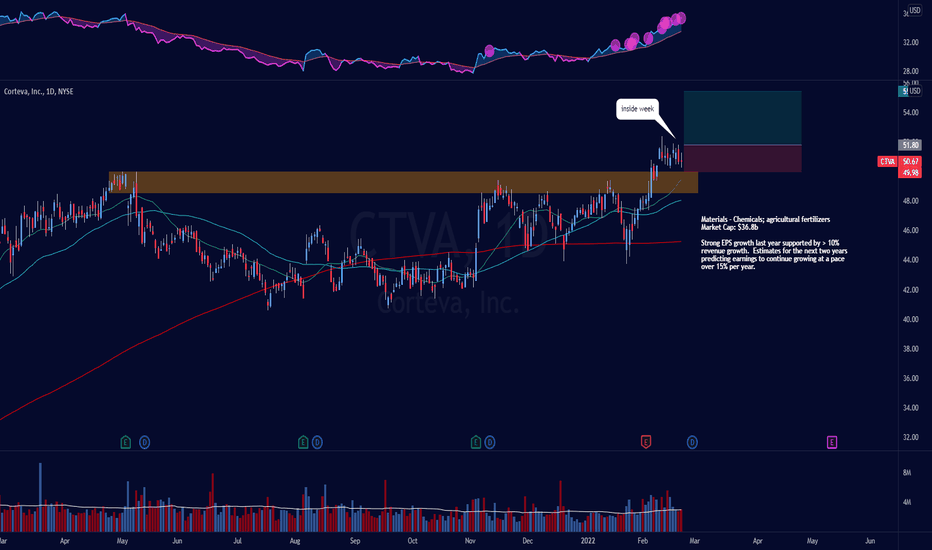

CTVA - Corteva, Inc.Stock recently broke out of a ~10 month base and is forming a very tight VCP / high handle.

The stock continues to make new relative strength highs, giving very little back while the indexes struggle, showing its superior strength relative to the overall market.

Look for a breakout over the February 9 closing print of $51.54 with a stop just below the low of the VCP.

VCP

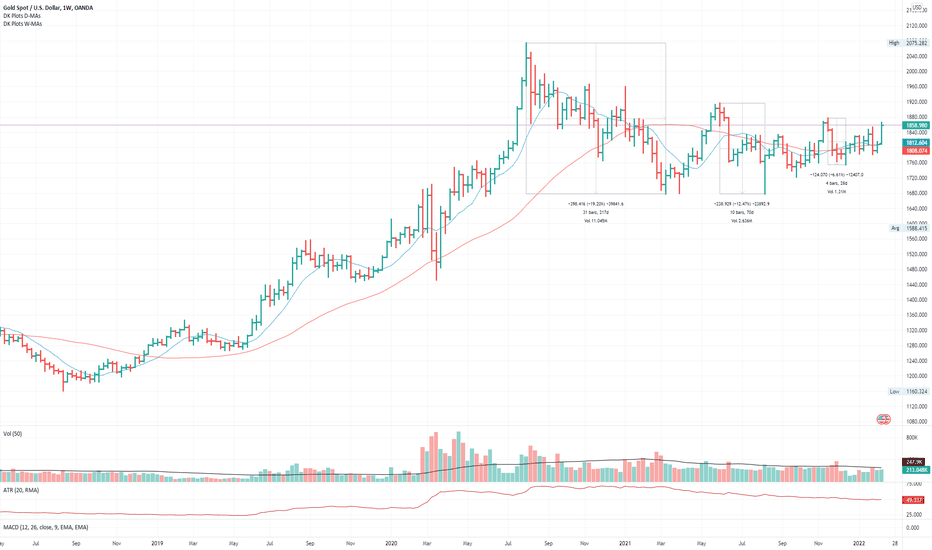

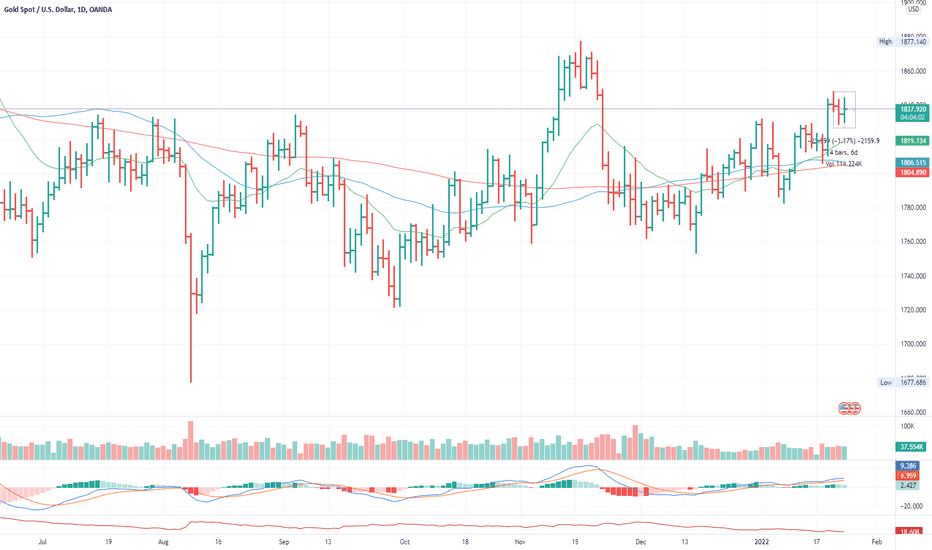

Gold and precious metals miners are setting up ... !I am not GOLD bull - i read charts. Feels like the price action is confirming what we see happening outside of markets.

i recently read a report that someone was secretly buying gold at around 1800 and putting it aside - based on yahoo search- here is the copy of it:

(Bloomberg) -- Spot gold is again bobbing along near $1,800 an ounce, as it has been since mid-2020. The stickiness of that level, particularly as fundamentals turned more bearish, suggests there’s a big buyer somewhere in these waters. (...) That would suggest that whoever is buying is able to buy in scale, leave little footprint in the market and then take delivery and store the metal in secure, invisible vaults. And that points strongly toward a sovereign buyer.

Today i share with you few tickers and price action on XAU.

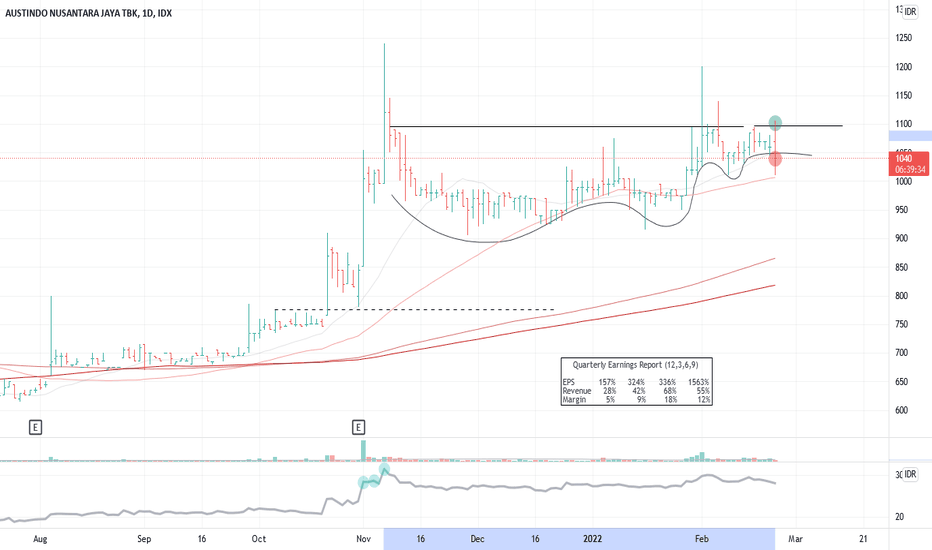

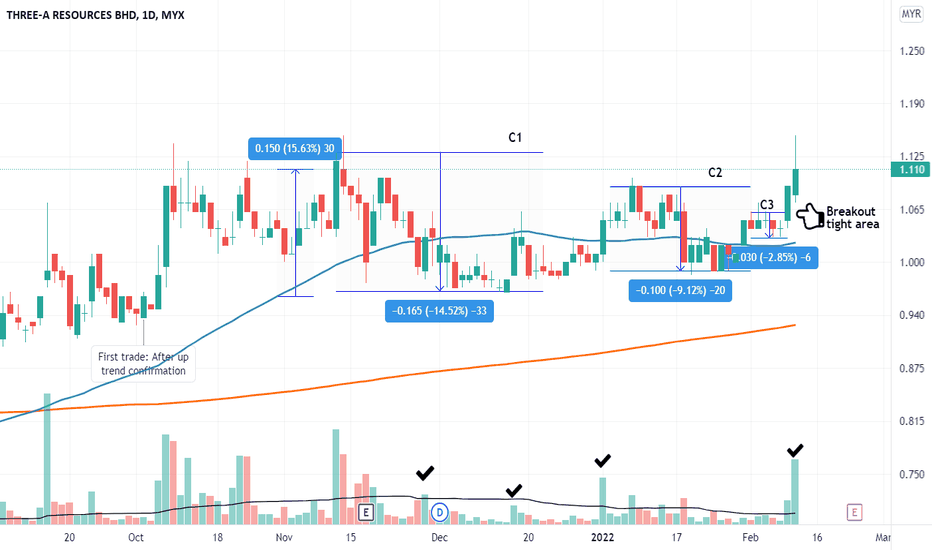

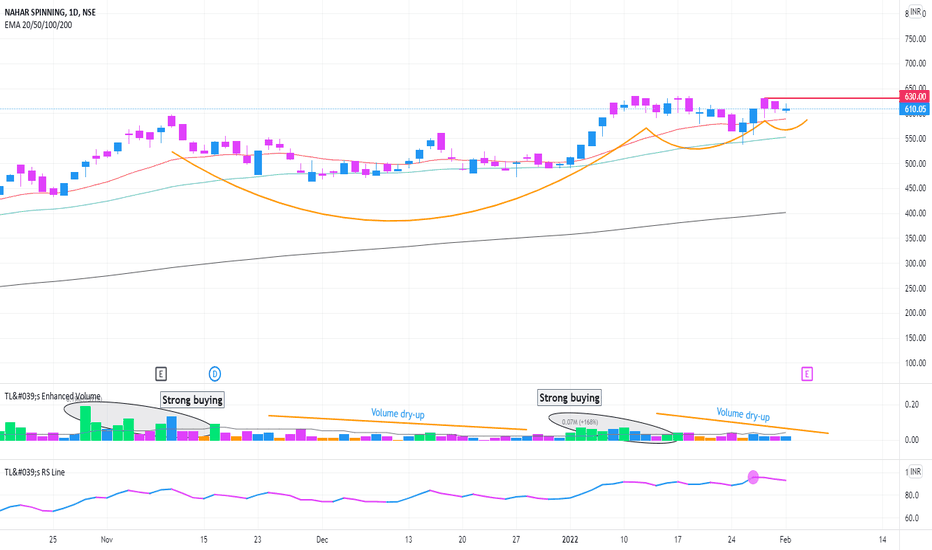

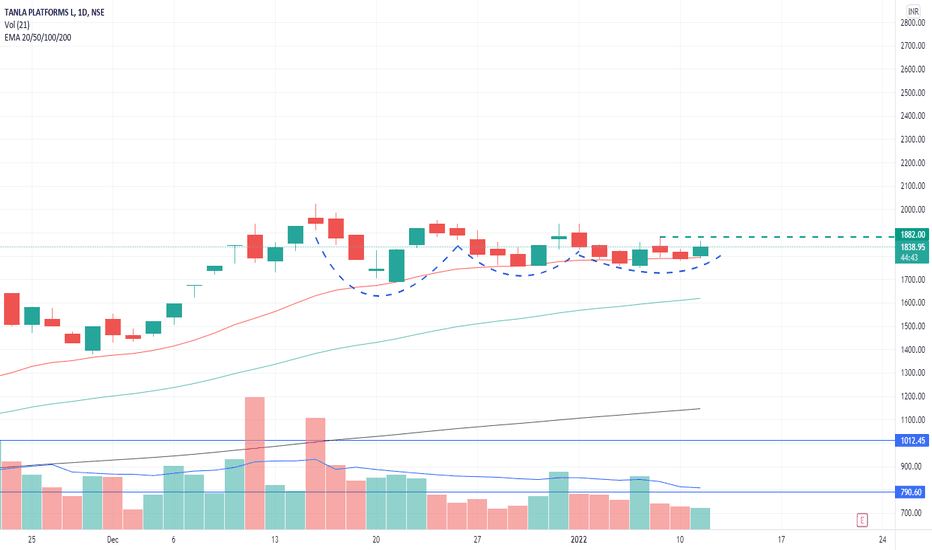

3A VCP (FOLLOW UP)I first traded 3A last year on 4 Oct after confirm up trend rally, gave me around 15% profit back then.

3A later undergo correction period and have been following since Jan 2022 when the price rise back up MA50. (Previous related ideas in link below)

The current VCP took 3 months to setup with below contraction:

C1: -14%

C2: -9%

C3: -3%

Price breakout with volume follow through on 10, 11 Feb show there is strong demand in market. Good QR coming soon? Let's see.

Disclaimer:

Not a buy call recommendation. Just personal technical analysis based on trend and chart pattern. Trade at your own risk.

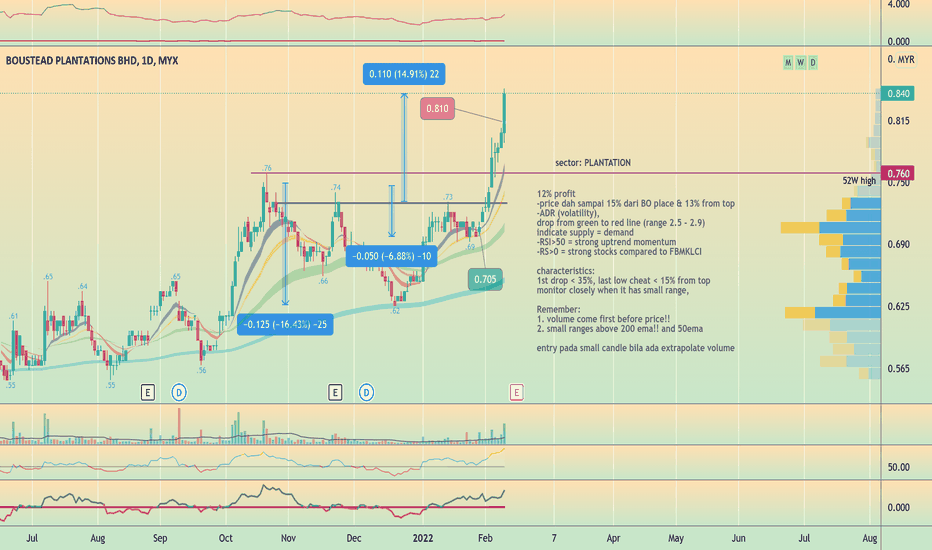

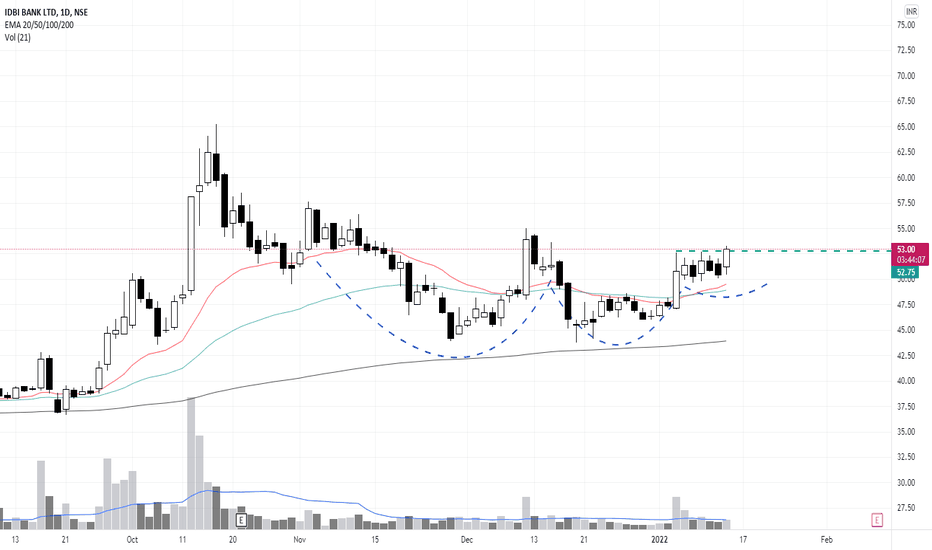

Post-Trade Analysis12% profit

-price dah sampai 15% dari BO place & 13% from top

-ADR (volatility),

drop from green to red line (range 2.5 - 2.9)

indicate supply = demand

-RSI>50 = strong uptrend momentum

-RS>0 = strong stocks compared to FBMKLCI

characteristics:

1st drop < 35%, last low cheat < 15% from top

monitor closely when it has small range,

Remember:

1. volume come first before price!!

2. small ranges above 200 ema!! and 50ema

entry pada small candle bila ada extrapolate volume

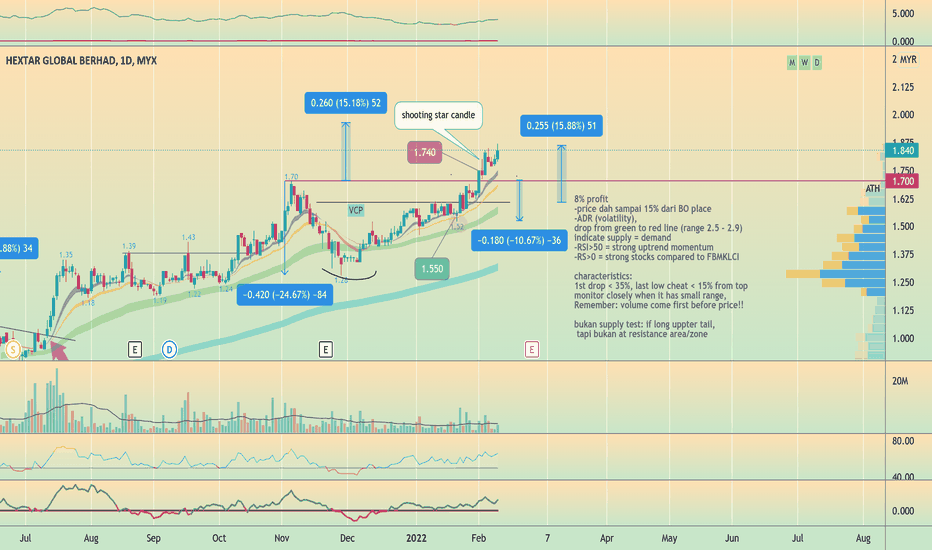

Post-Trade Analysis15% profit

-price dah sampai 16% dari BO place

-ADR (volatility),

drop from green to red line (range 2.5 - 2.9)

indicate supply = demand

-RSI>50 = strong uptrend momentum

-RS>0 = strong stocks compared to FBMKLCI

characteristics:

1st drop < 35%, last low cheat < 15% from top

monitor closely when it has small range,

Remember:

1. volume come first before price!!

2. small ranges above 200 ema!! and 50ema

first entry: terlepas,

that time, ema50 baru nak cross up ema200

Post-Trade Analysis8% profit

-price dah sampai 15% dari BO place

-ADR (volatility),

drop from green to red line (range 2.5 - 2.9)

indicate supply = demand

-RSI>50 = strong uptrend momentum

-RS>0 = strong stocks compared to FBMKLCI

characteristics:

1st drop < 35%, last low cheat < 15% from top

monitor closely when it has small range,

Remember: volume come first before price!!

bukan supply test: if long uppter tail,

tapi bukan at resistance area/zone

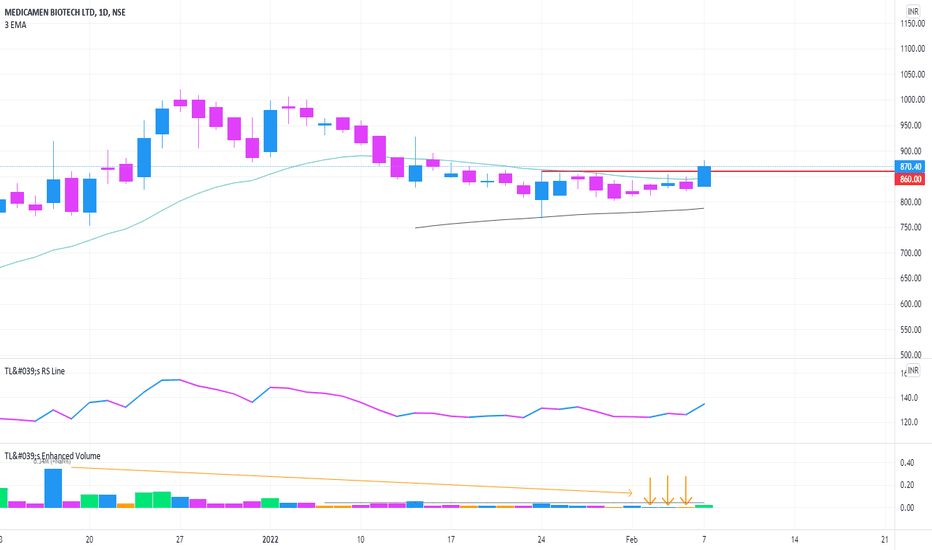

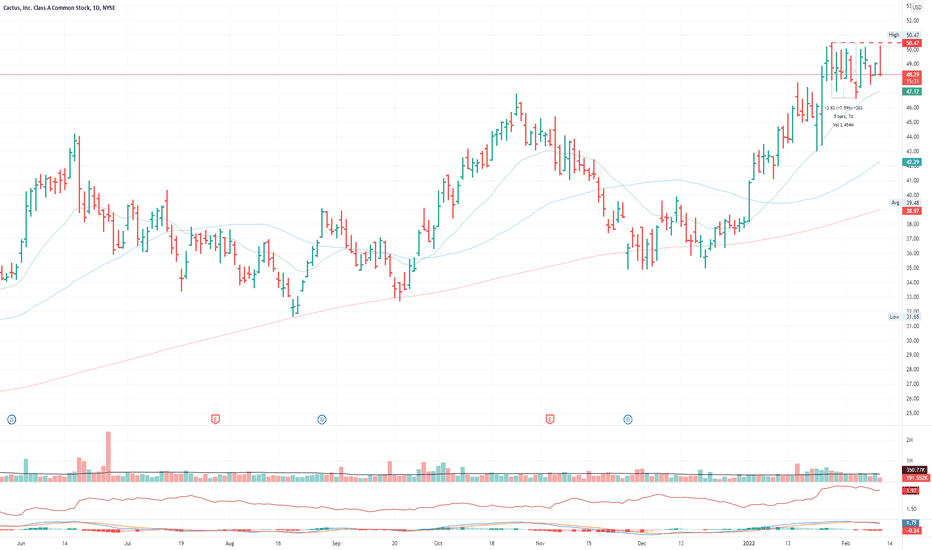

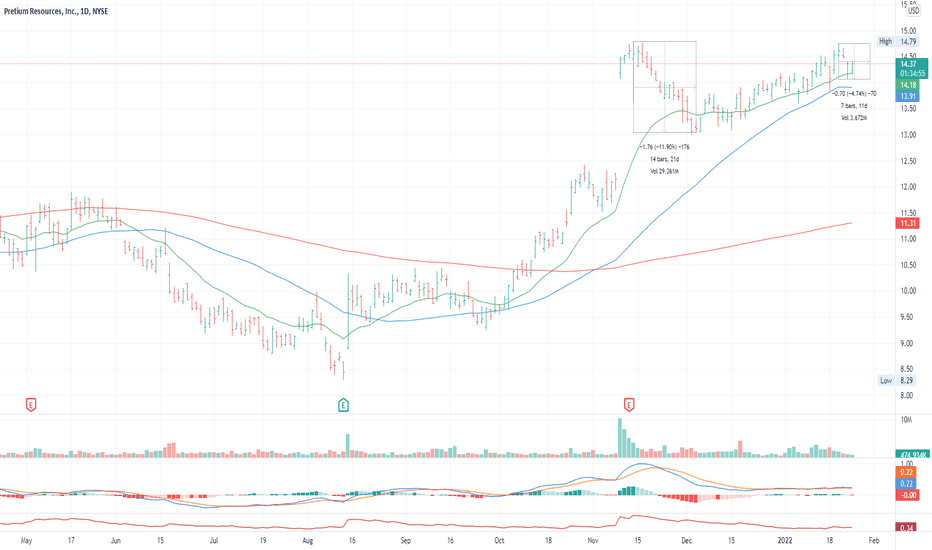

Possible VCP ... but will it hold in the current market?I have not been posting recently - due to one reason ... the market is not giving any nice setups. As i have learned CASH IS A POSITION. I do not need to be in the market all the time. I took couple of trades and got stopped out. You see breakouts working 2-2% above breakout level and then they fail. Better to watch from a side line. So i am actually posting this WHD as 'maybe it will work' but i have limited confidence. Time will tell :) Trade safely!

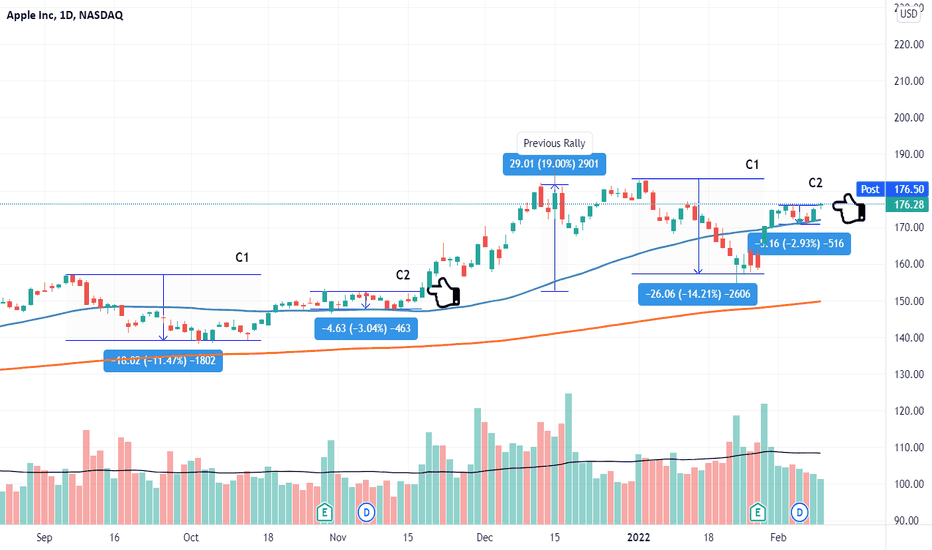

(US) APPL VCP SETUPApple Inc is showing VCP setup with below contraction of:

C1: -12%

C2: -3%

The setup is similar to its previous setup from Sep - Nov 21 with below contraction:

C1: -11%

C2: -3%

Previous rally gain was around 19%. Let's see if this round able to breakout ATH again or not!

Disclaimer:

Not a buy call recommendation, just my technical analysis based on chart pattern and trend.

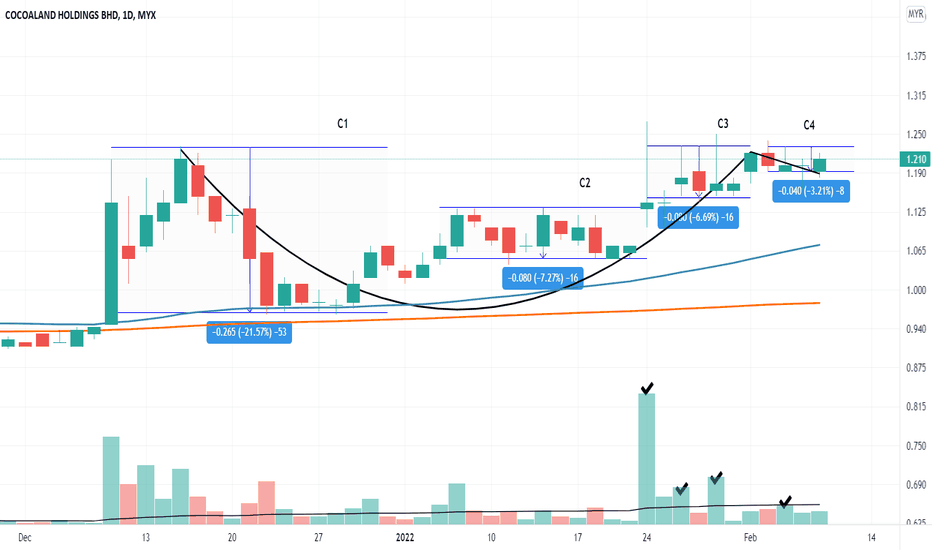

COCOLND VCP SETUPCOCOLND VCP setting up with below contraction:

C1: -21%

C2: -7%

C3: -7%

C4: - 3%

Price and volume interaction is rigid indicate strong demand. Pending another volume and price follow through.

Also observe a small cup and handle.(Black line)

Disclaimer:

Not a buy call recommendation. Just my personal technical analysis based on chart pattern and trend. Trade at your own risk.

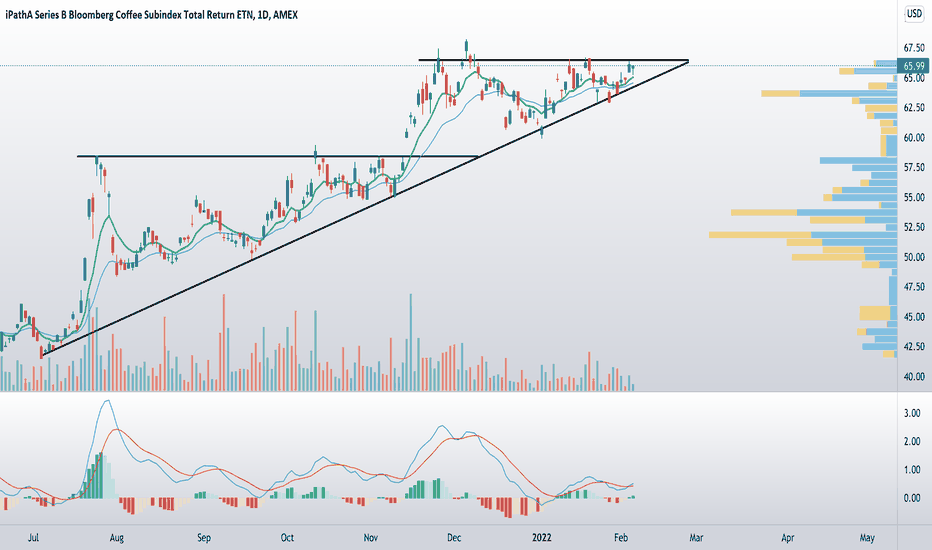

Coffee JO nice VCP Triangle breakoutsSome nice VCP / Saucer Handle patterns on JO as it continues to climb higher.

Watch for a break higher if it can chew through 67 zone resistance

Break lower out of triangle / trendline support invalidates long idea.

On a macro level we're seeing bullish setups in AG complex (coffee , rice, wheat, corn, soybeans, etc.) , coupled with inflation coffee should run.

Personally I've noticed my local coffee shops also charging $1 per cold brew which supports the bull case.

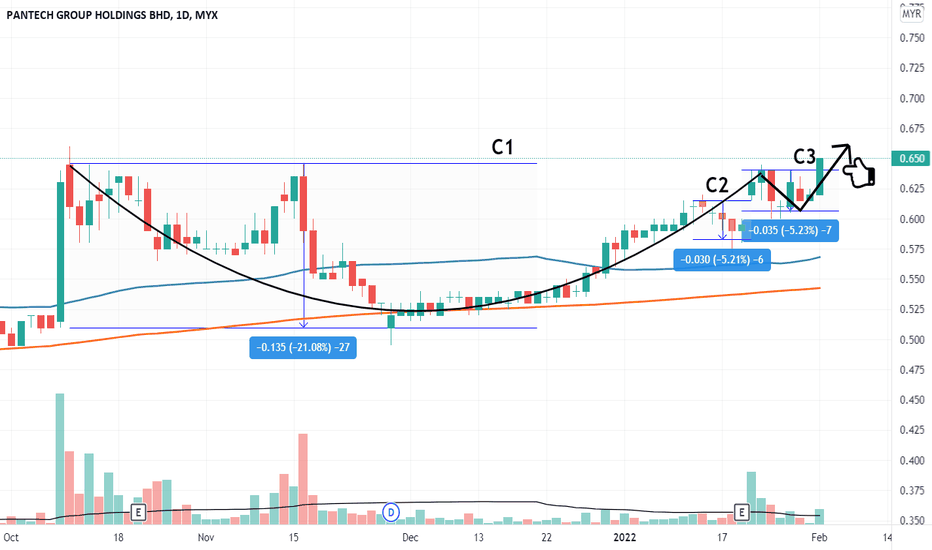

PANTECH VCP + CUP & HANDLEPANTECH has developed VCP with 3 contraction. Cup and Handle also observed at the same time.

C1: -21%

C2: -5%

C3: -5%

Price breakout on 3 Feb. Let's see will volume continue follow through the price out or not.

Disclaimer:

Not buy call recommendation, just sharing technical analysis through chart pattern. Trade at your own risk.

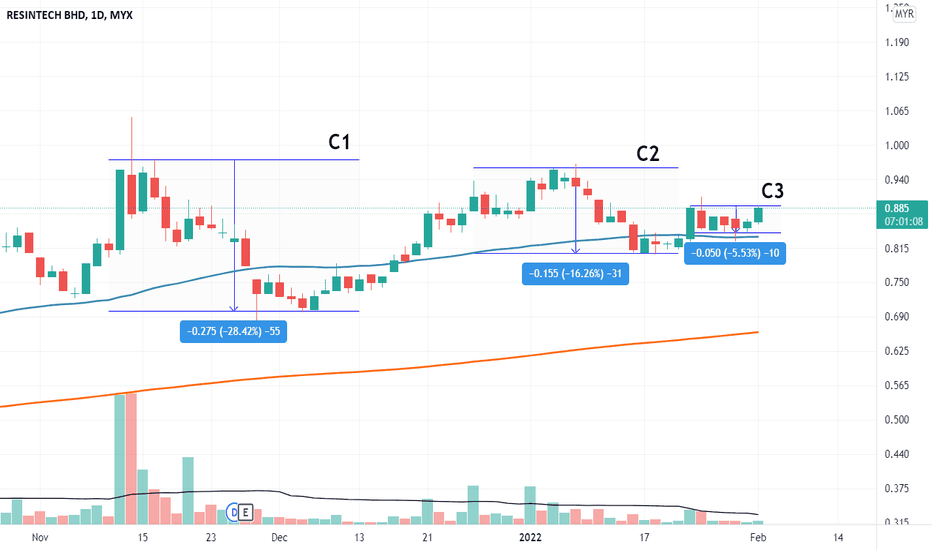

RESINTC VCP SETUPHappy CNY everyone!

RESINTC got decent profit last year around Oct. Have been monitoring RESINTC since Jan 22 when it showing rigid setup back MA50.

Currently developed VCP at C3.

C1: -28%

C2: -16%

C3: -5%

Let's see if this round can spike for ATH or not.

Disclaimer:

Not a buy call. Just sharing technical analysis through chart pattern. Trade at your own risk.

A possible miners VCP set up VCP characteristics in place ...

- above key lines

- first contraction already happened

- setting up another one ...

on short list now ....

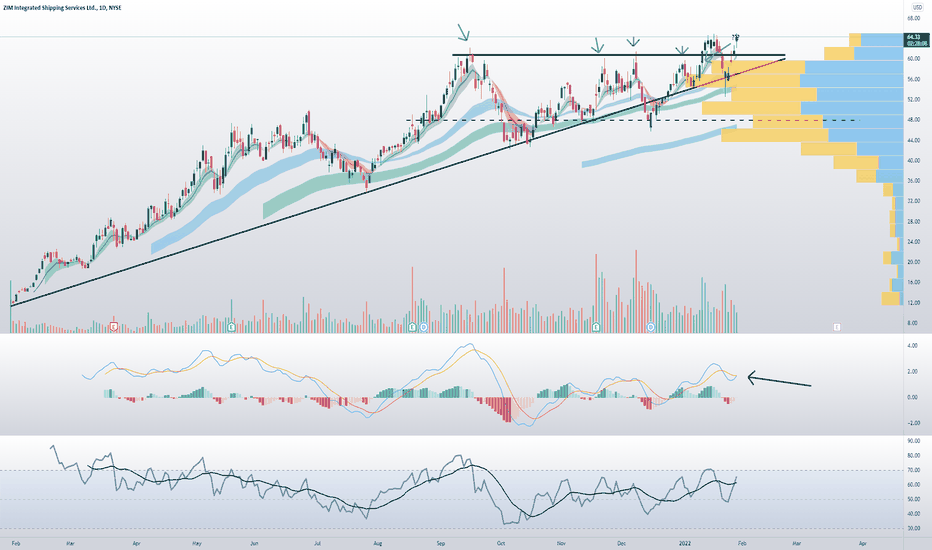

$ZIM nice VCP patternI'm bullish on shipping sector and love the price action on ZIM, follows trend line and nice VCP patter (volatility contraction pattern)

Not much downside in the name either with other tickers down pretty big - RELATIVE STRENGTH !

PLUS

Dividend !

I like the R/R starting a position here with a stop loss just below the breakout level !