Weeklyanalysis

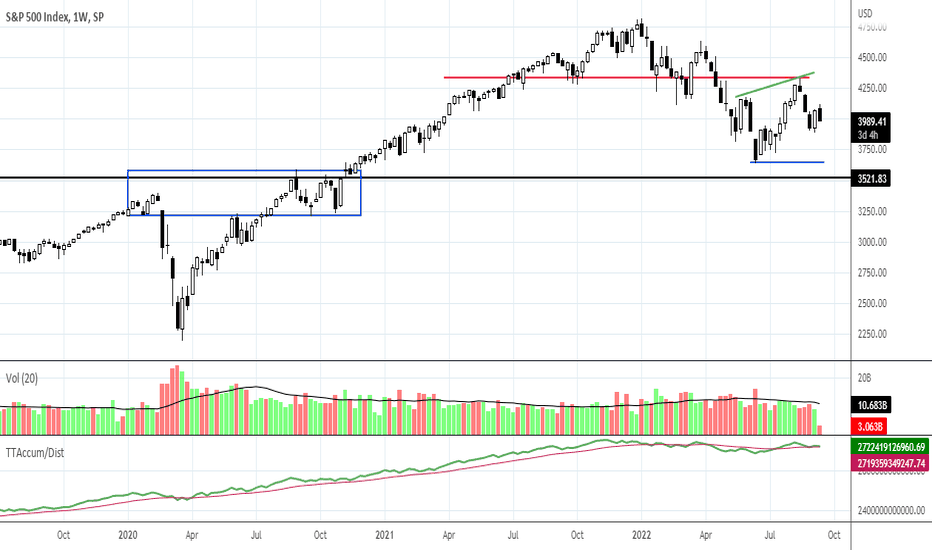

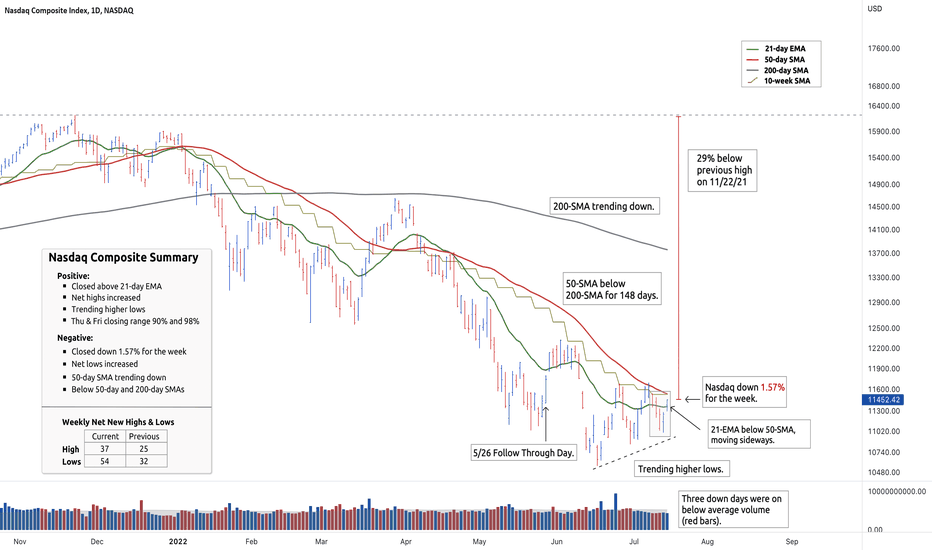

SPX: Watching Strong Support from the 2020 HighsWeekly charts are ideal for evaluating the retest of the lows of the stock market’s bottom attempt which reached a higher high in August. Volume on the weekly scale shows lower activity than in the prior weeks. The lows of June are still not yet reached; that is the level that is being retested currently. Support is strong at the 2020 yearly highs, which is also the neck of the bear market of 2020.

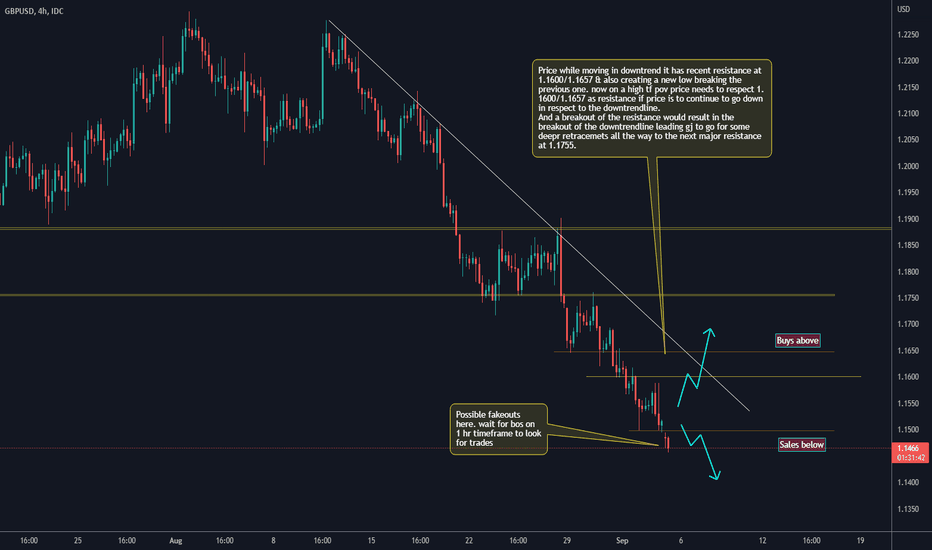

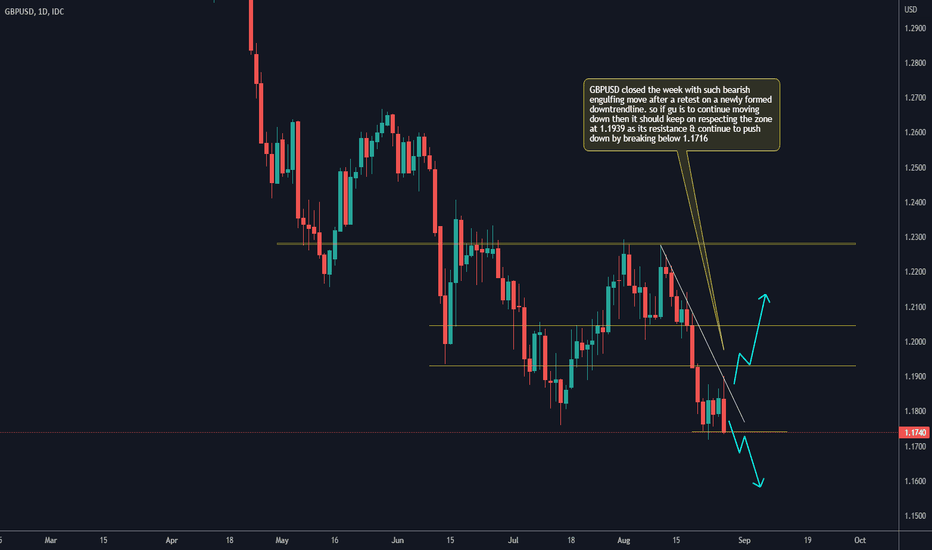

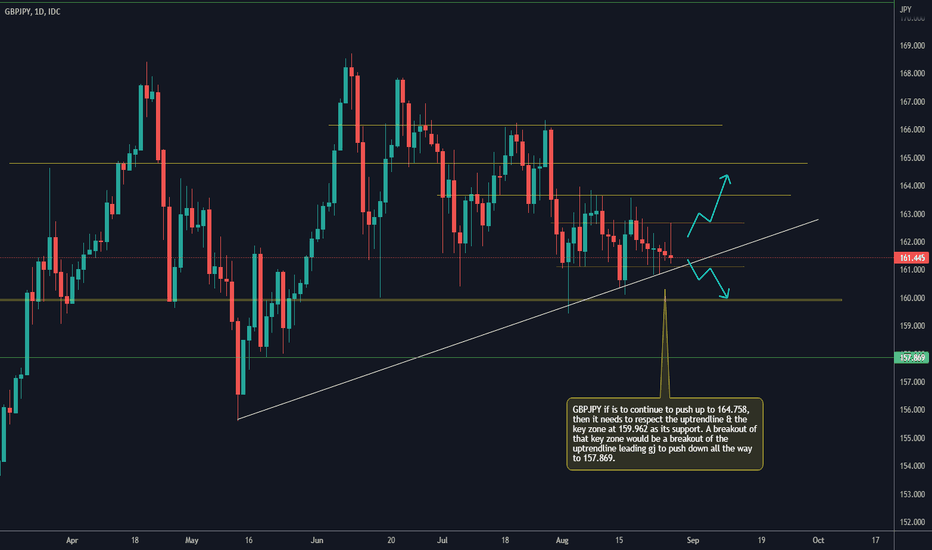

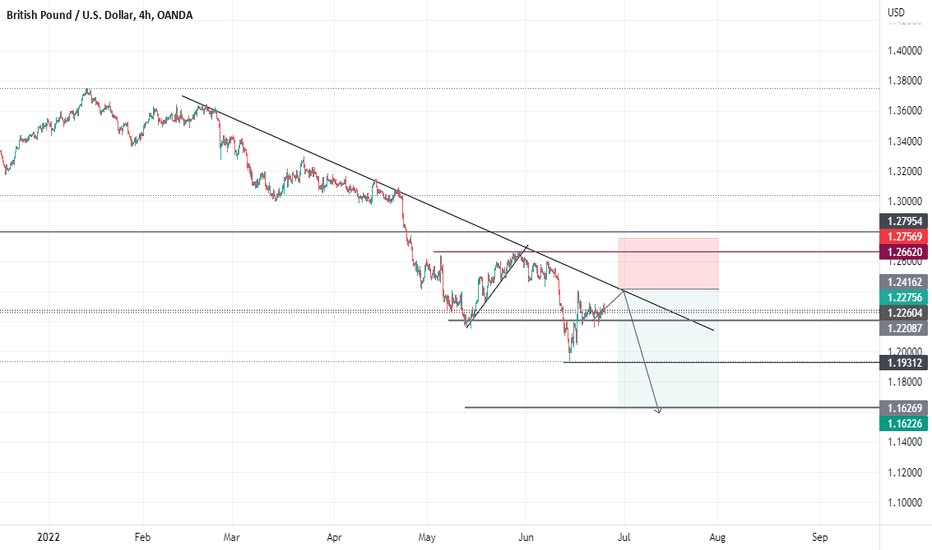

GBPUSD 05/09/2022 to 09/09/2022Price while moving in downtrend it has recent resistance at 1.1600/1.1657 & also creating a new low breaking the previous one. now on a high tf pov price needs to respect 1.1600/1.1657 as resistance if price is to continue to go down in respect to the downtrendline.

And a breakout of the resistance would result in the breakout of the downtrendline leading gj to go for some deepr retracemets all the way to the next major resistance at 1.1755.

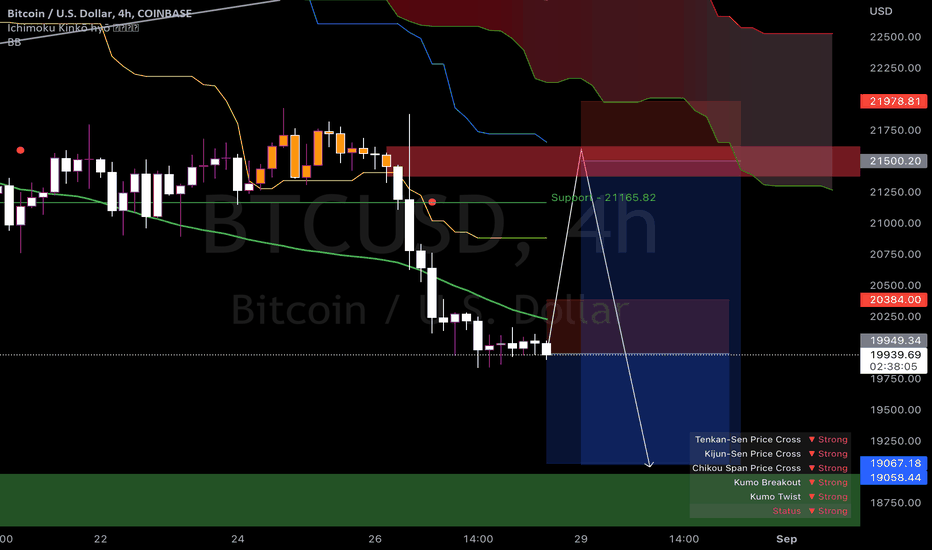

BTCUSD SELL IDEA (28.8.22)BTC broke the trendline (rising wedge) on 4hr and retested it, so I entered a first small sell with a tp at next demand zone, but it will very likely hit my SL, so I added an 3x big sell limit at the supply zone above us, that would be a 5RRR. You also can leave TP open and close partial at that level and let rest run till 10k-15k; because this could be a possible long term price.... use this opportunity and buy as much as you can.... BTC likely wont be that cheap ever again

GBPUSD Weekly Chart Analysis From 29 AUG to 2 SEP 2022GBPUSD closed the week with such bearish engulfing move after a retest on a newly formed downtrendline. so if gu is to continue moving down then it should keep on respecting the zone at 1.1939 as its resistance & continue to push down by breaking below 1.1716.

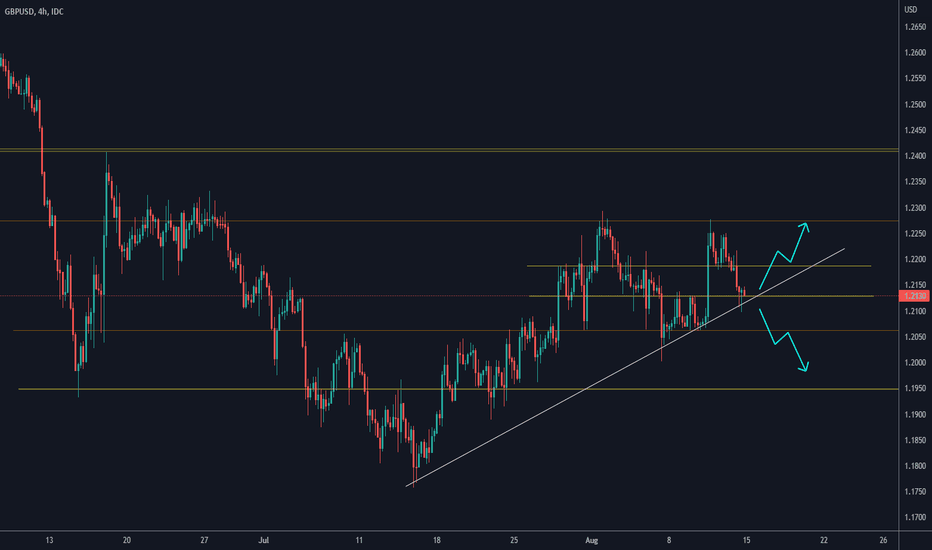

MichFX | GBPUSD started the next round of bearish movement

With an overall bearish trend , GBPUSD has finished a week+ bullish movement by reaching a strong resistance zone . It broke the ascendant channel and started its bearish movement. A successful retest of the zone will confirm the downtrend and will give more confidence to open short positions.

Share your opinion in the comments and support the idea with like.

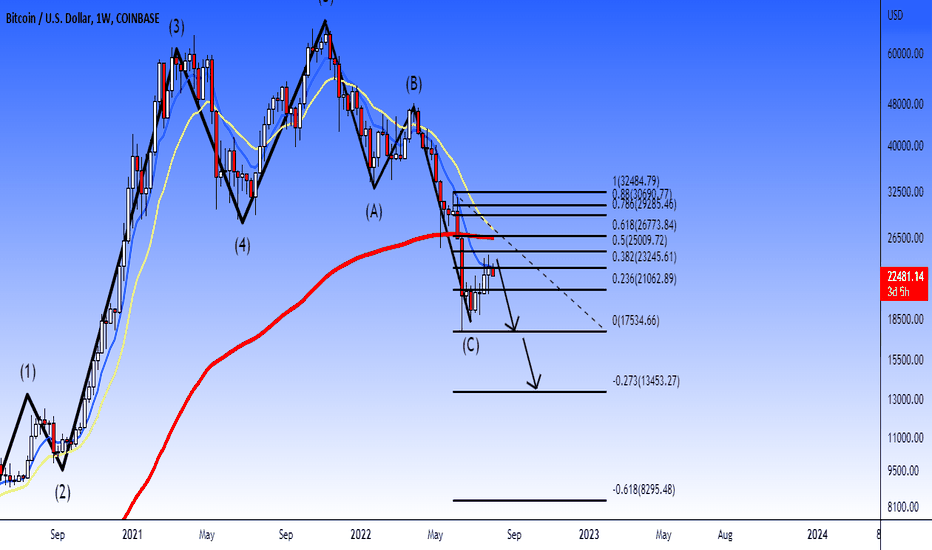

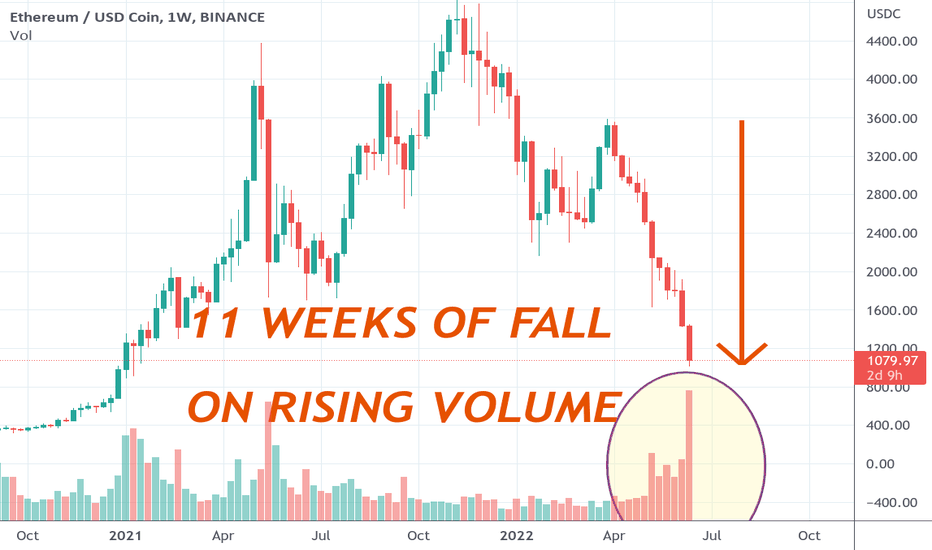

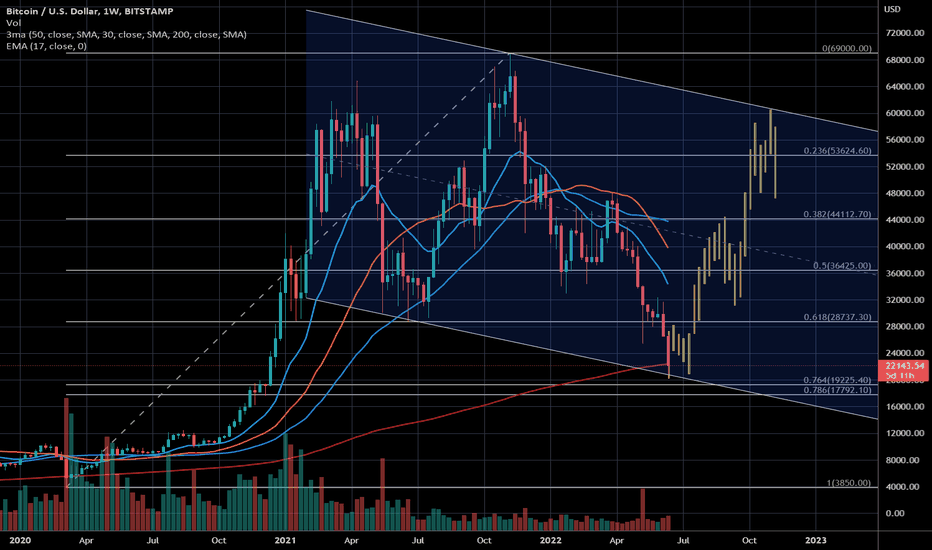

Weekly Analysis Overview: BitcoinIn this weekly analysis, Bitcoin it's in the 0.382% Fibonacci level, what we could to expect a market crash of another 40% to see. I expect that Bitcoin goes to $17,600 USD, and also the most lower price will be around $13,450 USD to watch and look if that price could be the stop of the bear market to know what could to happen in the future.

I'm still bearish in Bitcoin and altcoins.

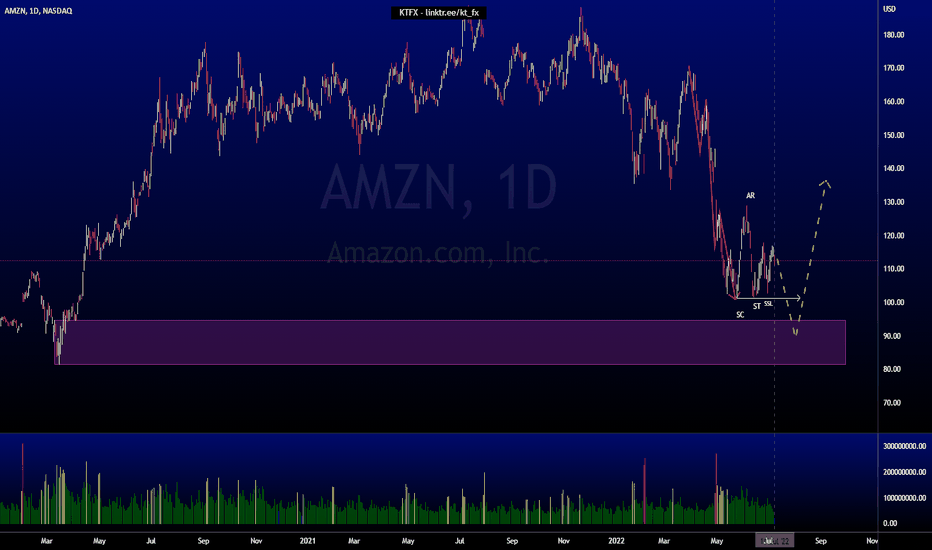

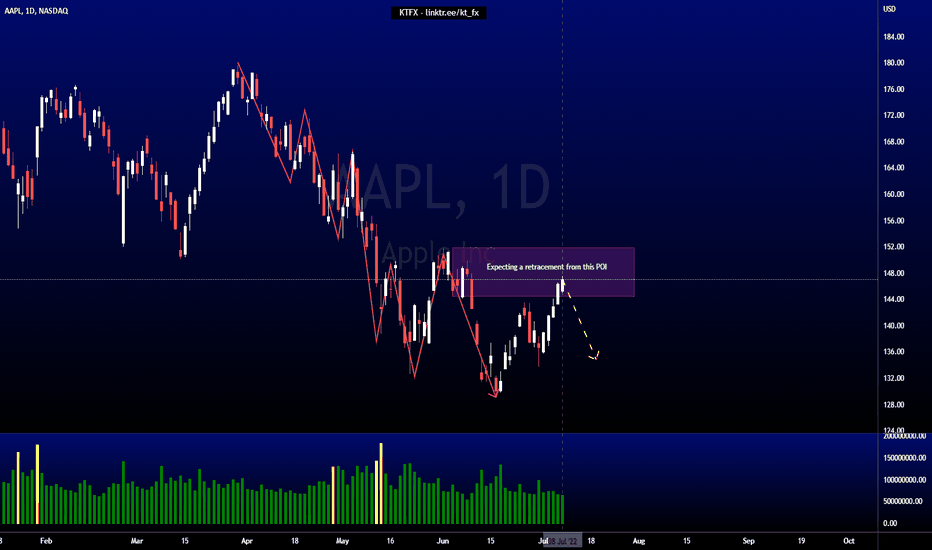

AMZN AnalysisPrice is on a downtrend. Seems like a wyckoff accumulation schematic has started with a change in character. However, price has created sell-side liquidity with a bullish POI nearby. I'm expecting a short term bearish move to take the liquidity and tapping into the bullish POI before we see any uptrend.

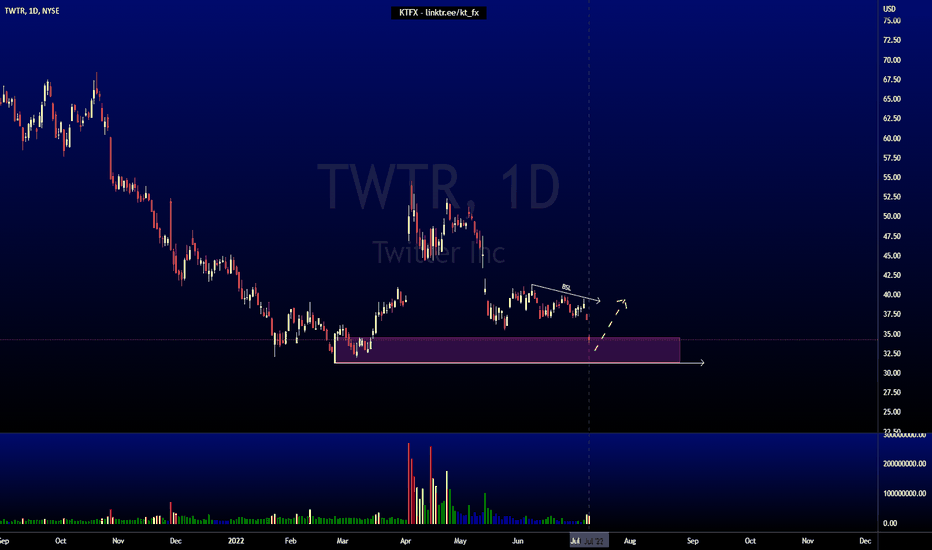

TWTR AnalysisPrice is on a downtrend, currently at a bullish POI. I'm expecting price to rally from here, taking out the buy-side liquidity created above. However, I do note of the fundamentals for this company and there is also a probability that price can take out the lows at 31.30. I'm leaning towards the bullish price movement.

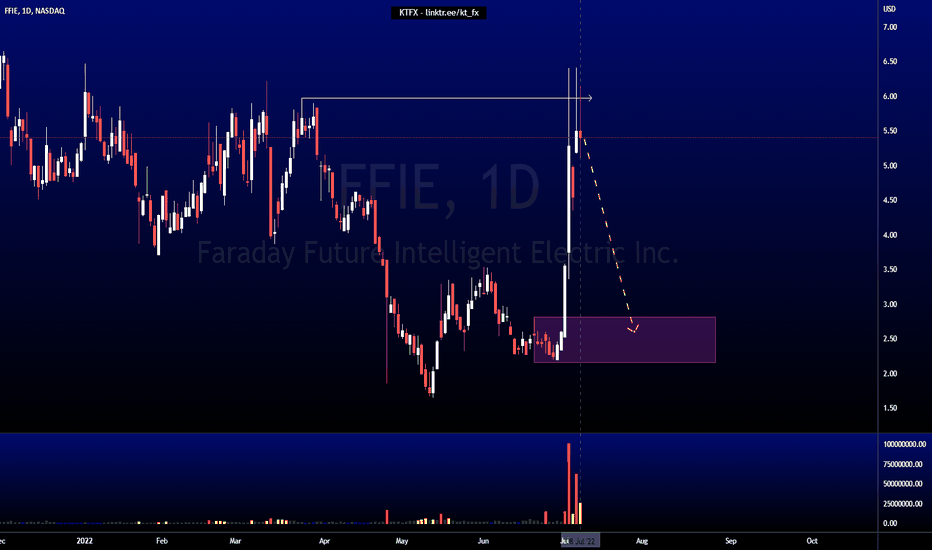

FFIE AnalysisPrice is on an uptrend. Price took liquidity and stop hunted the highs at 5.97. Price is unable to close higher. Expect price to retrace down to bullish POI.

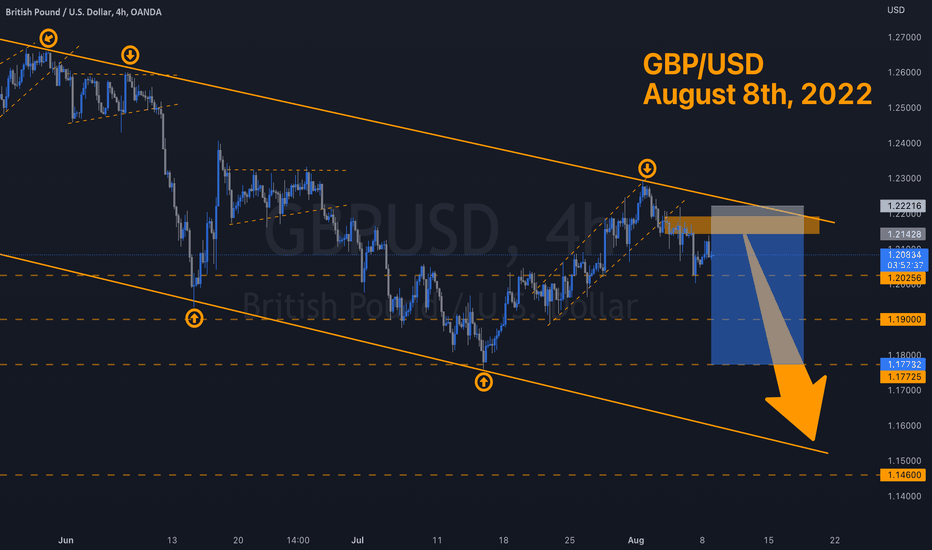

GBPUSDmy bias on gbpusd still remain bearish, tho anything can happen in the market but for now I'm expecting the market to retraced and form a new lower high around 1.24030 which in turn will create a double top and we short from there, if your bias is bullish you have to wait for the break of 1.27000 level