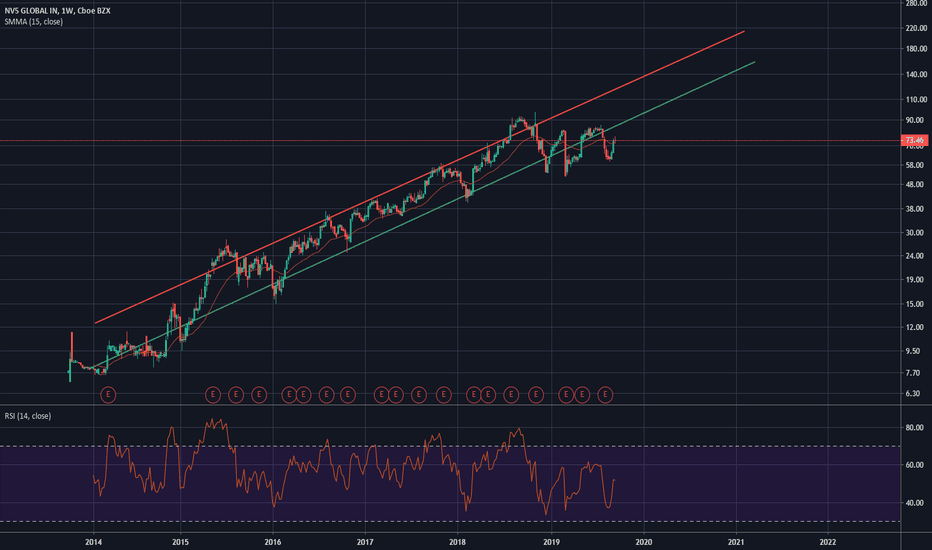

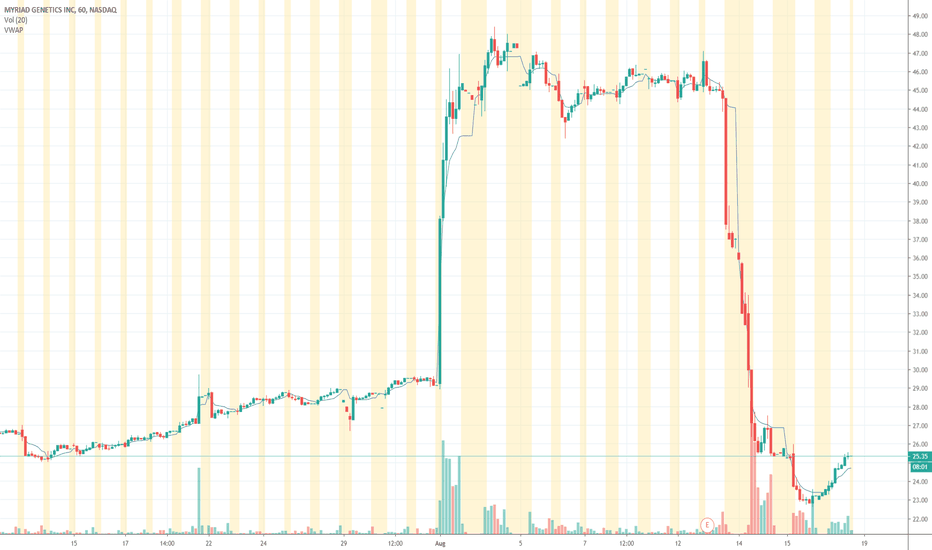

Looking for a Nice Rebound to 31I think this stock will recover some of it's losses, regardless of the outcome of the potential FDA restrictions on drug suggestions. The stock has a solid business model and the company has said they are seeing increased demand. This new fields of genetics testing still needs to establish itself in the healthcare payer ecosystem, which presents some risk, but all in all I think the fundamentals are sound, making this a buying opportunity.

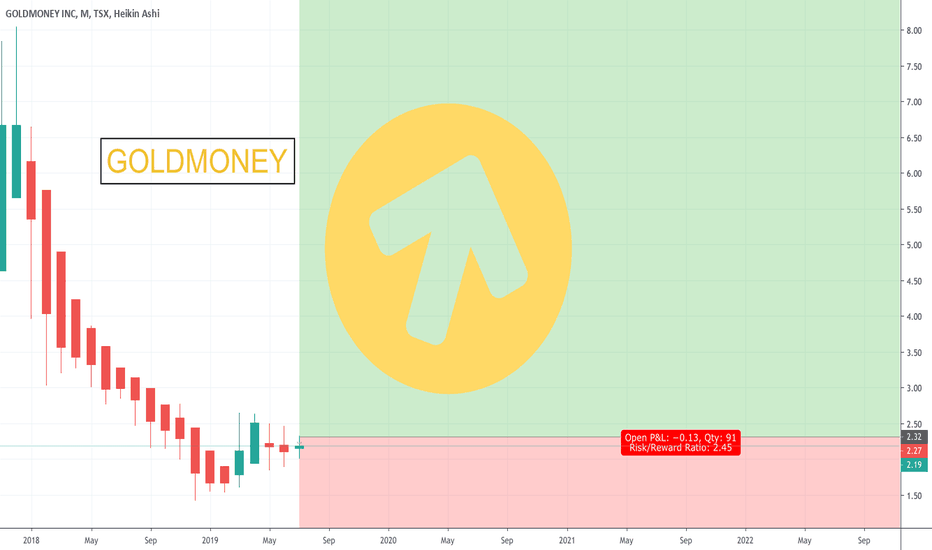

GOLDMONEY SHARE - 400% OPPORTUNITY?COMPANY & BUSINESS MODEL

GoldMoney is a Canadian financial technology firm listed on the Toronto Stock Exchange.

The company is a precious metals payment network, offering precious metals investment services to a broad audience.

Legally regulated Goldmoney Holding, based on the company's patented technology, allows customers to open a warehouse account that they can manage online.

Customers can invest in gold, silver and other precious metals stored in insured vaults in various countries. The stocks are customer tracked and can be physically repurchased.

Goldmoney also holds interests in "Mene" & Schiffgold, both e-commerce jewelry providers and "L & B Trust", gold-based lending. The crypto business has left Goldmoney again at the end of 2018.

CUSTOMER BENEFITS

The fear of a bank collapse? Goldmoney helps. The customer is not dependent on the solvency of his bank as usual. Where the mass currently does not worry too much, as you firmly believe in your deposit insurance.

In many countries, inflation is high and people are afraid of further devaluation. There are also extreme examples like Venezuela where the fiat money is practically worthless. The prices increase. The cash withdrawal is only very limited possible. In Europe we can not imagine that "yet".

With the Goldmoney Mastercard the customer has a decisive advantage. The gold is physically deposited. The value remains stable in a crisis or even increases massively. If the customer wants to pay with the card, he can do so in his desired fiat currency.

The fee model is m.E. very fair.

BUSINESS REVIEW

- Share is not significantly above book value

- Low schooling (equity ratio above 90%)

- Big cash & gold stocks

- Attractive investments (growth investments)

- Organic growth is right

EXCLUSIVE RESEARCH

In so-called field research, among other things, they talk to the management, make surveys and put the services of the company through their paces. However, please understand that I can not share all the content with you here.

However, some information is also available internally. Among other things, no less than George Soros is involved in the company. (Source by PN) Soros is one of the best known and most successful investors. His investments have made him one of the richest people in the world.

The company founders also hold significant shares in the company.

OPPORTUNITIES

- Timing could fit well (rising gold price)

The price of gold is currently bullish. That should have a very positive effect on Goldmoney in many ways.

- Rating

The market has not even begun to notice how attractive the valuation of Goldmoney shares currently is.

- Crisis Share

The ultra-loose monetary policy will one day take great revenge. The hype about cryptocurrencies comes not by chance. In a crisis Goldmoney could become a high flyer.

- Takeover

For various reasons, I think it's not unlikely that Goldmoney will one day be taken over. Nevertheless, I prefer, of course, if Goldmoney remains independent.

RISKS

- Customer is king. Customer satisfaction needs to be improved

- New laws

Historically, there have already been "gold bans". Here, however, the advantage is that the gold, outside the EU, is physically stored and legally owned by you. In an emergency, you can immediately change your gold holdings into fiat currencies or alternative assets, or even physically purchase them.

- Competitor

Among the competitors should count Libra, where I put Libra in the same drawer as Apple Pay and so on.

Although Libra has an extremely large network and can reach the potential customers through your reach (Whattsapp, Facebook, etc.) very quickly. However, Libra is anything but crisis-proof. The client must open a bank account and also has an exchange rate risk & liquidity risk.

At the moment the politics is in the middle of what is a big risk for Libra.

- Copy of the business model

I think this unlikely because of the high entrance barrier, patent rights and infrastructure.

CONCLUSION

Goldmoney is a good deal for me as an investor.

I regard this participation as a kind of insurance. In the event of a crisis Goldmoney could go through the roof (rates beyond 10 CAD) Currently, Goldmoney is still quite unknown, which will hopefully change soon.

As Fiat money grows, Goldmoney's customers should grow as well. Sounds silly, but it is.

The company has a solid balance sheet. The current price is not far above book value which indicates that the down-risk is limited.

Reputable investors like Soros are invested. That makes me in addition positive.

Disclaimer:

Disclosure pursuant to §34b WpHG due to possible conflicts of interest: I am regularly self-invested in the securities included in the investment universe. I take no responsibility for any consequences or losses that may arise from using my information.

Risk Warning:

The instruments mentioned here do not constitute investment advice or solicitation to buy or sell any securities.

Securities may be subject to high volatility.

In individual cases, this can lead to the total loss of the money invested or even to considerable losses.

There is no liability for loss of assets.

In addition, I point out that I personally hold positions in the respective genres and can dissolve at any time.

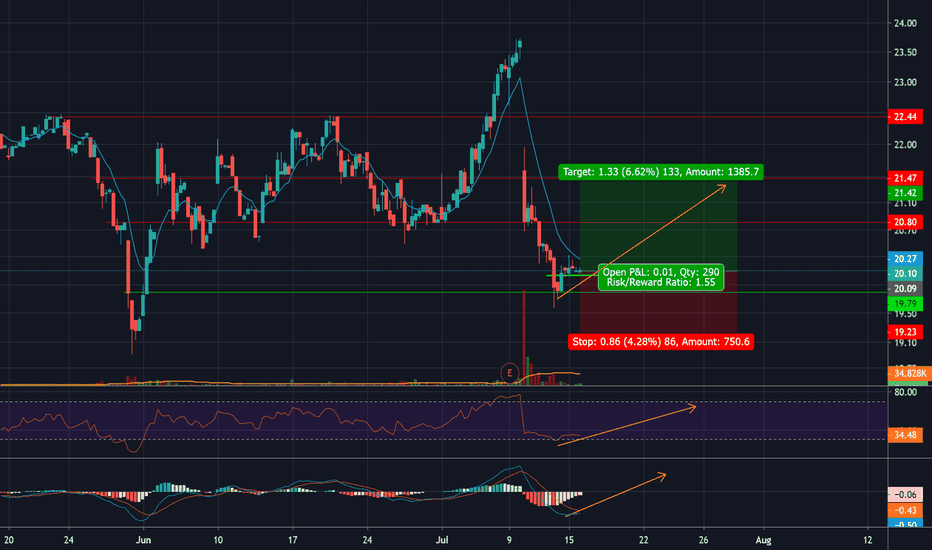

LONG LEVI REVERSAL Upwards, established SUPPORT, RSI OVERSOLD,THE MAIN REASON TO WHY THE STOCK FEEL MORE THEN EXPECTED WAS BECAUSE EARNINGS DID NOT BEAT LAST YEARS BUT THEY ARE STILL POSITIVE. THEY ARE A PROFITABLE COMPANY BASED ON THEIR FINANCIAL STATEMENTS, CASH FLOWS, AND BALANCE SHEET.

INDICATORS:

RSI: IT IS AT 34, WHICH IS REALLY LOW AND IS HEADED UPWARDS SINCE IT WAS AN OVERREACTION. THE COMPANY WILL EASILY GO BACK UP AT LEAST A 1 UPWARDS.

MACD: IT IS ABOUT TO CHANGE MOMENTUM IN TERMS OF UPWARDS TREND. IN A DAY OR SO FROM NOW IT SHOULD BE POSITIVE MEANING GREEN MOMENTUM UPWARDS.

THE REVERSAL IS HAPPENING.

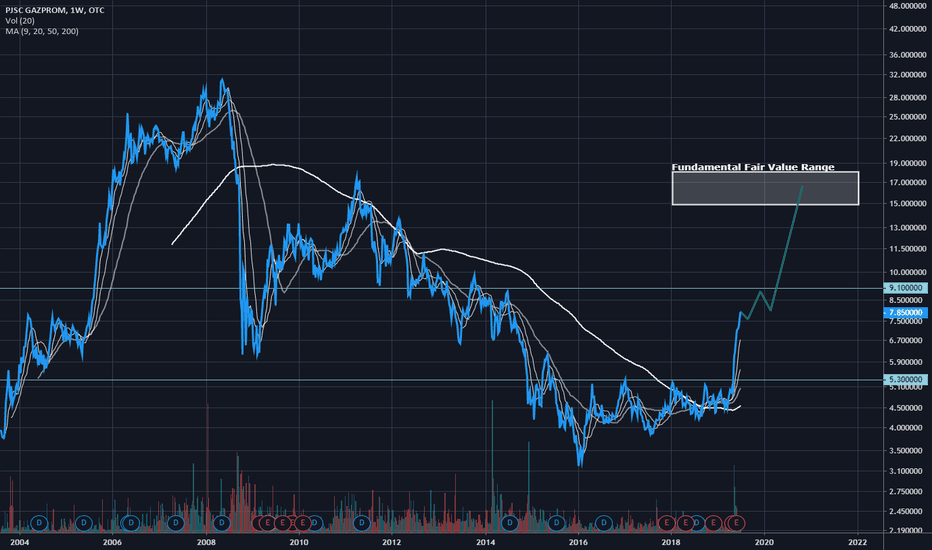

Why Gazprom Has Plenty of Fuel Left in the Tank.Gazprom has been undervalued for years, so why buy today? The price spike of 2019 shows a change of sentiment. Investors are now willing to dip their toes into Gazprom.

Statistically, stocks that are trading at 12-month highs, perform better in the long term than otherwise. So the 2019 price spike is actually another good reason to consider investing in Gazprom.

Looking back over the last 4 years, Gazprom failed to break above $5.3 (a technical “resistance” line). Making any buy above $5.3 a good entry point into Gazprom. That line was breached in 2019, and since then Gazprom rocketed up. Where is the next resistance? Potentially around $9.1 where historically there has been a lot of price action. It would not be surprising for Gazprom to range in this area for a time. Beyond that, the air is clear.

Arguably the most important thing to look at from a technical perspective is momentum. Momentum is the trend (up or down) of a stock’s price. Gazprom has been in a downward trend, below the 200 Day Moving Average (DMA), for most of the last decade. However, recent spike above the 200DMA has put Gazprom back into “buy” territory. This is a classic example of what Jim O’Shaughnessy would call: “a cheap stock on the mend”.

Cheap from its fundamental valuation, with price appreciation on the mend.

Daimler post-dividend drop offers buying opportunityDaimler recently gapped down in a big way after its dividend and a CEO change, which offers an opportunity for investors to get back in at low prices. Daimler isn't the sexiest automotive company, but it's fast becoming a leader in the autonomous vehicles space. It's already got a level 2 autonomous rig on the road, cutting the cost of traffic incidents by 95%. By 2025 it expects to field a fully autonomous truck. Whatever you think about putting truck drivers out of business, this is bound to be insanely profitable for Daimler.

Analyst ratings on Daimler are super mixed, mostly because some analysts are more forward-looking than others. Last year Daimler's earnings were down year-over-year, mostly because of R&D costs. However, the company delivered a solid earnings beat in Q1 on the strength of its autonomous truck business, and I think it will solidly beat estimates again in Q2. In the meantime, Daimler's formed a nice, gentle upward channel. Pick it up on pullback to channel bottom for a steady return until next earnings on July 25. Analyst upgrades or earnings estimate revisions could benefit the stock before then.

Note that Daimler trades as both DMLRY and DDAIF.

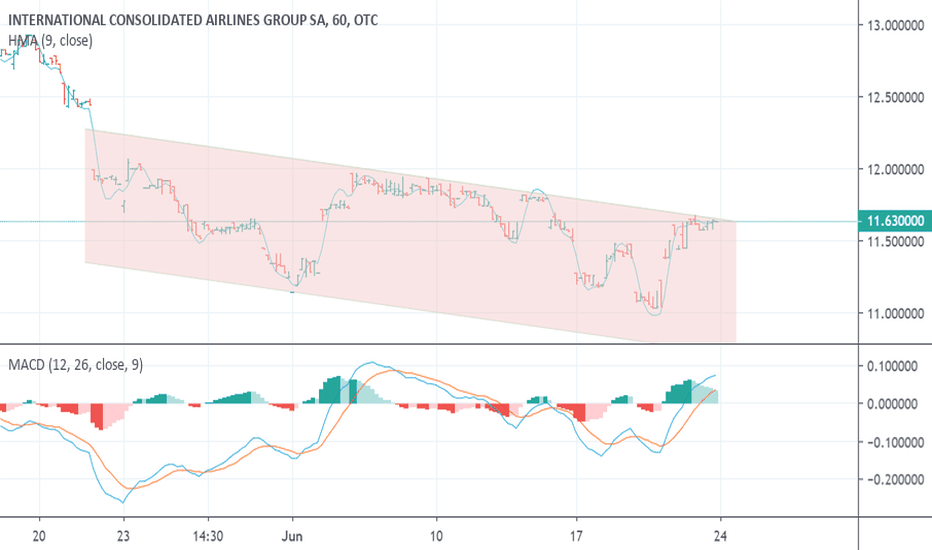

ICAGY short-term short play -- currently near channel topICAGY is a great value stock, and I've been watching for a turnaround for a long time. It's got excellent analyst ratings, a good dividend, and a great P/E.

Unfortunately, it's been in a downward trend for months and is likely to continue downward until a significant catalyst such as a beat on the August 2 earnings report.

It got a bump a couple days ago when it announced a big order of new Boeing jets, but this only pushed it to the top of its channel. With a lower high and bearish divergence on the MACD, I expect a turn downward toward channel bottom on Monday. The alternative is upward channel breakout, which is unlikely but would be nice.

Sidenote: ICAGY always does really well in November, leading up to its dividend payout, then drops hard on the ex-dividend date. That'll be a good month to go long on this stock, if not before.

Bluzelle: 12M Cap on Binance / Decentralized DatabasesBluzelle built a decentralized storage technology that makes it an edge network. This ensures that data is as close to the customer as possible, leading to fast performance. Current data storage systems are centralized. This makes them vulnerable to attacks, system failures, and performance issues.

Bluzelle’s servers are spread out all over the world. These servers are interconnected and they each replicate the same data. Customers can request data and the request will be fulfilled by the server that is able to respond the fastest. Thanks to this massive replication, even if a server goes down, it does not matter as all the other servers can handle the same request. New servers can be deployed at any time to replace existing ones or to increase geographic availability. Much like how Cloudflare fulfilling requests for web content on the edge, Bluzelle fulfills requests for data.

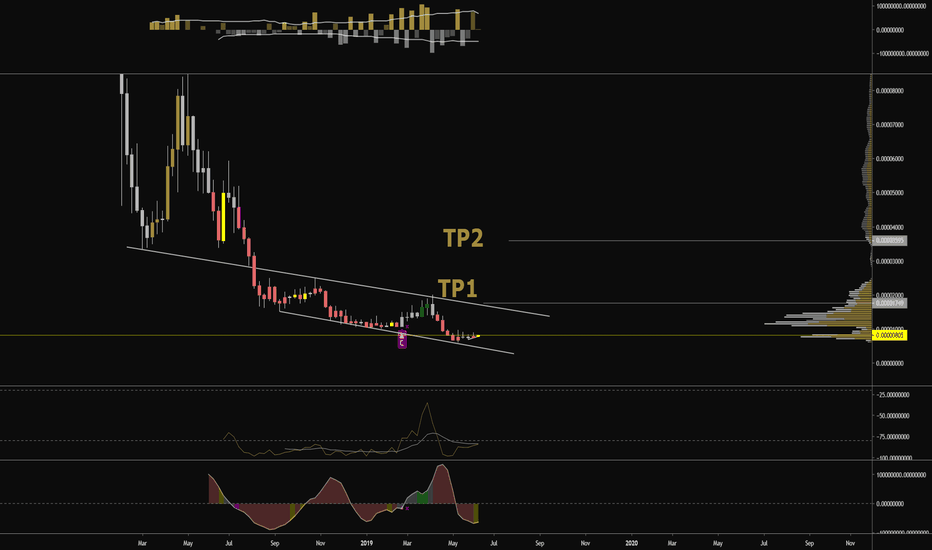

TA:

Bluzelle is currently bouncing from the bottom of the channel where it has resided for the past 10 months. Willy indicator has crossed upwards and volume has picked up significantly. Three drives to the downside on the weekly chart indicate a potential exhaustion from sellers.

FA:

Bluzelle is one of the lowest market cap coins on Binance, currently sitting around 12M total cap.

Bluzelle is a technology project w/ low hype and high development. The trade is not crowded.

Bluzelle has a live data cache product with 30x the performance of the competition: blog.bluzelle.com

Bluzelle will have nodes with node requirements. All services are paid for in Blz.

Two targets are posted on the chart for traders... but I believe Bluzelle has the ability to go much higher for the patient investor.

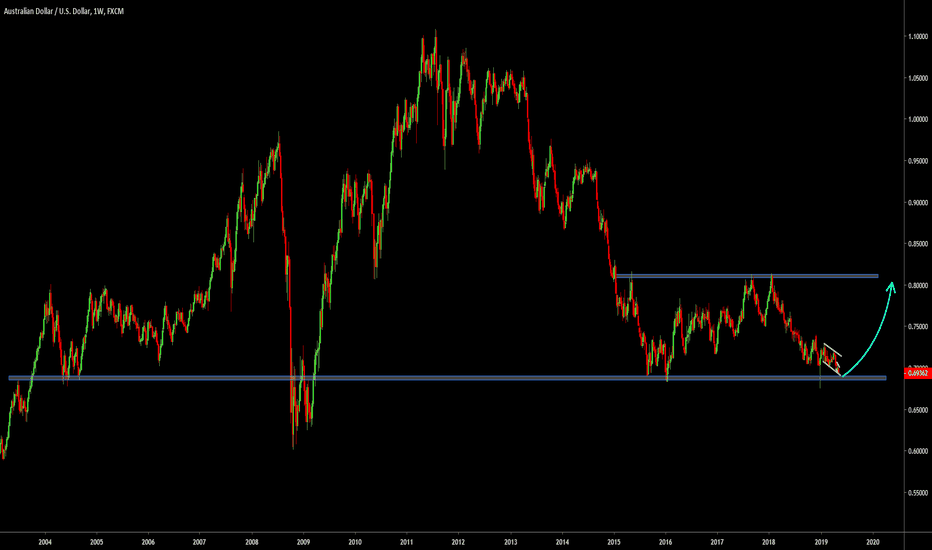

AUDUSD 1,000 PIP POTENTIAL. LONG TERM BULLISH (Heaps of Upside) AUDUSD WEEKLY

minus a brief stint in the midst of the financial crisis, AUDUSD hasn't seen price maintained below .6900 for over 15 YEARS!!

As a long-term value play I can't think of a better opportunity at the current moment,

Heaps of upside.

1,000 Pip Trade in the making!