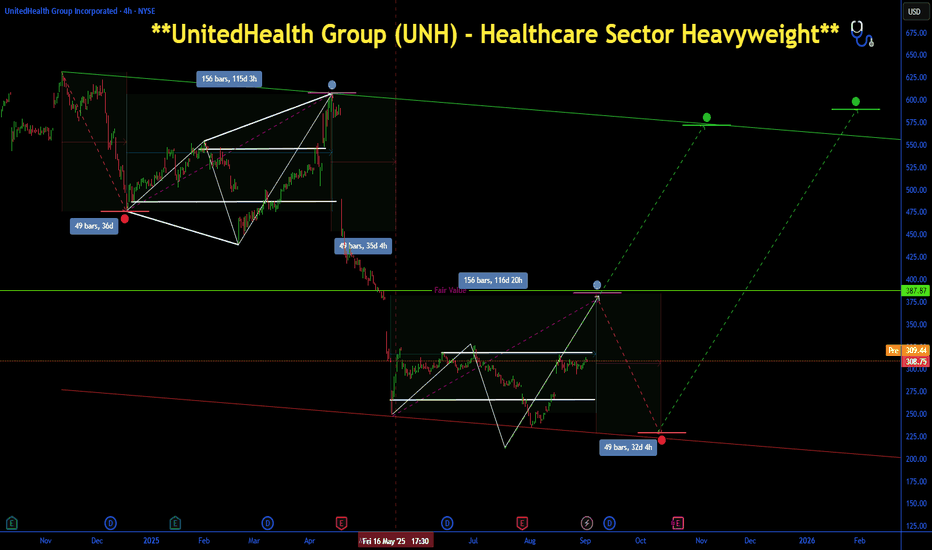

UnitedHealth Group (UNH) - Healthcare Sector Heavyweight**UnitedHealth Group (UNH) - Healthcare Sector Heavyweight** 🩺

Managed care leader trading cheap post-regulatory noise, straight from Graham's discount playbook—evoking Buffett's healthcare forays like his DaVita stake, leveraging moats for enduring value.

- **Key Metrics Showing Why It's Undervalued 💹**: At **$308.80**, trailing P/E **13.37** (below industry ~18), forward P/E **17.54**, P/B **2.95**, juicy yield **2.86%**. Market cap: **$279.67B**, ROE **21.65%** screams efficiency.

- **Potential Upside 🚀**: Analyst targets **$327.71** eye ~6% quick gain, but aging demographics could fuel 15-25% over 12 months—defensive sector moat buffers volatility.

- **How dcalpha.net Strategies Help 📈**: Leverage our portfolio tools with "Warren Buffett tips" on ROE filters—allocate 10-20% to healthcare, blending UNH for balanced growth and dividends, echoing value legends' resilience.

Warrenbuffetttips

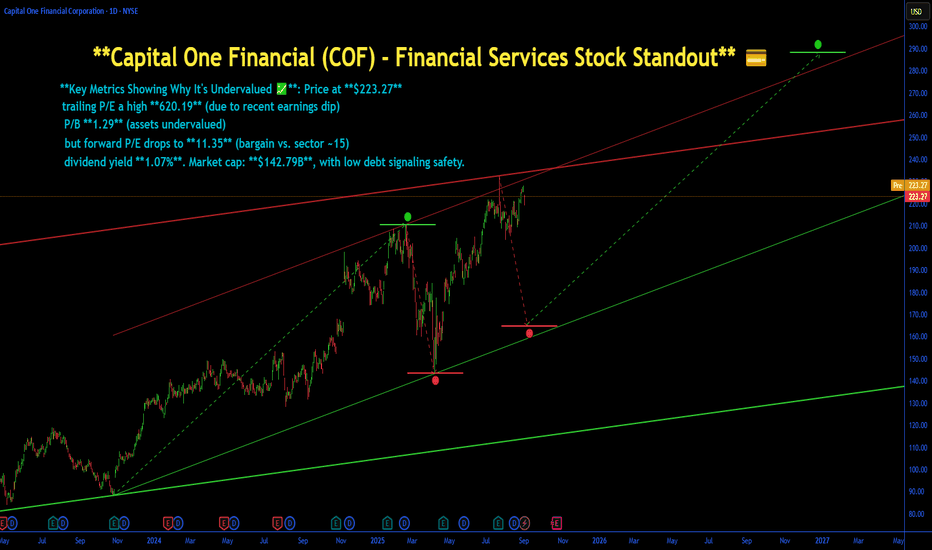

Capital One Financial (COF) - Financial Services Stock Standout**Capital One Financial (COF) - Financial Services Stock Standout** 💳

Credit powerhouse overlooked in rate volatility, mirroring Buffett's "Warren Buffett tips" on banking bets with deep moats—think his Goldman Sachs rescue turning turmoil into triumphs.

- **Key Metrics Showing Why It's Undervalued 💹**: Price at **$223.27**, trailing P/E a high **620.19** (due to recent earnings dip), but forward P/E drops to **11.35** (bargain vs. sector ~15), P/B **1.29** (assets undervalued), dividend yield **1.07%**. Market cap: **$142.79B**, with low debt signaling safety.

- **Potential Upside 🚀**: Targets average **$252.76** for ~13% lift, plus 20-30% growth if rates stabilize and consumer spending rebounds—moat from data-driven lending shines long-term.

- **How dcalpha.net Strategies Help 📈**: Our "value investing strategies" use forward P/E screens and moat analysis to add COF to diversified financial buckets, timing entries with Graham's safety margins for steady compounding like Buffett's winners.