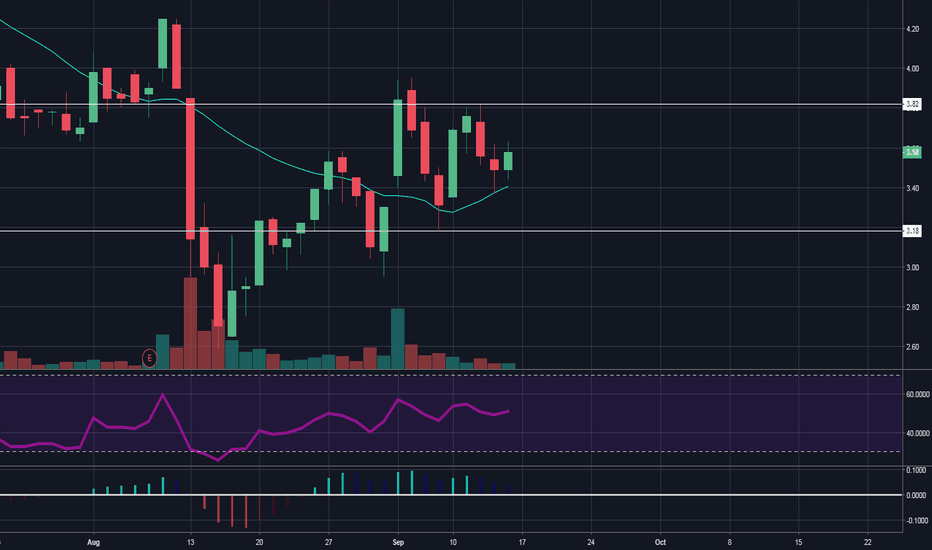

VLE.TO attempting breakout of daily descending channelCanadian energy sector has been hit hard as of late, and VLE.TO has been no exception as it continues to trend downward in a channel. A beauty of an equilibrium is currently playing out on the daily chart right now new the top of that channel. A bear break will have us retest the lower limits, and a bull break on big volume will be a notable shift in momentum for the first time in months.

Vle

Simple Trading Techniques – Pullback Candlestick Strategy

Go long the VLE if it trades at 3.96 or higher. If triggered, place your stop at 3.57 and exit the position for a profit at 4.24 or at your own discretion. (Signals are valid for today only. Always invest wisely).

Learn the rules of this strategy at: www.udemy.com