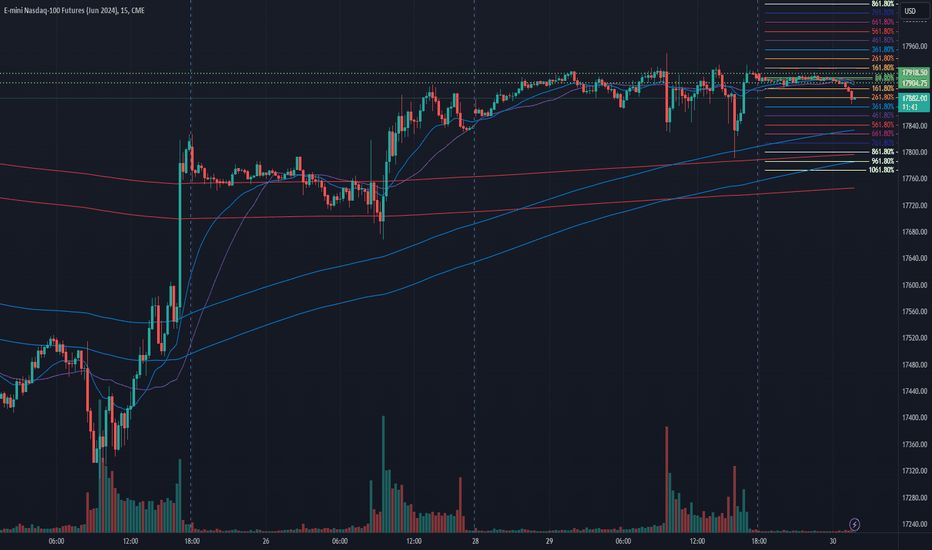

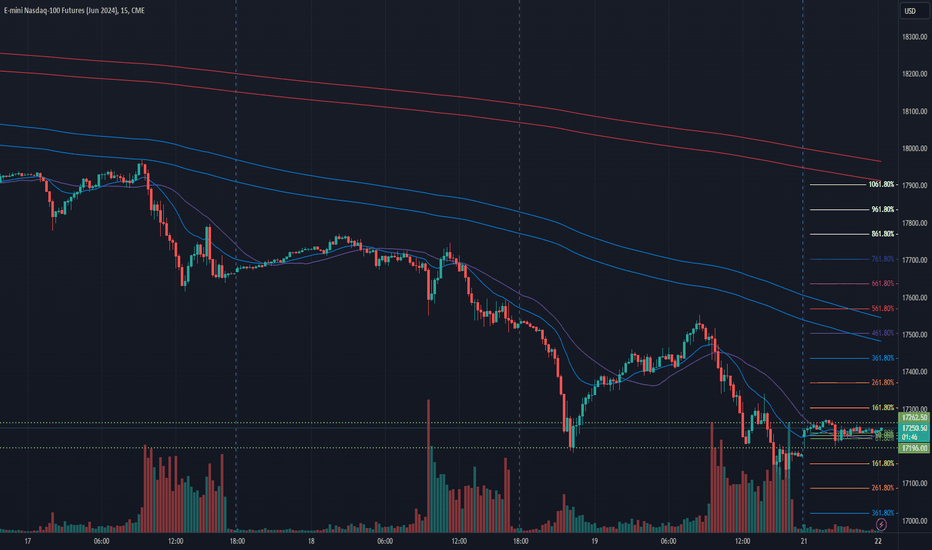

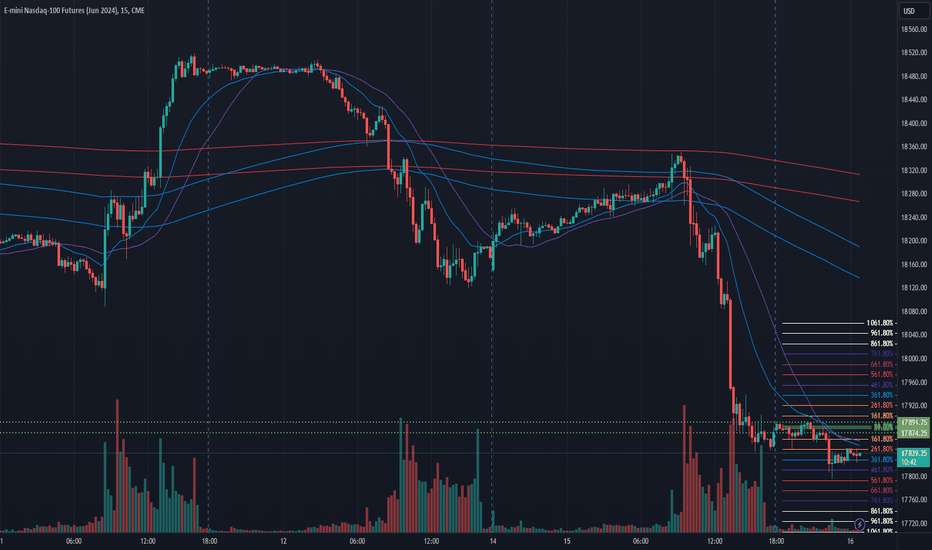

NQ Power Range Report with FIB Ext - 4/30/2024 SessionCME_MINI:NQM2024

- PR High: 17920.00

- PR Low: 17904.50

- NZ Spread: 34.5

Key economic calendar events

09:45 | Chicago PMI

10:00 | CB Consumer Confidence

Last day of the month, 1 day ahead of FOMC

- Prev session closed virtually flat

- Fading from prev highs after a low vol session open

- Above half-back of prev session range

Evening Stats (As of 12:35 AM)

- Weekend Gap: +0.16 (filled)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 287.87

- Volume: 13K

- Open Int: 248K

- Trend Grade: Bull

- From BA ATH: -4.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

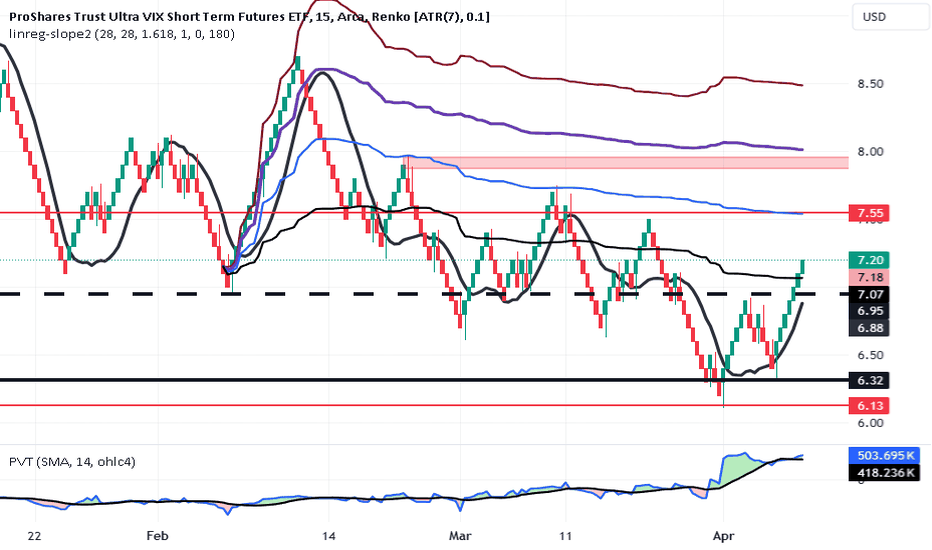

Volatility

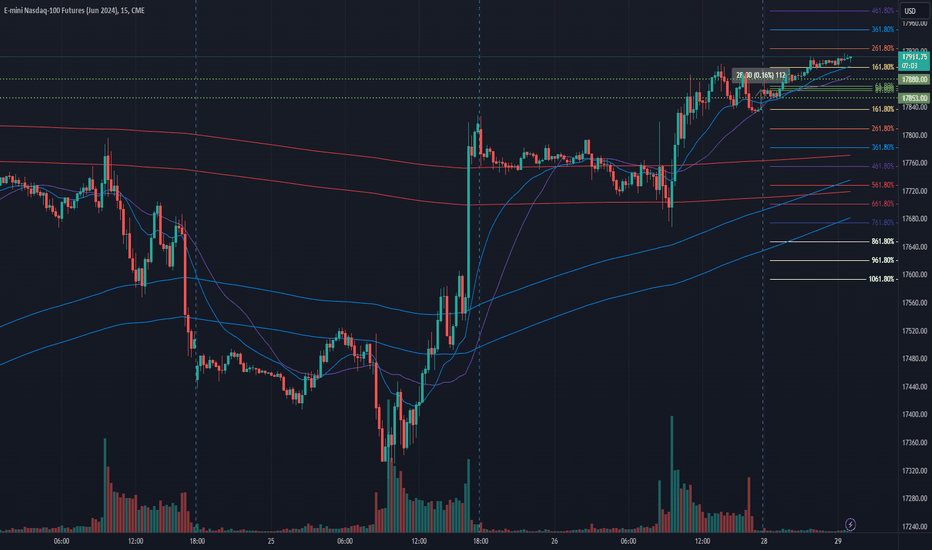

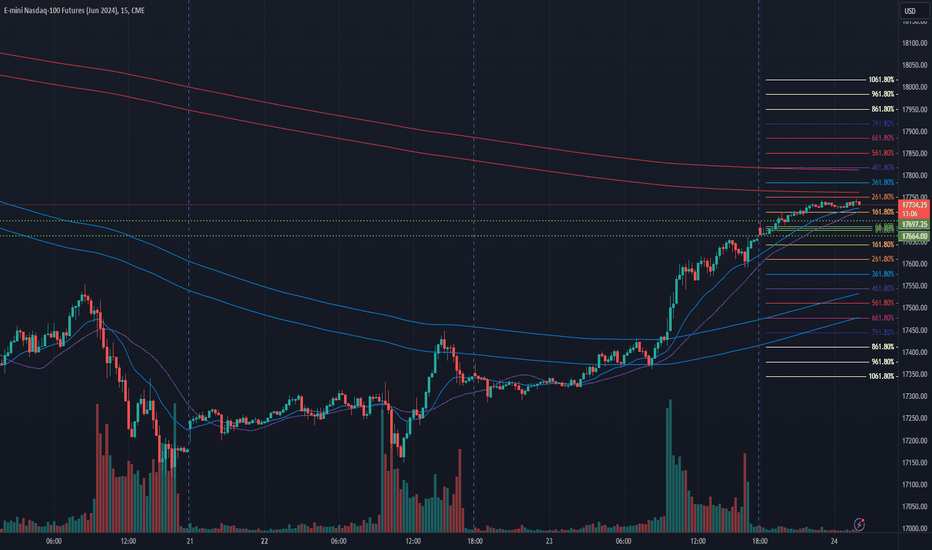

NQ Power Range Report with FIB Ext - 4/29/2024 SessionCME_MINI:NQM2024

- PR High: 17877.25

- PR Low: 17852.50

- NZ Spread: 55.25

No significant economic calendar events

Climbing back to 18000

- Partial weekend gap fill

- Found inventory in 17850s

- Above Friday's high

Evening Stats (As of 12:35 AM)

- Weekend Gap: +0.16 (open < 17840)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 302.43

- Volume: 23K

- Open Int: 247K

- Trend Grade: Bull

- From BA ATH: -4.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

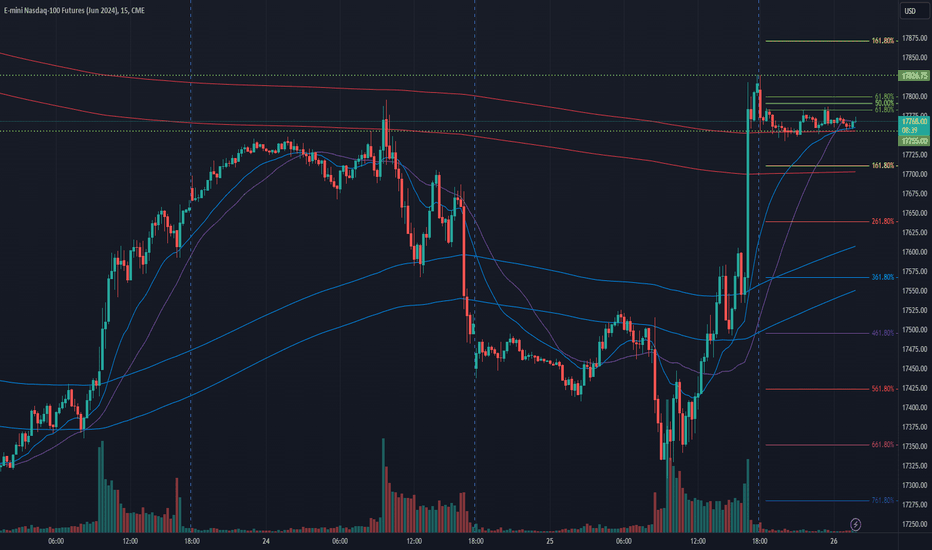

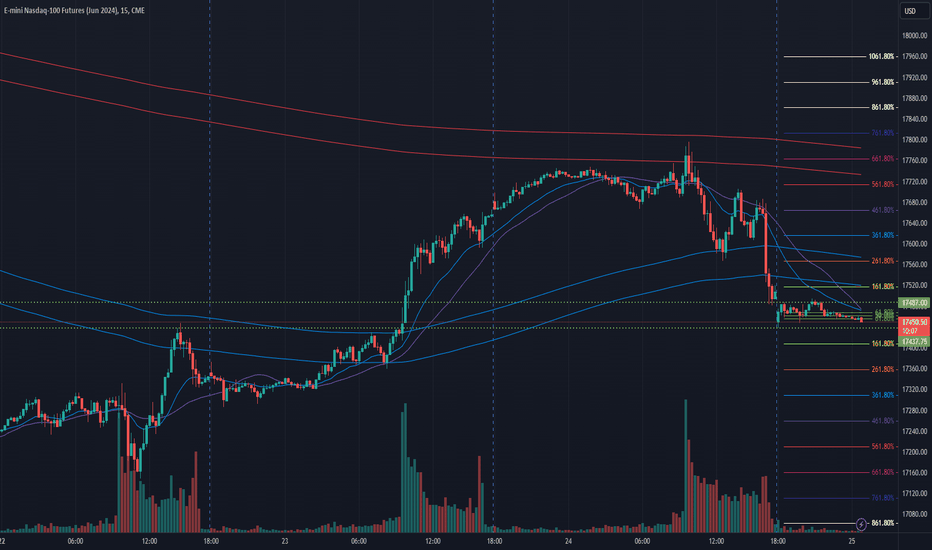

NQ Power Range Report with FIB Ext - 4/26/2024 SessionCME_MINI:NQM2024

- PR High: 17822.50

- PR Low: 17755.25

- NZ Spread: 150.0

Key economic calendar event

08:30 | Core PCE Price Index (2x)

Closed prev high with vol spike back to week highs

- Faded with strength at open from prev session high

- Holding inventory in 17740s

Evening Stats (As of 1:35 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 309.22

- Volume: 30K

- Open Int: 256K

- Trend Grade: Bull

- From BA ATH: -4.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

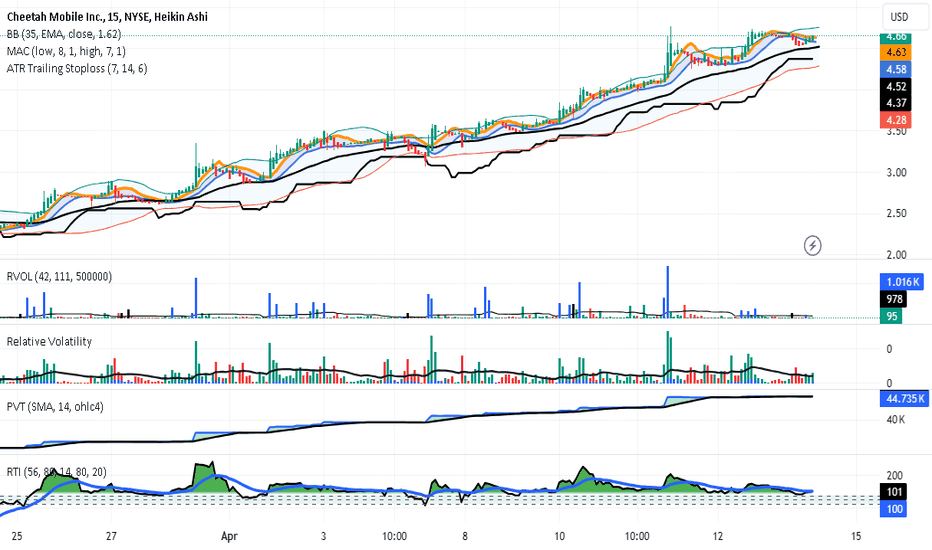

CMCM could chasing a Chinese internet stock be profitable? LONGCMCM is on fire with a 90% gain since the earnings report which was not verified by any

outside forensic accounting auditors . The Ciniese economy may be recovering with it

Cheetah.

The price-volume trend is impressive in the past month as a combination of the price moving

up responding to spikes of buying volume and positive volatility. I will enter this as a small

position chasing the momentum using a trailing ATR stop loss currently $.25 per share.

Since I will risk $25 in the trade for this small position I can take 100 shares as a long position.

I will continue to watch for selected Chinese stocks responding to the economic recovery to

exploit for gain.

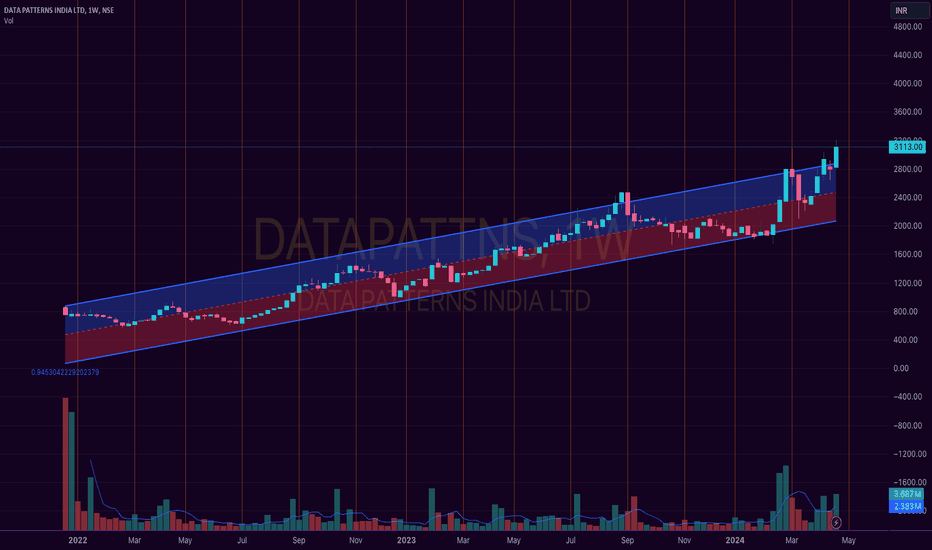

Data Patterns (India) Limited: A Deep DiveIntroduction:

Data Patterns (India) Limited is a prominent player in the Defence and Aerospace Electronics sector in India. With a focus on in-house development and manufacturing facilities, the company has been catering to the indigenously developed defence products industry for over 35 years. In this blog, we will delve into the key aspects of Data Patterns (India) Limited, including its product portfolio, manufacturing facilities, ongoing projects, key customers, and financial performance.

Product Portfolio and Manufacturing Facilities:

Data Patterns (India) Limited offers a diverse range of products, including radars, underwater electronics/communications/other systems, electronic warfare suite, BrahMos programme, avionics, small satellites, and ATE for defence and aerospace systems. The company's manufacturing facility spans across 200,000 sq. ft and is equipped with design, manufacturing, qualification, and life cycle support of electronic systems used in defence and aerospace applications. The facility has an EMS assembly capacity of 600 boards/day and employs 1,130 employees, with 700+ qualified engineers as of March 31, 2023.

Ongoing Projects and Key Customers:

The company is currently engaged in the supply of critical products to several prestigious defence projects in India, including the Light Combat Aircraft (LCA), the HAL Dhruv, Light Utility Helicopter (LUH), and the BrahMos missile programme. Key customers include Bharat Electronics Ltd (BEL), Hindustan Aeronautics Limited (HAL), the Indian Space Research Organization (ISRO), and Defense Research and Development Organization (DRDO). DRDO contributed 42% of the total turnover.

Financial Performance:

In FY22, the company raised 588 crores through an IPO, with 240 crores being a fresh issue and the remaining 348 crores being an offer for sale. The IPO proceeds were utilized for expanding manufacturing and testing facilities in Chennai and enhancing the system integration facility. In FY23, the company raised further funds of 500 crores through QIP for the development of satellite, radar, electronic warfare, and communications products. As of March 31, 2023, 51.21 crores was unutilized from the IPO proceeds, and 462.73 crores was unutilized from the QIP proceeds.

Technical Analysis:

From a technical perspective, the regression channel pattern applied on the weekly timeframe indicates a breakout failure in September 2023, followed by another potential breakout. This could be an opportunity for long-term trend trading on an undervalued stock.

Conclusion:

Data Patterns (India) Limited is a leading defence and aerospace electronics solutions provider with a strong product portfolio, manufacturing facilities, and a diverse customer base. With ongoing projects in the defence sector and a focus on product development, the company is well-positioned for growth. The technical analysis suggests a potential breakout, which could be an opportunity for long-term investors.

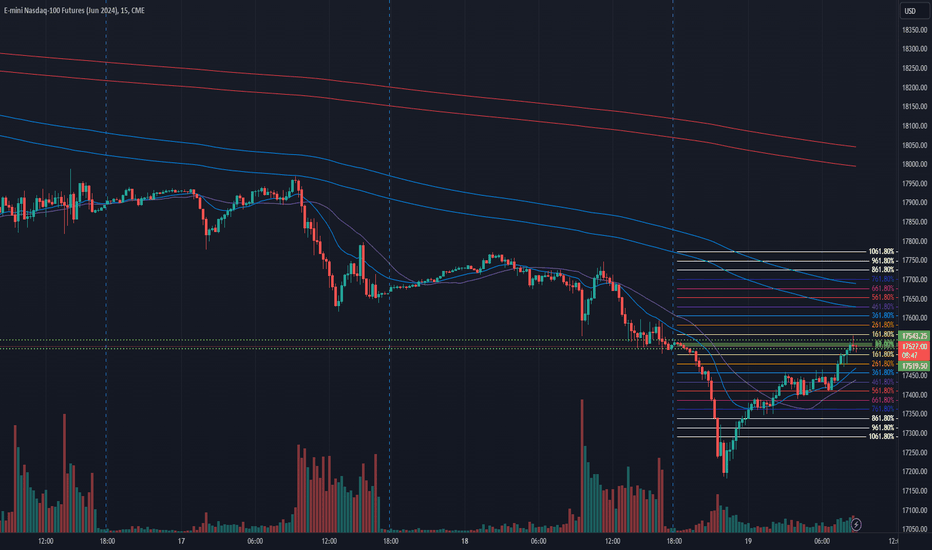

NQ Power Range Report with FIB Ext - 4/25/2024 SessionCME_MINI:NQM2024

- PR High: 17486.75

- PR Low: 17437.25

- NZ Spread: 110.25

Key economic calendar events

08:30 | Initial Jobless Claims

- GDP

Strong inventory run to close prev session

- Mechanical print resulting in pivot back into 4/23 range

- Another technical session gap that structurally filled but left room to the close

- Full gap fill at 17509

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 294.38

- Volume: 28K

- Open Int: 253K

- Trend Grade: Bull

- From BA ATH: -6.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/24/2024 SessionCME_MINI:NQM2024

- PR High: 17698.50

- PR Low: 17664.00

- NZ Spread: 77.0

Key economic calendar events

08:30 | Durable Goods Orders

10:30 | Crude Oil Inventories

Daily gap up print of ~65 points, 0.35% from prev close

- Climbing above prev session high

- Inside lows of 4/17 range

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 295.59

- Volume: 30K

- Open Int: 254K

- Trend Grade: Bull

- From BA ATH: -5.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Volatility Valuation Index - ES FuturesThe " Volatility Valuation Index " proved to be quite reliable ... again....

Mind you this is a SETUP tool, to locate EXTREMES in Volatility.

It is NOT a SIGNAL tool, to be used for entries / timing.

That said, its accuracy sometime can be impressive.

But even under these circumstances, I do not use it as a timing tool

(Works across all markets & timeframes)

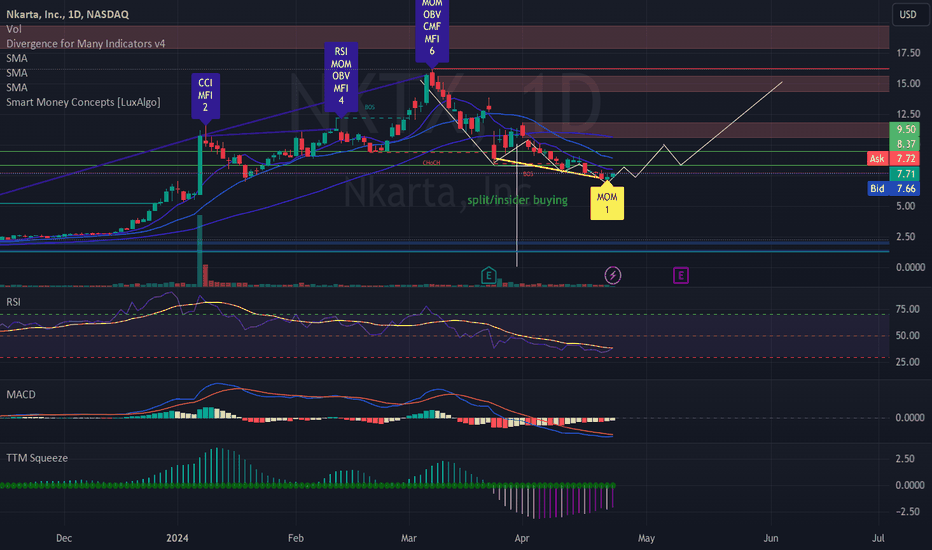

Nkarta to 15$NASDAQ:NKTX

Looking like a technical reversal on the daily chart - MACD, TTM, and MACD look very resilient after a selloff.

Analysts set price targets at 15$, indicators seem to match up with this. Earnings in 17 days and mid-year treatment trials could be catalysts to move the price towards this target. Earlier results were promising.

Make sure to manage your R:R and size appropriately. Tell me what you think about this setup in the comments.

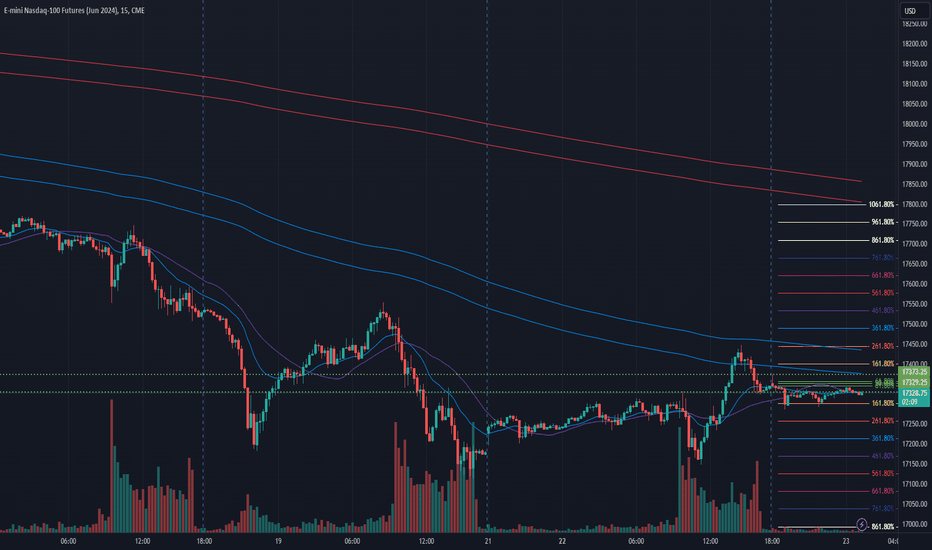

NQ Power Range Report with FIB Ext - 4/23/2024 SessionCME_MINI:NQM2024

- PR High: 17371.75

- PR Low: 17329.25

- NZ Spread: 95.0

Key economic calendar events

09:45 | S&P Global US Manufacturing PMI

- S&P Global Services PMI

10:00 | New Home Sales

Prev session closed as double wick inside bar

- Holding near prev session close

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 4/18 +0.04% (open < 17665)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 290.59

- Volume: 26K

- Open Int: 264K

- Trend Grade: Bull

- From BA ATH: -7.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/22/2024 SessionCME_MINI:NQM2024

- PR High: 17263.00

- PR Low: 17196.00

- NZ Spread: 150.0

No key economic calendar event

Volatile open creating relatively wide range

- Holding above Friday's close

- Value declined back to Dec-Jan range

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 4/18 +0.04% (open < 17665)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 291.55

- Volume: 37K

- Open Int: 267K

- Trend Grade: Bull

- From BA ATH: -7.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

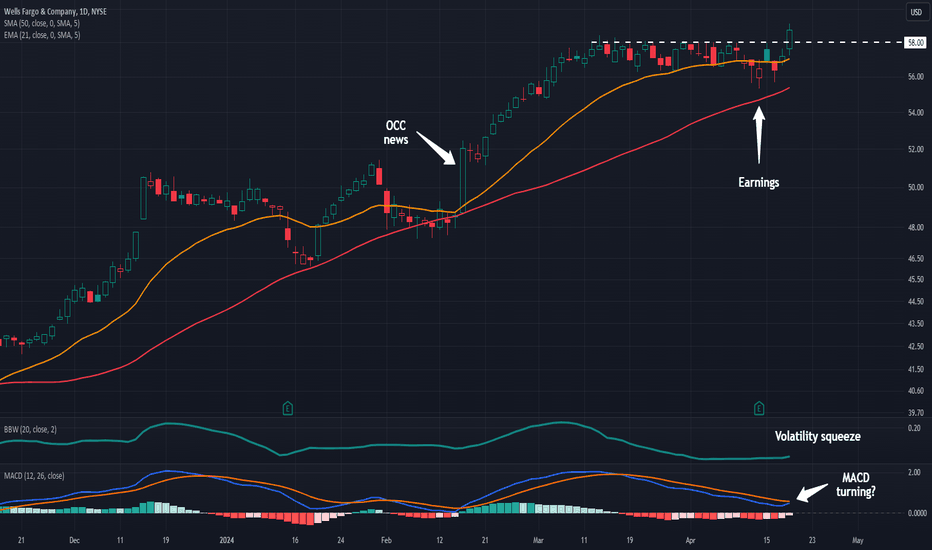

Wells Fargo Quietly Breaks OutStocks inched lower yesterday, but not Wells Fargo.

The first pattern on today’s chart is $58. WFC was trapped below that level since March 12, but closed above it on Thursday and reached its highest level in over two years. That may suggest the bank stock is breaking out.

Second, Bollinger Band Width highlights the narrow consolidation since early April. Will that price compression give way to price expansion?

Third, WFC is back above its 21-day exponential moving average. Traders could view that as evidence of a bullish trend. MACD is also trying to turn higher.

Finally, there have been some positive news events. The Office of the Comptroller of the Currency (OCC) terminated a cease-and-desist order on February 15 and earnings beat estimates on April 12. (The stock initially dropped but advanced this week.)

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

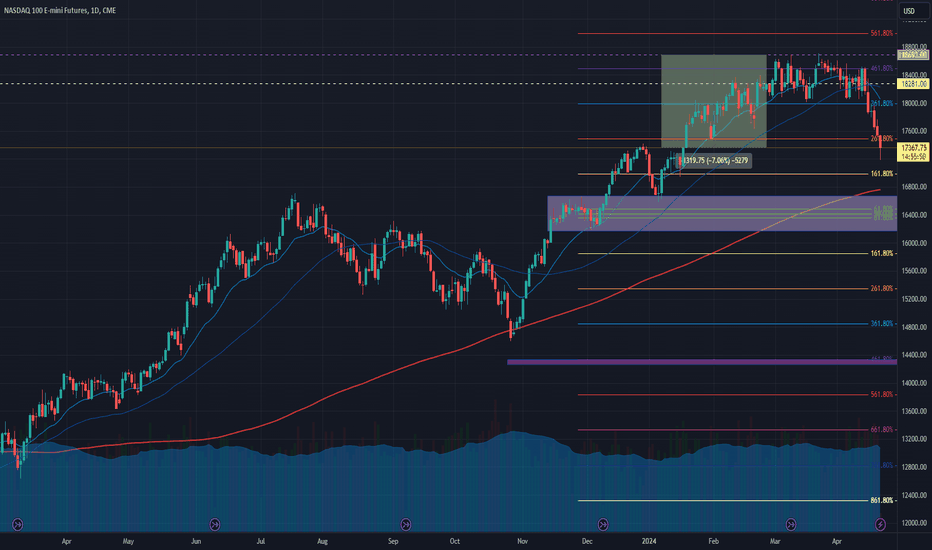

NQ Power Range Report CORRECTION - 4/19/2024 SessionCME_MINI:NQM2024

- PR High: 17543.00

- PR Low: 17520.00

- NZ Spread: 51.5

Evening Stats (As of 1:55 AM)

- Weekend Gap: N/A

- Gap 4/18 +0.04% (open < 17665)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 301.12

- Volume: 144K

- Open Int: 260K

- Trend Grade: Bull

- From BA ATH: -7.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 4/19/2024 SessionCME_MINI:NQM2024

- PR High: 17543.00

- PR Low: 17520.00

- NZ Spread: 51.5

No key economic calendar events

Heavy selling through prev session

- Below prev daily supply, 17400

- Found inventory response inside mid Jan range

- Establishing value between 17240 - 17390

Evening Stats (As of 1:55 AM)

- Weekend Gap: N/A

- Gap 4/18 +0.04% (open < 17665)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 301.12

- Volume: 144K

- Open Int: 260K

- Trend Grade: Bull

- From BA ATH: -7.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

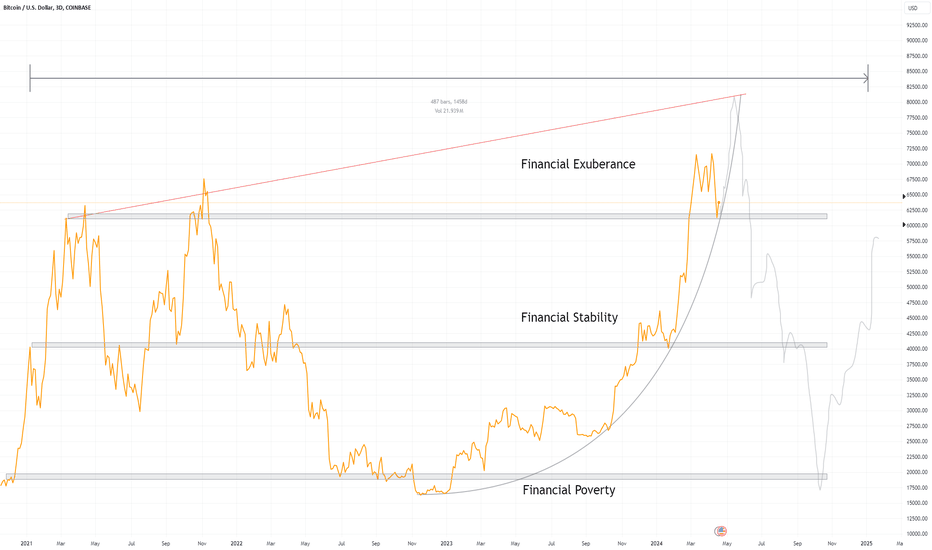

Argument: Bitcoin is only going to get MORE volatileThe first macro recession for crypto assets is perhaps right around the corner.

Bitcoin will be put to the test at a time when it has never been more viewed as a stable store of value by so many people.

The volatility is going to be brutalizing.

Don't get wiped out on the path to infinity.

NQ Power Range Report with FIB Ext - 4/18/2024 SessionCME_MINI:NQM2024

- PR High: 17685.50

- PR Low: 17670.00

- NZ Spread: 34.5

Key economic calendar events

08:30 | Initial Jobless Claims

- Philadelphia Fed Manufacturing Index

10:00 | Existing Home Sales

Value continuing to decline below 17000

- Responding to 2/21 inventory

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 4/18 +0.04% (open < 17665)

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 282.68

- Volume: 21K

- Open Int: 254K

- Trend Grade: Bull

- From BA ATH: -5.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

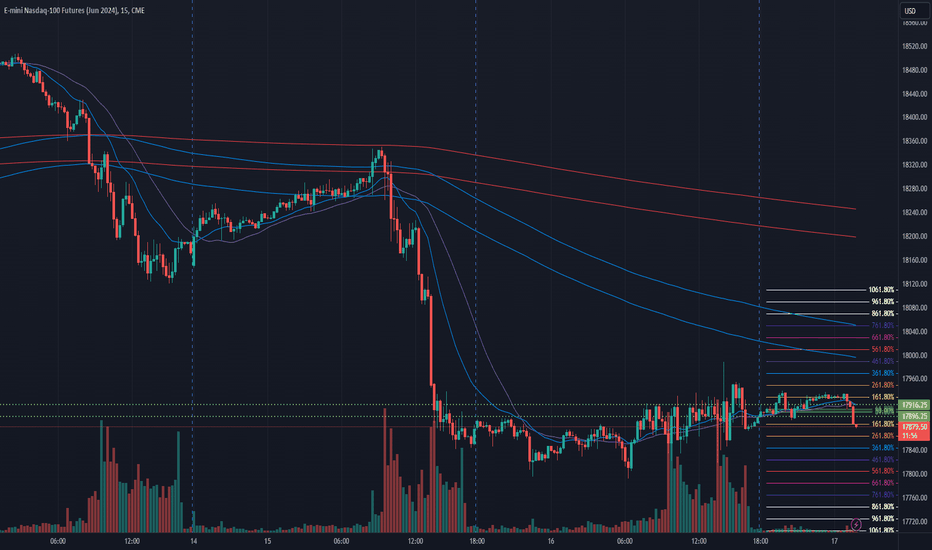

NQ Power Range Report with FIB Ext - 4/17/2024 SessionCME_MINI:NQM2024

- PR High: 17916.00

- PR Low: 17896.00

- NZ Spread: 44.5

Economic calendar event:

10:30 | Crude Oil Inventories

Prev session closed flat

- Maintaining 50% of prev session range

- Above Monday's close

Evening Stats (As of 12:55 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 277.30

- Volume: 28K

- Open Int: 253K

- Trend Grade: Bull

- From BA ATH: -4.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

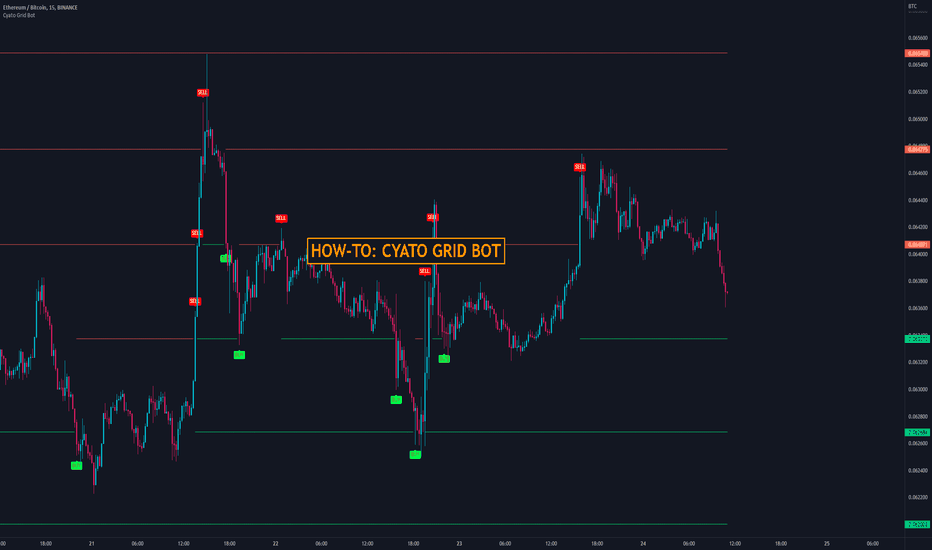

HOW-TO: Cyato Grid BotThe grid strategy is one of the most popular and interesting in the world of crypto and forex trading.

Simply because it abuses volatility, market fluctuations, and those markets are well known for it.

In this guide, I will explain the strategy and showcase a powerful grid trading indicator that can help traders to better understand and implement this strategy.

█ The Key to the strategy

It involves placing buy and sell orders at predetermined intervals or levels, called "Grid Steps". If a step is crossed to the downside, the strategy will buy. If price crosses a step to the upside, the strategy will sell. The last step to be crossed becomes inactive.

When configuring the strategy, the process is pretty simple.

The user can choose the number of steps with a higher and lower step price. With just these 3 settings, you can create a strategy.

Now, the challenge with grid trading, is to optimize these 3 settings.

█ Maximizing its effectiveness

The first thing you want to do before even going into the settings is to find a suitable market for it.

You want these 3 requirements:

• A ranging/going sideways market

• High volatility

• High liquidity

For example, ETH/BTC is one of the most traded pair in grid trading. It has good volume for the strategy, behaves in a range since late 2021, and has decent volatility daily.

█ Knowing the risks

Very often, the lowest step is used as a stoploss.

As with every trading strategy, there are risks and it is important to understand it.

With grid trading, we take a bet that price will fluctuate in a range, and abuse that assumption to profit from price action.

If price decides to leave the range, there is one scenario that will put us at risk.

In the scenario where price breaks to the top, we are fine, this is take profit.

However, if price breaks through the bottom (lowest step), we will find ourselves with a lot of buy orders above current price.

That means we have unrealised loss. Now two difficult two choices are in our hands: sell at a loss, expecting price to go lower, and stop the strategy to start a new one at lower prices. Or wait until price climbs back up.

In this example, we set a stop loss at 0.063 BTC below the lowest step, and price falls down to 0.048 BTC. If we decided to hold, the unrealised loss would grow bigger as price drops.

Now that we know what are the risks, let's see how is profit calculated.

█ Calculating Grid Profit

We will have two types of profit when grid trading. One this called grid profit.

Grid profit is generated every time a step is bought and sold at a higher price. The grid step "height" is the spacing between two steps, usually visualised in a % percentage of price.

The sum of all the profits generated from the grid steps is the grid profit.

The second type of profit is the open profit. This one is really important and should not be forgotten when calculating your strategy PNL.

To put it simply, it is the profit or loss that would be realised if you would close all the open orders at current price.

The open profit can vary a lot and it is crucial to know its value when you are looking to take profit or stop the strategy.

In this example, I chose round numbers to make it easier. I used 2000 usd as initial capital for the strategy, which contains 20 steps. The strategy will therefore split this equally through the steps, so 100 usd per steps. I chose a grid step of 1.1% of price, which is makes around 1% after fees. It will consequently take 20 closed steps to generate 1% grid profit from the initial capital.

After running the strategy for 74 days, we have 21 steps closed, which makes a tiny bit more than 1% grid profit in total.

However, the open profit from the 12 orders still open is negative because price dropped.

If we were to close all open orders and stop the strategy right now, the total profit would be 1.03 - 4.35 = -3.32 %

We can see that it would not be a good time to stop the strategy, and shows that grid trading needs time to generate grid profit. That is why even though it is run on low timeframes, it remains a long term strategy.

█ Cyato Grid

Cyato Grid is a powerful indicator that can help to better understand and implement this strategy.

I will now explain the key features and settings of the indicator, provide examples of how to use it in real-world trading scenarios, and offer tips and advice for maximizing its effectiveness.

Backtesting

As soon as you set the 3 settings - number of steps, lowest and highest price -, you will get results in the Strategy Tester and in the Backtest table in the top right of the chart.

Those results will vary based on your strategy initial capital and order size. The order size being the amount to buy on each step, and is usually the same for each step. A good practice is to divide your inital capital by the number of steps to make sure you will never run out of funds to run the strategy.

Order Type

The strategy can be configured to use market or limit orders, as you prefer.

With market order type, the strategy will place market orders at the current price every time a step is crossed.

This allows to ensure that every order is filled, however you are subject to buy and sell a bit higher or lower than the exact grid step prices, and you will pay taker fees.

With limit order type, the strategy will place limit orders.

This allows to ensure that the strategy will buy and sell at the exact step prices and pay maker fees, which are usually less than taker fees.

To make it work, the "Start Date" setting comes into place.

Key Features

• Price percentage % step

Lets you set a price percentage between steps. The grid is then generated starting from lower or upper, configurable.

• Trailing Up

Automatically creates new steps when price climbs out of range.

• Trailing Stop

When trailing up is activated, the stop loss will dynamically follow the lowest price.

• Take Profit

Secure profits by stopping the strategy once total volume (grid profit and open profit) reaches a configurable percentage %.

Automation

You can fully automate the strategy through its alerts.

Set the alert messages for buy, sell, take profit, stop losses directly in the indicator settings.

Use the parameter "alert() function calls only" and you're good to go.

It will use only 1 alert slot to run the whole strategy.

Since it is not possible to place orders directly in TradingView, you will need a bot-software to do it.

You can use any bot that work with TradingView alerts.

Now, I offer a bot system for Binance along with the indicator. More info on my website, link below.

Sample Use cases

Crypto

BNB/BTC

BNB/ETH

LTC/BTC

Forex

GBP/JPY

EUR/JPY

NZD/USD

Tips and advice

1 — Set up the grid properly: Make sure you have a clear understanding of the asset you're trading and the market conditions that are affecting it. Set your grid levels based on your analysis of the asset's price movements and volatility.

2 — Adjust the grid as necessary: Keep an eye on market conditions and adjust your grid levels as needed. This will help you capture gains and limit losses as the market moves.

3 — Use proper risk management: Make sure you have a clear understanding of your risk tolerance and use appropriate risk management techniques, such as setting stop-loss orders, to limit your potential losses.

4 — Don't overtrade: Grid trading involves placing a large number of orders, so be mindful of transaction costs and don't overtrade. This will help you maximize your profits and reduce the potential for losses.

5 — Consider using automated software: Grid trading can be automated using software, which can save time and reduce the potential for human error. Consider using a reputable software provider and test your strategy thoroughly before using it in live trading.

6 — Keep a trading journal: Keeping a trading journal can help you evaluate your strategy and make improvements over time. Record your trades, including the grid levels and any adjustments you make, and evaluate your performance regularly.

7 — Stay disciplined: Stick to your strategy and avoid making emotional decisions based on short-term market movements. Stay disciplined and focus on the long-term profitability of your grid trading strategy.

═════════════════════════════════════════════════════════════════════════

█ SCRIPT ACCESS

Indicator and automation tools access can be purchased on my website. The link is in my signature below.

NQ Power Range Report with FIB Ext - 4/16/2024 SessionCME_MINI:NQM2024

- PR High: 17891.75

- PR Low: 17874.25

- NZ Spread: 39.0

Key economic calendar event

13:15 | Fed Chair Powell Speaks

Broke 200+ points below Mar inventory and holding

- Ranging below prev session low

- 17800 daily inventory from Feb

Evening Stats (As of 12:05 AM)

- Weekend Gap: N/A

- Gap 10/30 +0.47% (open < 14272)

- Session Open ATR: 287.80

- Volume: 40K

- Open Int: 257K

- Trend Grade: Bull

- From BA ATH: -4.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 18675

- Mid: 18106

- Short: 16963

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

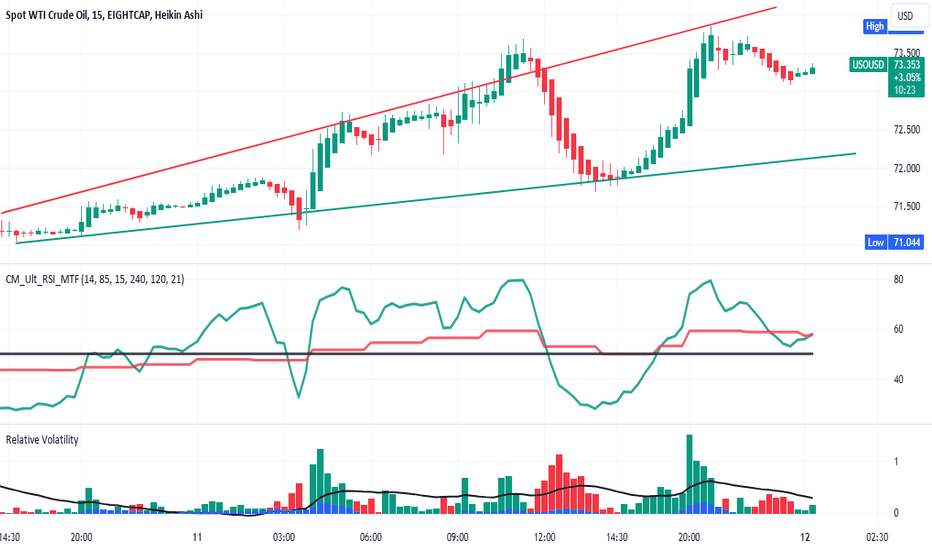

USDUSD Oil Prices react to Middle EastOn Thursday January 11th ( earlier today) WTI Crude prices gyrated widely

likely in reaction to US /UK intervention on the terrorists who seized a tanker on the behalf of

Iraq in the Red Sea / Suez Canal area putting shipping and supply concerns into the oil industry

to offset any weak demand. The 15 minute chart shows a megaphone pattern as a

demonstration of waves of relative volatility in price action. I have a position shorting oil

and will now close that position as I see a long entry developing here. US companies that use

rail and pipeline matching domestic production to consumption are less impacted by this

oceanic shipping issue. I will focus on them especially. OXY is at the top of the list and then

MRO.

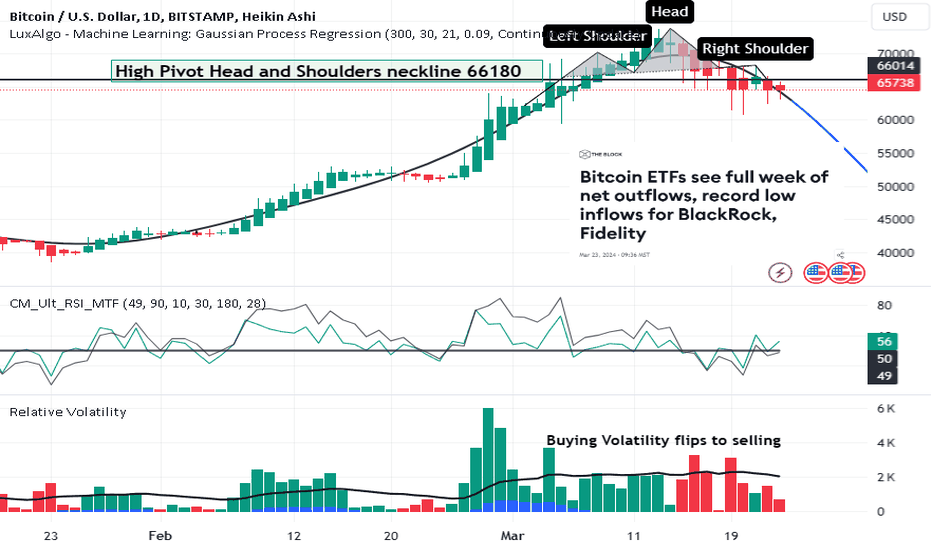

BTCUSD on daily chart falling under resistance SHORTBTC in the recent past put in a head and shoulders pattern. The neckline drawn onto the chart

is above current price and rejecting it. Volatility has flipped decidedly. News is that Bitcoin

and crypto ETFs have had several consecutive days of outflows some perhaps when stop gold

spiked. Dollar value has a role in this as well as it dipped and then recovered. I have followed

the crowd and sold my position for now and will look for a near term bottom when it

develops for re-entry. CLSK is down and other crypto-related stocks may now down trend.

Looking at MSTR, RIOT and BTBT.

UVXY crosses over mean anchored VWAP LONGUVXY which leverages the VIX as a measure of volatility / greed/ fear has finally crossed

over the mean anchored VWAP. This is a sign of bullish momentum and perhaps a signal that

traders should hedge or consider their positions in terms of hard risk management. Those

who traded this move up today made 10% or better in the trade. Those who bought call options

expiring tomorrow made 10X and those with call options for next Friday made 5X overnight.

Tomorrow is another day. Likely the market will rise from the correction and UXVY will fade

a bit. No matter, its value for insurance and hedging is reinforced on days like the past day.

I am maintaining a full position aside the call options closed at the afternoon bell which

expire on Friday and had time decay to contend with. My first target is 7.75 then comes

8.05 and 8.45. I will take off 20% at each target and keep the others for insurance for

a true market crash or black swan event to buffer losses while stops get hit.