Vixfutures

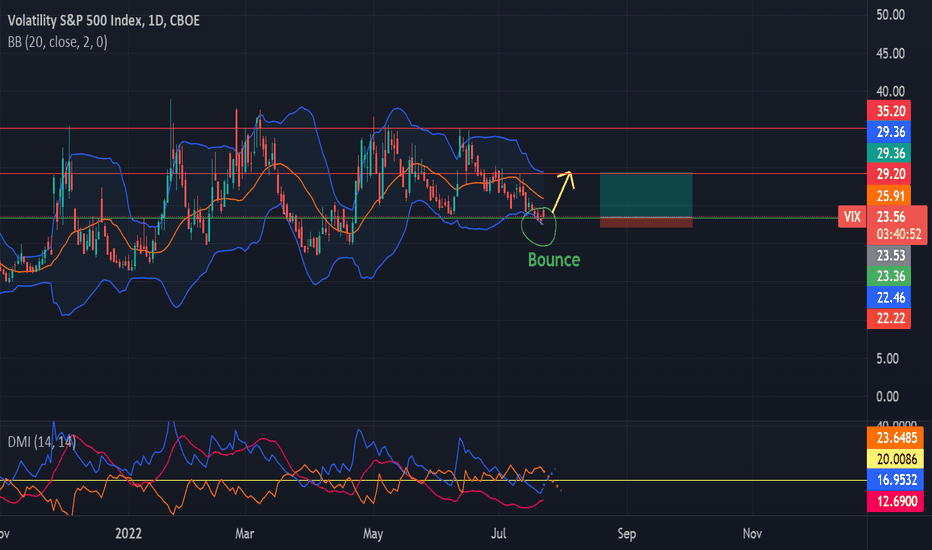

VIX long positionCurrently, price is at the support level: The last candle touches the lower bollinger band, it means that there will be a bounce and the price should increase.

Moreover, DMI indicator suggests a future crossroad between the blue line and the orange line so the blue line will go beyond the orange one, that it means the price will increase.

To conclude, we can except a price increasement with a target located on the resistance level, the entry is at the support level and the stop loss is below the support level.

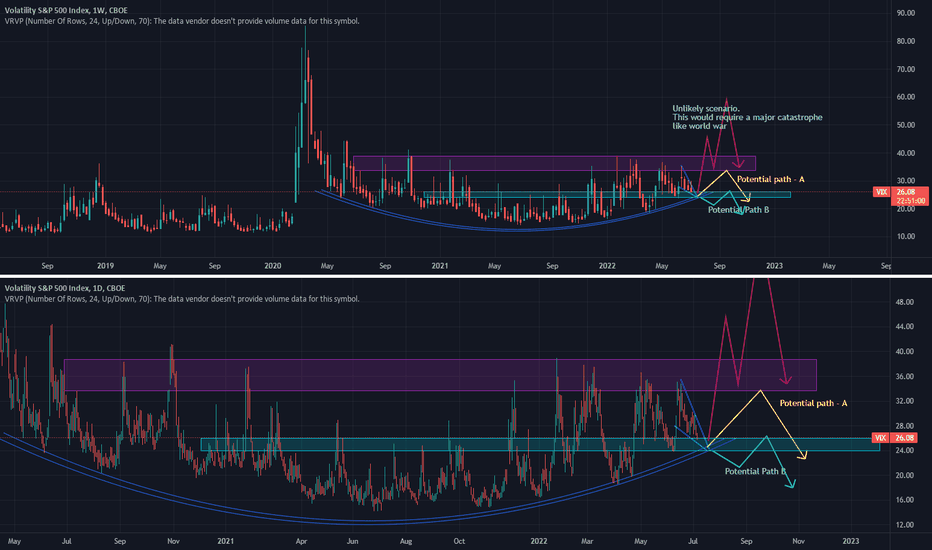

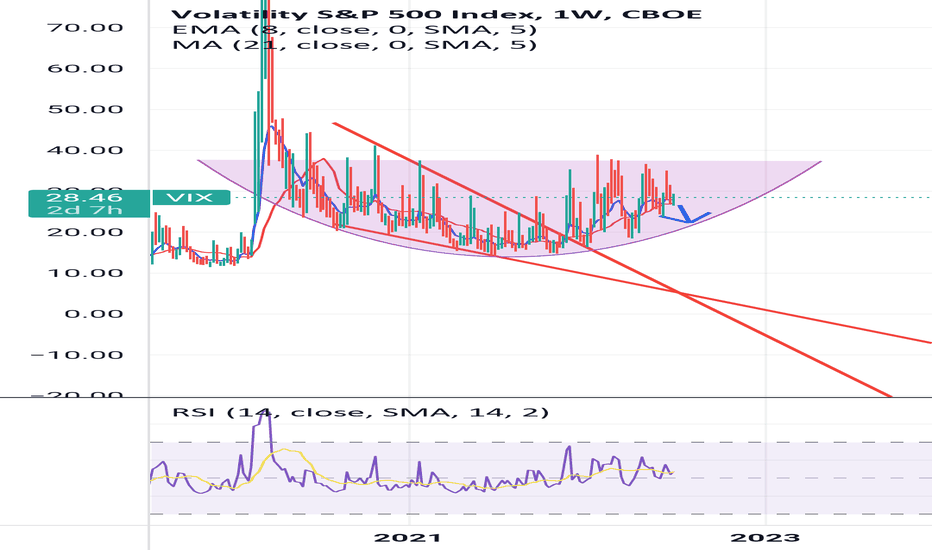

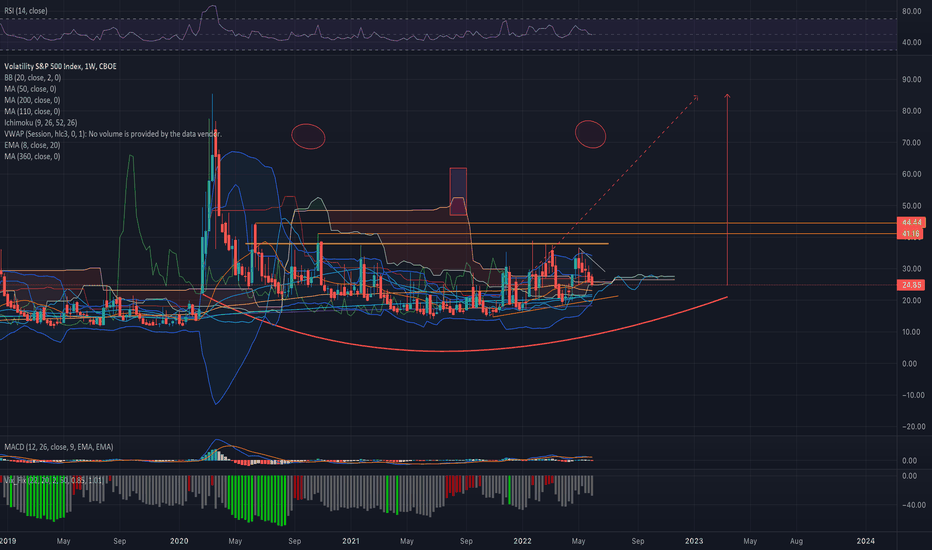

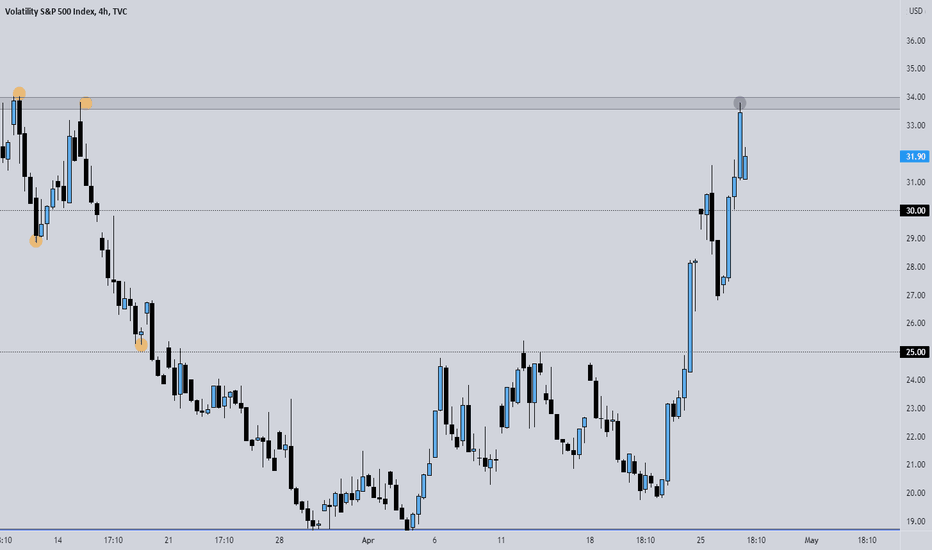

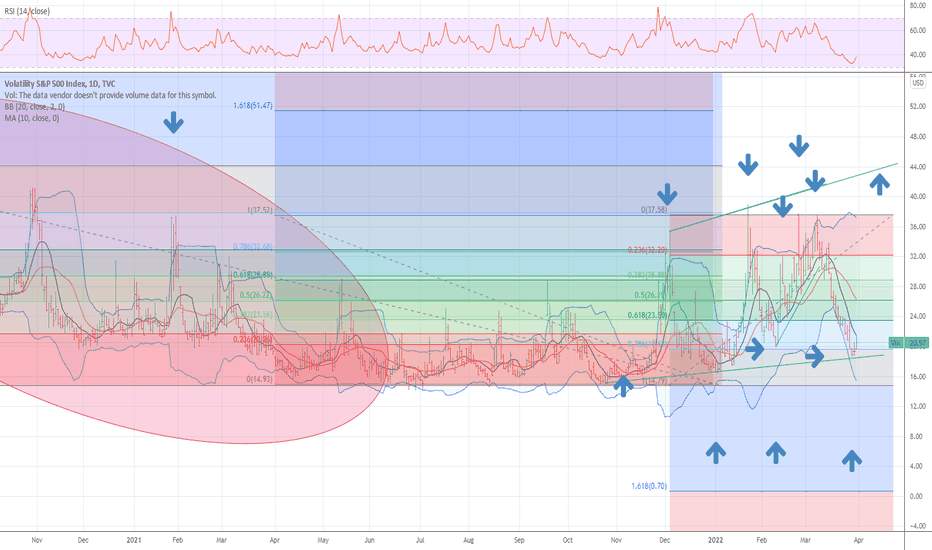

$VIX analysisAs most of you know, $VIX measures volatility index. It is usually inverse to $SPX/ US500. We have been trading within this curved pattern in $VIX since COVID. Break of this monthly curved pattern will likely imply a change in market sentiment. Downward break would likely imply a bull run resumption. Bounce from this area would likely lead us back to lows. Heavy supply and demands are marked in this chart. $VIX going back under 20 would be more bullish for the market.

34-38 is where I'd like to short as you all know. Break of this supply would be very unlikely as it would require a catastrophe news such as world war/ nuclear war.

Keeping an eye for another bounce on $VIX from this lower part of the curve to start shorting the market again. Would be patient for that, as it will provide plenty opportunities along the way.

Break of this curved trendline to the downside would be ending a 2yr trend in $VIX which may not happen until inflation is back under control.

Another bounce from this curve would likely imply market going back for another leg down. Been in this curved path for nearly 2yrs now.

Potential scenarios highlighted in the chart.

Approaching near the weekly demand where we have seen multiple bounces in 2022.

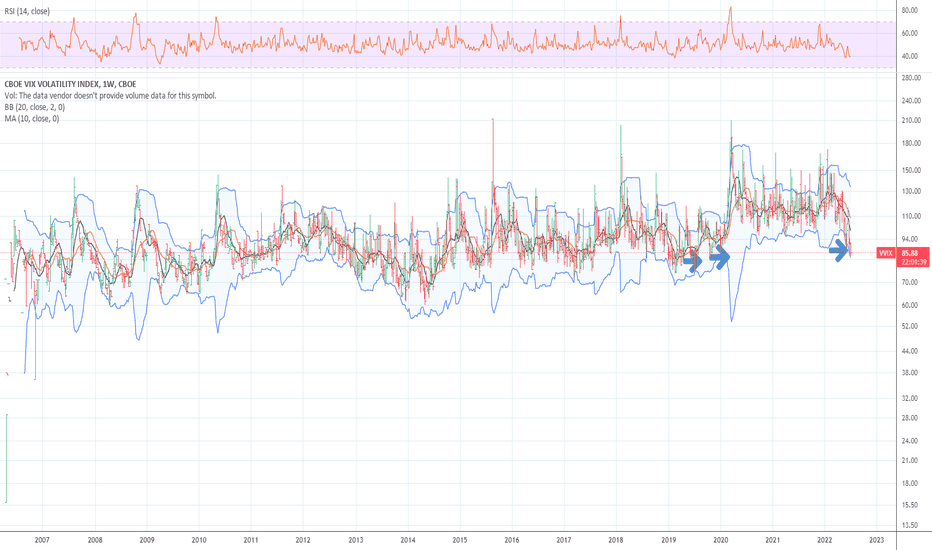

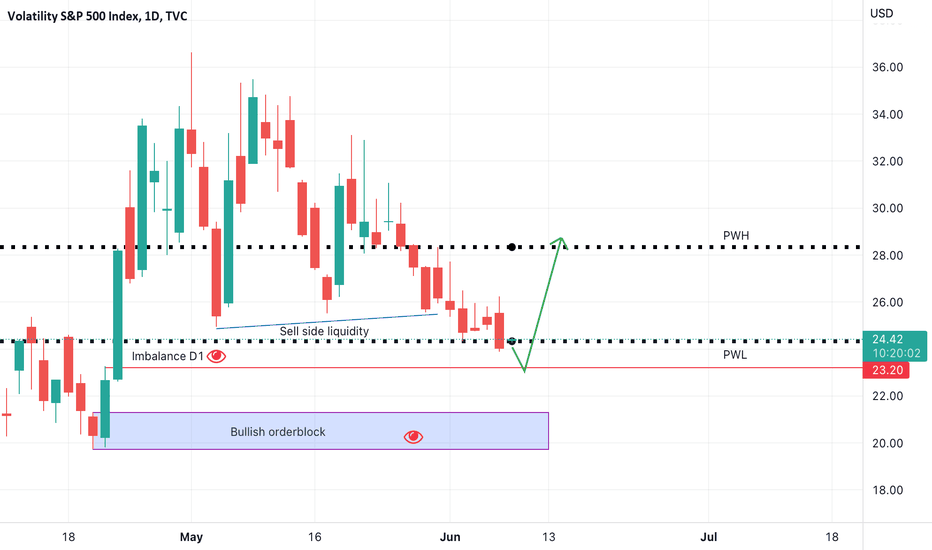

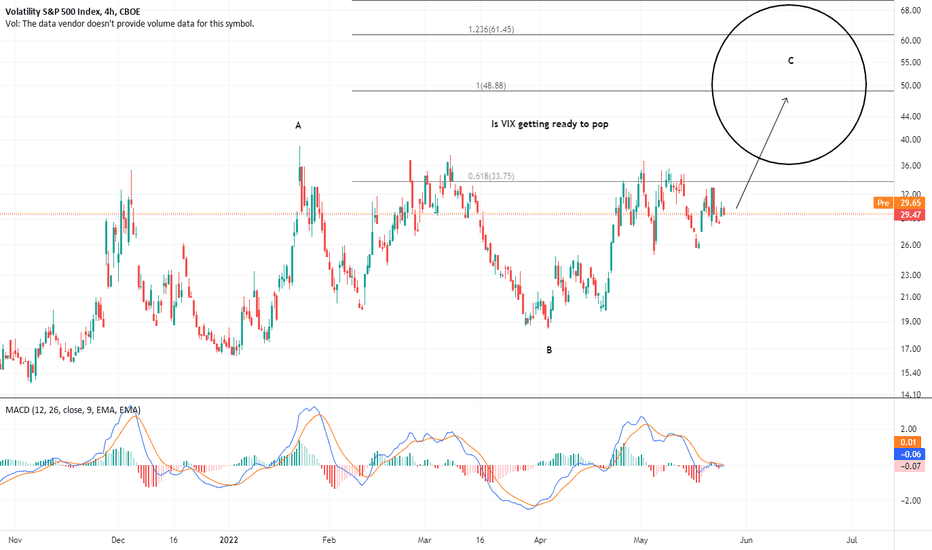

VIX - Volatility is set to skyrocketWith the FOMC only a week away, the volatility index is set to rise again. Our conclusion is based upon the premise that the upcoming rate hike will negatively impact the U.S. economy, which already started to manifest a return of selling pressure. In our opinion, this marks the resumption of the downtrend. We expect the selloff to accelerate in the coming weeks. Therefore, our short-term price target for VIX stays at 35 USD.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not serve as a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

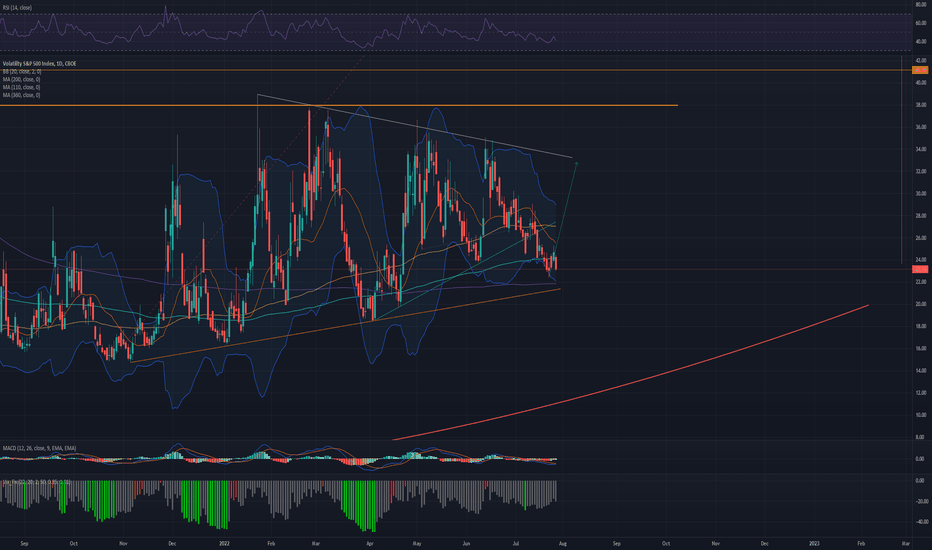

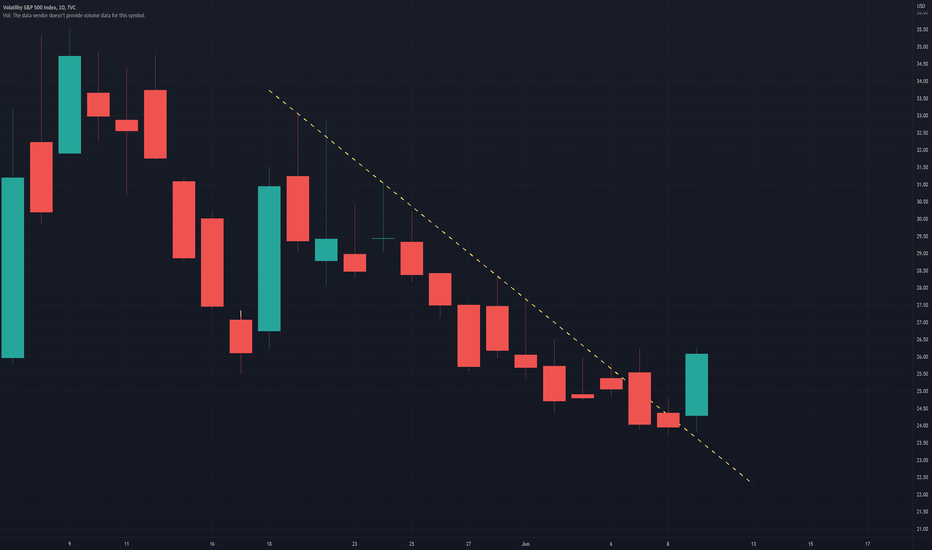

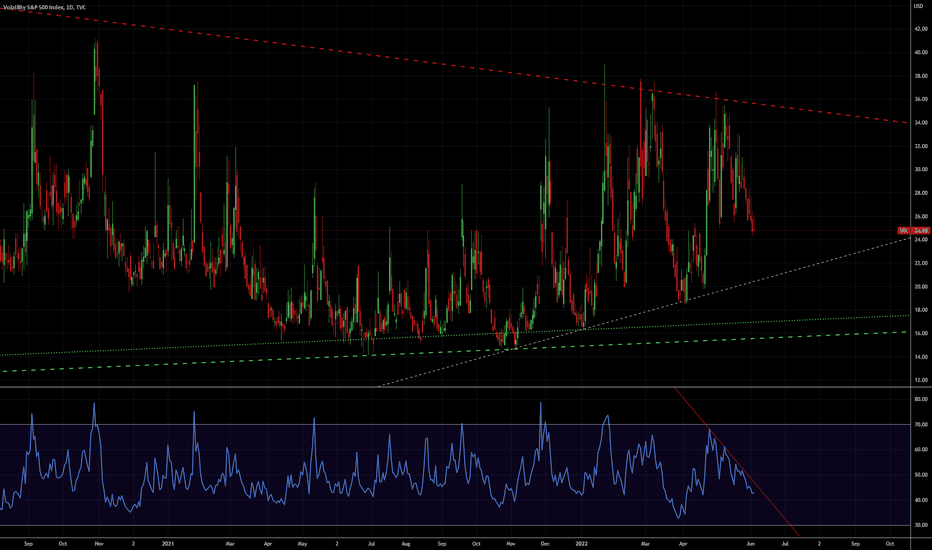

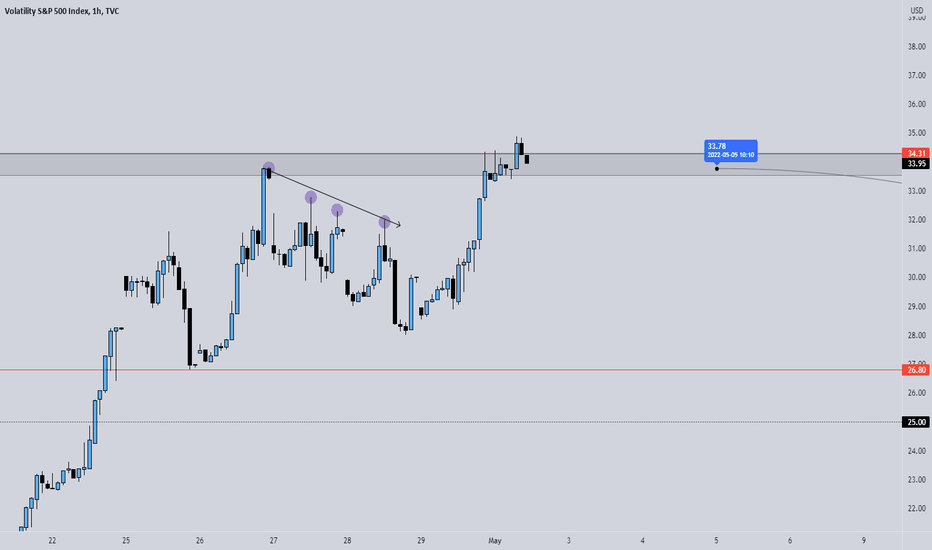

New VIX Cycle Continues - 6/5/22VIX at the daily view.

It looks like the red resistance has been working, for now. I've been shorting VX futures whenever the VIX crossed the red line. However, this red line has a time limit. It becomes less relevant as we get closer to September. It might be sooner... but that's too hard to tell.

As stated before, it will be hard for the VIX to achieve 50 - much to the dismay of the social media crowd. They treat the VIX like a purely inverse index (it's not). The VIX will get muted spikes due to one big reason: cash is a position too. The VIX really spikes when there is increased price range in ES and increased hedges in the options market. When cash is trash, options as a hedge is much more viable. However, during quantitative tightening (QT), cash is king. When cash is king, options as a hedge is not as attractive.

Also as stated before, it will be hard for the VIX to stay below 20 due to longer-term, legally required hedging. Hedge funds are legally required to hedge their positions. During QT, the hedges stay there quite a bit longer. During a bull market, the hedges cover and reposition.

What's next? The VIX is generally range bound for the near future, but it's also winding up. Would there be a big spike? Likely, just not now. I'm not 100% certain when. However, if I were to pick a general time, it would be around September, maybe slightly earlier. That is when there is a lot of rebalancing of the portfolios, fiscal year end for many funds, midterm elections (with some election hedging), and tightening would be in full swing. Near term? Well, June FOMC and Quadruple Witching OPEX are coming up. Usually, about 1.5 weeks lead up to them, there is a local VIX spike. That said, according to the VIX term structure, those hedges were there for several months. I've noticed them back in January 2022 when there is an unusual amount of hedges for July OPEX (which implies hedging for June).

That said, I'd rather wait for VIX spikes to short from. As stated before, during quantitative tightening, timing the VIX spikes becomes harder to predict. Going long in VX for a spike to 50 is the same type of greed as going long for a speculative small cap stock for the potential of similar gains. It's reckless and foolish.

Keep an eye for the VIXUVXY shown here is an ETF of the VIX and it is leveraged, which means its dip under the current trend is insignificant and mostly due to beta slippage. The VIX itself is still trending up and volatility is increasing at an alarming rate. Buyers beware, the winds are changing in the bear's favor and a deepened correction in the major indexes is HIGHLY likely

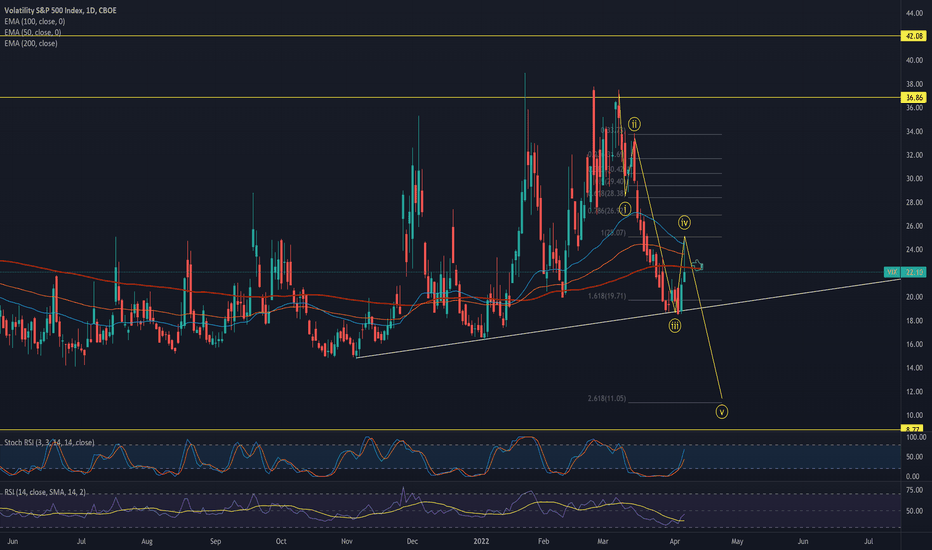

VIX on Triangular Track!Expanding triangle

Target: 49.5

In Elliot-Wave theory, triangles have 5 sides and each side is usually subdivided into 3 waves. Analysis valid as long as the channel stays intact. Equities will micro-bottom mid-June before the commencement of the melt-up rally!

Earlier analysis:

48.5/49.5 achievable with an extended market correction. Implied volatility uptrend due to fundamental reasons ( Inflation /War).

S&P 500 target would equate to 3950-4000 in this projection!

NASDAQ: 12K (Wave 1 top) or 11K (200 Week EMA / 50 Month EMA )

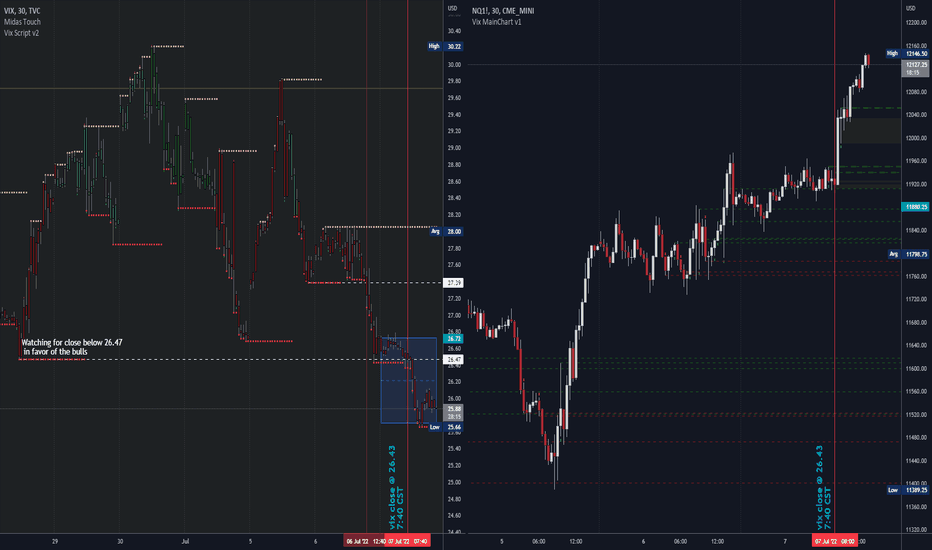

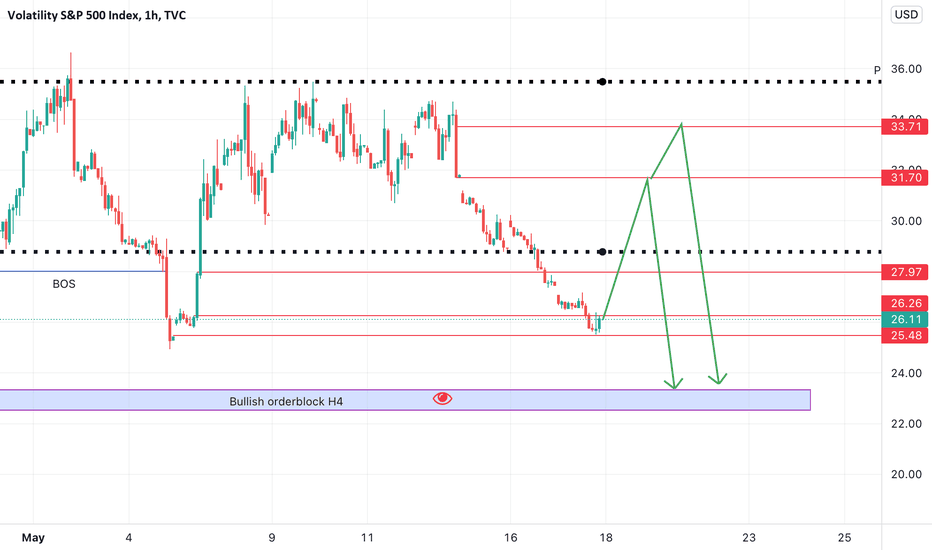

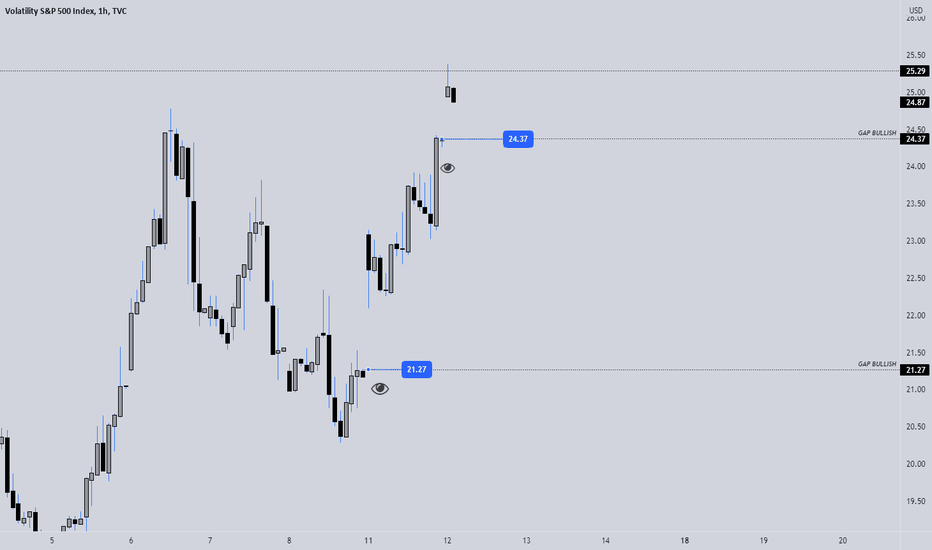

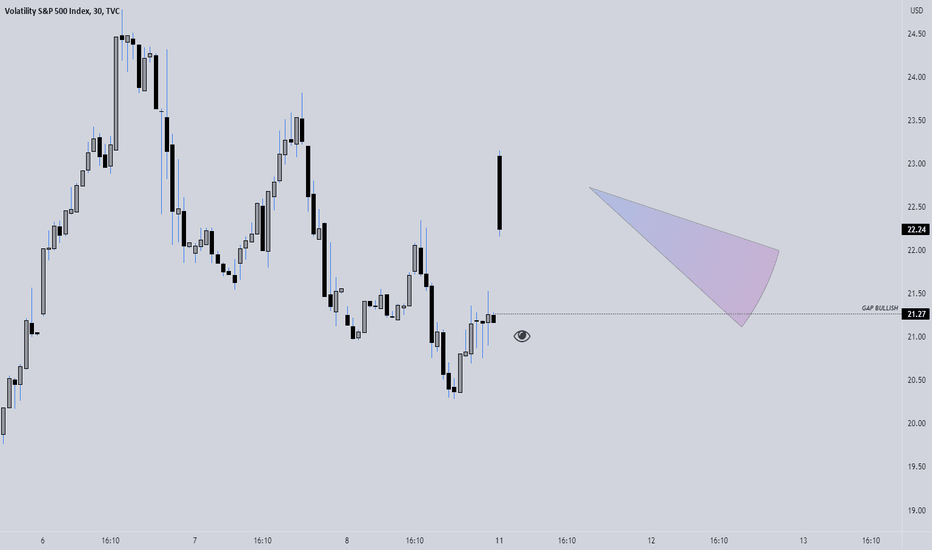

VIX SHORTS ✅✅✅Expecting bearish price action on VIX as price made a huge bullish GAP, in my experience VIX is filling the bearish/bullish GAP's very very quickly in the same day in 80% of the situations. VIX down means STOCK go up, volatility and fear decreases in the markets

What do you think ? Comment below..