Prostarm Microfinance Ltd: Investment Update Buy, Sell, OR Hold Technical Outlook: Prostar Microfinance Ltd.

Current Market Structure:

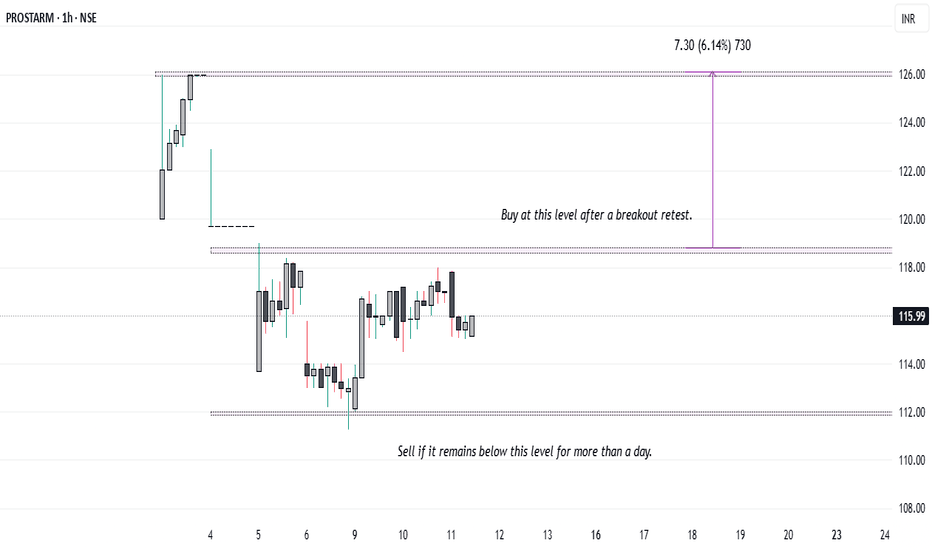

Prostar Microfinance Ltd. is presently consolidating within a narrow trading range between ₹112 and ₹118. This range-bound movement indicates indecision in the market, with neither bulls nor bears taking full control at this stage.

Scenario-Based Strategic Guidance

1. Existing Shareholders (Including IPO Allottees):

Investors already holding shares—especially those allotted during the IPO—are advised to continue holding their positions while the stock remains above the key support level of ₹112. However, if the stock breaches this level on a daily close basis and sustains below ₹112 on the following trading session, it would signal a breakdown of the current support zone. In such a case, we recommend exiting the position and waiting for technical stabilization or a new bullish setup.

2. Prospective Buyers (No Current Holdings):

Investors looking to enter fresh positions should adopt a wait-and-watch approach until a clear breakout above ₹118 is observed. A breakout accompanied by significant volume and a confirmed close above ₹118 could offer a potential buying opportunity, with a near-term price target of ₹126.

3. Risk Monitoring:

A sustained move below ₹112 could open the downside toward the ₹105–₹100 levels. Hence, strict stop-loss discipline is crucial, especially for short-term traders and technical participants.

Summary :

| Scenario Action Plan

-------------------------- --------------------------------------------------

| Holding from IPO Hold above ₹112; exit if closes below and sustains

| No Holdings Buy only after a breakout and close above ₹118

| Post-Breakout First Target ₹126

Disclaimer: This is a technical outlook and should not be construed as investment advice. Investors are advised to consider their risk appetite, broader market conditions, and consult financial advisors before making investment decisions.

Whatnext

Muln possible 3.00 break?+ Buy indication at 3.00?This is insane. After seeing a few bad days, Mullen's off to the races ONCE AGAIN. What does it mean though? What happens at 3.00? Do we buy and keep it up, or cash in, let it drop and buy back in lower? Stay tuned folks, were in for a bumpy (but profiting) ride.

P.S. Thanks to @markusd1984 for supporting me through this whole thing and being my first follower, your the man, man!