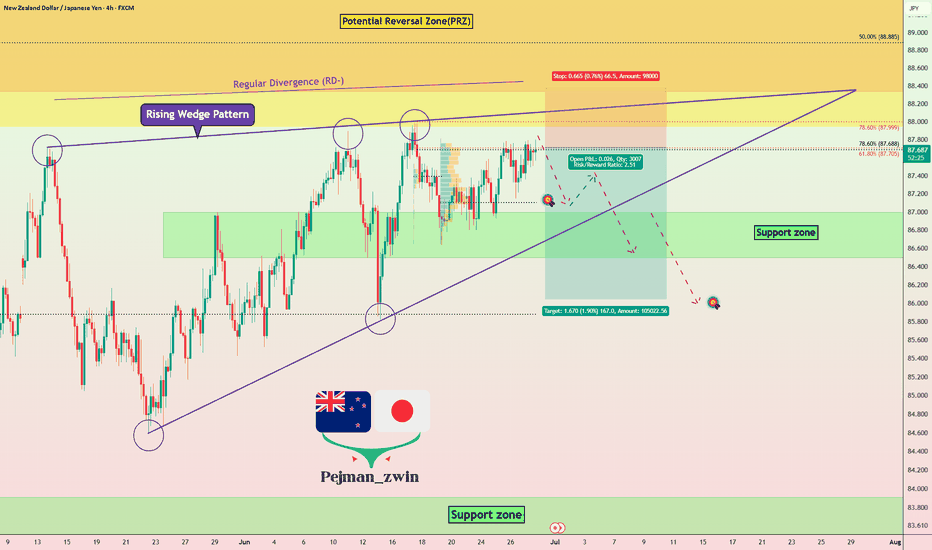

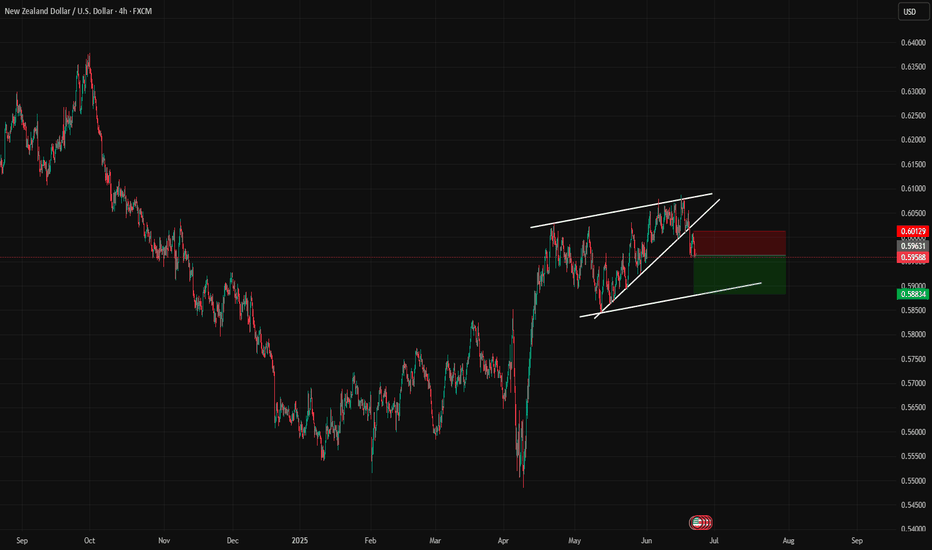

NZDJPY Technical + Fundamental Short Alignment = Short SetupToday, I want to review the NZDJPY ( OANDA:NZDJPY ) pair short position from a fundamental and technical perspective . It seems to be in a good zone for a short position.

Do you agree with me?

----------------------------------------

First, let's look at the fundamentals of NZDJPY.

New Zealand (RBNZ):

The Reserve Bank of New Zealand cut the OCR by 25bps in May and hinted at further easing if inflation continues to cool. Recent CPI data has shown clear disinflation trends, increasing the likelihood of more rate cuts in the second half of 2025. Consumer confidence is also declining, and retail sales have been weaker than expected.

Japan (BoJ):

The Bank of Japan is under growing pressure to tighten monetary policy. Inflation remains above 2%, and market expectations for a rate hike later this year are building. Any shift from ultra-loose policy supports JPY strength, especially against weaker yielders like NZD.

Macro Summary:

Diverging monetary policies: RBNZ easing, BoJ possibly tightening.

NZD weakened by soft data, JPY strengthened by policy expectations.

Risk sentiment is currently neutral-to-negative, favoring safe-haven JPY.

Conclusion:

Short NZDJPY is fundamentally justified. The pair aligns with macro forces: NZD is pressured by rate cuts and weak growth, while JPY is poised to strengthen with upcoming policy shifts.

----------------------------------------

Now let's take a look at the NZDJPY chart on the 4-hour time frame .

NZDJPY is currently trading near the Potential Reversal Zone(PRZ) .

In terms of classic technical analysis , it appears that NZDJPY has successfully formed a Rising Wedge Pattern .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

Based on the above explanation , I expect NZDJPY to drop to at least 87.159 JPY if the lower line of the Rising Wedge Pattern and the Support zone(86.50 JPY-87.00 JPY) are broken, the second target could be 86.043 JPY .

Note: Stop Loss(SL): 88.378 JPY

Please respect each other's ideas and express them politely if you agree or disagree.

New Zealand Dollar/ Japanese Yen Analyze (NZDJPY), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Wedge

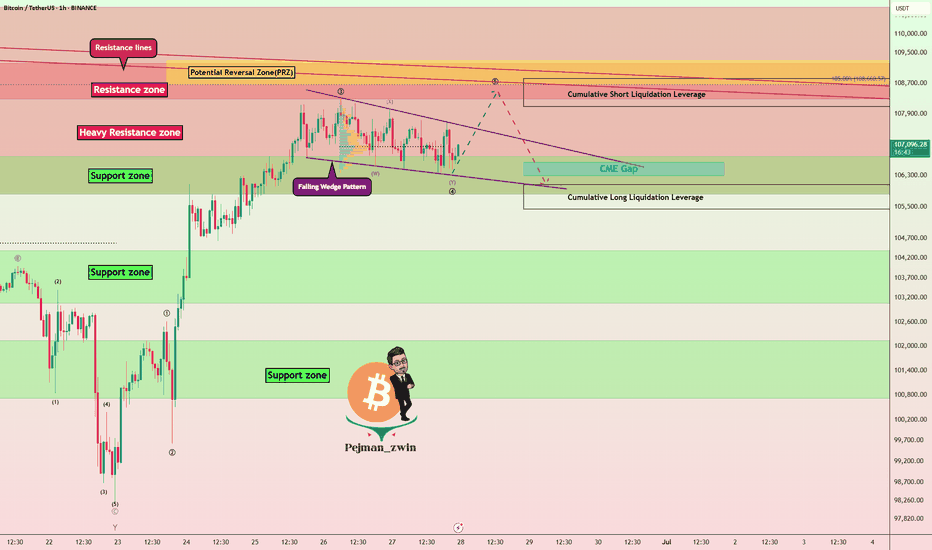

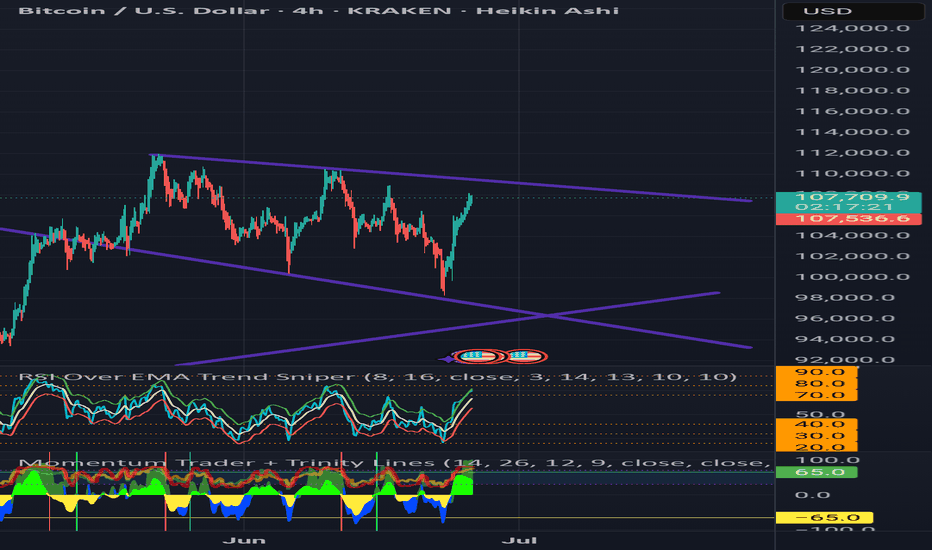

Bitcoin Approaches PRZ – Will the Falling Wedge Break ?Bitcoin ( BINANCE:BTCUSDT ) failed to break through the Support zone($106,800-$105,820) after attacking it five times , and started to rise again.

Bitcoin is currently moving near the Resistance zone($109,220-$108,280) , Cumulative Short Liquidation Leverage($108,800-$108,085) , Potential Reversal Zone(PRZ) , and Resistance lines .

From a Classical Technical Analysis perspective , Bitcoin's movements over the past two days seem to have formed a Falling Wedge Pattern .

From an Elliott Wave theory perspective , Bitcoin appears to have completed the main wave 4 within the Falling Wedge Pattern. The structure of the main wave 4 was a Double Three Correction(WXY) .

I expect Bitcoin to attack the Resistance lines after breaking the upper line of the Falling Wedge Pattern . If Bitcoin fails to break the Resistance lines before the global markets close , we can expect Bitcoin to fall again. Because entering Saturday and Sunday , the trading volume is generally low , and I think Bitcoin needs a lot of volume to break the resistances .

Do you agree with me?

CME Gap: $106,645-$106,295

Cumulative Long Liquidation Leverage: $106,055-$105,430

Note: If Bitcoin manages to break the Support zone($106,800-$105,820), we should expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

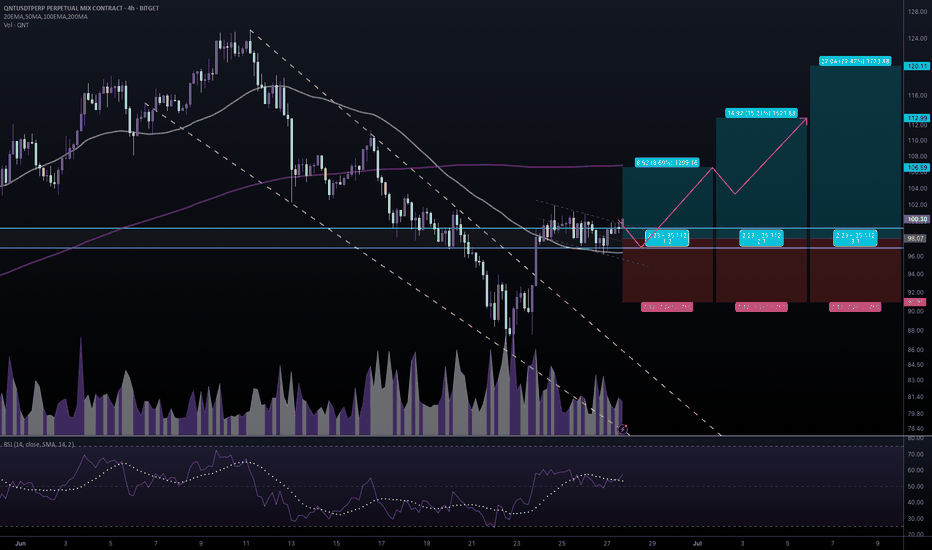

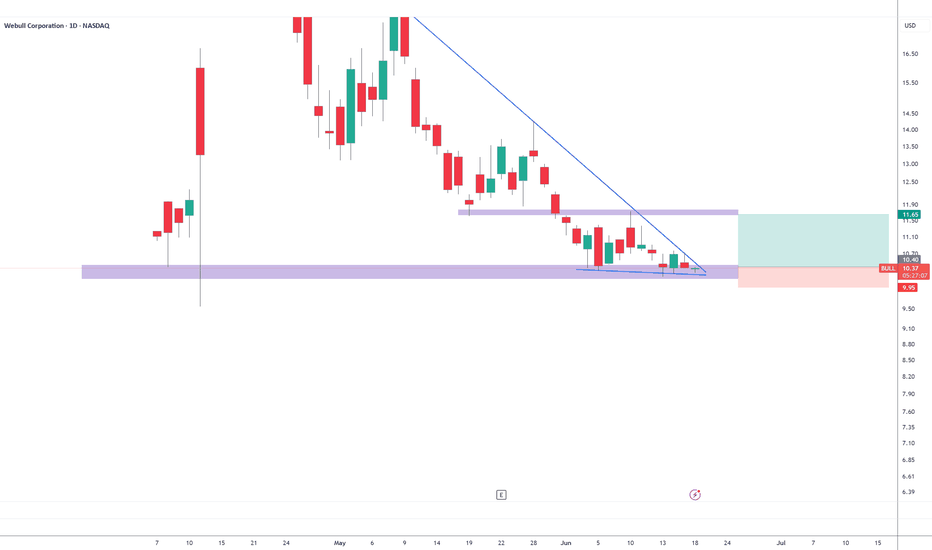

#QNTUSDT #4h (Bitget Futures) Bull flag near breakoutQuant regained 50MA support after breaking out of the falling wedge, bullish continuation seems likely.

⚡️⚡️ #QNT/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (6.0X)

Amount: 4.6%

Current Price:

100.30

Entry Zone:

99.22 - 96.92

Take-Profit Targets:

1) 106.59

2) 112.99

3) 120.11

Stop Targets:

1) 90.95

Published By: @Zblaba

GETTEX:QNT BITGET:QNTUSDT.P #4h #Quant #RWA quant.network

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.1

Expected Profit= +52.1% | +91.3% | +134.8%

Possible Loss= -43.6%

Estimated Gaintime= 1-2 weeks

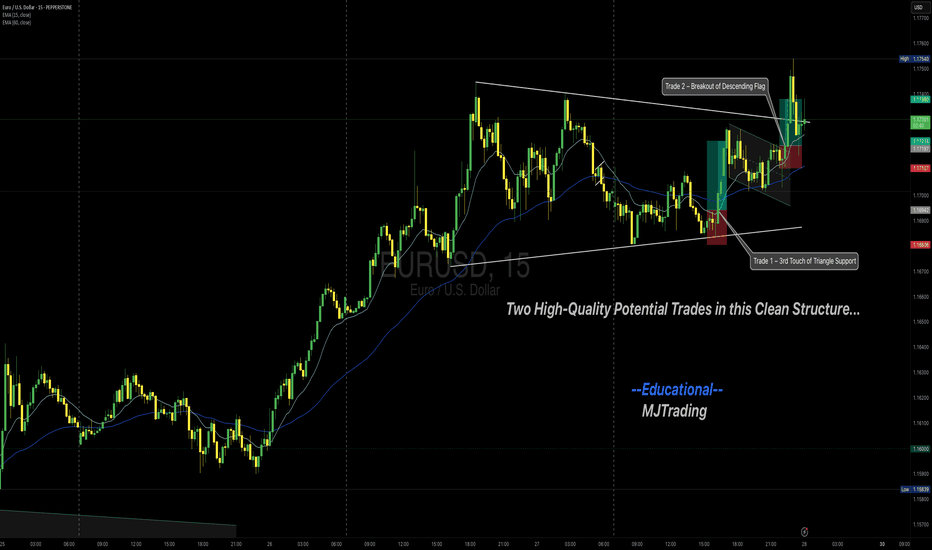

EURUSD – 2 Potential Intraday Setups (5-Min Chart)Chart Overview:

This 5-min EURUSD chart shows two example trade setups aligned with the main uptrend. These are shared purely for learning how to recognize and plan structured entries.

(Details are being shown in m5 chart- if this in not working for you please follow to be able to see it- as it is a private idea)

🔹 Example Trade 1 – 3rd Touch of Triangle Support

✅ Context:

Price retested the lower boundary of a broad triangle/wedge for the third time—often a strong area for reactive buys in an uptrend.

✅ Plan Concept:

Entry: Reversal signal on the 3rd touch.

Stop: Below the signal bar low.

Target: Mid to upper wedge area (or TP2).

🔹 Example Trade 2 – Breakout of Descending Flag

✅ Context:

After bouncing off trendline support, price formed a descending flag consolidation.

✅ Plan Concept:

Entry: Break and close above flag resistance.

Stop: Below the strong breakout candle.

Target: Extension toward recent highs (or TP2).

💡 Important:

These examples are not signals and not executed trades—they illustrate a possible planning process for traders studying price action strategies.

💡 Why These Matter:

Both setups align with the primary uptrend, use clear structure for risk placement, and rely on confirmation before entry.

🔹 Note:

These are educational examples only, not trade signals.

💬 Do you study similar setups? Share your charts and thoughts!

Thanks for your attention and your time...

Follow for more setups

#EURUSD #Forex #TradingEducation #PriceAction #IntradayTrading #BreakoutTrading #TechnicalAnalysis #LearnTrading #TradingView

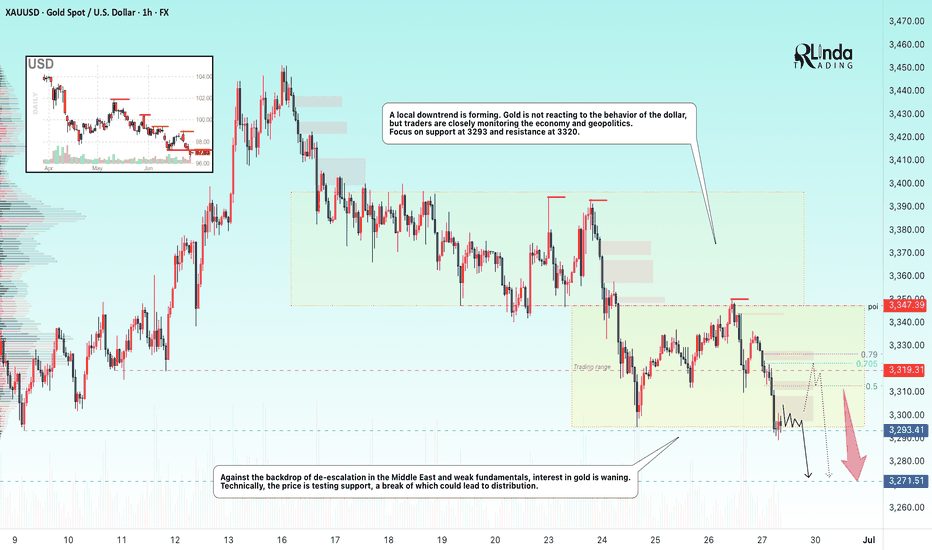

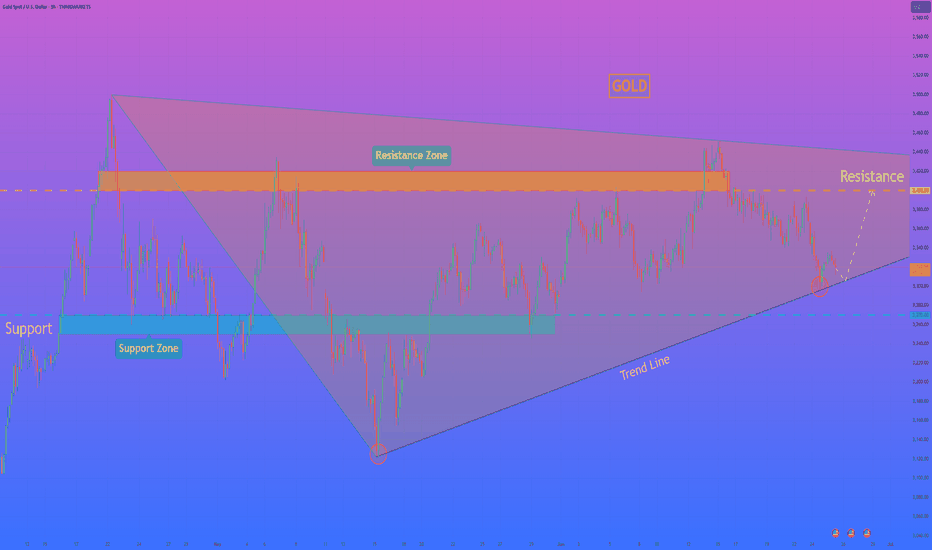

GOLD → Local bearish trend. Retest of support.FX:XAUUSD is technically looking a little weak. Support is being retested amid de-escalation of geopolitical conflicts in the Middle East. Interest in the metal is waning.

On Friday, gold remains under pressure ahead of data on the core PCE index, a key inflation indicator for the Fed. If inflation turns out to be higher than expected, this could strengthen expectations of a rate cut as early as July, supporting gold. The probability of a July cut is currently estimated at 21%, and 75% for September. Amid dollar volatility caused by rumors of a possible Fed chair replacement and trade negotiations with the EU and China, traders remain cautious, awaiting clarity on inflation and monetary policy

Technically, before falling, gold may form a correction to 3320 (liquidity capture).

Resistance levels: 3320, 3336, 3347

Support levels: 3293, 3271

If the fundamental background remains unchanged and gold continues to decline towards support at 3293 and break through this level, the breakout could lead to a fall to 3271. However, I do not rule out the possibility that after a sharp decline, a correction to 3320 could form before the fall.

Best regards, R. Linda!

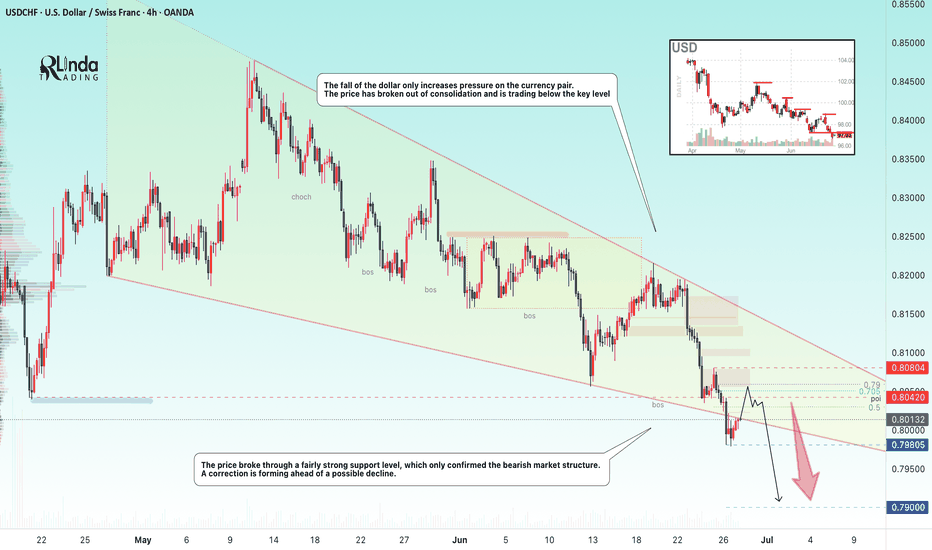

USDCHF → Hunting for liquidity before the fallFX:USDCHF , against the backdrop of the falling dollar and the exit from consolidation, is forming another ‘bos’, which only confirms the market sentiment.

The fall of the dollar only increases pressure on the currency pair. The price has broken out of consolidation and is trading below the key level. USDCHF has broken through a fairly strong support level, which only confirms the bearish market structure. A correction is forming ahead of a possible decline (liquidity capture).

Resistance levels: 0.803, 0.8042

Support levels: 0.798, 0.79

Fundamentally and technically, the currency pair looks weak. The decline may continue after the liquidity capture phase and a retest of resistance. A false breakout of resistance will be a strong signal.

Best regards, R. Linda!

HelenP. I Gold will rebound up from trend line to $3400 levelHi folks today I'm prepared for you Gold analytics. After looking at this chart, we can see how the price after a prolonged consolidation inside a large wedge pattern, XAUUSD, approached the ascending trend line again - this line has acted as a key support several times in the past. This time is no exception: the price reacted to it with a bullish bounce. We can see a confluence here — trend line support coincides with the lower boundary of the wedge and the local support zone at 3270 - 3250 points. Now the price is trading above this line, showing early signs of recovery. Given the symmetry of this structure and past behavior, I expect gold to continue rising from current levels. The nearest major obstacle lies in the resistance zone around 3400 - 3420, which acted as a turning point before. That’s why my current goal is set at the 3400 level. If bulls hold the trend line, we may see a steady move toward this key resistance. Given the trend line reaction, wedge structure, and current momentum, I remain bullish and expect further growth. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BTC.D ANALYSIS BTC.D – Daily Chart Analysis 🧠

Bitcoin dominance is forming a rising wedge pattern – a typically bearish structure.

We’re now at the upper resistance; a rejection here could trigger a strong move down, opening the path toward 56–57% levels.

If confirmed, altcoins might get temporary relief.

Watch for a break of the lower trendline for confirmation.

Not financial advice – DYOR

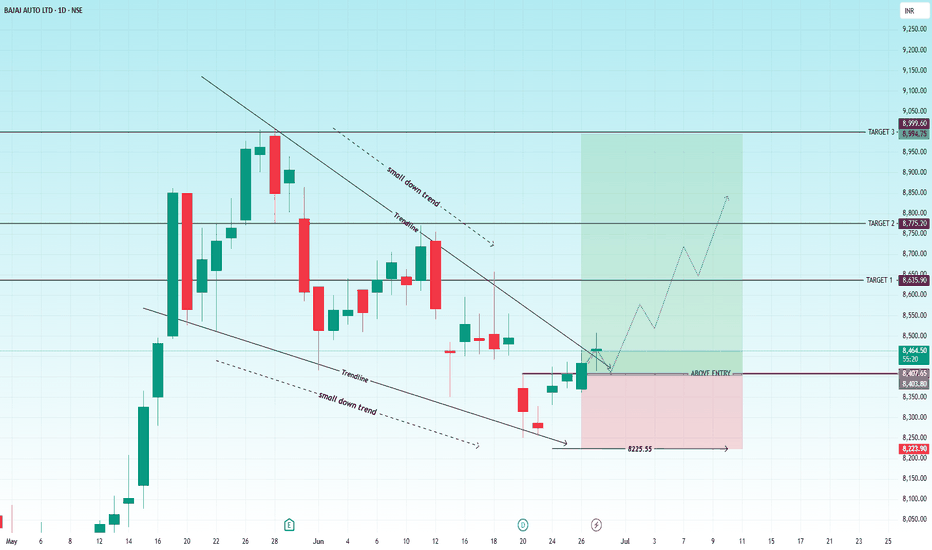

BAJAJ AUTO LTD – Trendline Breakout with Upside Potential NSE:BAJAJ_AUTO – Trendline Breakout (The setup offers a favorable risk-reward ratio, with potential for ~500+ points upside from the breakout zone.)

Chart Type: Daily (1D)

Current Price: ₹8,455

Structure: Falling wedge breakout with defined targets

Falling Wedge Formation:

The price has been consolidating within a falling wedge pattern, indicating a potential bullish reversal.

Both upper and lower trendlines (labeled as "small down trend") have been respected multiple times, validating the structure.

Breakout Confirmation:

A breakout above the descending trendline has occurred, accompanied by a bullish candle closing above the immediate resistance zone around ₹8,407.

This marks the breakout point and indicates a shift in momentum.

Support Zone:

Strong support has been established near ₹8,225.55, as marked on the chart.

This level can serve as a stop-loss for bullish positions.

-----

BUY: above 8410-8450

SUPPORT ( SL ) : 8220

RESISTANCE ( TGT) :8640-8780-9000+++

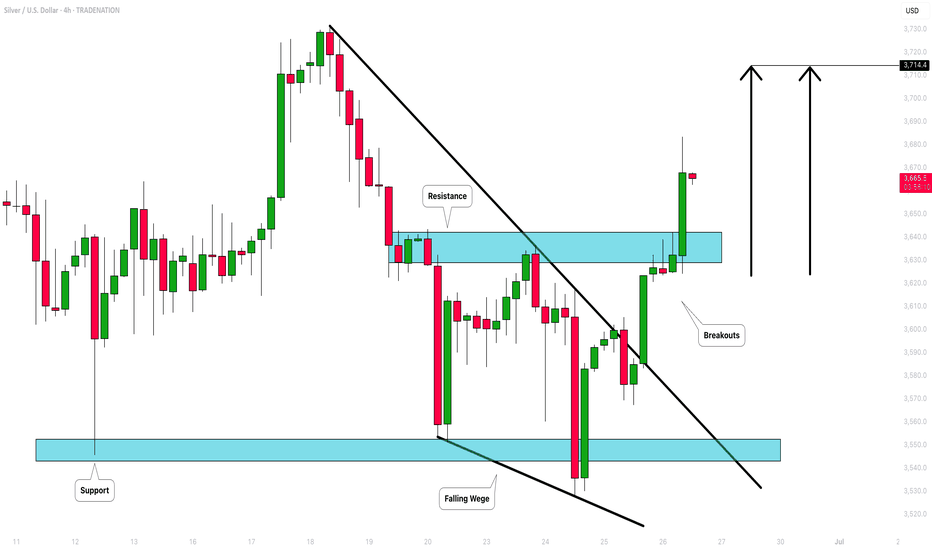

SILVER (XAGUSD): Buyers Show Strength

Silver is going to rise more, following a strong bullish sentiment this morning.

The price violated a strong falling trend line and an intraday horizontal resistance.

These 2 breakouts indicate a strong buying pressure.

The price may grow more today and reach 37.14 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

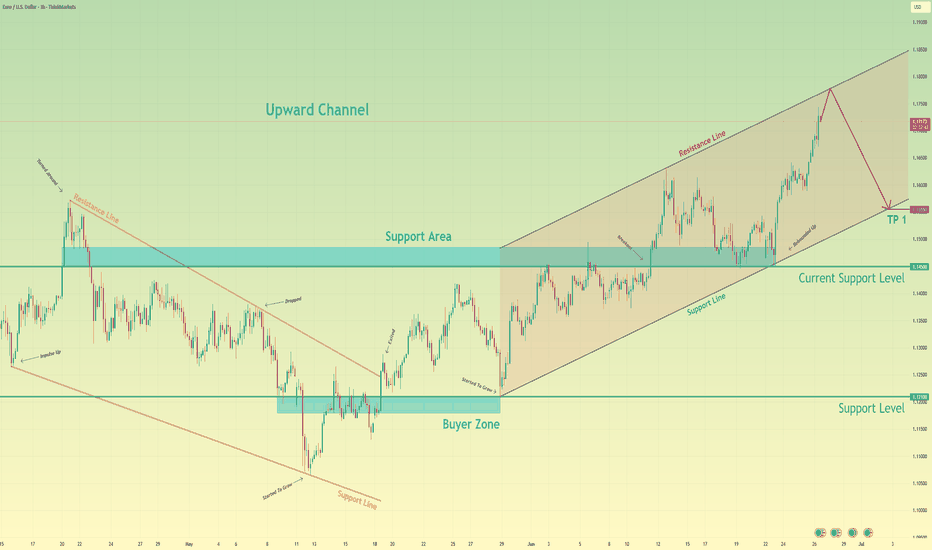

Euro may start to decline to support line of upward channelHello traders, I want share with you my opinion about Euro. Earlier, the price was trading inside a downward wedge, gradually making lower highs and lower lows. After reaching the bottom of the wedge near the buyer zone (1.1210 - 1.1180), we saw a strong bullish impulse that broke through both the resistance line of the wedge and the support area near 1.1450 - 1.1485. This breakout signaled the beginning of a new phase - a transition into an Upward Channel. Since then, the price has been forming higher highs and higher lows, respecting both the upper and lower boundaries of this new structure. Along the way, it has rebounded from the support line multiple times and recently made a strong move up toward the resistance line of the channel. Currently, the price is approaching that resistance line, which may act as a potential reversal area. Given the previous price behavior and the clearly defined channel, I expect the price to reach the top boundary and then start to decline toward the lower support line. That’s why I’ve set my TP 1 at 1.1555 points, which aligns perfectly with the support line of the upward channel. Based on the recent breakout, the structure of the trend, and the reaction from key zones, I remain short-biased for the upcoming sessions. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

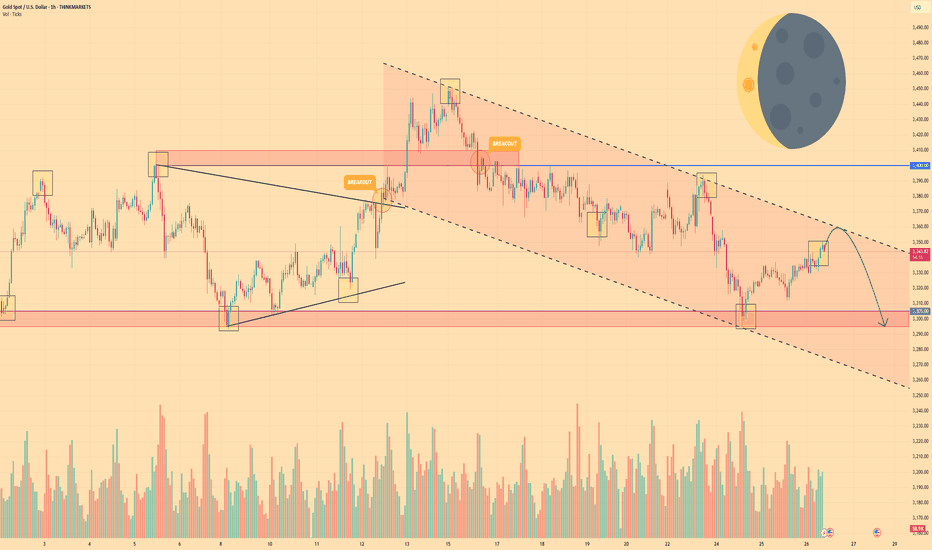

GOLD - Price can continue to move down in falling channelHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some days ago price bounced from support level and started to grow to $3400 level, making a small correction before.

When it reached this level, price entered to wedge, where it made a correction and then started to grow.

In a short time, price exited from wedge and soon broke $3400 level, but then it started to decline in a falling channel.

In falling channel, Gold broke $3400 level one more time and in a short time declined to $3305 support level.

After this movement, Gold turned around and started to move up to resistance line of channel.

I expect that Gold can reach resistance line of channel and then start to decline to $3295 support area.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

US30: Short setup brewingSitting in a rising wedge with bearish divergence after running into resistance at 43100, the US30 contract finds itself at an interesting juncture on the charts. If it can’t stage a definitive break above these levels, a short setup could be on the cards.

If the contract cannot break and hold above 43100, traders could look to initiate short positions targeting the 200-day moving average initially. If that were to give way, the target could be lengthened to 42000, where wedge support is currently found. A stop above 43100 would protect against reversal.

While MACD has staged a bullish crossover, the momentum signal is countered by what’s still bearish divergence between RSI (14) and price despite the latest bounce.

Given the proximity to month end—a period notorious for window dressing and false signals—the preference would be to wait for another retest and failure at 43100 before initiating the trade.

A de-escalation in trade tensions, lower crude prices and the prospect of a Fed rate cut as soon as July have been tailwinds for the contract over recent days. If it can’t continue to rally in this environment, it questions just what would be required to deliver further upside, just as negative tariff headlines potentially loom.

Good luck!

DS

Descending broadening wedge after peak BTC/USD 4hCurrently BTC/USD is in a descending broadening wedge after a peak.

This means high chance of upward breakout. Price increase from breakout point is usually the difference from pattern top to pattern bottom, which would mean a price of $123000.

Not financial advice. There is a chance of this not playing out, even though the chance is small.

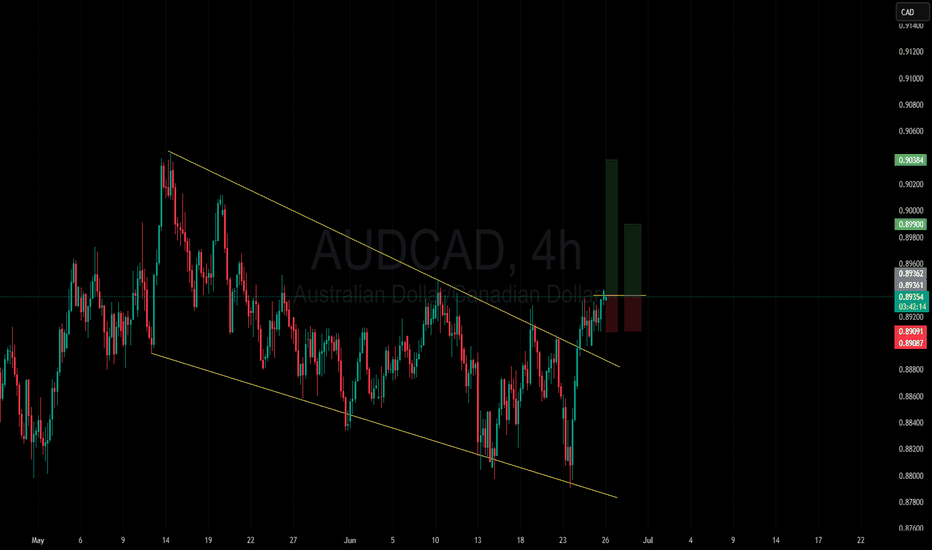

Expecting AUDCAD price increaseOn AUDCAD, the main bearish channel has been broken.

After the breakout of a micro channel as well, I’m expecting a potential bullish move to the upside.

Price action confirmation is aligned with this view.

There are two goals in this deal which is specified.

good luck

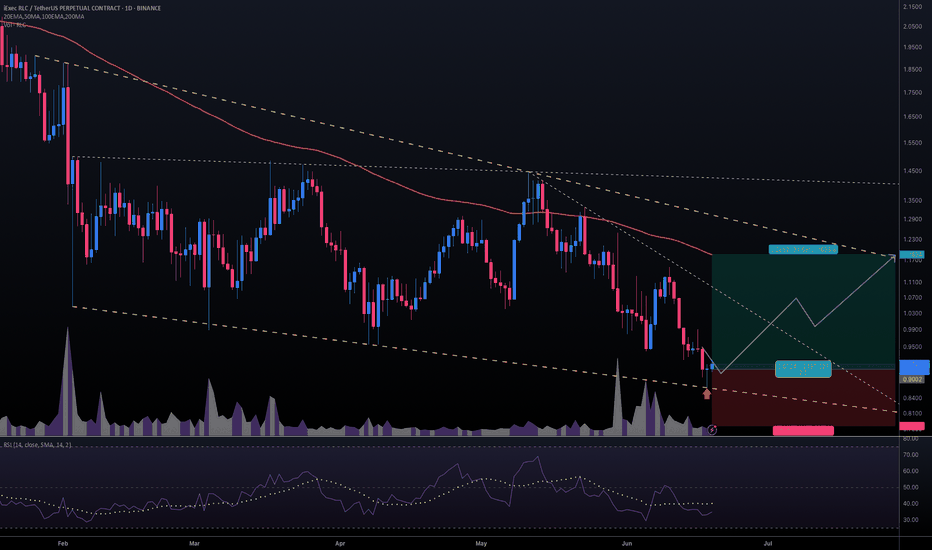

#RLCUSDT #1D (Binance Futures) Descending wedge on supportiExec RLC just printed a dragonfly doji which may have marked the bottom on daily.

A morning star is drawing now, recovery towards 100EMA resistance seems around the corner.

⚡️⚡️ #RLC/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 5.9%

Current Price:

0.9126

Entry Targets:

1) 0.9002

Take-Profit Targets:

1) 1.1854

Stop Targets:

1) 0.7859

Published By: @Zblaba

GETTEX:RLC BINANCE:RLCUSDT.P #DePIN #AI #iExec iex.ec

Risk/Reward= 1:2.5

Expected Profit= +126.7%

Possible Loss= -50.8%

Estimated Gaintime= 1 month

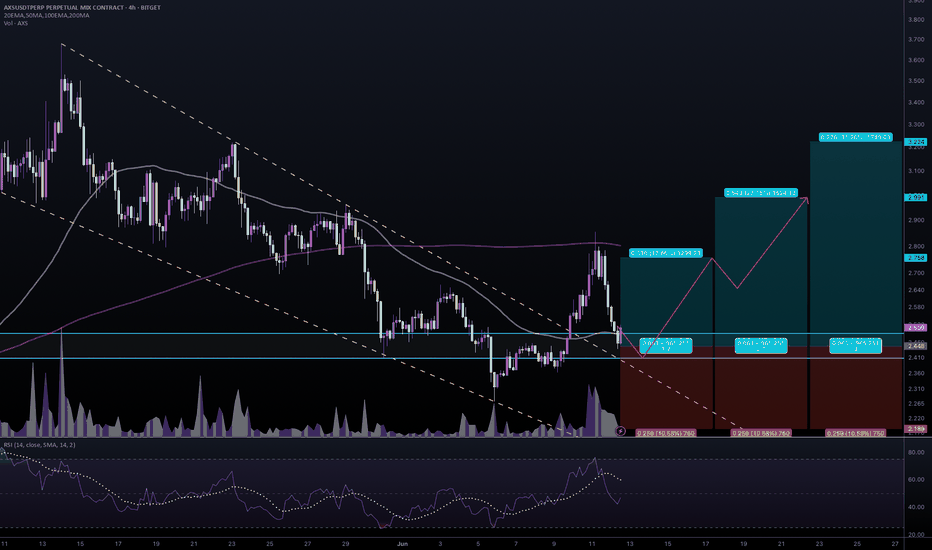

#AXSUSDT #4h (Bitget Futures) Falling wedge breakout and retestAxie Infinity just pulled back to 50MA support where it's bouncing, looks ready for recovery towards 200MA resistance and more.

⚡️⚡️ #AXS/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 4.7%

Current Price:

2.509

Entry Zone:

2.489 - 2.407

Take-Profit Targets:

1) 2.758

2) 2.991

3) 3.224

Stop Targets:

1) 2.189

Published By: @Zblaba

NYSE:AXS BITGET:AXSUSDT.P #4h #AxieInfinity #P2E axieinfinity.com

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +50.7% | +88.7% | +126.8%

Possible Loss= -42.3%

Estimated Gaintime= 1-2 weeks

ONDOUSDT – POTENTIAL BREAKOUT TRADE SETUP!Hey Traders — if you're into high-conviction setups with real momentum, this one’s for you.

ONDO is trading inside a falling wedge on the daily chart — a classic bullish structure that often leads to explosive breakouts. 📈

Accumulation Zone: Price is currently sitting inside the green support box, which has held strong multiple times. This makes it a good area to start accumulating before a potential breakout.

🚀 Breakout not confirmed yet, but structure looks promising. A breakout above the wedge will be the confirmation trigger.

📌 Trade Setup:

✅ Entry (Spot Accumulation): $0.73–$0.78

🎯 Targets after breakout: $1.10 / $1.45 / $2.05

🛑 Stop-loss: $0.58

📈 Bias: Bullish on breakout

🔸 Monitor for a clean breakout candle + volume above the wedge.

🔸 Manage position sizing while accumulating in the zone.

Let’s see if history repeats and ONDO gives us a strong breakout move.

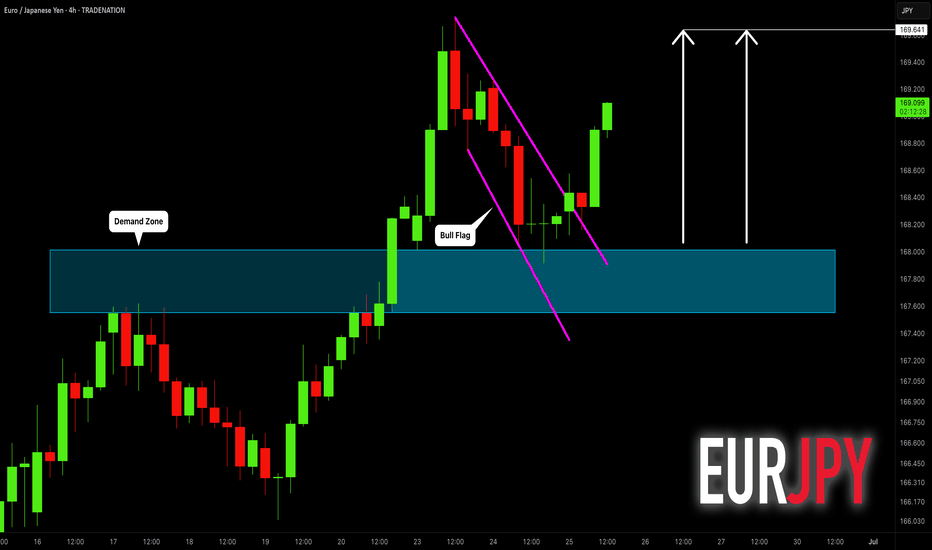

EURJPY: Bullish Trend Continues 🇪🇺🇯🇵

EURJPY shows a strength after a test of a significant demand zone.

Bullish breakout of a resistance line of a flag pattern provides

a strong trend-following signal.

Goal - 169.64

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

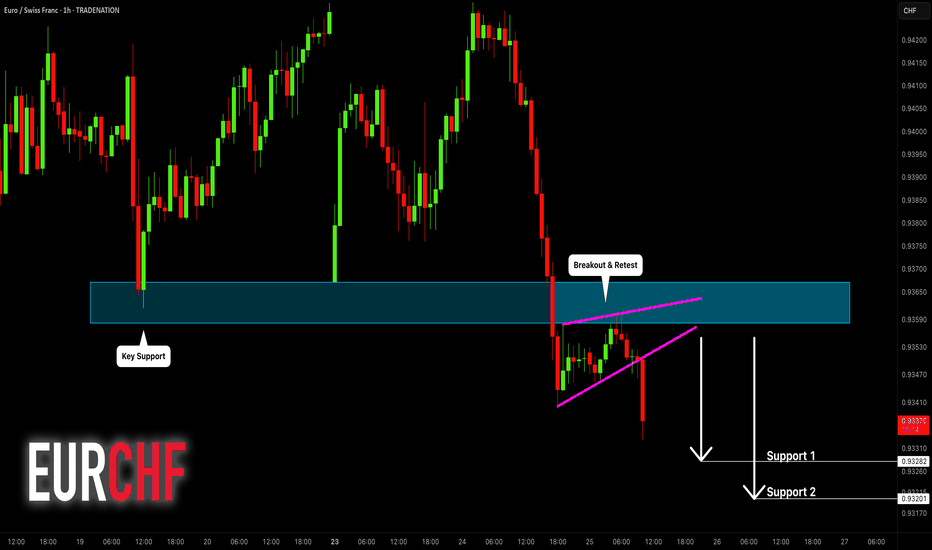

EURCHF: Bearish Continuation After Breakout 🇪🇺🇨🇭

EURCHF violated a significant horizontal support.

Retesting that, a bearish flag pattern was formed.

Its support violation provides a strong intraday confirmation.

The pair may drop lower at least to 0.9328

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.