EUR's Retracement: ECB indicated Yield-Seeking on USDWelcome Investors, Dear Esteemed Viewers,

Technicals

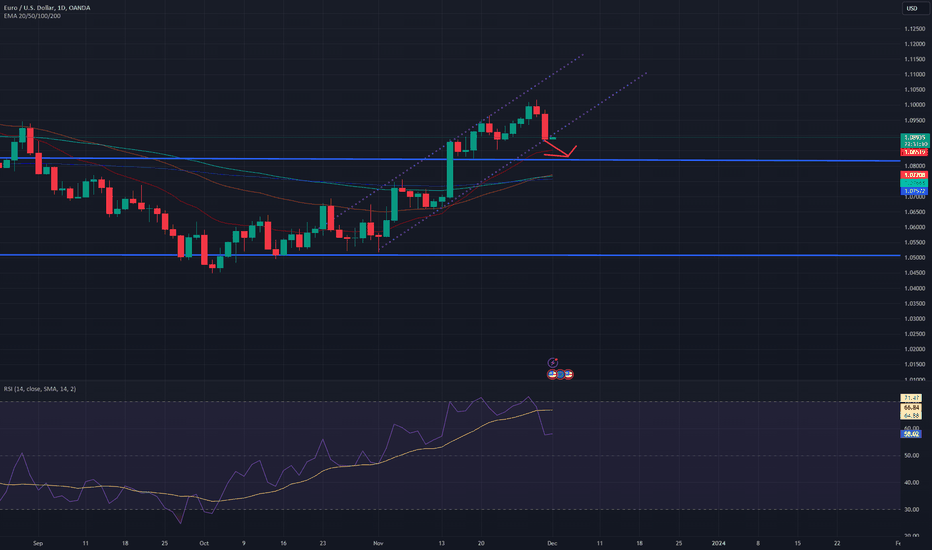

Today's the 30 of November, and EUR's uptrend suffered a breaking. Technically, it means the downbreak of the rising dotted purple trendlines. This technically important price action aligned with a bearish cross on RSI and a bearish daily candle. The target price of this bearish setup is about $1.082, and then, I would re-assess the indicators for signs of possible support. In a bearish scenario, the next target could be $1.051.

News

Beyond technicals, the European Central Bank (ECB) has been cautious in raising interest rates to combat inflation, in contrast to the US Federal Reserve's more aggressive tightening cycle. This divergence in monetary policies has made the USD more attractive to yield-seeking investors.

In the near future, EUR might follow AI's investor sentiment analytics and the bearish technical setup, but if you actively trade EUR, you might want to commit yourself to continuous research because the landscape can sharply change.

Disclaimer:

It is not an investment advice. This idea is my personal opinion. Do your research.

Kind regards,

Ely

Video

Fundamental Shifting of USDJPY's Risk Sentiment Pressures PriceGreetings, Fellow Traders,

Technicals and Chart Explanation

Indicators

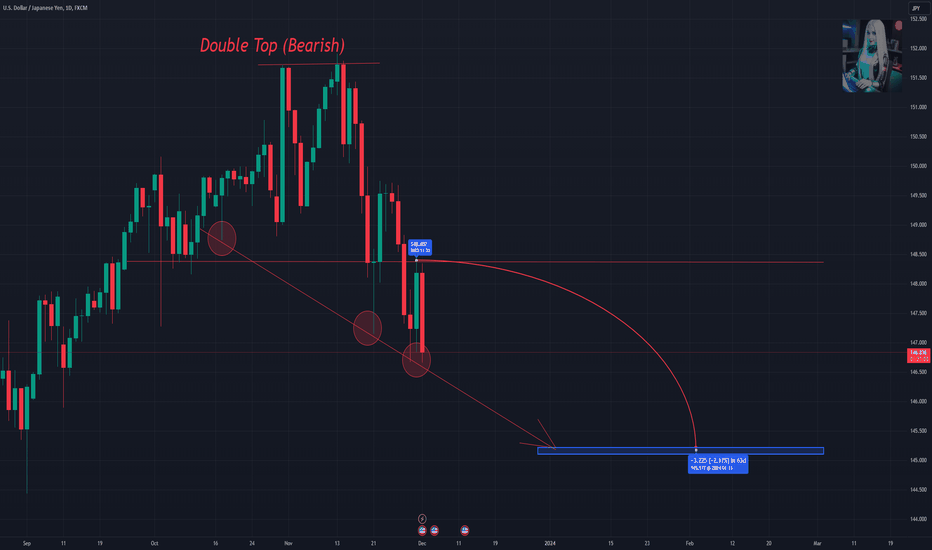

Trendline: A trendline is a diagonal line connecting at least two price points, typically peaks or troughs, to determine the overall direction of a trend. In this case, the downward trendline suggests a prevailing bearish trend in USDJPY.

Resistance: Resistance is a price level where upward momentum is likely to stall or reverse. In the USDJPY chart, the identified resistance level could act as a barrier for the price to break through, supporting the bearish outlook.

Downward Pressure: Downward pressure refers to the selling force driving the price lower. In the USDJPY chart, the repeated instances of price retracing toward the trendline and resistance level indicate ongoing downward pressure from bears.

Double Top Pattern: A double top pattern is a bearish reversal pattern formed when the price attempts to break upward twice but fails to surpass a previous resistance level. The double-top pattern observed in the USDJPY chart suggests a potential reversal of the upward trend and a continuation of the bearish trend.

Target Zone: A target zone is a price range that a trend is expected to reach based on technical analysis. In this case, the lower target price at $145.16 represents a potential area where the bearish trend could find support.

Forecast: A forecast is a prediction about the future movement of a price based on technical analysis and market sentiment. In this instance, the forecast suggests a potential continuation of the bearish trend in USDJPY, with the price potentially reaching the lower target zone.

Chart

As a discerning observer of market tendencies, I've identified a potential double top pattern on the USDJPY chart, preceding the recent bearish price action that gathered momentum and drove prices towards lower targets. This observable pattern, depicted above the candle formations, harmonizes with the prevailing downward trendline. Repeated instances of downward pressure exerted by bears, symbolized by the red circles, have guided the USD's descent toward this trendline. Currently, I discern a price range confined between resistance and the lower target price of $145.16. Therefore, I anticipate the potential continuation of this bearish trend.

News and Fundamental Analytics

Japan's Economy Stagnates as Yen Rebounds: Japan's economy, the third-largest in the world, grew at a mere 0.2% annualized rate in the third quarter of 2023, falling short of expectations and indicating signs of stagnation. This subdued economic growth could weigh on the Japanese yen, potentially further weakening USDJPY.

US Economy Faces Recession Fears: The US economy has exhibited signs of slowing growth, raising concerns about a potential recession. If economic conditions in the US deteriorate, the dollar could lose its appeal, contributing to a further decline in USDJPY.

Geopolitical Tensions Weigh on Risk Sentiment: Geopolitical tensions surrounding the war in Ukraine and other global conflicts have dampened risk appetite among investors. This risk-averse sentiment could drive investors towards safe-haven assets like the yen, further weakening USDJPY.

Technical Indicators Signal Bearish Momentum: Technical indicators on the USDJPY chart, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), suggest ongoing bearish momentum. These indicators could provide further confirmation of the downward trend in USDJPY.

Please note that these observations are intended for entertainment purposes only and should not be construed as investment advice. It is crucial to conduct thorough research and make informed decisions when managing your investments.

Warm regards,

Ely

Video - Powerful EUR Fundamentals - AI suggests Technicals AlignGreetings, fellow investors, and welcome traders!

I t's a video tutorial to share the knowledge behind my charts. If you're tuned, I'll continue sharing follow-up AI and FOREX content because there's much to learn from each other.

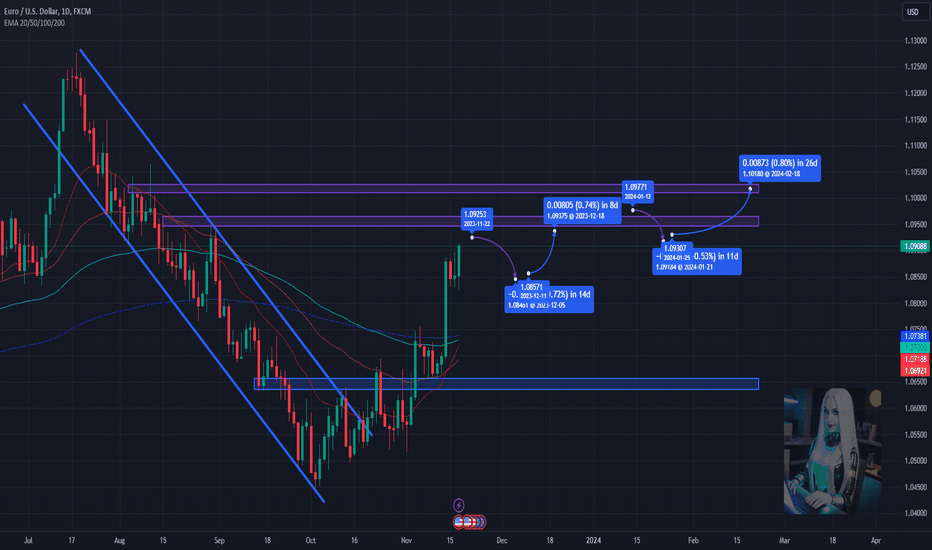

T oday, I'm excited to share with you a fascinating generative chart I've created using a deep learning neural AI. This advanced technology enables us to analyze historical price data and identify potential future price movements.

I t's a bullish trend, with daily candles aligned in an upward trajectory. I've initiated a long position at the support level, and our AI analysis indicates the potential for further growth up to the resistance level.

While we might encounter a slight pullback below the double resistance, it's important to note that investor sentiment doesn't suggest any significant bearish signals.

S tay tuned for follow-up content where we'll delve into more trading scenarios and strategies.

It's not an investment advice.

Kind regards,

Ely

We are Bearish all the WayHey Guys!

So today i decided to test a publishing a video idea. lol

It feels great.

The video is a quick interpretation of what we have already stated on the EURUSD analysis.

PS: Apologies for the sound quality. It was just a test and I created it in a pretty noisy environment.

Feel free to drop your comments and boosts.And if you have a different persepctive on this pair, do well to share and we will be glad to learn together.

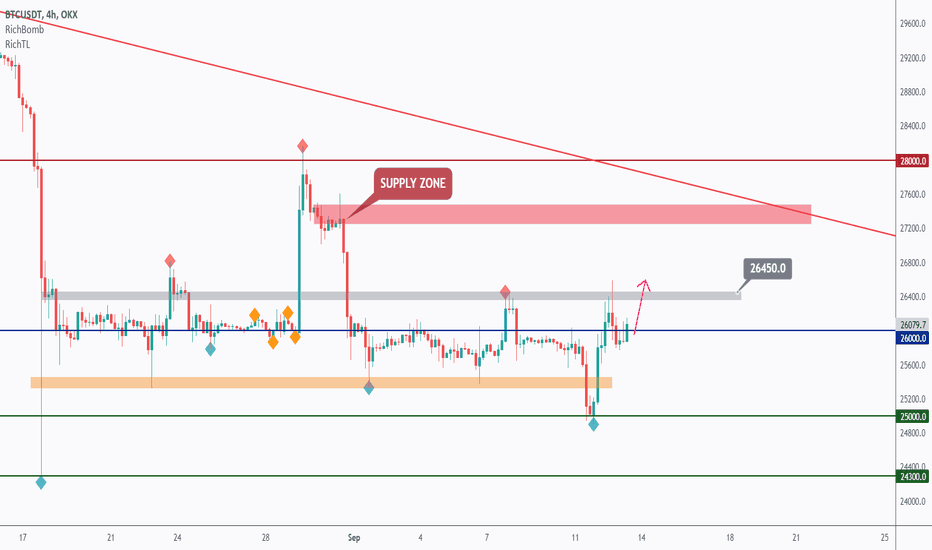

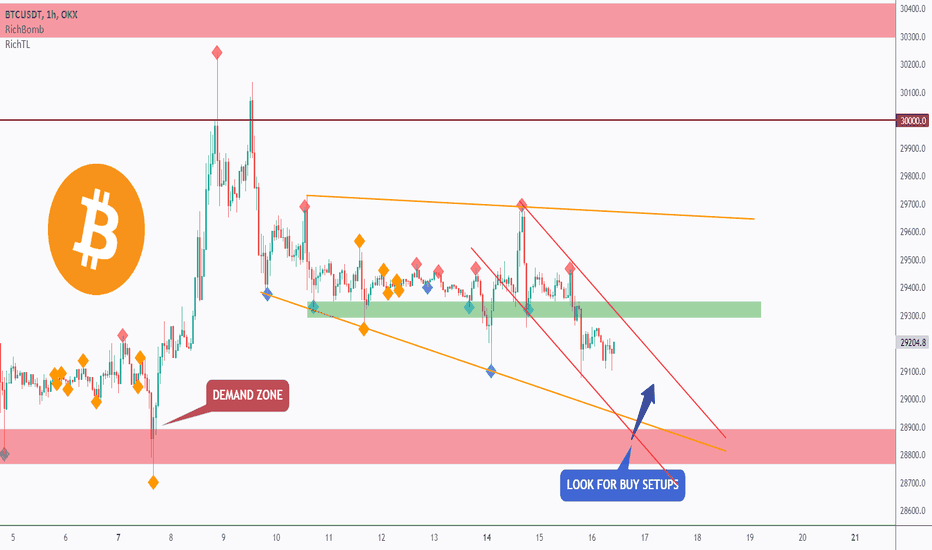

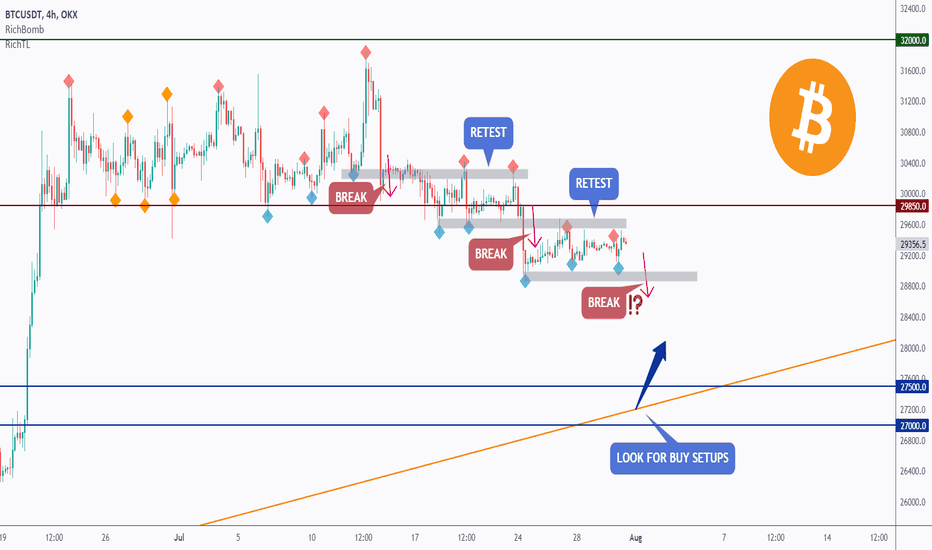

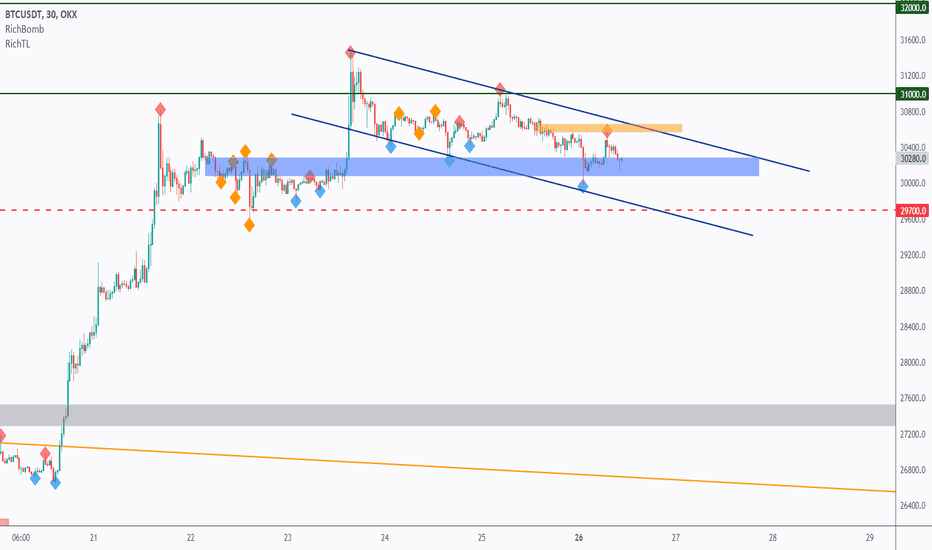

BTC - Critical Zone / Period ❗️📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

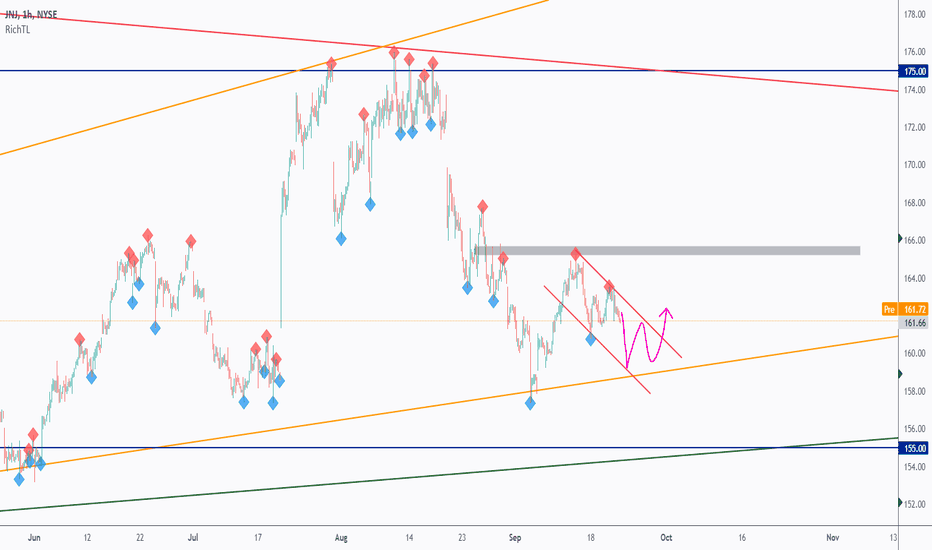

How To Analyze Any Chart 📚📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Today we are going to go over a practical example on #JNJ , but you can apply the same logic / strategy on any instrument.

Feel free to ask questions or request any instrument for the next episode.

📚 Always remember to follow your trading plan when it comes to entry, risk management, and trade management.

Good luck!

Remember, all strategies are good if managed properly!

~Rich

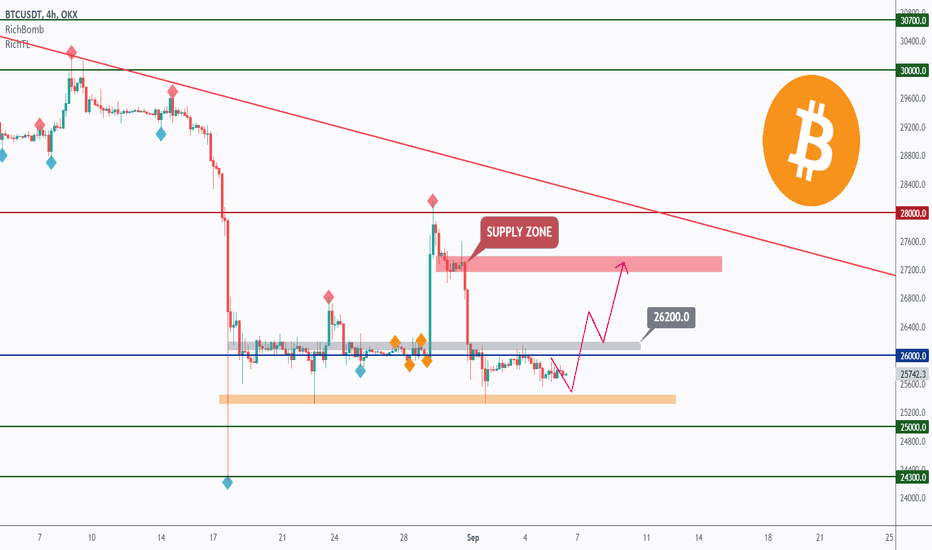

BTC - Detailed Video Analysis 📹 From Weekly To H1Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - Top Down Analysis 📹 From Weekly To H1Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

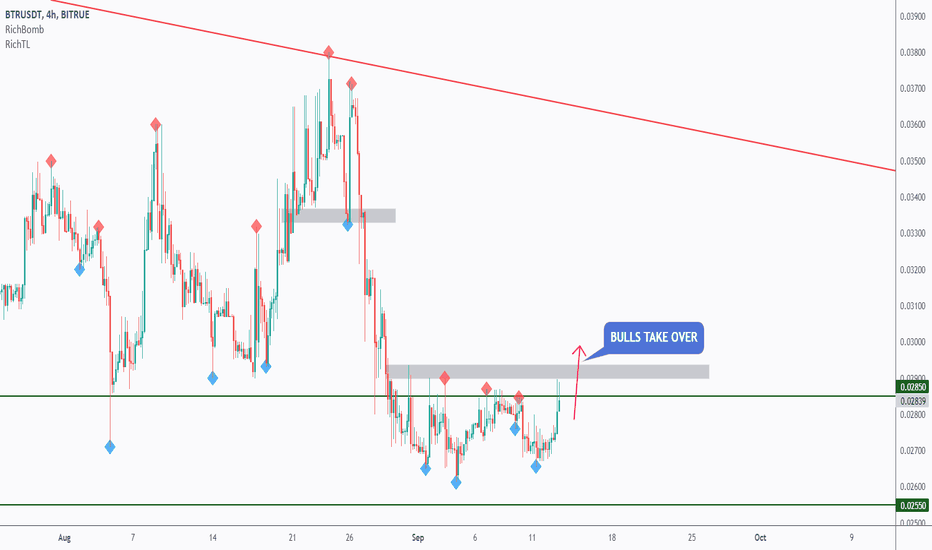

BTR - Top Down Analysis 📹 Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTR.

Which scenario do you think is more likely to happen? and Why?

📚Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - Top Down Analysis 📹 From Weekly To H1Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

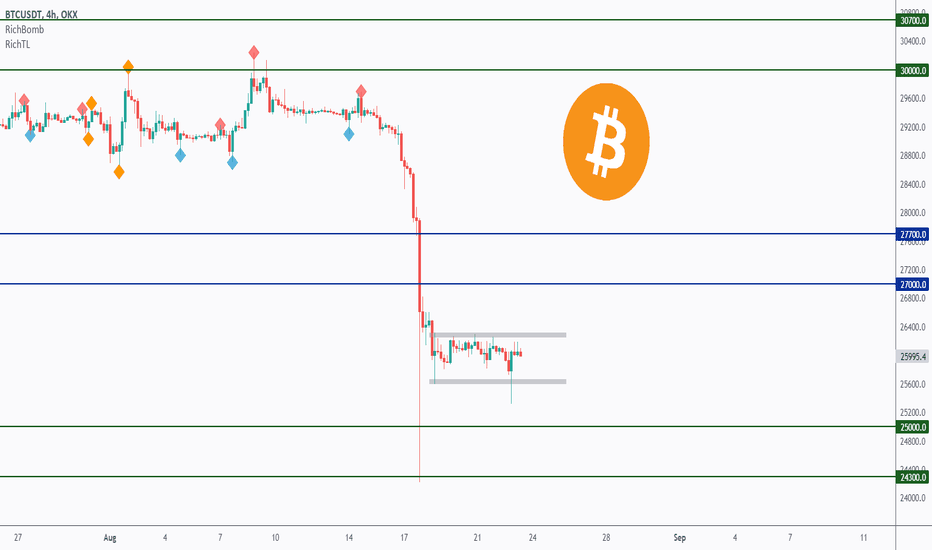

BTC - Top Down Analysis 📹 From Daily To M30Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

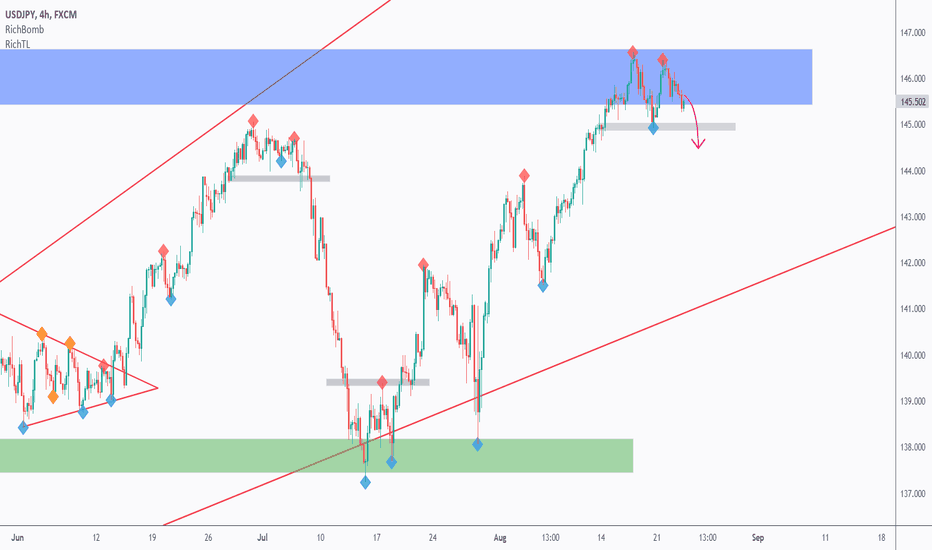

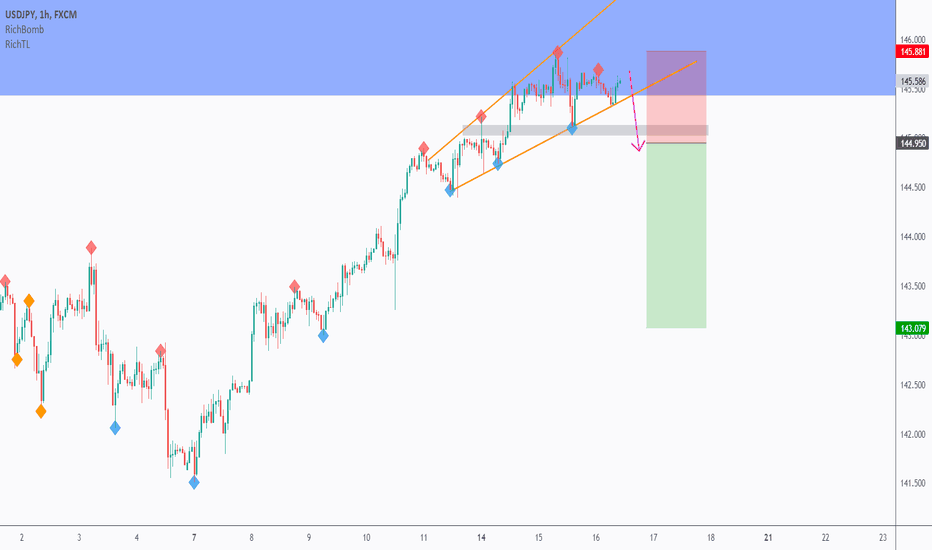

USDJPY - Market Structure Practical Example 📚Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #USDJPY.

Which scenario do you think is more likely to happen? and Why?

📚Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - Top Down Analysis 📹 From Daily To H1Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

USDJPY - from Daily to M30📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #USDJPY.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

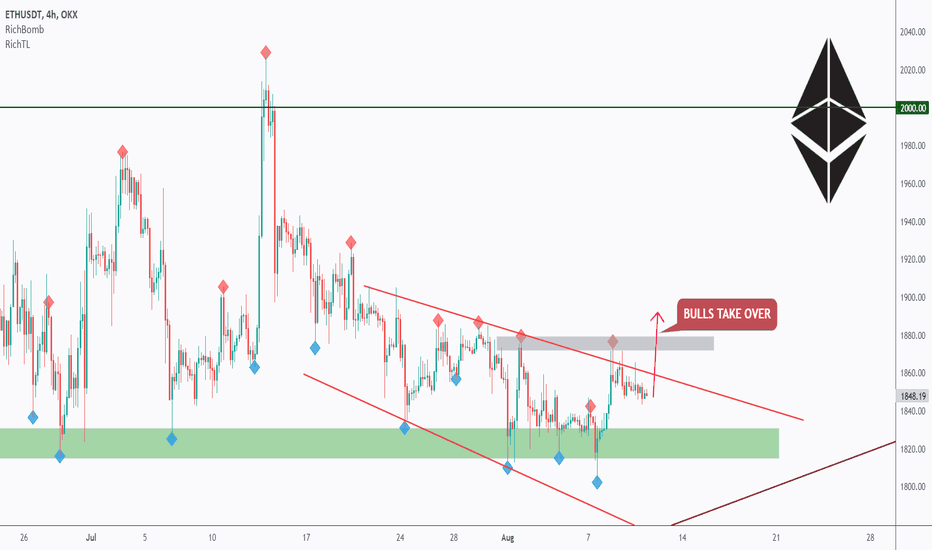

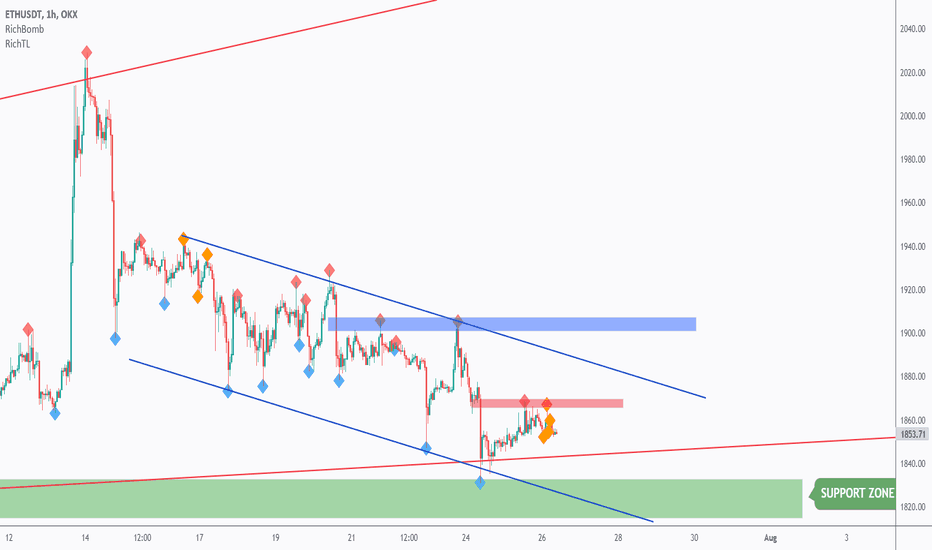

ETH - Top Down Analysis 📹 From Daily To H1Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #ETH.

Which scenario do you think is more likely to happen? and Why?

📚Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - Top Down Analysis 📹 From Weekly To H1Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

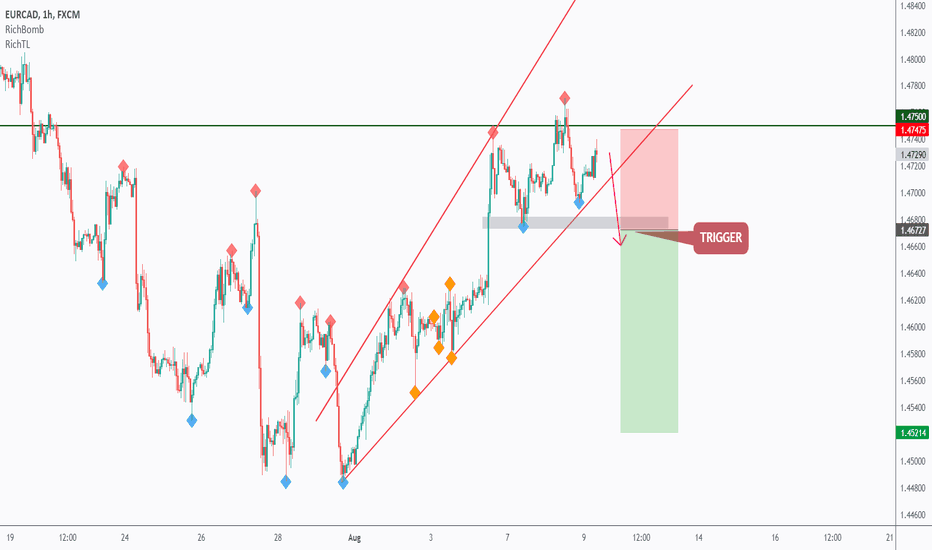

EURCAD - from Daily to H1📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for EURCAD.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - Detailed Top Down Analysis 📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

ETH - Video Update Before FOMC 📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for ETH.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

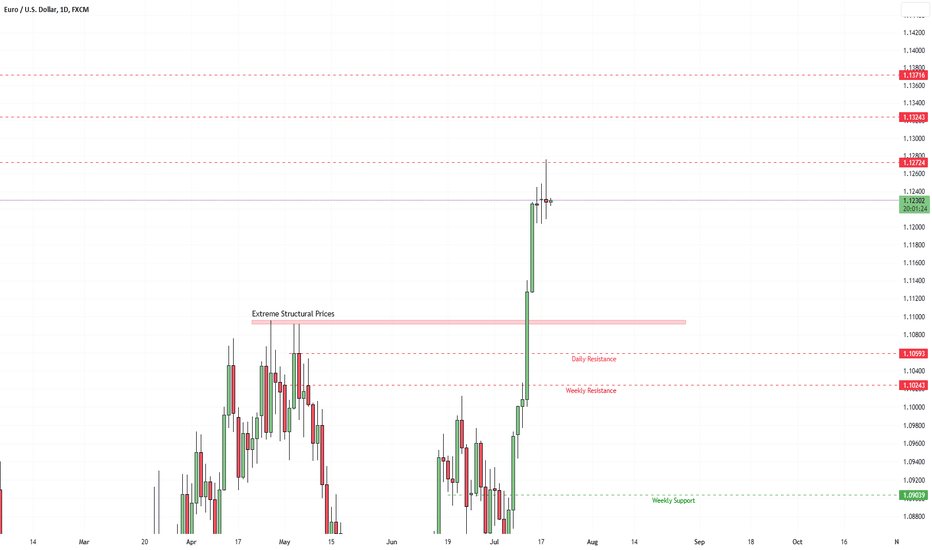

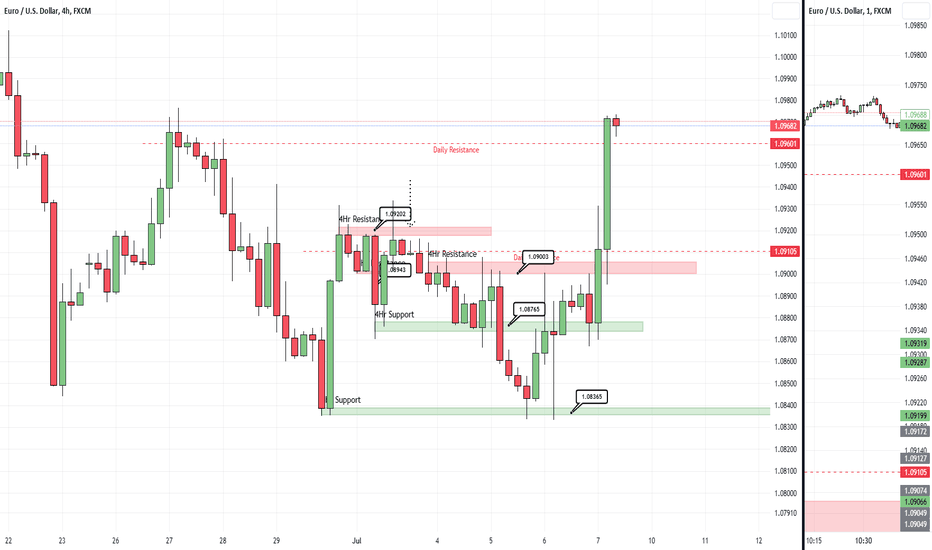

Review of the July Breakout 📨 / EurusdIf time permits you, I have a longer video analysis here of the past Breakout on Eurusd.

weekly tiemframe 1:45

Daily Timeframe 4:16

4hr timeframe 7:02

1hr timeframe & news events 9:47

In this Video I breakdown the July Breakout for Eurusd that has extended from 1.09 to 1.127. A 370 Pip move in approximately 1.5 weeks. Our key fundamental cpi release was a major catalyst for us to breakout of the range we've been in Since January of this year. The CPI was views as a risk on news release and the markets have responded in an optimistic way as the dollar is being sold off for more risk on assets like the Euro. We have momentum on the weekly and monthly timeframe here as so I'm bullish here. We do have interest rates next week and it is pssible we may continue to consolidate or even pullback just a bit prior to a Bullish Eurusd interest rates push towards 1.146 weekly resistance zone. We do have a few daily resistance zones to be aware of in the short term such as 1.137, 1.1324, and the current daily zone that we are rejected 1.1272. We rejected this zone with london price action and retail sales data earlier today. The Daily candle closed bearish with a large top wick. I'm not completely sold on taking sells though, no pun intended.

5 Trades this week & +2.40% 🥲 / Part 2This is Part 2 of Weekly Review video analysis where I detail some of the markets price action this week. I talk about ideas such as the psychology of the market, key levels that played an important role, and my NFP buys.

If you enjoyed this video analysis, please leave your support with a rocket or a comment below. If this was interesting, follow for more! Anyways have a nice rest of your weekend and have a safe next trading week.

5 Trades this week & +2.40% 😆 / Part 1In this Weekly Review I breakdown my thought process for my first 4 trades of the week. The video was cut short due to a 20 Minutes max length for tradingview. I just learned about this since I am new to video analyses on tradingview. I will be uploading the Part 2 for my final (5th) trade of the week at some point this weekend.

If you enjoyed the video, please leave a rocket or a comment 😁

I will be making more video analysis for the channel as I have been enjoying them myself. Anyways have a nice weekend.

BTC - Still Around A Strong Resistance 📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich