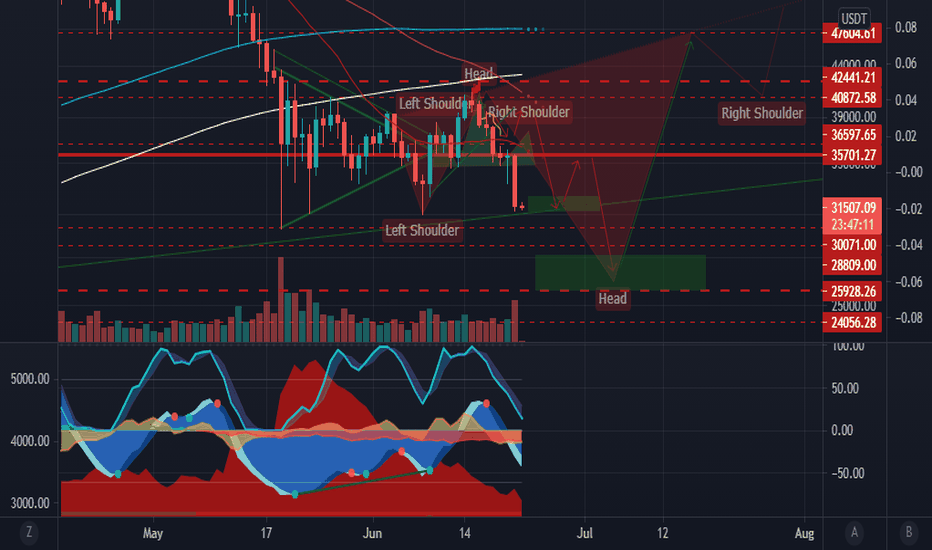

BTC/USDT SHORT...BITBAY:BTCUSDT

Like I already told you. DONT LAUGH AT ME...

I mentioned that I WILL NOT DO ANYTHING :) and you laughed at me. But it is okay.

Hope we will do better now and help each other and send me a more informative criticism not just bullsh^t comments.

I am here to share these trades

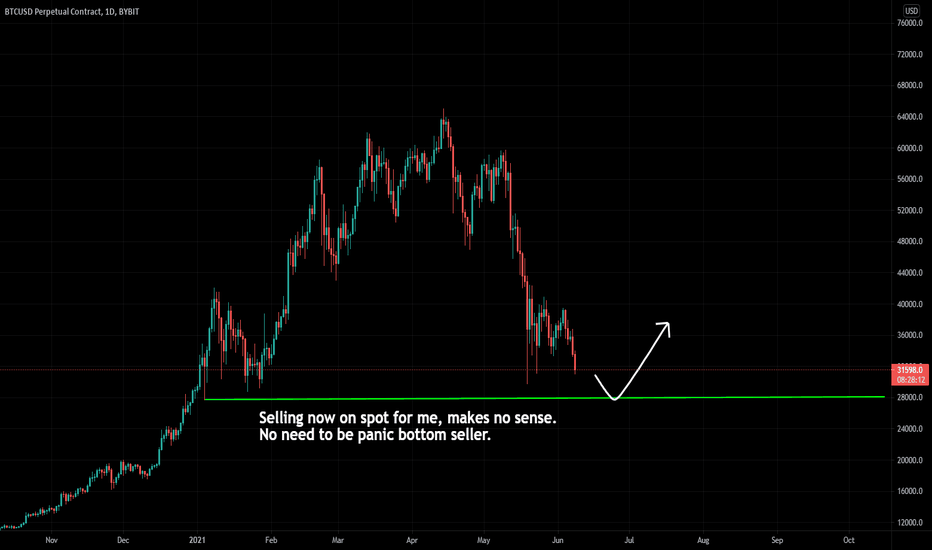

I have been telling you not to do anything unless we are close to that 30K wall. We need to hold that wall and or we will fall if we don't.

The only mistake i did with you guys is I DID NOT let you make aware that we will face a huge fight of FUDs and Official news even tho it is old.

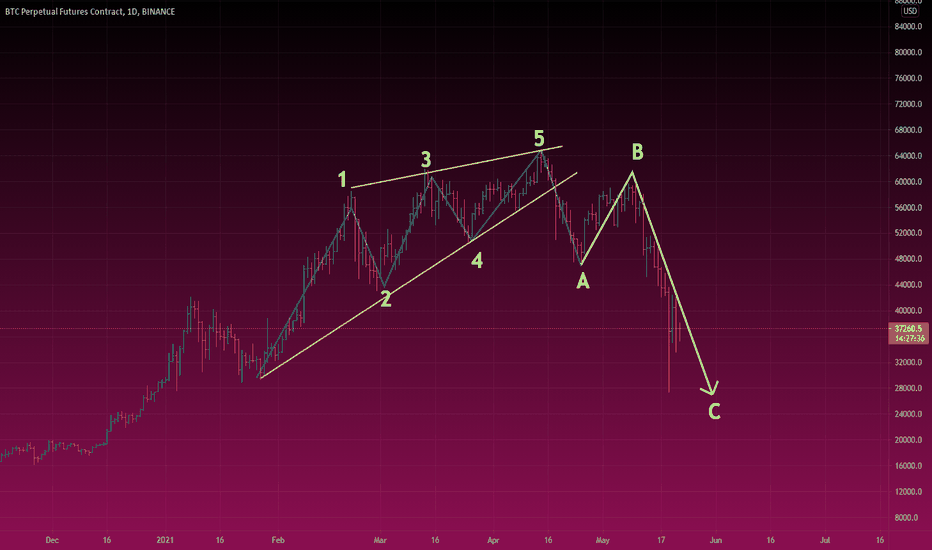

This is not Bear Market (prolonged) this is just place we need to retrace from a raging heights from 10K to 30K to 40K back to 30K to 50K to 64K and we are here.

Still fvvck the government. Let's not say things about race. Government are one and their goal is to control us. Real Democracy is Decentralized. This is the time we can own something finally don't sell your BTC to the whales and bad whales. They will really buy it.

my techanalysis is still the same for the last week. I am the only consistent. I wont change. we are still shorting this then take profit to safe coins then move those short profits at buying more good project coins...

HODL wallet I have is...

$LTC $BTC $ETH $ADA $LINK $DOT $BNB

Whales

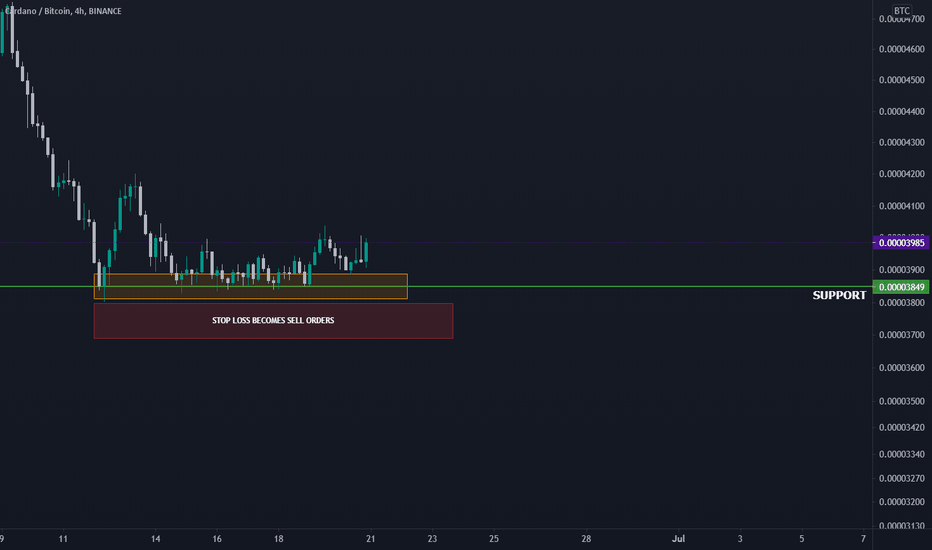

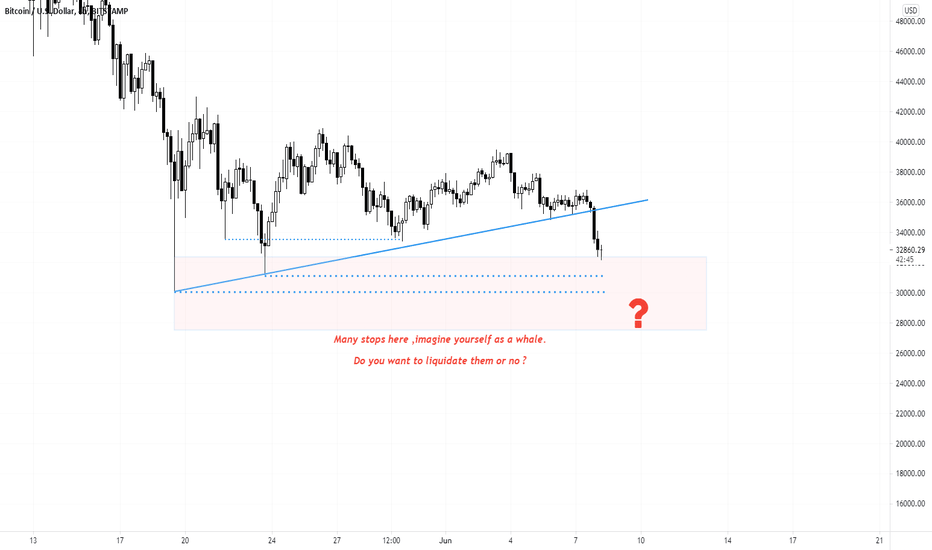

The Liquidity GrabI'm going to do my best here at explaining the basics around a liquidity grab (some times called a stop hunt), why it happens and how it works (ignore the chart I'm using, I'm not saying this is a manipulated move just showing you an example of how it works)

I often refer to this in my playbook as an STL "Sweep The Legs" coupled with a picture of Johnny Lawrence from the karate kid lol

First you need to understand that Big money plays a different game to retail.

When you want to place a buy order at a specific price point, lets say your buying a thousands dollars worth of BTC @ $30,000, you can put an order in and boom it gets hit your filled and your ready to go to the moon.

Now imagine some bigger traders who play with a lot more money than you, lets say there order is more like a billion dollars.

Well in order for them to fill there position, there needs to be a large amount of selling at that level other wise they may only get a small piece filled...... theeeeeen of course the price moves away and your priced out of the market (imagine putting your $1000 order in, only getting $10 of it filled and then having the price moon....yeah it would suck)

They do not want to chase candles or buy up the order book, thats just not good business, and if you have to do that in order to get your orders filled thats a good indication that there is already liquidity issues within this market and you may have a similar problem trying to cover of your position later on.

So these players some times need to hunt down and find or even artificially create liquidity pools for them to take a big bite at like pigs at the trough.

One of the easiest ways to do that is to look for the most obvious levels of support with in a trend of sideways channel and look at the buying thats happening on that level.

If we dont get an instant recovery or bounce at that level it can normally indicate price being trapped or held down in order to encourage more retail to "buy the dip" or buy on support as these are some of the most basic tools and strategies taught to retail traders.

Now one thing to remember when all of these traders/investors are in there positions from this level, there will be a large number of these traders protecting capital with stop losses, normally under the level they where buying at.

This now created a liquidity pool...... You see every stop loss on a BUY order, becomes a SELL order, and with so many BUY orders created and entered at a specific level that means the stop loss orders are stacking more and more on top.

Think about it like this, if we hit 30k and someone buys $1m worth, that means there is possibly a SELL order (via a stop loss) of roughly 1m under that level.... now we hit that 30k level again, and someone buys some more, maybe another $1m worth... well now there is roughly $2m worth of SELL orders in that stop loss zone. Hit that 30k super sweet safe support level 5 or 6 times and all the sudden you could have 8-10m worth of SELL orders at a single price point below support.

Now if I wanted to enter this market long and I had 10m order to fill, it would make sense for me to run the price down to clip these stop losses creating a large amount of selling straight into my pig of a buy order.

Once my orders filled I can stop holding the price down and let the price begin to organically rise again, this often creates fomo for all the retailers who just got knocked out of there trades from "tight stop losses" to chase the market back in only adding to the momentum and mark up of my position.

The same thing can happen in vice versa when they are covering or exiting a position as well, and its often followed by a square up to reduce or remove the risk taken on to manipulate the price during there accumulation or distribution of there order, more specially into a short position as they take on more exposure to the underlying asset to manipulate the price, in a long there exposure is fiat and there isnt any need to cover. (ill explain square up in detail next time)

This is often what is referred to as a liquidity grab and its how big players enter the market, they do not chuck a limit order in on Binance and hope for the best...

I hope that made sense and added some value, but if you have any questions please chuck them below

BTC/USDT DEATH CROSS (I am not doing anything)BINANCE:BTCUSDT TF 1D

Sometimes Lazy is good, We rode that 31K you saw our previous Chart.

Yet to admit I really acted like a whale getting greedy to the Death cross momentum and

get the 20WEEK MA be Gold Cross for everyone not just for me and for you as well.

Open your eyes it is being fished we are fished by whales. Why not let the whales vs whales...

Let sit at the bottom of the ocean floor and buy the whale that will crash. Let's not fight it.

REMEMBER WE CAME FROM THIS TO HERE WHERE WE AT SITTING WHERE THIS DEATH CROSS; it's Inevitable!

15/6/2021

> G7 Leaders Ask Russia to Urgently Identify Those Who Abuse Cryptocurrency in Ransomware Attacks.

> Experts: Regulatory Uncertainty and Slow Embrace Hampering Crypto Growth in Kenya. Here

> Crypto Not a ‘Viable Investment,’ Goldman Sachs.

> Johannesburg Stock Exchange Rejects Bitcoin ETF Application, Cites Lack of Regulatory Framework.

> MicroStrategy could hold more than $4B in Bitcoin after latest private offering and crypto purchase.

> Bitcoin price hits $40K as Paul Tudor Jones slams Fed inflation claims.

> Lack of crypto regulations alarming, says Italy's stock market regulator.

> Bitcoin sell pressure may hit zero in July thanks to Grayscale’s giant 16K BTC unlocking.

> China debuts blockchain-based digital yuan salary payments in Xiong’an.

> Korean banks will need to classify crypto exchange clients as ‘high risk’.

> Paul Tudor Jones on the Fed, Inflation and Why He Recommends 5% in Bitcoin.

> Bitcoin Remittances to El Salvador Surge 300% Ahead of BTC Becoming Legal Tender.

> New Zealand already had a bank recognize to accept El Salvadors National Currency (btc) as an act of now waging war against them.

> Elon musk is operated by his own company. He is what he is and he does what his company needs, getting the news out and riding the obvious and claim he did it, and he caused that major movement at the market. (we know he did not)

> French Football Federation launches official player NFTs with Sorare.

Psych : they will use FUD to really push that price down until they fill in the depression stage where whales will be profitable on that death cross.

It is programmed to happen and it must, to call it a healthy market. Tendency small to mid hands like you and me are making ways to snipe that cross and call for a short. Sometimes doing nothing is the best thing to do. start selling your spot 50% incase you got left out at the top use your investment and 50% you sold to buy that efing DIP... in anycase still that is just how I always do it and it is aggressive and safe at the same time. Going High risk to security stage putting stop loss even at spot. Auto selling this coins using tools that I use like coin panel.

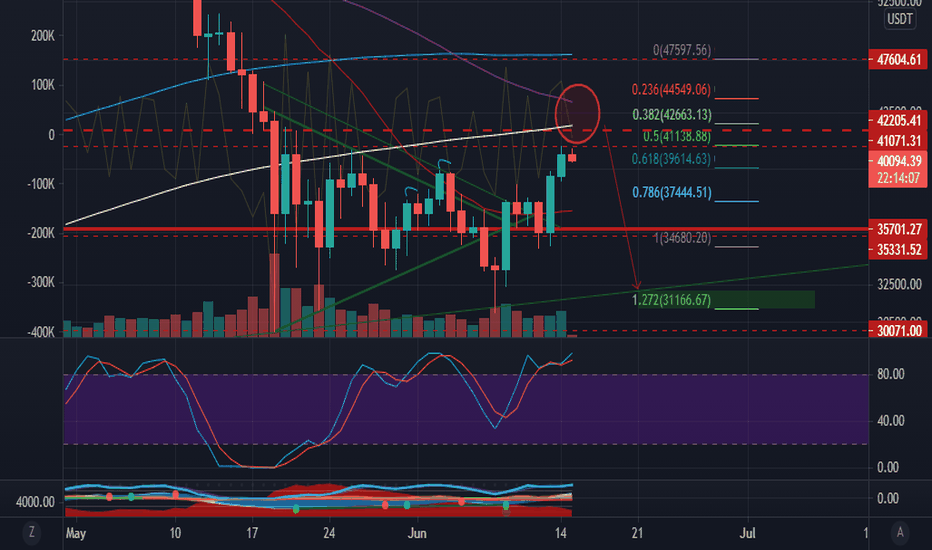

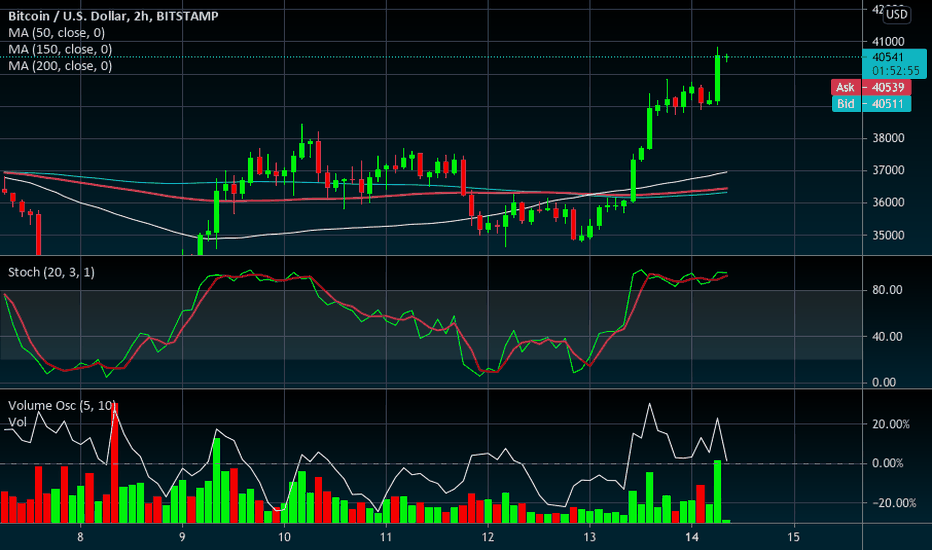

Whales are at it again....Elon Musk and Tudor Jones both came out talking bullish about BTC and it rallies up..... Come on people, we've seen this before, its called um.... oh yea, PUMP AND DUMP!!! (2 hour chart displayed)

Don't fall for the same tricks! Take a small amount of profit if it seems logical to do so depending on your position and buy the dips! Don't give in to the hype - and don't buy at the top of a wave! Oh yea, and have a beautiful day. :)

Sincerely your Crypto Helper Friend,

- Jay

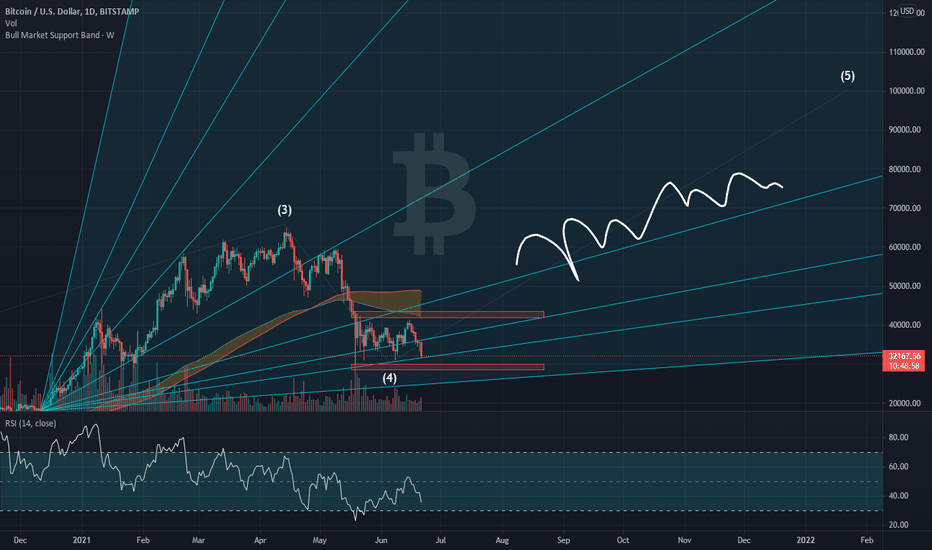

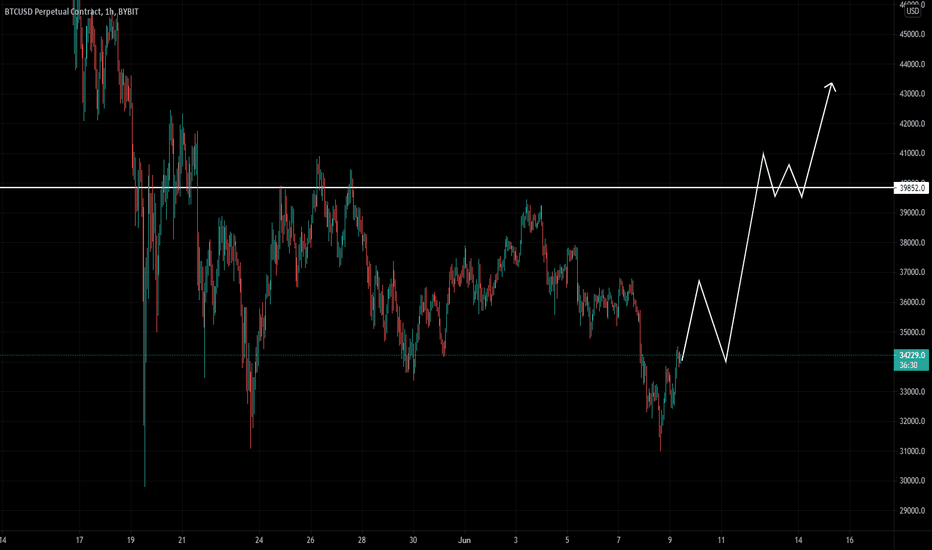

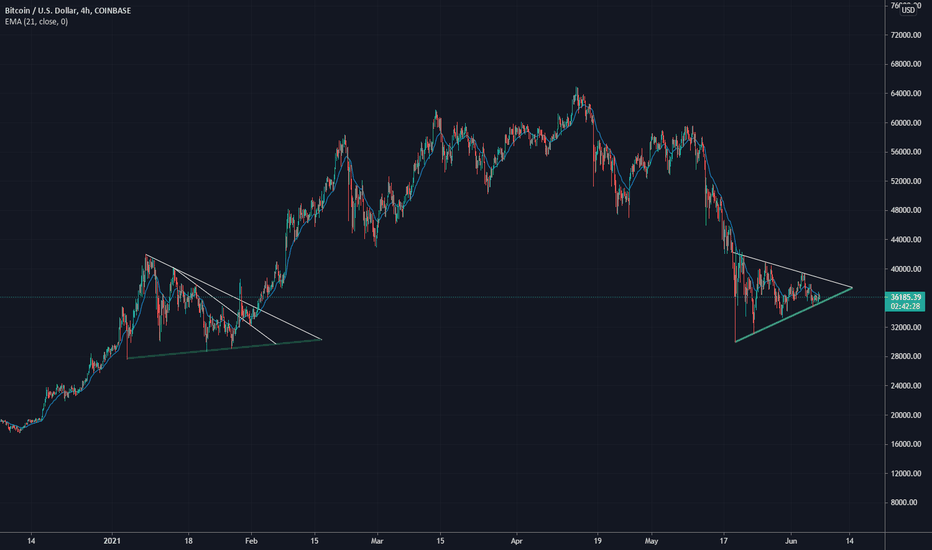

Rising Wedge for previous correction vs Current oneKeeping it simple. This correction is almost done and it formed a stronger rising wedge than the previous correction.

The news narrative has changed to positive mostly as the Market Makers pretty much finished accumulating.

We should expect BTC to break 40K soon if there are no unforeseen panic events and I don't think our beloved market makers would like a broken market where nobody would buy their mostly fake positive news.

Bitcoin Death Sunday

Just a quick post to explain why i never trade on SUNDAY.

-----------------------------------------------------------------------

So in the Graph Color Palette is :

- Green = Bullish Day

- Red = Bearish Day

- Blue = Neutral ( Standard Doji )

-----------------------------------------------------------------------

- So now look at graphic because it speaks by himself. How many Green Lines, how many Blue Lines and how many Red Lines ? just count.

- it's very simple to understand the reason, institutionals like CME are closed, so Whales are alone and play around with markets and try to Rekt Retails investors.

- For Security its always better to wait Monday and check if CME Markets sentiments are Bullish or Bearish.

- Some Sunday.. TheKing is Bullish but if u check the ratio, it not worth the try..

Enjoy with your family on Sunday !

Happy Tr4Ding !

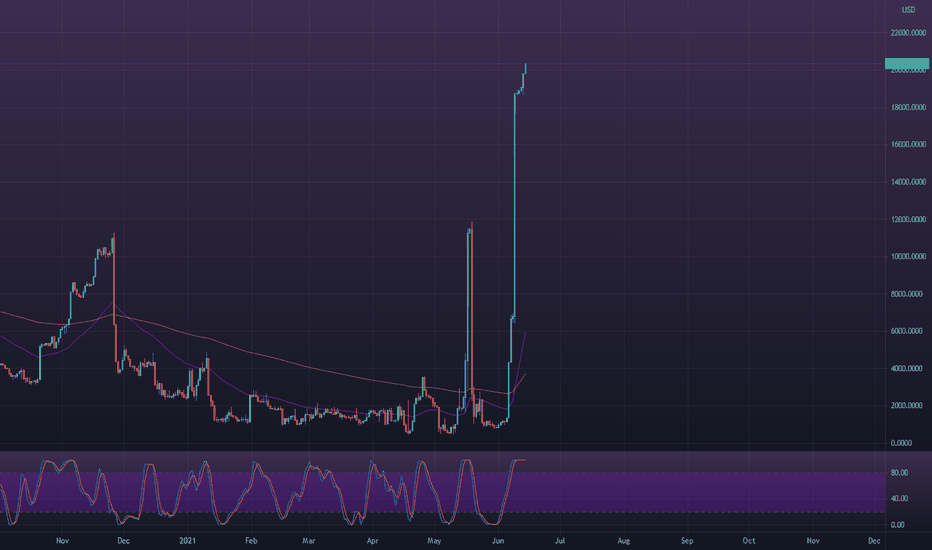

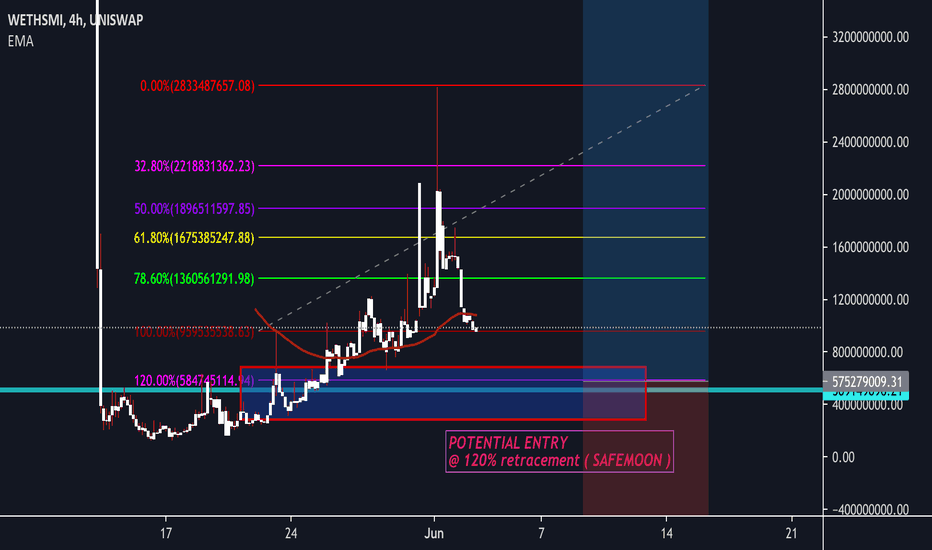

CRYPTO POTENTIAL ( SAFEMOON ) Lets take a look at Technicals first and then ill give my indepth opinion on this Crypto.

Market Cap

$2,359,673,071 if this continues to drop we may see the price we would like in order to get the best possible price!

^3.14%

Fully Diluted Market Cap

$4,099,440,235

*3.14%

Volume

24h

$28,348,534

^3.63%

the way to play this would be wait for the extension of the 120% fibb. this will most likely look like a long bearing candle with an extremely long whick / candlestick . if prices reach our extension i will have to break down on a smaller time frame to find percise entry location but anywhere near 0.02-0.001 would indicate to me that we have entered the final wave before entering the next 5 way extension to the upside.

key locatons 120% - 222% retrace .

breaking down the charts is indeed a hobby , perfecting this skill is entirely underrated.

im analyzing from a more practical outlook , waiting for oppertunites when none seem to be

Present is indeed something more of a theory than a gaurante.

when monitoring these charts for entries i personally like to set alarms / slerts around key areas

just incase i am inn-active when these prices become present.

this will indeed help refine the technique .

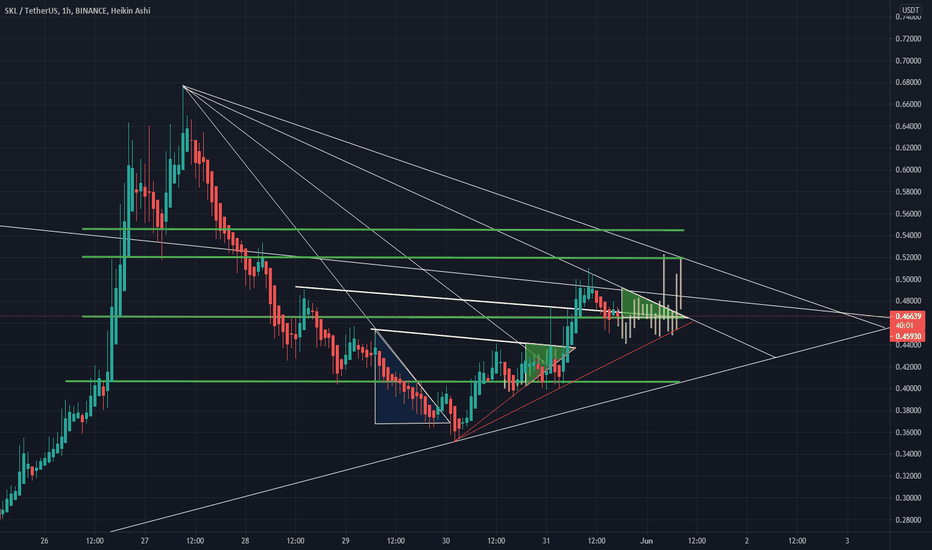

#SKL will need a few daysHi guys

if I'm correct, I believe SKL will need a few days to get back to 0.60 - 0.70

we will probably see some up and downs over the next days.

lets hope some whales can see the opportunity and help us out!

the market supply is so low for SKL... how I wish to see half of #XRP market cap down here...

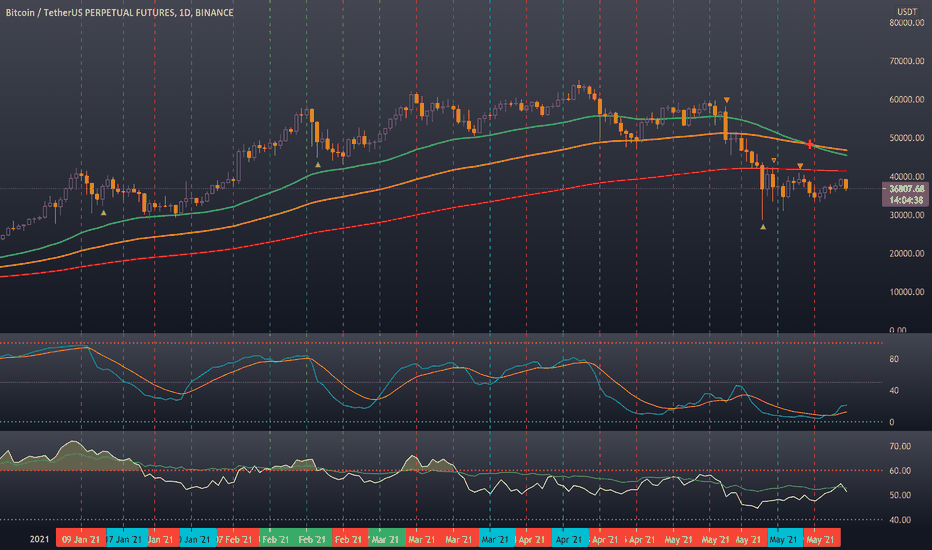

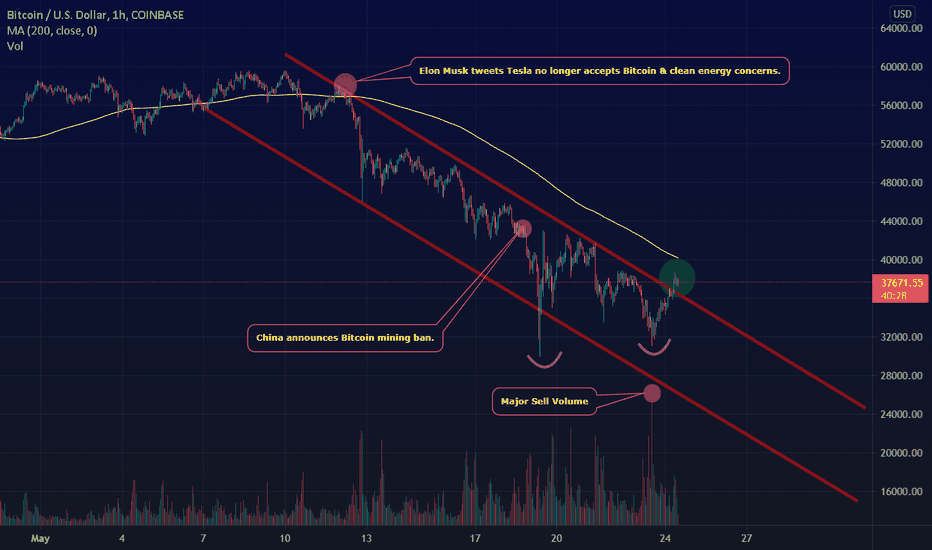

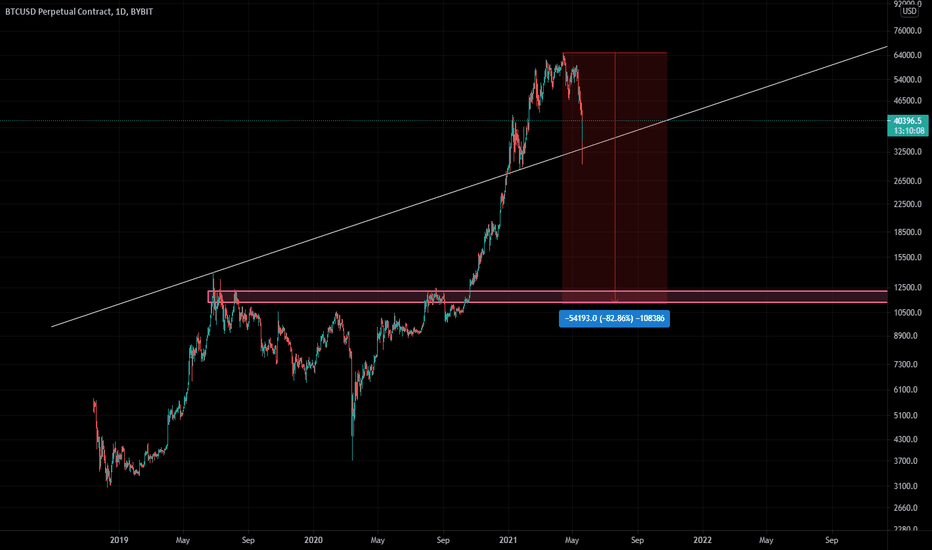

Bitcoin Out of Capitulation? Can we get back above 200 day MA.It wouldn't be cryptocurrency if we didn't have eye watering corrections like these. I guess this is the price we pay for having astronomical gains and cryptocurrency still being in its infancy stages as a market and technology. Its been blatantly clear that there has been a lot of institutional and whale buying during this market crash.

I have a short term 1 hour channel of Bitcoins capitulation trend. We slightly broke out of the capitulation channel but we may re-test $35,000. Seems like we may have formed a double bottom but we'll see. We're trending back towards being over the 200 day moving average. These are good signs of recovery.

A lot of other analyst are stating we're in a "dead cat bounce" and we may head towards the lower $20,000 levels. That's possible if we drop back below $30,000 but I see way more support and recognition above $30,000 than there is at the $20,000 level. Even if we did drop back to $20,000 most people would buy that up in a heart beat. This crash is driven by nothing more than fear and emotions because at the end of the day the fundamentals of Bitcoin remains the same. Just my opinions.

Much peace, love, wealth, and health. And yes, I strengthened my family's Bitcoin and Ethereum positions this crash.

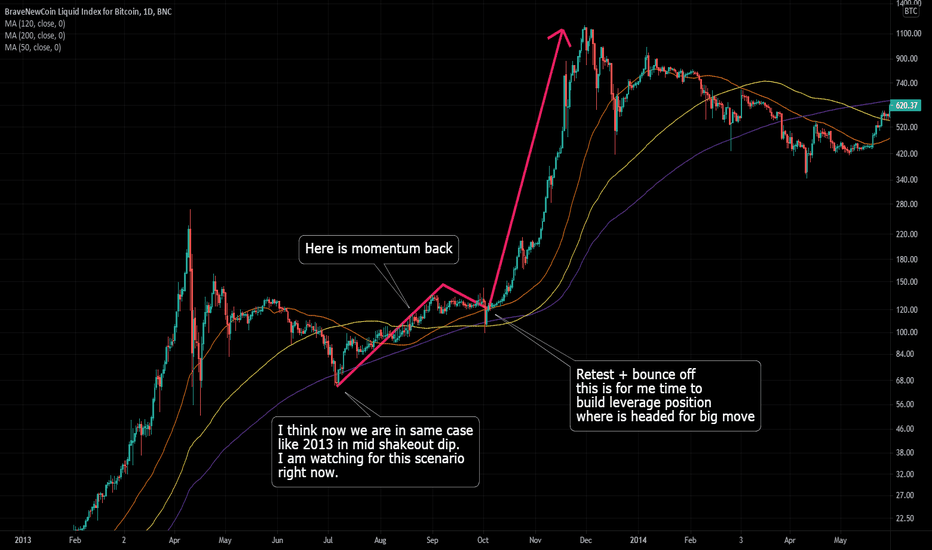

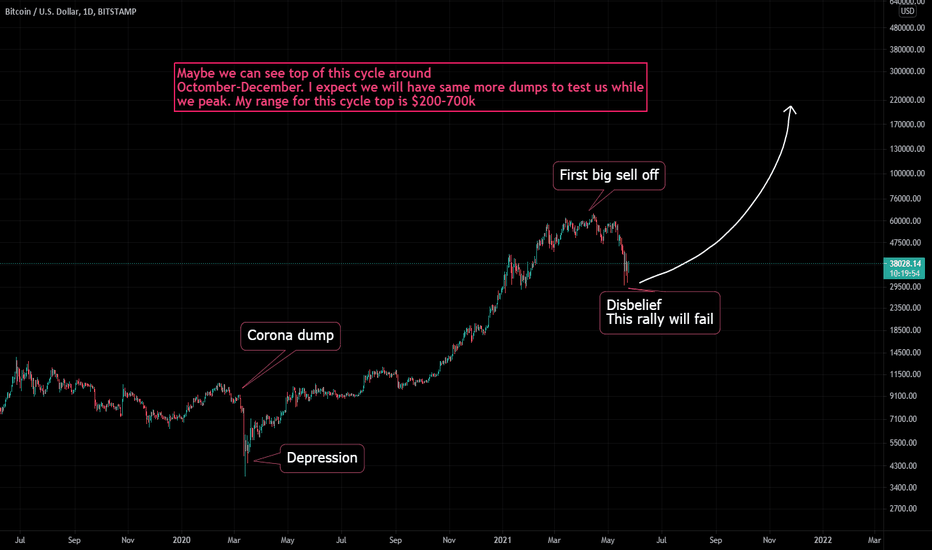

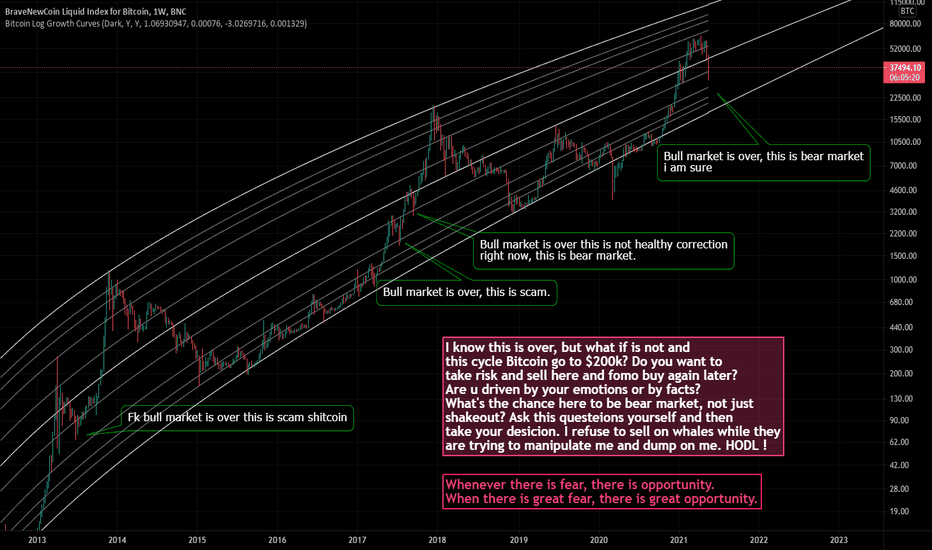

BTC- Fundamental, market cycle and capitulationThe great unwind... As Mark Cuban calls it. Such capitulations are, however, not uncommon throughout Bitcoin's history. Feb 2018, Nov 2018 and Mar 2020... To name a few. Of course, to newcomers, such volatility is difficult to stomach. At least, that was how I felt back in 2017.

The latest China FUD is simply three banking and payments associations in China reiterated on the central bank's 2017 ban on financial institutions and payment firms engaging in cryptocurrency transactions and these rules have been in place since 2017. China has been banning the retail trading and the operation of crypto exchange within China’s jurisdiction since 2017. I know this because I was at the front row seat and watched this event unfolded which also coincided with the deep correction of Ethereum from $400 to $140.

China’s latest crackdown on Bitcoin mining will be limited to operations that are not using hydroelectric power. If you think about it, it’s actually good for BTC’s reputation and the global environment in the long run as the world’s adoption of the decarbonation accelerates.

Elon musk’s bashing of BTC…. Hard to take him seriously when he doesn’t even know the high ownership concentration of DOGE and when he believes that he can magically 10x the block size of DOGE. Obviously, he hasn’t thought seriously about the scalability dilemma and the tradeoff between privacy & decentralization and transaction volume/speed/cost. He is right about the BTC’s environmental impact though and it is an important issue for Bitconers to address as the worldwide trend toward the greener environment marches on. I just wish that he didn’t flipflop on whether or not he would allow Tesla to accept BTC payment.

FOMOers, long-term holders/whales and miners determine crypto’s market cycle. Let’s examine them one by one.

Short-term holder's capitulation-

Panic selling is actually good as weak hands get shaken out and market cools off a bit.

Both aSOPR and STH-SOPR have dipped below 1.0 recently indicating the widespread and aggressive panic selling by new holders.

# of address with a non-zero balance has also decreased which is another sign of panic selling by FOMOers.

Bitcoin’s Net Transfer volume from/to Binance is another panic selling indicator as it went up when panic selling intensified.

Long-term holder is HODLing-

The ASOL, CDD and Dormancy metrics are all down indicating HODL sentiment among long-term holders.

# of Bitcoin supply held by Long Term Holders indicating that LTHs haven’t distributed their holdings to the lvl where the new accumulation phase typically begins.

Coinbase’s outflow continues to increase and its balance continue to decline which indicating institutional accumulation and demand and the increasing # of accumulation addresses also point to the same trend.

Total supply held by long-term holders has also slightly increased though this data by itself doesn’t tell us if LTH is accumulating at the bottom of the bullish retracement or the beginning of bearish cycle.

Miners' accumulation-

Last but not the least, miners’ behavior has great influence on the market sentiment. Both Bitcoin’s Miner Net Position Change and OTC Desks Balance indicate that miners are bullish and are accumulating BTC instead of distributing it.

Most other on-chain datas and technical indicators such as BTC NVT price, Bitcoin Difficulty Ribbon and Mayer multiple paint a bullish picture as well . However, one thing that concerns me is that Bitcoin Wallet Sizes: > 1,000 BTC seems to be declining a bit.

It’s possible that the price can continue to fall and bottom around 25k, but the likelihood of it happens will depend on if BTC can convincingly break above 38k and how long BTC stays below 40k. Whatever you do, base your judgement on the combination of different source and analysis rather than the biased intuition and simple trading patterns. Most importantly, play the long game. It's paramount that you can survive the bearish cycle, which will come eventually, and have enough capital set aside so you can buy at the bottom formation and enjoy the fruit of your labors when the market rises up again.