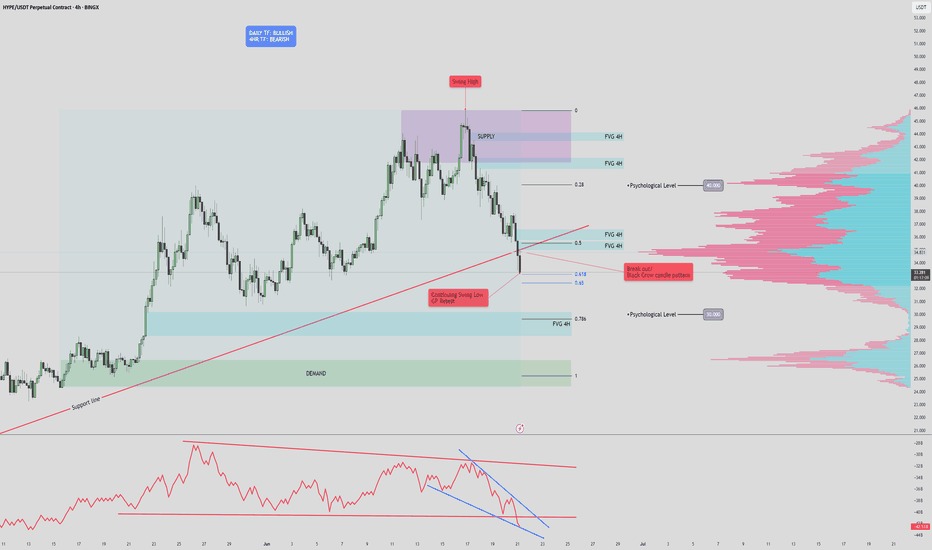

HYPE/USDT Technical Analysis (4H Chart)🔍 HYPE/USDT Technical Analysis (4H Chart)

High Time Frame (Daily): Bullish

Despite recent pullbacks, the overall trend remains bullish on the daily timeframe. However, current price action suggests a potential fakeout or legitimate breakdown, as we test key structural and volume-based supports.

Short-Term Time Frame (4H): Bearish

The 4-hour chart displays clear bearish pressure, confirmed by the Three Black Crows candlestick pattern. This signals sustained selling interest and supports the current downward move.

🧱 Key Zones

Supply Zone: $41.7 – $45.9

Strong resistance marked by prior selling pressure and overlapping FVGs.

Demand Zone: $24.4 – $26.3

Historical area of buying support, aligned with a low-volume node and an unfilled FVG.

📏 Fair Value Gaps (FVGs)

Above Price:

Four 4H FVGs act as upside inefficiencies, offering targets in a bullish recovery:

~$34.9

~$36.6

~$37.8

~$40.0 (psychological level & POC cluster)

Below Price:

One major 4H FVG remains unfilled, directly above the demand zone.

📐 Fibonacci Analysis

Price is testing the Golden Pocket (0.618–0.65) from the recent swing low to high.

A clean break below this area (with confirmation) targets the unfilled FVG around $30, and potentially the demand zone ($24.4–$26.3).

📉 Volume Profile Insight

Volume is clustered around $34–$37, indicating strong past market participation.

Very low volume between $29–$30, creating a volume void — if price loses support at the FVG and golden pocket, it could rapidly drop into the demand zone.

🔻 OBV Analysis (Volume Momentum)

OBV has broken below a larger rising wedge, confirming bearish divergence.

A falling wedge is now forming within OBV.

Break below this wedge: Confirms further price breakdown.

Reclaim of the larger wedge trendline: Suggests potential bullish reversal.

✅ Trade Scenarios

🔺 Bullish Scenario

Trigger: Bullish reversal pattern at the golden pocket (e.g., double bottom, falling wedge, inverse H&S) + OBV recovery.

Entry: Upon confirmation around $32.5.

Targets:

$34.9 (FVG)

$36.6 (FVG)

$37.8 (FVG)

$40.0 (psychological)

Stop: Below $30 or recent swing low (tight below FVG).

🔻 Bearish Scenario

Trigger : Confirmed breakdown of golden pocket & 4H FVG with OBV falling wedge breakdown.

Entry : Below $32.5 with confirmation (e.g., retest or strong momentum candle).

Targets:

$30.0 (psychological level)

$28.5 (FVG zone)

$26.3 → $24.4 (Demand zone)

Stop : Above golden pocket resistance (~$33.8–$34.2).

📝 Conclusion: The market is at a pivotal point. A confirmed break below $32.5 could accelerate selling due to the volume gap, while a strong bullish reaction from the golden pocket could drive a recovery toward $40. Always wait for confirmation before entering either scenario.

Volumeanalysis

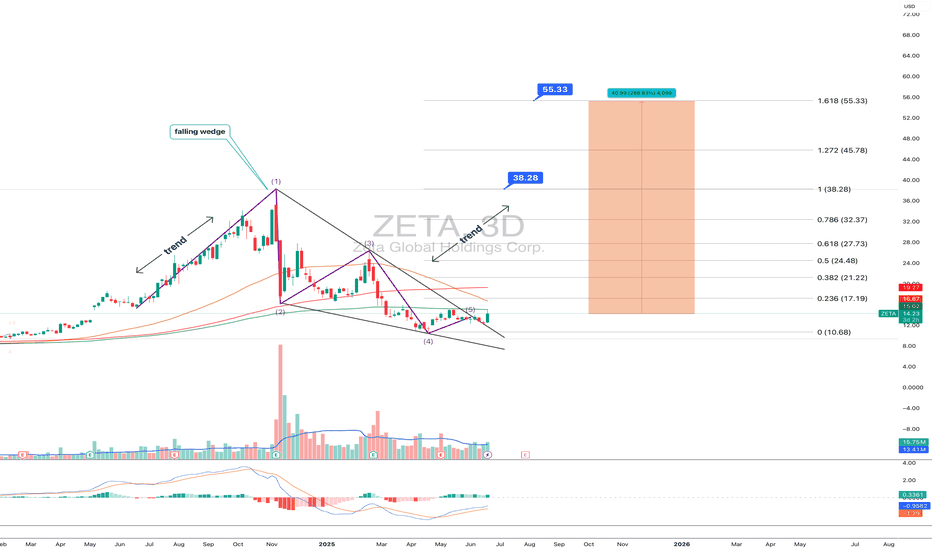

ZETA: when a wedge isn’t just a wedge — it’s a launchpadTechnically, this setup is textbook clean. Price completed the fifth wave within a falling wedge and instantly reacted with a bullish breakout. The expected breakdown didn’t happen — instead, buyers stepped in, confirmed by rising volume. All EMAs are compressed at the bottom of the structure, signaling a clear shift in momentum. The volume profile shows strong accumulation around $14, while the area above current levels is a vacuum — ideal conditions for acceleration.

The key resistance zone is $16.70–17.20 — former base highs and the 0.236 Fibonacci retracement. If price breaks this area with volume, the next stop is likely $24.48 (0.5 Fibo). Classical wedge targets land at $38.28 and $55.33 (1.272 and 1.618 extensions). If a trending leg begins, it could move fast — because there’s simply no supply overhead.

Fundamentals:

ZETA isn’t a profitable company yet, but it shows consistent revenue growth and aggressive expansion. Capitalization is rising, debt is manageable, and institutional interest has increased over recent quarters. In an environment where tech and AI are regaining momentum, ZETA could be a speculative second-tier breakout candidate.

Tactical plan:

— Entry: market or after a retest of $14.00–14.30

— First target: $17.20

— Main target: $24.48

— Continuation: $38.28+

— Stop: below $13.00 (bottom wedge boundary)

When the market prints a wedge like this and the crowd ignores it — that’s often the best trap setup. Only this time, it’s not for retail buyers. It’s for the shorts. Because when a falling wedge breaks to the upside with volume — it’s time to buckle up.

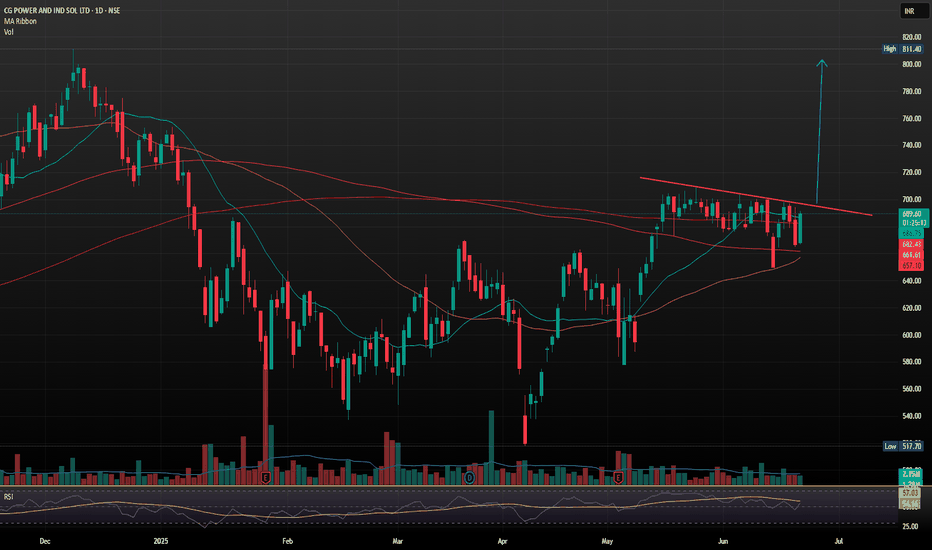

CG Power and Industrial Solutions with Strong Bullish Flag SetupCG Power and Industrial Solutions just landed its largest-ever single order a 641 crore contract from Power Grid Corporation of India Ltd (PGCIL) for high-voltage transformers and reactors

The company, now under the Murugappa Group, reported consolidated FY25 revenues of 9,909 crore. However, annual profit dipped to 972.98 crore from 1,427.61 crore in FY24, despite a strong Q4 showing with a 17% YoY rise in net profit to 274.26 crore.

- Inverse Head & Shoulders Breakout: The stock recently broke out of an inverse H&S pattern, a classic bullish reversal signal, with strong volume confirmation. Holding above 690 could push it toward 750 TO 800.

Support & Resistance Levels

- Support: 663–679 demand zone

- Resistance: 694, 704 and 712

Trend Summary

- Short-Term: Neutral to bullish

- Medium-Term: Bullish bias if it sustains above 690

- Volatility: Elevated, so expect sharp swings

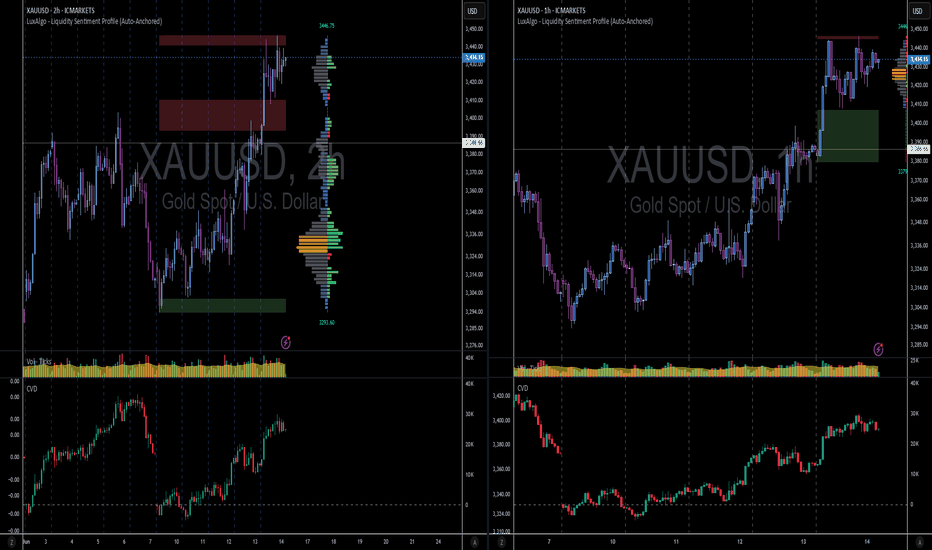

XAUUSD - High possibility of volatile market opening (20250616)Well, it is quite obvious we have a volatile geo-political crisis this weekend, so market may overreact once again to bring Gold to at least 3500 opening.

Looking at volume, though Gold is in uncharted territory and it can be move as high as 3550 - 3600, I rather play for a quick profit.

Hope later this Sunday, we can find some positive news that can at least hold the surge of Gold to minimum.

Trade safe, Trade wisely. Monday will be a very volatile opening.

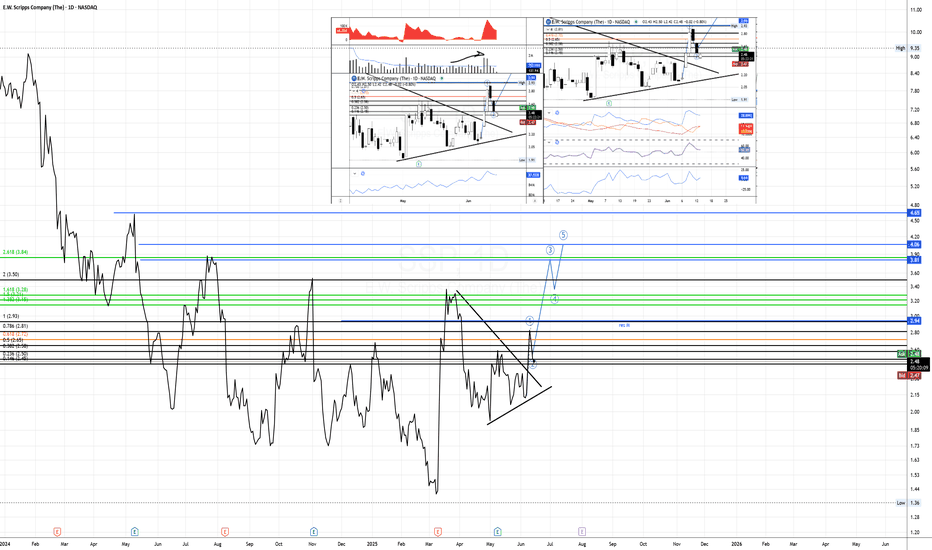

$SSP Low volume on Wave 2, momentum risingFirstly, on the line chart is possible to watch the possible targets - blue lines - which one of it is almost as the same level as 2,618.

Fibonacci measured from the breakout to monthly resistance.

res M = monthly resistance

During the Wave 2, the two candles from last two days showed low volume as usual to happen during formation of W2, and it is possible to see that price at the breakout and after it was above average which can be read as high interest from buyers.

Confirming the volume, the EFI even though is decreasing still show strength,OBV follow the price trend but looks like buyers are entering again.

When it comes to momentum is possible to see that RSI did not crossed the equilibrium even after two bearish days, as ROC being a leading indicator which already changed direction . ADX is showing some strength for the trend direction confirmed by as DMI+ is still above DMI-

DTC = 1,36

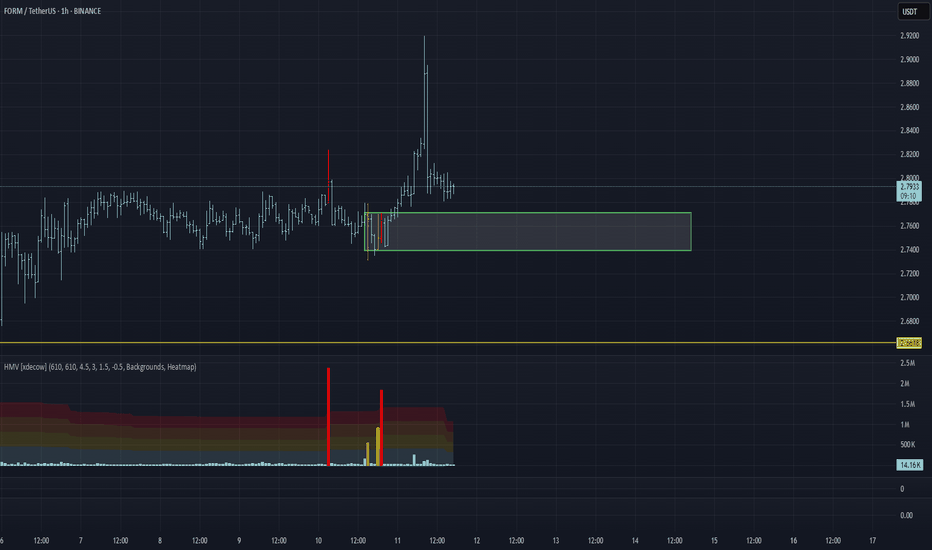

FORM/USDT Analysis: Another Growth Wave Possible

For this token, abnormal buying by a large player has been visible for several days, followed by strong moves with very low volume.

One of these zones is $2.77–$2.74. We consider buying from this zone if a reaction appears.

This publication is not financial advice.

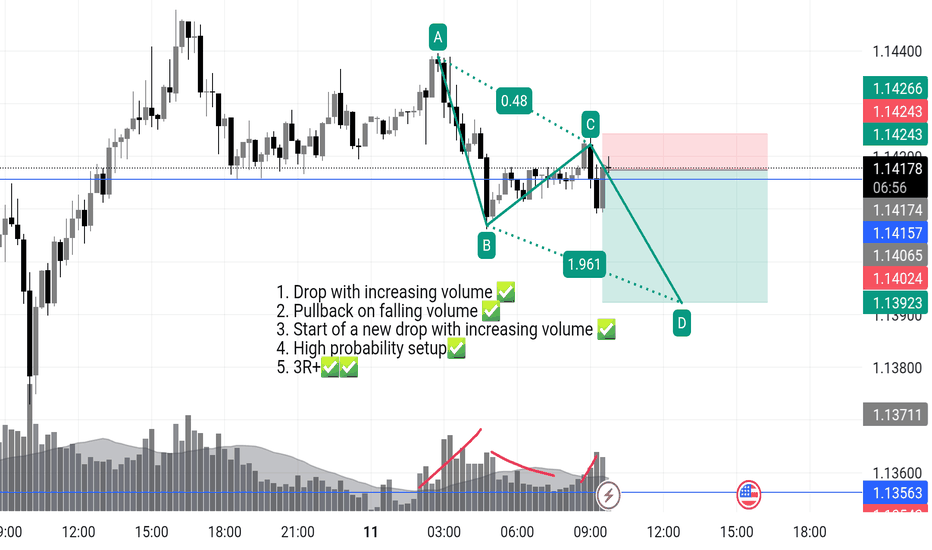

EURUSD shortThe Setup:

1. A-B: Strong impulsive drop on increasing volume → clear evidence of real selling pressure.

2. B-C: Pullback forms on decreasing volume → classic corrective behavior, not buyer aggression.

3. C-D: Entry just below point C as new volume confirms sellers stepping back in.

4. Targeting >3R with stop tucked above C — logical structure, clean invalidation.

✅ Volume confirms the trend

✅ Structure is tight, no randomness

✅ Timing aligns with volatility spike (news at the bottom?)

✅ Clear bearish continuation pattern

what do you think of this a head of cpi?

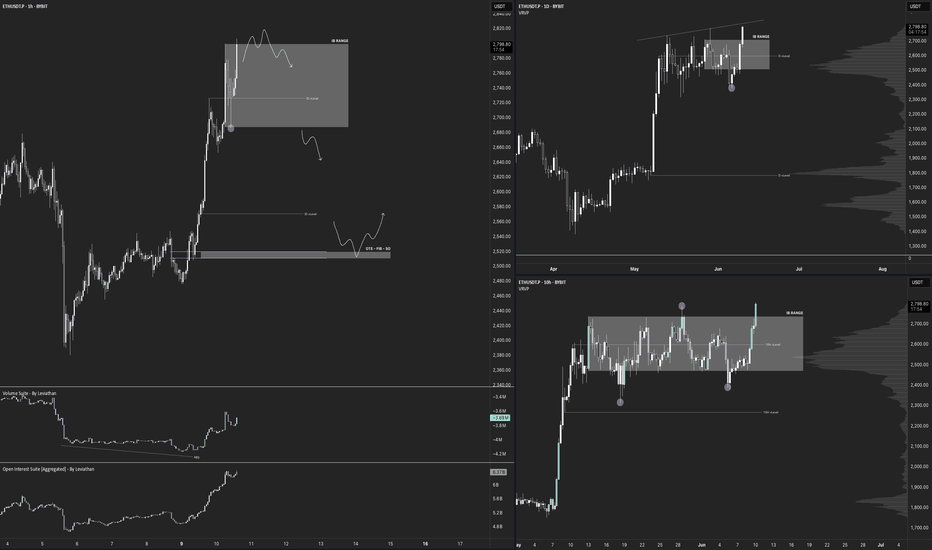

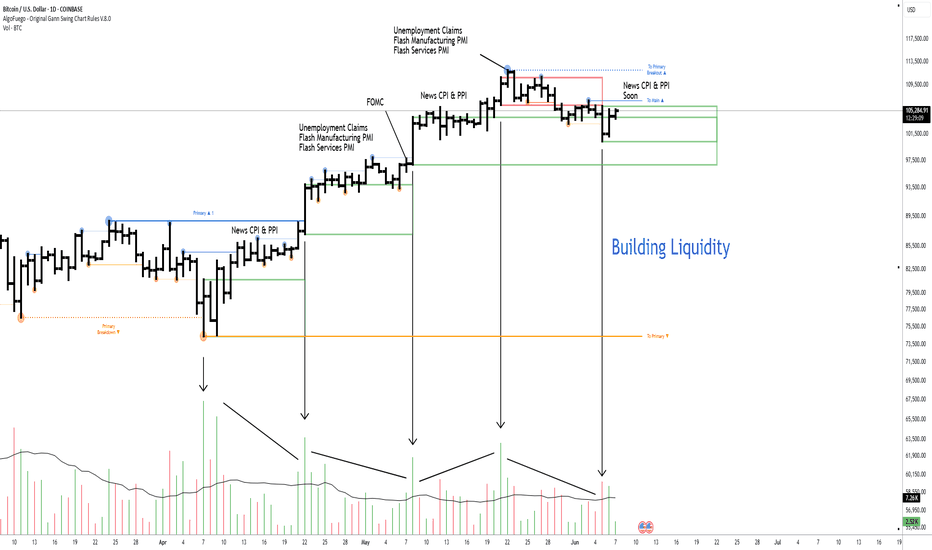

$ETH - Top DownBYBIT:ETHUSDT.P Top Down (10/06/25)

V-Levels Bias

Weekly = Bullish

Daily - Bullish

10-Hour = Bullish

1-Hour = Bullish

V-Levels Momentum

Weekly = Bearish FA

Daily = Neutral

10-Hour = Neutral

1-Hour = IB Range (Neutral)

DeCode Market Breakdown

Macro Context

Weekly Chart

Strong bullish MS, printing clean HHs and HLs.

Price has rejected from the same V-Level multiple times.

Rejections are paired with high relative volume and aggressive selling footprints → indicates strong passive interest above.

This area is not ideal for aggressive long entries.

Daily Chart

Still in bullish structure, holding above key POCs and range lows.

The Failed Auction at IB lows has added fuel for upside momentum.

However, we’re trading right into a potential liquidity pocket just below resistance.

Context calls for a wait-and-see approach: either clear breakout or rejection confirmation.

Intraday Picture (10H & 1H)

10H Chart

Still within an Inside Bar (IB) range.

FA at range lows suggests momentum continues upward — but we are at the top of the range.

Key risk: trap above range highs → ideal area for shorts if we get absorption and selling imbalance.

1H Chart

Market is rotating inside the current IB range.

No breakout confirmed yet.

Best short setup: Rejection from IB Highs + Absorption on CVD / Footprint charts.

Breakdown scenario: Short on range low breakdown with volume confirmation.

Longs: Only valid if HTFs confirm breakout → then look for bullish retest or mid-retest entries.

⸻

Summary & Trade Plan

Big Picture: Still bullish, but this isn’t the area to long blindly.

Short Setup 1: Rejection from IB Highs with clear absorption + imbalance.

Short Setup 2: Breakdown below IB Range Lows with volume follow-through.

Long Setup: Wait for HTF confirmation of breakout. If confirmed → retest of prior resistance as support.

Final Notes

This is where traders get chopped. HTF resistance meets LTF momentum.

Let price prove itself. Let volume confirm the move.

No breakout = no long. No trap = no short.

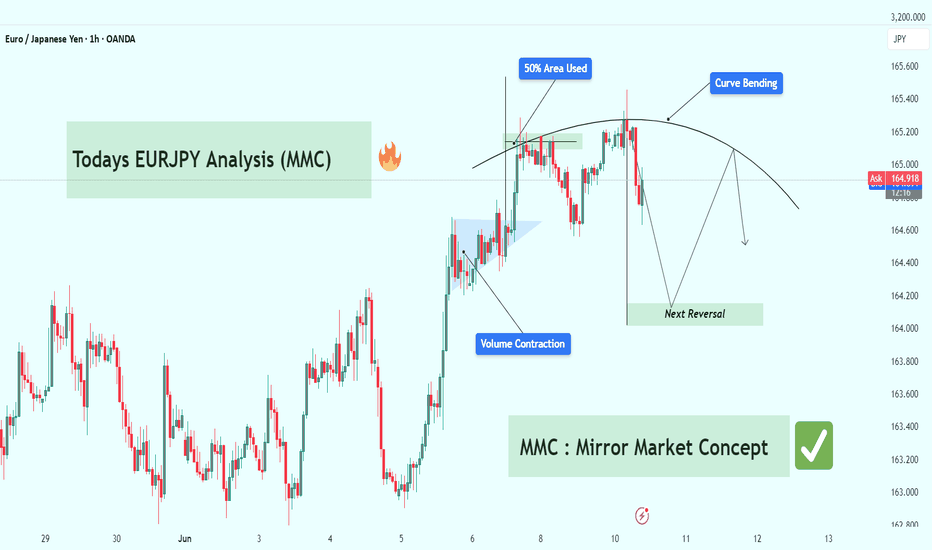

EURJPY Technical Breakdown (MMC Strategy) : Target Zone 🧠 Concept Focus: MMC – Mirror Market Concept

The Mirror Market Concept (MMC) helps identify pattern inversions, price reflection zones, and structural symmetry that hint at upcoming market turns. This chart reflects a curve-based reversal logic rooted in smart money behavior, volume analysis, and pattern exhaustion.

📊 Technical Structure Breakdown

🔹 1. Volume Contraction + Breakout (June 6–7)

Early signs of bullish pressure were detected with volume contraction, forming a tight range wedge/triangle.

This is often a liquidity trap where weak hands sell into strength.

Smart money absorbed sell-side liquidity before impulsively breaking out.

This is a common MMC move: contract > trap > expand.

🔹 2. 50% Area Used – Smart Money Trap (June 9)

After the breakout, price tapped into the 50% equilibrium zone of the previous major move.

This level often acts as a liquidity sweep zone, ideal for smart money to unload or build counter positions.

The rejection wick here confirms that institutional traders reacted at this level.

🔹 3. Curve Bending Pattern – Exhaustion in Play

The market has now entered a curve bending phase, visible with the arching price movement.

This signifies momentum exhaustion, where bullish attempts get weaker.

Think of this curve like a mirror ceiling — as each high gets tapped, it bends, showing the market can't sustain higher levels.

🔹 4. Next Reversal Zone (Projected Target: ~164.150–164.200)

Based on MMC symmetry and previous demand zones, the area highlighted as Next Reversal is a key structure zone.

This is where we expect price to react — either bounce (for buyers) or break (for continuation shorts).

A clean bounce here could mirror the earlier pattern in reverse, hence the Mirror Market Concept.

🔁 Summary of Market Psychology

🧲 Volume contraction signals manipulation.

🎯 50% zone rejection shows trap completion.

🪞 Curve bending shows buyers losing strength.

🔻 Price likely to drop into the reversal zone, completing the mirror leg.

🧩 What Traders Should Watch

Indicator/Zone Notes

50% Area Used Smart Money Exit or Entry Trap

Curve Bending Reversal Geometry (Momentum Exhaustion)

Next Reversal Zone Smart Money Demand Zone (~164.150)

Break Below 164.100 Confirms deeper bearish continuation

🎯 Trading Strategy Outlook

🔍 Short Bias: Look for confirmation (e.g., bearish engulfing, BOS on lower TFs) to enter shorts below curve zone.

🛑 Invalidation Level: Clean breakout above 165.500 would invalidate the mirror structure and shift to continuation long.

🎣 Reversal Scouting : If price respects the Next Reversal Zone, there could be a potential long scalp back into mid-range.

🧠 Educational Note: MMC in Action

The Mirror Market Concept is powerful for intraday trading. It uses pattern reflection, liquidity logic, and price symmetry to forecast reversals before typical indicators catch up. If mastered, this concept can give early reversal entries and trap avoidance.

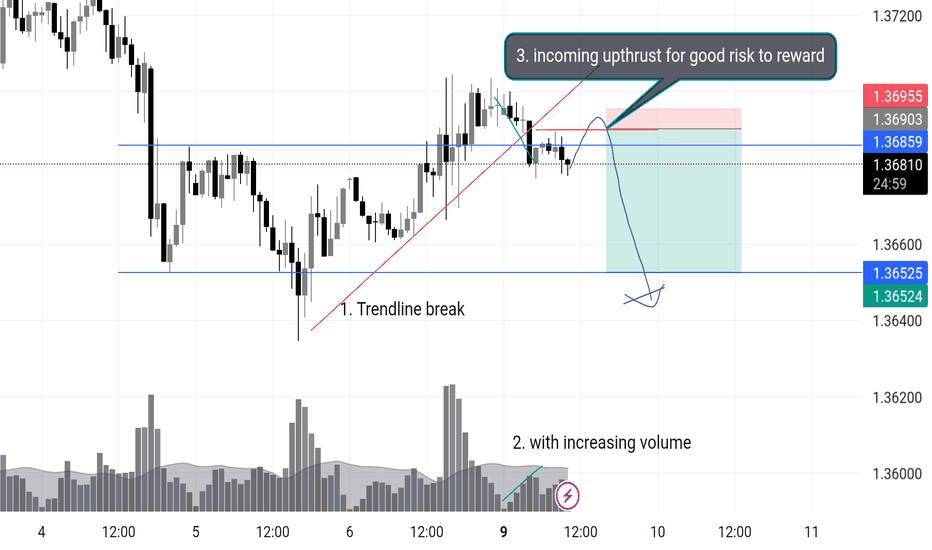

USDCAD Short Opportunity Description :

USDCAD is setting up for a potential short — I’m watching closely for an upthrust into the highlighted zone to initiate the position. Here’s my current read:

🔍 Technical Breakdown:

1. Trendline Break

Previous bullish trendline broken with conviction. Market structure now vulnerable to bearish continuation.

2. Volume Spike with Selling Pressure

Notable increase in volume on bearish candles — suggests smart money exiting or early sellers stepping in.

3. Anticipating an Upthrust

Watching for price to sweep the highs around 1.3695–1.3700, fail to sustain, and drop back inside range.

This would provide a low-risk entry with tight stops above the highs and 5r+ down to 1.3652, possibly even lower.

📌 Trade Plan:

Entry Zone: 1.3695–1.3700 (after upthrust confirmation)

Stop: Above 1.3710

TP1: 1.3652 (structure low)

TP2: 1.3600 (extended target if momentum builds)

---

🧠 Why This Setup?

This aligns with key principles I trade:

Trendline breaks often lead to retests followed by continuation.

Rising volume on the break is confirmation, not noise.

A failed breakout (upthrust) into previous supply zones is often the "last push" before price collapses.

Let me know if you're seeing something different. This is how I’m planning to attack the chart today.

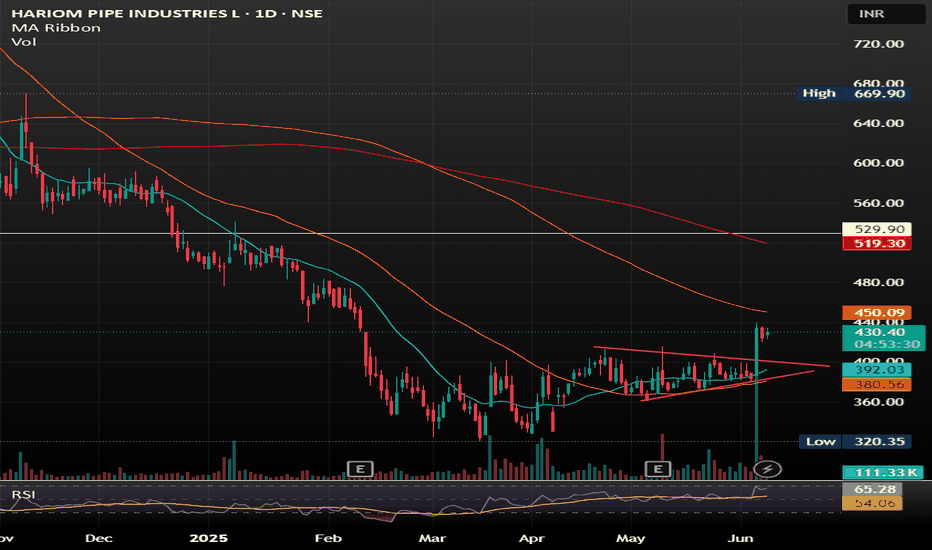

Hariom Pipes Industries Ltd Hariom Pipes Industries Ltd is a leading manufacturer of high-quality steel products, including HR Pipes, GI Pipes, GP Pipes, MS Pipes, HR Coils, and Billets. The company was established in 2007 and has grown into a major player in the iron and steel industry in India.

SYMETRIC TRIANGLE BREAKOUT WITH GOOD VOLUME SHOWING GOOD UPWARD MOMENTUM .

BUY IN ANY PULLBACK SUGGESTS.

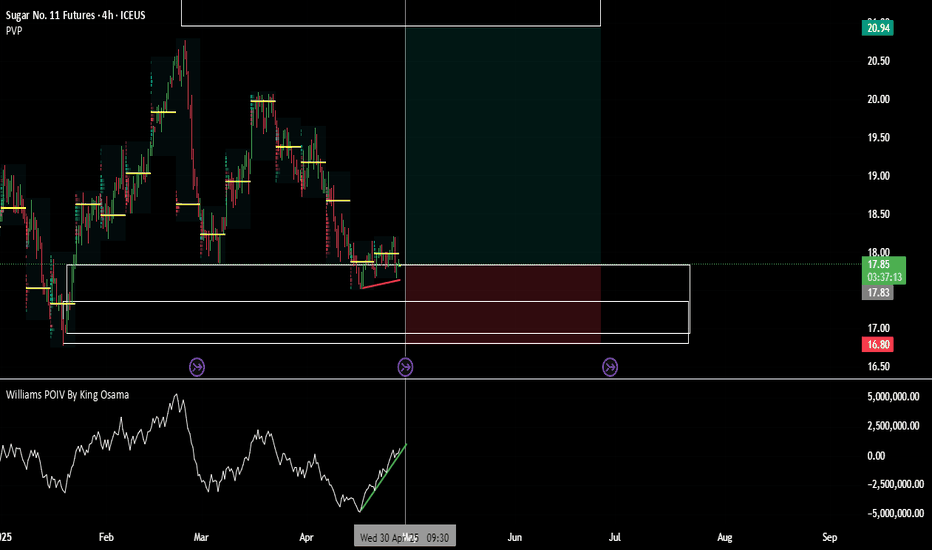

Building Liquidity: What It Really Means🔵 Building Liquidity: What it really means

Professional traders often need liquidity (buyers and sellers) to enter/exit large positions without moving the market too much.

This means manipulating the market within a pre-determined range, which serves as the operating center for everything that follows.

🔹 How is liquidity built

Price Ranging: Sideways consolidation before big moves attracts both buyers and sellers.

False Breakouts (Stop hunts): Price may briefly break support/resistance to trigger retail stop-losses and fill institutional orders.

News Timing: Pro traders often execute during or just before major news when volatility brings liquidity.

🔹 How can you spot a Liquidity-building zone

🔸 Volume

Unusual spikes in volume: Often indicate institutional activity.

Volume clusters at ranges or breakouts: Suggest accumulation/distribution zones.

Volume with price divergence: Price rises but volume falls = possible exhaustion. Volume rises and price consolidates = potential accumulation.

🔸 Price Action

Order Blocks / Imbalance zones: Sharp moves followed by consolidations are often pro trader footprints.

Break of Structure (BoS): Institutions often reverse trends by breaking previous highs/lows.

Liquidity sweeps: Price moves aggressively above resistance or below support then reverses = stop-loss hunting.

🔸 News Reaction

Watch pre-news volume spikes.

Look for contrarian moves after news — when price moves opposite to expected direction, it often reveals smart money traps.

Analyze price stability post-news — slow movement shows absorption by pros.

Wick traps and reversals around news events = stop hunting.

🔸 Narrative is Everything

Higher timeframe trends show intent.

Lower timeframes show execution zones.

Look for alignment between timeframes in a specific direction.

🔹 Why do whales move the market in an orderly manner

To fill large positions at optimal prices.

To create liquidity where there is none.

To trap retail on the wrong side of the move.

To trap other whales on the wrong side of this move.

To rebalance portfolios around economic cycles/news.

🔹 Professionals never forget what they've built

When you track price, volume, and news, you’ll find specific bars that form areas that are the foundation for the short-term direction.

This is pure VPA/VSA logic, the interplay of Price Analysis ,Volume Analysis and News, where each bar is not just a bar , but a clue in the story that professionals are writing.

When you monitor volume, price, and news together and perform multi-timeframe analysis, it becomes clear what the whales are doing, and why.

🔹 From the chart above

The market reached a weekly resistance level and then pulled back slightly after whales triggered the stop-losses of breakout traders.

Prior to the breakout, whales had accumulated positions by creating a series of liquidity-rich buying zones on the daily timeframe.

It's essential to understand the broader context before choosing to participate alongside them—whether you're planning to buy or sell.

🔴 Tips

Use volume and price analysis together, not separately.

Monitor any unusual volume bars before economic market news.

Monitor news and volatility spikes to detect traps and entries.

Combine this with liquidity zones (support/resistance clusters).

Build a "narrative" per week: What is smart money trying to do?

A smart trader understands the tactics whales use, and knows how to navigate around them.

Adjustments for Better ReadingsMany traders rely on technical indicators to identify opportunities for profit—that's the whole point of this game. Whether it’s scalping, day trading, swing trading, or shorting the market, most trading decisions are based on indicator readings—be it a single indicator or a combination of several.

But here’s the truth: not all traders truly understand what an indicator is. They don’t grasp its nature—let alone the fact that this nature can be adjusted.

Those who don’t understand how or why an indicator works often find themselves in stressful and uncomfortable situations. It’s no coincidence that we often hear the common phrase: “Only 1% of all traders succeed, while 80% blow their accounts, and the remaining 19% barely break even.”

Why? Because the elite traders understand something most don’t:

Whether an indicator is leading or lagging, it can be customized to behave differently across different timeframes.

These adjustments can be found in the settings section of every indicator.

Let’s take the Relative Strength Index (RSI), which I’ve mentioned in previous ideas. Some of you may have noticed that my RSI plot looks different from yours. That’s because I don’t use the default 14-period RSI, which averages out the last 14 candles.

RSI is naturally lagging by default—but that doesn’t mean it can’t be trusted. In fact, with the right adjustments, that lagging nature can become leading. Learn how to do this. Push yourself. Educate your mind. Master this, and you might just find yourself among the top 1%.

Markets react to signals—signals that are often hidden in plain sight, created by the big players who always leave behind footprints. This is the trader’s true skill: seeing the whole picture.

A good friend once told me: Be a detective.

Now let’s go to the chart.

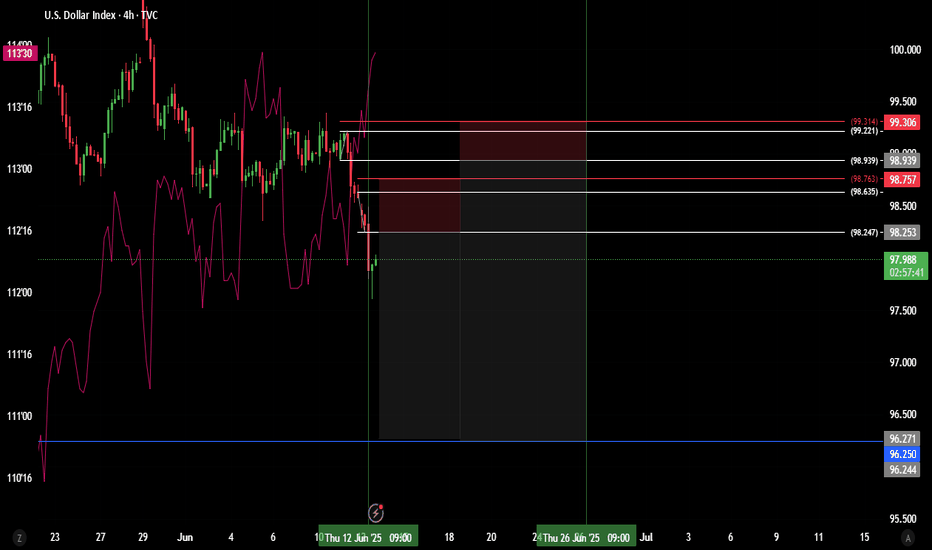

We clearly see a bearish strength unfolding.

Not only is the 9-period RSI plot trending below the yellow 28-period Weighted Moving Average (WMA), but we also observe a healthy continuation of the downtrend, confirmed by the WMA itself.

Using a 9-period RSI gives faster signals, while the 28 WMA offers smoother confirmations. This combo is applied on the daily timeframe—but every timeframe has its own ideal settings.

Now, when the RSI plot trends above the WMA, this can act as a potential reversal signal or even a confirmation of a trend change, depending on the broader market structure and volume context. It's not just about the crossover—it’s about what follows next. That’s where the detective work begins.

What do we see today?

Looking solely at the daily timeframe, the downtrend seems far from over. But to analyze it professionally, we must wait for the candle of Friday, June 6th, 2025 to close.

Switching to the lower timeframes, we see something interesting—a sort of bullish dominance unfolding during this incomplete trading day. But the real question is: Is it actual dominance?

Let’s break it down:

We have a clearly formed Head & Shoulders pattern.

The bearish Marubozu candle from June 5th made a new lower low (LL).

But—it did not close below the key swing low at 100.718.

Therefore, the Head & Shoulders pattern is not confirmed—it hasn’t broken and closed below that swing level.

So what’s happening in the lower timeframes?

In the 4-hour timeframe, we’re seeing a real-time crossover above the WMA (though the session isn’t closed yet).

In the 1-hour timeframe, the crossover has already occurred.

Now, such a crossover—where the RSI plot moves above the WMA—can often act as an early signal for a reversal, or at the very least, indicate a strong pullback. But don’t take it at face value—context is king. This is why we pair it with other signals like divergence, price action, and volume behavior for confirmation.

Across the 4H, 3H, and 1H timeframes, we’re observing this bullish pullback, yet it’s accompanied by an RSI Hidden Bearish Divergence (see: Macro Noise vs Micro Truth: The Art of Hidden Divergences).

Is this pullback a true reversal?

According to Volume Spread Analysis (VSA) (read: VSA vs BTC: Into a Bearish Scenario or Not?), a new narrative is emerging—but not without contradiction.

Price is climbing, yes.

But bullish volume spikes are declining, supporting our RSI hidden divergence. This volume-price disagreement is a clue.

What will reveal the truth?

Today's closing candle.

If price action (PA) creates a higher high (HH) but RSI creates a lower high (LH) → Bearish Divergence

If RSI makes a HH but PA creates a LH → Hidden Bearish Divergence

And for those of you who truly understand market structure:

The 100.718 level was a buy opportunity to secure profits.

If you caught that—congratulations. You’ve done your homework.

Now, you can sit back, relaxed, and wait for the next signal.

The market is a breathing organism. If you’re in sync with it—you’ll feel it.

And for those who believe there’s more to learn—but are struggling to find answers—there’s no shame in asking questions.

Till next time, take care—and trade wisely.

P.S. RSI plot, WMA, candlestick patterns, and Volume Spread Analysis (VSA)—when combined and used properly—can become a powerful toolset. For those willing to go deeper, they’re more than enough.

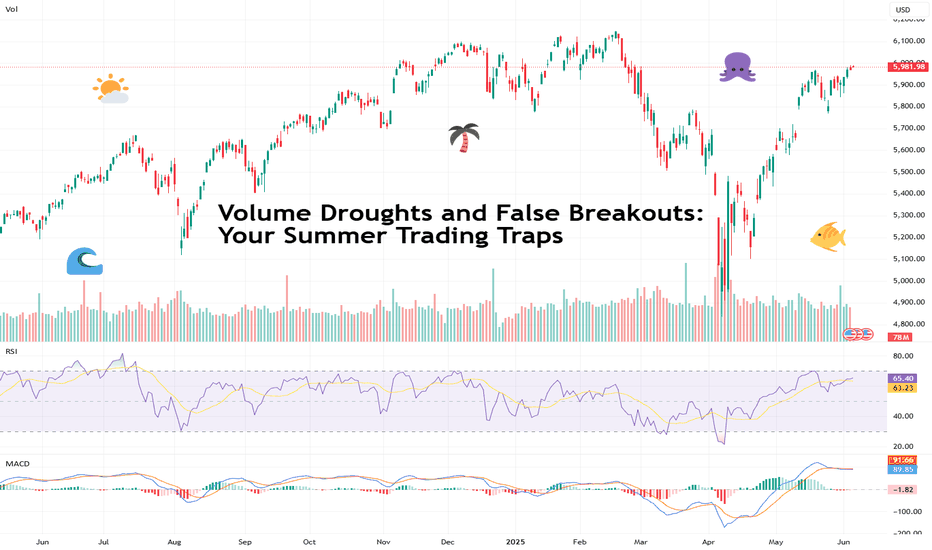

Volume Droughts and False Breakouts: Your Summer Trading TrapsThe market’s heating up — but is your breakout about to dry up? Here’s a word about the importance of summer trading success (helped by volume — the main character).

☀️ Welcome to the Liquidity Desert

Summer’s getting ready to slap the market with a whole flurry of different setups. Picture this — the beaches are full, your trading desk is half-abandoned, and the only thing more elusive than a decent breakout is your intention to actually read that big fat technical analysis book you bought last year.

And yet, here you are — eyes glued to the chart — watching a clean breakout above resistance that’s just begging for you to hit “buy.” Everything looks perfect. Price rips through the level like it’s made of butter. But there’s just one tiny problem: no volume. None. Nada. Niente.

Congratulations. You’ve just bought the world’s most attractive false breakout.

🏝️ Summer Markets: Where Good Setups Go to Die

Let’s set the scene.

It’s June. The big dogs on Wall Street are golfing in the Hamptons and sipping mezcal espresso martinis, interns are running the order flow, and every chart you love is doing just enough to get your hopes up before crushing them like a half-melted snow cone.

This isn’t your usual high-volatility playground. Summer markets — especially between June and August — are notorious for thin liquidity . That means fewer participants, smaller volume, and a much higher likelihood of being tricked by price action that looks strong… until it’s not.

And it’s not just stocks. Forex, crypto, commodities — even the bond boys — all face the same issue: when fewer people are trading, price becomes more fragile. And fragile price = bad decisions.

🚨 Why False Breakouts Love Quiet Markets

False breakouts happen when price appears to break above resistance (or below support), only to reverse sharply — often trapping late traders and triggering stop hunts.

But in summer? It’s a whole different beast. Here’s why:

No liquidity cushion : In normal markets, you need strong volume to fuel a breakout. Without that, the breakout doesn’t necessarily have the gas to keep going.

Market makers get bored : Thin markets mean it’s easier for a few big orders to push prices where they want. Welcome to manipulation season (there, we said what we said!).

Algos go wild : With fewer humans around, algorithms dominate. And they love playing games around key levels.

🧊 The Mirage Setup: A Cautionary Tale

Let’s say you’re watching GameStop NYSE:GME stock. Resistance at $30. Price hovers there for days, teasing a breakout. Then — boom — a sudden 6% pop above.

You buy. Everyone buys. The trading community goes nuts. “This is it bois!”

But there’s a problem. Look at the volume: a trickle. Not even half the average daily volume. Ten minutes later, NYSE:GME is back below $30, your stop loss is hit, and you’re left explaining to your cat why you’re emotionally invested in a ticker.

Moral of the story? Don’t trust breakouts when no one’s trading.

📉 Volume: Your Summer Lie Detector

Volume is more than just a histogram under your chart. It’s your truth serum. Your smoke alarm. Your buddy who tells you to think twice before jumping in that trade.

Here’s how to read it right when everyone else is checking out:

Confirm the move : If price breaks out, but volume doesn’t spike at least 20–30% above the average — be suspicious.

Look for acceleration : Healthy moves gather steam. You want to see volume growing into the breakout, not fizzling.

Watch for volume cliffs : A sudden volume drop right after a breakout often signals that the move is running on fumes.

Add Volume Profile Indicators : Just to be safe, you can always add Volume Profile Indicators to your chart — they analyze both price and volume and can highlight what your keen eye might miss.

Remember what happened last summer? And how we all learned the downside of something called "carry trade"? Those who were short the Japanese yen remember .

🧠 Context Over Candles: Be a Liquidity Detective

Let’s say you see a double top pattern — your favorite. Clean lines. Tight price action. Perfect setup.

But now zoom out.

It’s July 3. Pre-holiday half-day. No volume. And the S&P 500 SP:SPX has moved 0.04% all day. Still want in?

Technical analysis doesn’t work in a vacuum. Chart patterns lose their predictive power when the environment they live in is compromised. And thin liquidity is a compromised environment.

🐍 Snakes in the Sand: How Market Makers Bait Traps

Market makers (and large players) are like desert snakes — quiet, patient, and very good at making you move when you shouldn’t.

Here’s how they bait traders in illiquid markets:

Run stops above resistance to trigger breakout buyers.

Dump shares immediately after breakout to trap retail.

Ride the reversal as trapped longs scramble to exit.

They’re so powerful some say they run the game — and can stop it anytime it’s not going their way (remember the GameStop freeze? ) It’s a psychological game — and in the summer, it’s easier to do shenanigans because most players aren’t watching.

Don’t be the one jumping at shadows. Be the trader who expects the trap.

🛠️ How to Survive (and Thrive) in the Summer Slump

Not all is lost. You can still trade — smartly.

Here’s your Summer Survival Toolkit :

Wait for volume confirmation on every breakout.

Lower your position size . Less liquidity = more slippage risk.

Set wider stops , or better yet, sit out the chop.

Focus on trending names with relative strength and solid weight (think: tech titans, oil plays, or financials).

Use alerts instead of staring at charts . Don’t mistake boredom for opportunity.

And most importantly: Know when not to trade . Discipline is a position too.

🔚 Final Word: This Isn’t the Off-Season. It’s the Setup Season.

Summer might feel slow, but it’s not dead.

Smart traders know that the best trades of Q3 and Q4 often begin in July — as early trendlines form, consolidation patterns develop, and institutional footprints quietly appear in the tape.

So use this time wisely. Don’t force trades. Watch volume like a hawk. And never forget: the best breakouts don’t need hype — they bring their own thunder.

Stay cool, stay patient, and trade smart. The mirage may be tempting, but the oasis always belongs to the ones who go far enough and don’t give up.

Off to you : How are you navigating trading during the summer months? Staying poolside with one eye on the charts or actively seeking out opportunities while folks catch a break? Share your insights in the comments!

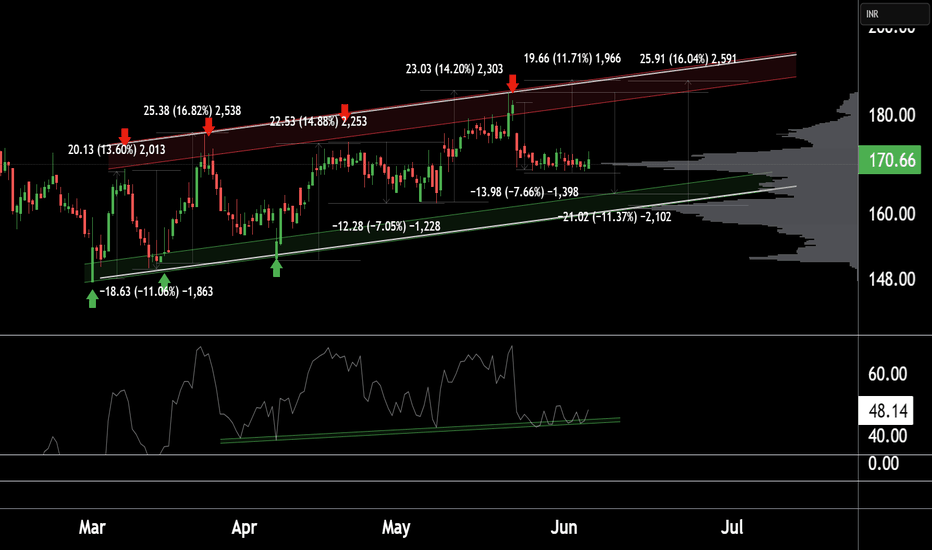

TV Today Network is currently near its key support zone.This is the 4 hour chart of TV TODAY.

Stock is trading in an ascending channel.

Post a corrective phase of 8–11%, the stock typically rebounds with a return of 11–14%, aligning with the upper and lower boundaries of the ascending channel.

VRVP is indicating two significant price levels—₹170 and ₹160—where notable volume accumulation has occurred, suggesting potential support or resistance zones at these levels.

If this level is sustain, then we may se higher prices in the Tv Today.

RITESRITES showing good strength in recent session. And currently trading near strong hurdle. It has a strong resistance near 310-15 levels and rejected many times earlier. So if now closing above 315 may start new momentum rally in the counter which may continue for next 20-22% upwards. On lower side 270 seems very good support But closing above 315 is very crucial. I would avoid before that but surely keep a closer watch on it.

TSLA: Continues to form a Cup and Handle reversal patternHey folks,

Just a quick analysis of NASDAQ:TSLA on the daily chart. Compared to my last analysis, price has fallen a bit since, as a new flag (handle) continues to form following a cup pattern.

- Cup and Handle pattern forming. The handle would also count as a bull flag. This is known as

a cup and handle reversal pattern, after a downtrend. So yes, it is possible for a stock to

reverse its trend through the formation of a cup and handle reversal pattern (as you can see

in the chart).

- Major resistance at $366 which marks the peak of the flag (handle) pattern. This would have

to be broken in order for the cup and handle to be valid.

- Volume has also been decreasing during the formation of this pattern: this is typical amongst

Cup and Handle patterns, and generally a positive sign.

Note: Not financial advice.

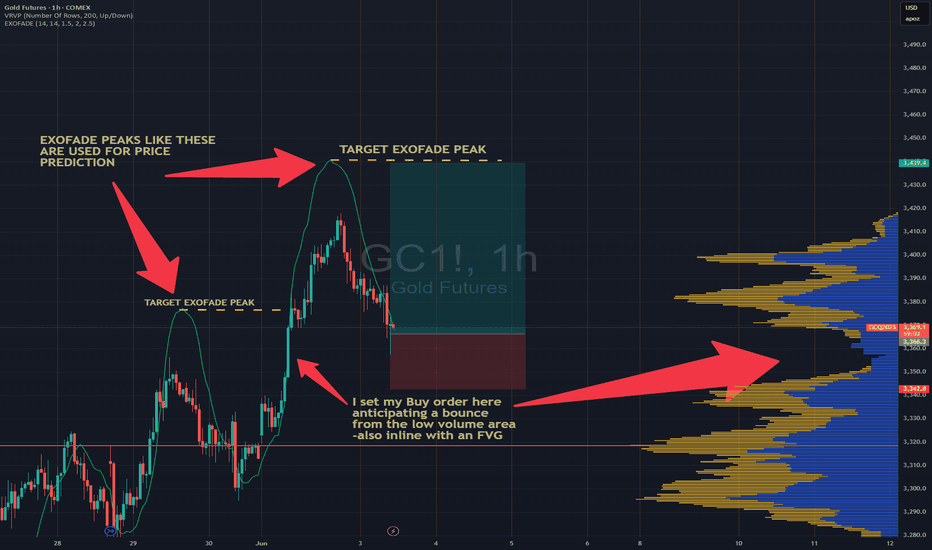

Gold Pullback Entry Opportunity Gold resumed its rally, sparked by recent tarrif news. Price is pulling back at the moment and has entered an sweet spot where we can confidently take our first low risk Buy.

BUYING HERE BECAUSE

1. We're entering into a low volume area, which is also in line with an FVG on the 1hr chart

2. When a new uptrend starts, i like to buy first 2 instances price pullback to bounce from my trend cloud indicator We didn't get a perfect bounce as it has broken below it, but i'am still buying regardless due to my first reason above about the low volume gap.

PROFIT TARGET

Setting my profit target to my trusted Exofade peak. As long as the uptrend continues, Exofade peaks will ALWAYS get taken out. That why i love this indicator, and its free. It's my gift to y'all :) . Just search for it in trading view indicators.

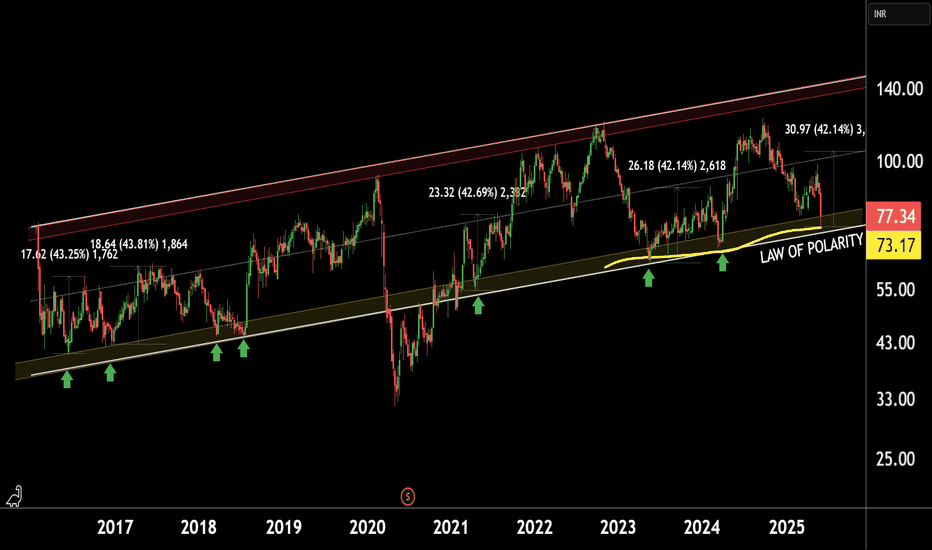

ABFRL at Best Support !!This is the Weekly Chart Of ABFRL .

ABFRL having good Law of Polarity at 70 range.

ABFRL having EMA support at 72 range

If this level is sustain , we may see higher price in ABFRL ||

Based on time-wise analysis, our initial expected return is 40–42%, which the stock consistently forms beyond the Law of Polarity (LOP).

Thank You !!

RAILTELRAILTEL showing very good strength and currently trading above resistance line. It has also been observed cup and handle pattern breakout with decent increased volume in recent days. If I consider recent depth then we may see approx 30-33% rally in coming days provided that it holds and closing above 380 levels all the time. Strong up move is on the table!