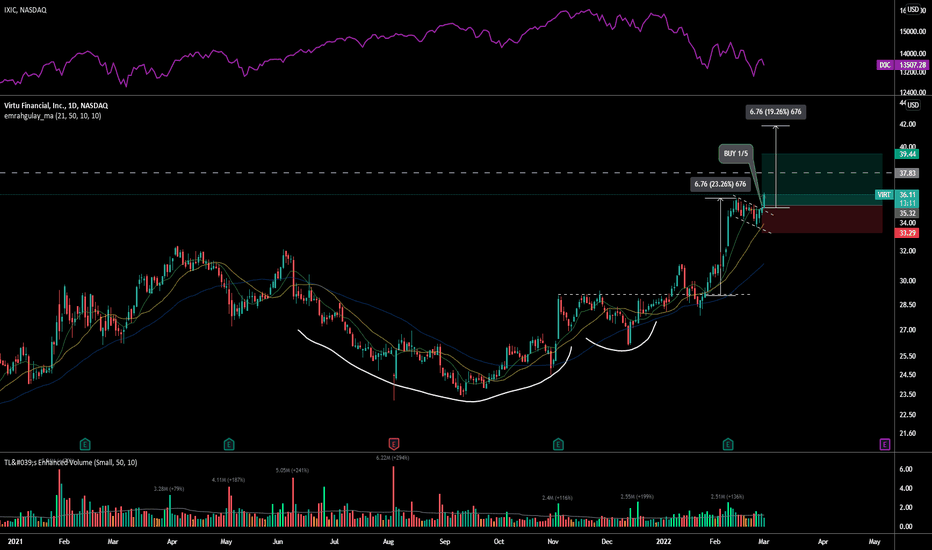

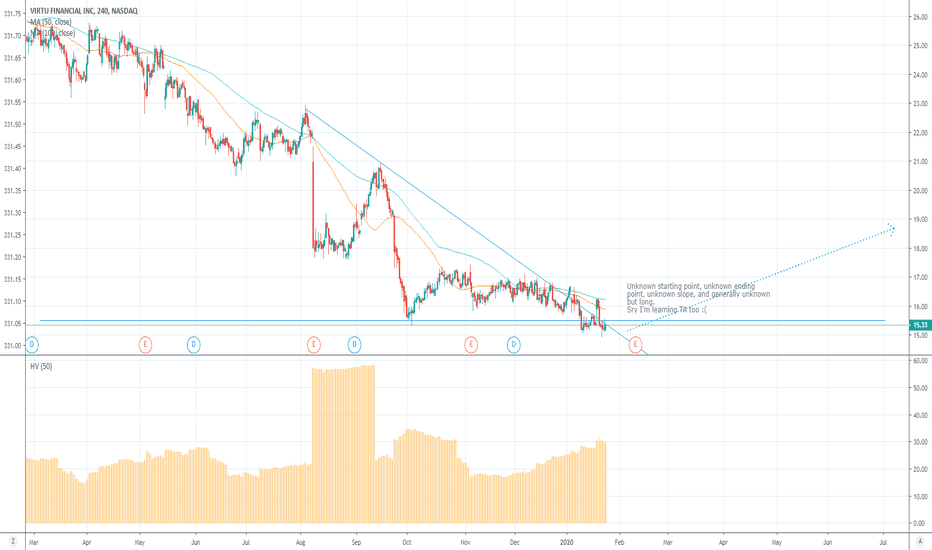

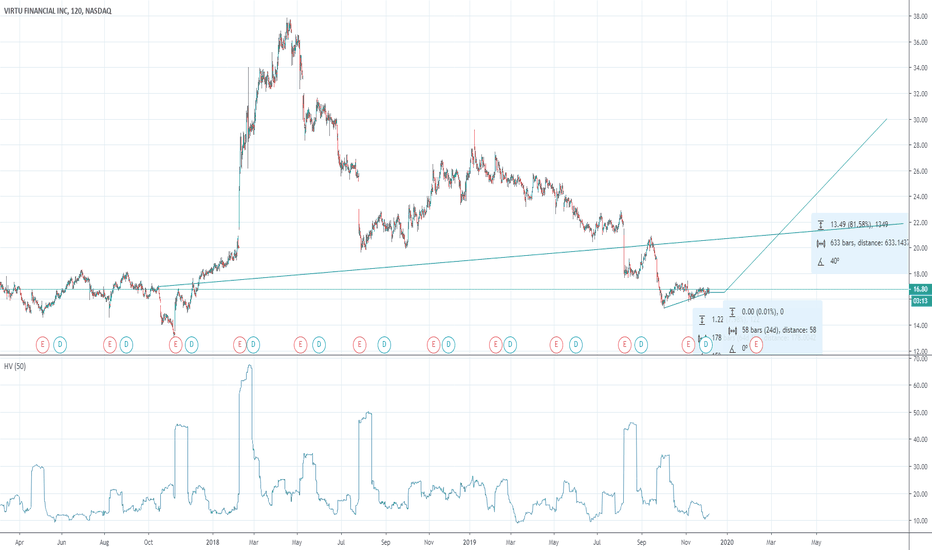

Next market leader? $VIRTVirtu Financial is an American company that provides financial services, trading products and market making services. Although its fundamentals aren't what I ussually look for, its technicals are showing real strength in a market that laks strength.

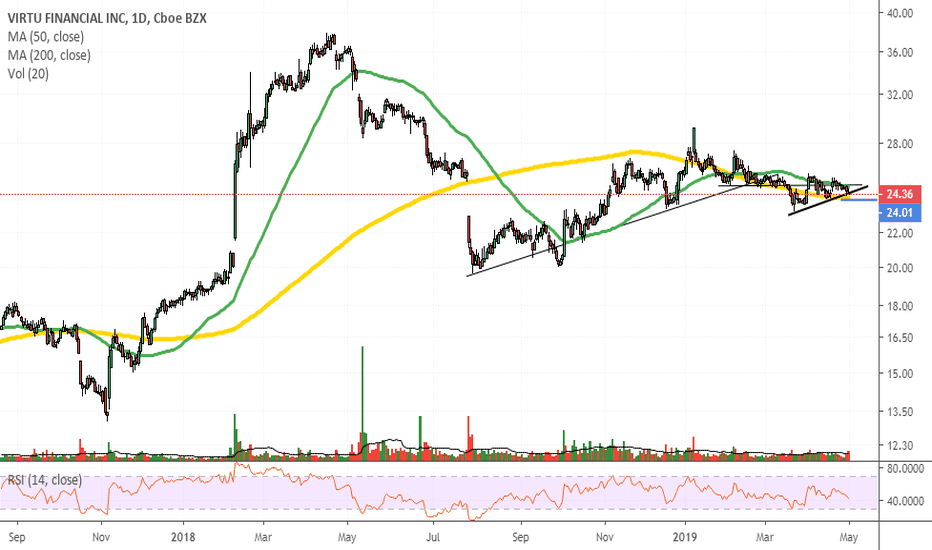

After a nice leg up from a long cup & handle NASDAQ:VIRT took a rest and formed a nice flag pattern. In which, yesterday made a breakout and I bought a small position.

This flag has a flagstaff of 6.76 points. TA rules state that after the breakout, the price should reach the same 6.76 points up. That would be equal to target price near $42, or a +19% advance. But I'll be very cautious as there is a strong resistance level at $38.

With a IBD RS rating of 95 and a number 3 in the IBD Industry Group Rank, Virtu is posted to be one of the leaders of the next bull market. Today is a good example of leadership as is having a good follow through day with an up day of +3% while the NASDAQ is down -1.70%.

VIRT

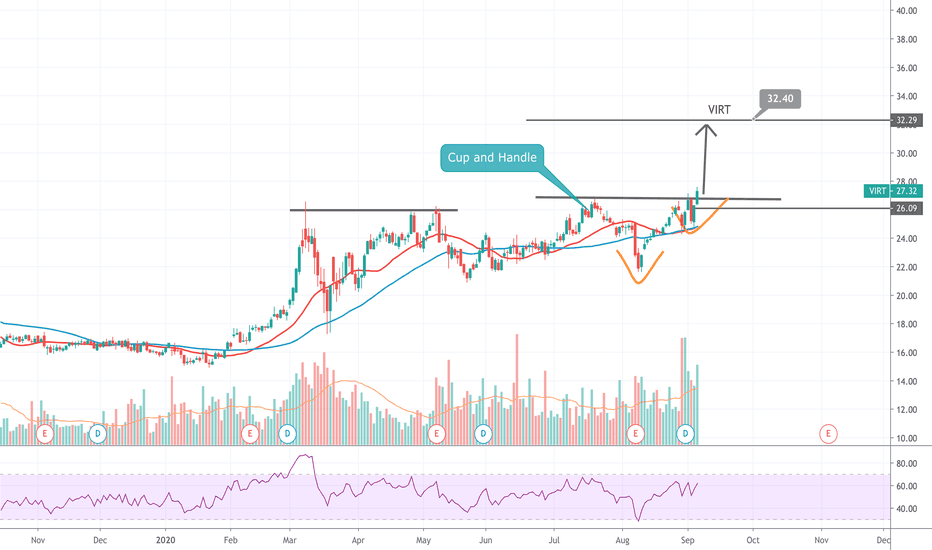

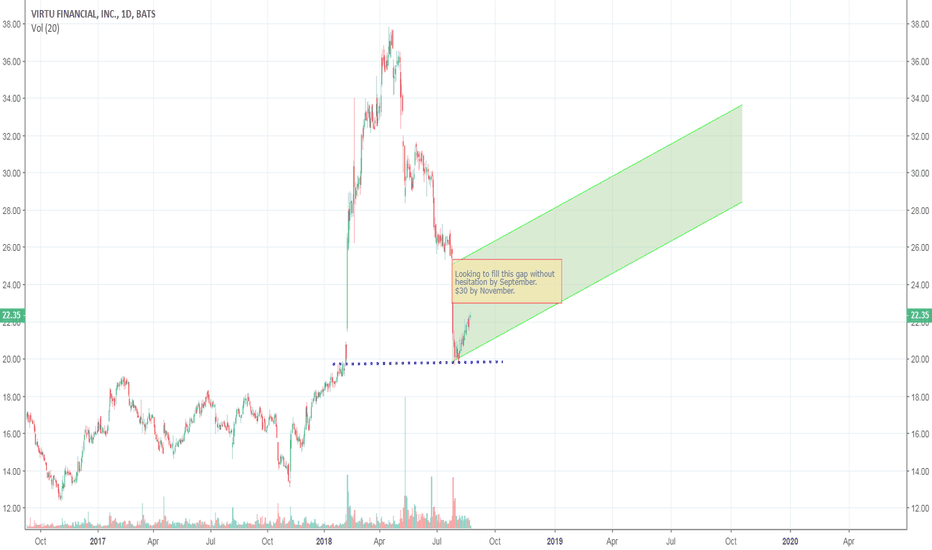

VIRT BUY OR LONG , TARGET UP TO $32+VIRT confirms the "Cup and Handle" pattern at $27.30

VIRT buy : $27.30

VIRT target : 32+

Stop loss : $26 or 5%

Wish you a good deal!

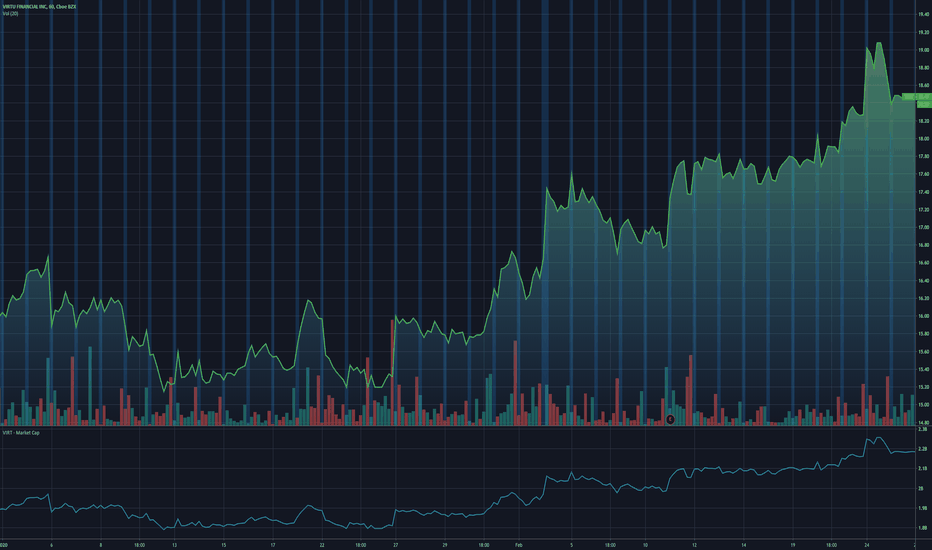

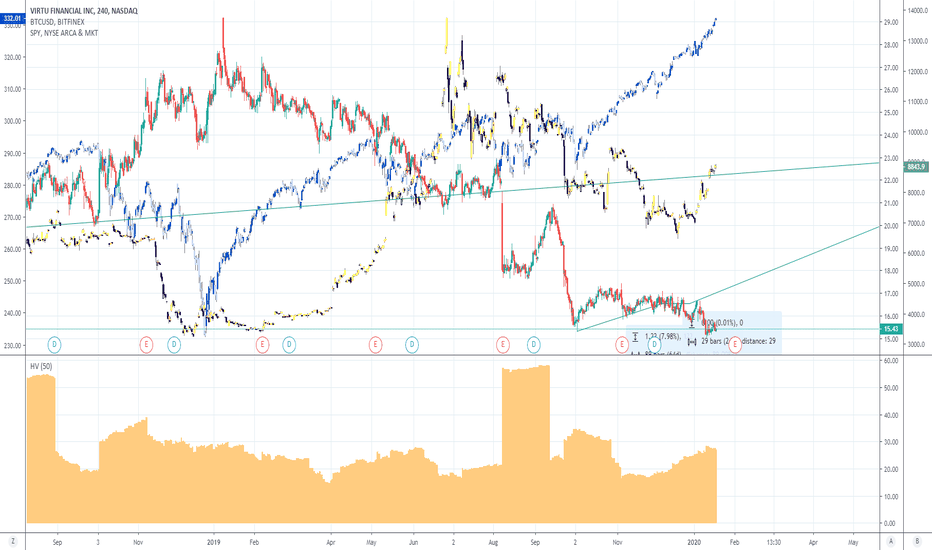

$VIRT - HTF's doing just fine - Undoubtedly, the HFT world is making a killing with the recent volatility. I've been a longtime investor in VIRT, but just watching this go up feels a bit sickening.

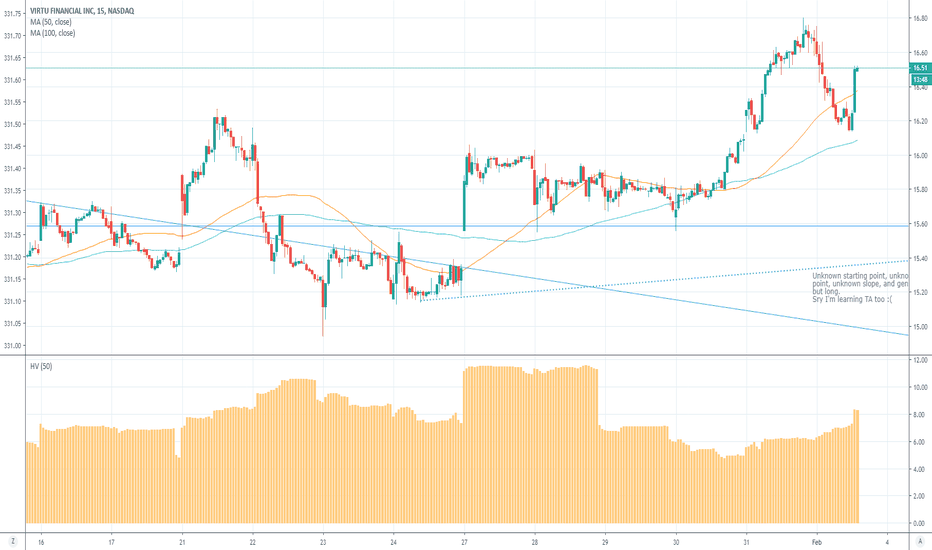

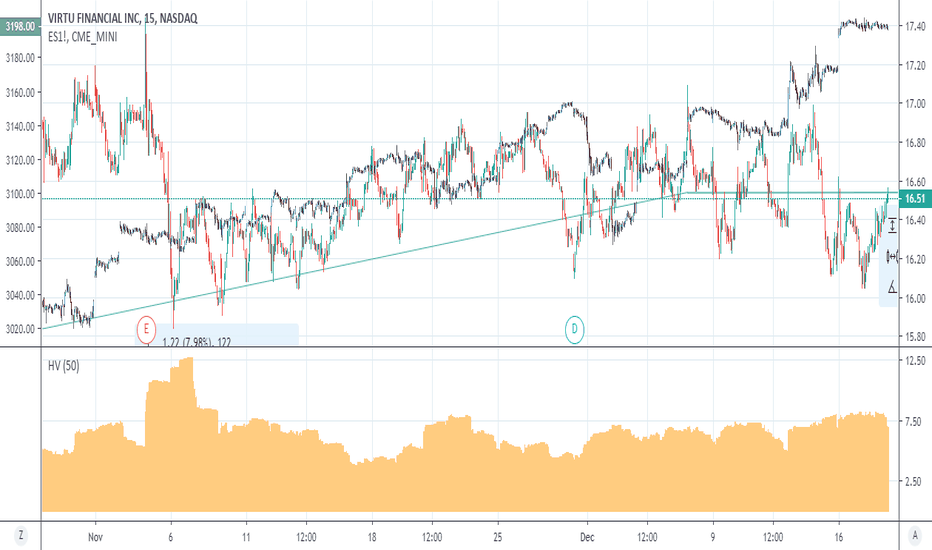

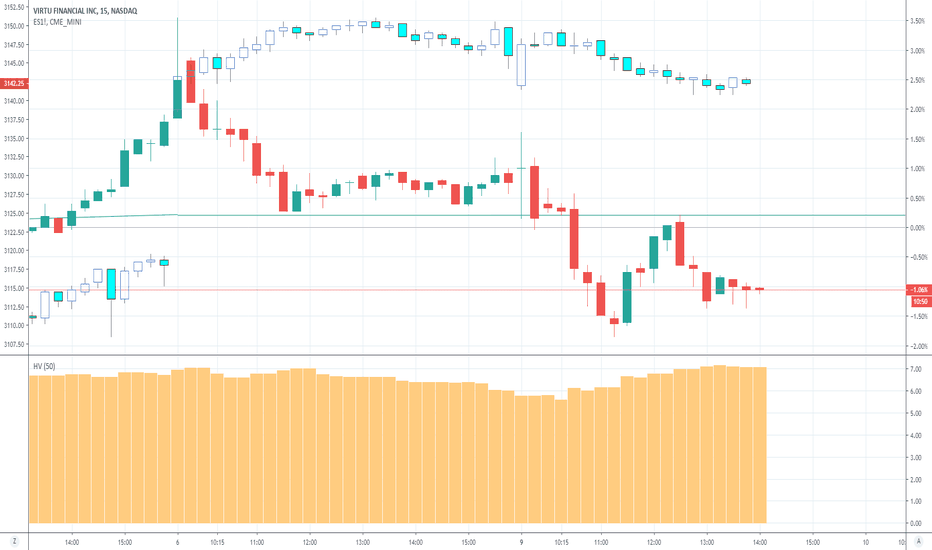

VIRT $1k lossOn Thursday just before the close (the red ellipse) I decided to give going short a try just to see how it is to hold an overnight short position and how the Fidelity website handles it. Continued putting on a short position on Friday morning up to 4k shares because it seemed like the liquidity on the buy side that I could see on the book was weak and fragile, plus the momentum seemed to be on my side. Unfortunately it seems that there turned out to be a pretty solid support level there and the liquidity quickly firmed up, so I ended up having to cut my losses for a $1k loss. Live and learn I suppose; giving $1k back after $20k profits is acceptable but it does seem that I need to be more careful. Since I haven't had any successes making money going short so far, I'll limit my short positions to less than 1k shares until I have a better idea of what I'm doing. When I go long, things are much easier because it matches my fundamentals based long disposition, and I've consistently made money that way.

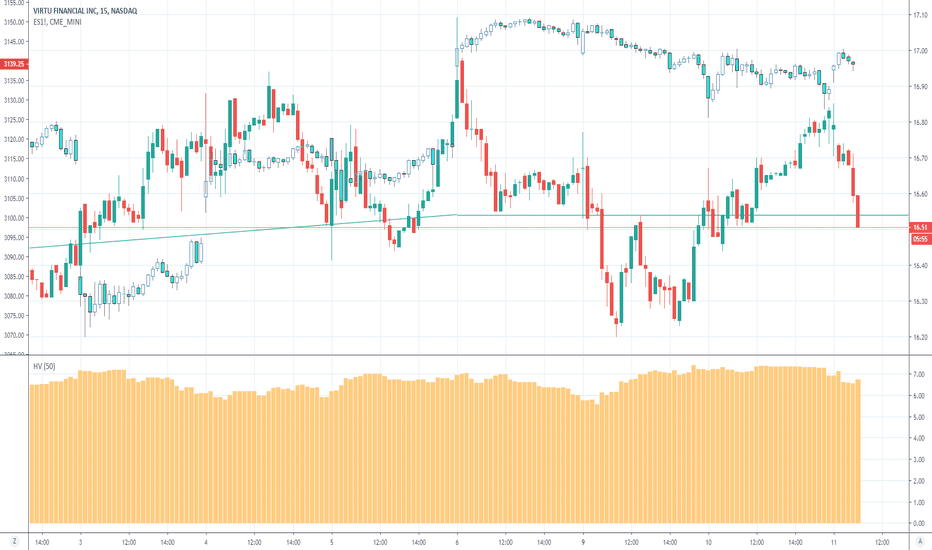

VIRT intraday noteMade another $5k or so for $20k between Friday and today, using a basic tape reading market making strategy. Highly recommended for this stock. I'm flat again because I don't see any way to tell which way the stock is going from the $16.50 level. (But then again I'm just a beginner, maybe there is a way using TA that I don't know).

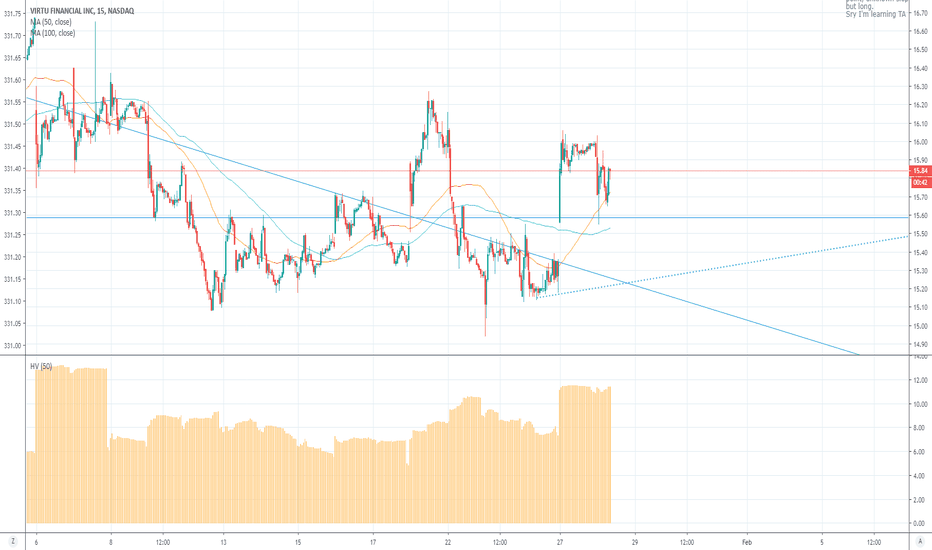

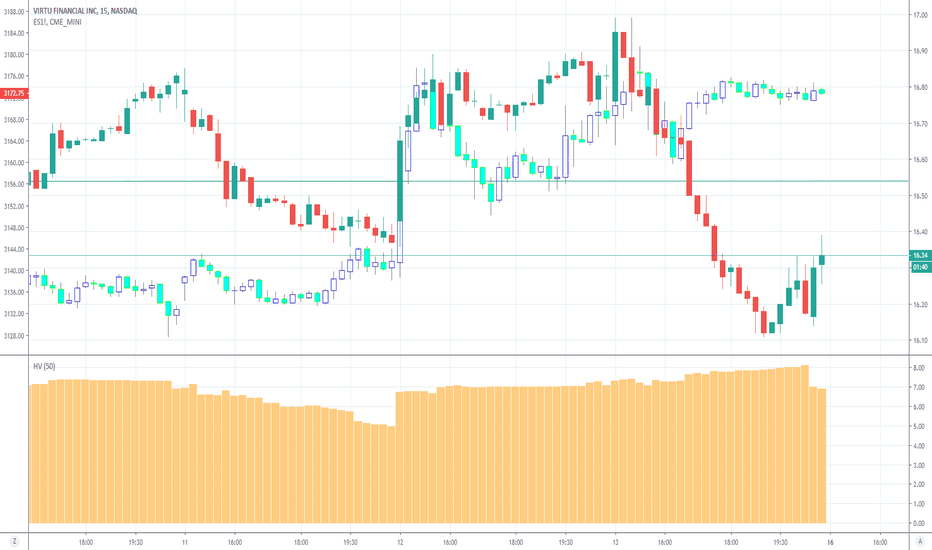

Everything went better than expected pt 2Got my account fully un-restricted today, and had a fantastic trading day in which I started flat, made about $15k, and then ended flat. I'm not sure what to expect on Monday but I have a feeling that the longs are overextended so there might be a substantial price drop. However I'm not going to prejudge that and I'll wait to see where the stock opens before I open up a new position. Happy Friday everyone :)

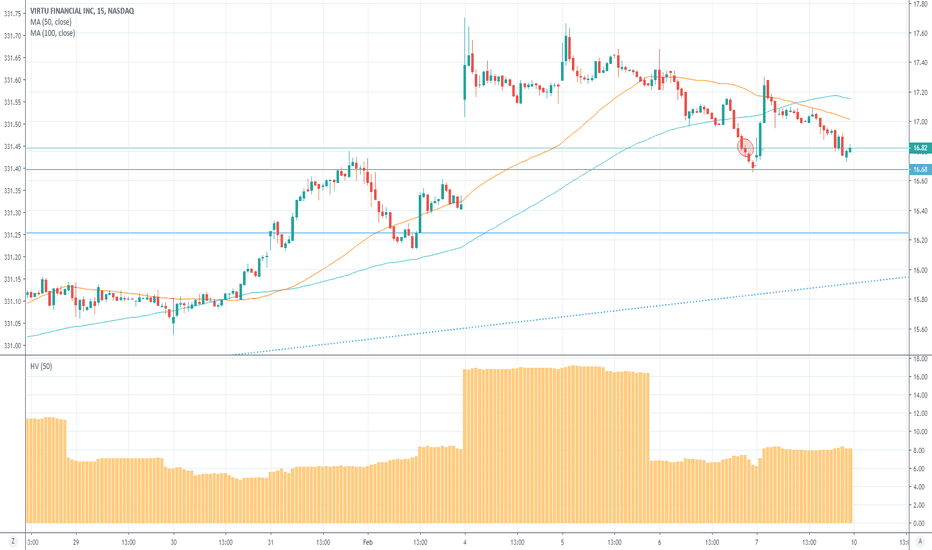

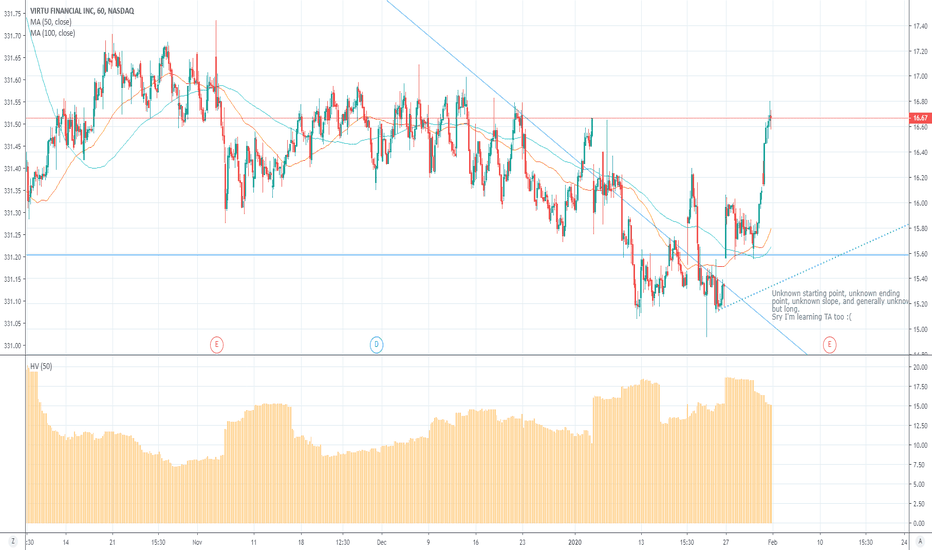

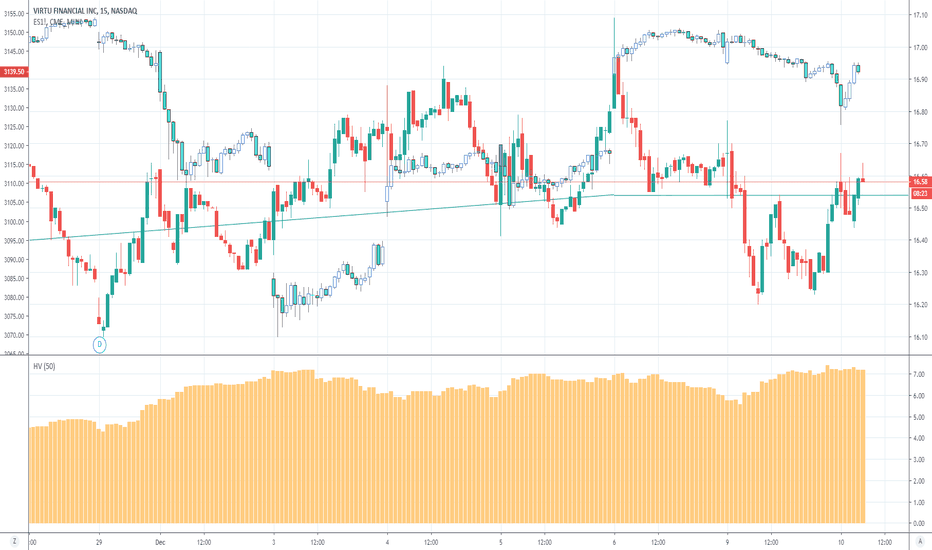

Everything went better than expectedAs you can maybe see, the recent price action has actually been matching my TA lines pretty well (and it's not me, because my account is still restricted from buying, I suppose until I unwind my long margin position and rewind it back through my cash account, if that makes sense). I adjusted my upward diagonal line to match the price action, but please note that the line is actually made of grains of salt

Updated VIRT meme linesSome of the recent price action has been directly caused by my working into a position from my retail brokerage account (working my cost basis down), but one thing I'd point out is that since I started trading the liquidity has thickened up from something like 5-10 price increments wide with 100 - 200 shares on the best bid and offer to a point where it's usually 1 price increment wide by 10 am with thousands of shares on the BBO. I intend to continue accumulating shares gradually over the next year or so.

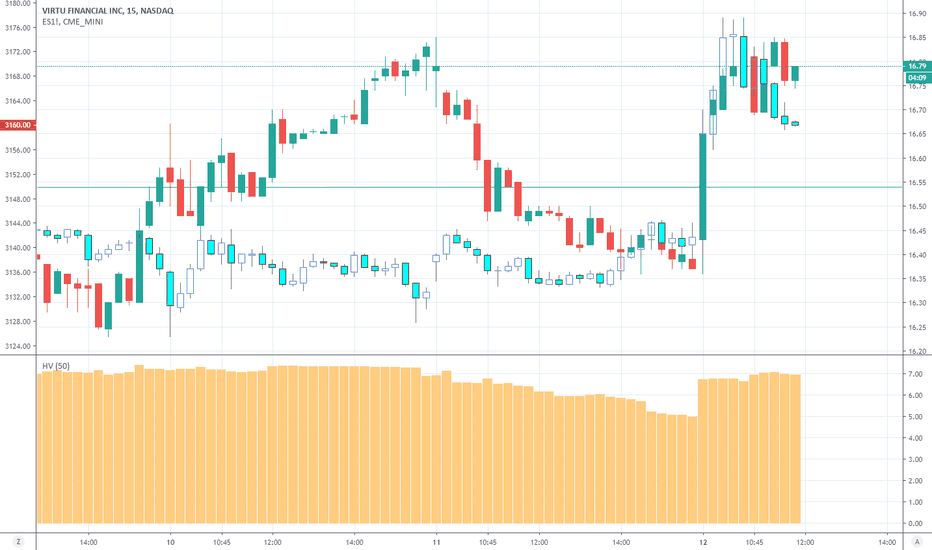

This week I got gently liquidated by Fidelity so many times that I was unable to buy any more shares since Tuesday, but I should be back and ready for action sometime this week. Still in profit in my account, but only small profits so far (a few thousand $$)

VIRT - get your bodies ready, cause mine sure isMy previous idea got flagged for advertising because I directly linked some south park stuff, so I'm reposting it with the BTCUSD chart also added. Have a very excellent Tuesday everyone :)

VIRT/ES1!I ended up closing out my margin long position for a nice profit, but I'm having too good a time trading to do out the numbers

VIRT/ES1!Ended up taking a small loss today (on the order of $100 or so I think), but the more important thing is whether I managed to avoid the pattern day trader designation. Fingers crossed, and I'll probably find out one way or the other from Fidelity next week.

VIRT/ES1!Made a few bucks (literally like $10-$15 or something) market making this morning, but I'm avoiding using up any more cash buying power until my pattern day trader warning has gone away. Who knew market making could be so complicated, amirite?

The good news is that I made money on every single individual trade, so my PNL was strictly positive at all times today.

I'm marking this as "neutral" not because I'm any less long than before, but just because my trading activity this morning was 100% market neutral.

VIRT, with ES1! for contextI've been making a market in VIRT (unhedged, long) over the past couple of days.

Current (unsettled) position: 31,800 shares

Current cost basis: $16.59

Dollar value: $525,600

VIRT/ES1! wider angle view, including my meme linesMaking even more money this morning, but got a small margin call that I just handled and also got a pattern day trader warning. Is this a new record for the shortest amount of time between getting margin enabled and getting both of those at once?

VIRT vs ES1! with 15 min candlesI was buying more VIRT intraday today. Up to around 0.95%, believe it or not

$VIRT: Long for exposure to Vol.Great company. Great management. Concentrated institutions increasing their exposure.

Note: Great hedge to have exposure to volatility.

VIRT - Possible flag or breakout Momentum trade from $18.57 VIRT seems breaking out its long term resistance forming a flag formation. On the weekly frame it seems breaking out of a downward channel. It has strong insider buying, Strong Moneyflow on weekly chart and above all moving averages supporting this Long trade.

* Trade Criteria *

Date first found- January 25, 2017

Pattern/Why- Flag formation, Breakout of Long-term resistance.

Entry Target Criteria- Break of $18.57

Exit Target Criteria- Momentum trade

Stop Loss Criteria- $16.87

(Note: Trade update is delayed here.)