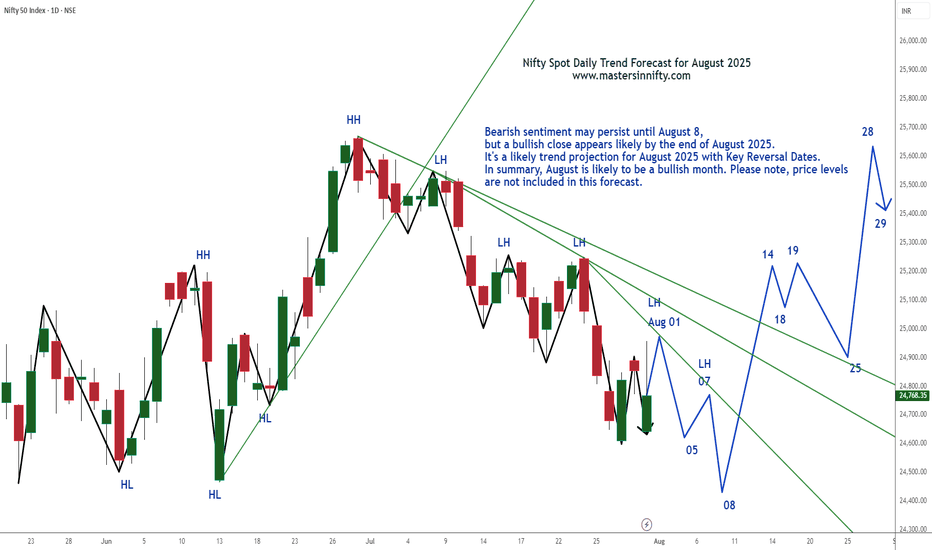

Nifty Spot Index Projection Line for August 2025Bearish sentiment may persist until August 8, but a bullish close appears likely by the end of August 2025.

It's a likely trend projection for August 2025 with Key Reversal Dates. In summary, August is likely to be a bullish month. Please note, price levels are not included in this forecast.

Traders are suggested to conduct own technical studies before entering into the trades and proper risk management is a must.

This is just my personal view.

Best of Luck & Happy Trading.

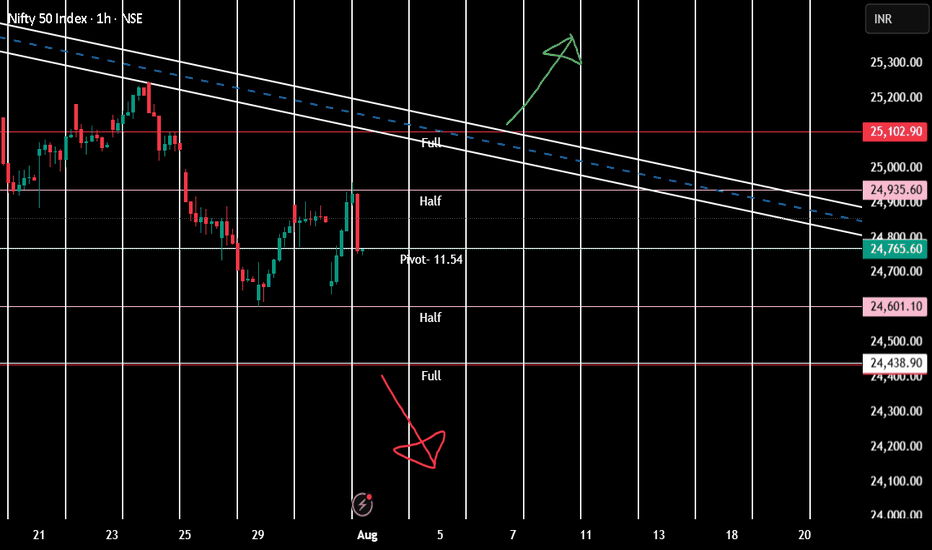

Wave Analysis

Positional tradeAt present market is for scalper/intraday trader. Positional trade to be done only once,

1. 24438 is crossed on day closing basis. Bearish view

2. 25102 is crossed on day closing basis. Bullish view

Pivot- Half-Full are weekly range and applicable only till 7th August.

Vertical lines are important times for intraday as buyer

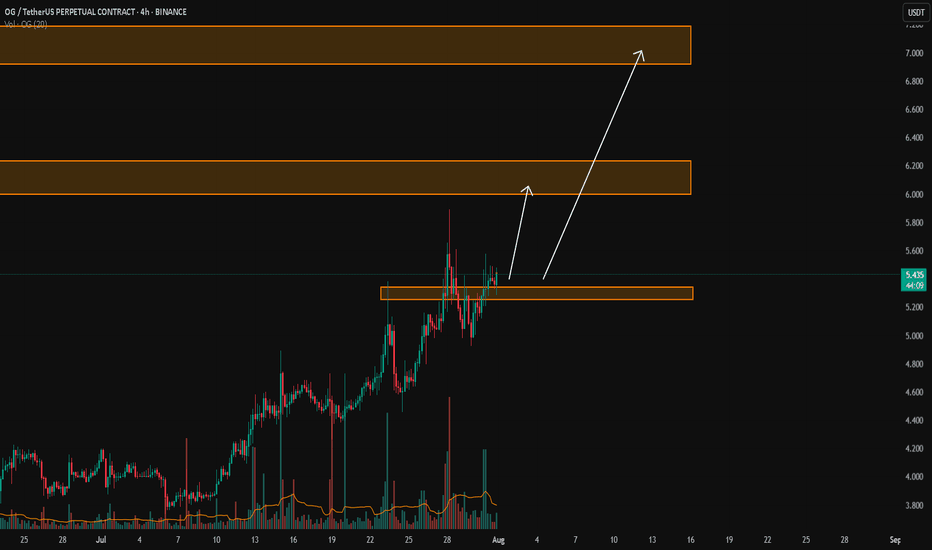

OG/USDTKey Level Zone: 5.250 - 5.340

LMT v2.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

LMT v2.0

Date: 11/06/2025

- Fully restructured lower timeframe (LTF) momentum logic

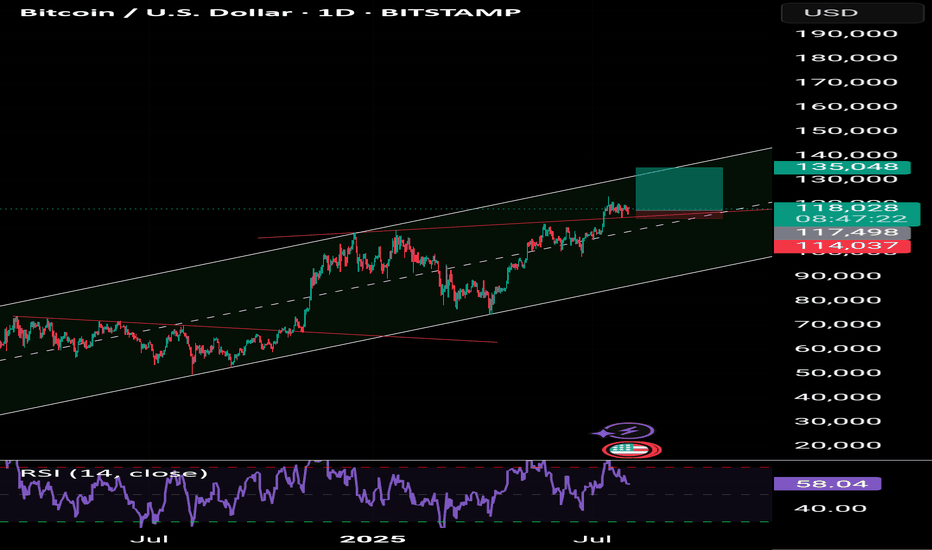

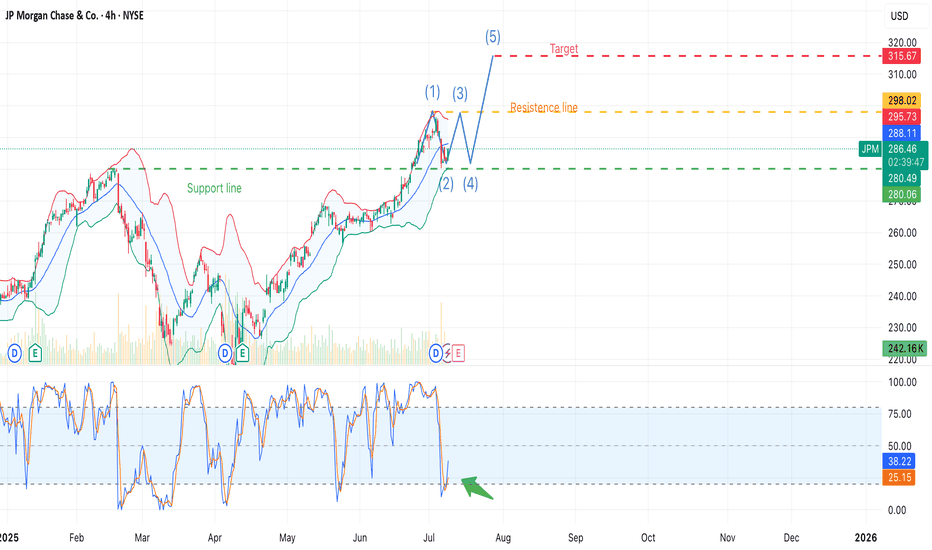

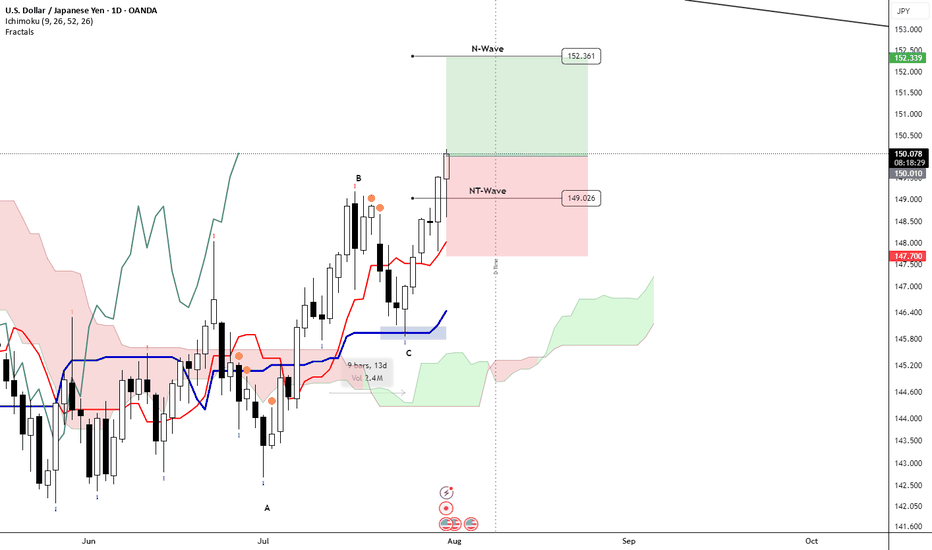

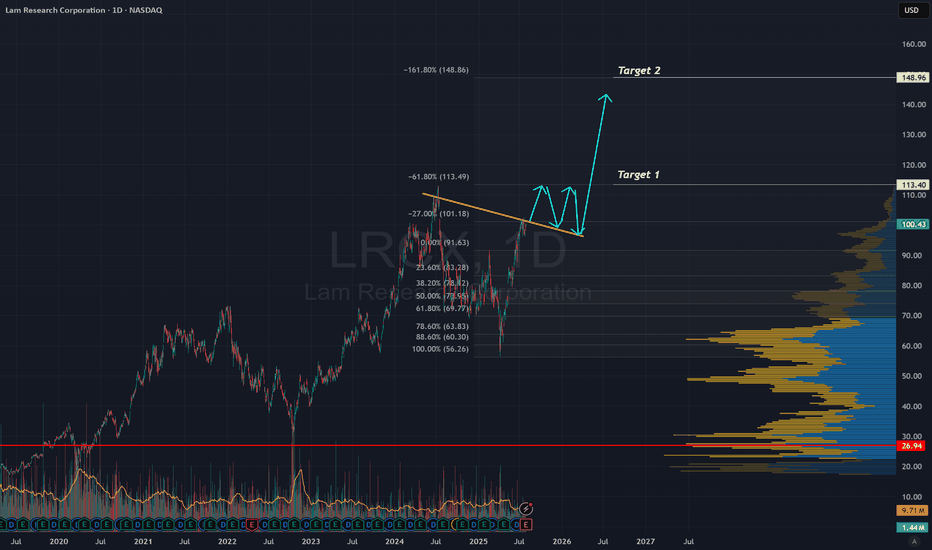

JPM + $500B Capital Forecast + Banks to Profit from Tar NYSE:JPM , 4H chart

ALVO13 Insight: A strong mix of technical structure and positive fundamentals.Technical Setup (Elliott Waves):

The chart suggests a potential start of wave (5) after a completed correction (4).

Stochastic is in the oversold zone, and $280 support is holding — a key signal for a possible reversal.

Key Levels:

• Support: $280.00–280.47

• Resistance: $295.73–298.02

• Target (Wave 5): $315.67

Fundamental Factors:

JPMorgan forecasts up to $500B in new equity inflows from retail and institutional investors during H2 2025. This could lift the market, especially financials.

Banks are likely to benefit from upcoming trade tariffs — via increased demand for hedging, transaction fees, and advisory services.

PM remains one of the most solid U.S. banks, with strong dividend policies and excellent return on equity (ROE).

ALVO13 Trade Idea:

• Entry: $282–286 (confirmation-based)

• Stop-loss: below $280

• Take-profit: $315+

• Risk/Reward: 3:1

Break below $280 invalidates the bullish wave 5 scenario.

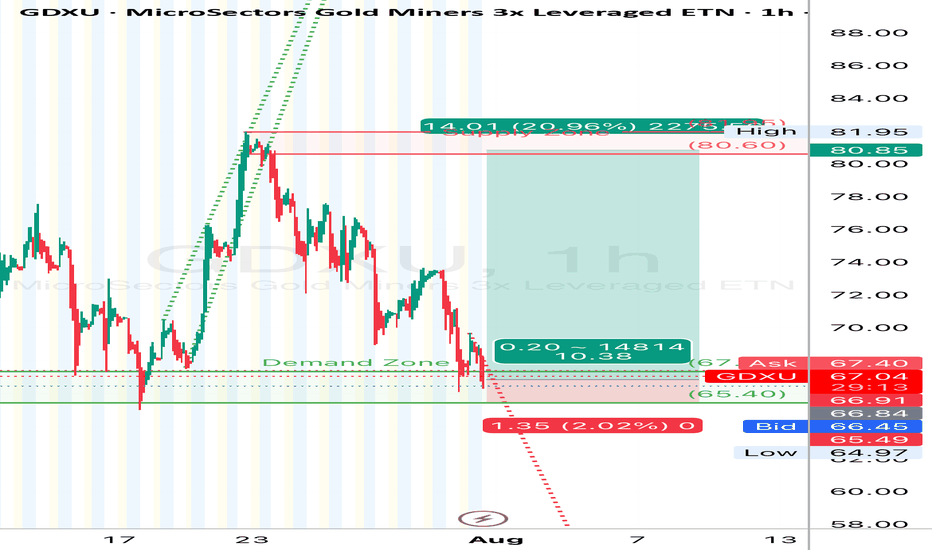

GDXU (Gold Miners 3x Bull ETF) Long SetupGDXU (Gold Miners 3x Bull ETF) | 1H Chart**

**The Fed held rates flat**, signaling a potential **pause or pivot**, which gave a bullish jolt to gold and miners.

* Lower rate expectations = weaker dollar = stronger gold = **GDXU gets rocket fuel**.

* This macro tailwind is **highly favorable** for leveraged gold miners in the short term.

* Strong rally from the \$65 zone may mark the beginning of a **Wave 3** move after a clean corrective structure.

* Impulse leg looks textbook — higher highs and rising momentum suggest bulls are in control.

* **Demand Zone:** \$65.00–\$67.33 — **key structure support that's held multiple times**, proving itself as a strong accumulation zone throughout July.

* **Supply Zone:** \$80.60–\$81.95 — recent rejection area; heavy volume and selling pressure reside here.

That \$65–67 demand zone? Straight-up Fort Knox. It’s been the bulls' home base all month. Now toss in the Fed holding rates and gold catching a bid — GDXU’s primed like TNT under \$82.”

🎯 **Long Trade Setup:**

* **Entry:** \$67.33

* **Stop Loss:** \$65.49

* **Take Profit 1:** \$80.60

* **Take Profit 2:** \$81.95

* **Risk/Reward:** \~**5.0 R**

*“Markets are driven by perception and momentum, not certainty.” – Stanley Druckenmiller*

#### ⚠️ **Disclaimer:**

This is not financial advice. Chart setups are for educational purposes only. Always do your own research, use stop-losses, and apply sound risk management.

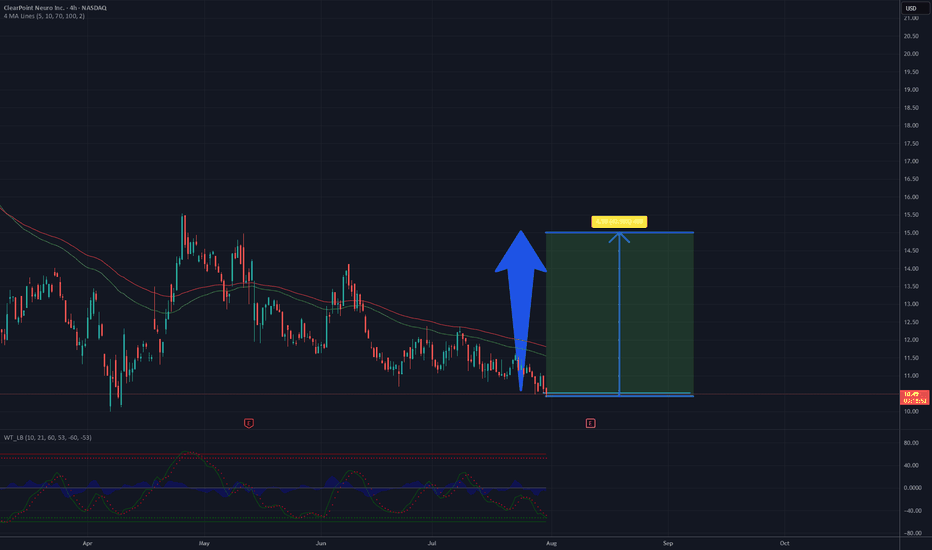

Is a time for CLPT? Around 50% profit - 15 USD targetThe chart depicts a 4-hour candlestick pattern for ClearPoint Neuro Inc. (CLPT) on NASDAQ, covering late 2024 to mid-2025. The stock has recently declined from a peak near 10.7 USD, with the price currently around 10.07 USD as of July 31, 2025. The moving averages (red and green lines) show a bearish crossover, indicating short-term downward momentum, but the price is close to a support level around 10 USD. The oscillator at the bottom suggests oversold conditions with a slight upward bounce, hinting at potential reversal. If buying volume increases and the support holds, a recovery to 15 USD appears feasible in the coming weeks, supported by historical resistance levels near that mark.

The continued expansion of clinical sites globally and the commercialization of the ClearPoint PRISM Neuro Laser Therapy System may broaden the company’s market reach, potentially boosting sales and partnerships in the neurosurgery and gene therapy sectors.

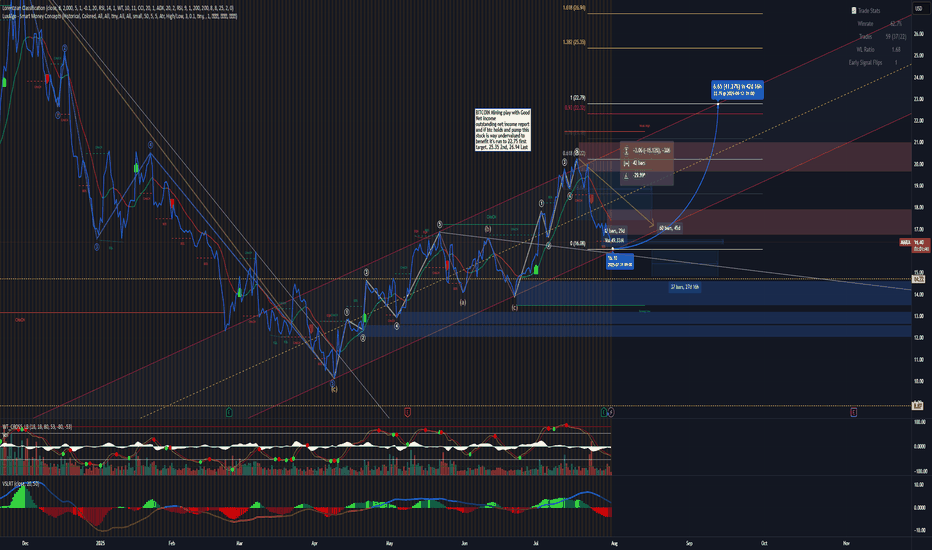

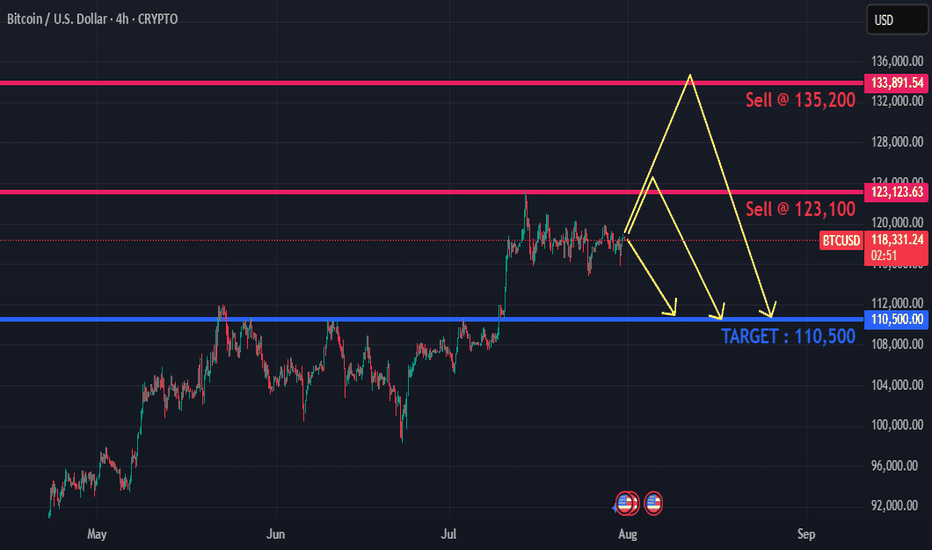

Mara Push higher expectationWith recent outstanding earning report MARA is a undervalue bitcoin mining play offering better risk and Elliott wave count on wave 4 completion looking for wave 5 push up. anytime to see a green reversal day and further movements above the current redline, the hold can last over 1 to 2 weeks. the upmove can last over 27 days. looking over the trendwave. so it's better to seek 60 days options contract

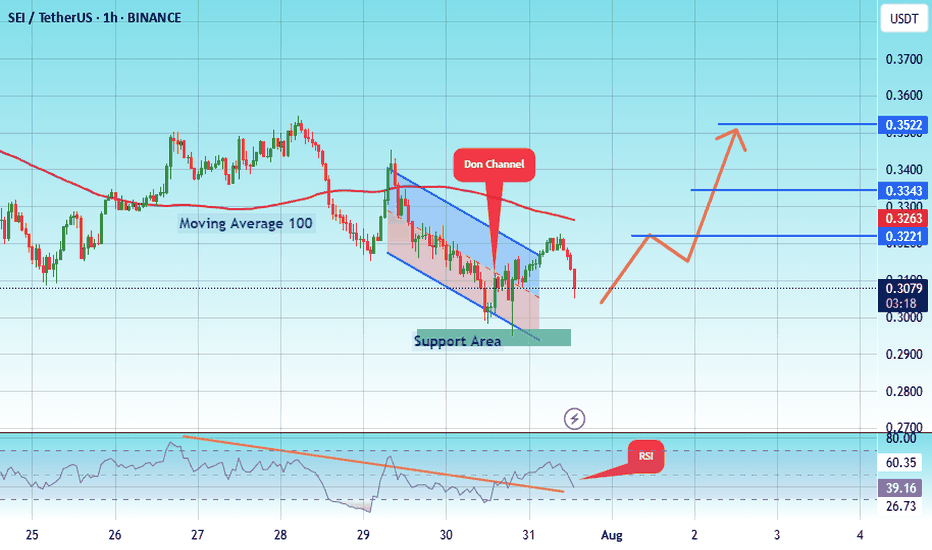

#SEI/USDT The best future belongs to this coin.#SEI

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.2967.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.2950, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3080.

First target: 0.3221.

Second target: 0.3343.

Third target: 0.3522.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

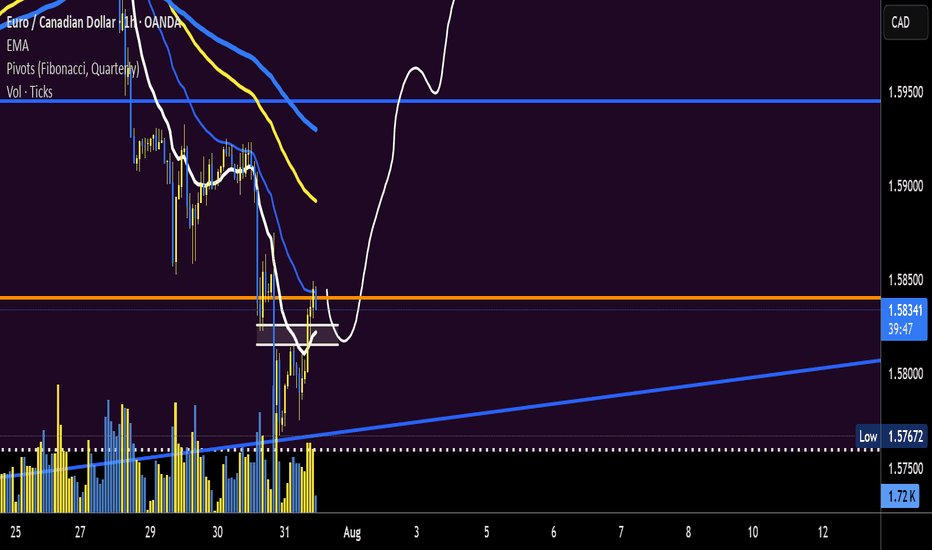

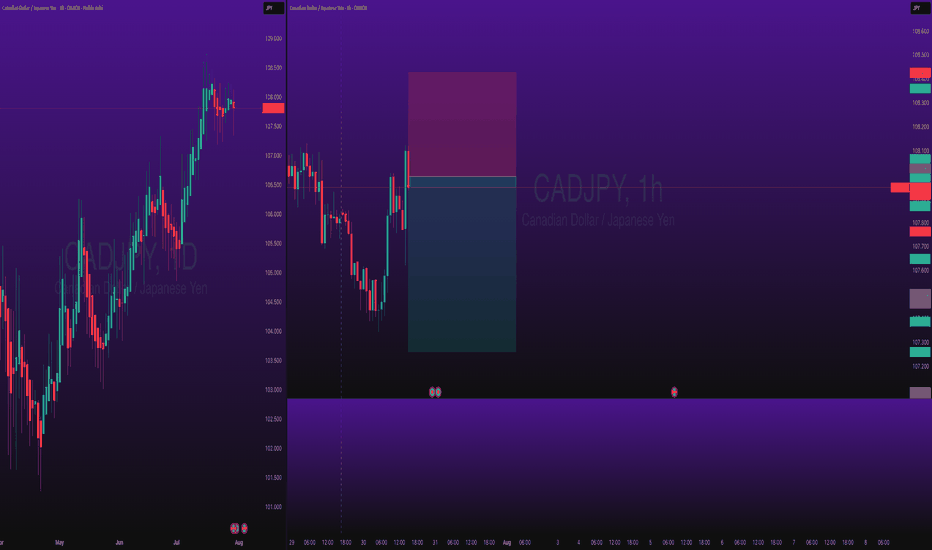

CADJPY Short Day Trade OANDA:CADJPY Short Day Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

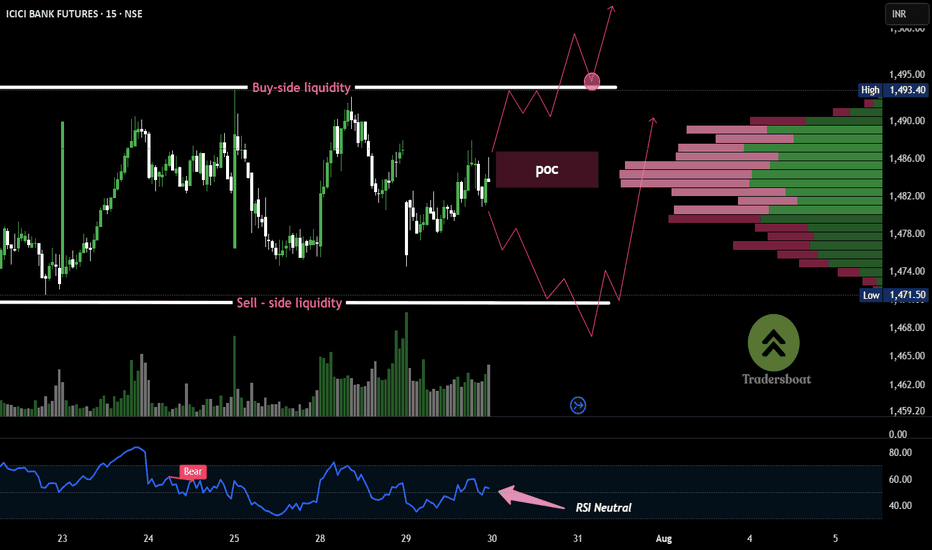

ICICI BANK -15MIN Volume bulge at ₹1485 = decision pointICICI Bank Futures is consolidating in a tight range between ₹1462 and ₹1493, building both buy-side and sell-side liquidity. This structure typically precedes a strong breakout.

The volume profile shows a concentration around ₹1484–₹1486, indicating it as a decision zone. RSI remains weak below 50, suggesting short-term bearish control, but a breakout in either direction could trigger momentum.

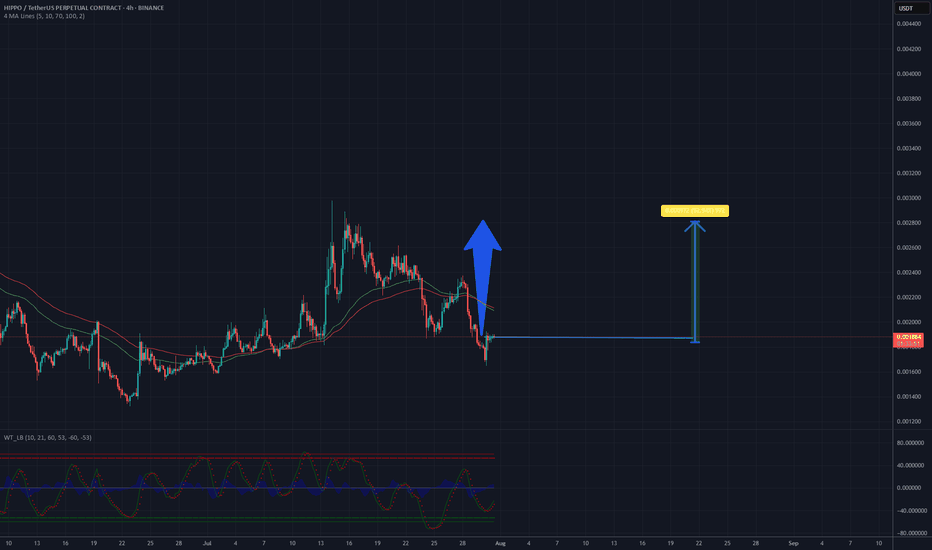

Is a time for HIPPOUSDT? Potential 50% - 0.0028 USD CRYPTOThe chart displays a 4-hour candlestick pattern for the HIPPO/USDT perpetual contract on Binance, showing price movements from late June to mid-September 2025. The price has recently experienced a downward trend after reaching a peak, with a noticeable drop from around 0.0028 to the current level of approximately 0.00186. The moving averages (red and green lines) indicate a potential bearish crossover, suggesting continued downward pressure in the short term. However, the price is approaching a support level near 0.0017, where historical buying interest might emerge. The oscillator at the bottom shows mixed signals, with a slight uptick that could hint at a potential reversal if momentum builds. Based on this analysis, a price recovery to 0.0028 seems plausible if the support holds and buying volume increases in the coming sessions.

Potential TP: 0.0028 USD

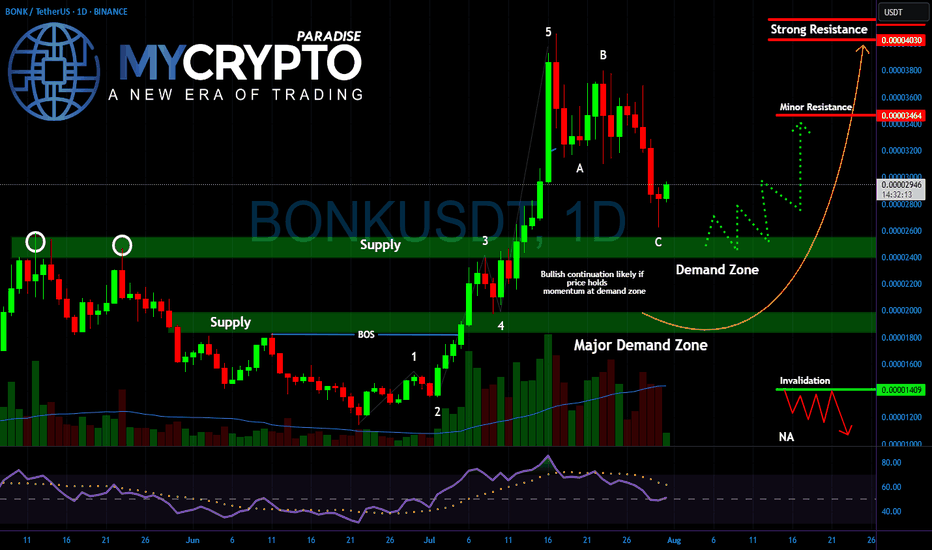

BONK About to Break Out or Break Down?Yello Paradisers! Are you ready for the next explosive move in #BONK? After nailing the last rally and spotting the impulsive 5-wave structure early, we’re now entering a critical phase — and what happens next could decide whether BONK flies or collapses.

💎The recent pullback has followed a clean A-B-C corrective structure, landing perfectly into the key demand zone between 0.00002600 and 0.00002200. This zone now acts as the battlefield between smart money buyers and weak-handed sellers. Price action is slowing down, volume is drying up, and RSI is resetting all classic signs of a potential bullish continuation. But if buyers fail to step in with conviction, the market could easily sweep lower to test the major demand zone closer to 0.00001800.

💎As long as price holds this area and confirms a reversal with follow-through momentum, we could see #BONK heading back toward 0.00003460 as the first stop, and possibly a retest of the 0.00004030 resistance. However, if price closes below 0.00001409, that would invalidate the bullish setup and confirm a deeper corrective phase.

Patience and strategy win the game, Paradisers! The market is designed to shake out weak hands before the real move happens.

MyCryptoParadise

iFeel the success🌴

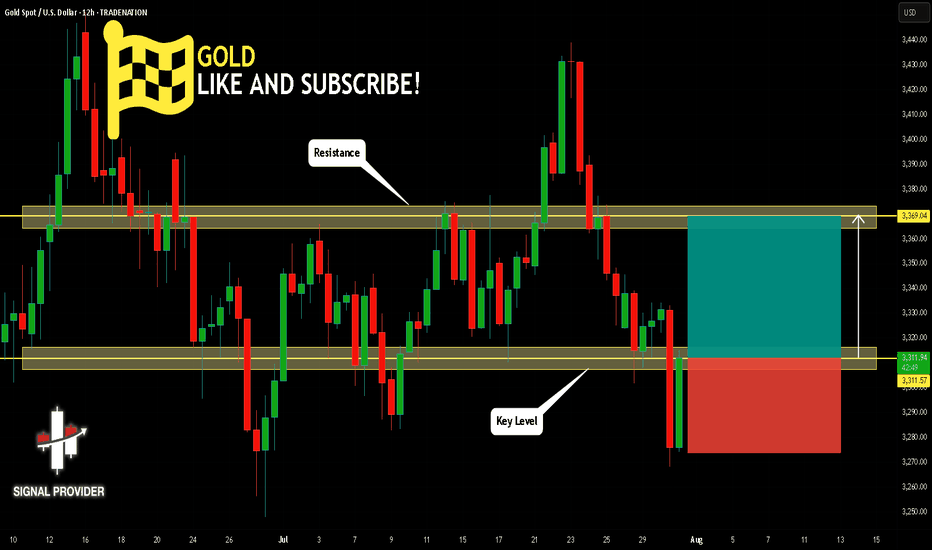

GOLD Will Go Higher From Support! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 3,311.57.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,369.04 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!