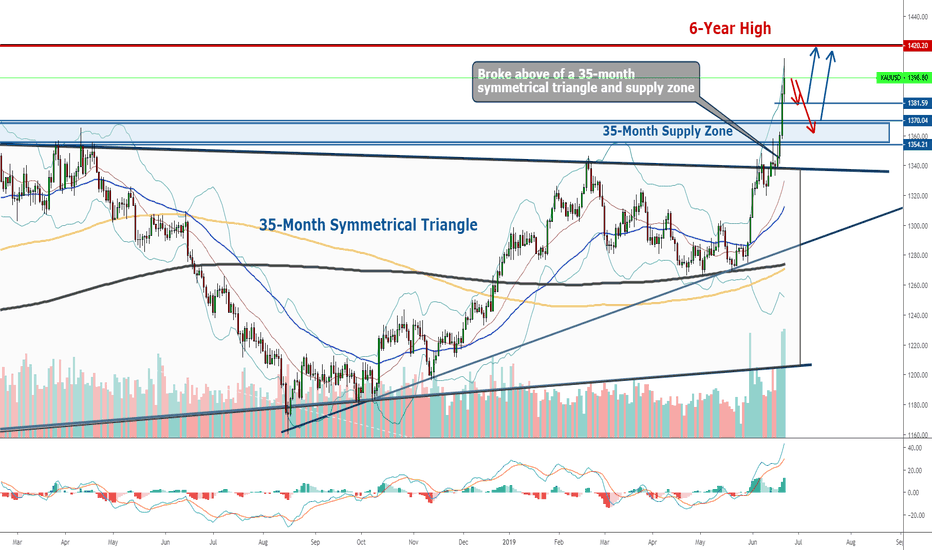

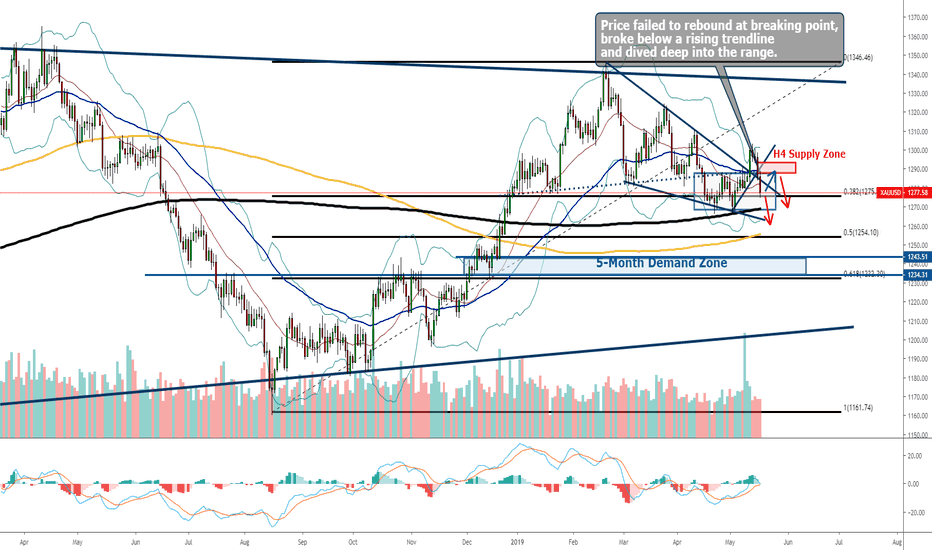

Gold: Weekly Forecast 24th - 28th JuneThe gold price surged and broke out of close to 3 years consolidation and is heading towards a 6-year high in the coming week.

The gold has gained close to 60 dollars last week with the biggest one seen on Thursday hours after the Fed has signalled for a probable rate cut in the foreseeable future.

The market is expecting a maximum of 2, if not, 1 rate cut as early as September this year and that would potentially mean a crisis for the dollar.

As for the gold price, all losses have been recovered earlier this year and before the Fed signals for a rate cut (or holding interest rate), yet the price has climbed so fast before any rate cut.

On the monthly chart, the price can easily climb further and beyond 1500 but will meet with strong resistance at 1590.

It is almost guaranteed that gold will continue to climb for the next 3 months if the trade war persisted and global interest rate continues to edge lower.

In this week, we will wait for the price retrace lower and test 1388, followed by the demand zone at 1382 to look for a buy opportunity.

Weeklyforecast

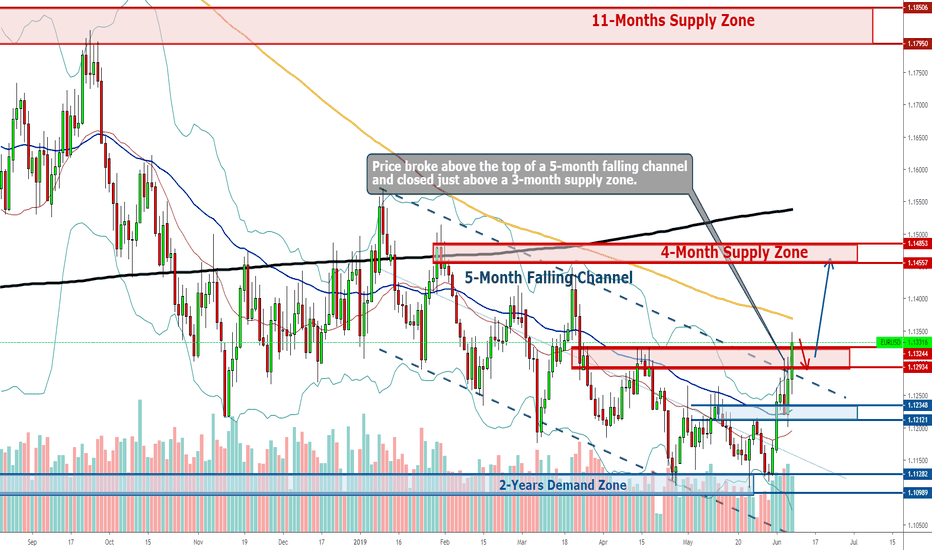

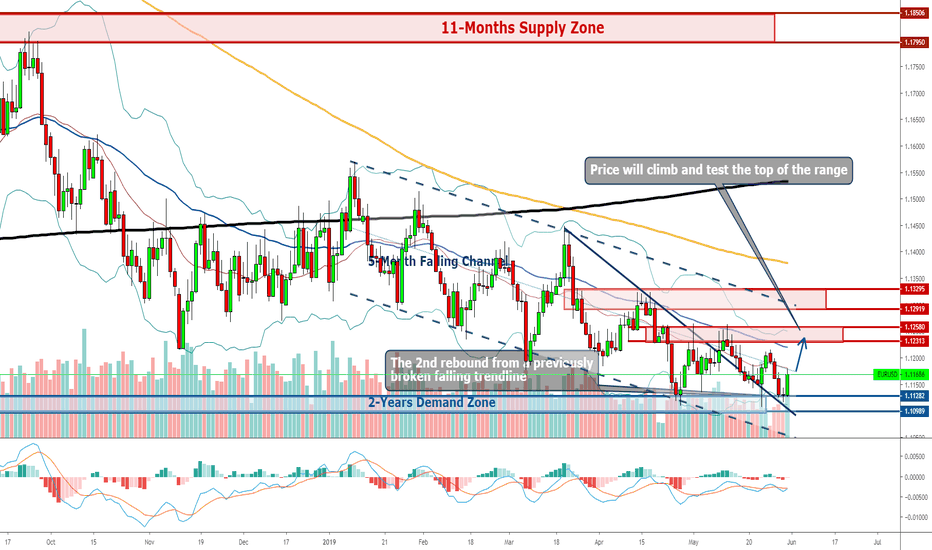

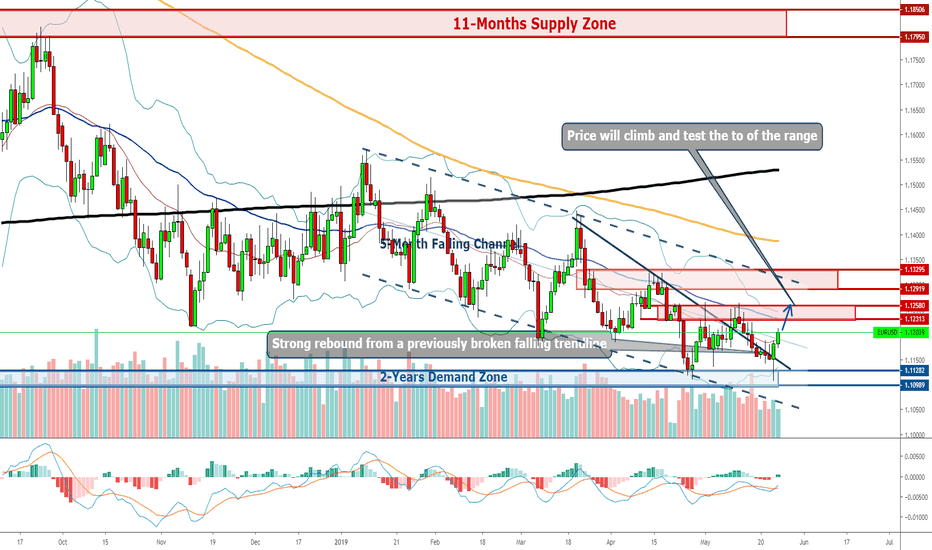

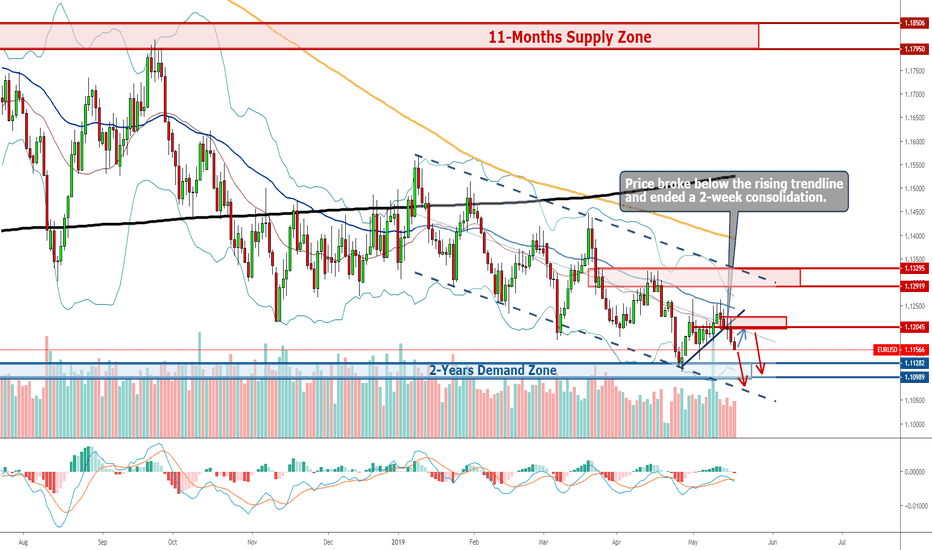

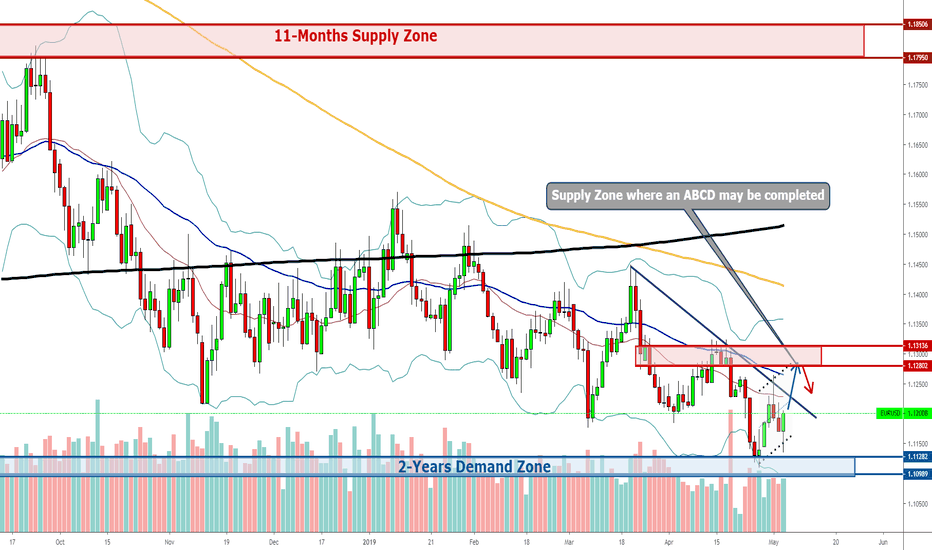

EURUSD: Weekly Forecast 10th - 14th JuneEURUSD had the biggest gain in 10 months and the price has broken above a 5-month falling channel and closed just above a 3-month supply zone at 1.33.

The reversal of a bearish trend came after the price found support at a 2-year demand zone and consolidated for more than a month.

We can't be certain if this is a major or a temporary reversal but without a doubt, the price is going to climb higher.

If the price retraces at first, look for buy opportunity at 1.13 and the current projection of this bullish trend should at least reach 1.15.

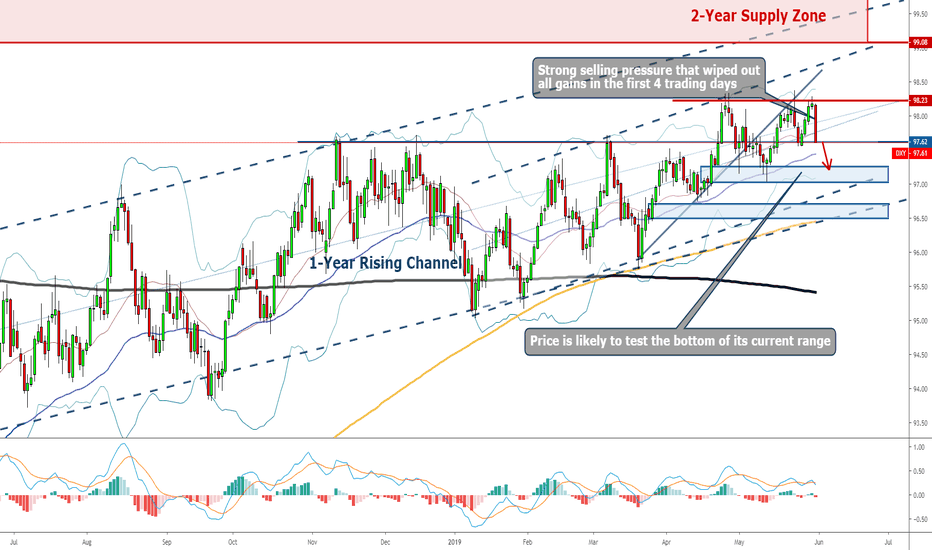

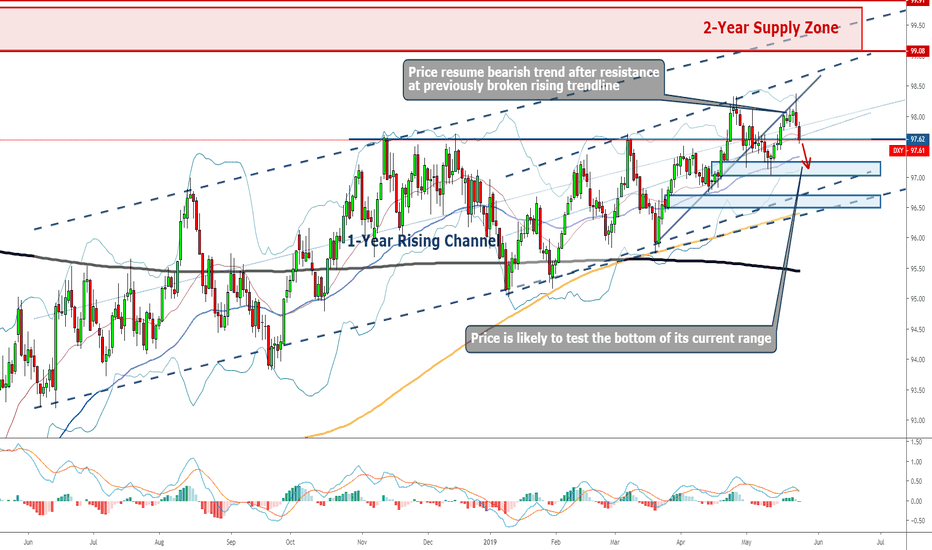

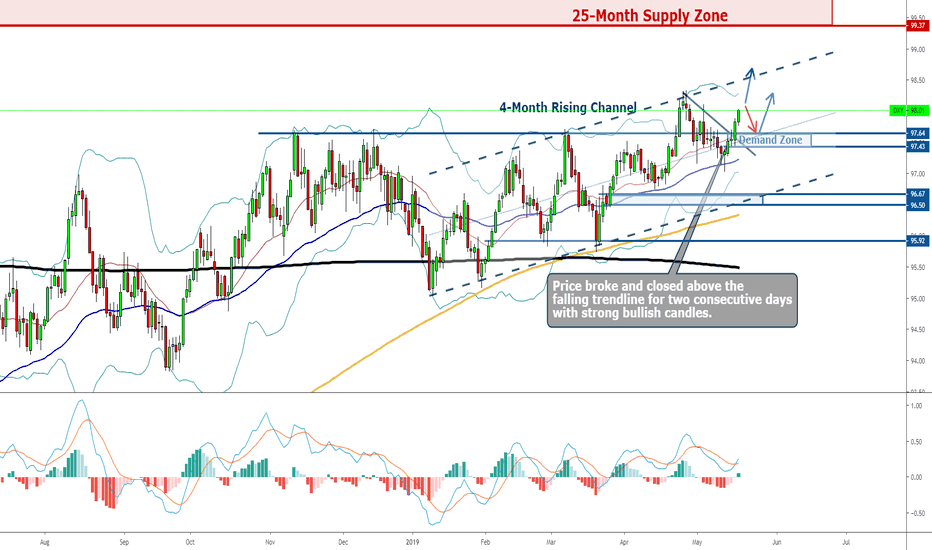

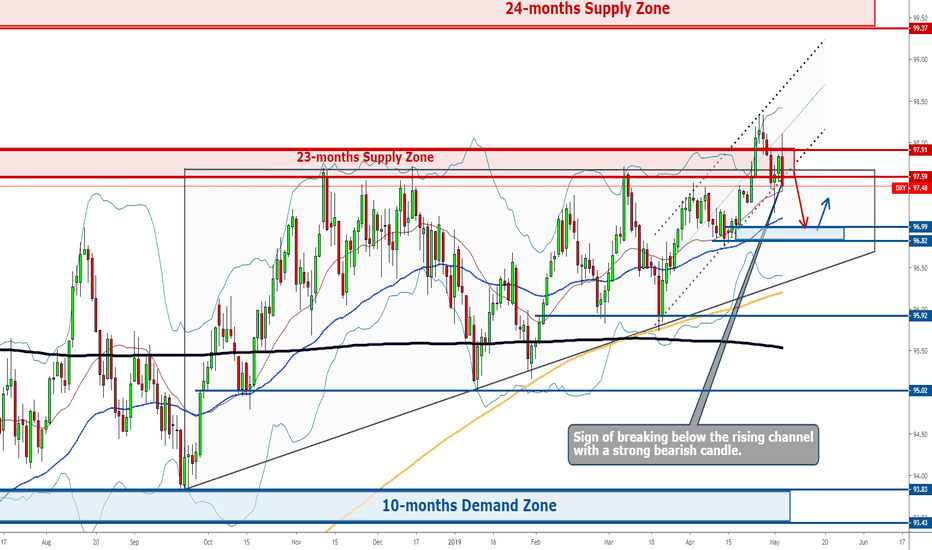

Dollar: Weekly Forecast 10th - 14th JuneThe dollar had the biggest fall in 6-month and the price was seen breaking below the bottom of a 4-month rising channel.

The NFP was very disappointing and a dovish Fed is starting to look at a possible rate cut based on economic data.

This is already a very clear sign of a major reversal and the dollar is actually resisted and falling from a 618 level in the weekly chart.

Following a poor NFP, the dollar is most likely to resume falling in the first 2 trading days.

The immediate supply zone is seen just below 97, with the next one seen at 97.3.

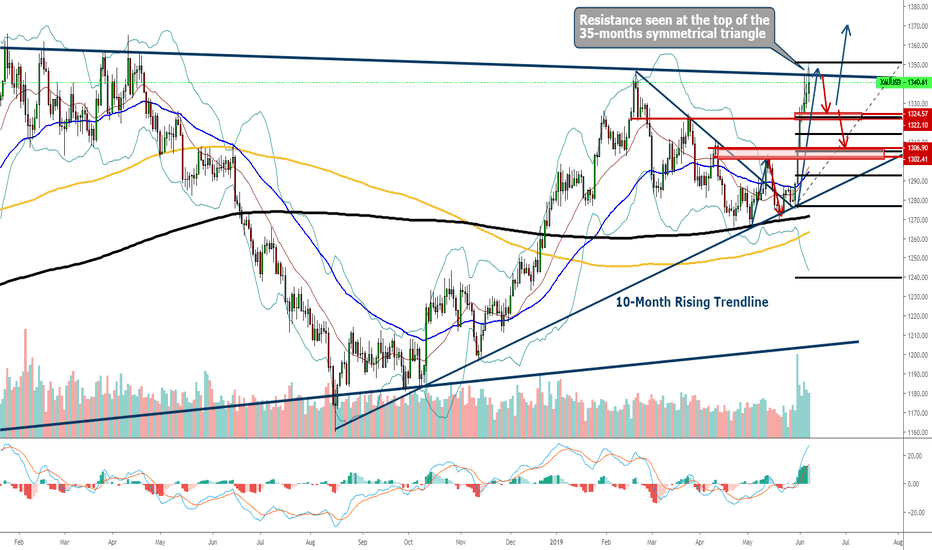

Gold: Weekly Forecast 10th - 14th JuneThe gold has led the longest gain in 3 years and now the price is at an all-time high.

The price has climbed for 7 consecutive days and resistance has been seen rejecting the price from the top of a 35-month symmetrical triangle.

The current wave of a bullish trend was the 2nd and the longest one since the rebound and will likely face with retracement soon.

The first immediate support is seen at 1336 which could lead to the continuation of another higher low and retest the high.

If 1336 fails to hold the price, a major retracement shall begin and first demand zone is seen at 1320.

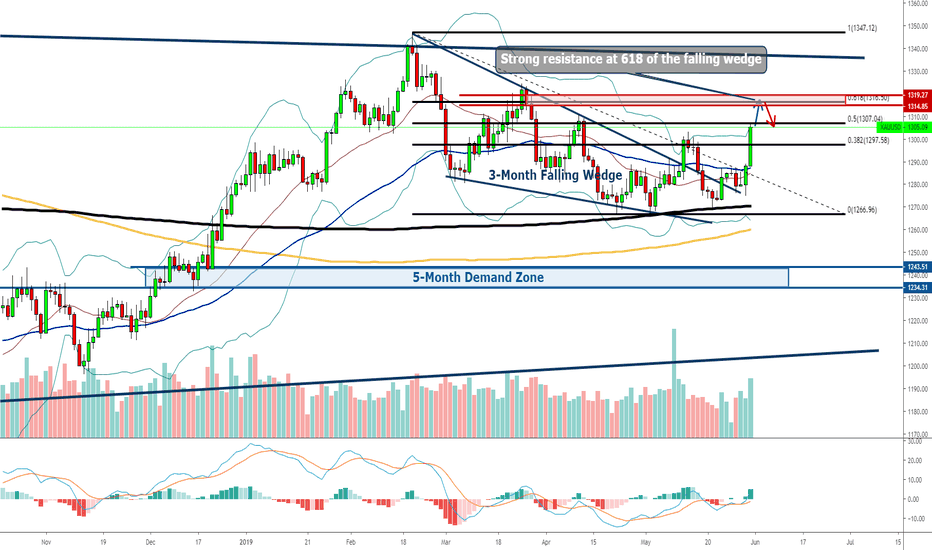

Gold: Weekly Forecast 3rd - 7th JuneThe gold has made strong gains in the last 2 trading days and finally broke a new high first time in more than 3 months.

Also, this marks the 4th consecutive weekly depreciation for the US stocks, with the most recent week being the weakest week.

With the dollar being rejected and fell from the high and the US stock market continues to plunge, it clearly shows that the gold stands a good chance to climb further.

In this week, the gold is most likely to climb and test the 618 level of the falling wedge.

The price may find some resistance and drop but would most likely be temporary and the price will rise again.

EURUSD: Weekly Forecast 3rd - 7th JuneEURUSD fell through last week but rebounded off strongly at the bottom of the current range at 1.1120.

It is also a second rebound from a previously broken falling trendline.

In this week, we expect the price to continue to climb towards the top of the range near 1.1260.

Dollar: Weekly Forecast 3rd - 7th JuneThe dollar climbed in the first 4 trading days and attempted to break new high above 98.3, only to find itself rejected and plunged.

The strong bearish candle on the last trading day was enough to wipe out all gains.

In this week, it is almost inevitable for the dollar to fall further and will most likely retest the demand zone right below 97.3.

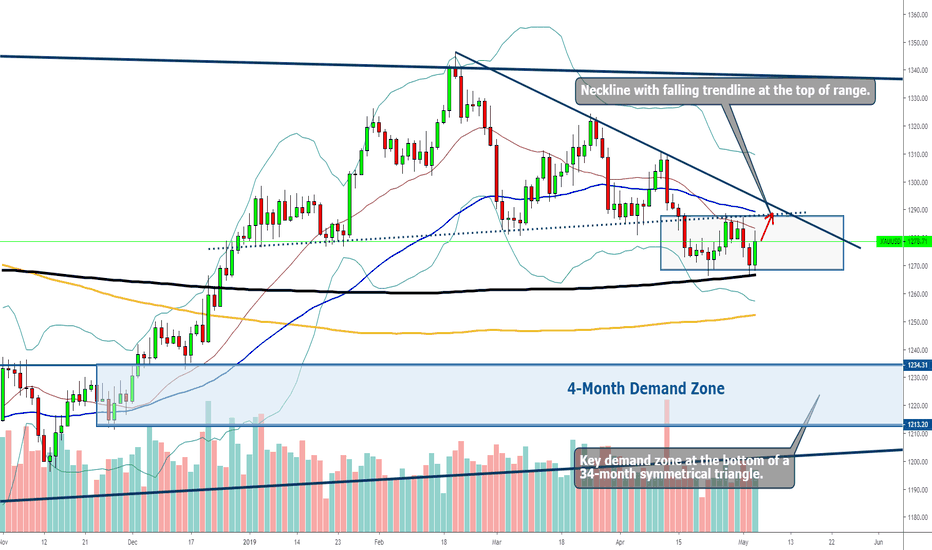

Gold: Weekly Forecast 27th - 31st MayThe gold has failed another attempt to break new low and rebounded off strongly which led to a 2-days again.

The strong rebound by a strong bullish candle also shows a second break-above of the 3-month falling wedge.

The price is expected to climb further towards the current supply zone at 1296.

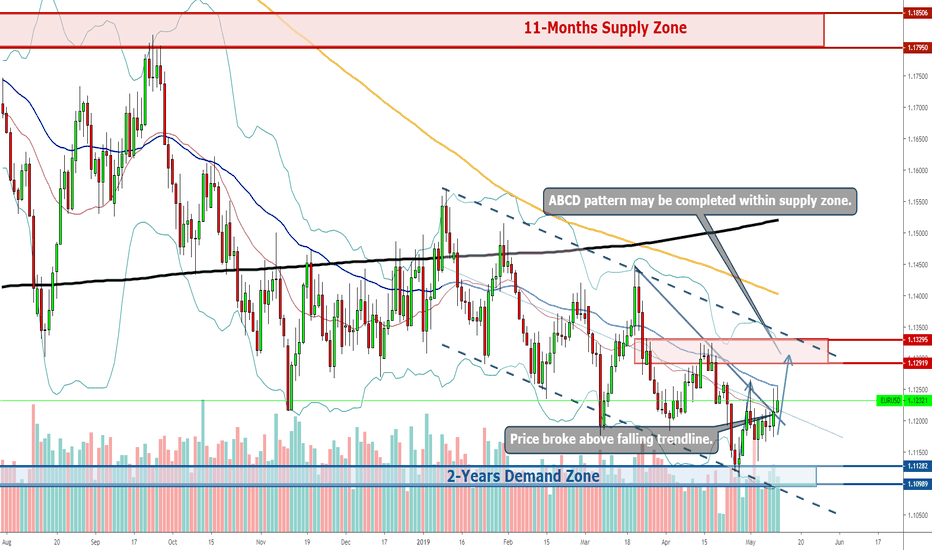

EURUSD: Weekly Forecast 27th - 31st MayEURUSD has made an attempt to break new low as it tested its previous low at 1.1110.

The price rebounded off strongly from the previous low as well as from a previously broken falling trendline.

The bull is strong now and in this week, we do expect the price to climb further and test the top of its current range at 1.1250.

Dollar: Weekly Forecast 27th - 31st MayThe dollar was somewhat consolidating at the beginning and suddenly it attempted to break new high.

The price went slightly above the previous high at 98.3 but immediately got rejected by strong selling pressure.

This is somewhat quite expected of the dollar whenever it attempts to break a new high.

The situation where the U.S. economy is in surely isn't one that favours a stronger dollar, one that is in the midst of a trade war.

In this week, we do expect the dollar to fall further and test the bottom of its current range at 97 where it will probably just continue to trade within the range.

EURUSD: Weekly Forecast 20th - 24th MayJust like the dollar, and since EURUSD has been moving in harmony with the dollar this week, EURUSD has clearly turned bearish after breaking below the key level of 1.1173 after the break below a rising trendline.

And all indicators such as MACD, moving averages and Bollinger band has pointed toward a bearish trend in the week to come.

Therefore in this week, we are setting a bearish tone for the EURUSD and expecting the price to fall further and test the previous low or break new low.

Should the price retrace at first, we will look for sell opportunity at the supply one right above 1.1200.

Gold: Weekly Forecast 20th - 24th MayThe gold price failed to maintain its bullishness even after it had broken above a 2-month falling trendline.

The break came on the first trading day where a strong bullish candle pierced through the top of the range at 1288 together with the falling trendline.

However, the bear came in unexpectedly strong, recover all losses and ended up closing with a bearish candle with a long upper shadow in the weekly chart.

Nevertheless, the price continued to stay supported above 1270.

This week, the gold is still likely to fall further as the bear has proven strong, and the price will eventually retest 1270 again.

Should the price retrace at first, look for sell opportunity at 1288 supply zone.

Dollar: Weekly Forecast 20th - 24th MayThe dollar has shown that the consolidation has completed as it headed north through the whole of last week.

Every indicator is in favour of a bullish dollar such as the 20,55 and 200 moving averages that are pointing upward, the Bollinger band that has opened its mouth, and the MACD has crossed upwards above level zero.

The low and the high keep getting higher as it rises through a 4-month rising channel.

This week, we are expecting the dollar to keep rising and should the price were to retrace in the beginning, the price is likely to rebound off the demand zone below 97.6.

EURUSD- Weekly Forecast 13th - 17th MayEURUSD consolidated at the beginning and finally climb as expected, breaking above a falling trendline too.

The price is now facing strong resistance at 1.1250, preventing it from breaking new high.

If the price continues to climb, it will complete an ABCD pattern as it reaches 1.1300.

The first 3 trading days will be very crucial for whether EURUSD will resume its downtrend or the bull is still strong enough to climb higher.

Dollar - Weekly Forecast 13th - 17th MayThe dollar turned out as expected and broke below the bottom of the rising channel.

The price is most likely to continue falling further and will eventually complete an ABCD pattern within the demand zone around 96.6.

However, it is crucial that the price has to break below 97.2 in the first 2 to 3 trading days or else it may form a strong support for the bulls to come back.

Gold- Weekly Forecast 6th - 10th MayGold had a week of consolidation as it failed to break previous low and rebounded off quite strongly, closing higher than its previous day high.

The price is expected to climb further and test the top of the current range of 1287 and 1267.

The major trend will still be unclear until the price has chosen to break out either side of the range.

If the price falls a little but maintains above 1273 for the first 2 trading days, there's a good opportunity to buy from the low to the top of the range.

If the price climbs and reaches 1286 - 1294 for the first 2 days and provided the candles get smaller after one another, that will be a good chance to sell again.

EURUSD- Weekly Forecast 6th - 10th MayEURUSD has climbed strongly but got rejected at 1.126 which led it to fall for another 2 days.

However, the dollar plunged and pushed EURUSD up again and the week ended with a bullish candle.

Based on the structure, the price could be forming an ABCD which will be completed within a supply zone at 1.1300.

But just before that, the price should face some resistance by a falling trendline at 1.1230.

So, if the price were to fall at first in the first 2 trading days but managed to maintain above 1.1170, it will provide a good opportunity for a short-term long.

If the price continues to climb at first, we will keep a lookout for a breakout of the falling trendline at 1.1230, and keep waiting for a selling opportunity only when it reaches 1.1300.

Dollar - Weekly Forecast 6th - 10th MayThe dollar did not turn out what was expected and the entire sentiment has turned from a bullish to bearish.

It started off by falling for 2 consecutive days which dived a little deep below the breakout level of 97.7 but managed to pull another 2 days of bullish movement that covered most of the weekly losses.

And then the market chose to buy the story and sell the fact which led the dollar to sink below the breakout level once again, which also cause a break at the bottom of the rising channel.

So this week, more bearish movement is definitely expected and there's a good chance for it to reach the demand zone just below 97 before we see any significant rebound.

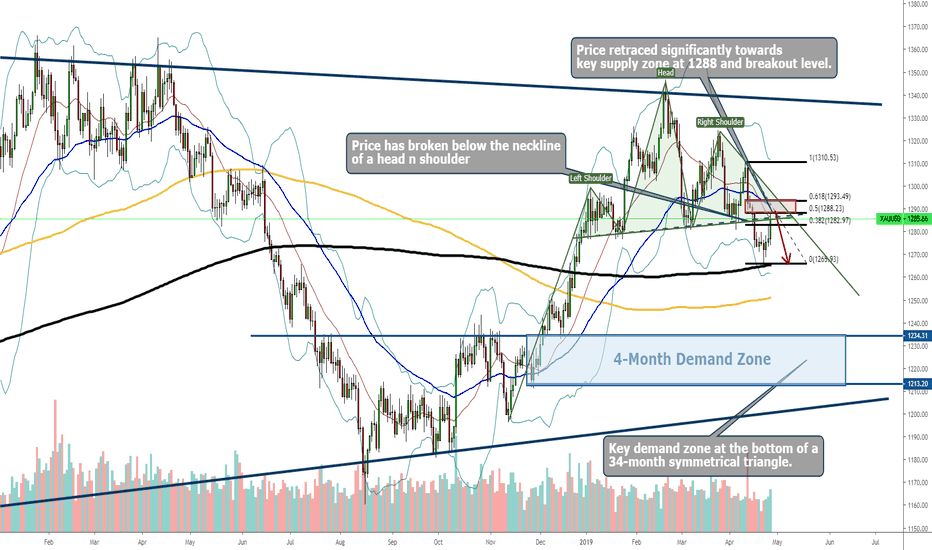

Gold - Weekly Forecast 29th April - 3rd MayThe gold has climbed last week as it proceeded with the retracement after breaking below the neckline of a head n shoulder.

This is also considered a break-below of a range at the top of the 34-month symmetrical triangle which will bring forth a bearish market.

In this week, we will observe the price closely at its current level and as it creeps into the supply zone at 1288 and the broken neckline.

Since the dollar has taken a bullish stance after it broke its previous high, it will boost the case of a bearish gold in the coming week.

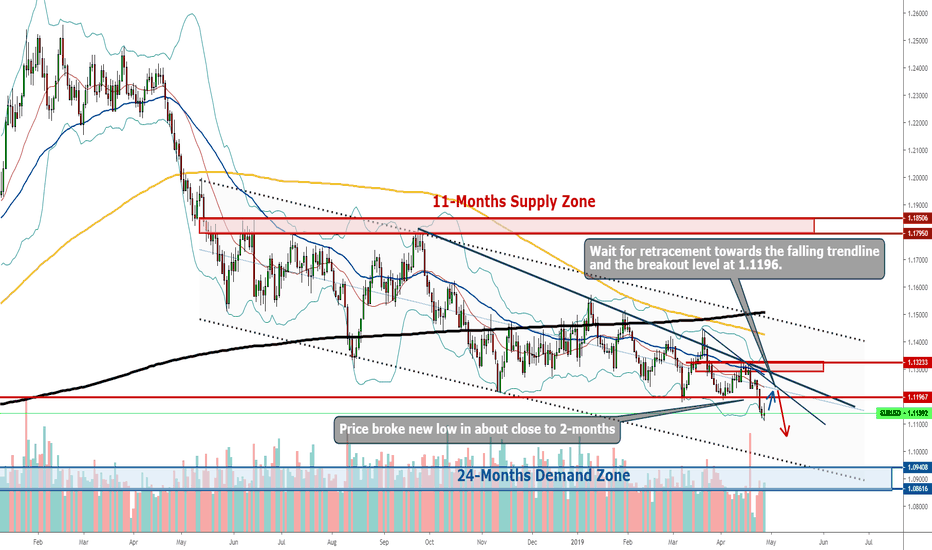

EURUSD - Weekly Forecast 29th April - 3rd MayEURUSD fell and broke below a 2-month low at 1.1196 and it managed to close below despite strong rebound at 1.1120.

The technical chart clearly favours a bearish market now and there will be a selling opportunity again this week.

In the H4 chart, the price has completed a wave of retracement and awaiting the 2nd wave to be completed.

In this week, we will wait patiently for the price to retrace towards the breakout level and find an opportunity to sell just below 1.1200.

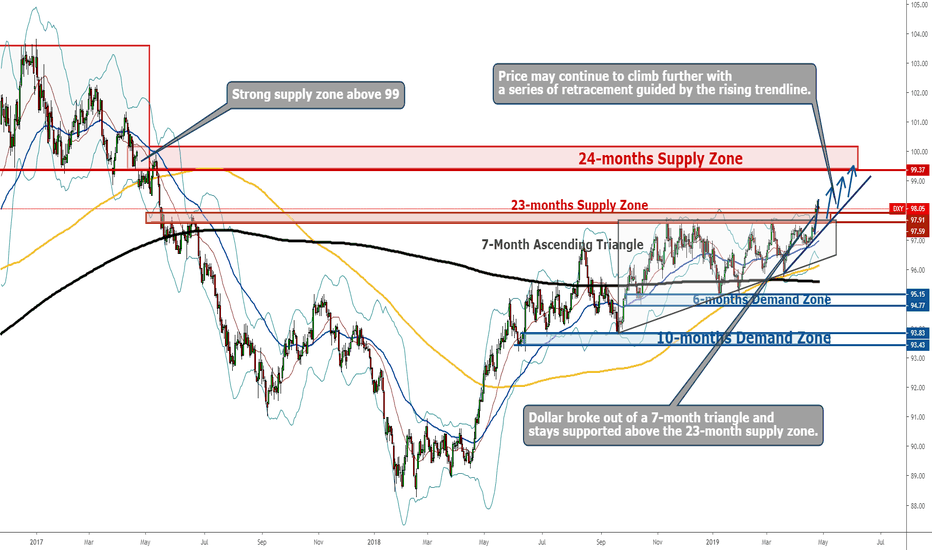

Dollar - Weekly Forecast 29th April - 3rd MayLast trading week was an eventful one as the dollar finally broke a new high in 5 months.

It was a clean break as it closed above the previous high with a strong bullish day candle and the retracement was shallow and the price still sits on to of a 23-month supply zone.

However, it is unlikely that we will see the dollar climb straightaway towards the 24-month supply zone above 99.

The dollar is expected to make a series of climbing and retracing, supported by a rising trendline.

In this week, if we were to take a look at the H4 chart, the short-term trend actually favours a bearish market.

The price is most likely to retest the previous high at 97.6 and only when the retest is successful, the price will continue to rise to a new high again.

Gold- Weekly Forecast 22nd - 26th AprilThe gold continues to break lower as US stocks market continued to climb steadily.

The neckline of an HnS was successfully broken creating the case for further bearish movement.

And looking at the weekly chart, the price has also closed below a range at the top with a significantly bearish candle.

In the first trading day of the week, we can expect further retracement before the price resumes depreciation.

Look for selling opportunity within the supply zone of 1284 - 1289.

EURUSD- Weekly Forecast 22nd - 26th AprilEURUSD took an unexpectedly bearish turn as a lack of demand failed to maintain the price higher and a weak Euro data caused a snapped in the shared currency.

The price broke 2 higher lows in one wave thus making a strong case for further bearish movement to follow.

Due to Easter Day, volatility will be low and the price may continue to retrace higher.

We can wait for a selling opportunity near 1.1280 just above the Fibonacci level 50% and short towards 1.1180.