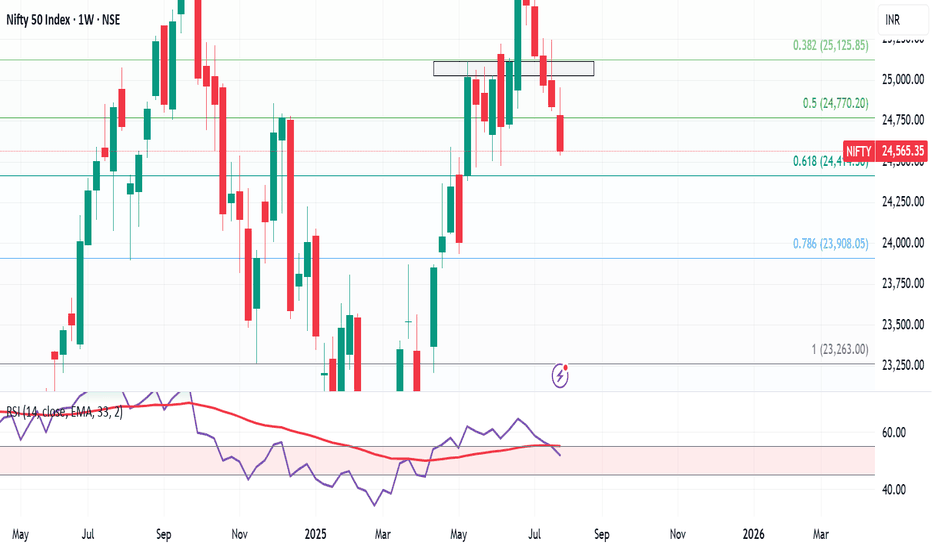

Weekly Market Wrap – Nifty Slides, Global Sentiment WeakensNifty ended the week on a bearish note, closing at 24,565, down 270 points or nearly 1.1% from last week's close. It touched a high of 24,956 and a low of 24,535, perfectly respecting the range I shared last week: 25,300–24,400.

As I highlighted earlier, the inverted hammer formation gave the bears an upper hand—and the index corrected 1.74% from the recent highs. My view continues to favor caution, with the expected trading range for the upcoming week at 25,000–24,100.

Key Levels to Watch:

Support Zone: 24,400 (key bounce area), followed by 24,100 / 23,900 in case of further breakdown.

Resistance Zone: Upside capped near 25,000.

If the market holds 24,400 around 6th–7th August, expect a short-term bounce. However, if this level is breached, expect dips to 24,100 or 23,900, which could offer short-covering opportunities.

Global Cues:

The S&P 500 also had a rough week, closing at 6,238, down 2.5% week-on-week. This decline sparked a wave of selling across global markets. The 6,200 level is crucial—if it holds, we might see a rebound globally, including in Indian equities. Below that, 6,100 remains the breakout retest zone, which I believe should provide some cushion.

💡 Strategy Going Forward:

Focus on stocks showing relative strength in this falling market—they’ll likely lead the rally once sentiment turns.

Avoid chasing rallies, and watch for signs of bottoming out near key support zones.

Keep an eye on global indices like the S&P 500 and Dow Jones, as their stability will dictate near-term direction for Indian markets.

Stay sharp, stay prepared. Let the bears have their moment, but be ready to pounce when the tide turns.

Weeklyupdate

Market Insights with Gary Thomson: 31 March - 4 AprilMarket Insights with Gary Thomson: RBA Rates, US and Canada’s Employment Data & Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

- RBA Interest Rate Decision

- US Nonfarm Payrolls and Unemployment Rate

- Unemployment Rate in Canada

- Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.