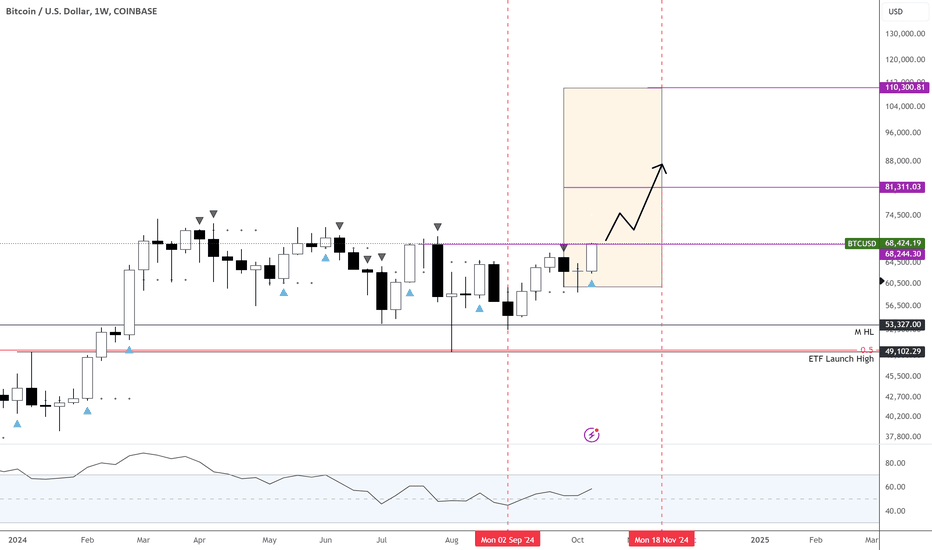

Bitcoin's Last Stand: Can It Break Above $68.3k?MARKETSCOM:BITCOIN has finally reached the weekly block—the last level before ATHs.

Is this the moment we’ve been waiting for? I believe it is. For the first time, it’s printing a bullish weekly signal at this critical level. The last attempts, in June and July, were merely bounces without the momentum or reversal signals needed to push higher.

This time feels different. We have an expansion candle on the weekly, and hopefully, it will close above the $68.3k level. If we compare the timeline to the previous breakout before the $30k surge, this consolidation phase seems to be coming to an end.

I think the odds are now better for an upward move.

I’ll revisit this chart at the end of the week—we still need a solid close.

If everything aligns, November could be a strong month, potentially pushing toward $81k!