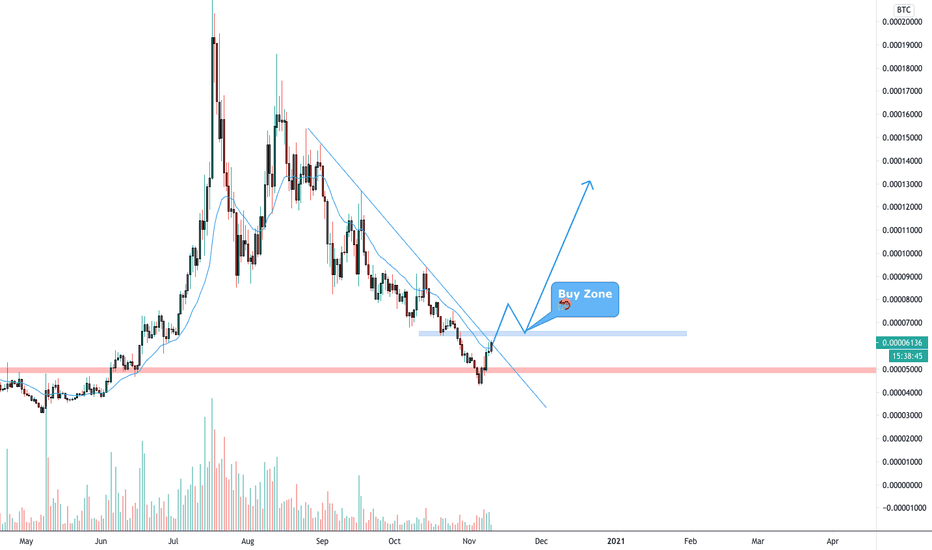

RLCBTC bounced on weekly support 🦐RLCBTC bounced on weekly support and now the price is testing daily resistance.

IF the price will have a breakout upward, We can set a nice order on the retest, According to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <4h structure.

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

Weeklyforecast

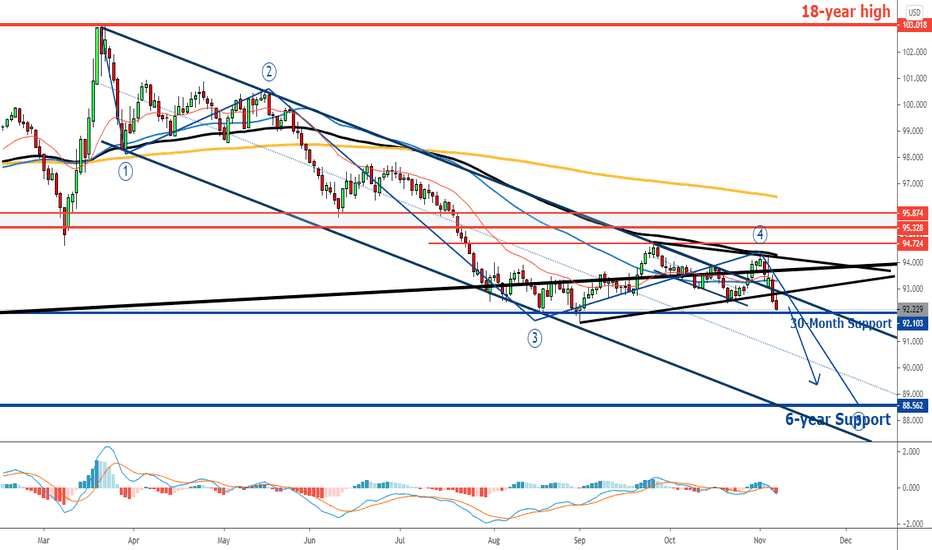

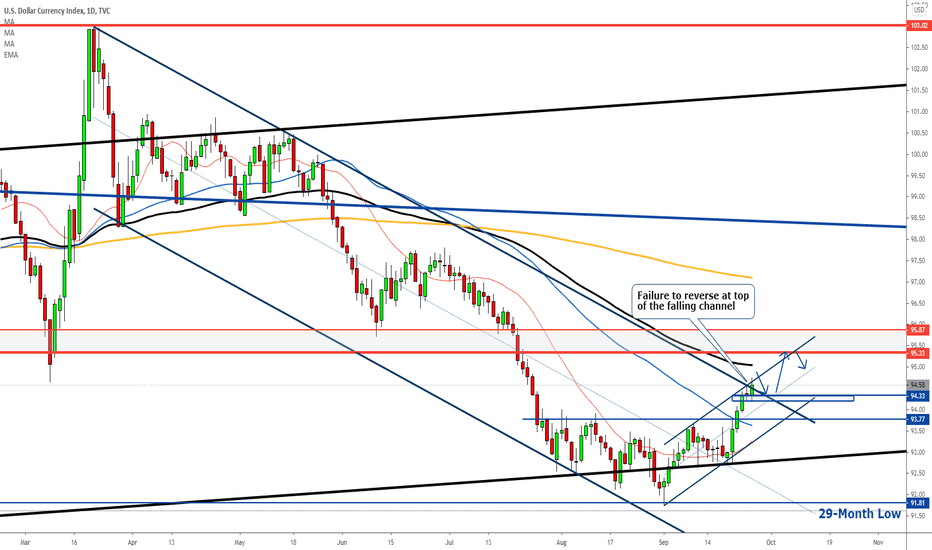

Dollar Resumed Bearish TrendThe dollar fell with conviction last week and broke out of a symmetrical triangle.

This marked the end of a 4th corrective wave and the 5th motive wave has just begun.

With the election coming to a close, the dollar is set to fall with some major uncertainties off the table, especially since the winner is Biden.

Wait for pullback and sell the dollar.

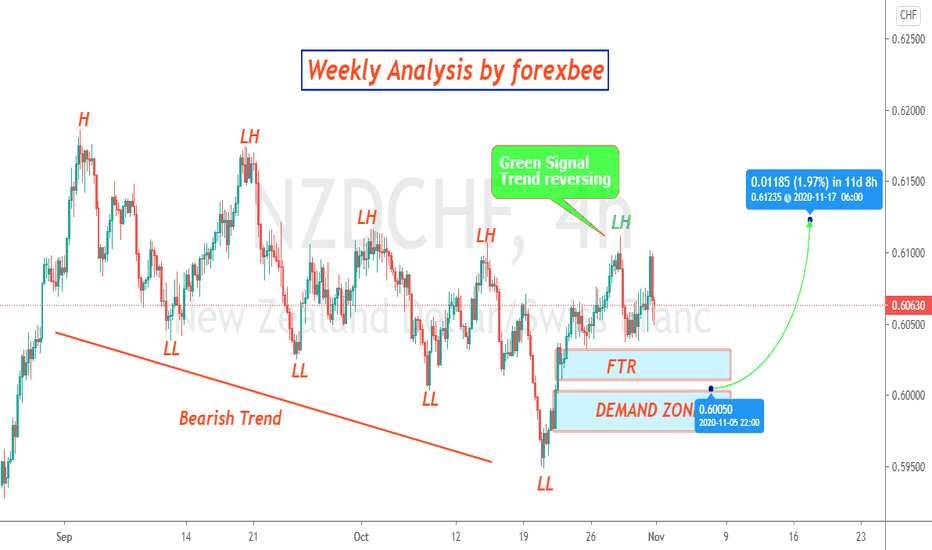

NZDCHF Analysis by forexbee.coNZDCHF Analysis: Looking to buy from the below demand zone between 61 and 78 Fibonacci level.

Trend: Trend Reversal on break of last lower High in NZDCHF.

Trade Idea:NZDCHF was retracing downward from 1st September. it was in a clear bearish trend due to four consecutive lower lows. Recently due to a massive upward move and break of last lower high, trend has been reversed. Now we will look for a bullish entry instead of bearish.

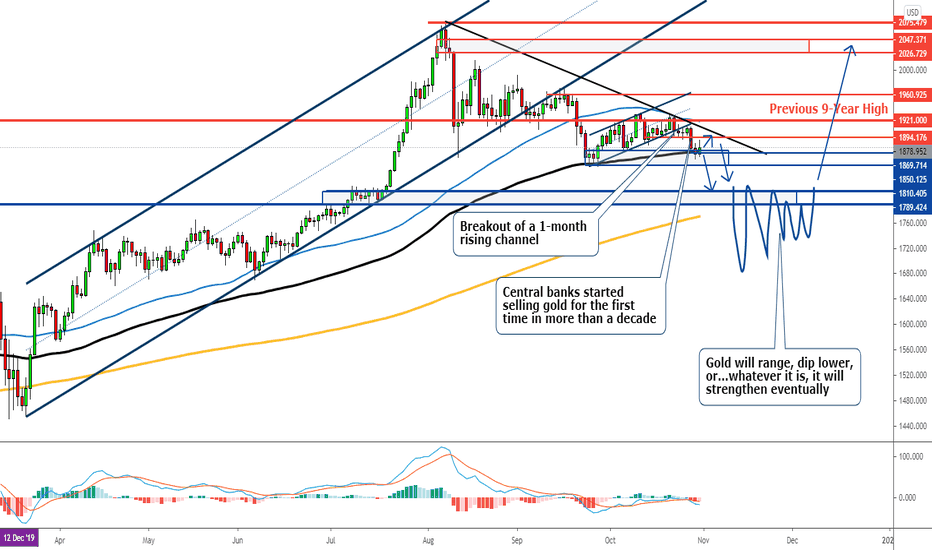

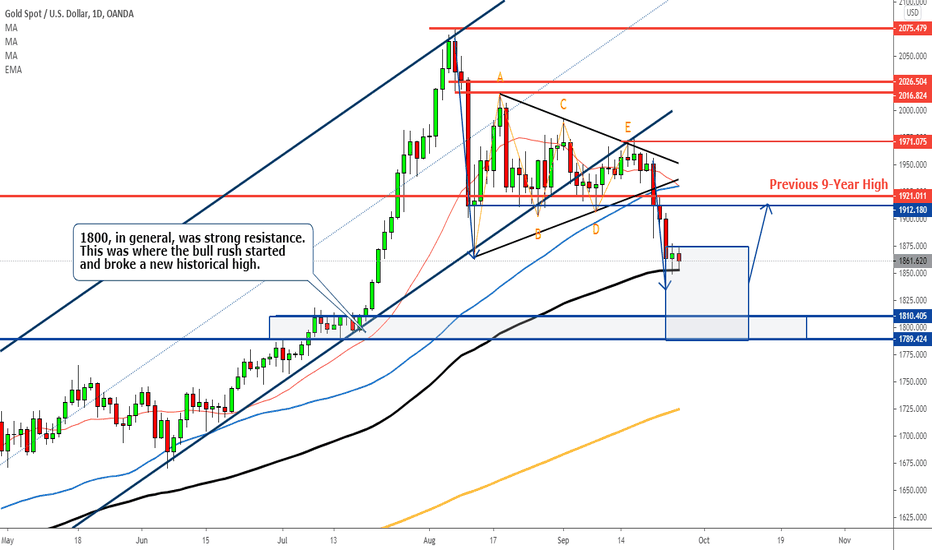

Gold for Cash Amid PandemicAfter failing to break above past historical high 1921, the gold fell and ranged, and eventually broke out of a 1-month rising channel.

The gold continued to find support at 1894 but failed to gain any bullish momentum.

It finally gave way to a plunge as central banks started to sell their gold reserve to support their economy against the second wave of the pandemic.

These are enough factors to expect the gold to dip lower since countries need money now more than ever and the gold is not at a satisfactory discount yet.

We expect the gold to break new low dip below 1800 this month.

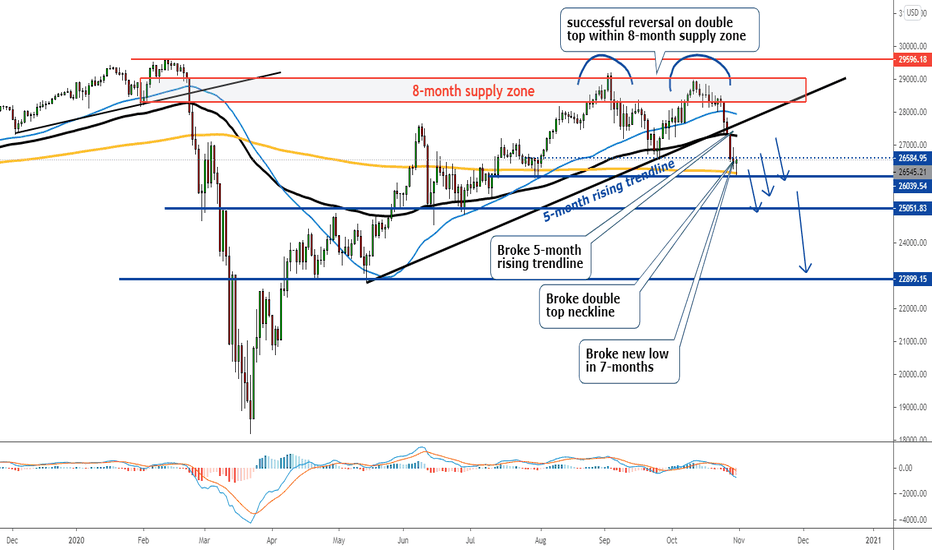

Dow Jones: Is this the beginning of a 2nd SELL-OFF? Cont'd2nd wave of coronavirus has become a factor in Europe.

Central banks are selling gold for the first time in more than a decade to keep their economy afloat.

Dow Jones had the biggest weekly drop in 7-months after multiple breakouts such as 1) the 5-month rising trendline, 2) the neckline of a double top and 3) created a lower low in 7-month.

With all the above factors, we have a case to expect the 2nd wave of the selloff in the stock market which probably has begun.

The strategy to sell is simple:

1. Don't be a fortune teller and try to time the market and trade with tight stop loss.

2. Make sure your trade does survive before the price pulls all the way back to the double top at 29200.

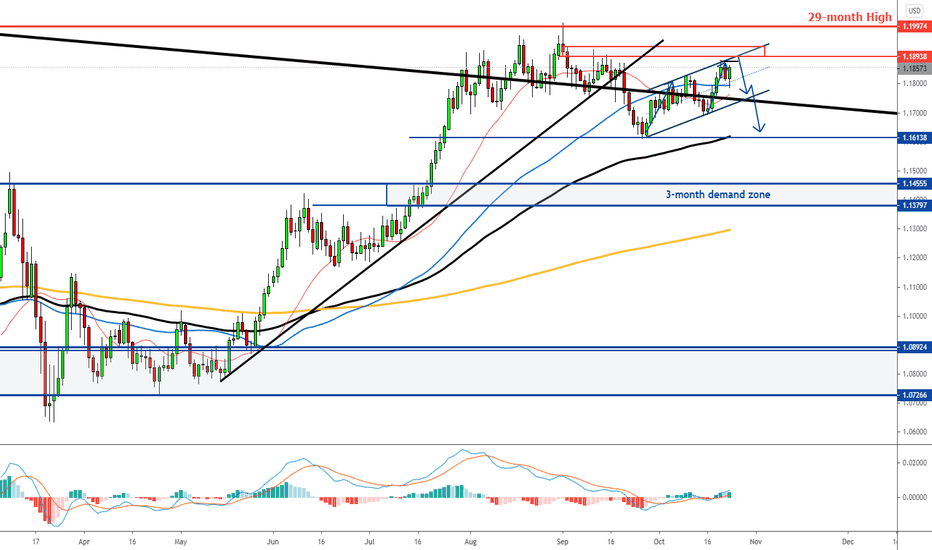

EURUSD Facing Pressure at Range TopEURUSD has rebounded and retraced from a 1-month low just above 1.16 for the entire October and has completed 2 bullish waves by now.

As the US election draws closer, uncertainty continues to brew, causing risk sentiment to rise and boost demand for safe-haven assets such as the dollar.

Besides, the ECB conference will be up this week and chances are the ECB might take a dovish stance if they are ready to bring interest rate deeper into the negative territory.

Otherwise, the market has retraced significantly from the previous bearish trend and is definitely a decent price to attempt selling EURUSD.

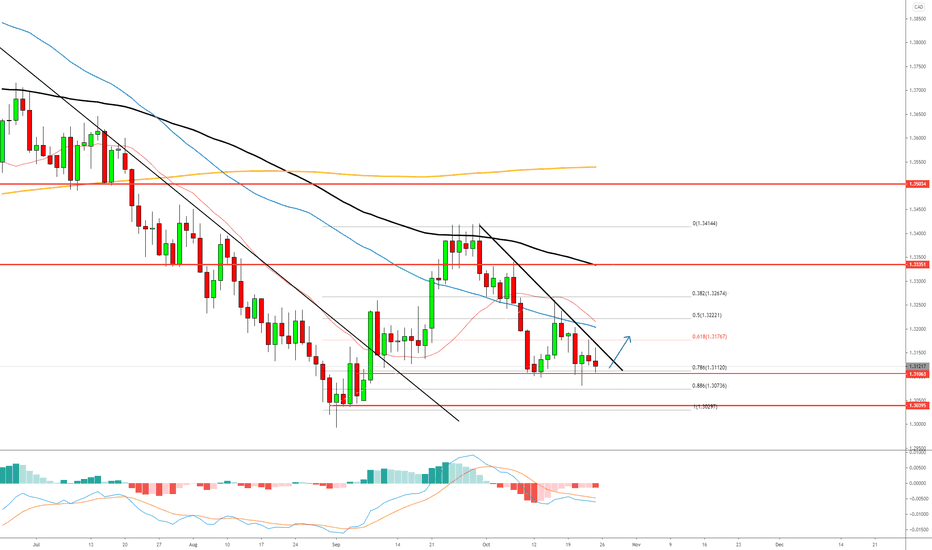

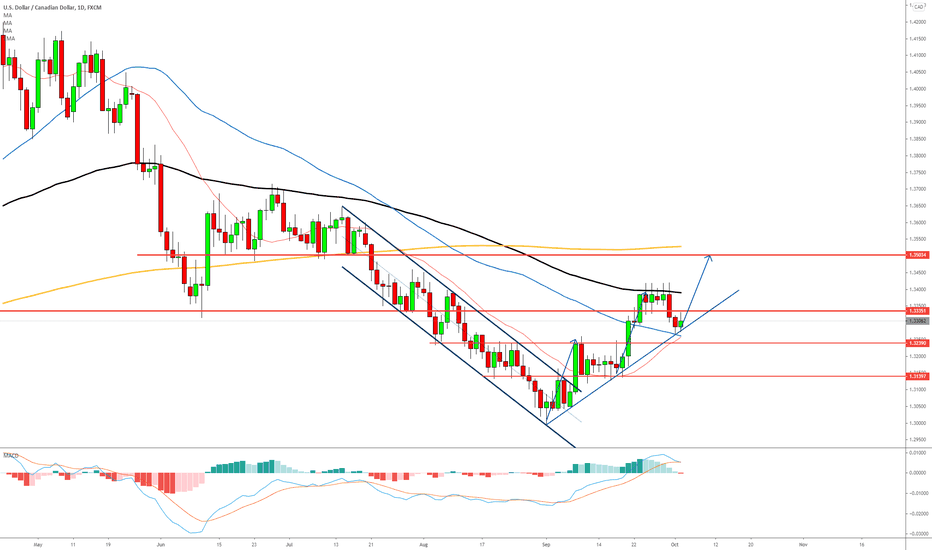

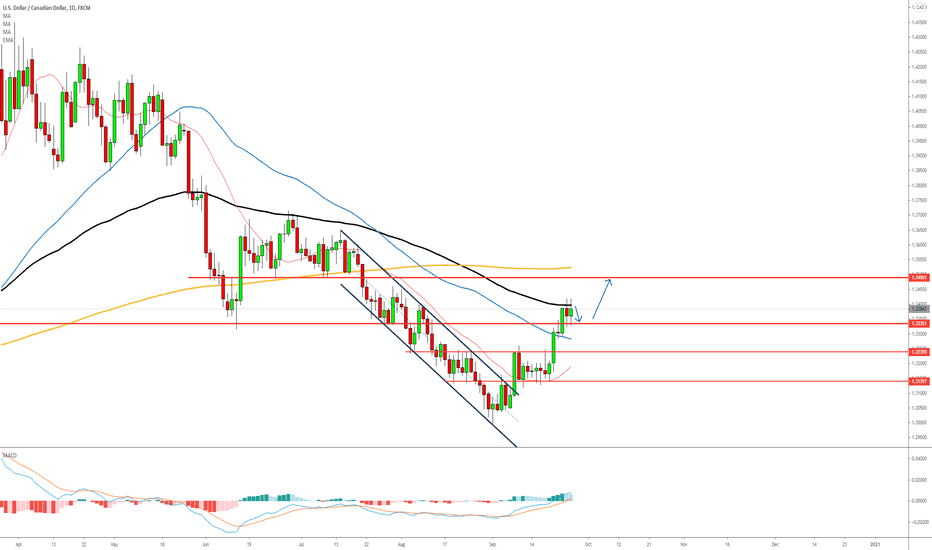

Can USDCAD's Support Hold?USDCAD has retraced back to the breakout point of it's 6-month downward trendline, back to a strong support zone, which coincides with the 78.6% level retracement.

With oil prices hovering below $40 after breaking below key channel, and the Canadian economy being heavily reliant on Oil prices, the effects should be seen in Canada's currency.

This week, should the current support hold, we could look to buy USDCAD again, however, should price break current support, next level of support could be seen at the previous low at 1.300.

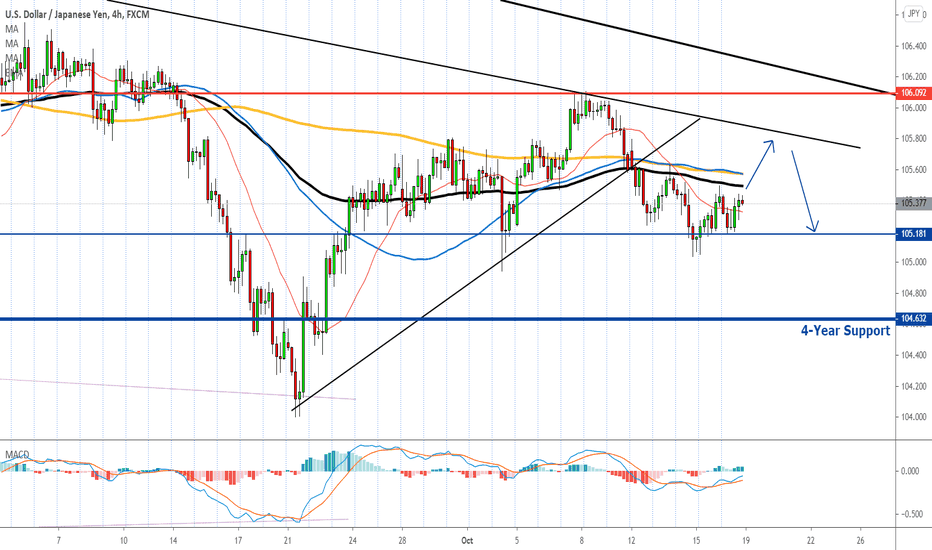

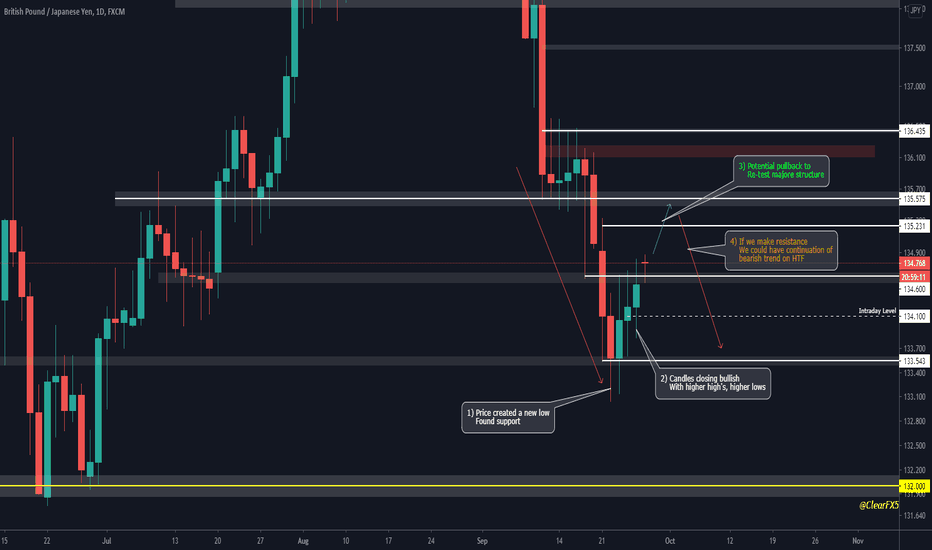

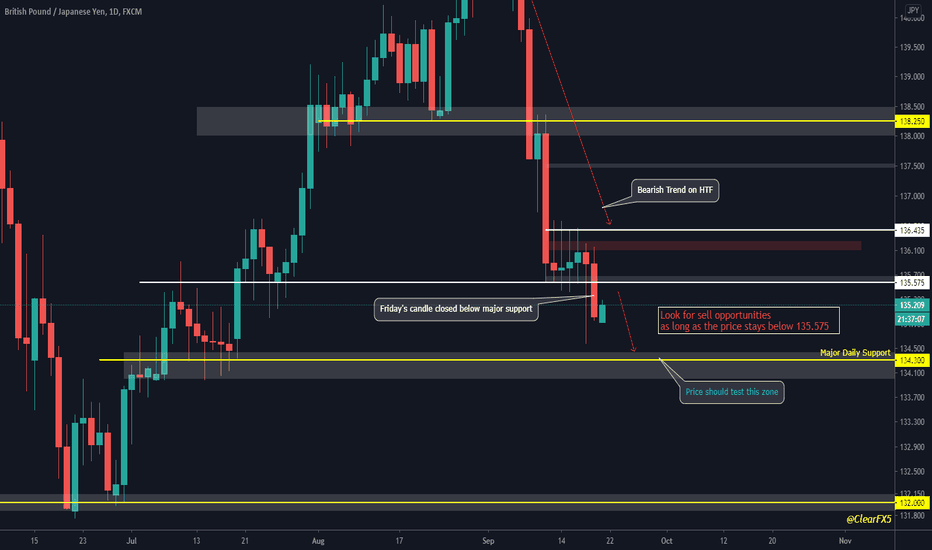

USDJPY to Range before Further DownsideUSDJPY fell last week after rejection from a 3-month falling trendline but found support just above 105.

The yen has gained across all major peers amid growing uncertainties due to the pandemic and political turmoil in the US and Eurozone such as the US election and the Brexit talk.

However, the dollar rose too on safe-haven demand which therefore causing USDJPY to stuck in a range.

However, the price has reflected that the yen will eventually strengthen against the dollar ever since the pandemic broke out.

We expect the market to rebound a little higher towards the 105.6 - 105.8 region before it provides more downside movement.

Gold's Demand ReturnsThe gold has shown a clear sign of a bullish reversal for the first time in nearly 2 months.

The gold broke above a near 2-month falling trendline which started forming since the gold peaked at a new historical high of 2075.

However, we are not expecting huge and fast buying of the gold and we do expect the price to range upwards through October.

In general, the gold market has provided a pretty satisfactory discount and buyers will inevitably start to pile up.

Wait for the price to pull back and observe the price action to find a good entry point and as of now, 1916 looks like a good price to buy.

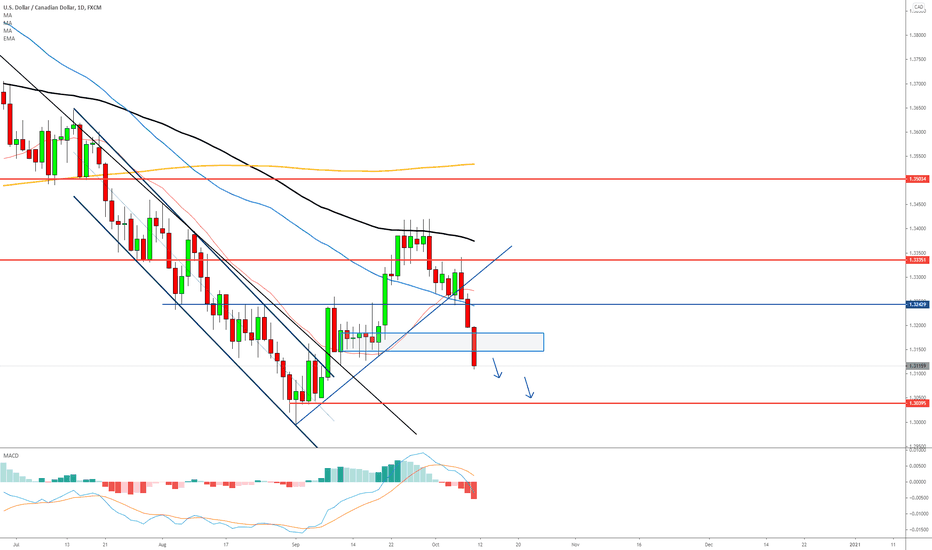

USDCAD More Room for DownsideUSDCAD was unable to keep the bearish momentum after breaking above a significant resistance level. Price came back to the trendline formed after the initial break out of the falling channel, but could not find support either.

The last 3 days of this week formed 3 very bearish candles, even breaking through previous demand zone, providing USDCAD with more downside.

This week, we could look to continue selling USDCAD to it's previous low, waiting for small retracements too add positions.

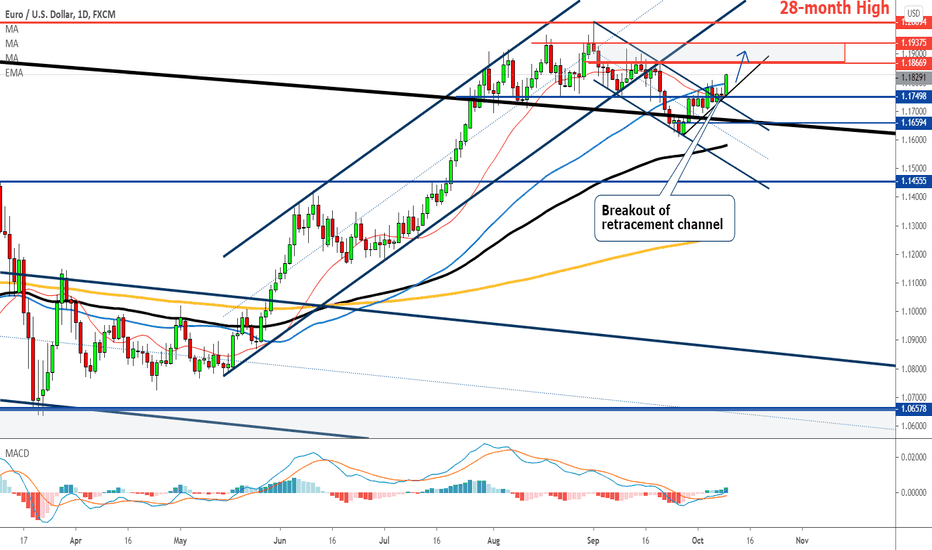

EURUSD Ready to Resume Bull RunEURUSD is probably ready for a whole new wave of a bullish run after gaining stronger ground from last week.

The market has broken out from a retracement channel and the price has also resurfaced above all moving averages, as well as an important pivoting level at 1.1750.

The MACD is also showing a returning bull and the line is about to cross above level zero which indicates a sustainable bullish trend.

This week, we expect EURUSD to climb further and traders may wait for a pullback towards 1.1790 to long.

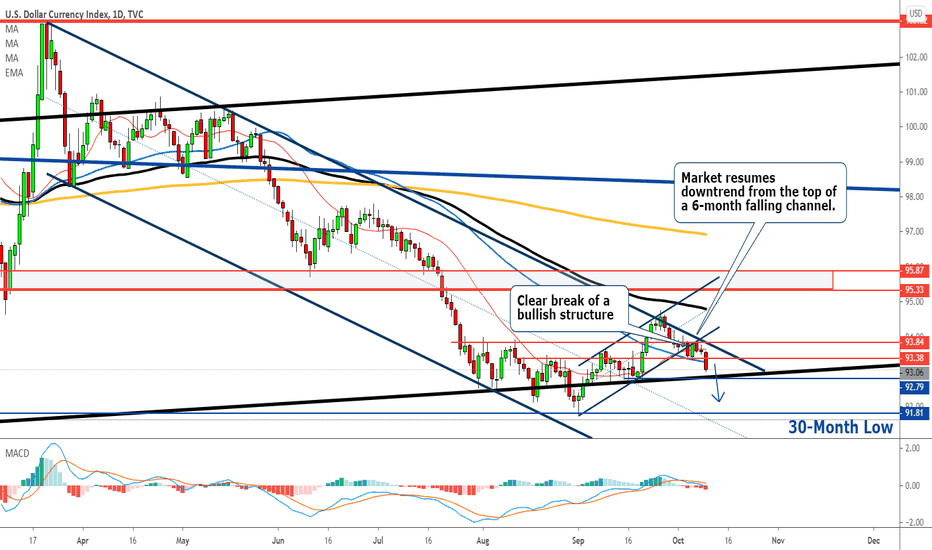

Dollar Resumed Bearish after 3 MonthsThe dollar broke away from a rising structure after breaking below a 1-month rising channel and a demand zone around 93.6.

The MACD is also about to cross below level zero which indicates a sustainable bearish trend to follow.

The market sentiment seemed to have turned risk-on again in anticipation of the fresh stimulus package.

It has also taken the dollar a little more than 3 months of retracement and consolidation since the completion of a previous bearish trend to once again resume depreciation.

This week, we expect the dollar to continue weakening towards 92 and traders may wait for a pullback towards 93.38 to sell the dollar.

USDCAD Newly Formed Trendline.After USDCAD broke out of a 3 month channel, price has been slowly appreciating.

USDCAD has mainly been pulling back this week after a second wave of appreciation.

Price has came back down and found support on newly formed trendline on Friday.

Next week, should this support on trendline hold, we could look to continue buying USDCAD back to next resistance level at previous head and shoulder pattern.

GBPUSD - WEEKLY ANALYSISGBPUSD - Refer the charts, I have marked the levels for both side movement probability.

Current situation : Positive bias is there, momentum is in buying side, For now approach should be a BUY at current price range 1.29200 - 1.29400

Maintain stop loss around 1.28700, If your risk appetite allows you can keep 1.27600 as a major support zone or stop loss level.

Potential upside move 1.32000

In the lower side Sell below 1.27500

Maintain stop loss around 1.28700

Potential down side move 1.24800

Follow the levels as mentioned above.

Traders, if you liked this idea hit the like button & write in the comment section.

Why you should follow this tradingview account ?

Managed by top most renowned trader - Pulak Priyesh

10 + years of trading experience

Professional Day trader

Excellence award winning mentor

Professional chart, clear chart without junks.

Major S/R levels with inner insights

Frequent Day & Swing trade levels

All major and minor FX/INDICES covered

Thanks !!

USDCAD More Room for Upside.USDCAD continued its gains this week following a break from a downward channel early September.

Price has managed to break and close above key resistance area, signifying that there are more room for appreciation.

We can continue the bullish stance on USDCAD till next key resistance at neckline of previous HnS pattern.

Upon market opening, await for signs of retest on support area for long opportunities.

Practice Patience with GoldGold had the biggest weekly loss in close to 2 months.

It also ended a 5-week ranging market that took the shape of a symmetrical triangle soon after the breakout from a near 6-month rising channel.

With that, the gold is now on sale, an 11% discount from its all-time high.

While the dollar seems to be in high demand as a safe haven currency, what performed the best is still gold especially in a risk-off market like the one we are facing now.

Gold was just too overpriced but many will be observing for the right time and best price to buy the gold again before the next gold rush.

Therefore, we will probably expect the gold to fall into another range eventually and we will practice more patience with trading gold.

Otherwise, the best price to start buying the gold will be from the 1800 demand zone.

It was once a very strong resistance throughout 2012, and the bull rush has begun shortly after it was broke through.

Dollar's Comeback ContinuesAfter ranging for more than 2 months and reaching a 29-month low, the dollar started to show signs of reversal.

The reversal took off strongly and broke above the top of its previous range just below 94 with very little pause.

The dollar continued to climb and finally reached the top of a 6-month falling channel where resistance was presented.

However, a reversal failed to take place and the dollar went out to break above the previous day high on the very last trading day.

US dollar rose amid a risk-off market sentiment and also due to a technical oversold.

The dollar is likely to inch higher further before Friday's NFP.

We will keep our short-term view bearish or slightly towards ranging for now until it reaches the supply zone above 95.