Verizon

October 19 Earnings: Verizon Communications: Recovery TimeThe company has been under immense pressure overcoming spectrum crunch and stiff competition in a saturated market.

Verizon's purchase of Yahoo!'s services will allow the company to boost its online offerings and penetrate a new market.

The company's new prepaid offering will aid revenue streams as well.

Weaknesses in the company is impact from Hurricane season with decreased services output.

A further weakness is the still saturated market with stiff competition forcing lower prices.

I believe the company's turnaround phase is in full effect and the company should report a solid beat.

I'm starting Verizon with a $52.50 PT for the post-earnings move.

Verizon Buy IdeaW1 - Double cycle completed

D1 - Special Cycle (second leg of the weekly cycle) completed

Higher highs on D1 and we can now expect either a flat correction and up move or double wave down and up move

Aggressive - if you want to be more aggressive you can try to scalp buys near the bottom of the potential intraday range. Of course this scalp should come with lower time frame cycle inside the range, divergence and at least a trend line breakout.

Always mind the risk reward.

Verizon Ascending Triangle EntryVerizon (VZ) is showing strong bullish signals and an ascending triangle pattern. It is currently at a great entry point. This is a good 10-20 day trade (somewhere between a swing a medium term play).

Strategy:

- Enter LONG immediately. Set price target just below previous peak at $54.50. Set stop loss below support line at $48 (can be adjusted based on time value).

Other notes:

- Keep an eye on this stock. It's an ascending triangle! If price action breaks through the resistance line (~$56.50) and remains there for a second consecutive day, re-enter the position long with another price target of $61, but immediately exit the position upon seeing "choppiness" in the candlesticks. That is, when the candlesticks start to show long sticks to the upside.

VERIZONEVerizone is gone. May be some new highs coming in and that is why I kept the red line dotted. Once the top is in and uptrend is gone, guess what? Needs to fall. In few months though as it is monthly chart. The bottom red line may act as a guide in future but only time can say. Thanks.

techcrunch.com

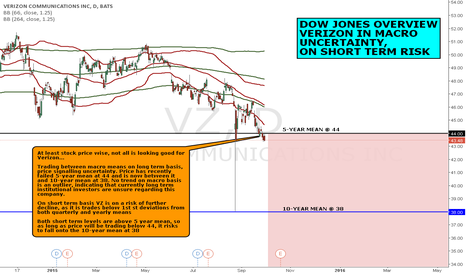

DOW JONES OVERVIEW: VERIZON IN UNCERTAINTY, ON SHORT TERM RISKAt least stock price wise, not all is looking good for Verizon...

Trading between macro means on long term basis, price signalling uncertainty. Price has recently failed 5-year mean at 44 and is now between it and 10-year mean at 38. No trend on macro basis is an outlier, indicating that currently long term institutional investors are unsure regarding this company.

On short term basis VZ is on a risk of further decline, as it is trades below 1st st deviations from both quarterly and yearly means

Both short term levels are above 5 year mean, so as long as price will be trading below 44, it risks to fall onto the 10-year mean at 38