Wave Analysis

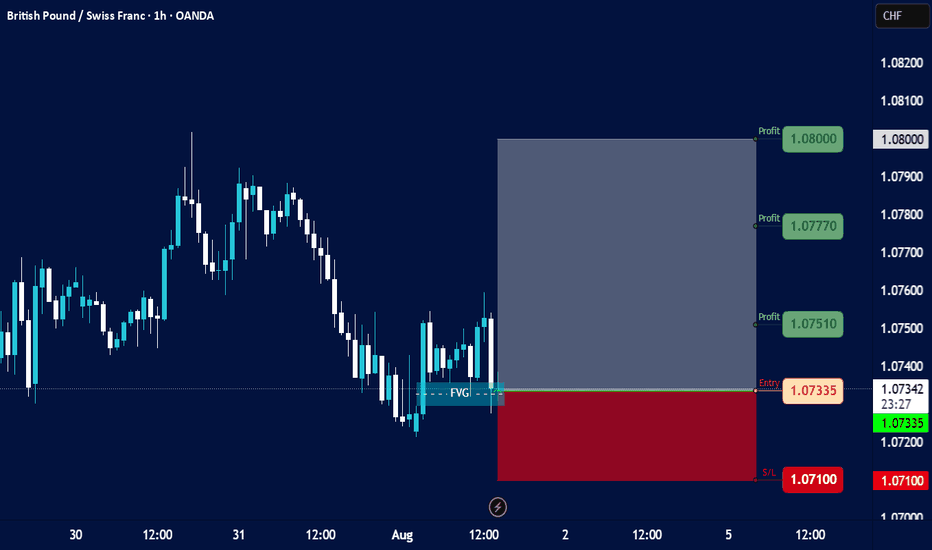

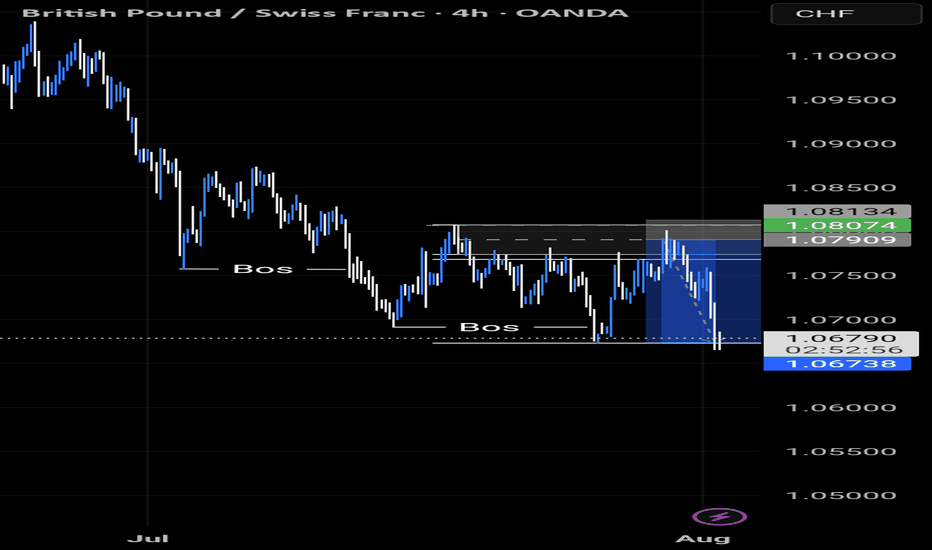

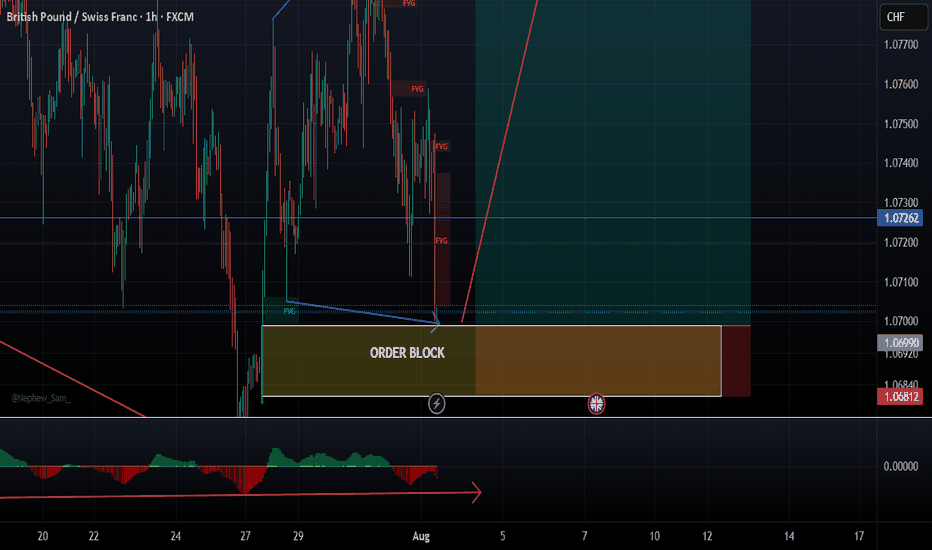

Technical Analysis: GBP/CHF (British Pound / Swiss Franc)Timeframe: Hourly (H1) – *Data as of Aug 01, 2025, 14:33 UTC+4*

Source: OANDA via TradingView

1. Key Price Levels

Current Price (C): 1.07357 (+0.09% from previous close).

High/Low (H/L): 1.07386 / 1.07308 (narrow range, indicating consolidation).

Resistance Levels:

R1: 1.07514 (near-term resistance).

R2: 1.08208 (stronger resistance).

Pivot Point (P): 1.07723 (intraday benchmark).

2. Price Action & Trends

Short-Term Trend: Slightly bullish (+0.09% gain), but trading near the day’s low (1.07308).

Volatility: Low (tight range between 1.07308–1.07386).

Support Zone: 1.07200–1.07335 (critical for bearish reversals).

3. Technical Indicators (Implied)

Pivot Points (PVC): Price is below the pivot (1.07723), suggesting bearish pressure unless it breaks above.

Resistance/Support:

Bulls need to push above R1 (1.07514) to target R2 (1.08208).

Bears aim for S1 (1.07335) or lower (1.07200).

4. Trading Signals

Bullish Scenario: Break above 1.07514 (R1) could signal upward momentum toward 1.07723 (Pivot).

Bearish Scenario: Drop below 1.07308 (today’s low) may extend losses to 1.07200.

Neutral Zone: Price oscillating between 1.07308–1.07386 suggests indecision.

5. Risk Management

Stop-Loss (S/L): Below 1.07200 for longs; above 1.07514 for shorts.

Take-Profit (T/P):

Longs: 1.07723 (Pivot) or 1.08000 (psychological level).

Shorts: 1.07200 or 1.07000.

6. Conclusion

Current Bias: Neutral-to-slightly bullish, but lacks strong momentum.

Watch For: Breakout from the 1.07308–1.07514 range for directional clarity.

Caution: Low volatility may lead to false breakouts; confirm with volume/RSI if available.

Recommendation: Wait for a confirmed breakout with volume before entering trades.

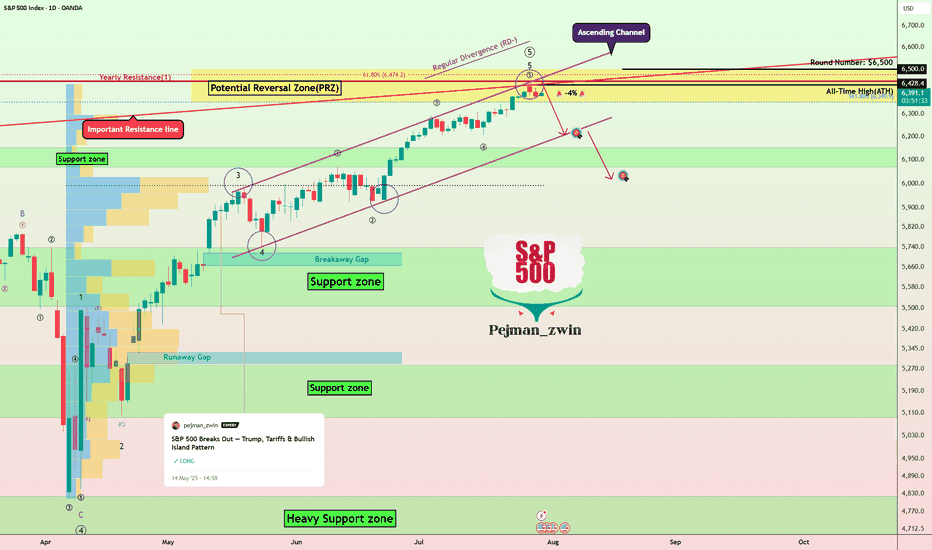

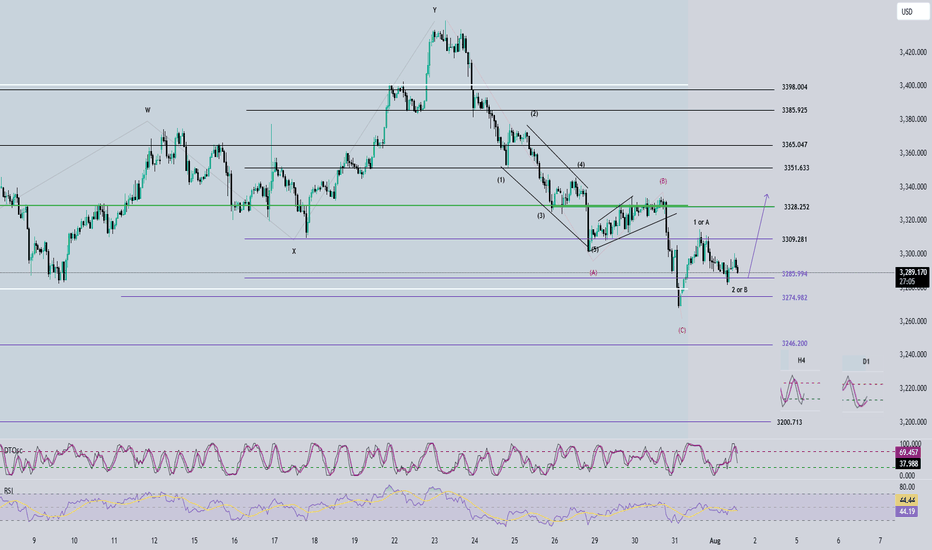

S&P500’s Bullish Island Turns Risky: Elliott Wave Says “Top”The S&P500 Index( SP:SPX ) started to rise and even created a new All-Time High(ATH=$6,428) with the help of the Bullish Long Island Pattern , as I published in my previous idea on May 14, 2025 .

The S&P500 Index is currently moving near the Potential Reversal Zone(PRZ) , upper line of the ascending channel , the Important Resistance line , and the Yearly Resistance(1) .

In terms of Elliott Wave theory , the S&P500 Index appears to be completing microwave 5 of microwave 5 of the main wave 5 .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect the S&P500 Index to correct at least -4% and fall to the lower line of the ascending channel .

First Target: $6,233

Second Target: $6,033

Note: Stop Loss(SL) $6,513

Do you think S&P500 Index can create a new ATH above $6,500 !?

Please respect each other's ideas and express them politely if you agree or disagree.

S&P 500 Index Analyze (SPX500USD), Daily time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

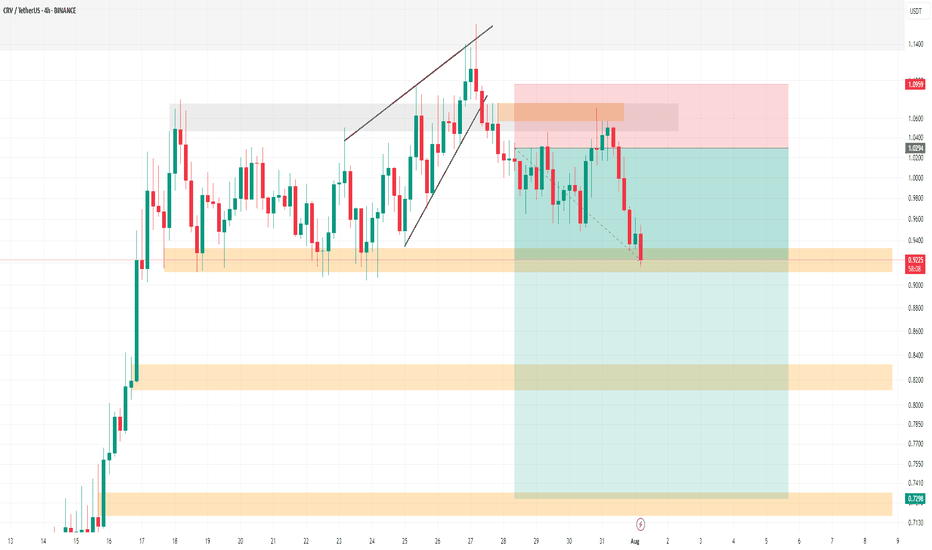

CRV SHORT Update Hello.

CRV Update

💁♂️ TP1 🔥

You can see this analysis in the analyses I posted before. It has now reached its first target. Please don't forget to like, share, and boost so that I can analyze it for you with more enthusiasm. Thank you. 💖😍

✅ TP1: 0.93$ Accessible (done)🔥

TP2: 0.82$ Possible

TP3: 0.73$ Possible

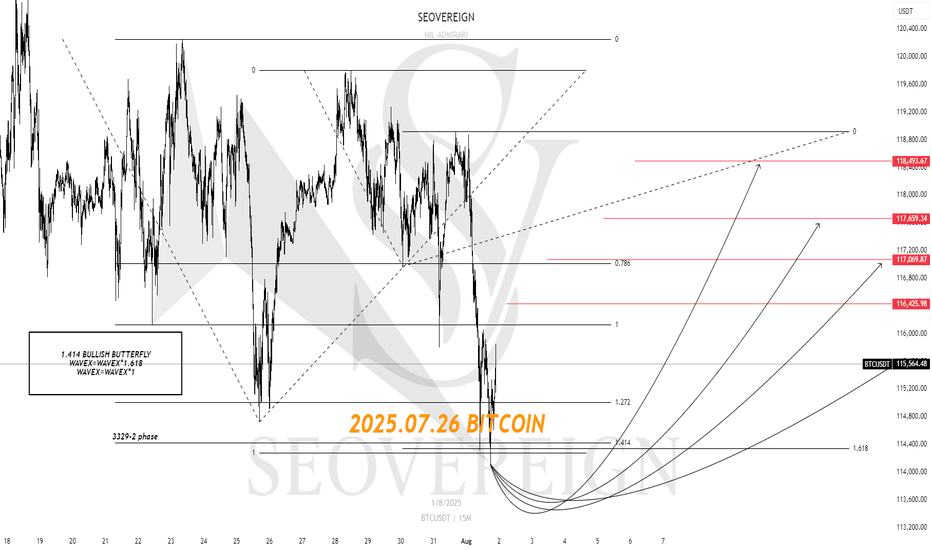

[SeoVereign] BITCOIN BULLISH Outlook – August 1, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Hello.

This is SeoVereign.

My fundamental view on Bitcoin, as mentioned in the previous idea, is that I am anticipating an overall downward trend. In the mid- to long-term, I believe the downward pressure will gradually increase, and this is partially confirmed by various indicators and the overall market sentiment.

However, before we fully enter this downward phase, I have been judging that one more upward wave is likely to remain. I have focused my strategy on capturing this upward segment, and I have recently reached a point where I can specifically predict the development of that particular wave.

If this upward move unfolds successfully, I plan to set my take-profit range conservatively. The reason is simple: I still believe there is a high possibility that the market will shift back into a downtrend afterward. The core of this strategy is to minimize risk while realizing profits as efficiently as possible toward the tail end of the wave.

The relevant pattern and structure have been marked in detail on the chart, so please refer to it for a clearer understanding.

In summary, I view this rise as a limited rebound that could represent the last opportunity before a downturn, and I believe this idea marks the beginning of that move.

I will continue to monitor the movement and update this idea with additional evidence. Thank you.

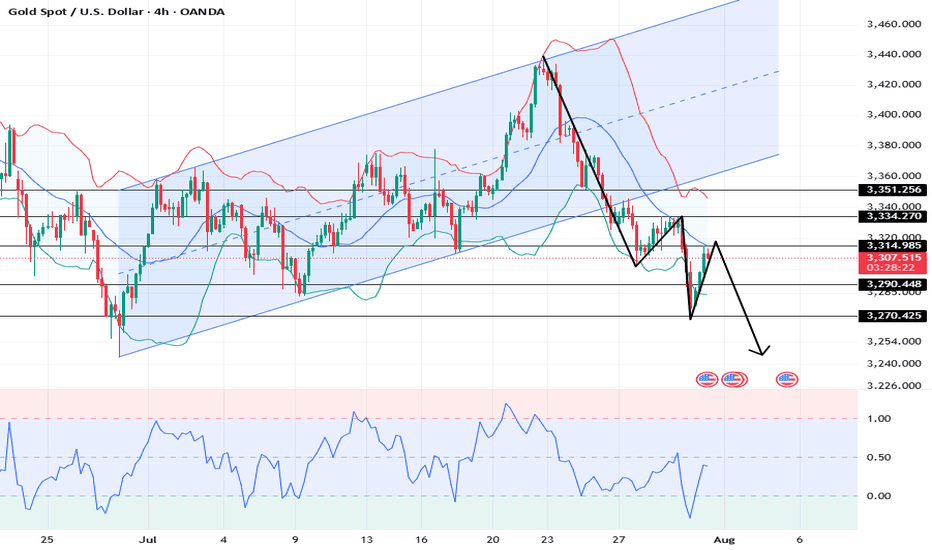

XAUUSD: Market Analysis and Strategy for July 31stGold Technical Analysis:

Daily chart resistance: 3351, support: 3250

4-hour chart resistance: 3335, support: 3270

1-hour chart resistance: 3315, support: 3290.

Gold was trading sideways between 3320 and 3333 yesterday before the New York market. During the US trading session, the release of US ADP employment figures and PCE price data was bearish for gold, causing it to plummet below Monday's low of 3301. The Federal Reserve held interest rates steady, and Powell's hawkish speech sent gold plummeting to around $3268.

Affected by the news, gold prices fell rapidly yesterday, reaching a low near the lower Bollinger band on the daily chart. It rebounded in the Asian session today, reaching a high near 3315. Selling is recommended in the sideways range between 3310 and 3320. The US PCE data will be released in the New York market, so avoid the news release period.

BUY: near 3290

SELL: near 3270

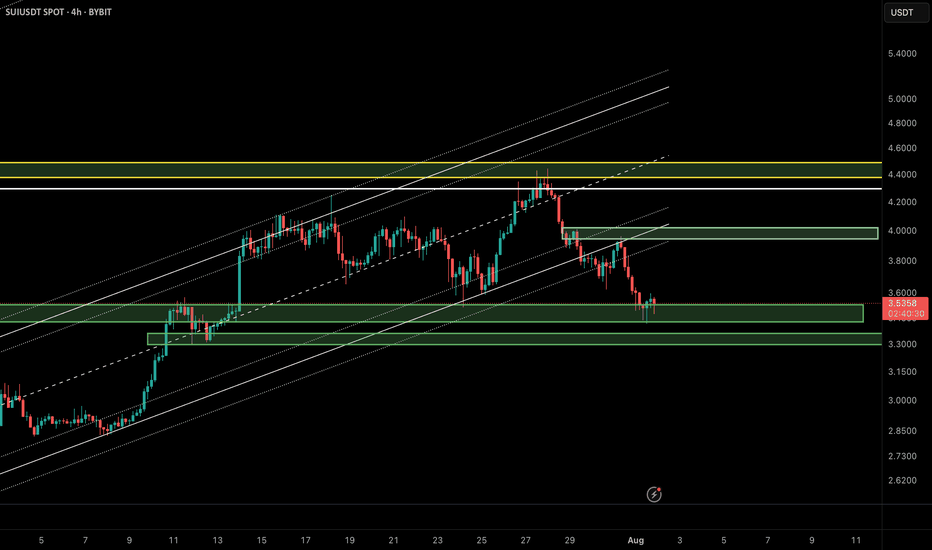

SUI/USDT Update – Bounce Setup from Demand Zone?In the previous analysis, we highlighted a short opportunity near $4.20, which played out perfectly. Now, SUI has reached a key demand zone around $3.40–$3.55, overlapping with the lower boundary of the ascending channel and a previously defined bullish order block.

🔹 Market Structure:

After breaking the bullish structure, price is now revisiting a major liquidity zone between $3.40 and $3.55.

🔹 Price Behavior:

Wicks to the downside suggest buy-side absorption and potential for short-term reversal.

🔹 Possible Scenario:

If the $3.40 zone holds, we could see a corrective move up to the supply zone around $3.90–$4.00.

📌 Key Levels:

• Support: $3.40–$3.55

• Resistance: $3.90–$4.00

❗️If the $3.40 support fails, bullish momentum will likely be invalidated in the short term.

🧠 Pro Tip (SMC-based):

When a demand zone aligns with liquidity sweep and channel support, it often becomes a high-probability area for institutional re-entries. Wait for a clear confirmation like BOS or bullish engulfing candle before entering.

⸻

🔗 Like, share, and follow for more Smart Money & Elliott Wave-based insights!

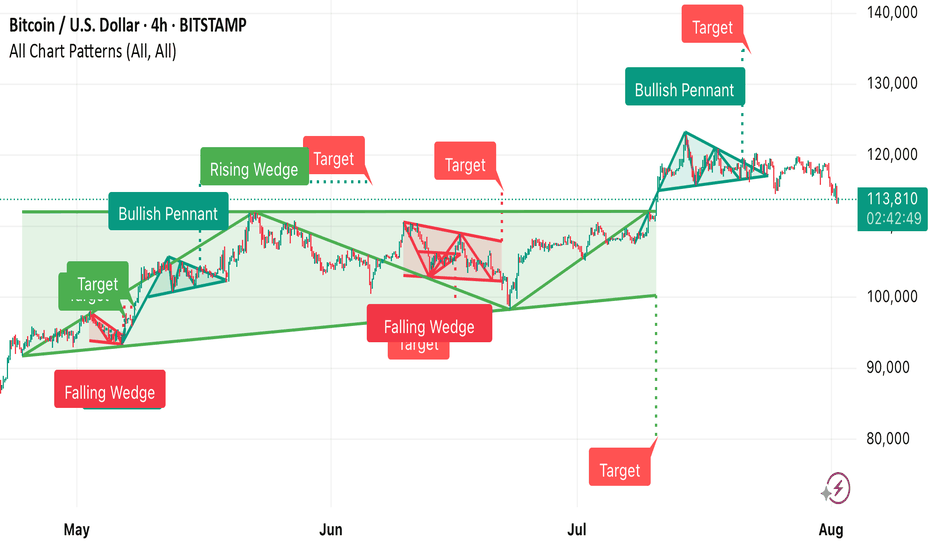

This Bitcoin 4-hour chart from TradingView shows multiple techni • Falling Wedge (early May) → Bullish breakout, target achieved.

• Bullish Pennant → Strong upward continuation.

• Rising Wedge (June) → Bearish breakdown, target met.

• Falling Wedge (mid-June) → Bullish breakout, target achieved.

• Bullish Pennant (late July) → Upward move toward the 140,000 target zone.

Currently, BTC is trading around 113,829, below recent highs, and near the dotted horizontal support zone from the last breakout.

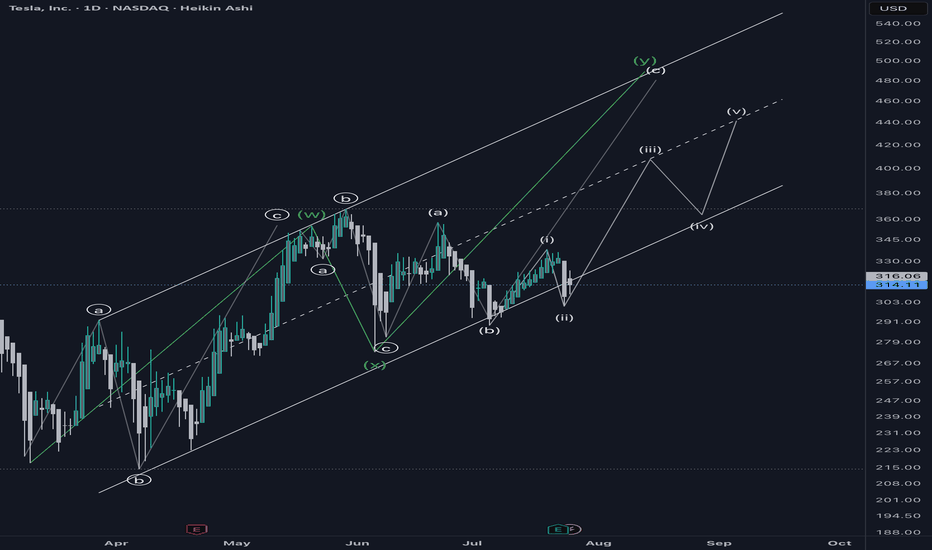

WXY structure with a double topTesla has been in a uptrend with a corrective structure WXY. I am not sure if the WXY is a part of wave 5 terminal structure or a B wave. However expecting a double top or 78.6 retrace to 425-430 range as a minimum. For this scenario, an impulsive upside move is expected within the next few weeks. However the price needs to move back into the channel next week as a first step.

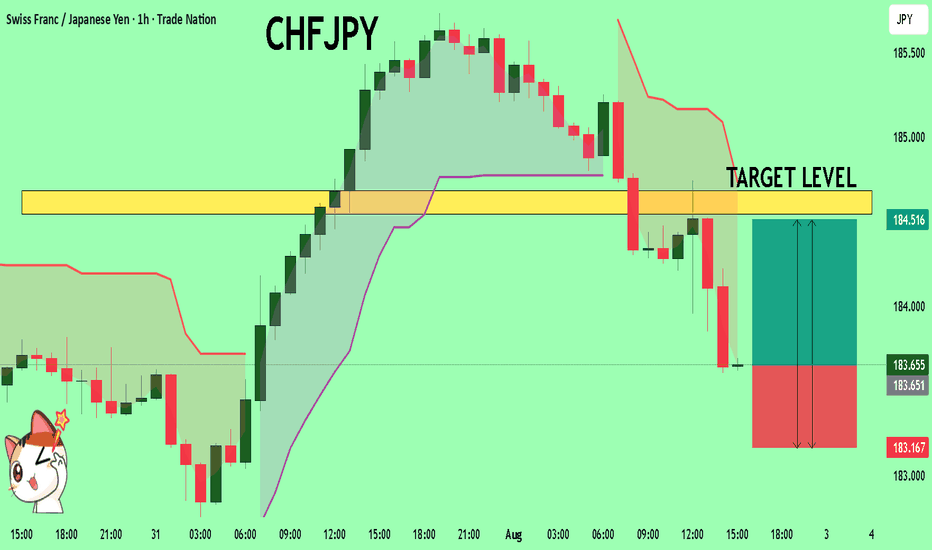

CHFJPY On The Rise! BUY!

My dear friends,

My technical analysis for CHFJPY is below:

The market is trading on 183.63 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 184.54

Recommended Stop Loss - 183.16

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

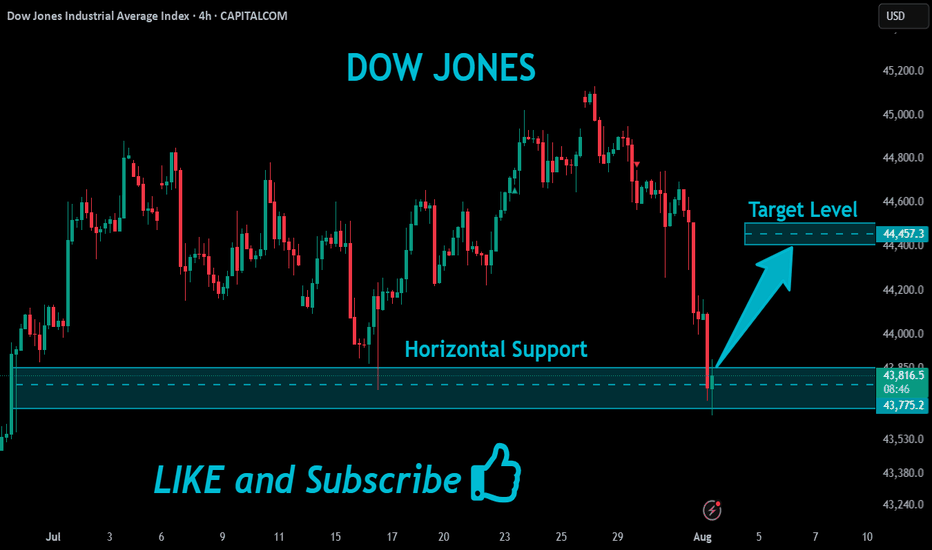

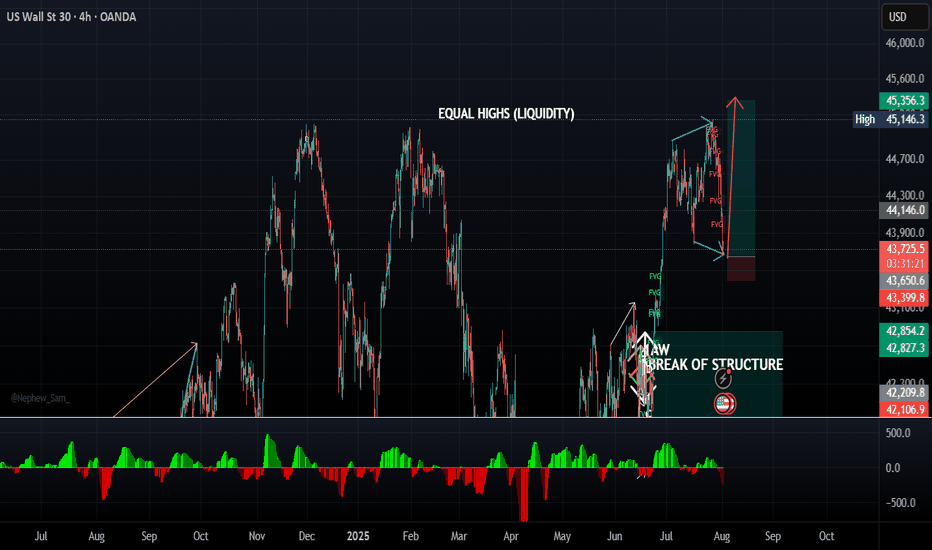

DJ30/US30 LONG Reason for trade:

1. Expanding flat in play

2. Equal highs (LIQUIDITY)

3. Currently at the order block area (Ready)

Entry: 43647

Stop Loss: 43386

Take Profit: 45246

Strategy: Wait for a 30 minute engulfing candle closure.

Once in profit of 1:1 R, place the trade at BE

Blessings, in CHRIST.

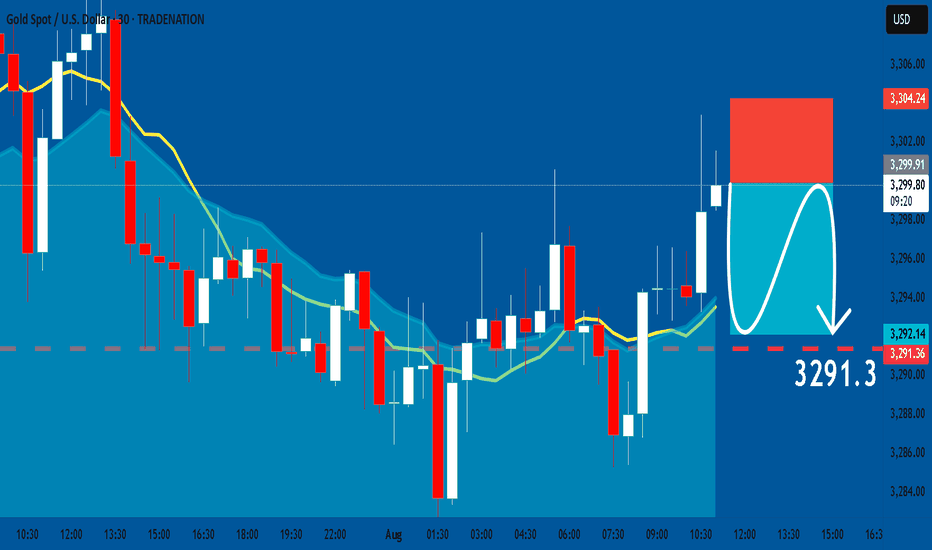

GOLD: Short Trading Opportunity

GOLD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry Level - 3299.9

Sl - 3304.2

Tp - 3291.3

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

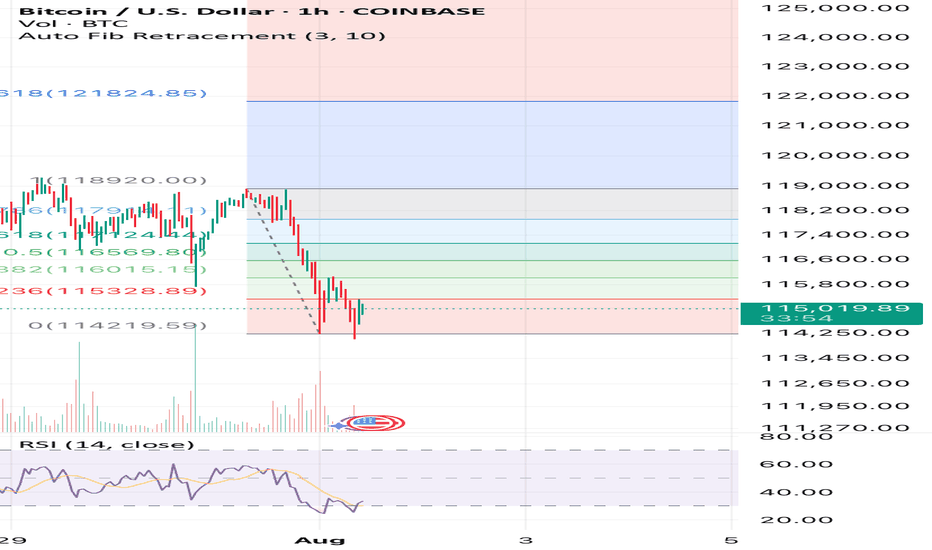

Bitcoin willIt hold if we stay above $115k ?? Fixing up last post I’ve deleted now as image was not good. Anyway simple RSI and Auto Fib Retrace with only general CRYPTOCAP:BTC market understanding backing this. This isn’t finacial advice at all. It’s pure speculation this post and anything related to it. I’m

Not a finacial advisor and I will not be held accountable for anyone’s actions that I didn’t do.

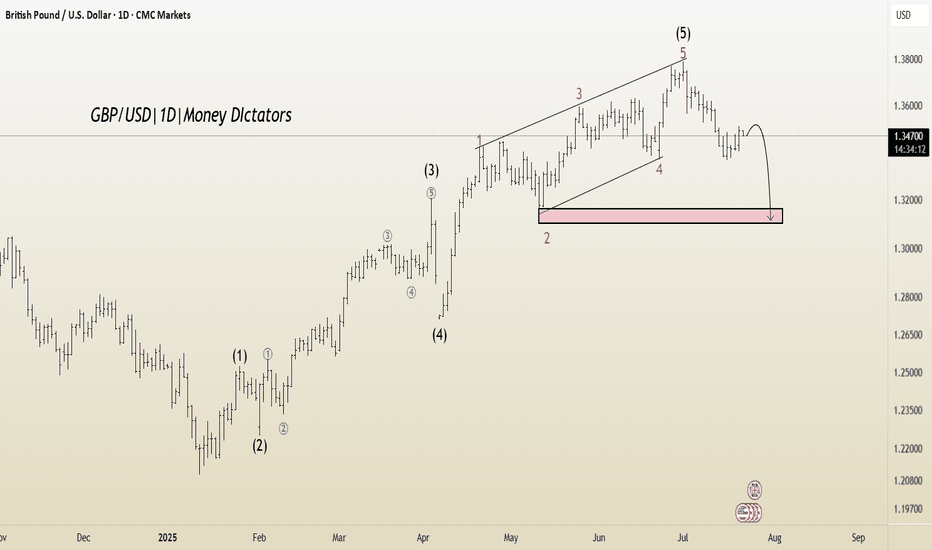

GBP/USD: Post-Impulse Sell Setup from Ending DiagonalThe chart depicts a completed 5-wave impulsive structure, culminating at the top of wave (5). The internal wave structure of the final fifth wave forms a classic ending diagonal pattern, typically signaling a trend reversal or deep correction.

After this extended fifth wave, the price has started rolling over, confirming the start of a corrective decline. The wave count now expects an ABC correction targeting the previous wave 4/2 demand zone, highlighted in red.

Target 1 (T1): 1.33608

Target 2 (T2): 1.32436

Stop Loss (SL): 1.35988

Ending diagonal at the top of wave (5) signals exhaustion of bullish momentum.

Clear bearish divergence (not shown here) is commonly seen with this pattern.

The price has broken the short-term structure and is now forming lower highs.

Target zone aligns with previous wave 2 consolidation – a typical retracement zone for post-impulse corrections.

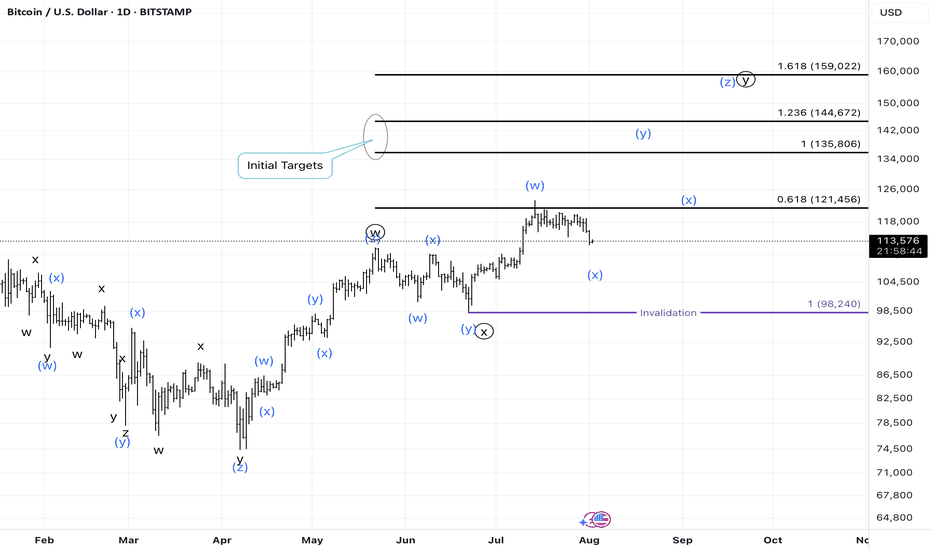

BTC Daily Elliott Wave CountAs mentioned in my analysis on youtube post on Total Market Cap short-term, the daily bullish case is now verified, canceling the bearish case with a break through the daily bearish invalidation level.

This past week price action suggests a move towards the completion of a blue wave x. Make sure to check out my latest analysis on short-term Crypto Total Market Cap.

The link to the chart:

Bullish Count

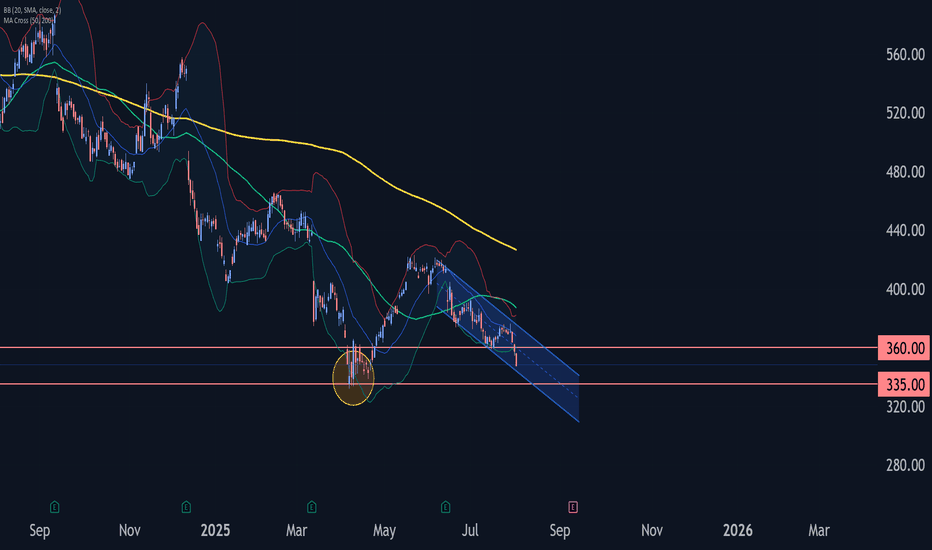

Adobe Wave Analysis – 1 August 2025- Adobe broke the key support level 360.00

- Likely to fall to support level 335.00

Adobe recently broke below the key support level 360.00 (which stopped the previous minor impulse wave i at the start of July).

The breakout of the support level 360.00 accelerated the active impulse wave C of the medium-term ABC correction (2) from the end of May.

Given the strong daily downtrend, Adobe can be expected to fall further to the next support level at 335.00 (the double bottom from April and the target for the completion of the active impulse wave C).

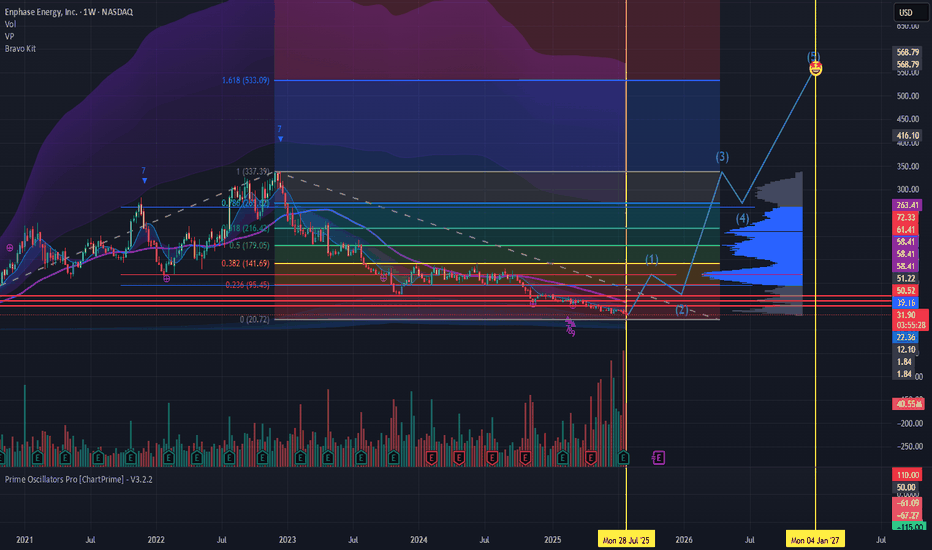

$ENPH About to make new highs Enphase trades inverse crypto and the crypto trade is coming to a quick end. Stored energy theory states during times of excess energy BTC will thrive. We are now in a new regime of AI energy cost and ENPHASE has the best batteries to scale. Minimum Target $550

Positions

1130 ENPH $50 Calls for 10/17/2025

511 ENPH $100 Calls for 01/15/2027

Elliott Wave Analysis – XAUUSD August 1, 2025📊

________________________________________

🔍 Momentum Analysis:

• D1 Timeframe:

Momentum has reversed to the upside. Based on this signal, we expect a bullish trend to continue for the next 5 daily candles — likely until mid-next week.

• H4 Timeframe:

Momentum has also turned upward → This suggests that from now until the U.S. session, the price will likely continue to rise or consolidate with an upward bias.

• H1 Timeframe:

Momentum is currently turning down → We anticipate a short-term corrective move. We should wait for H1 to enter the oversold zone and give a bullish reversal signal before looking for long entries.

________________________________________

🌀 Wave Structure Analysis:

The current wave structure remains complex and lacks clear confirmation. Thus, the current wave labeling should be considered provisional. However, the wave count has not been invalidated, and D1 momentum supports a bullish outlook — so we continue to maintain our wave structure bias.

Important Note:

Wave (C) in red appears relatively short. This leaves open the possibility that the price may continue lower, targeting:

• ⚠️ 3246

• ⚠️ 3200

→ This scenario will be triggered if price breaks below 3268, especially given today's Nonfarm Payroll (NFP) report.

________________________________________

📌 Two Possible Wave Scenarios:

1. Scenario 1: Black Waves 1 – 2 – 3

o Wave 1 (black) is complete.

o We are now in Wave 2 (black) → Preparing for Wave 3.

o Wave 3 tends to be strong, impulsive, and sharp with large candle bodies.

o Target: 3351

2. Scenario 2: Black ABC Correction

o The market is currently in Wave B (black).

o Potential target for Wave C: 3328

________________________________________

🛡 Support Zones & Trade Strategy:

• Support Zone 1: 3290 → A good area for potential buying, but we must wait for H1 to enter the oversold region and show a bullish reversal.

• Support Zone 2: 3275 → Deeper buy zone if the price corrects further.

________________________________________

💡 Trade Plan:

📍 Option 1 – Buy Limit:

• Buy Zone: 3290 – 3289

• Stop Loss: 3280

• Take Profit 1: 3309

• Take Profit 2: 3328

• Take Profit 3: 3351

📍 Option 2 – Buy Limit:

• Buy Zone: 3275 – 3273

• Stop Loss: 3265

• Take Profit 1: 3309

• Take Profit 2: 3328

• Take Profit 3: 3351

________________________________________

📎 Notes:

• Experienced traders should wait for clear confirmation signals on H1 before entering trades.

• New traders may consider using limit orders in the proposed buy zones.