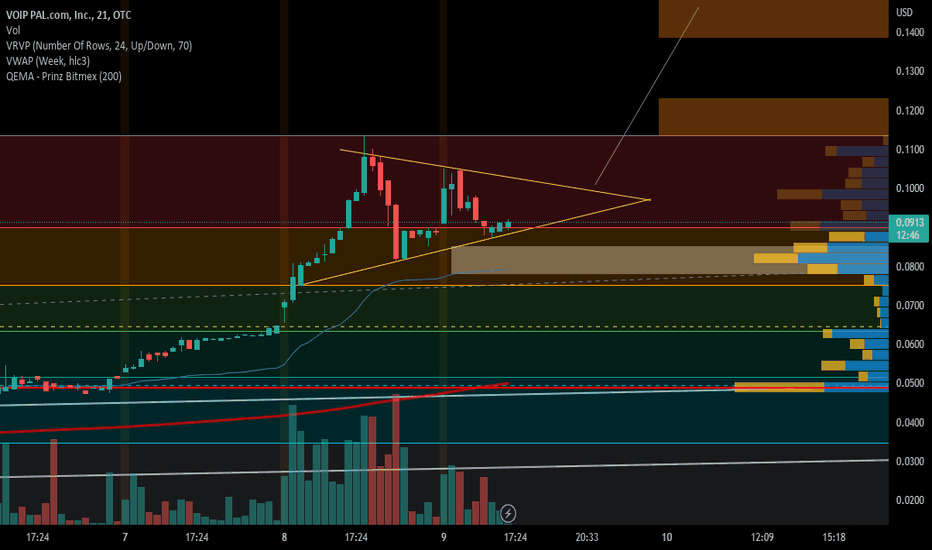

VPLM Bullish AF- STOCKTWITS STRONG BUY!!! TODASO!I have anchored the FIB from the breakout earlier his year and then included the wick at the top. I have Vwap anchored to weekly and it's nice how all these level have similar confluence. We have a pennant which is neutral but it's also a bull flag as well. The flag pole gives us the extrapolation for a target above. Fib levels, vwap and 200ema etc for lower targets. Not financial advice, DYOR.

From Stocktwits

History101

Yesterday 7:09 PM

$VPLM for all the new visitors to the VPLM board, welcome. I thought I'd re-post some info to get you up to speed (several posts below). Summary: VPLM has been defending its patents against multiple HUGE tech company infringers for 10+ years. Google, Samsung, Tmobile, Meta, Amazon, etc. VPLM has been winning over & over again, in court and at the patent board. It is the 9th inning now, with court dates set for this summer IN WACO TEXAS, a court (and jury) that supports patent property rights. The big boys are in a big bind, and we investors might have a decent shot at some real $$. Not investment advice, GLTA

From

investorshub.advfn.com

GreenBackClub

Re: None

Tuesday, January 24, 2023 7:01:49 PM

Post#

112387

of 113349

FOR ANYONE CLAIMING THAT VPLM HAS NOT DONE ANYTHING MEANINGFUL FOR THE COMPANY AND SHAREHOLDERS I OFFER THIS LIST OF ACCOMPLISHMENTS BY VPLM THUS FAR:

* Up-listed from OTC-PINK to OTCQB

* Removed the DTC Chill

* Conducted an annual financial audit to be in full SEC compliance and fully reporting.

* Conducted an initial damages analysis for RBR parent patent.

* Initiated 4 federal infringement lawsuits to enforce VPLM's IP rights against Verizon, Apple, AT&T, Twitter.

* Initiated 1 federal infringement lawsuit to enforce VPLM's IP rights against Amazon.

* Agreed to having all 5 cases venue transferred to Northern California and consolidated for pre-trial purposes.

* Defended and defeated 8 IPR petitions brought before the PTAB by Unified Patents, Apple and Verizon/ATT.

* Successfully defeated a motion, in part, for sanctions by Apple at the PTAB.

* Successfully defeated an Alice motion brought by Verizon & ATT.

* 27 total patents granted and issued as of February 2019 (21 U.S. Patents).

* Granted RBR patent in Europe without any opposition challenge within 9 month challenge period.

* successful efforts to recoup most of the 100 million shares from Richard Kipping et al

* Upgraded the Board of Directors to include new members with extensive experience in M&A.

* Brought on board new boutique NYC law firm (Kevin Malek) to go to battle against the big silicon defendants.

* Brought on board terrific superstar lawyer in luis Hudnell

- ceo malak returned many hundreds of millions of shares back to the treasury to reduce the outstanding share count (to the benefit of shareholders)

And more recently…….

***Patents have been validated***

***Initial damages analysis done***

***Defeated 12 more IPRS (20 total)**

***IPRs have been appealed and upheld unanimously***

***No patents have been invalidated***

*** Current with all requisite filings***

***current with prosecuting patents and keeping both parent and child patents current***

***Reduction in OS count (thanks Emil!)***

***Some claims (@20) invalidated for RBR but could be overturned with a decision on Axle at the Supreme Court***

***NDCA is a very difficult court to win as it is defendant friendly. Waco is fair and plaintiff friendly***

***Foot in the door in WACO and now some defendants must remain in Waco (Amazon’s writ of mandamus denied!) and face a trial. Other defendants currently stayed in NDCA are tied to Waco results***

***Albright is a judge that is perceived as fair, by the books and fast which means vplm will be given a fair chance to argue / defend patents on the merits (all we could ask for)***

***99% of Albright's cases settle before trial. Albright encourages settlement ALL THE TIME. If defendants get to trial they have been given multiple chances to settle so they can’t expect Leniency from judge Albright***

***Defendants are NOT working together as a formal consolidated group. There is a disconnect - which plays into VPLM’s favor***

***Most big defendants will settle before providing source code when discovery is requested and required. Vplm is well into discovery phase so it is only a matter of when and not if source code will be demanded***

***Apple's own expert admitted in court in virnetx case - on the record - that they use relays to route their calls (imessage, facetime, etc.). This admission will come to bite the apple in the butt***

***Apple tried to file a patent when VPLM was updating their RBR child patent but they failed to do so before VPLM did. We were first to file at USPTO. Now why did they do this? --> because they wanted to get around infringing. Sorry apple, you lose again***

***60+ companies have received letters that notified them of possible infringement AND offered them the chance to take a license. This was years ago. Willful infringement equals treble damages!***

***Apple and others can be brought back into litigation as they were dismissed WITHOUT PREJUDICE***

Verizon

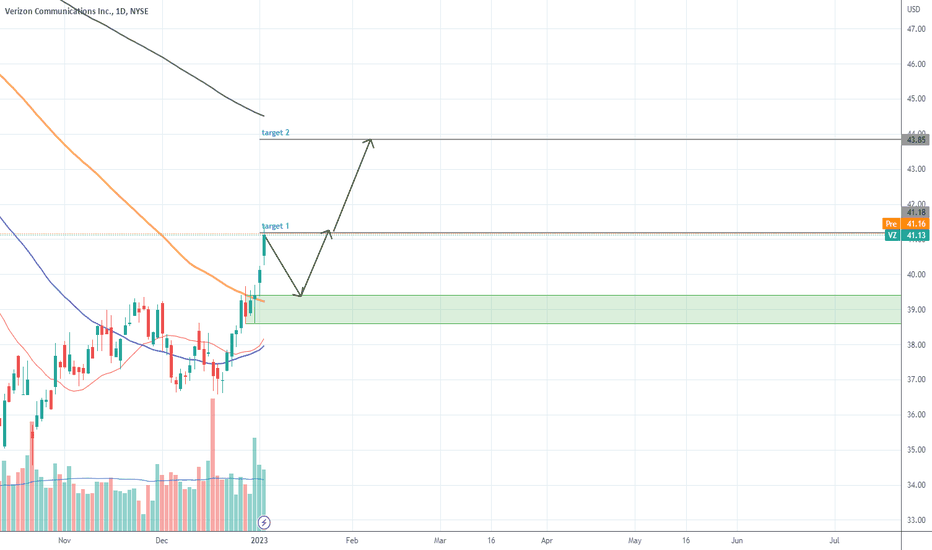

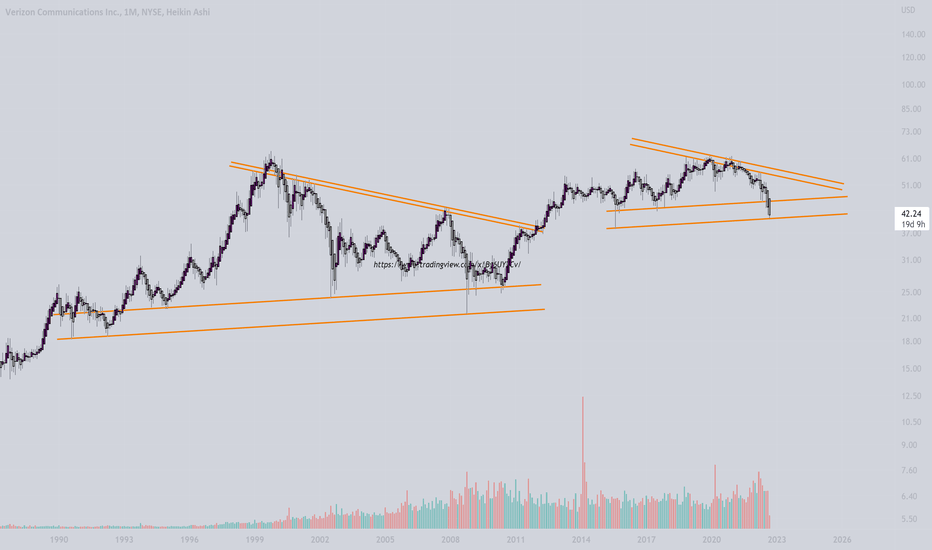

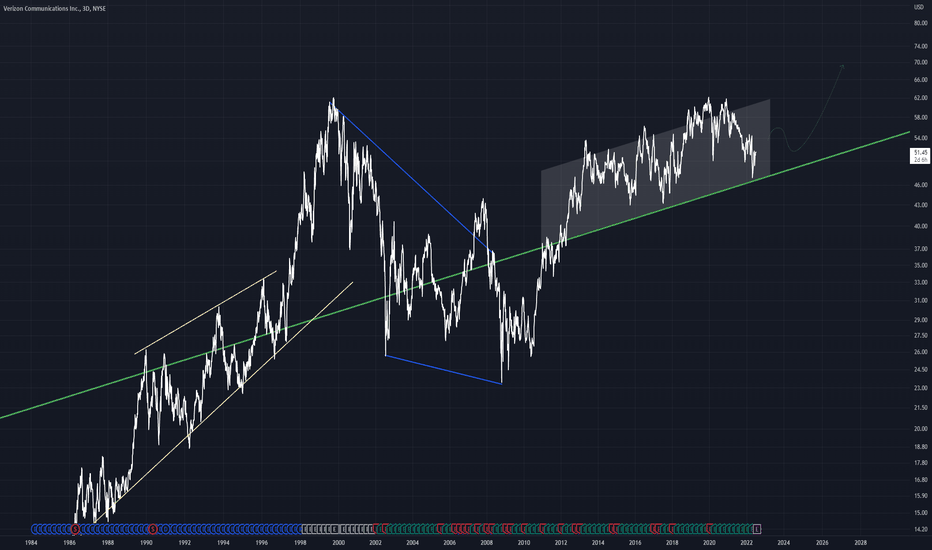

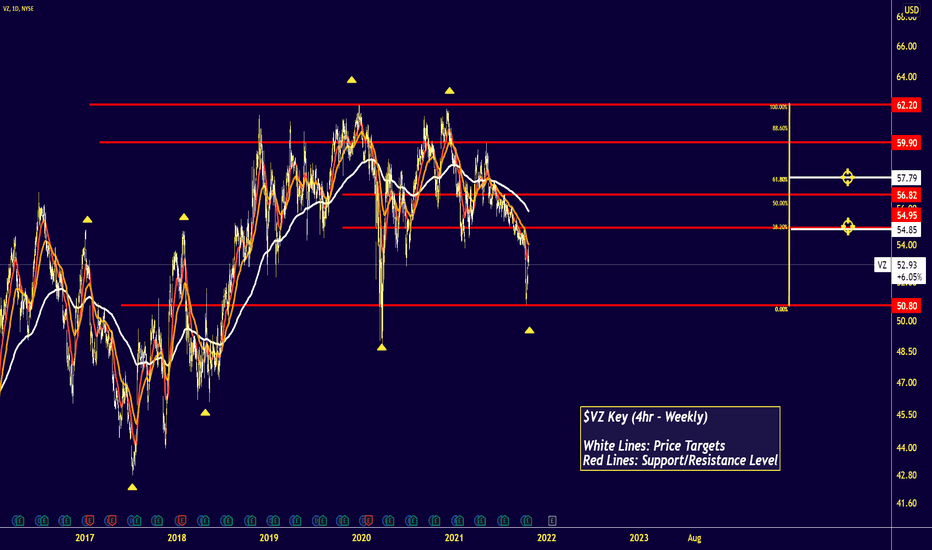

VZ-Sitting at critical supportOn August 15th it became known that Berkshire Hathaway dumped its Verizon Communications, Inc. position and since then the stock has lost about 13.5%. While I do see this as an overall headwind for the stock it could be due for a bounce and looking over the monthly chart IF a bounce was to occur it would in the $39 area as we are about to test a very long term trend line. Typically a 3rd hit of a non-horizontal trend line will usually hold but I will not bag hold this position given the overall market weakness right now.

SL-38.50

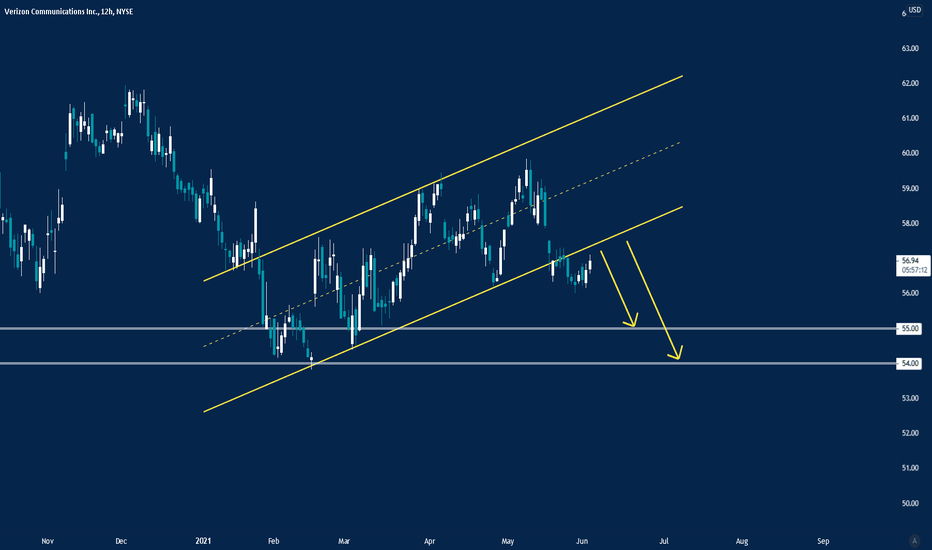

Verizon... is not in the zone. VZAnyway, we are shorting it.

Goals49. One only.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

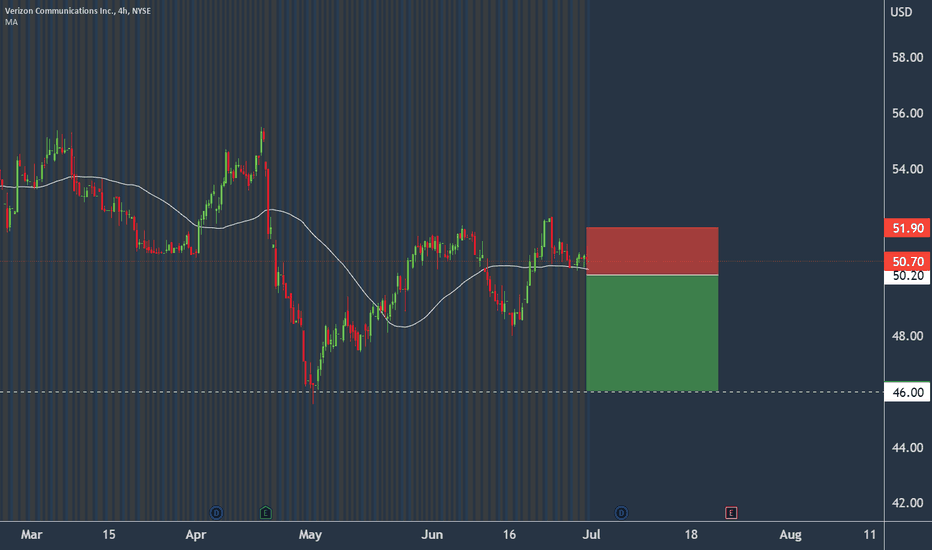

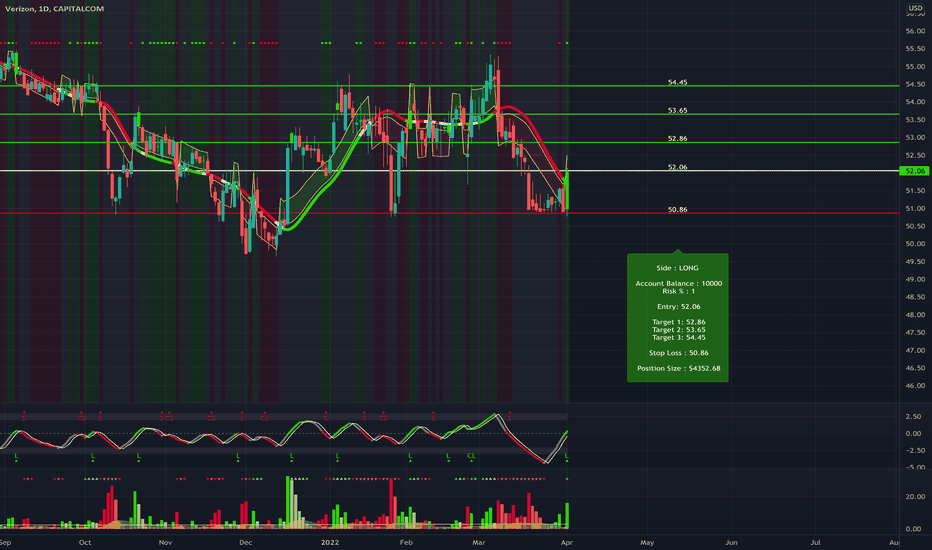

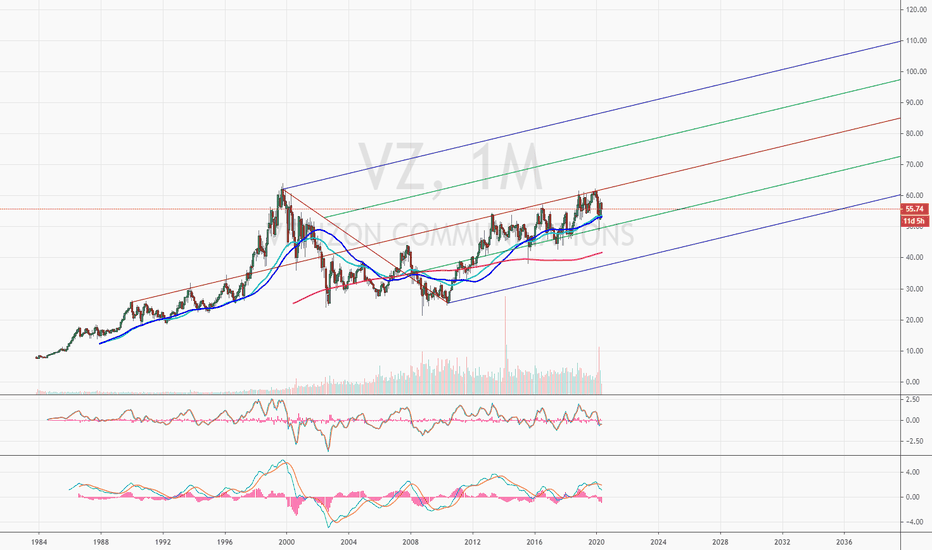

Verizon: High Div Yield vs CG Loss?Verizon Communications Inc

Short Term - We look to Sell at 50.20 (stop at 51.90)

A sequence of weekly lower lows and highs has been posted. We can see no technical reason for a change of trend. 50 4hour EMA is at 50.38. We expect a significant move lower if prices manage to break the 50.38 support. Further downside is expected.

Our profit targets will be 46.05 and 45.00

Resistance: 52.00 / 55.53 / 59.80

Support: 46.00 / 42.80 / 38

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

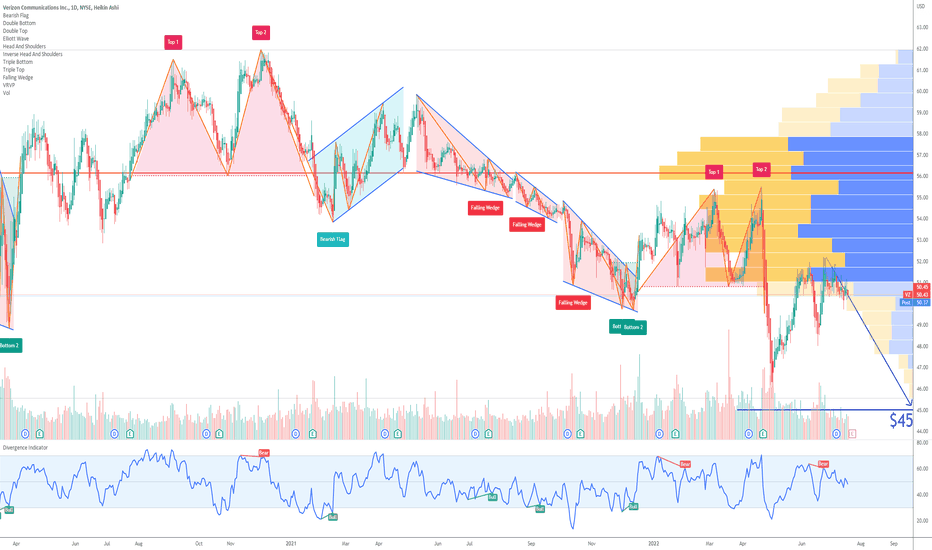

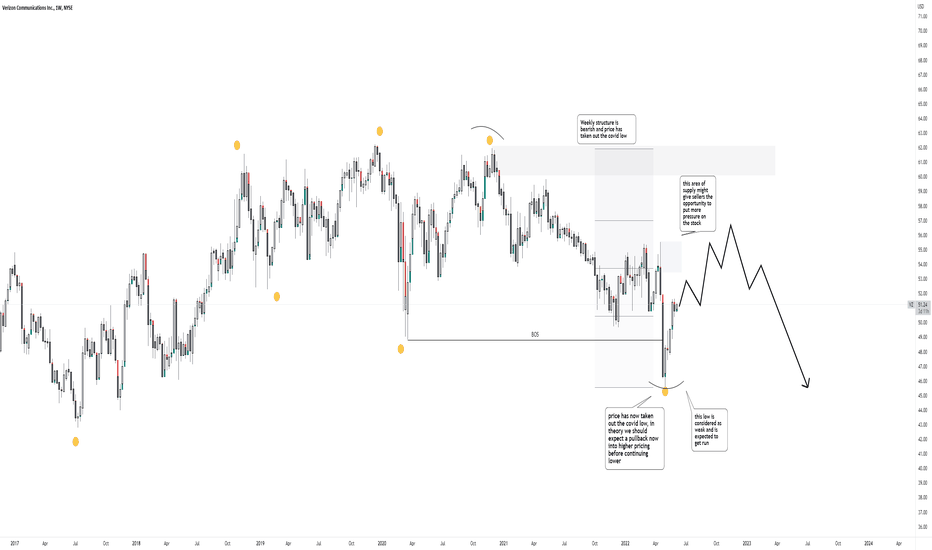

How Far will Verizon continue to DROP?Technical Analysis on Verizon Communications

Was it the right choice to add more shares to my portfolio?

Fundamentally it makes totally sense for me to own the stock. The numbers speak for themselves.

If we start viewing the stock from a technical point of view, then it's getting interesting and I can understand why many people say they keep their hands off it and wait.

So basically the stock recently took out the massive low that got created in 2020 during the huge sell of in the pandemic. So overall the price continued to be bearish and it will be bearish until we break the recent high.

I view the current pricing as a great opportunity to add more shares to my portfolio as it pays an incredible dividend at the current pricing value.

Hopefully, we can see the bulls getting back in control in the future but until then we are gonna be reactive, not predictive.

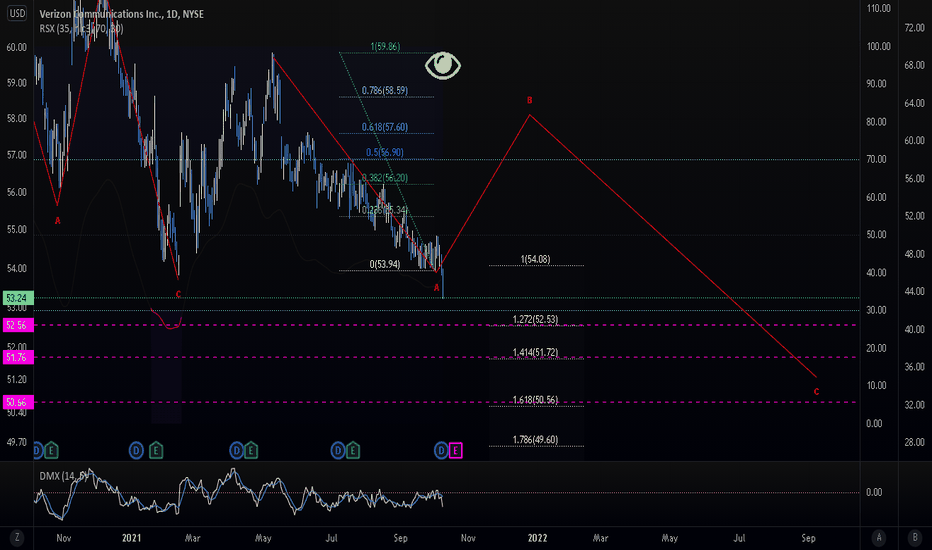

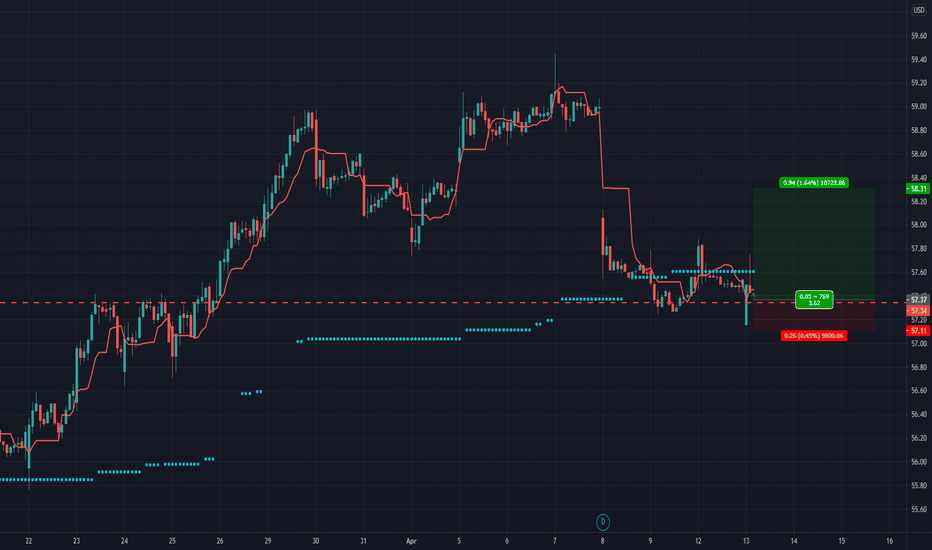

VERIZON, Intraday Strategy, Pivot point (PP) $53.93Hey there, if you are waiting for selling, this could be an interesting strategy, considering the pivot point ( PP ), support (S1,S2,S3), and resistances (R1,R2,R3).

For the next 2 days, we migth have a downward. Let's take a look at these band's results, Intraday strategy.

Target S1 $53.68 until S2 $53.52, controlling the stop loss at R1 $54.09 or R2 $54.34

R3 54.75

R2 54.34

R1 54.09

PP 53.93

S1 53.68

S2 53.52

S3 53.11

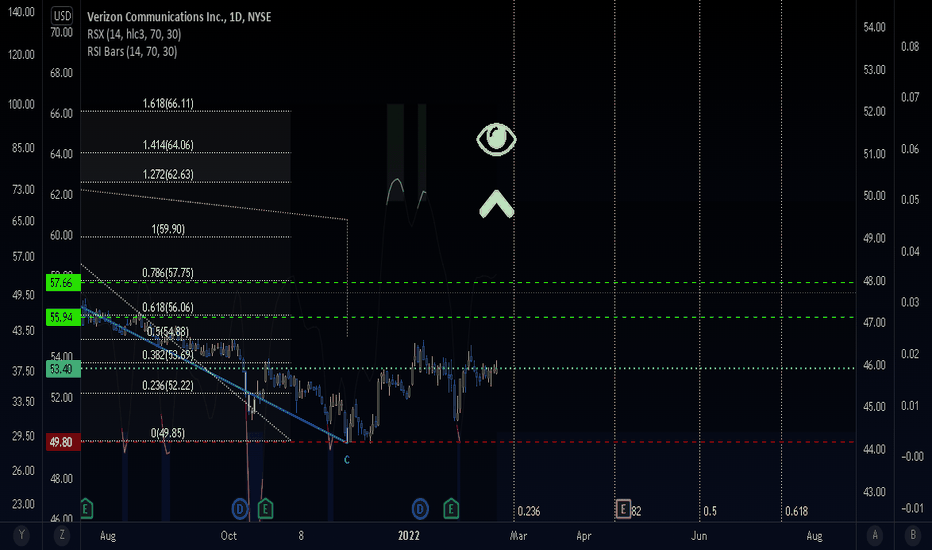

Verizon - Up in the Horizon. VZShort term and temporarily.

Immediate targets 55, 57. Invalidation at 49.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

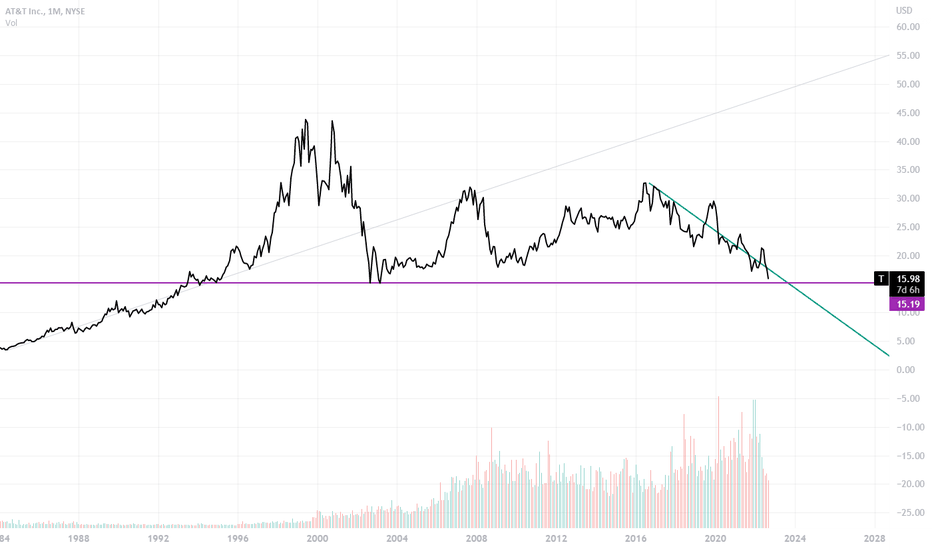

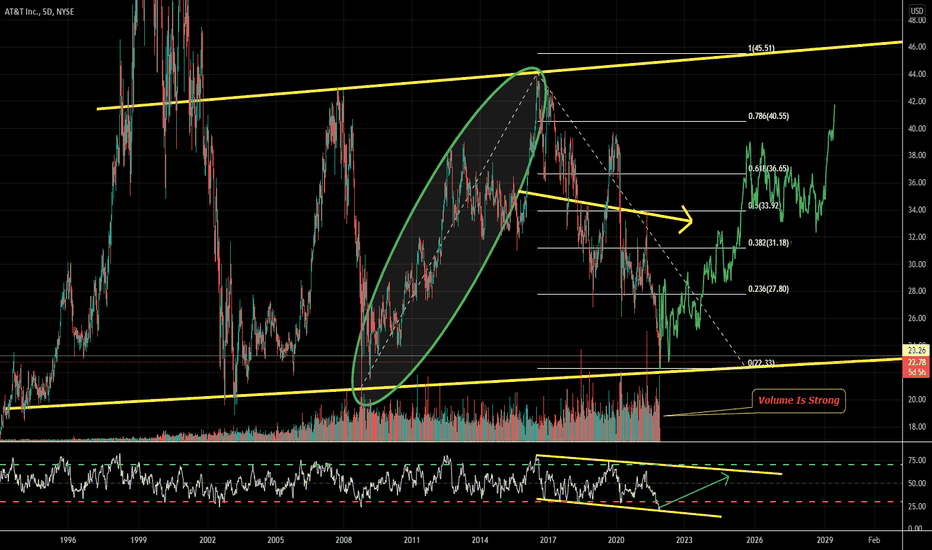

ATT AT&T: Upside Potential BeginningQuick Analysis on AT&T Inc (ATT) on a 5D Linear Chart.

1) The AT&T stock price is back to the 2008-2010 lows.

2) The RSI (relative strength index) has been hovering in the oversold region and met the bottom trendline.

3) In the chart, a fractal from the previous price increase is shown assuming price moves in the same direction.

4) A Trend Based Fibonacci Extension is also shown to give the reader areas to focus on.

5) The Volume is healthy.

6) The price has suffered over the past 10 years and now there may be a chance for it to go back up. Let's see!

What are your opinions on this?

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #cryptopickk

VerizonLooks like we are at a support that's backdated towards last Spring. I buy your tears GANG. I want a retracement of the previous high on the daily where we have strong resistance since November of 2018. We are oversold on the Macd on the weekly timeframe as well as the weekly. AsJay-z would say...."What More Can I Say?"

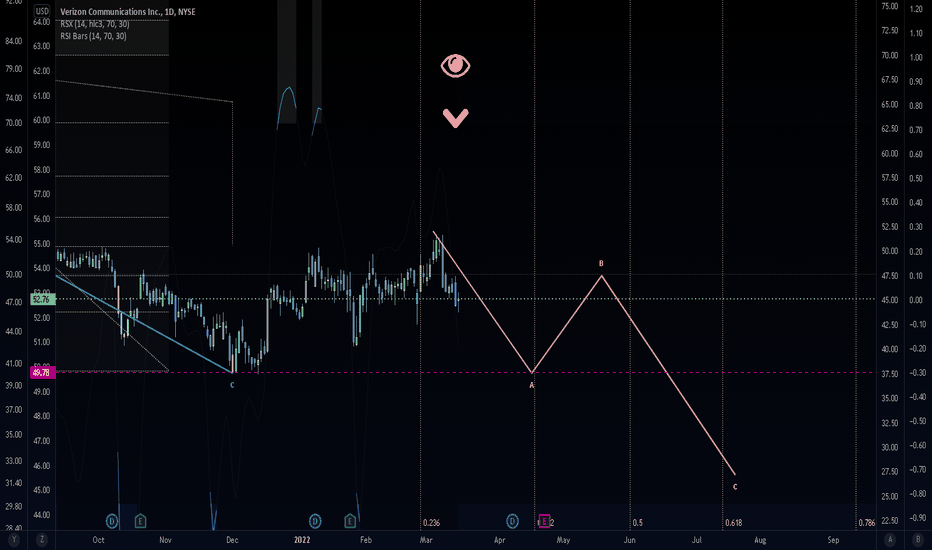

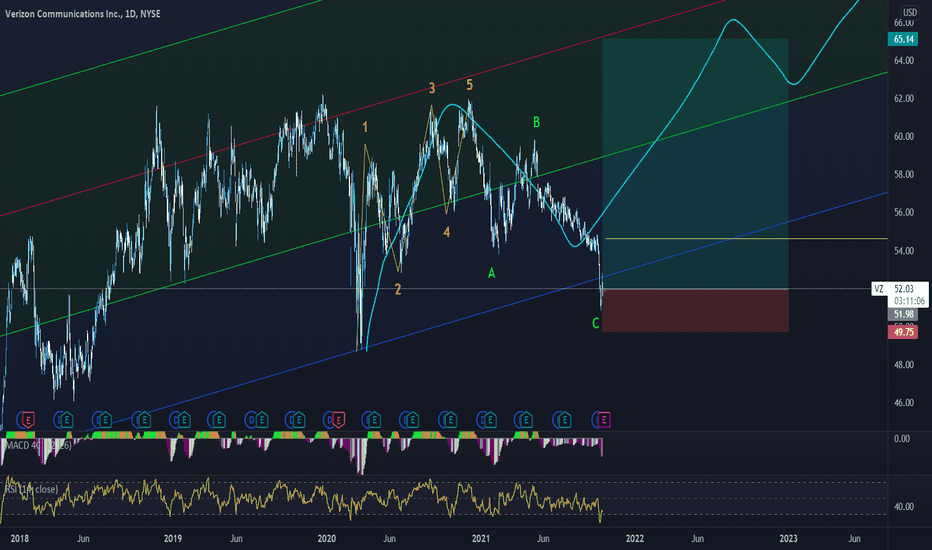

Verizon Communication should be in attention!It has been in a correction mode as I described it on the chart A B C. I think 1 to 5 is a impulsive wave to the upside. As per the theory, we should expect an impulse since we have had a correction for a long period of time. Next earning report is about to be released on October 20th. Yes, I expect it to be good.

More drops for Verizon. Oh my! VZBroke floor, heading for lower lows. Fibonacci shows us some favorable goals. Bearish in a nutshell.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

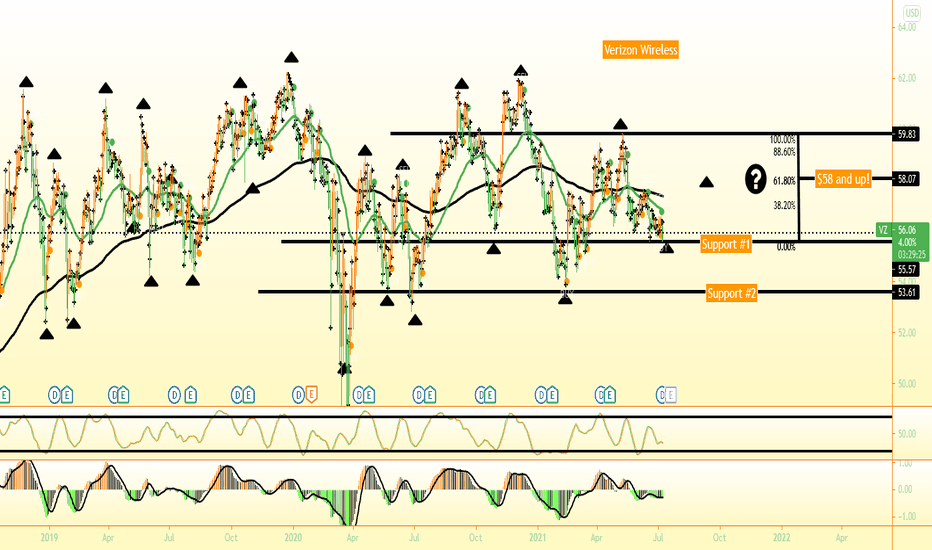

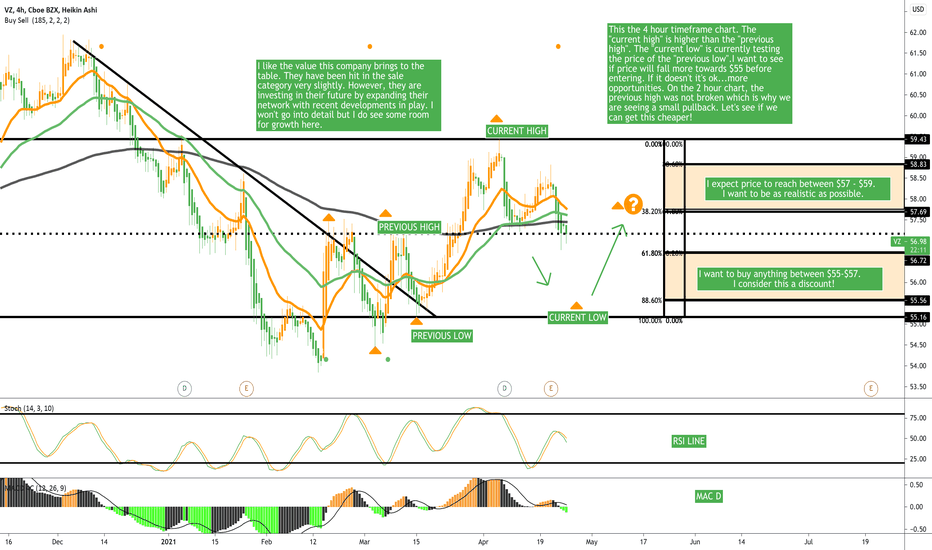

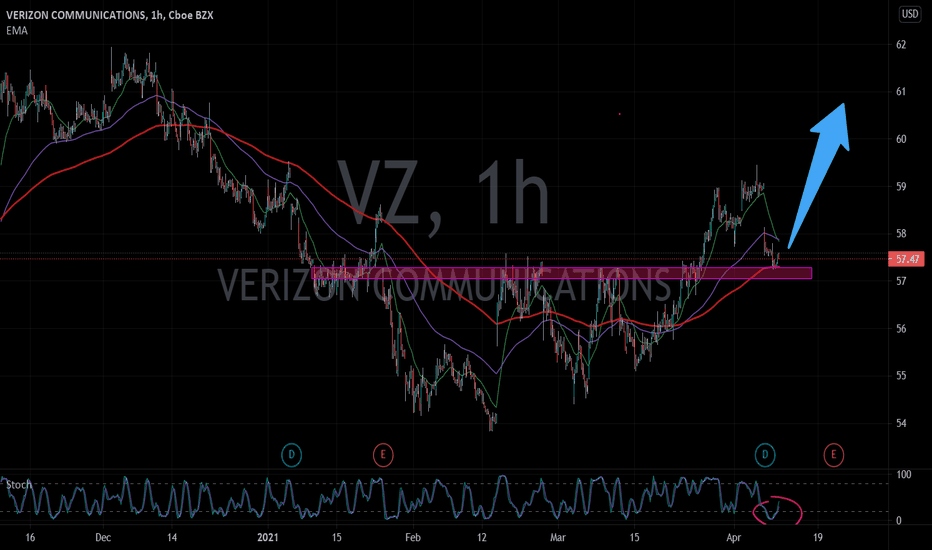

Verizon WirelessLooks like the XLC is down today when compared to yesterday. Went from a 90% stochastic to currently 79% around noon today. I've been watching sector for the past couple of weeks. In my opinion, this company has reasonable financials with a quality product and consistent customer base.

I noticed that price was at a support a few days ago and entered a debit spread last week. However, I want to own the company so I revisited. I saw last that the stochastic was oversold on the Daily, 4 hour, and 1 hour. Everything looks the same outside of the 4 hour. I'm giving this the benefit of doubt because of the way the market opened today. Price is still at support or close by and I have used the Fibonacci tool to retrace the previous high up to 38-61%.

What do you think?

VERIZON VZ : DETAILED FUNDAMENTAL ANALYSIS | SHORT VIEW ⭐️Despite the fact that VZ stock has consistently lagged behind the S&P 500, it is still a stock of interest to income-oriented investors because of its dividend yield. Nonetheless, if 5G wireless services once again lead to revenue and earnings growth, Verizon stock could become much more attractive.

The problem is that competition in the 5G wireless market is foreseen to strengthen. T-Mobile US's acquisition of Sprint has formed a more robust contender for Verizon Communications and AT&T. T-Mobile owns the most radio spectrum for 5G wireless services.

Moreover, AT&T lately decided to merge its WarnerMedia division with Discovery. As a result, a reduced AT&T is assumed to have more funds to invest in 5G wireless technology and fiber services.

VZ on May 3 sold 90 percent of its media and advertising business to Apollo Global Management for $5 billion. The deal is planned to conclude by the end of this year.

Besides, Verizon stock was the top bidder in the recent state auction of the mid-band radio spectrum. Verizon spent $53 billion, including incentive payments to satellite operators and clearing costs. This spending will postpone the VZ stock buyback for several years.

At its March 10 investor day, Verizon said it expects revenue growth of 4% or more in 2024 as the company expands 5G wireless services. The company forecasts revenue growth of 2 percent in 2021, the same as its previous forecast. The company says that growth will increase to 3% in 2022 and 2023.

Now that Verizon owns enough 5G midrange spectrum, network development will be pivotal. Verizon plans to reach 175 million users by the end of 2022 with 5G services based on a medium-frequency spectrum that delivers faster data speeds.

Also, Verizon stated that 5G mobile services will lead more consumers to switch to unlimited monthly plans. Currently, 61 percent of subscribers have unlimited data plans, up from 40 percent three years ago.

Verizon also told analysts that it plans to use a 5G mid-band spectrum to provide fixed broadband services in homes. Currently, cable TV companies dominate residential broadband.

The telecom company said its fixed broadband service will reach 30 million homes by the end of 2023.

The management awaits 5G business services to expand next year. The company is investing in "mobile computing centers" that provide private 5G business services.

The telecommunications company plans to spend another $10 billion over the next three years to build a 5G wireless network infrastructure. That's about $3.3 billion a year. That's in addition to the $18 billion a year the company already spends to maintain its entire network. Some of that money is already earmarked for 5G.

Verizon and rival telecommunications company AT&T are seen as defensive stocks because of their high dividends. Verizon stock, a component of the Dow, pays a 4.6 percent dividend.

Verizon has less debt than AT&T, which acquired media giant Time Warner and previously satellite TV company DirecTV. Although Verizon has avoided major acquisitions, its attempt to enter the media business by acquiring AOL and Yahoo was ultimately a failure. In 2018, the company wrote off the value of its media business, called Oath, to the tune of $4.6 billion.

New York-based Verizon has partnered with Walt Disney on streaming video. In August, Disney and Verizon expanded their streaming partnership to include Hulu and ESPN+. Verizon is also partnering with Apple Music and sports leagues.

Verizon is much more exposed to the U.S. wireless market than rival telecommunications company AT&T. Verizon derives nearly 85% of its adjusted profits from its wireless business.

The company has reduced debt since it bought Vodafone Group's 45% stake in the wireless joint venture for $130 billion in early 2014.

In addition, the company has new senior management. CEO Hans Vestberg was CEO of network equipment maker Ericsson before joining Verizon. Vestberg and Chief Strategy Officer Rima Qureshi, also an Ericsson veteran, joined Verizon five years ago.

Ronan Dunne, Verizon's head of consumer business, was previously CEO of the U.K. wireless company O2. He joined Verizon in 2016.

To be sure, revenue growth remains an issue. Verizon's long-term problem is that the U.S. wireless market is oversaturated.

Many consumers are putting off upgrading to new smartphones. In addition, data-intensive mobile video isn't generating much revenue.

For the March quarter, Verizon reported earnings of $1.31 per adjusted share, excluding items. Revenue rose 4 percent to $32.9 billion.

Last year, Verizon earned $1.26 per share on revenue of $31.6 billion. Analysts had projected Verizon earnings of $1.29 per share on revenue of $32.47 billion.

Wireless revenue rose 2.4 percent to $16.7 billion. Verizon said it lost 178,000 postpaid wireless subscribers against analysts' forecast of 198,000.

Analysts expect wireless subscriber growth to resume in the June quarter.

For 2021, Verizon expects adjusted earnings per share in the range of $5 to $5.15 per share. The company expects total revenue growth to be at least 2 percent, including wireless revenue growth of at least 3 percent.