Trading the VIX – Part 2Trading the VIX – Part 2: VIX ETPs and Strategic Applications

In Part 1 of this series, we explored the structure of VIX Futures, focusing on the roll-down effect in a contango VIX futures curve—common in calm market conditions.

In Part 2, we turn our attention to VIX-related Exchange-Traded Products (ETPs)—specifically, the popular and liquid:

• VXX – unleveraged long VIX ETP

• UVXY – leveraged long VIX ETP

• SVXY – inverse VIX ETP

Each of these products is based on a specific VIX futures strategy, the “S&P500 VIX Short Term Futures Index” , which is maintained by S&P, Dow Jones (the “SPDJ-Index”). The Fact Sheet and Methodology can be obtained from the S&P Global website.

What is the SPDJ Index that these ETPs track?

The SPDJ-Index is a strategy index that maintains a rolling long position in the first- and second-month VIX futures to maintain a constant 30-day weighted average maturity.

Key Features of the SPDJ Index:

• Starts with 100% exposure to VX1 (the front-month future) when it’s 30 days from expiration.

• Gradually it rolls from VX1 to VX2 (next-month future) each day to maintain a 30-day average expiration.

• At all times, the index is long either one or both VX1 and VX2, with exposure shifting daily from VX1 to VX2.

• This roll mechanism causes value erosion in contango (normal markets) and gains in backwardation (during volatility spikes).

• Since contango is the dominant market state, the index loses value over time—with occasional short-lived gains during sharp volatility increases.

Importantly, the SPDJ Index does not represent the VIX or any other volatility level, it simply reflects the value of this futures-based rolling strategy.

________________________________________

Breakdown of the ETPs: VXX, UVXY, and SVXY

VXX – Long SPDJ Index (1x)

• Tracks the SPDJ Index directly

• Suffers from the roll-down drag in contango environments.

• Useful only for short-term exposure during expected volatility spikes.

• Timing for long positions is critical

UVXY – Leveraged Long (Currently +1.5x)

• Replicates a strategy that maintains a constant leverage of 1.5 to the SPDJ Index.

• Formerly +2x leverage; reduced in April 2024.

• Highly sensitive to VIX moves; underperforms long term due to both roll-down drag and leverage decay (see below). Timing for long positions is even more important than for the VXX.

SVXY – Inverse (-0.5x)

• Replicates a strategy that maintains a constant exposure of -0.5 to the SPDJ Index.

• Benefits from falling VIX levels as well as from contango in the front part of the VIX futures curve.

• Formerly -1x before the Feb 2018 volatility spike triggered massive losses (XIV, a competing ETP, collapsed at that time).

• Performs well in calm conditions but is vulnerable to sharp volatility spikes.

Leveraged & Inverse ETPs – Important Notes affecting the UVXY and SVXY (without going into details):

• Daily resetting for the replicating strategies to maintain constant exposure factors (different from 1x) are pro-cyclical and can cause compounding errors, specifically in turbulent markets (e.g. Feb 2018).

• The real volatility of the VIX futures itself acts as a drag on returns, independent of the index’s direction.

• Risk management is essential—especially with inverse products like SVXY.

All three of these ETPs track a VIX futures strategy, they are not levered or unlevered versions of the original VIX index. Each of these ETPs benefits from liquid option markets, enhancing the toolkit for volatility trading.

Trading Strategies Using VIX ETPs

Here are several practical approaches to trading these products:

VXX and UVXY

• Best used for short-term trades aiming to capture volatility spikes.

• Options strategies such as zero-cost collars, vertical and calendar spreads can help mitigate the challenge of precise timing.

• Avoid long-term holds due to erosion from roll-down and leverage decay (see historical performance!).

SVXY – The Carry Trade Proxy

• Ideal for profiting from prolonged calm periods and the contango structure.

• Acts like a carry trade, offering a positive drift—but must be paired with robust stop-loss rules or exit strategy to guard against sharp spikes in volatility.

Switching Strategies

• Tactically rotate in/out of SVXY based on short-term volatility indicators.

• One common signal: VIX9D crossing above or below VIX, i.e. long SVXY if VIX9D crosses under VIX, staying long while VIX9D < VIX, closing long SVXY position when VIX9D crosses over VIX. Some traders also use crossovers with VIX3M or the individual expirations of the VIX futures curve to manage entries.

• Switching between SVXY and VXX based on crossover triggers through the VIX futures curve is often advertised, but very hard to get working in practice due to the importance of timing the VXX entry and exit – signals from the VIX curve may not signal VXX entries and exits timely enough.

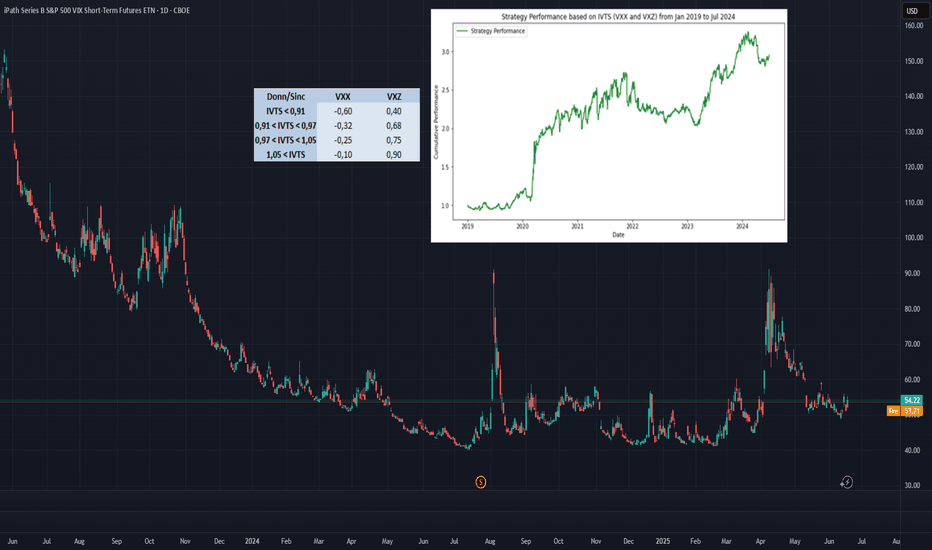

Term Structure-Based Combinations

• Combine short VXX with long VXZ (an ETP tracking longer-dated VIX futures, balancing the 4th to 7th VIX contracts to achieve a constant expiration of 60days).

• Weighting is determined by the Implied Volatility Term Structure (IVTS), calculated as VIX / VIX3M. This approach adjusts positions based on the shape of the VIX futures curve, indicated by the IVTS. For instance, when the VIX futures curve shifts from contango (where near-term futures are cheaper than longer-term ones) to backwardation (where near-term futures are more expensive), it involves reducing short positions in VXX and increasing long positions in VXZ.

• This approach mimics the spirit of a calendar spread strategy in VIX futures and reflects the “S&P 500 Dynamic VIX Futures Index” , with weightings backed by research from Donninger (2011) and Sinclair (2013) - see performance chart and weighting-matrix enclosed in the introductory chart).

________________________________________

VIX Curves as Market Indicators

Beyond trading, VIX instruments and their term structure are widely used as market sentiment gauges. For instance:

Signs of Market Calm:

• VIX9D < VIX

• VIX < VIX3M

• VIX < VX1

• VX1 < VX2

These relationships imply that short-term volatility is lower than longer-term expectations, indicating near-term calmness in markets, occasionally leading to market complacency.

Traders and institutions use these signals to:

• Adjust positioning in broad market indices

• Determine hedging requirements

• Evaluate suitability of selling naked options

________________________________________

Final Thoughts

VIX ETPs offer a powerful toolkit for traders seeking to profit from or hedge against volatility. But they come with structural decay, leverage dynamics, and curve risk. Timing, strategy, and risk control are key.

Vixtrading

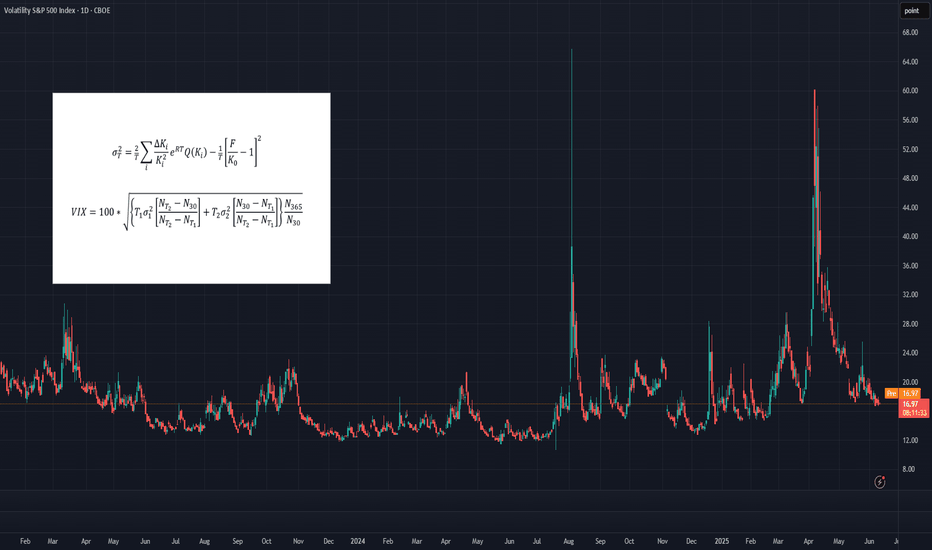

Trading the VIXOften dubbed the "fear index," the VIX gauges SPX options' implied volatility, typically rising during equity market declines and vice versa. It quantifies investor anxiety, demand for hedging, and market stress, crucial for traders and risk managers seeking to measure turbulence.

The VIX calculates a constant 30-day implied volatility using SPX options expiring over the next two months. Unlike simple weighted averages of equity indices, its methodology is more complex, involving implied variance calculation for the two nearest monthly expirations across all strikes. For detailed formulas, refer to the introductory chart or visit the CBOE’s official VIX Index page.

While the VIX Index itself isn’t tradable, exposure can be gained through VIX futures or exchange-traded products (ETPs) like VXX, UVXY, and SVXY. However, these instruments come with their own unique risks, pricing behaviors, and structural nuances, which can make directional VIX trading considerably more complex than it might initially appear.

What You Need to Know About Implied Volatilities

• In calm or uptrending markets, the volatility curve typically slopes upward (contango), indicating higher implied volatility with longer maturities.

• In declining or turbulent markets, the curve can invert, sloping downward (backwardation), as shorter-term implied volatilities rise sharply.

• This pattern can be observed, comparing VIX9D, VIX, and VIX3M against the SPX. In stable markets: VIX9D < VIX < VIX3M. In stressed markets, this relationship may reverse. The VIX9D and VIX3M are the 9-day respectively 3-month equivalent to the 30-day VIX.

What You Need to Know About VIX Futures

• When the volatility spot curve is in contango, the VIX futures curve will also slope upward.

• In backwardation, the futures curve slopes downward, reflecting heightened short-term volatility and short-term volatility spikes.

• While in contango, VIX futures "roll down the curve," meaning that—independent of changes in volatility—futures tend to decline in value over time.

• In backwardation, the opposite occurs: futures "roll up the curve," potentially rising in value over time even without volatility changes.

• VIX futures’ responsiveness to VIX Index movements – the beta of VIX futures against the VIX index - declines with longer expirations; front-month futures may react to 70-80% of VIX changes, compared to 40-60% for third or fourth-month futures.

Key Consequences for Traders

• Directional trading of VIX futures can be strongly influenced by the shape of the futures curve.

• Contango in low-VIX environments creates strong headwinds for long VIX futures positions, caused by the “roll-down-effect”.

• Conversely, backwardation in high-VIX environments creates headwinds for short positions.

• These effects are more pronounced in front-month contracts, making timing (entry and exit) for directional trades critical.

• There's a trade-off in directional strategies: front-month futures offer greater exposure to VIX movements but suffer more from negative roll effects.

How to Trade VIX Futures

• Due to these structural challenges, directional VIX futures trading is difficult and requires precision.

• A more effective approach is to trade changes in the shape of the futures curve using calendar spreads (e.g., long VX1, short VX2). This reduces the impact of roll effects on individual contracts.

• In low-VIX, contango conditions, a rising VIX typically leads to VX1 increasing faster than VX2, widening the VX1–VX2 spread—an opportunity for spread trading.

• While VX1 may initially suffer more from roll-down than VX2, this can reverse as the VIX rises and VX1 begins to “roll up,” especially when VIX > VX1 but VX1 < VX2.

• The opposite dynamic applies in high-VIX, backwardation environments.

• More broadly, changes in the shape of the futures curve across the first 6–8 months can be profitably traded using calendar spreads. Roll-effects and the declining beta-curve can also be efficiently traded.

How to capture the Roll-Down-Effect

One of the more popular VIX-trading strategies involves capturing the roll-down effect,, while the curve is in contango. It is a positive carry strategy that is best applied during calm or uptrending market conditions. Here’s a straightforward set of guidelines to implement the Roll-Down-Carry trade:

• Entry Condition: Initiate during calm market conditions, ideally when VIX9D-index is below VIX-index (though not guaranteed).

• Choosing Futures: Use VX1 and VX2 for calendar spreads if VX1 has more than 8-10 trading days left; otherwise, consider VX2 and VX3.

• Spread Analysis: Short VX1 and long VX2 if VX1–VIX spread is larger than VX2–VX1; otherwise, VX2 and VX3 may be suitable.

• Contango Effect: VX1’s roll-down effect typically outweighs VX2’s during contango.

• Relative Beta: VX1 shows higher reactivity to VIX changes compared to VX2, mimicking a slight short position on VIX.

• Exit Strategy: Use spread values, take-profit (TP), and stop-loss (SL); consider exiting if VIX9D crosses over VIX.

________________________________________

Conclusion

Directional trading of the VIX Index—typically through futures—demands precise timing and a good understanding of the volatility curve. This is because curve dynamics such as contango and backwardation can create significant headwinds or tailwinds, often working against a trader’s position regardless of the VIX’s actual movement. As a result, purely directional trades are not only difficult to time but also structurally disadvantaged in many market environments.

A more strategic and sustainable approach is to trade calendar spreads, which involves taking offsetting positions in VIX futures of different maturities. This method helps neutralize the impact of the curve's overall slope and focuses instead on relative changes between expirations. While it doesn’t eliminate all risk, calendar spread trading significantly reduces the drag from roll effects and still offers numerous opportunities to profit from shifts in market sentiment, volatility expectations, and changes in the shape of the futures curve.

What else can be done with VIX instruments

VIX indices across different maturities (VIX9D, VIX, VIX3M), along with VIX futures, offer valuable insights and potential entry signals for trading SPX or SPX options. In Part 2 of the Trading the VIX series, we’ll explore how to use these tools—along with VIX-based ETPs—for structured trading strategies.