Walmart Earnings Play: Cheap Calls Into Earnings

## 🚀 Walmart Earnings Play: Cheap Calls Into Earnings (Aug 21, 2025) 🚀

### 🏦 Earnings Outlook

* 📊 **Revenue Growth:** +2.5% TTM (stagnant but stable)

* ⚖️ **Margins:** Thin → Profit Margin 2.7%, Operating Margin 4.3%

* 🏷️ **Analyst Sentiment:** Still *Strong Buy*, but guidance slippage = caution

* 🛡️ **Defensive Sector:** WMT benefits from consumer staples resilience

---

### 🔎 Options Flow Insight

* 📉 **Put Activity:** Heavy flow at \$97.00 strike = hedging/defensive tone

* ⚠️ **Put/Call Skew:** Bearish leaning, but IV rising ahead of earnings

* 📈 **Opportunity:** Leverage upside surprise with cheap calls

---

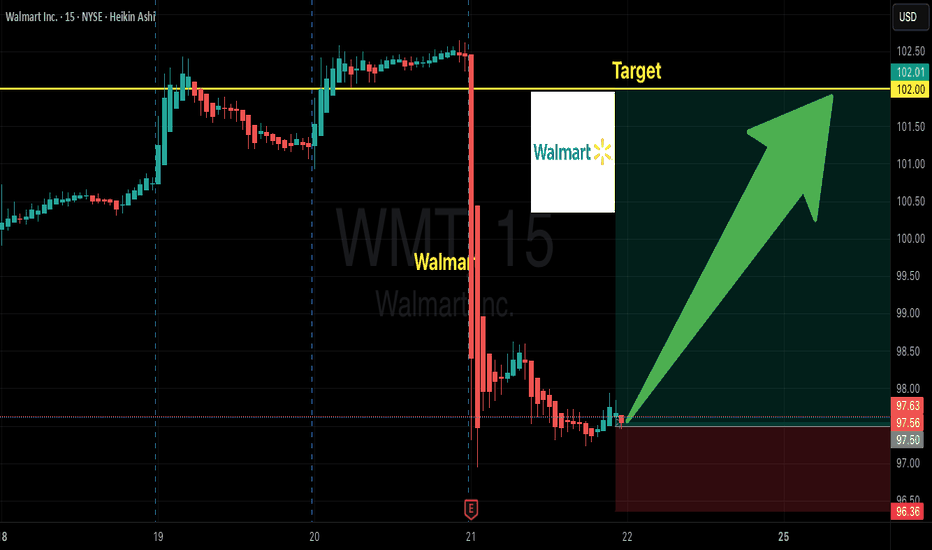

### 📉 Technical Setup

* 📊 Trading **below 20D & 50D MAs** (neutral → bearish drift)

* 🔑 **Key Levels:** Support \$97, Resistance \$105

* 💥 Volume spike: 2.48x avg (earnings speculation)

---

### 🎯 Trade Setup (Earnings Play)

* 🟢 **Direction:** CALL (Bullish Bias)

* 🎯 **Strike:** \$102.00

* 💵 **Entry Price:** \$0.04

* 📅 **Expiry:** Aug 22, 2025

* 📊 **Size:** 2 contracts

* 🕒 **Entry Timing:** Pre-earnings close

📌 **Profit Target:** \$0.08 (200% 🚀)

📌 **Stop Loss:** \$0.02 (50% risk cap)

📌 **Exit Rule:** Within 2 hours of earnings OR market open to avoid decay

---

🔥 Hashtags for Reach 🔥

\#WMTEarnings #OptionsTrading #EarningsPlay #TradingSetup #SP500 #OptionsFlow #StockMarket #DayTrading #SwingTrading