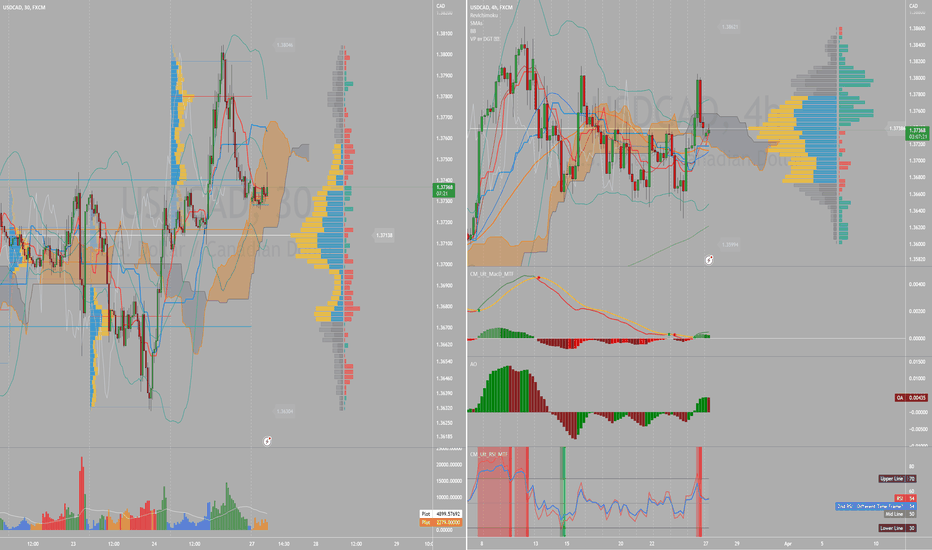

The Steamroller Secret: Why Chasing Small Gains Could Cost YouSimply put, the current market seems to be reaching its limits and it's wise to be cautious. As the saying goes, "Never pick up nickels in front of a steamroller," we shouldn't take unnecessary risks for small profits when there's a chance for significant losses.

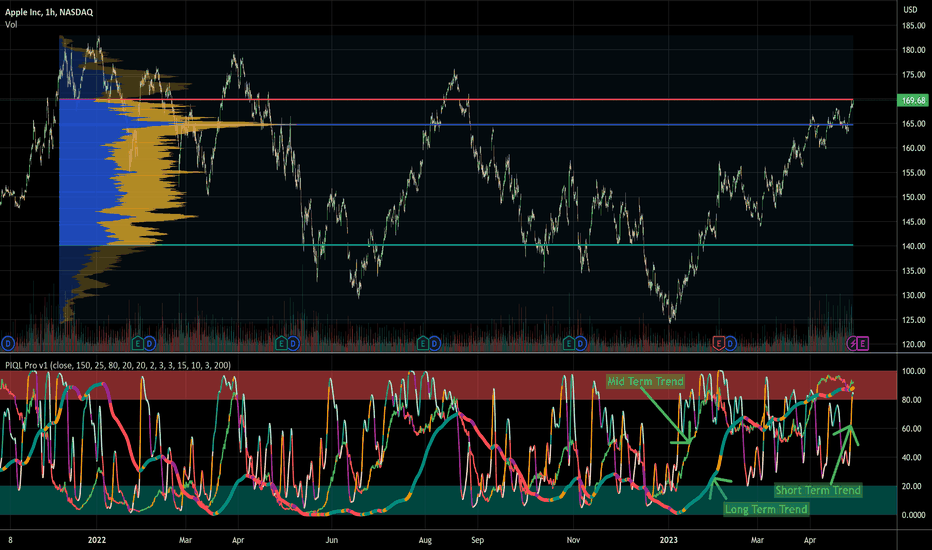

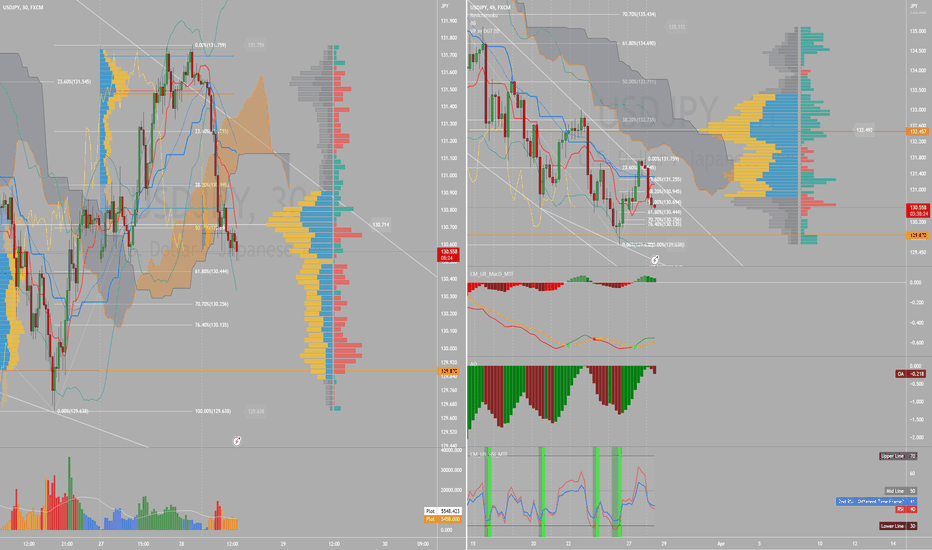

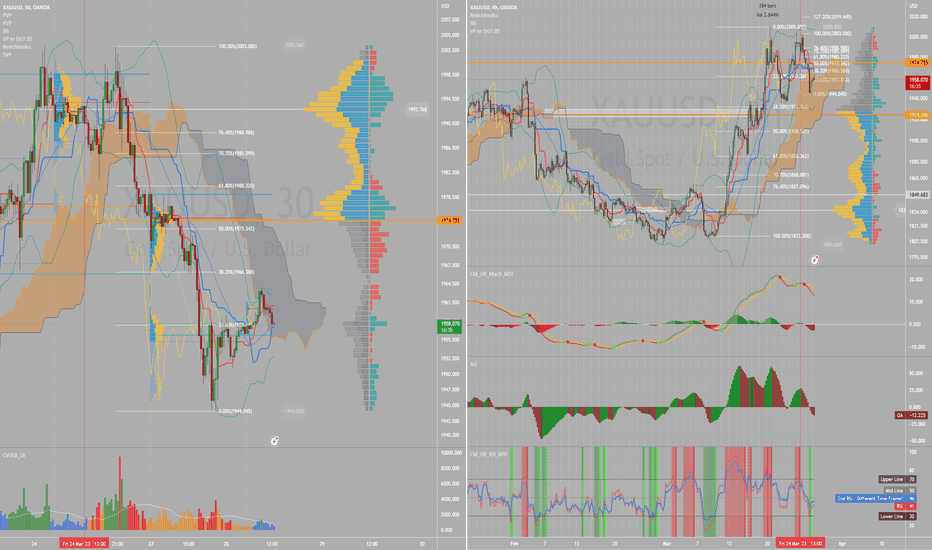

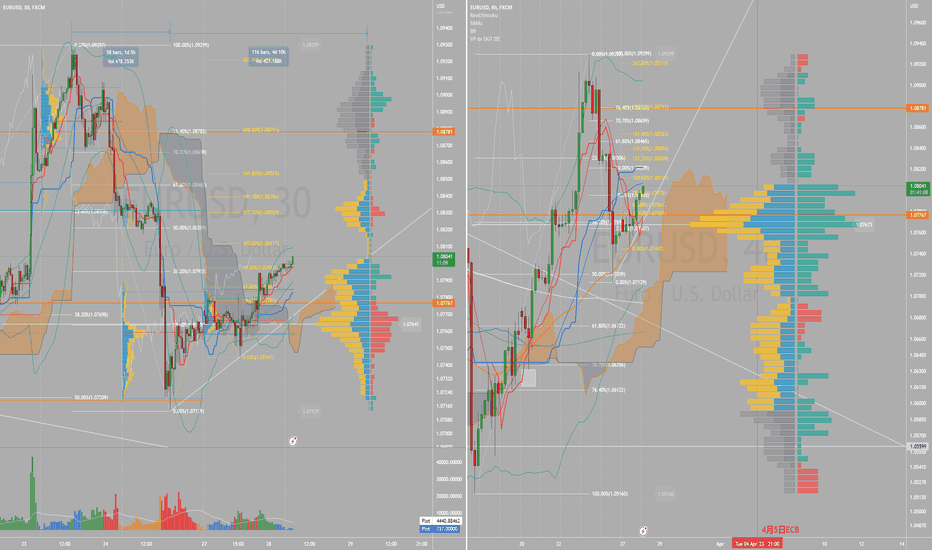

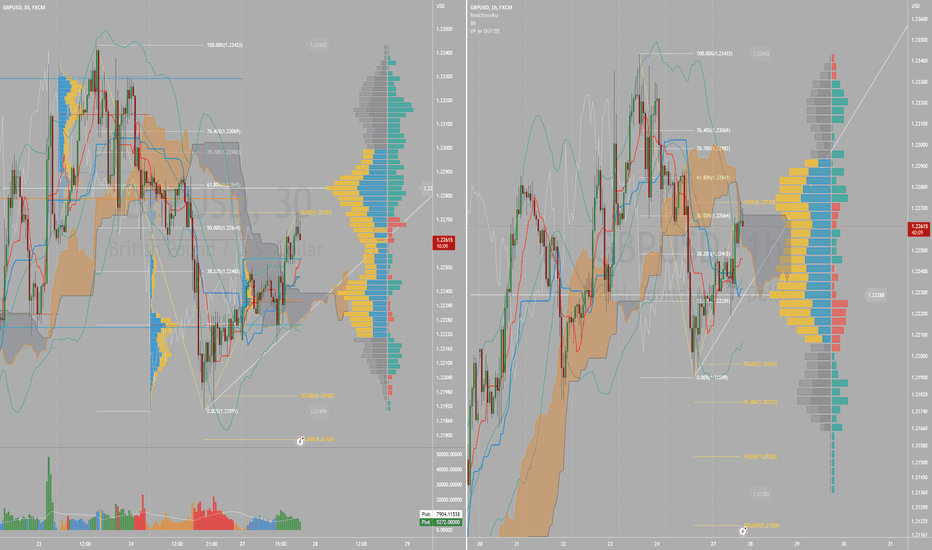

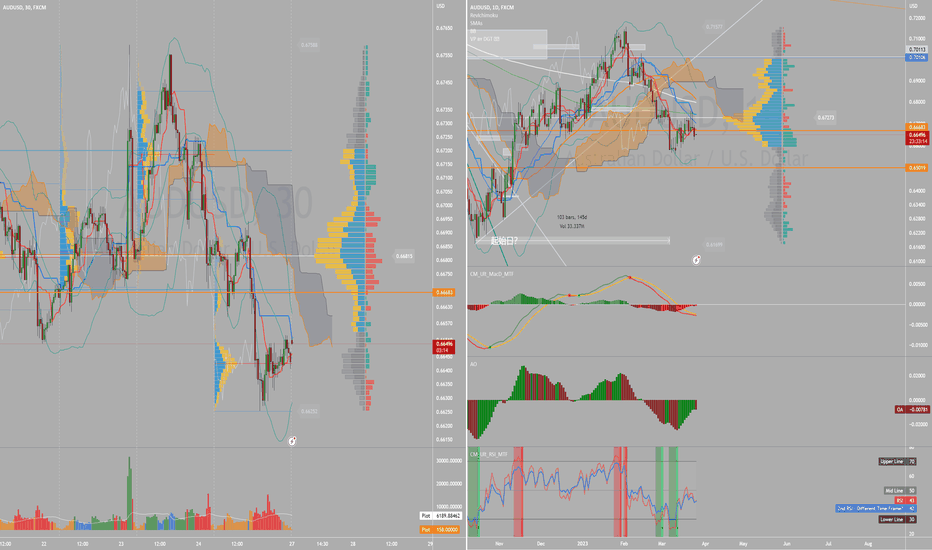

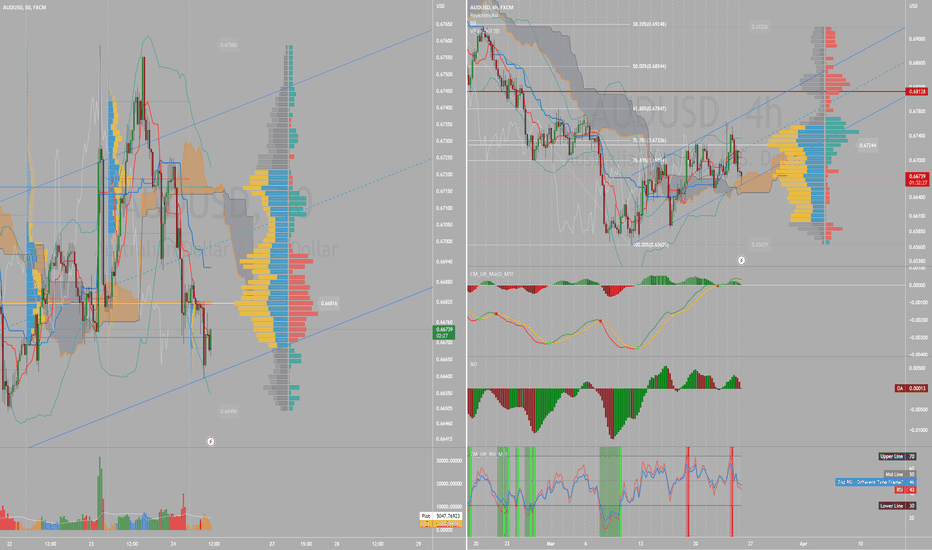

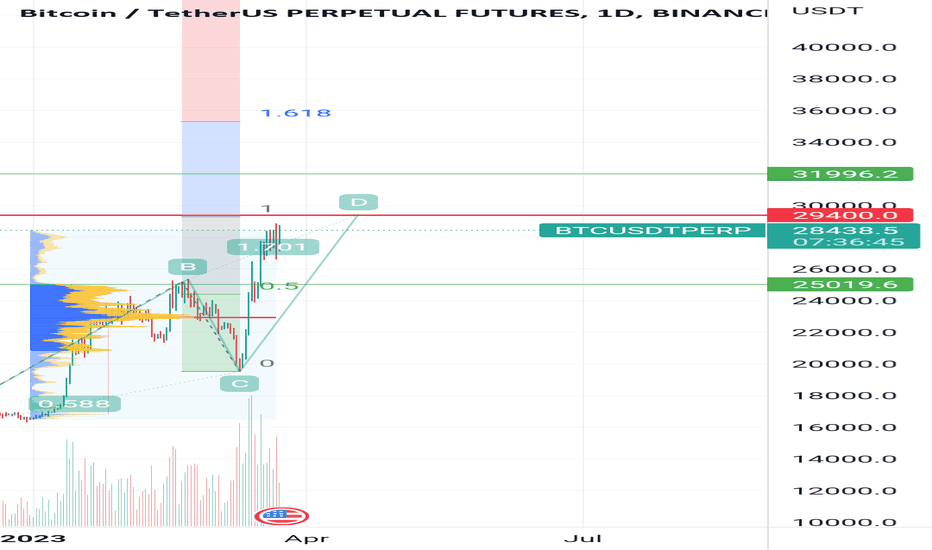

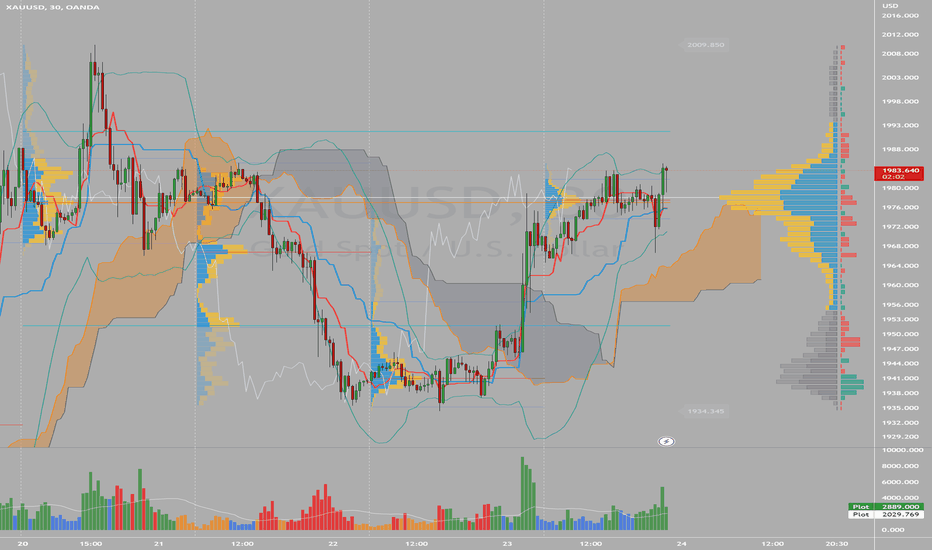

The tools we use to analyze the market usually go through highs and lows. It appears that there might be one last upward move before the cycle heads back down.

When looking at the volume profile, we see we're entering risky territory since we're now two standard deviations away from the volume point of control. This implies that the market might be reaching a level that can't be sustained for long.

In short, the current market conditions seem pretty uncertain to the upside, and it's essential to consider these factors when deciding on trading actions.

#cycletheory #auctiontheory #PrimeIQLabs #volumeprofileanalysis

Volumeprofileanalysis

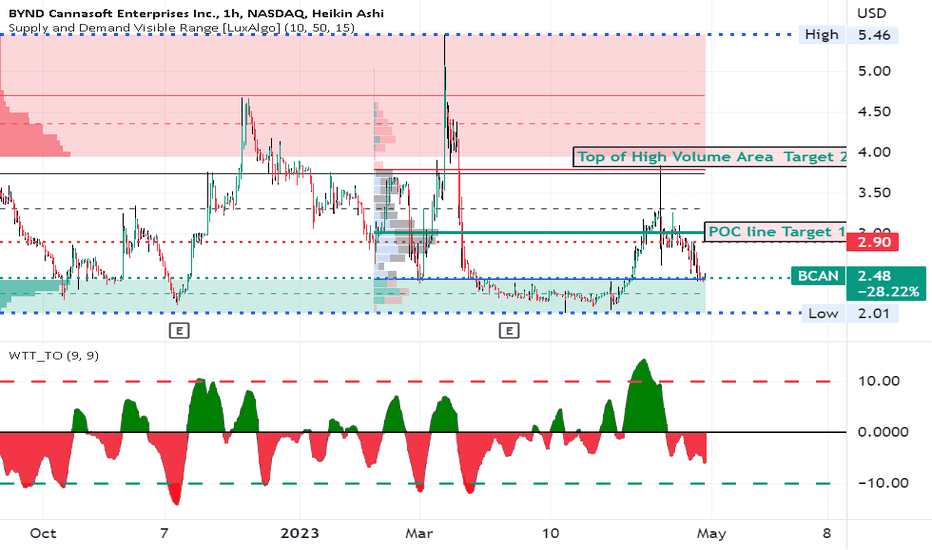

BCAN penny stock microcap combining AI and Cannabis LONGBCAN is a microcap in the AI serving the cannabis industry. It's software is patent protected.

It is currently trading at less than 25% of its all time high and has a history of volatile spikes.

This is a low float stock with insiders holding significant positions.

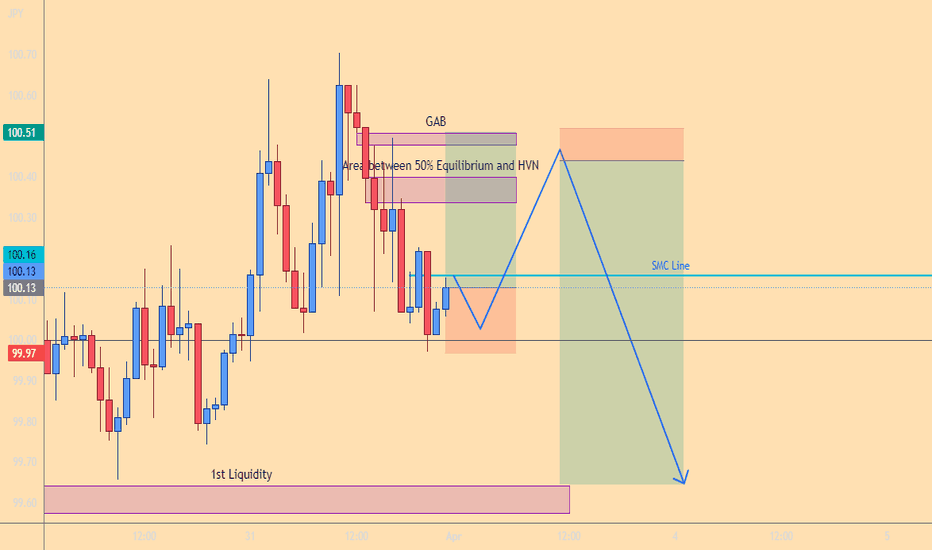

On the one hour chart, in the past couple of days, price has descended from the POC line of

the volume profile down to sit on top of the demand zone as shown by the LuxAlgo indicator.

The Wycoff volume oscillator shows the corresponding selling volume dominating over

buying volume.

I see this as a long trade with targets of the POC line and the top of the high volume

area of the volume profile. The overall profit of about 17-18% . The stop loss is set at

5% below the entry in the demand zone.

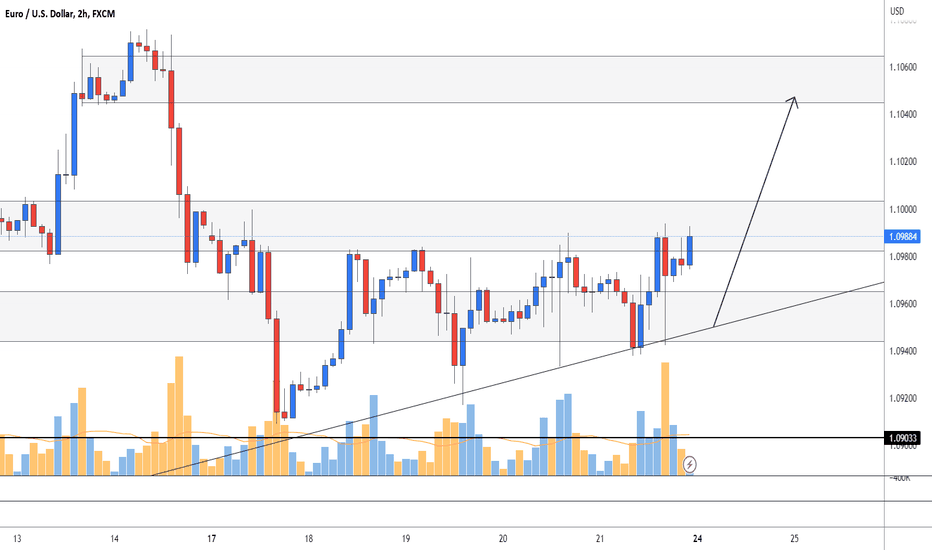

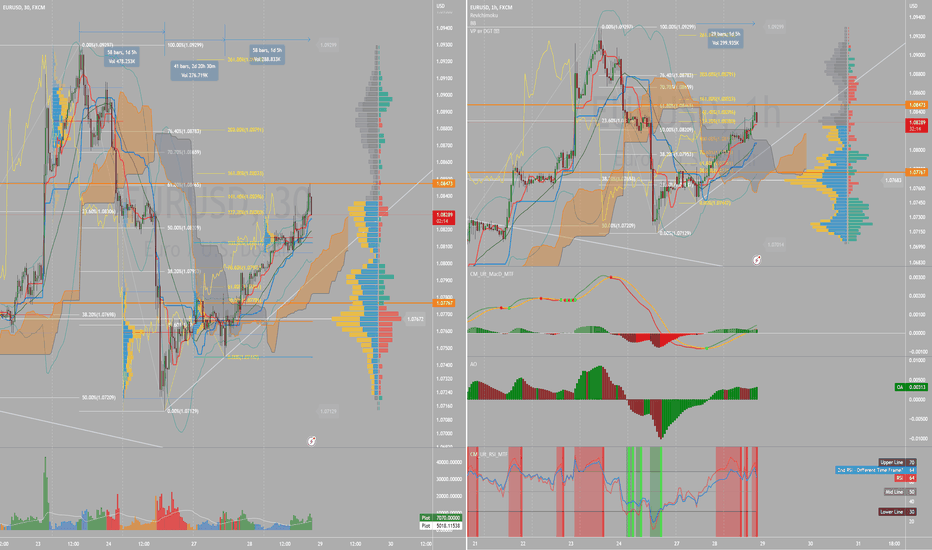

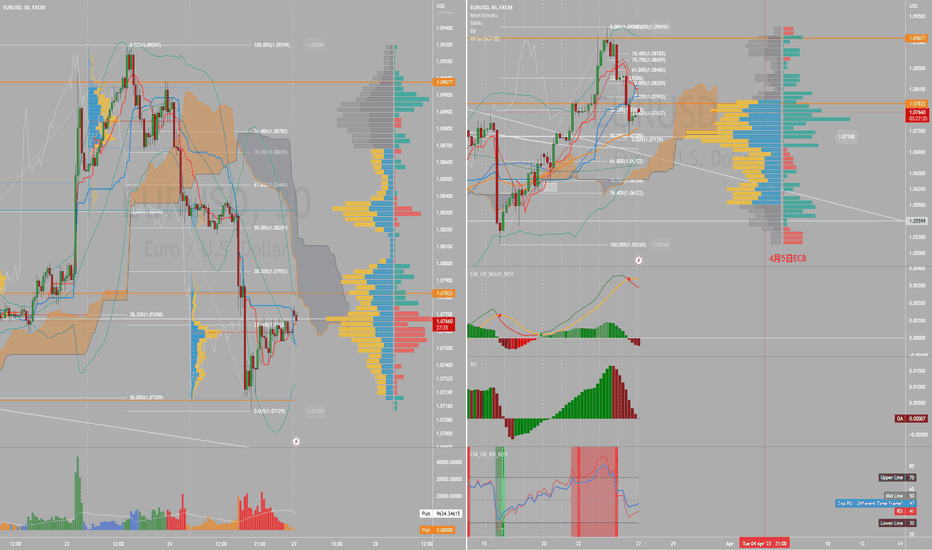

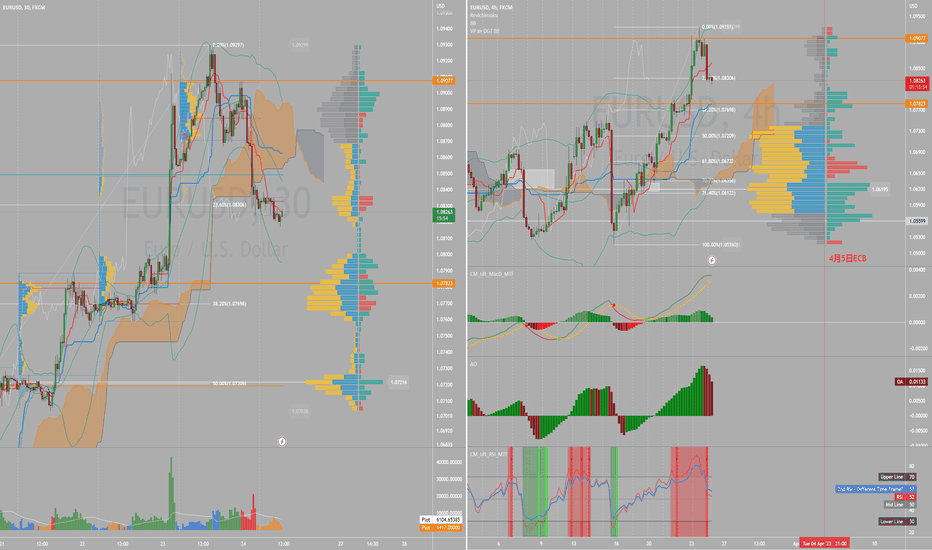

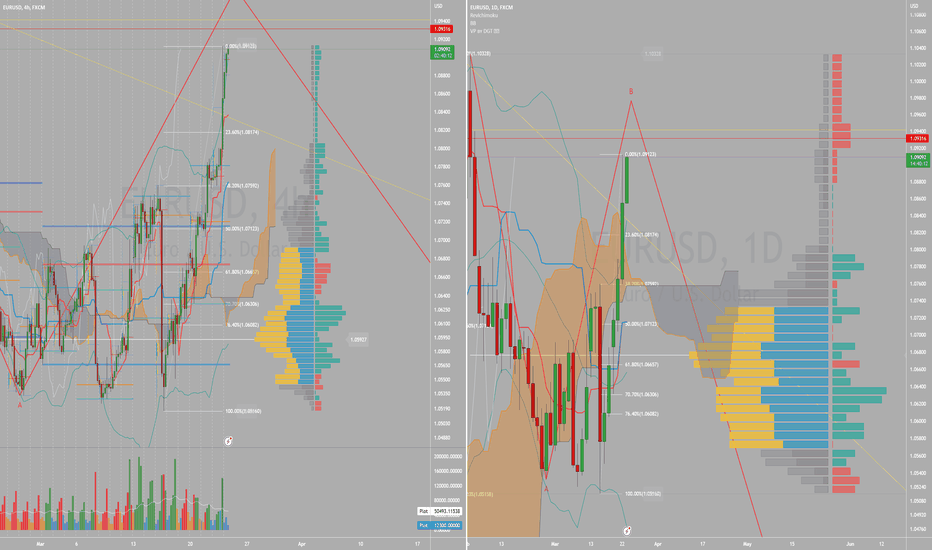

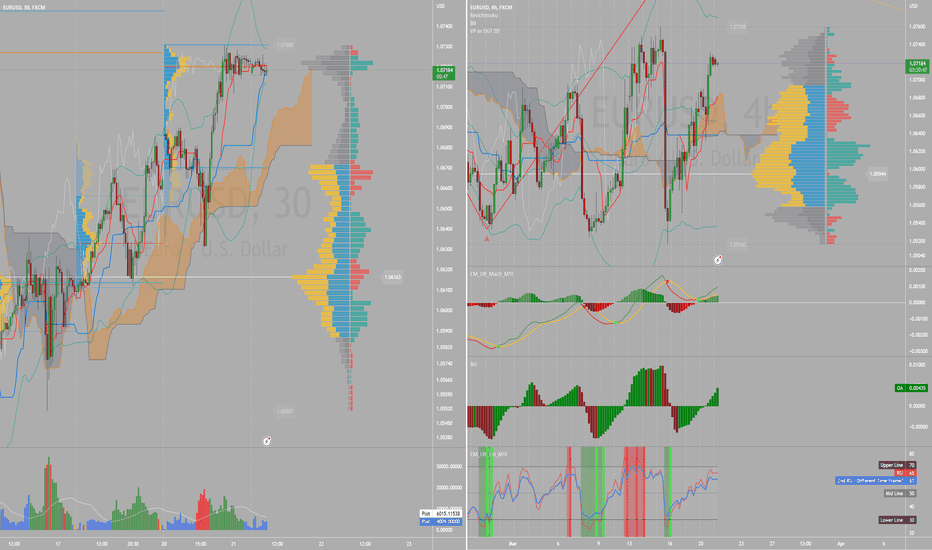

2023-03-23 EU looking for pull back and long againThe euro currently seems to be in the B-wave of the daily rebound, and it is not yet the end. A better long point is the 50% pullback, which is just close to the daily turning line and baseline, and is also supported by the intensive trading volume area . Continue to wait patiently for the pullback to appear.

2023-03-22 EU intraday looking for chance to go long dailyThe Federal Reserve will discuss interest rates in the early hours of tomorrow, and it is expected that there will be large fluctuations. Everyone should be careful.

The euro is still the view of the previous weekend's unwinding. The key pivot area is around 1.066, which is also the POC in March. From the details of the day, the 50% retracement is at 1.065, and the trading volume at this position is relatively small. If the retracement reaches here, then you can pay attention to whether there is support. If you meet the conditions, you can continue to do more. If it falls below 1.06, the euro bulls will be in danger. . Before that, we still maintain the bullish idea of the euro daily line.