BILL ACKMAN, JOHN PAULSON & SARAH KETTERER UPS STAKE IN VIAC Here's yet more BULLISH news for VIACOMCBS (VIAC)

We feel along with several other large institutional investors that VIAC is DIRT CHEAP!

News Releases..

www.benzinga.com

www.gurufocus.com

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from

negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

Verizon

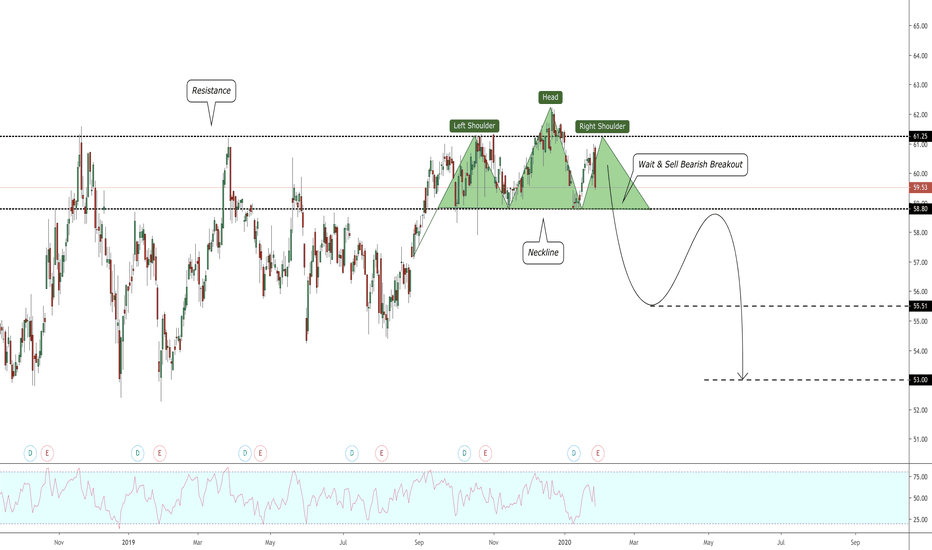

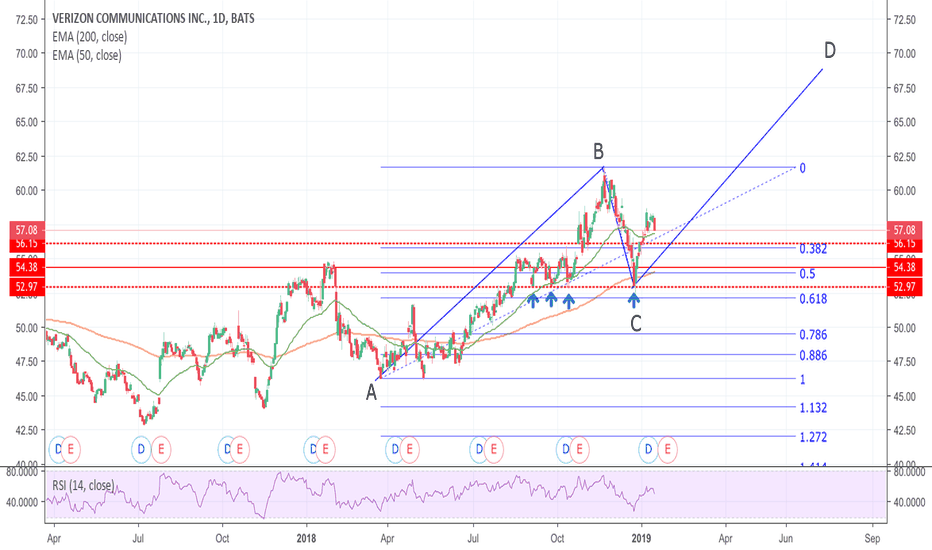

VERIZON COMMUNICATION (VZ): Reversal Clues

hey traders,

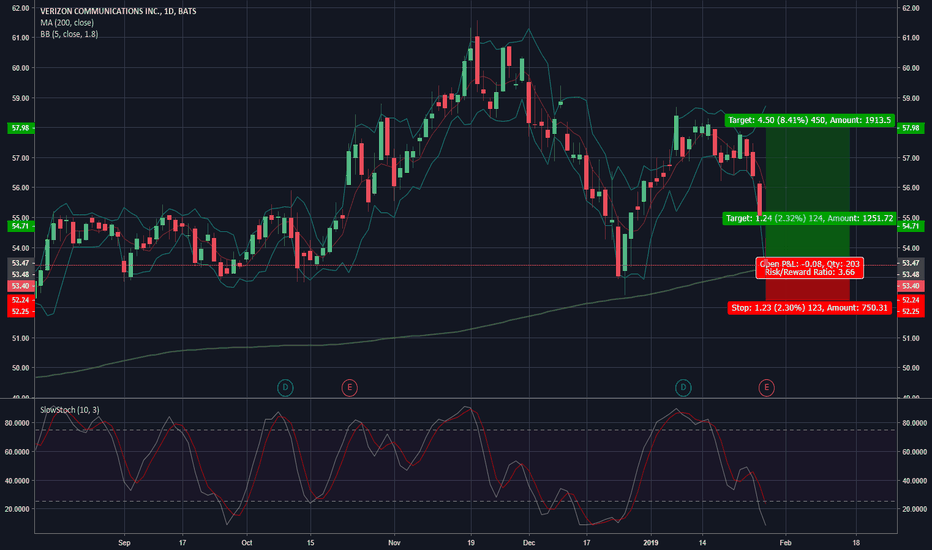

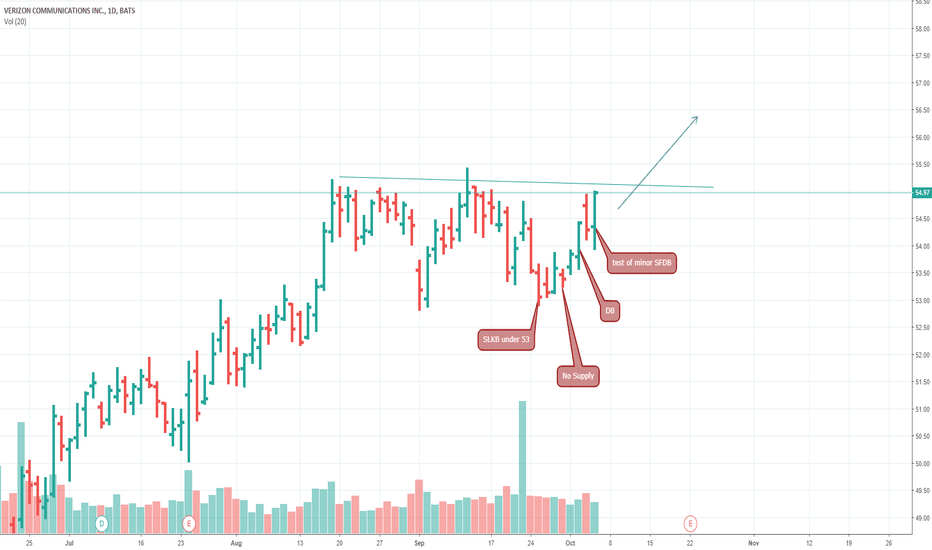

it looks like the breakout above the previous structure high in December was false!

the market was trading about 1 week above 61.0 resistance and then dropped.

Now it looks like the market is forming a classic reversal pattern - head and shoulders pattern.

currently, the price is completing the right shoulder.

I suggest setting the alert below the neckline level.

Being broken it gives us a perfect selling opportunity.

key levels will be 55.55 / 53.0

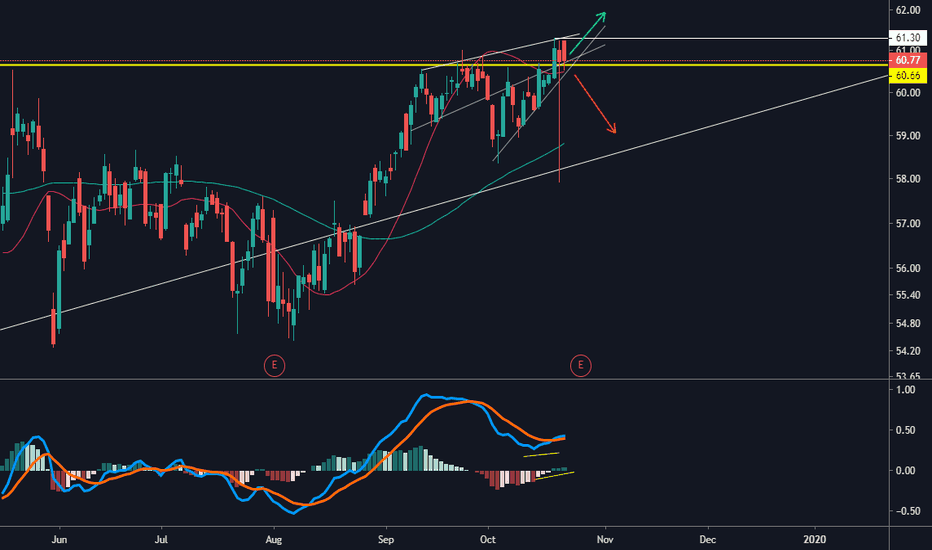

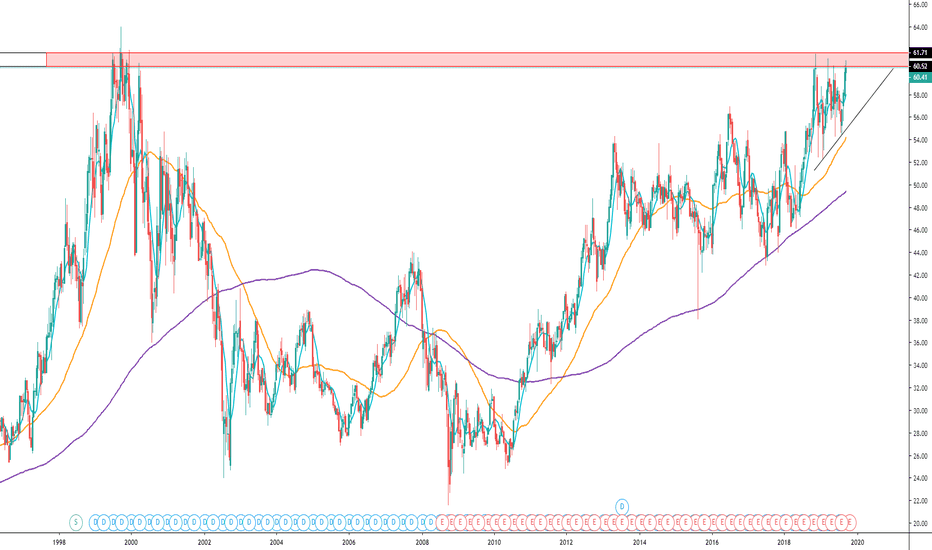

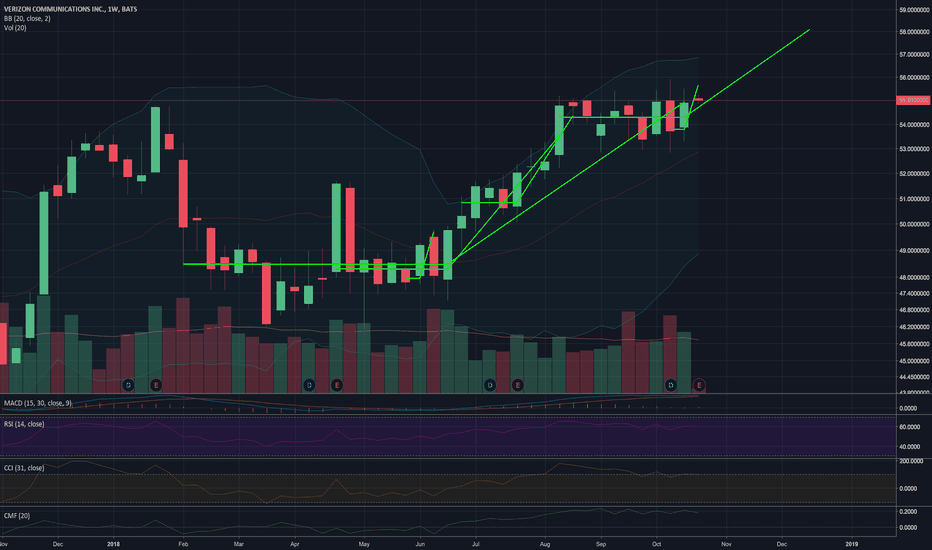

LONG - VZ - Trading OpportunityAfter many years of downside after reaching a peak NYSE:VZ , seems to be trying to go on an uptrend again and break the previous resistance, an ascending triangle formation has been taking place for quite some time now, hitting it's head against the same resistance while continuously making higher lows, this is a chart to keep an eye on and buy a possible breakout, which would be a candle on at least the weekly chart closing above the resistance.

Possible targets would be to take profits at ~10%, and trail the stop-loss for the remainder, as the break of this resistance would probably start another huge uptrend.

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance 1.71% whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgement sums (including interest thereon).)

ERIC earnings trend is very bullishEricsson earnings trend has been growing on earnings since Q1 of 2018. (check chart for more info.)

We also received the following news today (07/15/2019 by MT Newswires :

-- Verizon Communications (VZ) and Ericsson (ERIC) said on Monday they have introduced cloud native, container based technology on the core of Verizon's network in a trial, the first deployment in a live network environment that will enable deployment at scale for new services in 4G and 5G.

"By evolving our core network past simply using virtualized machines and instead changing our underlying software architecture to run on cloud-native technology, we are able to achieve new levels of operational automation, flexibility and adaptability," said Bill Stone, vice president of Technology Development and Planning for Verizon.

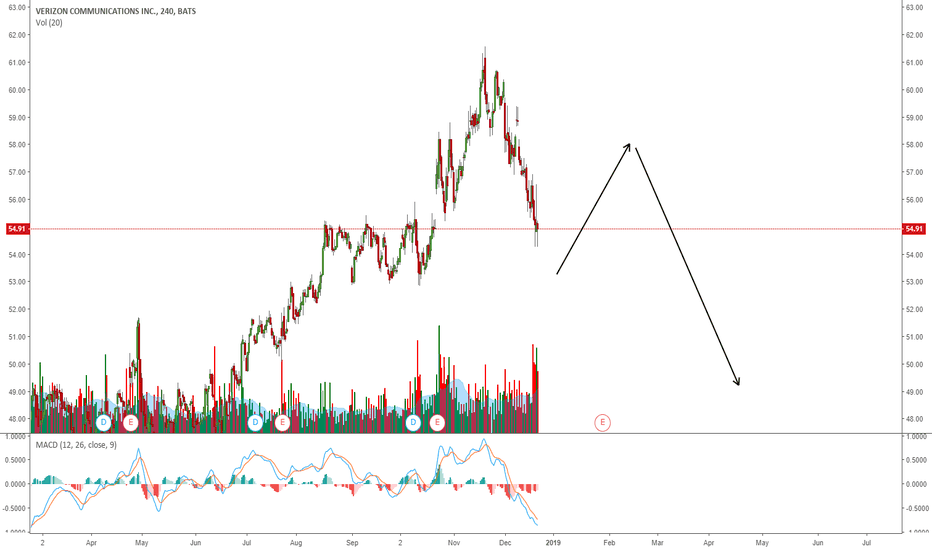

VZ with Mixed Fundamentals and Weak TechnicalsFundamentals:

Verizon reported earnings for Q1:

EPS for 2018-Q1: 1.17

Estimated EPS before earnings: 1.17

Actual EPS: 1.20 a

Surprise: + 2.56%

Revenue stayed at 32.1B, barely missing consensus.

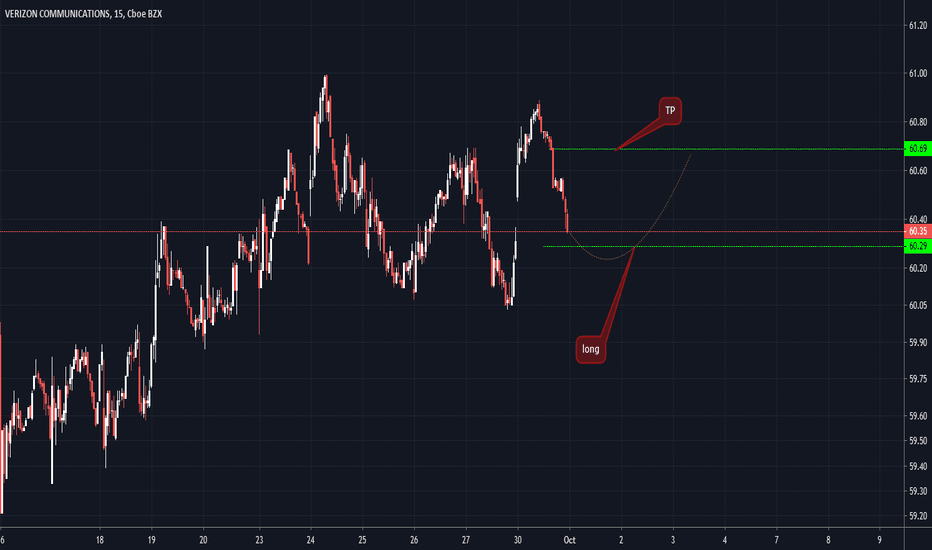

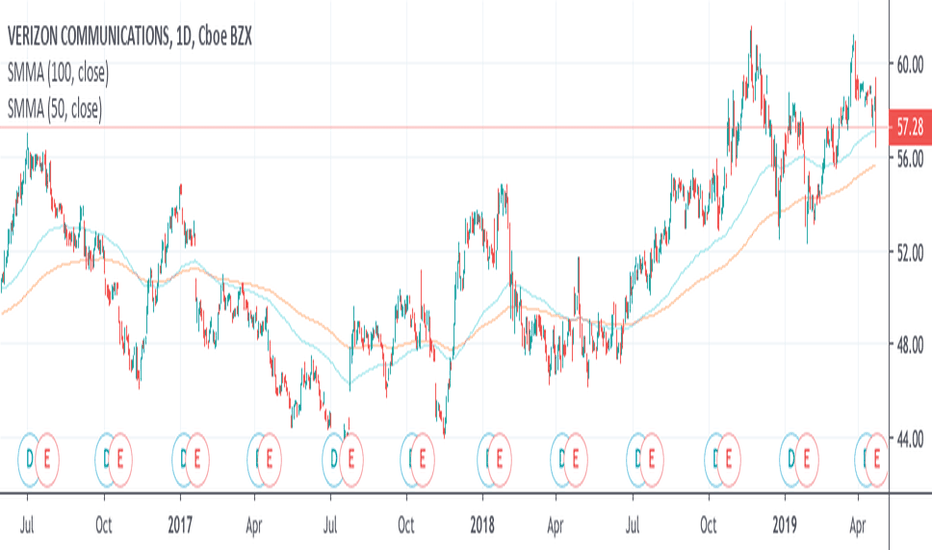

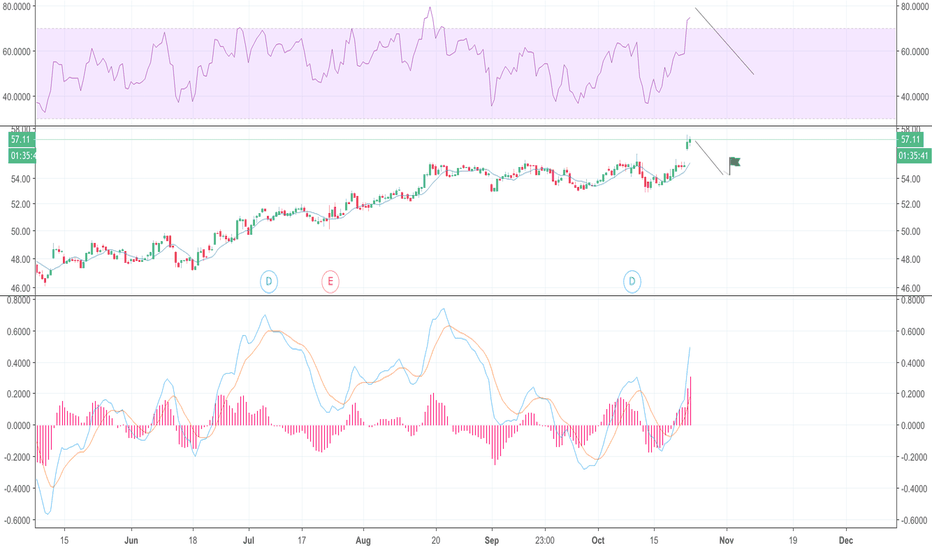

Technicals:

RSI(14) @40.5, reaching lower lows (specifically on the following dates: 2-apr,9-apr,17-apr,23-apr)

SRSI(14) @0

MACs @.26 > MACD @.01

CCI(10) @-200

Resistance level: 60.8

Support level: 53

I would be very cautious trading this. Wait until CCI(10) reaches -100, and RSI above 56 to go LONG.

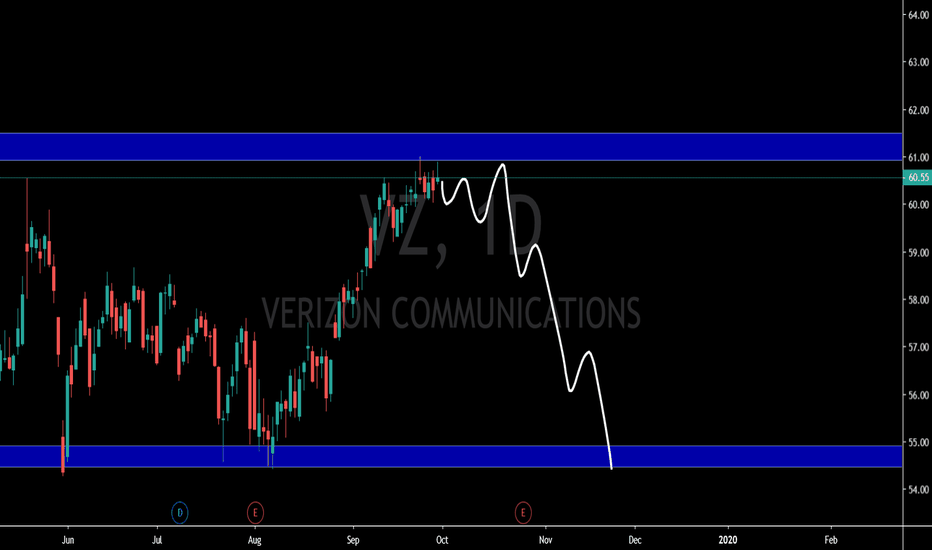

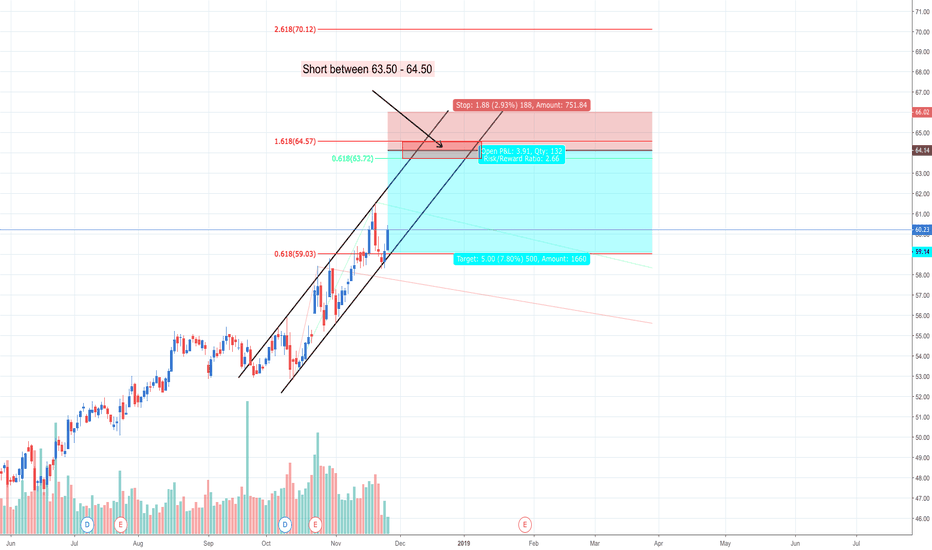

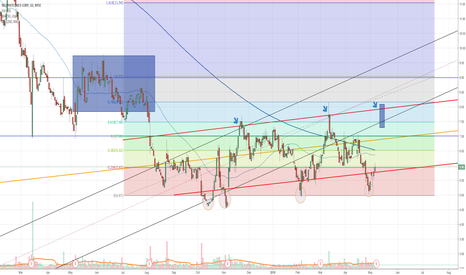

Verizon Short Short based of channels and fibs

My Entry: 63.50 - 64.50 (any entry in that range is okay)

Stop Loss: 66.02

PT: 59.00

Risk/Reward: ~1:266

Ive been planning this trade for the past 3 weeks and it is finally coming to fruition. The reason the r/r out of the gate is slightly under 1:3 is because I would rather keep my inital stop slightly looser, so that in case of a slight over extension I can be slightly more flexable at first, wait to see the trade go in my direction and then tighten the stops down and potentially add. I will post updates as that happens for anyone that is planning to participate in this trade. If the price flips where my projections tell me, I will pull my stop to 65.00 and add size so that the r/r will shift to about 1:4.

2H Growth & Acquisition Friendly (PT: $9.00)Second half of the year has already been projected by various telecom companies and suppliers to be strong and accelerated compared to the first half. Seasonally weak Q1 numbers came in almost across the board. However, NPTN managed to not do as badly as most had anticipated, hence the growth in March fueled by positive sentiment that momentum was returning.

NPTN has repeatedly shown that it will dip under its overall trend lines (red+yellow) and return fiercely for some gains. It will take a stable, forward looking market with growth and momentum to get it back to $9. However, in the short term, I can easily see it retracing back up towards $7.50 before some profits are taken and the price drops back around $6.50. NPTN guided for a solid Q2, though the ZTE news may have a bit of a negative effect on it. However, that news has probably been baked into the current price, which is in part why it's dropped to where it is now. Ignore the Huawei noise, as China talks are at least still neutral, but moving forward again with additional talks and likely more extensions for negotiations.

Q3 guidance should remain the same, specifically focused on getting margins up with flat revenue compared to Q2. Anything above that, and we've got a rocket that will easily coast to $8 I think. Sales and growth into its strongest areas of 400G and 600G continue, with Verizon and others quickly deploying and growing 5G capabilities that NPTN participates in. Additionally, now that LITE has chosen to buy OCLR, the speculation that NPTN could be acquired escalated, so owning a piece of NPTN has additional leverage.

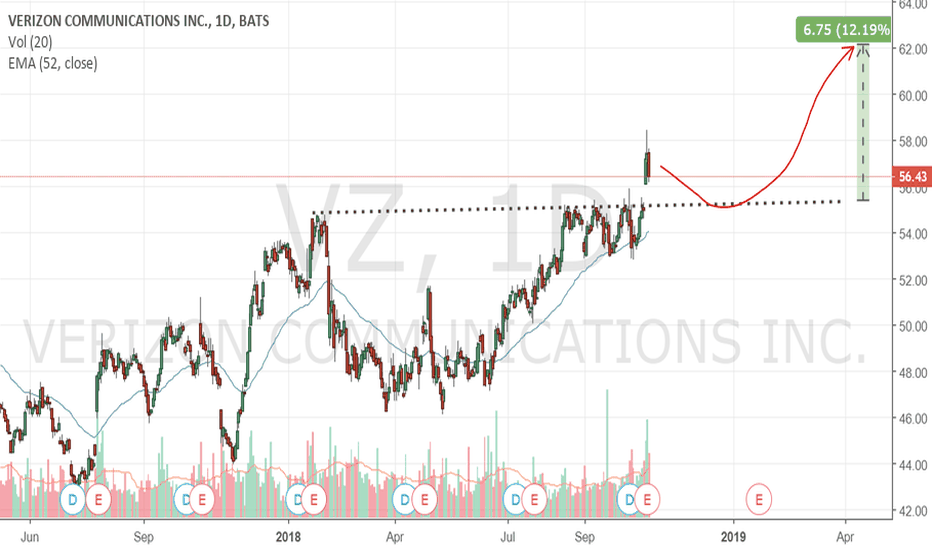

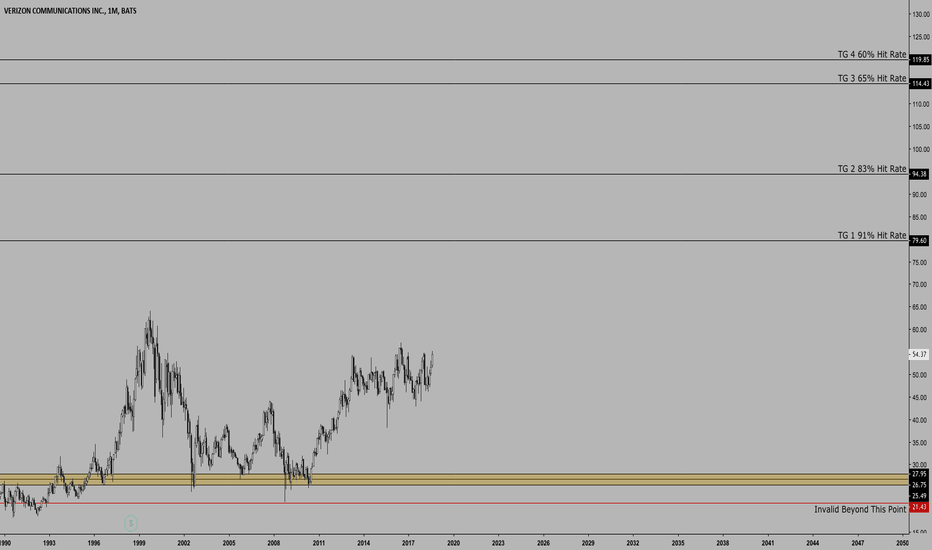

Cup and Handle Pattern?We see a Cup and Handle pattern starting on the 10/30/17 selloff when they announced that the merger between NASDAQ:TMUS and NYSE:S was officially off after years of talk. Once price recovered and hit the $62s level again on 11/27/17, we see a slight decline, as people who bought in at that level were looking to get out. The price is finally back at the mid $62s finishing the Handle pattern. Will we see a breakout next week?