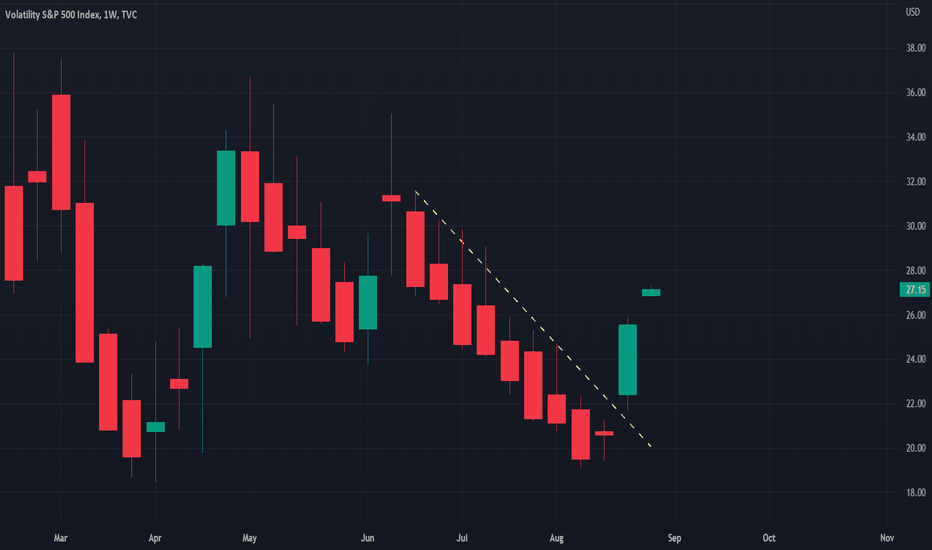

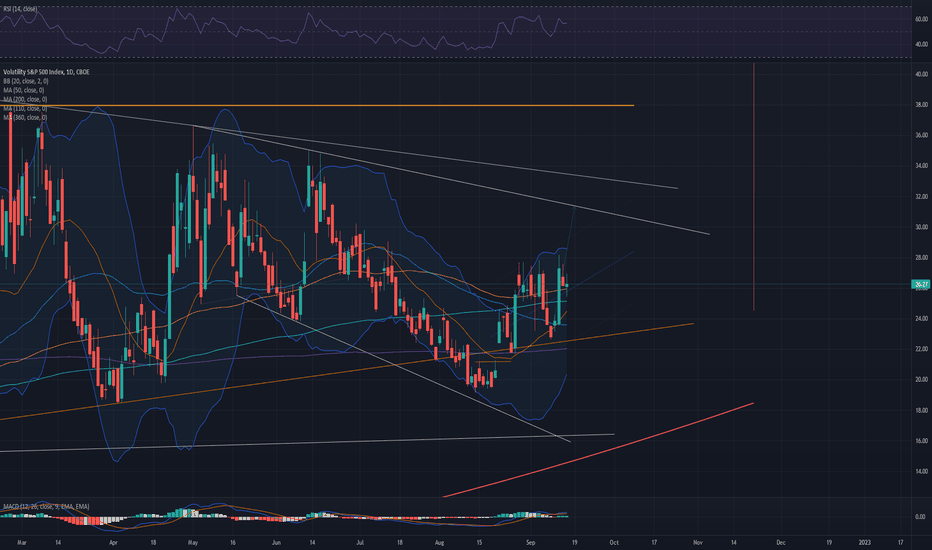

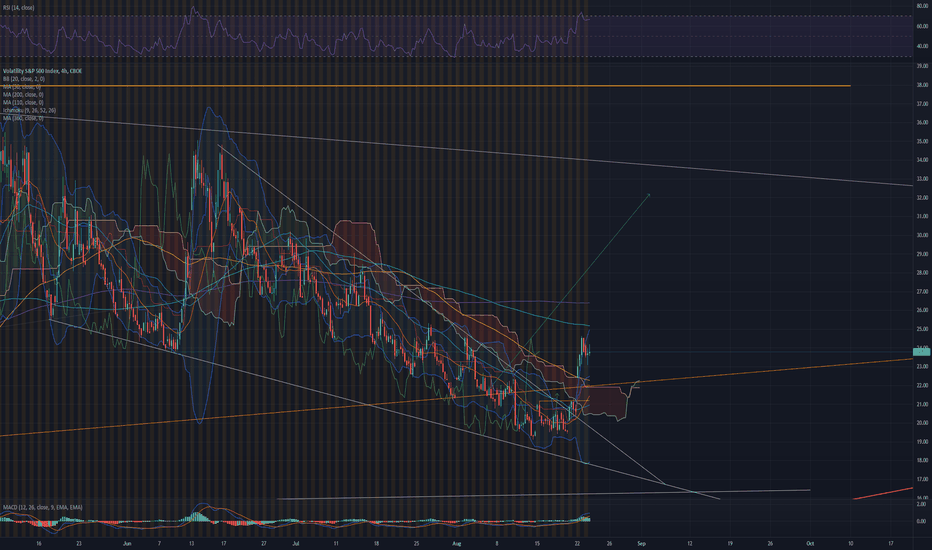

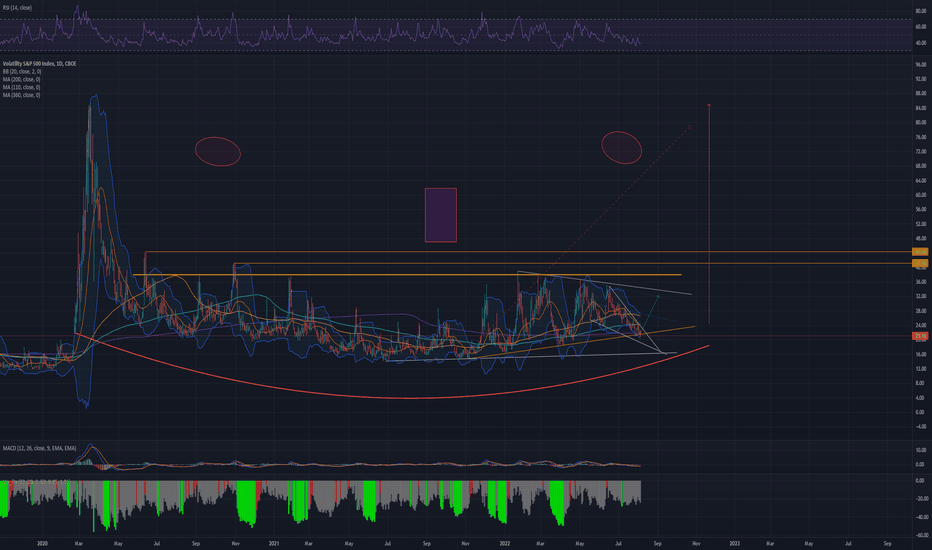

VIX - Volatility is skyrocketingIn early August 2022, we warned that volatility would creep back into the market. Not long enough after that, the market started to sell off, and VIX skyrocketed from 20 USD to over 27 USD. Therefore, we stick to our short-term price target of 30 USD for VIX. However, we want to set a new medium-term price target at 35 USD.

Illustration 1.01

The chart shows a bullish breakout above the resistance and two opening gaps on VIX. All of these developments are immensely bullish for VIX.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

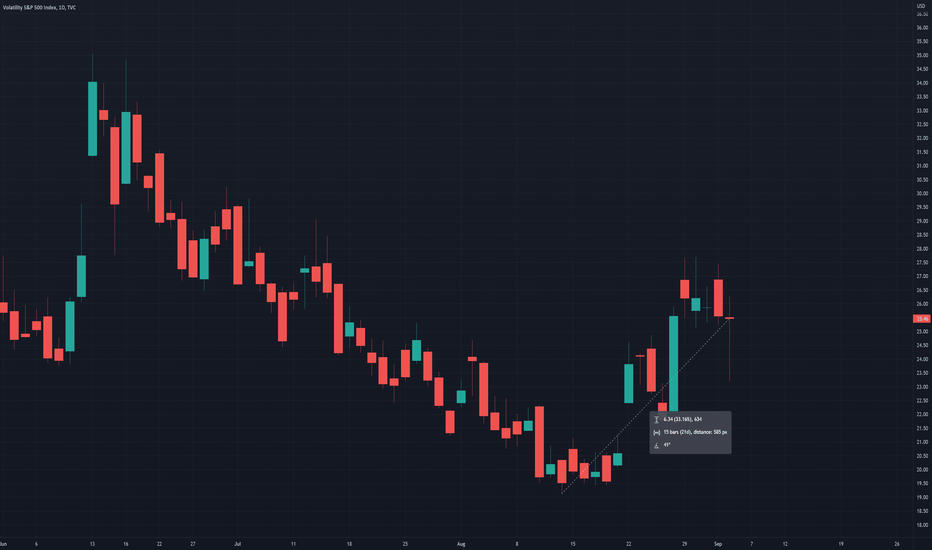

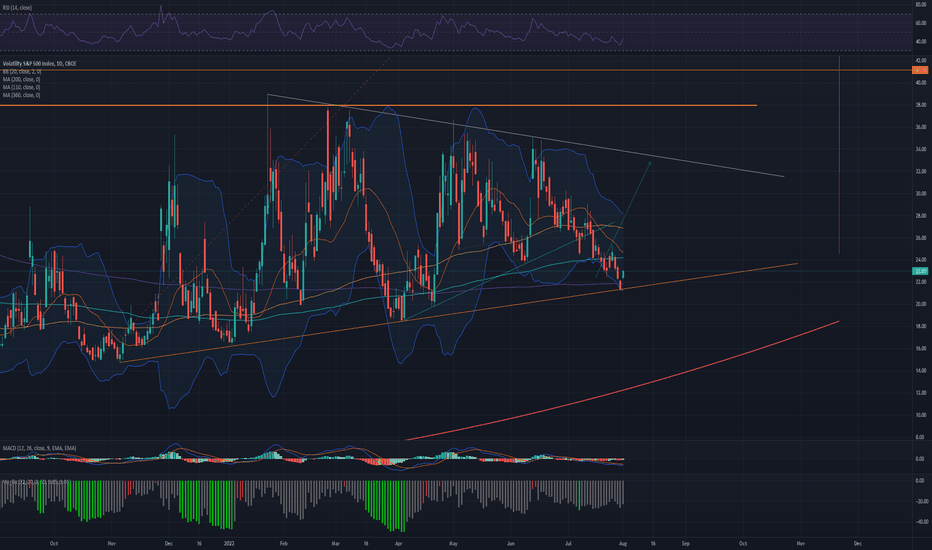

Vixfutures

VIX - The market weakness will lead to higher volatility The market volatility is on the rise, with VIX rising over 30% since 12th August 2022. We continue to be bullish on the index as we forecast more pain for the stock market. Our view is based upon fundamental factors. Because of that, we will pay close attention to the upcoming FED meeting. Accordingly, we maintain a short-term price target for VIX at 30 USD and a medium-term price target at 35 USD.

Illustration 1.01

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

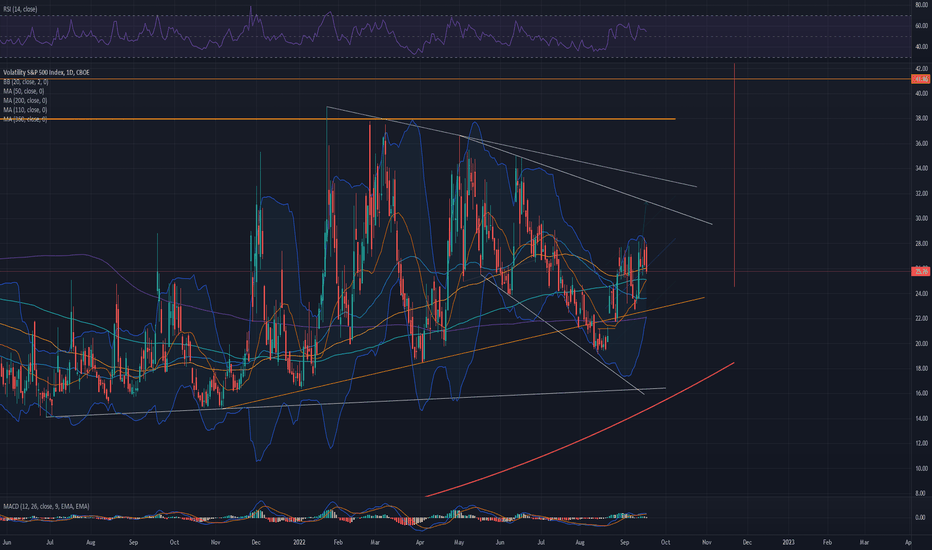

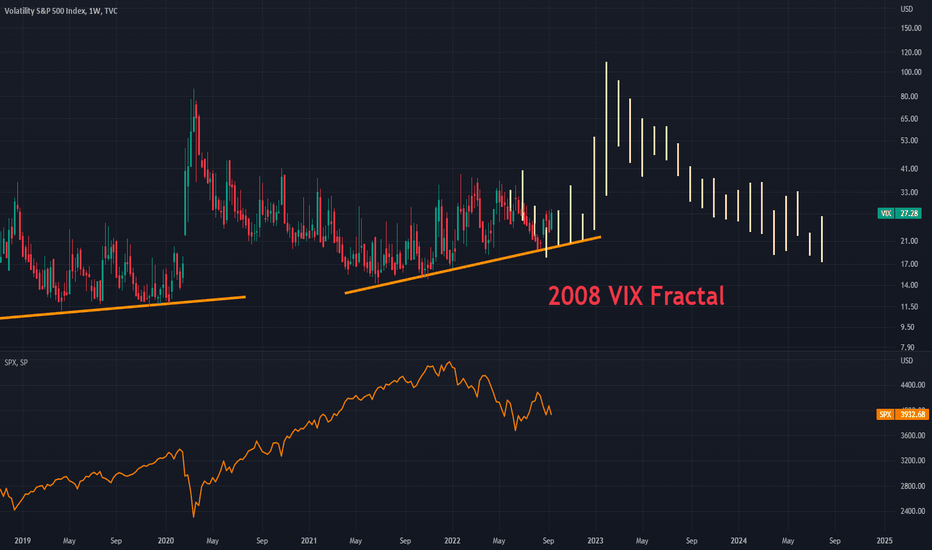

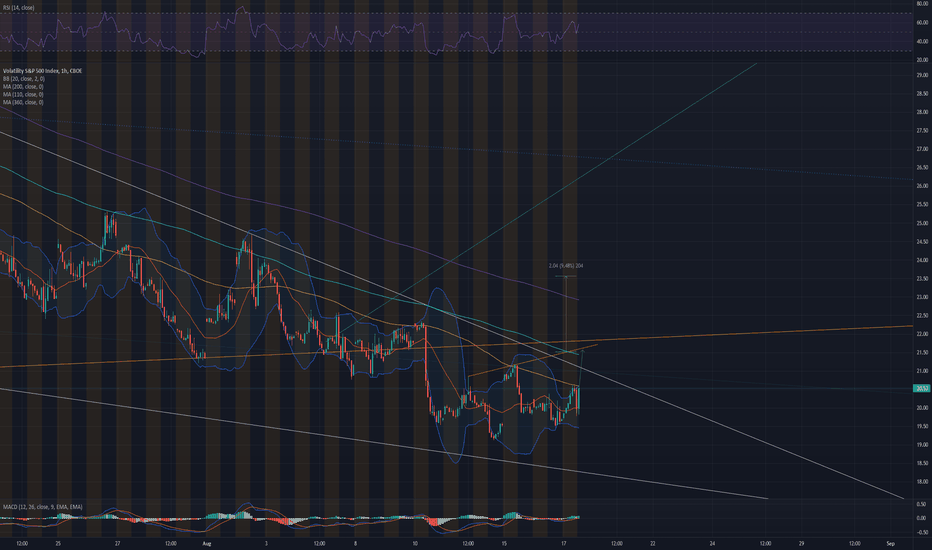

VIX Weekly is ready for a strong move UPI really like this chart, it's getting close for that pop Im looking.

Ideally we see it Oct/Nov and should bring the price down to 3200SPX or even 2800SPX (if really bearish)

My main SPX target is 3580 and 3500, ideal is at 3200-10

P.S. Dont forget to like (click star-ship button) my posts, so it gets pushed up on TV for others to see as well.

Thanks in advance!

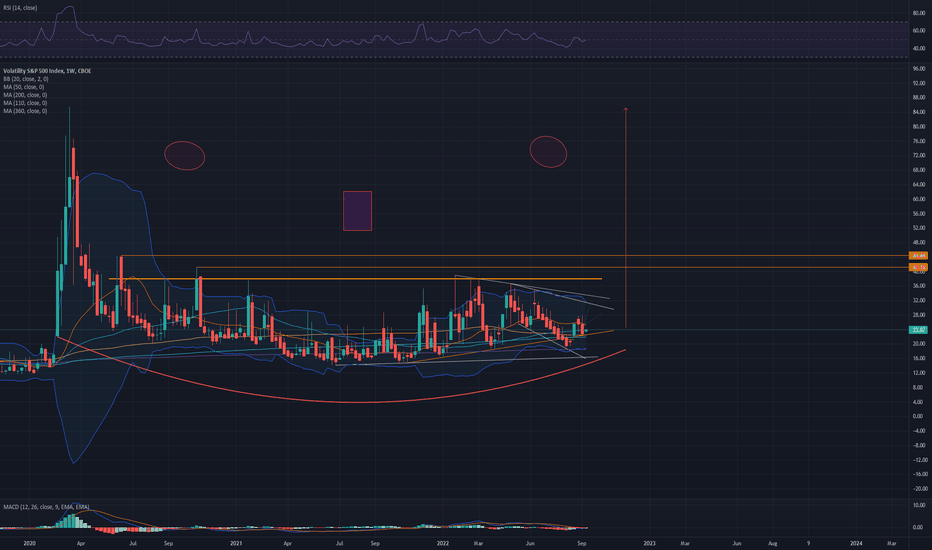

VIX is bull flagging It does looks that VIX will spike up hard soon, min target is 31.30-45

So far futs already below 3880-86SPX level, that could mean a gap down tomorrow into 3800-20 zone and VIX gaping up nicely

P.S. Dont forget to like (click star-ship button) my posts, so it gets pushed up on TV for others to see as well.

Thanks in advance!

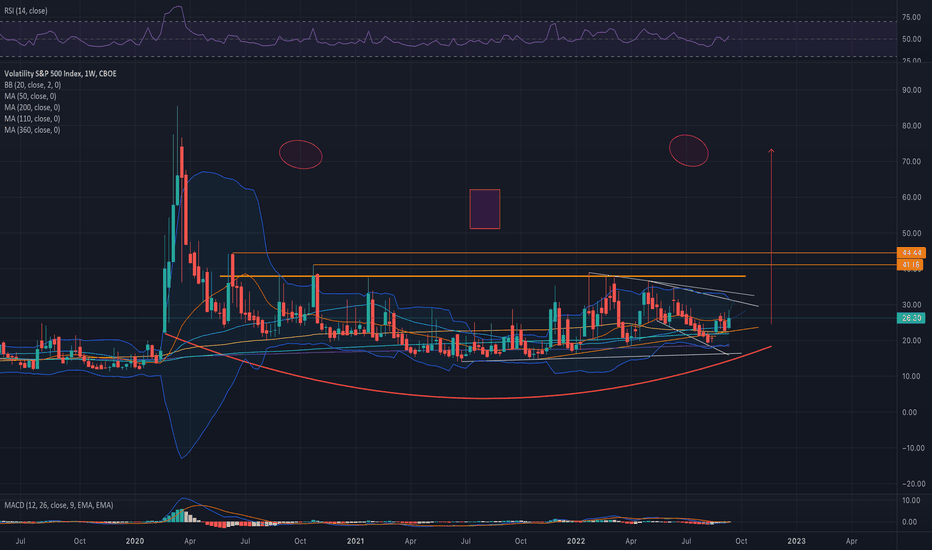

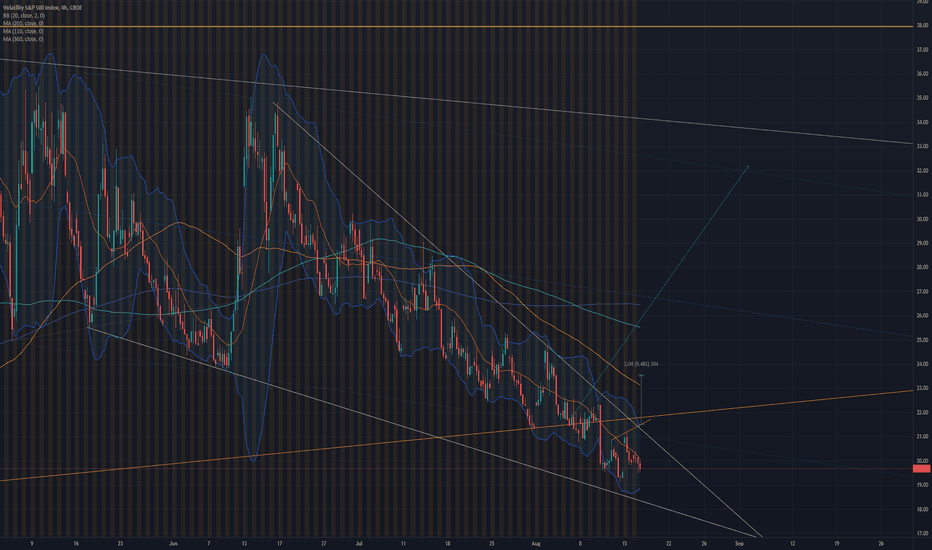

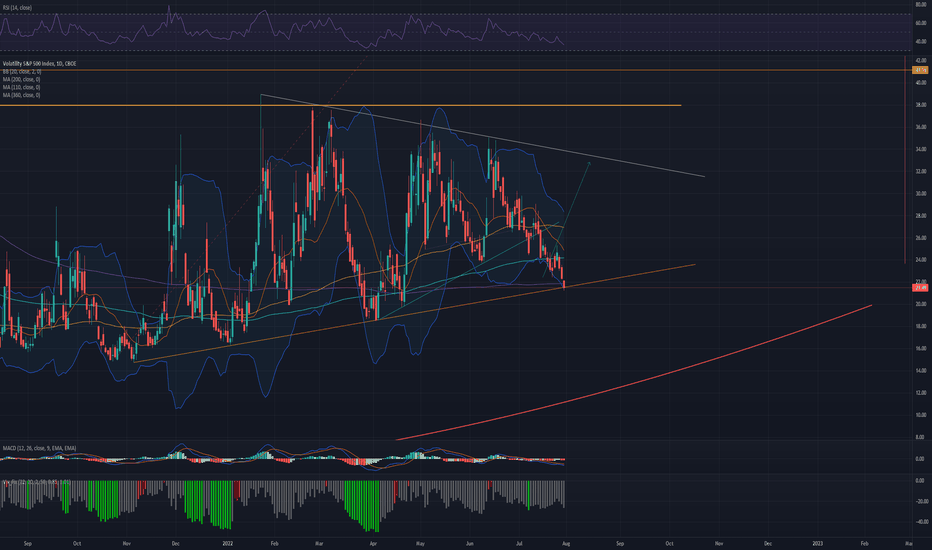

VIX remaining bullishVIX is one of the indicators I watch and it doesnt look promising for the bulls.

So far its a 3 wave move, but its in its new bull trend channel.

Next week or two will not be easy for the markets, volatility is going up, things might start to get crazy any time after Sep 13th!

P.S. Dont forget to like my posts, so it gets pushed up on TV for others to see as well.

Thanks in advance!

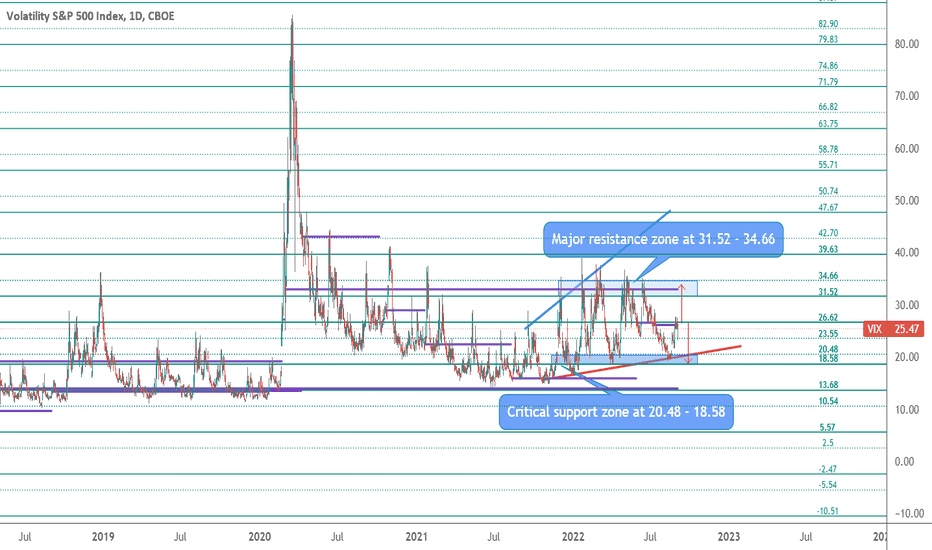

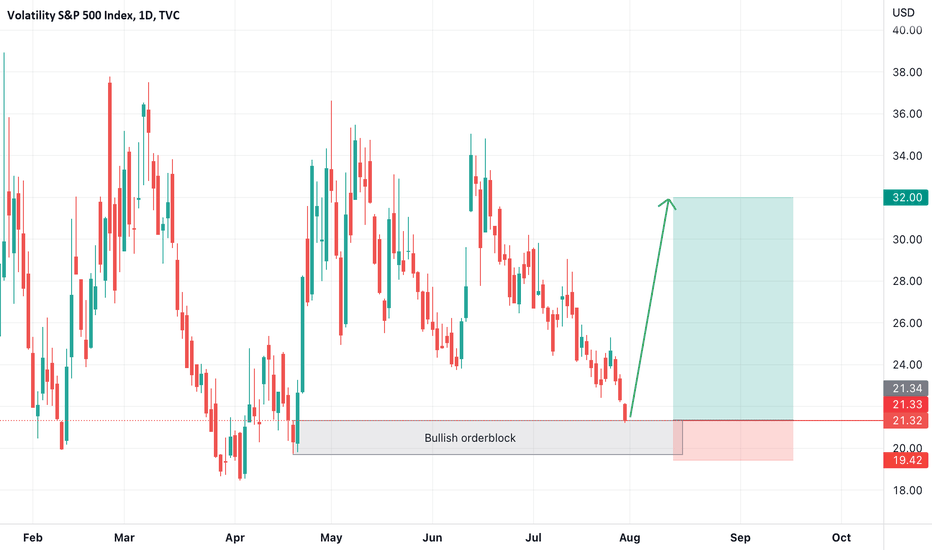

Critical support zone at 18.58-20.48.

The attached chart reveals the major support zone where major pullbacks seem to find support since Jan 2022. The recent retreat has tested the same spot and has risen to around 26.62, a crucial point in next week's session to the upside. 31.52 and 34.66 are potential targets if the price holds above 26.62; if it fails, it will likely come down to retest 20.48 and 18.58 support zone.

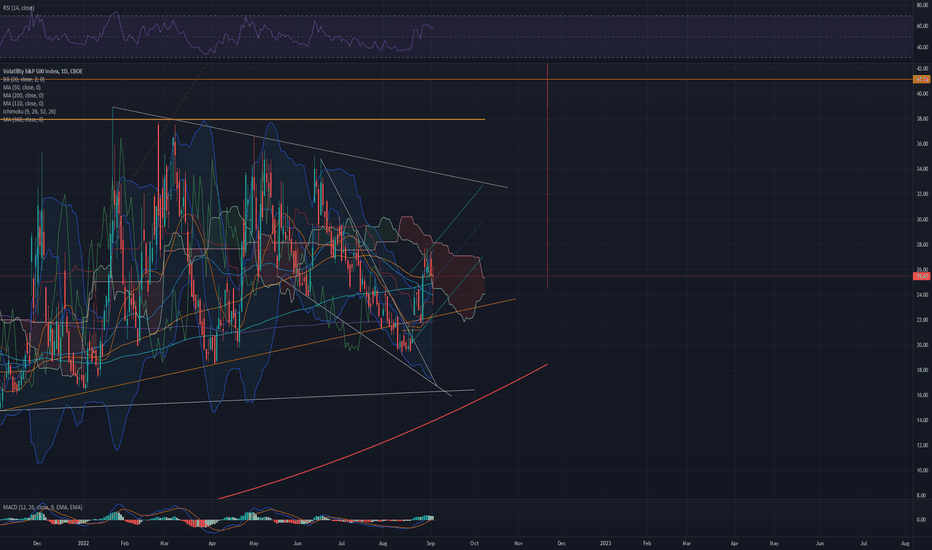

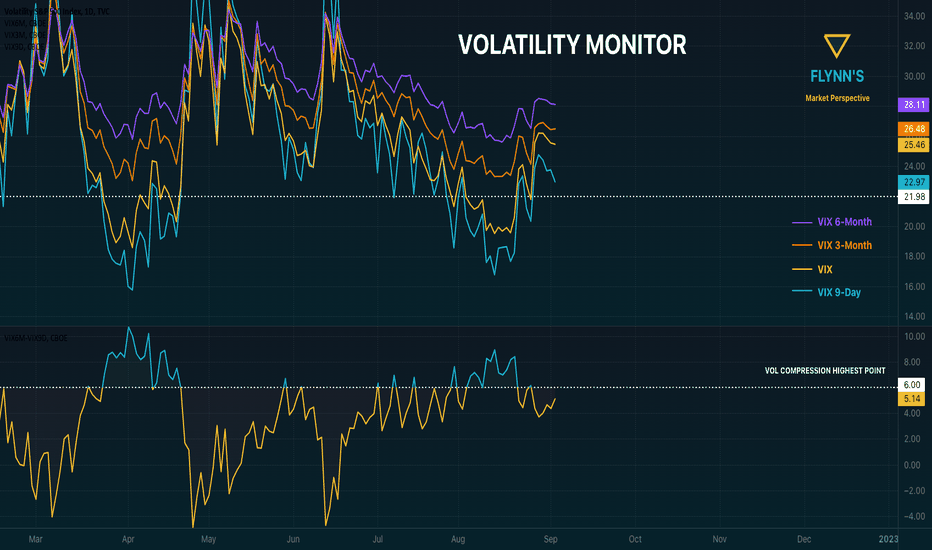

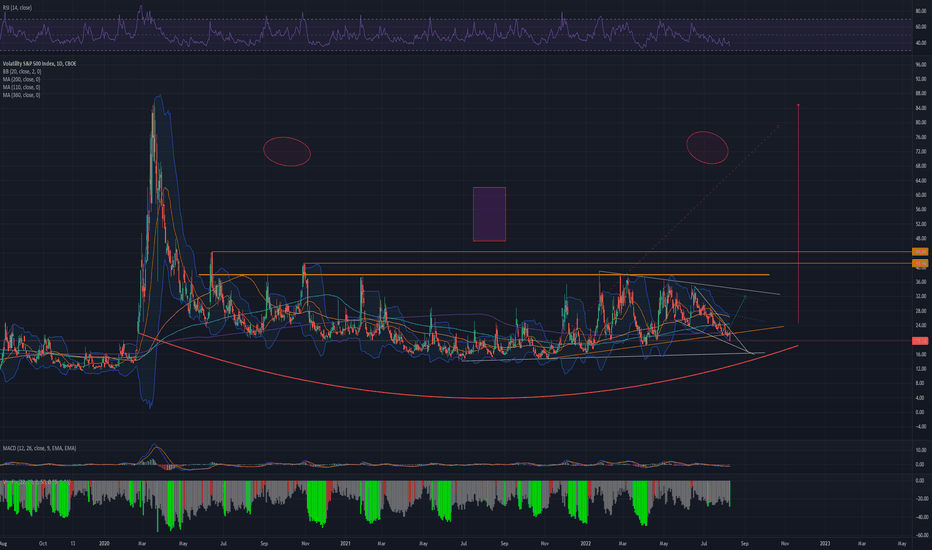

Volatility MonitorThis is a volatility monitor I use to tell when volatility is peaking in vol compression.

To give yourself alerts from trading view.

Right click on the vol compression horizontal line and select Add Alert on Horizontal Line.

Select preferences and now you will get an alert when vol compression is at its highest compression point and you can maximize your returns on your hedges.

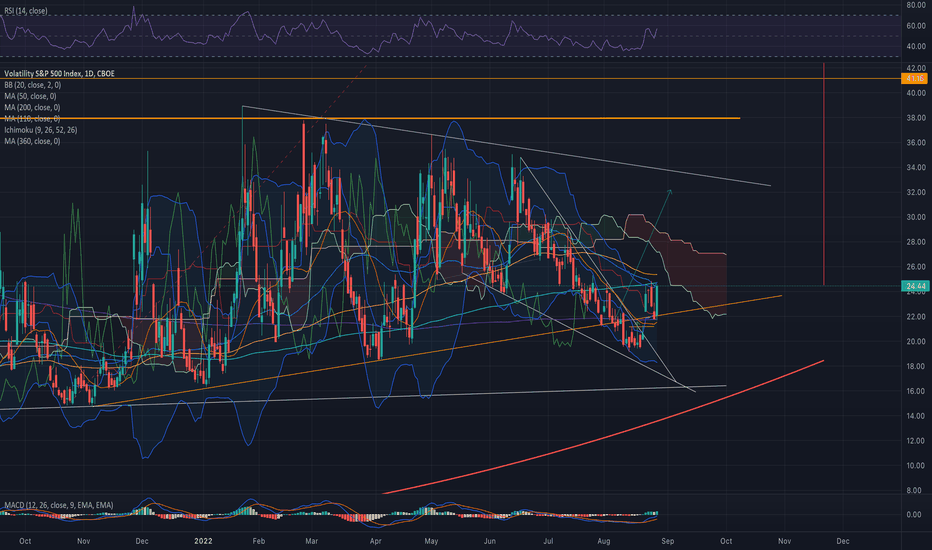

VIX is back into it's channelInteresting if that move below the support orange line was the OPEX stop run

The Bollinger bands are about to start widening as well as turning up! Pay attention to this, as its going to go parabolic within next week or 2.

Only one thing is kinda stopping me to be fully short is the reaction of 29th low into the Sep Quarterly OPEX, then the markets are free to move big again one way or another

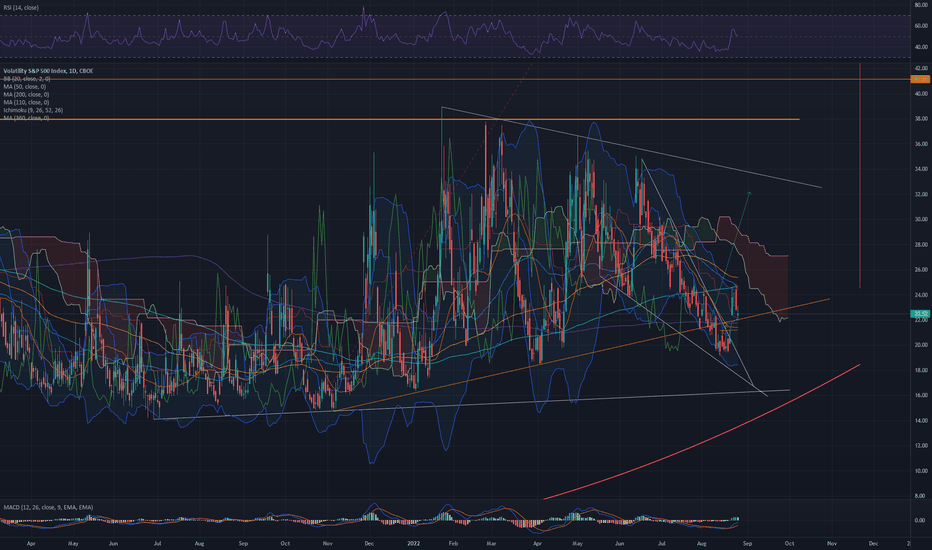

VIX broke one important support, still in consolidation mode imoVIX will start moving in Sep. Im not touching it till EOM or 4330SPX+

We got another VIX long signal with the close, same as we had on July 29th

Ideally it wont make a lower low from Apr 4th, it was 18.45. A gap up tomorrow is possible.

Going to do my homework, was an amazing wake up opening for me with both NQ and ES longs since last night, didnt trade much but the end of the day for extra more points