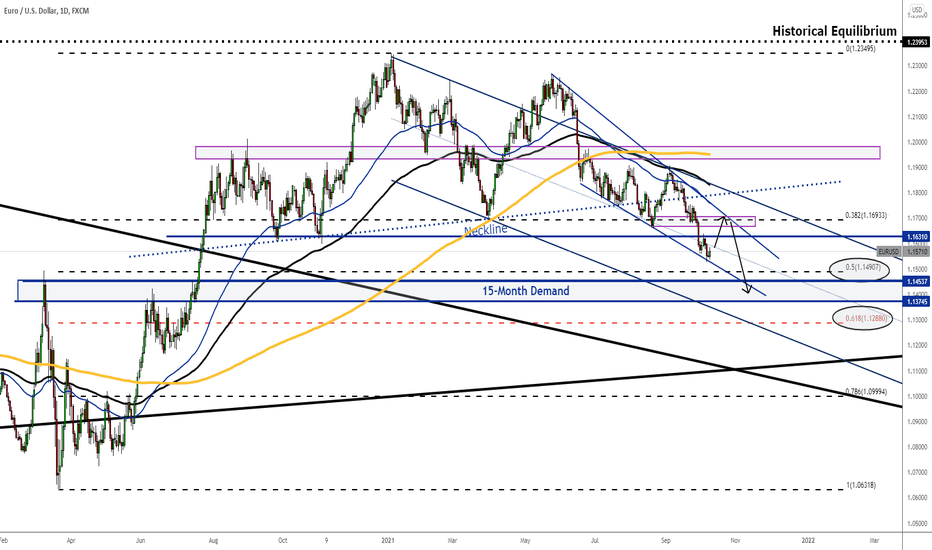

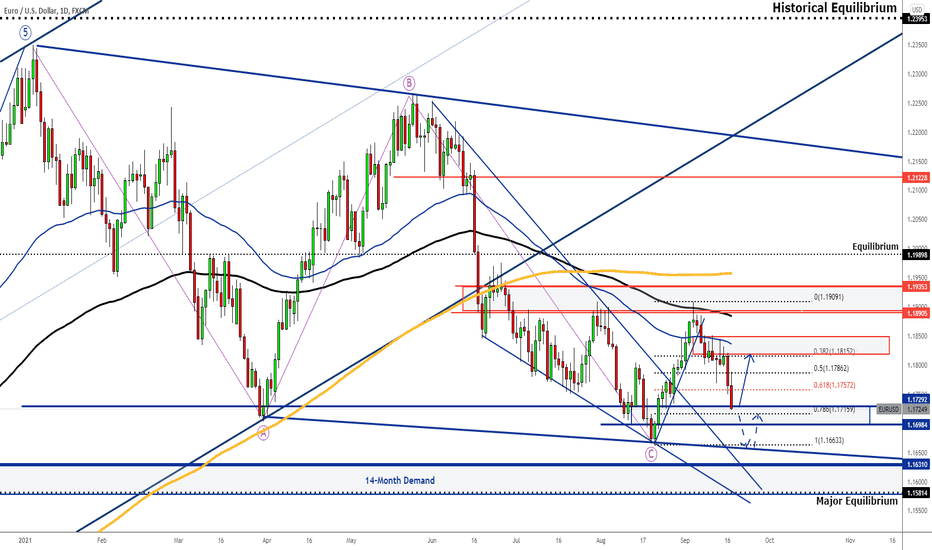

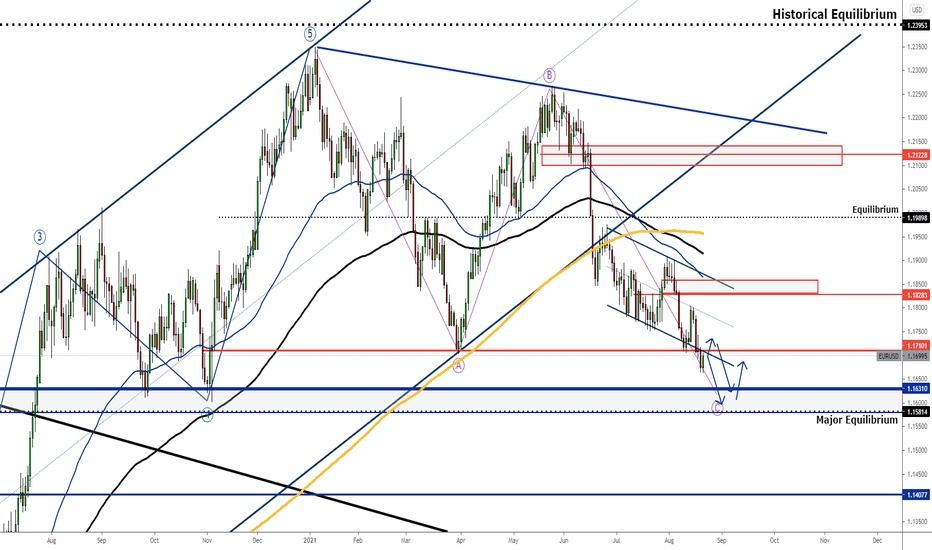

EURUSD: Weekly Forecast 10th October2021It's been close to 5 months since EURUSD embarked on a downtrend.

The current market conditions favour a bear market both fundamentally and technically.

On the technical aspect, the price is trading well below all moving averages where all of the fast MAs are below their slow MAs respectively.

The price is now less than a hundred pips from the FR50% level and right underneath is a 15-month demand zone, followed by the golden ratio.

Therefore, the current trading plan should be more accommodative towards selling, with 1.1680 - 1.1710 as the best supply level for entry.

Stay tuned for more daily trading ideas on EURUSD in the coming week!

Weeklyforecast

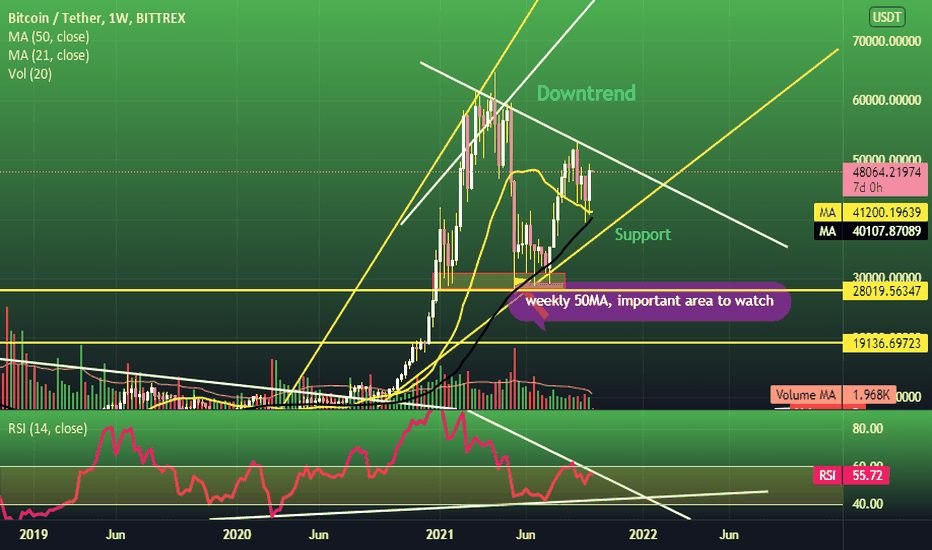

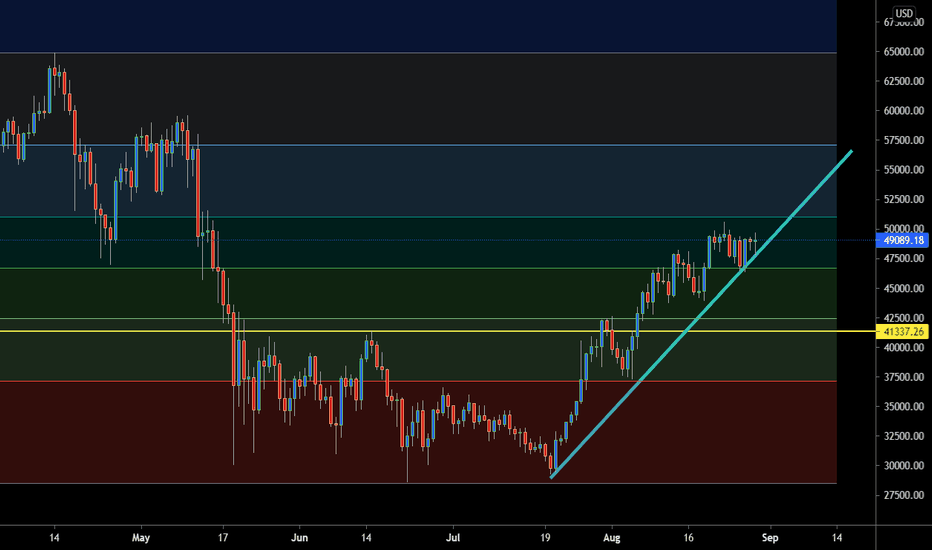

Btc nicely closed on weeklychart but Don't be FOMO in!!Technical Analysis: #Bitcoin(weekly closed)

In weekly time frame, btc trade above the both MA's( 21 and 50) and did nice bounce from 21WMA and Bitcoin did really nice closed on weekly chart but need break downtrend on weekly basis as well as RSI at resistance now, so Do not let your emotions make you FOMO.

Keep a hold, look at this chart again and again until you understand that the momentum is fading while the price is increasing. I don’t know. Just my thoughts.

DYOR

REMEMBER what I said, close above 52.5k means moon. Until then everything is a trap, at least for me.

You can make your own choice.

🥰If you find this helpful and want more FREE forecasts in Tradingview😍.

Please show your support back🙏,

Hit the 👍 LIKE button,

Drop some feedback below in the comment✍️!

❤️🤝 Your Support is very much 🙏 appreciated!❤️🤝

💎 Want me to help you become a better Crypto trader?

Now, It's your turn!

Be sure to leave a comment; let me know how you see this opportunity and forecast.

Trade well, 💪

#bitcoin #crypto #nextmove #bullmarket #sideways #btcusdt #weeklyclosed

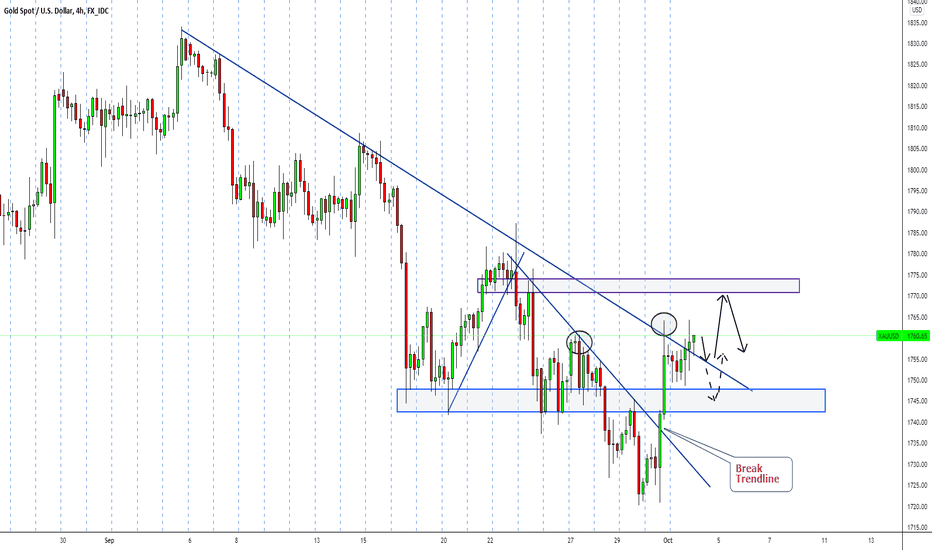

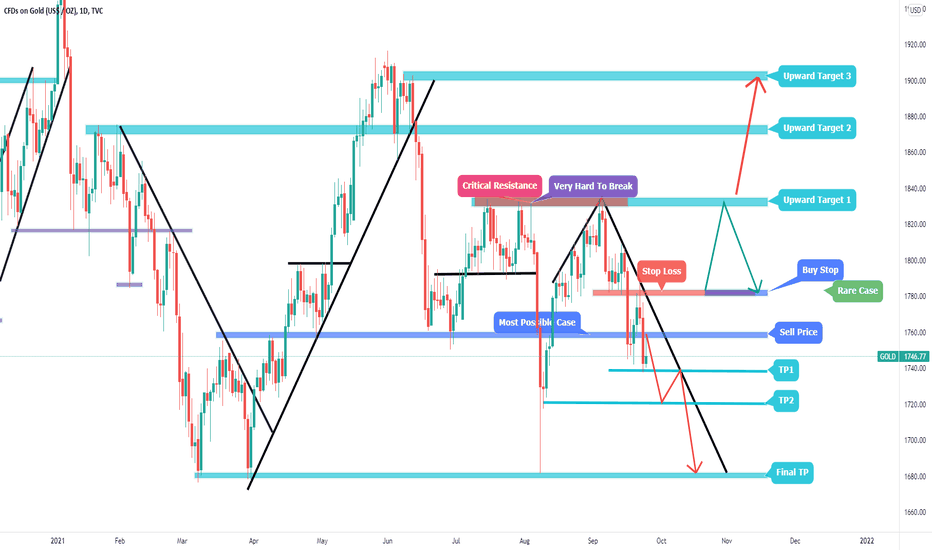

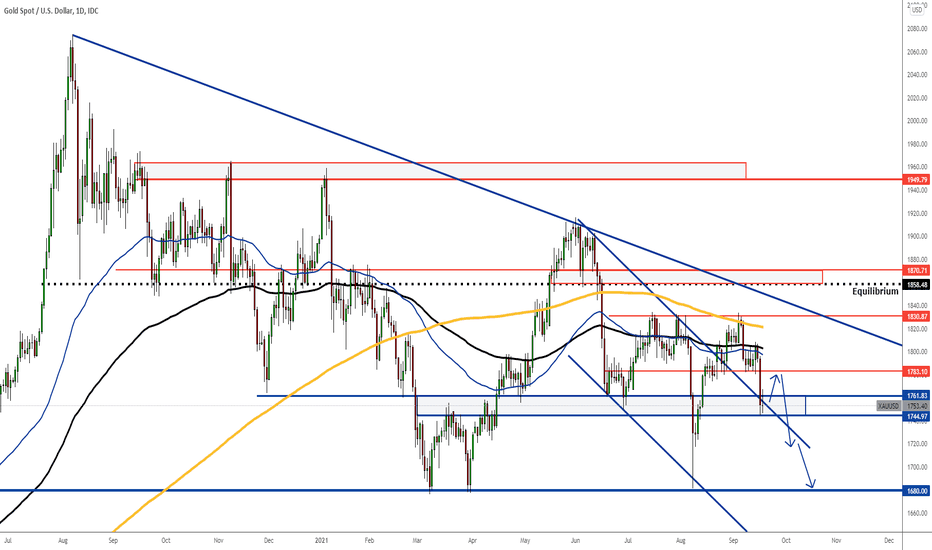

Gold: Weekly Forecast 3rd October 2021Gold was trending downwards at first but managed to rebound strongly at 1720.

It was managed to break above a falling trendline and created a higher high against two previous lower highs.

This is a strong sign that the gold will be able to recover further this week and therefore we can look to buy again if the price does pulls back lower before another jump.

This week, we will wait for a pullback towards 1750 demand level to look for buying opportunities.

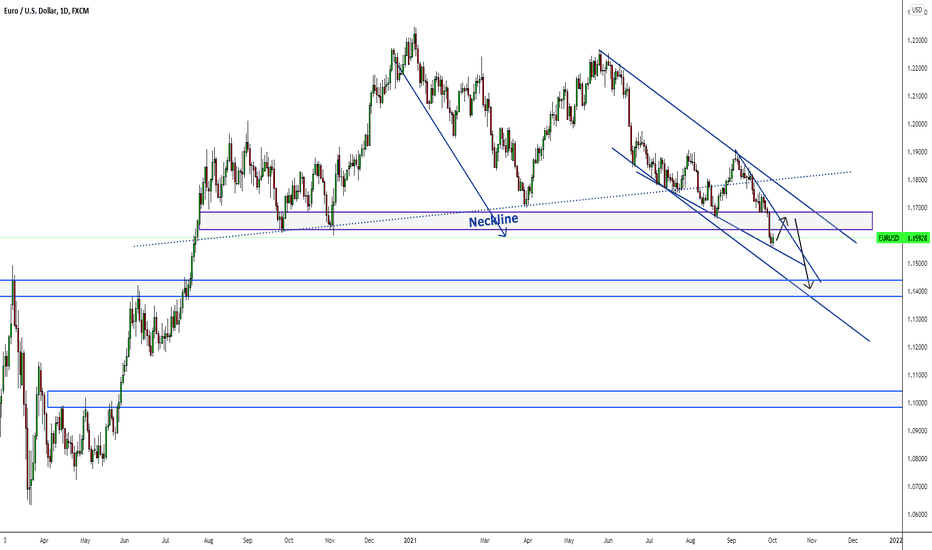

EURUSD: Weekly Forecast 3rd October2021EURUSD has broken below yet another important demand level at 1.1630 and closed with a very bearish weekly candle.

The dollar is clearly strengthening amid tightening expectation from the Fed grew stronger.

The trend is clearly bearish and thus we will continue to wait for selling opportunities.

If the market continues to find support at the beginning of the week, we could expect a pullback towards 1.1670 to sell, targeting 1.1520, then 1.1440.

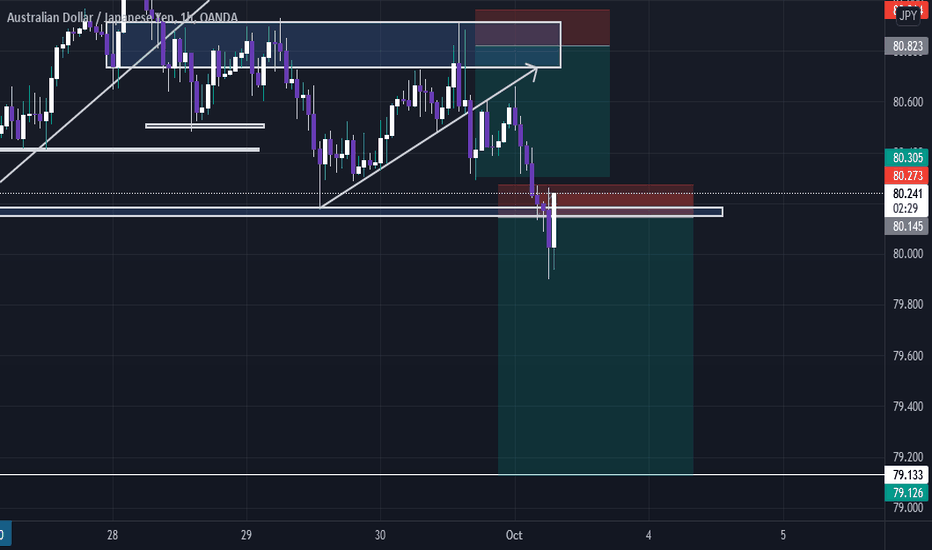

AUDJPY Bearish Weekly DirectionDespite Headlines showing traders sentiment stating traders (retail) are net Long on AUD/JPY . As a trader that can be misleading especial to the newbie traders coming into the industry , i find it easier to follow currently weekly structures and let the market lead me . Structure leaves clues, on a weeks perspective AUDJPY is bearish , it even started the week super bullish and that was my clue to wait for the break of structure and trade than on a retest . though its obvious now since its already friday. My point is if you follow structure and learn to see the market structure for the week let it develop then you will know around mid week the overall direction to trade. One good trade on each pair with a few scale ins were applicable is really all you need to be consisent. A consistent i picked up from ICT and added to my own trading

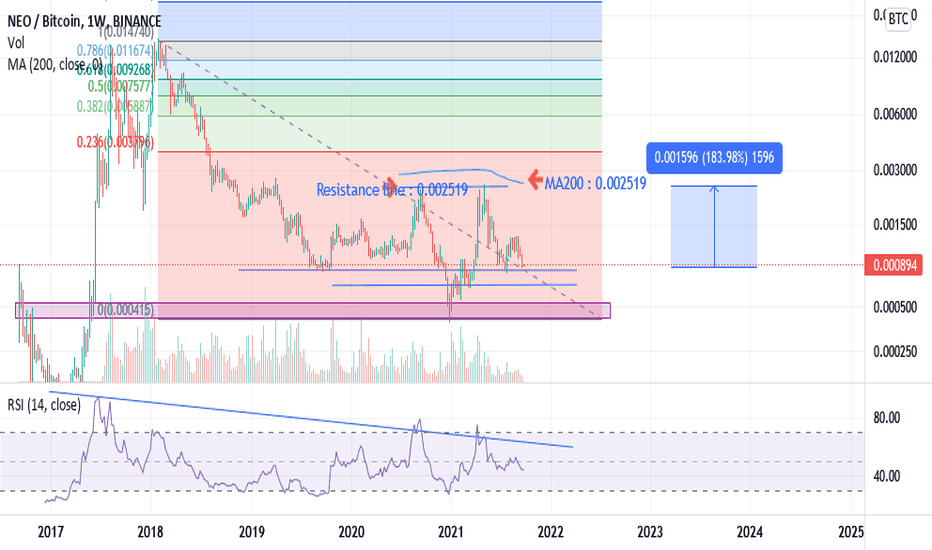

GOLDEN NEO WEEKLY TRAGET!!!Neo/BTC will buy two or three points on the weekly chart. In bitcoin modification, it is the best place to buy altcoins. I have no idea how much you want to buy or where to buy. Why?

Because at this moment, Neo is falling apart and with patience, you will earn a good profit.

Now look at the chart. Our distance to weekly MA200 is more than 180% profit. Will we get this benefit?

Look at the past of the market. Neo had already reached MA200 and hastily broke the roof. So the market is likely to repeat itself. We have to wait for the meeting.I will complete my point.

Also, this is not a financial Advise for you. And I draw this chart based on my own experience as well as my own trading spirit.

Be in profit!

Gold Weekly Forecast: September 27 to October 1st What happened last week? :

Last week was fantastic for the USD. USD became strong against all of the major currencies.

FOMC was hawkish as FED announced that if the U.S. upcoming economic data comes positive, they will start tapering very soon.

I mean, every high-impact positive report will help the USD and gold will drop.

What is not clear for the future?

Alternative scenarios, if the U.S. comes negative, FED's tapering chance will fade for this year. So, it will help the gold to push up.

But what my research says, as china injected al tons of money into their economy, that means they are trying to overcome the economic crisis. That may push down gold below the 1700 price zone.

FED also said, if the economic data support, they will also start the tapering. I mean, the U.S government will also start injection money to support their economy.

From my view, if the pandemic doesn't rise faster, till December, Gold will drop by impulse and correction way. I mean, gold's overall trend may be down.

What About the next week?

There are several high and medium pact reports due to publish.

Core Durable Goods Orders

Durable Goods Orders

Some FOMC members Speech

Crude Oil Inventories ( It will impact on Crude Price)

FED Chair Powell Speech

Final GDP

Core PCE inflation report

ISM manufacturing PMI

GDP, Powell Speech, Core PCE inflation report, and ISM manufacturing PMI report are very high impact and most market mover data.

The final GDP report expected positive, but the other two reports expected bit negative. Hopefully, these reports will bit supportive for the USD.

But numbers of FED members the cautious. If they hint, economic conditions are not good enough as they are expected.

Investors will take it harmful for the USD. Because that will indirectly hint, FED will wait for the subsequent tapering. That means gold also has a chance to go up again.

But I don't think most of the FED members will play with tapering issues. If you play, it will be bad luck.

Technical View:

Gold's downtrend is still caped. Gold's current market price is in the 1757 price zone. (while I am writing this analysis) I think it's an excellent place to sell. And stop-loss should be above the 1784 price.

First target 1740 price zone. Breaking below 1740, our 2nd target should be at the 1720 price zone. Finally, breaking below 1720 will open the door for the 1680/1685 price zone.

On the other hand, the U.S economic data comes than forecast. Gold price may go up above 1784/1785 price zone. Our first upward target would be the 1830/1835 zone. I don't think the market will be able to go above the 1835 price.

It's critical resistance. So, it needs robust economic reports.

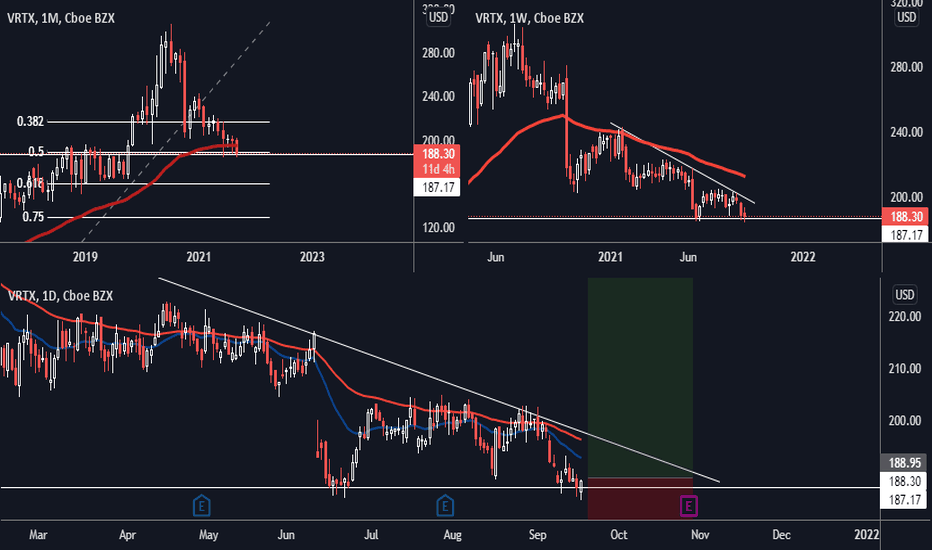

$VRTX HTF ACB LongWeekly Swing Watchlist

Couple great looking opportunities this week, otherwise equities look pretty quite with the broad sell offs we have seen. I am already at full risk after entering two trades last week so I will be sitting on my hands for now.

#1 Main Watch

$VRTX HTF ACB L

Monthly - 0.50 Fib/Decel/50 ema

Weekly - Support/MACD/Double bottom

Daily - Support/MACD/Double bottom/Descending triangle/Decel/Wave 5 completion

LTF - Break out of descending triangle/MACD/Double bottom

Entry - Waiting for 1HR close above 50 ema

RR - 10 (Previous M/W highs)

Management - Long term

Additionally on Watch:

Main:

$PENN Daily IBO L

Other:

6 stocks on this weeks development needed list

23 stocks on monthly watchlist (mostly in Tech & Health Care sectors)

Live Trades:

$OEG - Full Risk

$AMC - 0.5% Profit locked in

$MASS - Full Risk

$VUZI - Full Risk

$Z - Full Risk

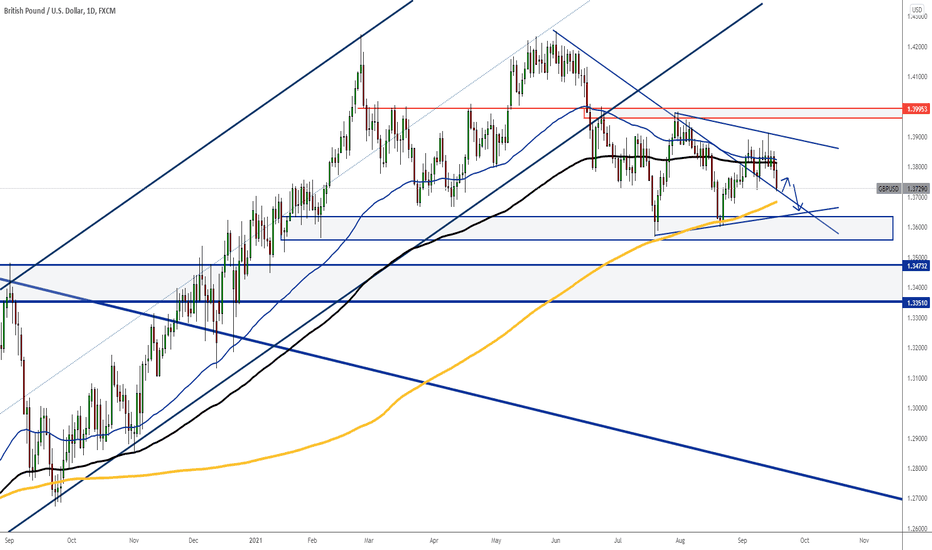

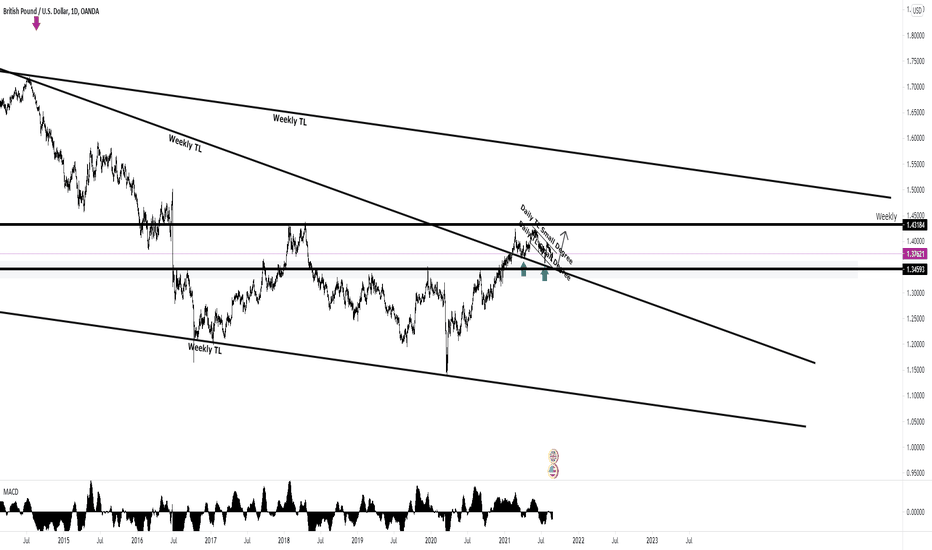

GBPUSD: Weekly Forecast 19th September 2021GBPUSD broke out of a minor range and headed south, essentially reversing the course of a short-term bullish trend.

Overall, the market is still seen trading within a range between 1.3960 and 1.3610 and it is most likely to continue heading down towards the bottom.

We can also see a symmetrical triangle forming so the rebound from the bottom may take place a little earlier at 1.3680 which could also be a buying opportunity.

This week, we will focus only selling, awaiting pullback towards at least 1.3770.

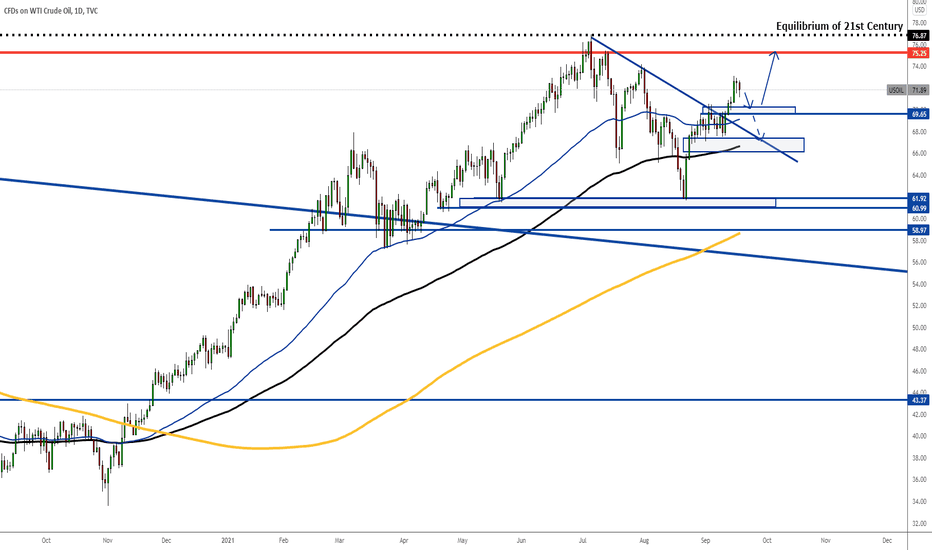

WTI: Weekly Forecast 19th September 2021WTI has continued with its bullish trend as it defied a rejection from a falling trendline and went ahead to breakout of it completely.

By now, it is becoming clear that the oil market will continue to rise as demand continues to rise as well during this recovery period.

This week, we will wait for a pullback beyond 71 and look for a buying opportunity in the demand zone around 70 which should potentially reach 74, then 76.

If the rebound doesn't happens after the pullback and price continues to go south, the next key demand is seen at 67.

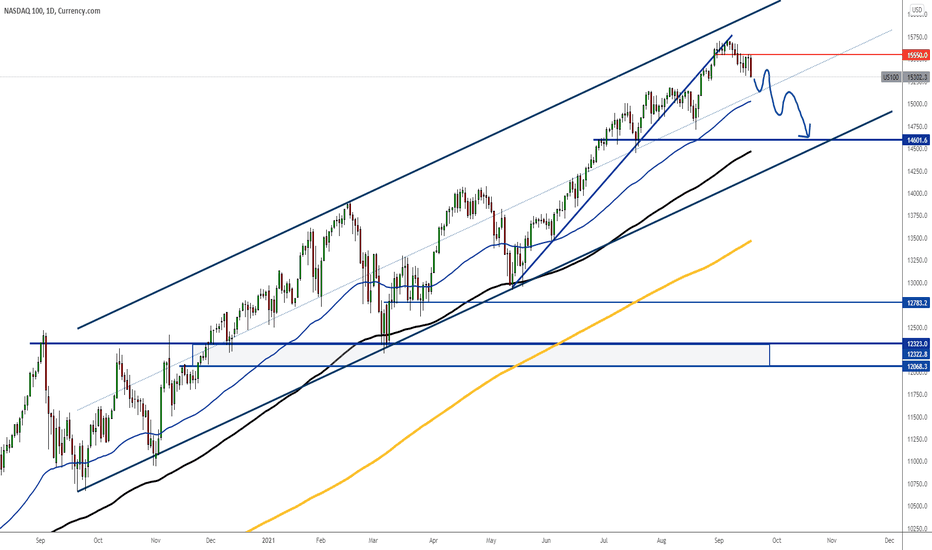

Nasdaq: Weekly Forecast 19th September 20214 months of a bull-run and we finally saw a 2nd consecutive bearish weekly candle.

As major central banks work towards tightening of monetary policies, a major correction in the stock market will follow and this could be it.

This week, we aim for nothing but sell, awaiting pullback to 15400 - 15450 area.

Our final target will be at 14600 for now.

Gold: Weekly Forecast 22nd August 2021The selloff of the gold continued through last week and trades steadily below 1800.

A rebound that came last Friday was easily wiped out, essentially trapping more buyers.

The market is clearly feeling bearish and we expect a revisit of the 15-month demand at 1700 in the upcoming week or the next.

We could still see a potential upside back to 1770 - 1780 area while it consolidates at the beginning and that's where we are looking to sell.

We could still look for intraday buy opportunity as long as 1750 stays unbroken.

EURUSD: Weekly Forecast 19th September 2021EURUSD has extended fall last week, resulting in a 2nd consecutive bearish week.

The price has now reached a strong demand zone from 1.1730 onwards to 1.1700.

At this point, an inverse HnS could still be formed since the right shoulder support isn't completely broken.

Besides, the market is already trading at a low of the entire range and there will definitely be an opportunity for buyers.

This week, we are expecting a rebound from the current demand zone as it dip a little lower to the Fibo 78.6% level.

If the price fails to rebound at all, the next key level is 1.1700.

On the upside, we expect the price to be able to reach 1.1820 before any strong resistance will be seen, followed by the neckline of a probable inverse HnS at 1.1880.

Forex, SPX 500, Bitcoin, Gold, Oil Forecast August 29 2021Hey Traders just wanted to give a weekly forecast on what I see happening in the markets this week. This could be a big week for the Forex, Stocks, Bitcoin, gold and oil.

This week will be big for the forex, stocks, bitcoin, gold and oil. This week will will have the Non Farm Payroll report. The Employment report is the first friday of every month. The forecast right now is that the US gained 750,000 jobs so lets see what happens. Stocks can become explosive on reports like this and so can the forex. Also bitcoin and other cryptos can be affected as well as gold and oil because of the US Dollar Volatility!

Enjoy!

Trade Well,

Clifford

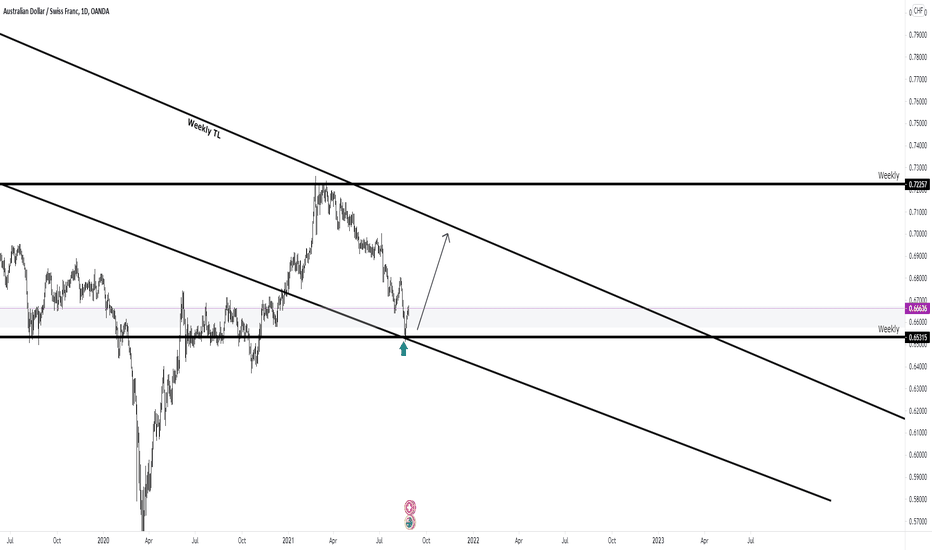

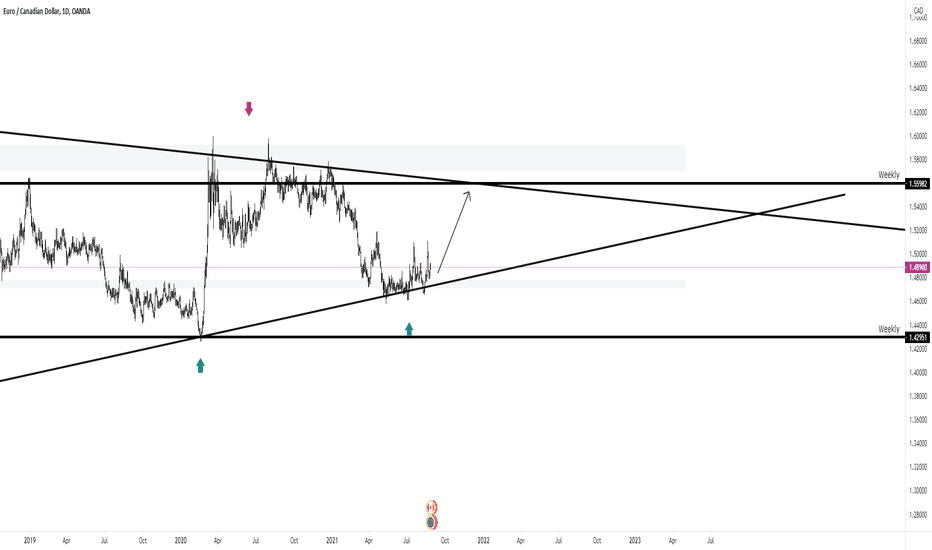

EURJPY Bullish Weekly ForcastI forcast EJ to push higher now that we have broken the bearish channel. This was also confirmed with divergence.

We could still see EJ make a final push lower before heading up so keep this in mind.

My idea will be invalidated if price breaks below my trendline and heads lower on HTF

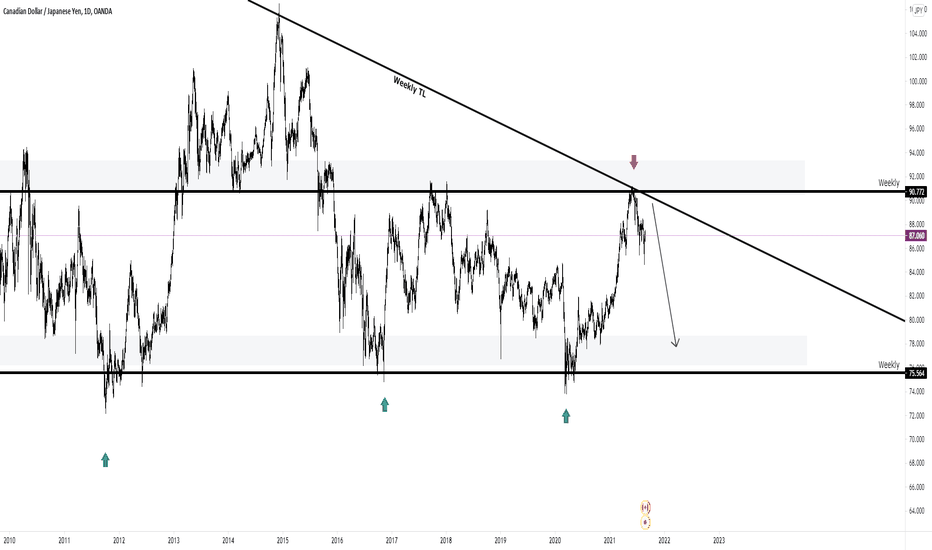

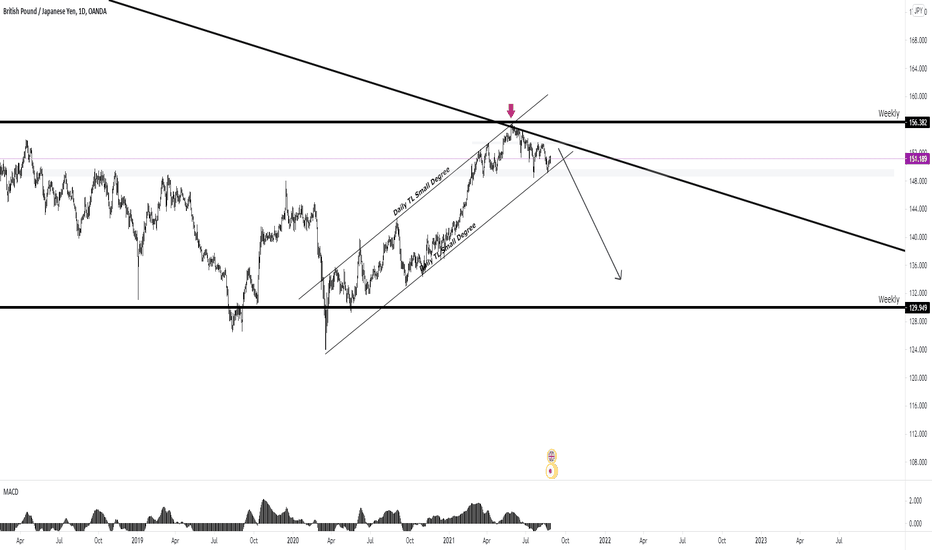

GJ Bearish ForcastI can see GJ heading lower over the longer TF. We see it had a strong rejection over the strong confluence area.

What im looking for in the comming week/weeks

Breakout of the bearish channel tells me the fractial is complete and we will now start a bearish drop.

My idea will be invalidated when price breaks above the weekly TL and stays above

Gold: Weekly Forecast 22nd August 2021The gold fell just a little after a very bullish recovery from the week before amid a strengthening dollar.

The gold has ranged throughout the week as it stayed resisted by the supply level at 1795.

The dollar has strengthened through the week on a hawkish Fed to start tapering this year and most pairs against the dollar had turned bearish but gold was somewhat resilience continued to stay supported within a range.

However, both highs and lows are notably becoming lower and we can expect the gold to start the week with a bearish tone at the beginning.

This week, we will look for selling opportunities as it pulls back to the top of its current range but expecting a strong rebound at the demand level at 1750.

EURUSD: Weekly Forecast 22nd August 2021EURUSD had another bearish week right after a short recovery from the week before, essentially breaking new low again.

While reviewing our past weekly forecast, it actually followed an ABCD pattern based on the weekly timeframe and shall be completed this week should the price drops further into the demand level at 1.16.

The dollar has been strengthening weeks before the Fed has turned hawkish where it now stands ready to taper this year, thus potentially bring about a reverse effect when it does taper.

This week, we shall follow the current trend and look for selling opportunity starting from 1.1710 supply level, and aiming for the demand level at 1.16.

Otherwise, we will be observing for a clear reversal signal as an ABCD in the weekly timeframe completes at 1.16.